#BCH Update #3 – July 31, 2025#BCH Update #3 – July 31, 2025

From a technical standpoint, Bitcoin Cash is currently one of the best rounding coins compared to others, and it hasn't broken its upward channel. It continues to move steadily within the trend.

It recently took support from the midline of the channel and made a move, though this move wasn’t very large — it stayed around a 4-5% profit range. It has now completed its correction, but if it drops back to the bottom of the channel and then rises again, the profit potential would be even higher. At the moment, there’s only about 4% upward space left before it meets the top resistance of the channel.

Bitcoin Cash is currently one of the most technically clean and consistent altcoins. If it pulls back slightly, it might be a better entry, but there’s no issue with entering from this level either. Therefore, I’m opening a 4.5% position here, with a profit expectation of 4.5%.

Bitcoincash

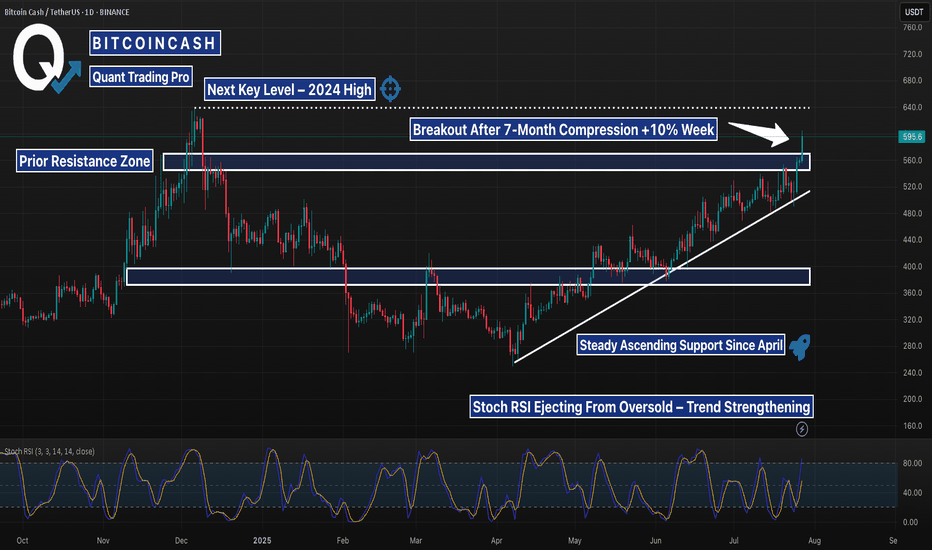

BCH Breaks Out of 7-Month Range — Eyes Set on 2024 HighsBCHUSDT 1D chart shows a clean technical breakout after months of slow grinding structure. Price has officially pushed through the $570–$580 resistance that’s capped upside since December 2023. This move comes on growing volume and renewed interest in BCH across crypto forums and analyst posts, with some calling it a long-overdue move for a top-20 coin.

The prior resistance zone around $430–$470 acted as a major accumulation range — now flipping into solid support. Price is also respecting a long-standing ascending trendline since April, showing consistent higher lows and steady bullish structure.

Stochastic RSI confirms momentum is shifting — pushing out of the mid-zone and suggesting trend continuation. With this breakout confirmed, the next major target sits near $640: the high from late 2024.

If BCH holds this breakout, it may be entering a new expansion phase. Watch for possible retests of $570–580, but structure favors bulls.

