Bitcoin Aligns with the 2017 Cycle ModelThere’s growing speculation that the current Bitcoin cycle mirrors the market behavior seen in 2017.

Intrigued by this, I conducted my own analysis. I overlaid the 2014–2017 cycle pattern onto the current chart for comparison.

The results?

A striking resemblance in both the overall shape and the distinct correction and impulse phases.

It seems history may not repeat itself exactly, but it certainly rhymes. 📊

Bitcoinforecast

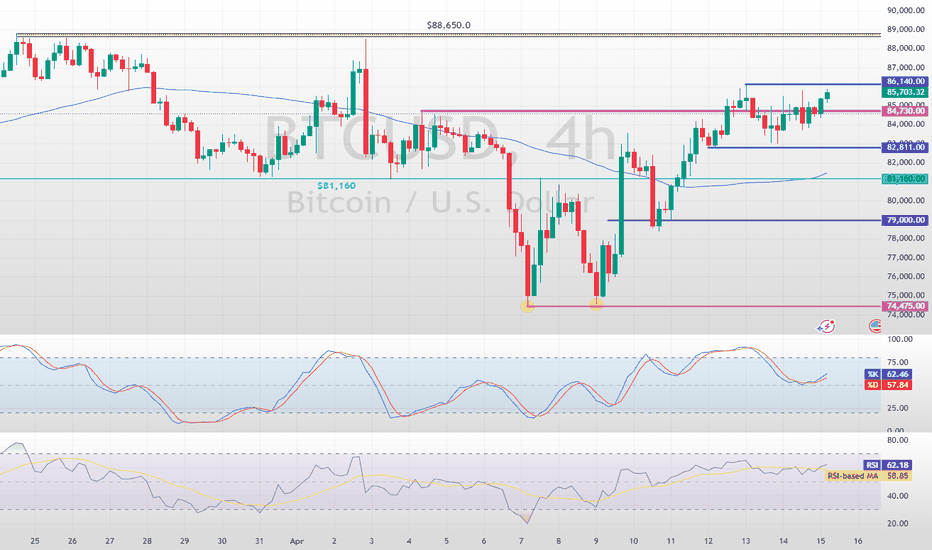

BTC/USD Rallies Above $82,140FenzoFx—Bitcoin has surged past $82,140 resistance and is now trading near $86,800, correcting 1.0% of its recent gains.

The bullish trend persists above the 50-period simple moving average, with immediate support at $86,140 offering a potential entry point for buyers. If this level holds, the uptrend could target $89,000.

Conversely, a dip below $86,140 might push prices toward $84,000 or $82,811.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at FenzoFx Decentralized Forex Broker

The Black Swan Method- Making TA as a trader is like reading a magical ball but some major unpredictable events are out of control.

- i usually accurate most of the time but i should be a fool to think i am always right, it's impossible to make TA in that markets conditions.

- So this post is not to make some kind of predictions but to warn peoples on what's going on right now.

- i will try to explain very basically the situation (with my bad english skills, so forgive me if i make some mistakes) :

1/ the first attack was based on Luna and UST, some entities started to short UST/Luna with some billions $, FTX and SBF surely did it. Luna tried to save the situation with their BTC reserve but it was effortless. they lost all. (Luna have never been hacked, important to specify this )

2/ the fail of UST was the first step to create a snowball effect.

3/ 3AC, Celsius, Voyager, and much more were all involved in Luna/UST and Anchor Protocol witch was giving 18% returns on UST. They used customers funds in UST and staked, when the situation started to turn really bad for Luna, they tried to save the situation trading customers funds and they failed. (any of those companies have been hacked, important to specify this )

4/ FTX used customers funds and started to short their own products, FTT, SOL, SRM, etc , Binance saw the move and twitted that they will drop all their FTT.

FTX locked their customers wallets. FTX used 8B$ Customers funds to short markets. they are still right now trying to short USDT on Binance. (FTX have never been hacked, important to specify this).

5/ The snow ball started to be transformed in an avalanche. The damage here is huge. An exchange implosion of this magnitude is a gift to bitcoin haters all over the world.

6/ Sam bankman-fried was a Trojan horse in the crypto space, surely backed by banks and govs, a kind of worm witch have to be eradicated.

