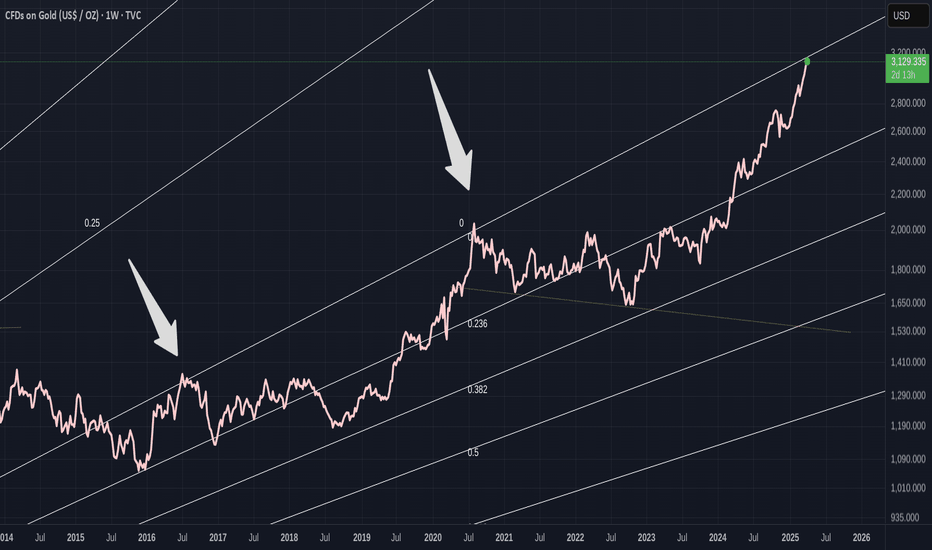

GOLD - on resistance- Could Bitcoin resume its Gains Over GoldAs you can see, GOLD has come to a point where it has been rejected twice previously.

And on each of the previous occasions, PA ended up back on the lower trend line., taking around 2 years to do so on each occasions

GOLD MOVES SO SLOW - mostly due to its HUGE market cap..... But thats another story

Has the recent rise of Gold come to a line of defeat ?

The Daily chart here shows how PA is stalling at this moment in time

Each push is getting Shorter. PA is tired.

PA is Getting OVERBOUGHT on many time frames. It needs a break

The thing is, Mr Trump will later today introduce the "liberation Tariffs"

The expectation is of FEAR as reprisals and reduced markets could cause issues in the USA , including reversing the Drop in inflation.

If the Tariffs backfire, the $ will Drop..and people will look to safe haves

Traditionally GOLD. Maybe Gold can break through its old nemesis of rejection.

But PA Is TIRED

BITCOIN has been under pressure recently, following posting a new ATH and this has taken a toll on the BTC XAUT trading pair while Gold has risen.

We can see how PA dropped and has in fact, fallen below the lower line of support.

But it needs to be understood is that RSI and MACD are now in very positive positions to make a push higher.

Gold is tired

In the Near Future, we may well see the tables turn in Bitcoins Favour again

But Me Trumps, today, May actually upset that idea.

We just have to wait and see how sentiment is towards Risk assets later today , after the announcement of these Tariffs.

But, in the Longer term, once the dust settles, I do see Bitcoin taking over again and continuing its rise to greatness.....

ENJOY

Time Will tell

Bitcoingold

The best investment since Nov 2021 - GOLD or BITCOIN ? - FACTSThe Main Chart is the chart from BITFINEX that trades Bitcoin to Gold DIRECTLY

I look to this often and find it a MUST See to compare the two assets.

This is Not done to try and make BTC like GOLD but that they are both investments with returns,

It is as simple as that

But which one has the higher return ?

I have taken the November 2021 Bitcoin ATH as the Datum point. a Worse case scenario for Bitcoin.

Bitcoin Directly to Gold.

As you can see on the main chart. If you had sold your Gold into Bitcoin and Just Held since Nov 2021, you are currently at a slight loss. Less ounces of Gold to one Bitcoin.

It is as simple as that. But PA has fallen from Above the buy price recently.

But to also mention, if you had bought Bitcoin with your Gold at the Bottom in Jan 2023, that is a 360% Rise in Value DIRECTLY OVER GOLD as opposed to the -75% Losses from ATH to Low.

Nothing else does that

Lets look at a comparison Via 100 USD investments into each asset

GOLD USD CFD

Let us say we invested 100 usd in Nov 2021 at the Bitcoin ATH that year.

Since then, there has been a 62.71 % increase in price; from your buy price, if you simply just held your investment.