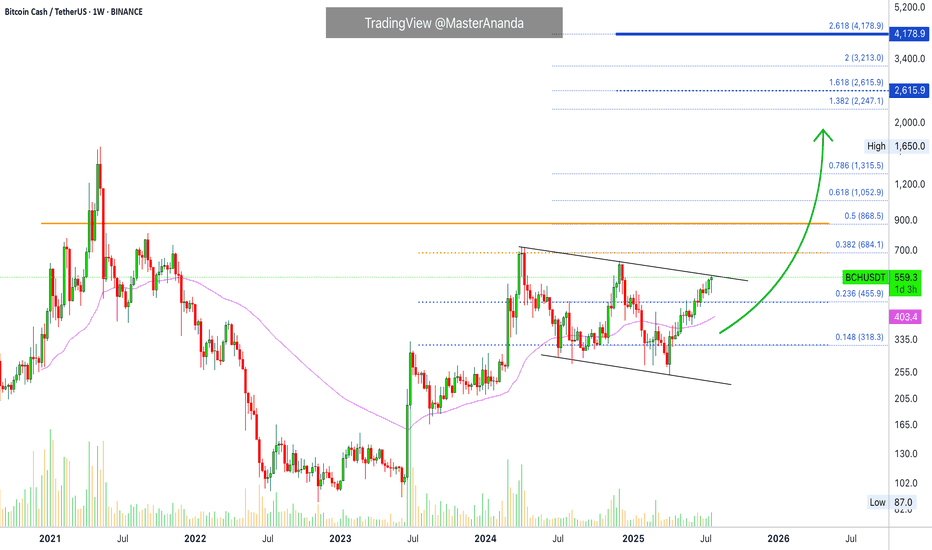

Bitcoin Cash $2,615 Minimum · $4,178 Possible · Plan Ahead105 days. This is definitely the longest stretch of bullish action since 2021. Bitcoin Cash has been growing non-stop for 105 days.

If someone told you this would be the case some months ago or a few years back you wouldn't believe it. What if someone tells you now that you've seen nothing yet? What if I told you that the best is yet to come? This is only the build-up process. Bitcoin Cash is about to shoot up really strong. It will skew the chart. People won't be able to comprehend what is happening less adapt to the market. It will be chaos, bullish chaos.

Years of consolidation. Bitcoin Cash has been on a wide trading range since February 2024. We can easily say since mid-2023 if we consider using a wider range. This is all the build-up process for this moment now. The 2025 bull market. Predicted years ago, now it cannot be denied, it is right in your face.

Let's play the other side for entertainment's sake. Bitcoin Cash stops rising, either a lower high now or a reversal at the December or April 2024 high. What would happen then? A bear market? No! Just a down-wave, more consolidation before the final advance, price jump and market bull run.

Let's go back to reality for accuracy's sake. Bitcoin Cash will grow in bullish momentum and will break all resistance one next to the other, stops will be short. If there is a correction in-between the action, it won't be long.

Look back to the 2021 bullish wave, the fifth wave; notice three weeks red, two weeks red, one week red, etc., in-between the rising wave. Straight up but obviously, there are some stops. When we are in the experience, when it is happening, these weeks feel like forever and we never know if it will continue rising or if that's it, we reached the end. I am telling you now, it will not be over until a major new all-time high hits, and the levels are being shown now. When we are more advanced in the market cycle, I will not try to predict the short-term. Instead, I will tell you to secure profits and move on. Once prices are really high, close your position and start looking for the ones still trading low near support. Of course, writing this won't change anything, people will still be attracted to the action and mistakes will be the norm. Only if you bought early when prices were low, you will be able to withstand the market pressure. If you buy late, the market will kill you and take everything from you. This is a friendly reminder. Plan ahead.

Namaste.