7/ Soon bankers will tell you, " u saw what happened with your exchanges ??!!, better use CDBC and stick with Banks!! ", this is their ultimate goal.

- i pray for everyone who got caught up in this mess and lost money with those bad actors.

- i hope you take care of yourself and continue to be a part of this journey.

- i hope it doesn't turn you off of crypto witch are here to stay in the future.

- BTC is resilient. No matter the magnitude of the earthquake.

- Buy BTC

- Store in Ledger, Trezor or Paper Wallet.

- Hodl and come back later.

Have faith in what you believe and fight. Thanks for reading!

PS : Not sure this post will get me banned or censored, but at this point the freedom of speech is an human right.

The Road to The Mooni like to make some graphs like that when peoples are in Dispair mode.

- i used a modified ADX indicator with a Monthly Timeframe ( thanks to the creator by the way )

- Look at the Mountains and tell me when in past bullruns we stopped at 100 ? - Never -

- The Highest Point is 160+

That said my advice for now is : " You don't really care if TheKing will back to 20k, what you have to care is the Highest point TheKing will reach! "

- Don't Think it's the end of this bullrun

- Don't Listen Fuders

- Use indicators for the Long Term

- Believe in Trends and cycles movements

- Believe in the future of cryptos

- Believe in TheKing because Theking cannot die.

Happy Tr4Ding !

Bitcoin are you Worried ?Everything is in chart.

- Like i said many times, more you look from far, more it's easy to predict the future.

- This Monthly Chart combinated with indicators show you how BTC moved in 2016-2017 BullRun so keep eyes open and you will find the way for 2020-2021.

- We cannot compare a Bullrun from 400$ to 20,000$ with a Bullrun From 4000$ to 3XX,XXX+$, the chart will be exponential. We are now playing with big numbers.

- imo right now we are in fake bear market stage, this stage happened also in 2016-2017 pre-bullrun ( but Numbers were smallers...), whales are just trying to create fear and remove retails investors.

- Actual stage could be a Consolidation Phase, if Whales see there's a lack of interest, they will push BTC up, or we could get a quick fast Trap to 20,000$ if Whales feel Retails not fear enough (Not sell their BTC).

- 100 000$ Target is still very preservative, past this stage it will be the FOMO Stage to go Higher!

TheKing is dead??? Long live TheKing!! :D

Happy Tr4Ding !

Bitcoin Bulls Pave Path to $100,000FenzoFx—Bitcoin is trading bullishly, staying above the 50-period SMA and the 81,160 support. Currently, it hovers around $85,650, testing resistance.

As long as prices hold above 81,160, the next target could be $88,650. However, if bears push below $82,811, consolidation may occur, with support at 81,160.

Trade BTC/USD swap-free, effortlessly. >>> FenzoFx Decentralized Forex Broker

BITCOIN Trending Higher - Can Bulls Maintain Momentum?COINBASE:BTCUSD is trading within a well-defined ascending channel, with price action consistently respecting both the upper and lower boundaries. The recent bullish momentum indicates that buyers are in control, suggesting a potential continuation toward higher levels.

The price has broken above a key resistance zone and successfully retested it as support, confirming the bullish structure. This retest strengthens the case for further upside, with the next target aligning with the upper boundary of the channel near $91,000.

As long as the price remains above this newly established support, the bullish outlook stays intact. However, if the price fails to hold above this zone, a deeper pullback toward the midline or the lower boundary of the channel could come into play.

Remember, always confirm your setups and trade with solid risk management.

Best of luck!

BTC → Bitcoin Retrace to $69,500? Or Bounce to $150,000?The short version, the probability that Bitcoin tests the breakout price around $69,500 is very high. That's simply the nature of breakouts; bulls take profits (sell orders) until the previous high is reached, at which point the bulls start buying again, and the bears take their profits (buy orders), driving the market up for another leg.

The question is, what is our next move as traders? Or even Bitcoin investors?

How do we trade this? 🤔

Let's zoom out to the Monthly chart. Bitcoin is resting on the 9EMA, a support area we've closed above it since September of 2023. Our current context is we've broken out of the 2021 cycle high of $69,500 and reached a new high just shy of $110,000. It's clear we're in pullback mode right now, so far-reaching down to $78,000.

