BTC Bitcoin Technical Analysis and Trade IdeaIn this video, we observe that Bitcoin has exhibited a bearish sentiment in recent times, as evidenced by the formation of lower lows and lower highs on the 4-hour chart. Presently, BTC is undergoing a retracement, approaching levels of previous resistance. Within the video, we delve into a prospective trading opportunity, taking into account essential factors such as prevailing market trends, price action and market structure.

It's crucial to emphasize that the video provides an analysis of these elements. However, it is essential to note that the content should not be interpreted as financial advice. Trading inherently involves substantial risks, and it is imperative to exercise prudent risk management strategies

Bitcoinidea

BTC Consolidation Continues at $26,000 - A Moment to PauseAs you may have noticed, BTC has been demonstrating a remarkable consolidation pattern, maintaining a steady value of around $26,000. This prolonged consolidation phase suggests a potential stabilization in the market, indicating a temporary equilibrium between buyers and sellers. Such periods can often serve as an opportune time for traders to reassess their strategies and make informed decisions.

Considering this situation, I would like to propose a momentary pause in active BTC trading. By stepping back and observing the market dynamics, you can gain valuable insights into the potential direction BTC may take in the near future. This pause will allow you to analyze the current market sentiment, evaluate any emerging trends, and make well-informed trading decisions based on a more comprehensive perspective.

While the decision to pause your trading activities ultimately rests with you, I believe it is crucial to consider the benefits of taking a momentary break during this consolidation phase. By doing so, you can minimize the potential risks associated with volatile market conditions and ensure you are well-prepared for any future opportunities that may arise.

I understand that trading is a dynamic and ever-evolving process, and it is essential to adapt to changing market conditions. Pausing your BTC trading now does not imply a long-term cessation but rather a strategic move to reevaluate your approach and align it with the evolving market landscape.

In conclusion, I invite you to take this opportunity to pause your BTC trading activities temporarily. By doing so, you can gain a clearer understanding of the current market dynamics and potentially position yourself for more favorable trading opportunities in the future.

Thank you for your attention, and please feel free to reach out if you have any questions or require further clarification. Wishing you successful trading endeavors.

BTC Bitcoin Price Target | Binance vs SEC Lawsuit Binance disputes the SEC's allegations of mishandling customer funds, deceiving investors, and violating securities laws.

The legal battle between Binance and the SEC has sent shockwaves through the cryptocurrency community.

Binance and its affiliates assert that the SEC is overreaching its jurisdiction on digital assets, especially without any clear legislative guidance from Congress. The original lawsuit, filed in June, accused Binance of unlawfully listing unregistered securities.

Historically, the actions of whales have been instrumental in shaping the price movements of Bitcoin and the broader cryptocurrency market.

Non-whale addresses, those holding less than 100 BTC, now account for over 41% of the total Bitcoin supply. Meanwhile, whales, entities holding between 100 and 100,000 BTC, have witnessed a decline in their collective holdings to 55.5%, marking their lowest ownership level since May.

The decrease in whale holdings could signal a potential change in the market's dynamics, potentially leading to increased volatility and uncertainty.

These developments collectively cast a shadow over the cryptocurrency market's near-term prospects.

In this context, my price target for BTC Bitcoin is $23700.

Looking forward to read your opinion about it!

Bollinger Bands Tightly Consolidated as BTC Remains Range Bound At present, Bitcoin has been trading within a narrow range of around $27,000, and this prolonged consolidation phase is a cause for caution. The Bollinger Bands, a widely used technical analysis tool, suggest that volatility is diminishing, and a significant price movement could be imminent.

In light of this information, we strongly urge you to pause your Bitcoin trading activities temporarily. It is crucial to exercise patience and avoid making hasty decisions during such periods of consolidation. While it may be tempting to seize potential opportunities, the current market conditions warrant a more cautious approach.

Here are a few reasons why we believe it is prudent to exercise restraint and pause BTC trading for now:

1. Reduced Volatility: The narrowing Bollinger Bands indicate a decrease in price volatility. During such times, market movements tend to be limited, making it challenging to predict short-term price trends accurately.

2. Potential Breakout: The tightly consolidated Bollinger Bands often precede a significant price breakout. By pausing trading, you can avoid potential losses resulting from sudden and unpredictable price swings.

3. Risk Management: Taking a step back from trading allows you to reassess your risk management strategies and ensure you are well-prepared for any potential market shifts. It is crucial to protect your capital and make informed decisions when the market provides clearer signals.

While the decision to pause trading ultimately rests with you, we strongly advise against making impulsive moves during this consolidation phase. Consider this as an opportunity to reevaluate your trading strategies, conduct thorough research, and seek expert advice if needed.