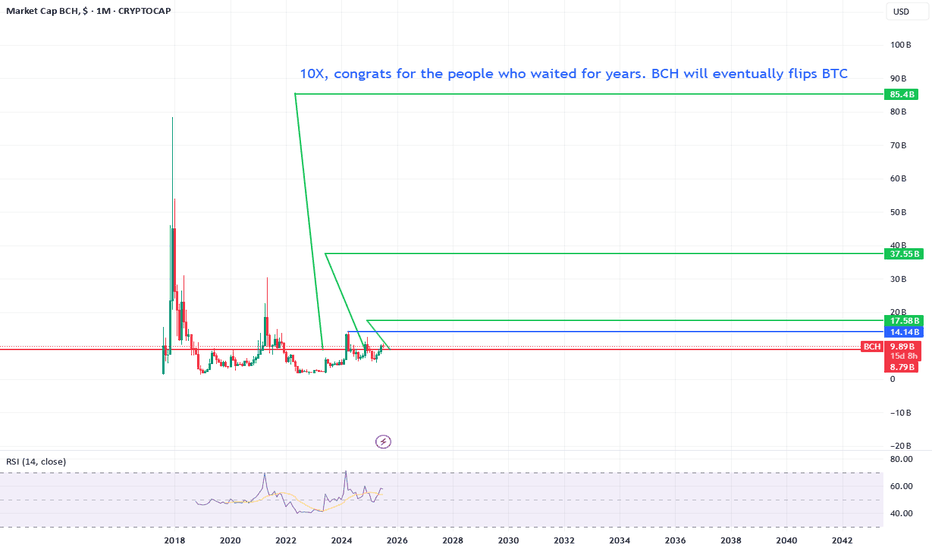

Bitcoin Cash will do a solid 10X For years bitcoin cash is been selling off.

But let me tell you this, we are just getting started.

If we pass the blue line we are officially triggered for a 85 billion marketcap.

Can still take some time but eventually it will happen. Make sure to fomo in when the party is starting!

"BCH/USD Heist Mode: Enter Long, Exit Before Bears Strike!🚨 BCH/USD HEIST ALERT: Bullish Loot & Escape Plan! (Thief Trading Style) 🚨

🌟 Greetings, Market Bandits & Profit Pirates! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

🔥 Mission Briefing:

Based on Thief Trading tactics (TA + FA), we’re plotting a bullish heist on BCH/USD. Time to swipe the loot & escape before the cops (bears) show up!

🔓 ENTRY: "The Vault is Open!"

📈 Buy Zone: Retest of recent low/high (15-30min timeframe).

💡 Pro Tip: Use limit orders for precision—don’t chase!

🛑 STOP LOSS: Live to Steal Another Day

📍 Thief SL: Recent swing low (~440.00 on 4H TF).

⚠️ Adjust based on your risk, lot size, & multi-order strategy.

🎯 TARGET: 540.00 (or Bail Early!)

🏴☠️ Escape before the red zone (overbought, reversal risk, bear traps!).

💰 "Take profit & treat yourself—you earned it!"

📢 WHY THIS HEIST? (Bullish Catalysts)

✅ Fundamentals: Strong macro + sentiment.

✅ Technicals: Pullback entry + bullish structure.

✅ Intermarket trends: Crypto momentum favors bulls.

(For full intel—COT reports, on-chain data, sentiment—check 👉🔗🔗!)

🚨 NEWS ALERT: Avoid the Police (Volatility Traps!)

🔹 Avoid new trades during high-impact news.

🔹 Trailing stops to lock profits & dodge reversals.

💥 BOOST THIS HEIST! (Let’s Get Rich Together!)

👍 Smash that "Like" & "Boost" button to fuel our next robbery!

🚀 Follow for daily heist plans—easy profits await!

See you at the next heist, bandits! 🤑💎

Bull Market Action Exposed—Bitcoin Cash Growing 91 Days Non-StopWhat we are seeing now is very different compared to the past. If you look at early 2024 the rise was composed of strong big candles, always fast as if in a hurry. Very strong growth. If we go further and consider late 2024, we got a lower high but still very big candles. Fast forward to present day 2025, and we have a perfect uptrend, prices rising week after week after week with relatively small candles, some medium-sized but not as big as before. This is bull market action.

In the past, the candles were really big because the bullish action was soon to end, it wasn't expected to last a long time and thus everything needs to be accomplished fast. Things are different now. The fact that we have slow and steady growth is good news. Since the market is going to be growing for a prolonged period of time, the candles are smaller.

Don't be fooled by current price action, it all ends up in a major bull-run. While the candles are small now you can take it as bullish consolidation. Prices are growing but this is still a sort of accumulation/build-up phase. Everything is building up to a very strong climax with new all-time highs all-across and then some more.

Bitcoin Cash has been growing straight up for 91 days. In June 2023, Bitcoin Cash produced only two weeks green. Back in late 2024 all the growth happened in 28 days. Early 2024 56 days was all that was needed and then the market turned red. This is the longest stretch of continued growth since 2021... Yes, the previous bull market. You are witnessing bull market action.

Thanks a lot for your continued support.

Namaste.

#BCHBTC #1W (Binance) Big falling wedge breakoutCRYPTOCAP:BCH just regained 50MA weekly support in sats, performing better than CRYPTOCAP:BTC

Seems likely to continue bullish towards 200MA resistance, probably after a pull-back.