Fundamentally, there aren't many catalysts for bullish activity. Bulls are simply taking profit at the first 6-figure Bitcoin price, which is both a psychological and technical price for selling. Monetary policy is still in a state of qualitative tightening, inflation has been slowly rising since September 2024, from 2.4% to 3%. Not a dramatic move, which certainly isn't helping Bitcoin move to the upside. Bitcoin seems to respond more to monetary policy than inflation rates and while the rates have steadily climbed, it's not enough to shock the market, while monetary policy has largely stayed the same.

Technical analysis shows TOTAL, TOTAL2, and TOTAL3 crypto market cap charts all were rejected at key resistance areas in early December. Bitcoin broke the 2021 right shoulder around $46,000 to $73,000, then had a measured move up to $109,000, about a 55% move each, give or take. We're simply in a state where we've reached a key resistance level after a breakout while the market as a whole is in a state of uncertainty. I believe that uncertainty will lead to a capitulation down to the high $ 60,000s, even if it's a quick wick. This would likely lead to a $1,500 ETH, $1.50 XRP, it may look ugly. But take a look at past cycles; a 30-40% pullback for Bitcoin is just another Thursday in the crypto market. The alts can pull back as much as 50%-60%.

I think we wait for the buy signal. Look for a pullback to the breakout area at $69,500, and wait for the market to tell us that we found the buy zone with a strong candle close on or near its high on the Daily chart, likely somewhere around $75,000. Then I believe $150,000 is the area for this cycle high based on the Lifetime Resistance and measured move target. The measured move shows a 57% move up after the breakout; if we take that 57% move up and stack it on the mid-price of the current trading range at $91,000, that takes us to right around $150,000. Anything beyond that is a bonus. I think from there, it makes a second attempt to breach the high, followed by our 12-18 month bear market as shown in the chart.

💡 Trade Idea 💡

Long Entry: $75,000

🟥 Stop Loss: $55,000

✅ Take Profit #1: $105,000

✅ Take Profit #2: $135,000

⚖️ Risk/Reward Ratio: 1:3

🔑 Key Takeaways 🔑

1. Breakout above 2021 Cycle High $69,500

2. Psychological and technical high of $100,000 reached

3. Pullback phase has been in motion since December, breakout zone is the buy target

4. Wait for a two-legged pullback toward the Monthly 30EMA (breakout zone), look for strong buy signal, large bull candle closing on or near its high.

5. RSI is near 64.00 and below the Moving Average. Wait for contact and a drop toward 60.00 in concurrence with the price action to enter.

💰 Trading Tip 💰

It's reasonable to take half profits at the first resistance target in a long trade, or the first support target in a short trade. Using a 1:1 Risk/Reward Ratio for your first target, you can move your stop loss up to your entry price, locking in profits. This allows you to watch the rest of the trade execute without worry of losing money. This helps improve trading psychology and the equity in your account.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology

Bitcoin Goes "Red Days Again" since "Relief Rally" Has Been NullBitcoin's price has experienced significant fluctuations over last "Intl Women's Day" weekend, reflecting the volatile nature of the cryptocurrency market. To understand these movements, it's essential to consider both the broader economic context and specific events that have influenced investor sentiment.

Background: Economic and Political Factors

In recent weeks, Bitcoin's price has been heavily influenced by economic indicators and political announcements. The U.S. Federal Reserve's stance on interest rates, particularly comments from Jerome Powell, has been closely watched by investors.

Political factors have also played a crucial role. For instance, Donald Trump's re-election and his proposals related to cryptocurrency, including the creation of a "Strategic Bitcoin Reserve," have contributed to market optimism and price increases. However, these developments also introduce uncertainty, as regulatory environments and geopolitical tensions can quickly shift investor confidence.

Recent Price Movements

As of the last weekend, Bitcoin's price has shown a decline of nearly 5%. This decrease is part of a larger trend where Bitcoin's price has struggled to maintain consistent gains, often experiencing sharp drops followed by rebounds. For example, on March 9, 2025, Bitcoin's price was noted to be choppy, trading around $81,500.

Bitcoin's price initially dropped but then rebounded slightly. This rebound was likely driven by renewed optimism in the altcoin market and strategic purchases by entities like Metaplanet, which has been actively buying Bitcoin. However, the overall sentiment remains cautious due to ongoing economic uncertainties and the potential for further interest rate hikes.