This gives you 162.71 usd currently

PA had risen 12% from that date but then dropped 22% to the low. From the Low, PA has risen 89 % and if you had Traded your investment, selling high, buying Low, you would now have 211.68 usd currently

Now to Bitcoin - again, 100 usd invested at the ATH in Nov 2021

100 invested in Nov 2021 currently has a 24.68 % increase from Buy price. if you just HODL, off the 2021 ATH and so you would have 124.68 currently

From that ATH point, we saw a Loss as PA dropped 77.2% to the Low but then Rose up 596% from the Low.

If you traded , Depending on when you sold your bad 100 investment , the gains are different But lets say, you sold what was left of your 100 at the slight rise in PA in March 2022 - that was a loss of 28.5%, leaving you 71.5 usd

Wait till the Low in Jan 203 and then continue Buy Low, Sell high, you currently have 743 usd , having sold the top at 109K and waiting for the next Low

So, in summery, from 100 usd investment in Nov 2021 BTC ATH

GOLD

HODL 162.71 - Traded 211.68

BITCOIN

HODL 124.68 - Traded 743.34

The ONLY REAL Loss currently is with the BTC GOLD pair, where BTC is -20% currently off Buy price, having fallen from HIGHER than Buy price recently,.

However, PA is on the lower trend line, as you can see in the chart, and the expectation is for a Strong Bounce over the next few weeks..This will set BTC off towards that magical 50 ounces of Gold per Bitcoin.

But it has to be said, the journey if you held Bitcoin having sold out from Gold has been painful.

Tthat pain is about to end, very possibly forever.

Trading is not for everyone and Hitting the perfect High or Low point is almost impossible.

But the Gains are there in Bitcoin against Gold if you even do basic trading.

And, inmy opinion, if you have gold....SERIOUSLY think abot Bitcoin now.

Gold is OVERBOUGHT on many timeframes....

Bitcoin is not...................

BTGUSD Major long-term bullish break-out!Bitcoin Gold (BTGUSD) broke today above the Lower Highs trend-line that started after the Cycle's High on May 2021. That is a major bullish break-out and the last Bear Cycle Resistance standing in the way is the 1W MA200 (orange trend-line), which even though it broke in mid October 2022, the 1W candle failed (emphatically) to stay and close above it.

Secondary bullish break-out signal is given by the 1W RSI which broke above the 53.10 Resistance, a level holding since November 2021, which has 2 clear rejections on it. The RSI is about to get overbought so failure to close above the 1W MA200 could deliver a pull-back for the final 1W MA50 (blue trend-line) test as Support. A 1W candle close above the 1W MA200 however, will be a buy break-out signal towards the Target Zone within the 0.5 Fibonacci level and the March 22 2022 High (42.000 - 48.250). Our long-term target falls within that zone at 44.000, which is the high of the October 17 2022 1W candle.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin Gold BTG Price Targets after the FSB meetingThe Finance Stability Board said today that many stablecoins won`t meet the requirements stipulated in its recommendations for cryptocurrency asset regulation.

This could have have ripple effects in the entire crypto industry!

My price targets for Bitcoin Cash BCH are:

BTG/USDT short

Entry Range: $147 - 153

Price Target 1: $138

Price Target 2: $119

Price Target 3: $110

Stop Loss: $171

Inverted Head and Shoulders on Bitcoin Gold/BitcoinThis is an old fork of Bitcoin that i haven't heard much about in awhile but it used to be liked for being easier to mine however since 2019 hardly anyone remembers it and during this time of silence BTG has been forming a Huge In Your Face Visible on both the Weekly and Monthly Harmonic Inverted Head and Shoulders Pattern that if plays out will send it up to the 0.786 Fibonacci Retracement.

Bitcoin Gold Conquers Resistance (70%+ Target)For the past three months MA200 has been working as resistance for Bitcoin Gold (BTGBTC).

We can see multiple rejections at this level.

Today BTGBTC is growing above this resistance which makes it clear that soon we will see more.

We are mapping 70% for the next bullish jump.

Namaste.

BTGUSDT(Bitcoin Gold) Daily tf Range Updated till 28-07-22BTGUSDT(#BitcoinGold) Daily timeframe range. a mid heavy asset with decent price action. it held its new low and #spring test from their which is a surprise compare to the retail interest it got. it got a bearable range space which makes option for range traders , dont need to pull our hair out for insane amount and percentage of wicks. which makes it a bit safer than those p and d alt's.

BTGBINANCE:BTGUSDT

No clean entry yet, just some levels to keep an eye on.

General metrics are cooling off.

Fractured market, tiny depth amounts, volume is also not great, makes BTG a high risk.

Bitcoin Gold (BTG) - June 8hello?