⚡️⚡️ #BCH/BTC ⚡️⚡️

Exchanges: Binance

Signal Type: Regular (Long)

Amount: 7.0%

Current Price:

0.004885

Entry Targets:

1) 0.004657

Take-Profit Targets:

1) 0.006329

Stop Targets:

1) 0.003987

Published By: @Zblaba

CRYPTOCAP:BCH BINANCE:BCHBTC #BitcoinCash #PoW bitcoincash.org

Risk/Reward= 1:2.5

Expected Profit= +35.9%

Possible Loss= -14.4%

Estimated Gaintime= 4-7 months

Bitcoin Cash: Altcoins Market Bullish Continuation Confirmed!The rise in late 2024, Nov-Dec, lasted only one month. This time the situation is much more different, it confirms what we already know, a major altcoins bull market.

Bitcoin Cash (BCHUSDT) has been growing for 85 days. No strong upthrust with high volatility, but steady growth, the type that exudes strength. At one point there will be a major impulse and this one will be followed by additional growth. What you are seeing is only the start.

Bitcoin Cash helped us predict a continuation of a bullish move for the altcoins several weeks ago. You can reach the same conclusion again. The fact that Bitcoin Cash is bullish now, confirms that the entire altcoins market will continue to grow.

Thank you for reading.

Namaste.

Is #BCH About to Fall or Will it Continue to Rise? Key LevelsYello Paradisers! Have you seen what’s cooking on #BCHUSDT lately? Let’s dive into the latest structure on #BitcoinCash and what may unfold next:

💎#BCH has been trading within a well-respected ascending channel since early April, consistently bouncing between dynamic ascending support and resistance levels. However, the current move into the $500–$505 resistance zone is showing clear signs of momentum exhaustion, as price stalls and volume fades.

💎The strong resistance area between $500 and $505 has rejected price multiple times, and this recent rejection aligns with both the channel resistance and a bearish momentum divergence in volume. Unless #BCHUSD can break and hold above this zone, bulls are fighting a losing battle.

💎The invalidation of the bearish setup lies above $555. Only a confirmed breakout and sustained hold above this level would negate the current bearish structure and open room for a larger bullish expansion. Until then, the risk of a deeper retracement is very real.

💎Currently trading around $490, #BCH looks vulnerable to a drop toward the moderate support zone near $393, with the strong demand zone between $335 and $340 being the high-probability area for a smart-money reaccumulation—if the market flushes weak hands first. This zone also lines up with previous high-volume nodes on the VRVP.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

BCH/USDT Robbery Blueprint | Bullish Breakout Swing Trade Setup🚨 BCH/USDT Robbery Blueprint: The "Breakout Bandits" Bullish Heist Plan! 🚨

(Thief Trading Style – Swing Trade Setup)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

We're about to pull off a high-stakes breakout heist on the BCH/USDT “BitcoinCash vs Tether” crypto market using the legendary 🔥Thief Trading Style🔥 — powered by technical + fundamental recon.

🎯 Mission Objective: Long Entry

"The vault is cracking open... our move starts above the 455.00 MA breakout level. Set your traps smart!"

✅ Buy Stop: Above MA @ 455.00 – The breakout point to initiate the heist.

✅ Buy Limit: Look for pullbacks on 15m or 30m swings for a sneaky entry at key levels.

📌 Set an alarm – don’t blink or you’ll miss the breach!

🛑 Escape Plan – Stop Loss

🔊 Yo crew, hear this:

If you're rolling with a buy stop, don’t drop your stop loss too early – wait till we’re inside!

📍 Ideal SL @ 425.00 on 4H swing lows — keep it smart, based on risk + lot sizing.

You’re the captain of this getaway — protect the loot!

🏴☠️ Target Zone

💰Profit Point: 500.00

(or escape earlier if heat increases 🔥)

Get out before the cops (bearish robbers) regroup!