Key Events Influencing Price

Mt. Gox Bitcoin Movement: The recent transfer of over $1 billion worth of Bitcoin from Mt. Gox to an unmarked address has raised concerns about potential market impact. Such large movements can lead to increased volatility as investors speculate about the intentions behind these transactions.

Regulatory and ETF Developments: The ongoing efforts to establish a U.S. spot Bitcoin ETF have seen mixed results, with periods of significant outflows followed by brief moments of positive inflows. These developments can influence investor confidence and, consequently, Bitcoin's price.

Global Economic Conditions: Trade tensions and economic stimulus measures, particularly those involving China, have also played a role in shaping Bitcoin's price. As investors seek safe-haven assets, Bitcoin's performance relative to traditional assets like gold can impact its value.

Technical challenge

The fluctuations in Bitcoin's price over the last weekend reflect the complex interplay of economic, political, and market-specific factors. As investors continue to navigate these uncertainties, Bitcoin's price is likely to remain volatile. The influence of major economic data releases, political announcements, and strategic investments will continue to shape the cryptocurrency's trajectory in the coming days and weeks.

The main technical 1-day resolution graph indicates that Bitcoin Goes "Red Days Again" since recent "relief rally" has been Null.

Ahead of upcoing week our "super-duper" @PandorraResearch Team is Bearishly calling to numbers between $30 000 to $50 000 per Bitcoin, that is correspond to major current support of 200-week SMA.

Conclusion

In summary, Bitcoin's price movements are a testament to the dynamic and speculative nature of the cryptocurrency market, where sentiment can shift rapidly based on a wide array of factors. As the market continues to evolve, understanding these influences will be crucial for investors seeking to navigate the volatile landscape of Bitcoin and other cryptocurrencies.

--

Best 'Jojoba oil' wishes,

@PandorraResearch Team 😎

BITCOIN Halving cycles and Pump %Monthly #Bitcoin chart with Halving dates

what is notable is how much the % increase in PA has been dropping each halving.

2012 Halving 10K% rise after

2016 Halving 3,5K% rise after

2020 Halving 700 % rise after

Projected PA below would also be 700%

BUT, Bitcoin is far more public now and the Halving Pumps will be talked about aLot. Could the Next halving actually be pumped a Lot earlier than previous dates

May well be a great idea to grab your NOW..because the price WILL go mental as the world sees the TradFi recession also.

2024 is going to be an interesting year to say the least

Ethereum — 2025. The Lord Giveth and Taketh Away (Caution! 18+)Donald Trump's recent policies and statements have generated significant negative sentiment towards Ethereum and the broader cryptocurrency market. As he resumes the presidency, his administration's approach to cryptocurrencies is expected to be more regulatory and cautious, which could impact Ethereum investors.

Historical Context of Trump's Views on Cryptocurrency

Trump has a mixed history with cryptocurrencies, as we mentioned in earlier published ideas. Initially, he labeled them a "scam", "based on thin air" as well as "threat to the U.S. dollar" and expressed skepticism about their value, stating that they are not real money and are highly volatile. However, in recent months, he has shifted his stance somewhat, reportedly owning between $1 million and $5 million in Ethereum as of August 2024. Despite this personal investment, his public comments continue to reflect a critical view of the crypto market.

Impact of Recent Tariffs on Ethereum

The most immediate cause of concern for Ethereum investors has been Trump's announcement of new tariffs on imports from Canada, Mexico, and China. This decision triggered a significant sell-off in the cryptocurrency market, with Ethereum experiencing a drastic price drop of over 26% in just one day. The overall cryptocurrency market lost nearly half a trillion dollars in value following these announcements, highlighting the interconnectedness of global trade policies and digital asset valuations.

The tariffs have led to increased uncertainty among investors, prompting many to liquidate their positions in riskier assets like Ethereum. This reaction is indicative of a broader trend where geopolitical tensions and economic policies directly influence cryptocurrency prices. Analysts noted that such trade policies could lead to inflationary pressures and a stronger dollar, making cryptocurrencies less attractive to international buyers.

Future Outlook for Ethereum Under Trump's Administration

Looking ahead, Trump's administration is likely to focus on stricter regulations for cryptocurrencies. This could manifest in enhanced oversight that may slow down the adoption of Ethereum by businesses and individuals. However, there is also potential for increased legitimacy if clear regulations are established.