Traders, welcome.

If you "follow", you can always get new information quickly.

Please also click "Like".

Have a good day.

-------------------------------------

(BTGUSDT 1W Chart)

You must climb at least 29.14 to get out of the bottom section.

If support is found above 29.14, it is expected to continue the upward trend from a mid- to long-term perspective.

(1D chart)

Since it is located in a new low, you should be cautious when trading as even if you switch to an uptrend, you can lose more if you don't break out of the bottom.

So, it's important to see support at 29.14.

Therefore, it is recommended to use the following information to check the flow.

(buy)

- After confirming the support in 21.33

(Stop Loss)

- When it falls below 18.42

(Sell)

- When receiving resistance near 29.14

- When resistance is received in the section 36.10-43.46

Since volume profile sections are formed around 59.03 and 83.70, I think that a sideways period is necessary to break through these sections.

------------------------------------------------------------ -----------------------------------------------------

** All indicators are lagging indicators.

Therefore, it is important to be aware that the indicator moves accordingly with the movement of price and volume.

However, for convenience, we are talking in reverse for the interpretation of the indicator.

** The MRHAB-T indicator used in the chart is an indicator of our channel that has not been released yet.

** The OBV indicator was re-created by applying a formula to the DepthHouse Trading indicator, an indicator disclosed by oh92. (Thanks for this.)

** Support or resistance is based on the closing price of the 1D chart.

** All descriptions are for reference only and do not guarantee a profit or loss in investment.

(Short-term Stop Loss can be said to be a point where profit and loss can be preserved or additional entry can be made through split trading. It is a short-term investment perspective.)

---------------------------------

Bitcoin Gold (BTG) formed big Gartley for upto 2095% huge pumpHi dear friends, hope you are well and welcome to the new trade setup of Bitcoin Gold (BTG)

On a monthly time frame, DCR has formed a big bullish Gartley pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

BTGUSDT - SETUPBTGUSDT price has shown a strong movement and hit the falling trendline which is now a test for the Bulls. If they successfully break that level we may see a strong upside with strong volume. Otherwise, just wait for a little retracement, and then one can take a long position. Watch the price action carefully.

Ethereum classic AND Bitcoingold BTG Hashrate (Tug of war)Tug of war between Ethereumclassic and bitcoingold BTG for ethereum hashrate.

As fundamentals of both cryptos are pointing for big shot.( short squeeze)

As all the technical analysis are pointing in Oversold category.

Ethereum miners are looking for switch to other cryptos as they cant ruin their big miners investments in ethereum.

HUGE HASHRATE SHIFT TO THESE TWO CRYPTOS ARE EXPECTED.

Bitcoin Gold (BTG) formed bullish Gartley for upto 24.5% rallyHi dear friends, hope you are well and welcome to the new trade setup of Bitcoin Gold (BTG) with BTC pair.

Recently, we had a nice trade of BTG:

Now on a 4-hr time frame, BTG has formed bullish Gartley pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

90% Mapped for Bitcoin GoldBitcoin Gold (BTGBTC) is breaking bullish today as it challenges EMA100.

Here I am mapping an easy 90% jump in the days and weeks to come.

There can be more than 90% of course.

This is not financial advice.

Below the red line it is wise to stop the trade at a loss.

(Always sell when prices GO UP!)

Namaste.

Bitcoin Gold (BTG) formed Gartley | A good long opportunityHi dear friends, hope you are well and welcome to the new trade setup of Bitcoin Gold (BTG) with BTC pair.

Previously I shared a long-term trade plan on BTG, which is still in play:

On a 4-hr time frame VIB has formed bullish Gartley pattern.

🆓Bitcoin Gold (BTG) Dec-27 #BTG $BTG

.

📈RED PLAN

♻️Condition : If 1-Day closes ABOVE 44$ zone

🔴Buy : 44

🔴Sell : 52 - 60 - 72

📈BLUE PLAN

♻️Condition : If 1-Day closes BELOW 44$ zone

🔵Sell : 44

🔵Buy : 40 - 36

❓Details

🚫Stoploss for Long : 10%

🚫Stoploss for Short : 5%

📈Red Arrow : Main Direction as RED PLAN

📉Blue Arrow : Back-Up Direction as BLUE PLAN

🟩Green zone : Support zone as BUY section

🟥Red zone : Resistance zone as SELL section

Bitcoin Gold (BTG) formed bullish Gartley for upto 182.5% rallyHi dear friends, hope you are well and welcome to the new trade setup of Bitcoin Gold (BTG)

On a long-term weekly time frame, BTG has formed a bullish Gartley pattern.