📊 Heist Intelligence:

Market’s flashing bullish vibes, driven by:

🧠 Fundamentals | 📈 Macros | 🧾 COT Report | 🔗 On-chain Data | 🌀 Sentiment | 🔄 Intermarket Forces

👉 Check our bi0 link for the full briefcase of intel 🔍🧠

⚠️ Trading Alert – News & Volatility Risk

📢 Avoid entries during high-impact news

🔒 Use trailing SLs to protect profits + survive crossfire

💖 Show love to the crew! 💥 Hit that Boost Button 💥

Support our robbery squad – grow stronger, smarter, richer!

Trade like a thief. Rob the markets daily. 🎯💪🏆🚀💸

I'll be back soon with another crypto vault raid – stay tuned, legends! 🐱👤🤑🤩

BCH Faces Resistance at $500.0 Amid Bearish SignalsBitcoin Cash rose to $500.0, a resistance zone backed by the June 19 high. Stochastic reads 85.0, indicating short-term overpricing.

The 4-hour chart shows a possible double top pattern, suggesting consolidation. If BCH stays below $500.8, it could target $494.8 and, if selling continues, drop to $480.9.

Bitcoin Cash, Anomaly or Predictive Signal?Some people can say that Bitcoin Cash right now is simply an anomaly, nothing to see here. But a closer look reveals nothing abnormal, more likely a very strong predictive signal that supports what we saw happening with the COIN stock and what was predicted recently to happen with ETHUSDT (Ethereum), that is, a very strong bullish breakout is the next main major market move.

Good morning my fellow Cryptocurrency trader, I hope this day finds you well.

How are you feeling?

Introduction —The market is one

In isolation, the market is tricky and hard to predict. Within a bigger context, we can easily predict what will happen next. Just look at Bitcoin Cash, it shows exactly what will happen because it has been being in perfect syntony with the rest of the market.

Many pairs are consolidating or retracing. My view is that a bullish move comes next.

Let's see how Bitcoin Cash has been behaving lately and compare this to the rest of the market. The fact that it is bullish now predicts that also the other pairs will be bullish because they are moving in the exact same way.

Price action —Past history

A crash ends in early August 2024. By late 2024 the action goes bullish. November 2024 marks the start of a month long advance that ends December 2024. This is true for most of the altcoins market.

The December 2024 peak leads to a correction with the main low happening 3-February. Another low and market bottom happens 7-April 2025. From this point on, we have a recovery and after a high in late May, the market goes into retrace.

Present day

This retrace is where we are today for most of the pairs. 100% of these are trading within a higher low compared to 7-April. Here BCHUSDT ended its retrace and moved ahead of the pack to hit a higher high compared to May. It also produced the highest price since January 2025.

The future

This is not an anomaly. Bitcoin Cash's price action simply reveals what is coming to the rest of the market. As it moved in perfect synchrony with other projects for months or even years, it will continue to do the same. The fact that it is trading higher now, means the other pairs will follow, in fact, some other pairs are already there; a bullish continuation.

Soon everything will grow.

Thank you for reading.

Namaste.

Bitcoin Cash Rebounds from $456 as RSI Shows Bullish DivergenceFenzoFx—Bitcoin Cash swept liquidity below $456.0 during NY midnight and is now rising around $464.0. RSI 14 signals bullish divergence, suggesting growing momentum. If BCH holds above $456.2, it could target $472.0 and potentially $481.2.

The bullish outlook is invalidated if BCH stabilizes below $456.0.

Bitcoin Cash BCH price analysisMore than 3 months have passed since the publication of the previous idea for #BCH, and the price itself has shown an increase of +40%

◆ Slowly but surely growing

◆ Does not react to the price fall CRYPTOCAP:BTC (for those who don't know, #BCH is the first CRYPTOCAP:BTC fork and probably the only one that survived. Then there were 8-10 more of them in 2017-2018... but hey...)

◆ It has been moving in its own direction for more than a year, when OKX:BCHUSDT is cheaper than $300, it is actively bought back by someone.

We have slightly revised the growth target for #BitcoinCash, but why not consider this asset as a long-term investment from $350-400 to $900 and $1250

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Bitcoin Cash Nears $485—Will BCH Hold Its Gains? FenzoFx—Bitcoin Cash remains bullish, nearing the previous monthly high at $485.0, though overbought conditions signal possible consolidation.