Moreover, Trump's interest in Central Bank Digital Currencies (CBDCs) might further complicate the landscape for Ethereum. As the U.S. explores its digital dollar initiative, Ethereum's decentralized finance (DeFi) ecosystem could face stiff competition from state-backed digital currencies.

Technical challenge

The main technical graph for Ethereum BITSTAMP:ETHUSD indicates on Bearish trend in development, since mid-December 2024, with acceleration occurred a day before Mr. Trump entered the White House.

Key support considered as 100-week SMA (near $2550 in this time) and $2200 flat multi bottom, that helps so far; otherwise (in case of breakthrough) we believe it could lead the Ethereum price much lower, as it described on the chart.

Conclusion

In summary, while Trump’s personal investment in Ethereum marks a notable shift from his previous criticisms, his administration's policies—especially regarding tariffs—have created a challenging environment for Ethereum investors. The combination of regulatory uncertainty and macroeconomic factors will likely continue to influence Ethereum's market performance in the near future.

Bitcoin accurate bottom and top zones

BINANCE:BTCUSDT

This is my market mood indicator. Accurate determine the bottoms and top of cycles.

Based on this analysis on BLX chart and Monthly timeframe we can find something interesting

- Marked Monthly green zones.

- We never seen white color disbeliefe zones.

- Previews 3 times when we saw BLUE color it was a bottom (I was impressed how accurate it play out!!!)

- Now it looks like 2018-2019 period (green box-blue-green)

- So now no euphoria on market. Need to see yellow, orange and top will be again at extreme red

- Hard to say about timing but most likely we will test trendLine at 35-36 (maybe with fake out to 41)

- Then we will see yellow and orange color on indicator and drop to covid trendLines again 21-19 and continue move forward till 2025 March to extreme RED zones and end of cycle.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Bitcoin road to 33 000 BITSTAMP:BTCUSD

✅Before we start to discuss, I would be glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it.

Thank you.

Possible Targets and explanation idea

➡️ Everything going according by my global 2023 plan for BTC what i’ve posted here in December 2022

➡️ We got uptrend line since covid dump

➡️ We retested downtrend line with FTX crash

➡️ Now we can see impulse-correction-impulse. Second impulse to test uptrend line and I think first rejection in April

➡️ All FOMC rate already included in price. Recession is only one things what not included, so we can see dump

➡️ After rejection at trend line and full fill of 3 month FVG we can drop by end of summer to 20K to find a support

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Bitcoin and Wyckoff Accumulation D1BINANCE:BTCUSDT

Lets check classic Wyckoff Accumulation phase since drop In June. This is D1 Timeframe and if Historically October is green month with 15-60% moves up. We have an all chances break resistance and hit even 28-30K.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

Bitcoin and green November? BINANCE:BTCUSDT

✅Before we start to discuss, I would be glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it.

Thank you.

Bitcoin made retested downtrend line on D1. According to my "Take profit" indicator we bounced at real value price in June. Usually when we touch this line we going to test take profit line on D1 timeframe. Marked this zone on a chart. Also my indicator "Direction" showed signal to buy, so now im waiting Bitcoin around 25-29K in this range and signals to take profit on this both indicators and others.

Possible Targets

➡️After retest trend line and fundamental value line - 25000 - 29000

➡️When we touch take profit line in this ill looking to open local short

➡️Watching on FOMC rate at the beginning November and continuation local uptrend.

In December Ill expect test 20K again

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

It's the king's turn, and it wants market cap dominance. Bitcoin is poised to regain market capitalization dominance. This usually means that (the majority of) altcoins will initially start losing in their sats value.

It is now a well-known phenomenon that venture capital will first pour into Bitcoin. Once people start skimming their profits, it often flows to the other top 10 coins, then the midcap coins and finally the low caps after this. That is, until the cycle is complete again and people move their capital from the low caps back to Bitcoin or eventually to fiat.

I have unfolded the Tom DeMark Sequential on this, and it flashes a 9 and even a 13, which usually means there will be a course change.

If there are no more surprises, bitcoin has finally capitulated

Mid August 2015: Bitcoin's price fell 14% in a period of just 30 minutes following a 'flash crash' on exchange Bitfinex yesterday night.