BCH/USD may stabilize around $431.0 before resuming its uptrend toward $485.0. A break above this level could pave the way for $568.0.

The bullish outlook holds as long as BCH stays above $349.0.

Bitcoin Cash Weekly Update, Moving Averages & Bullish PotentialI already looked at Bitcoin Cash recently, this time I want to see how the moving averages are doing here to compare with the other Crypto-projects. Good news for one pair is good news for other projects as well specially when they are in the same category. Bitcoin Cash is one of the big projects.

Here we can see BCHUSDT trading weekly above EMA34, EMA89 and MA200, while rising.

Resistance was found at $453, a fib. extension level. Once this level is broken as resistance you can expect a swift advance toward $680. It will be nice and easy. This is the last barrier and current price action is kind of mix.

It is good because this week trades at the highest since November 2024 coming from a low. It is bad because it is lower compared to 19-May on the wick but the week is yet to close.

A weekly close above $420 is highly desirable and favors the bulls, anything lower and we continue with a mixed situation. Make no mistake, the situation is mixed only short-term. The chart shows a clear bullish bias and there will be additional growth in the coming weeks and months. Only the short-term is questionable.

Bitcoin Cash, Bitcoin and the entire Cryptocurrency market is set to grow.

Thanks a lot for your continued support.

Namaste.

Bitcoin Cash Early Recovery & Bullish ContinuationToday's candle says it all. Bitcoin Cash moved to hit a low of $397, today, and the same session now trades at $449, the highest price since 23-May which was the date that produced the highest price since January 2025. This is an early recovery signal.

This signal is good and great but it needs one final bit to be confirmed, and that is a continuation tomorrow. The week is about to end and the close is what determines the next move. If the action closes above the 23-May high, $462, then ultra-bullish confirmed. If the session closes below then there is still room for some more shakeouts, retraces and corrections. But the early recovery signal is in. What one does, the rest follows.

Now, not all pairs will move in the same way. Some will continue lower, retrace, while some others produce an early recovery and move ahead.

Today's session is just too strong, we can easily say that Bitcoin Cash is ready to resume its bullish wave of growth. $684 next target, followed by additional growth.

Thanks a lot for your continued support.

Namaste.

BCH/USD Consolidates Eying $461.9FenzoFx—BCH (Bitcoin Cash) paused its uptrend near $448.1, a low-volume zone, suggesting the rally may resume after consolidation.

Technical indicators show overbought conditions, increasing the likelihood of a short-term dip. BCH/USD may consolidate near $430.0 before aiming for the next target at $461.0.

Everything Bitcoin Cash Points To a New ATH; $2,600 or $4,150?Bitcoin Cash is bullish, ready to grow within the bullish zone. There is zero doubt. I think it will be hard to know if the peak will happen around $2,600 or $4,150. There is a huge difference.

Knowing how erratic BCH has been in the past, we have to go with the second higher target; what do you think?

It is hard to say but we have two targets mainly for late 2025. There is no doubt that we will get a new all-time high we just don't know how high.

I will go with the second one just in case. Say this bull market top for Bitcoin Cash will reach somewhere around $4,000. Can be more or less.

You can leave a comment with your number.

How far up do you think Bitcoin Cash will go?

And remember, the bullish bias is already confirmed. Everything points up. The chart, the indicators, the patterns, the signals, the overall market, everything... Thank you for your continued support.

If you enjoy the content make sure to follow.

Namaste.

Bitcoin Cash, The Map! Technical Analysis GeniusEvery time I look at the chart I consider the possibilities of a bear market. You've seen me bullish, you know I am bullish and I share the signals, but I always stay open to being wrong so I keep on looking to see if I can find something that I might be missing.

To be honest, if the signals were there I wouldn't be able to see them, I am too hypnotized by hundreds of charts hitting bottom and recovering from this bottom to think that a bear market is just starting now. Bear markets tend to start from a major wave high or new All-Time High.

Here we have Bitcoin Cash, see May 2021.

The ATH, the top, leads to a strong bear market. Notice that a bear market does not happen from bottom prices but from peak prices; obviously duh!

Ok, ok... My job is to clear all doubts for you but since you are reading this and you are my follower, you already know what is happening and we agree.