Let's hope CPI data tomorrow is more positive now that Russia is retreating and withdrawing. That'd be something.

If all else fails, revisit dotcom Amazon fractal and great depression facebook fractal.

BTC The State NowHere’s a quick market update with a timeline and trend analysis :

- As always, it’s as simple as checking the colors and trends in the graphic.

- We’re currently in a phase of solid consolidation.

- The bull run hasn’t started yet, but in time, BTC is expected to go parabolic, as it usually does.

- The current cycle is taking longer to play out.

- The differences between 2020 and 2024 corrections are clear. Back in 2020, BTC was still maturing, not widely accepted, and impacted by the Covid crisis.

- In 2023, BTC has gained more recognition with ETFs, attracted wealthy investors, and is evolving into a true store of value.

- For these reasons, TheKing may be retracing, but it’s doing so with power and resilience.

- Everyone wants a piece of the cake, which is why Bitcoin's price remains elevated.

Just HODL and you'll be rewarded in the long run.

Happy Tr4Ding

Will Bitcoin ever break above it's old trend line again ? The point of this chart is not to look at future peaks, although we will touch upon it. The point is to take a dive into the indicator called the BTC log regression {Rainbow Dark} that is based on the Fibonacci sequence and the possible transition to the lower band from the top band.

Bitcoins entire history has been on the upper band of this log and in the recent crash of this year it has broken below. It did break this upper band support once before it the covid crash of 2020 marked with the orange circle. Price action broke through but as we can see it quickly recovered and held as support into the eventual bull run. This sequence of events seems to have left us a couple of clues, being the first time there was a substantial breach of the bottom and the bull run not hitting the top. I think yes, it could telling us that Bitcoin is now transitioning {reset} to the lower part of the band and it's most likely could be the new trending range. To confirm this theory we need two touches, one on top and one on the bottom.

In my opinion the only questions that remains is which line will be touched first and what will be the path. I do believe the top of this lower band could be the top of Bitcoins next bull run and the bottom of could be the bear market, of course only time will tell. I do not believe we ever go to top of the band ever again and could possible be the new resistance point for future bull market tops.

Just purely on looking at this lower band and assuming that we have a new bull market that tops in March of 2025, price point is showing a possible of just over 200k top.

My speculation is bitcoin moves towards the top first and then touch the lower part of the band later next year at relatively the same price point as now which would mark a double bottom that ultimately sparks the new bull run. There is only one thing for sure, Bitcoin will surprise everyone.

Keys to look at is the stochastic RSI. this will show which way momentum is going.

This is not financial advice and should not be taken as such. it's an observation.

Thanks for looking and leave comments below.

Bitcoin standard in progress..This idea is more of a message than an investment speculation. And a reset of my previous ideas with shitcoins reminding me of where I was.

We need to learn from the past and put it behind us, looking to the future because our actions affect our future, not our past. Much has changed since my first experience with cryptocurrencies (early 18). Yes, it usually starts with cryptocurrencies, rarely bitcoin only. And when bitcoin only, few can resist the lure of shitcoiners, the potential profit. In short, I don't think a bitcoin maxis can grow without proof-of-work, without cutting through the jungle of scammers. But if the individual in question is a thoughtful creature and occasionally examines the arguments for/against, why yes/no, and is not lazy to verify the arguments in question, to read something, they will come to the inevitable conclusion, that's my opinion. My opinion is that we are very lucky that bitcoin was created, we have the hope of freedom, versus the inevitable inflationary, monetary and tax bullying, surveillance by the state. We are fortunate that it came into existence as it did - naturally, anonymously. That is unrepeatable in this day and age. That alone is a bulletproof foundation and a guarantee of my peaceful sleep. I could list dozens more. But I won't prolong it.

Thanks for bitcoin , for the hope of a better future.

Always and forever bullish , there is no ceiling. Dips are discounts, that's all. Volatility is a feature, not a flaw. Welcome volatility , learn to work with it. It's a game for the long term. Forget fiat profits, only increase the stack of bitcoins owned. Use HW wallets for your savings! Once the bull market hits, it's time to reward yourself, enjoy life, send some of that bitcoin back out into the world for some fine goods, services. Bitcoin is money that makes sense to save in. Simple.

Satoshi thank you!