The zone that worked as resistance in late 2023, worked as support in April 2025, last month.

There was a bottom in November 2022. From the bottom we grow.

This bottom signaled the start of the new bull market.

The low in April is a long-term higher low. From this low we will experience the latter part of this long-term growth period, but it continues.

The incoming bullish wave will produce a new All-Time High. This ATH will be followed by a bear market. The bear market will end in a long-term higher low. This higher low we will call a bottom, the bottom of that bearish cycle and from this bottom a new wave of growth and so on. It keeps on happening long-term.

This is good for today.

Enjoy the chart for the All-Time High targets.

Thank you for reading.

Namaste.

Bitcoin Cash Short-Term: Trading Above Support And...Ever since 7-April, which marks the correction bottom and trend reversal, the maximum we have is three consecutive days closing red. This is great news.

Currently BCHUSDT closed the last three days red. This is the fourth day.

1) It can happen that this day also closes red, this puts pressure on tomorrow being green based on past action.

2) It can happen that todays ends up closing green and the market starts to turn.

This is not only true for this period but also other periods. Whenever Bitcoin Cash is rising, long sequences of bearish days are rare to come by.

If the market starts to turn, the current down period will result in nothing more than a very short stop with minimum retrace before additional growth. This is a transition period. The whales move billions of dollars and the algorithms need to be recalibrated, "reprogrammed," after just a few weeks.

Each time a set of Altcoins move forward for several weeks, there is a small pause, the programs are updated, the money is positioned and a new set of Altcoins will grow. The previous set can continue growing but the top performers tend to change. You will see this happening week after week after week throughout the entire bull market.

The trick to achieve high profits is to forget about catching the next big wave. Choose your pair and hold, if you look closely, it has been growing day after day after day. When you try to catch the next wave, it is always too late, but everything is growing slowly, we are soon to be one level up marketwide. I predicted 2-3 levels up by the end of the month. Watch!

Bitcoin Cash already produced more than 70% growth since the 7-April bottom. It will continue rising long-term, this is only the start.

Diversification can be a good strategy if you want to catch those moving up strong. But it is better to focus on strategy and sure success rather than excitement and perceived high gains. The market is growing anyway and it is not going away.

Do it right and you will earn more mid-, short- and long-term.

Namaste.

Mid-term uptrend starts: 333.5-348.2 or higher

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(BCHUSDT 1D chart)

The M-Signal indicators on the 1M, 1W, and 1D charts are showing an upward trend in a convergent state.

Accordingly, if the price is maintained above 333.5-348.2, it is expected to continue the uptrend in the mid- to long-term.

If the uptrend continues,

1st: 473.4-480.4

2nd: 590.6

You should respond depending on whether there is support near the 1st and 2nd above.

If it falls below 333.5, you should check if it is supported around 294.6.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

Bitcoin Cash, 200% In 3 WeeksThis is my idea, Bitcoin Cash will grow some 100-200% within the next 2-3 weeks, what do you think?

Sounds-looks possible?

It would have to be a very strong rise but I think it is possible maybe a bit longer but for higher prices.

The first target here for a long-term higher high and the higher in years sits at $993. The next target is $1,439. The All-Time High is $1,650 and we know there will be a new All-Time High in 2025.

So maybe 200% in two weeks is too much for Bitcoin Cash because it is too big, but this based only on left brain logical thinking. Bitcoin Cash can grow 200% in the coming weeks. 2-3 weeks. It can happen fast and then after a strong retrace additional but long-term growth. Makes sense?

It can happen. Cryptocurrency is wild and while it has been slow for years that's only because these were the years of slow. When it goes fast it is the time of being fast and all can happen in a flash. By the time we try to act or react it is already too late and the action has gone off the chart.

It is a guess, a prediction. I don't know if it will grow 200%, 300% or 500% but I know for certain it will be going up.

The consolidation period is over. This week is the fifth week since the correction low.

The market is bullish now and the next advance will produce the highest prices since November 2021.

It will be easy for Bitcoin Cash to grow by 200%. A new All-Time High will be very interesting, it's been so long.

Are you ready for what the market is preparing?

I hope you are.

Namaste.