We will continue to closely monitor the market and keep you updated on any significant developments. Remember, patience and discipline are key virtues in the world of trading, and it is during these uncertain times that they become even more crucial.

If you have any questions or require further guidance, please do not hesitate to comment below. We are here to assist you throughout this period of consolidation.

Thank you for your attention, and we wish you all the best in your trading endeavors.

Look Beyond BTC : Counters get you REKTHi Traders, Investors and Speculators of Charts📈📉

The markets are trading in the red and it can be hard to spot good trading opportunities during bloodbaths. Trading Bitcoin NOW can be tempting, especially when prices are actively moving. However, acting on impulse without a plan leads to reckless gambling more often than not. Savvy traders wait patiently for ideal opportunities with defined risk-reward ratios.

Rather than reactively jumping into trades, experienced traders proactively plan out trades and target entries. This means identifying key price levels in advance where the risk-reward ratio is favorable. For example, if your analysis shows a strong support level for Bitcoin at $23,000, you would wait to buy until that price is reached rather than FOMO shorting at $25,000. Executing trades according to a plan have higher success rates than jumping-the-moving-train trades.

Look Beyond Bitcoin.

BTC grabs attention when it moves, but plenty of other assets offer worthwhile trading opportunities. Expand your watchlist across stocks, forex, commodities, indexes, and more. Evaluate which markets are exhibiting solid technical setups or fundamental catalysts right now. Don't feel pressured to trade BTC just because it's moving. Sometimes the best trade is no trade if conditions aren't ideal.

By targeting defined entry levels, expanding your watchlist, and waiting patiently for prime risk-reward setups, you take the gamble out of trading. Plan your next trade systematically instead of trading impulsively on emotion. This approach leads to consistent profitability over the long-term.

_______________________

📢Follow us here on TradingView for daily updates and trade ideas on crypto , stocks and commodities 💎Hit like & Follow 👍

We thank you for your support !

CryptoCheck

BTC Bitcoin Price ahead of the FOMC decision next weekWhile Bitcoin has experienced a recent surge in price, there are notable indicators suggesting caution. Investors have begun to take profits, signifying a potential shift in sentiment. This could be indicative of a more cautious market stance, especially considering the prevailing uncertainties.

A critical concern arises from Bitcoin's current position below its 200-week moving average. Historical data shows that this zone has often acted as a formidable barrier for Bitcoin's price movement. This pattern suggests that a sustained breakout above this level might prove challenging in the near term.

The recent inflation figures from the Consumer Price Index (CPI) have sent shockwaves through financial markets, with a year-over-year increase of 3.7%, surpassing earlier estimates. This level of inflation, combined with the Federal Reserve's current interest rate range of 5.25% to 5.5%, is a cause for concern. The surprising stability of Bitcoin amidst such economic turbulence may not be sustainable in the long run.

Adding to the apprehension is the concept of 'sticky' inflation, where prices continue to rise even in the face of elevated interest rates. The core CPI data, excluding energy price fluctuations, still reported a yearly increase of 4.3%, albeit lower than the previous month. This persistent upward trend in core CPI since September 2022 raises valid questions about the Federal Reserve's strategies moving forward.

In light of these factors, it would be prudent to approach the current Bitcoin market with a degree of caution. While the cryptocurrency has shown resilience in the face of economic headwinds, the potential for increased volatility and the presence of significant barriers in its price movement could pose challenges for sustained bullish momentum.

My Price Target for BTC Bitcoin is $23700.

Looking forward to read your opinion about it!

Bitcoin Trade #9 - Trying to catch a false breakoutHello friends!

Despite the fact that the market is difficult, with no trading volumes and low volatility, we continue to publish personal potential trades.

Today we're going to talk about a local trade for Bitcoin.

Yesterday, we witnessed Bitcoin's price drop sharply on small timeframes and then shoot up just as sharply:

As you can see on the 15-minute timeframe , this price movement first took positions away from buyers and then from sellers (look at the volume delta indicator below).

However, BTC did not update the main local lows , below which it would be clear what awaits the price of BTC next.

In turn, buyers failed to break sellers' stop orders above $26150 . Therefore, in our opinion, yesterday's events are a rehearsal for a real battle.

Taking this into account, we are ready to implement the following Bitcoin trade:

#BTCUSDT Long

Enter 1 = 25556

Enter 2 = 25067

Average entry price = 25311

Stop = 24830 (- 1.9%)

TP = 26831 (+6%)

P/L ratio = 3.16

Why are there two entry points on the chart?

We are not sure that sellers will be able to update the local lows from the current price. It is likely that the price of BTC will first rise to 26831 and then try to update the lows. Therefore, we divide the amount of the Bitcoin position into 2 parts:

$5000 at $25556 and $5000 at $25067

we will definitely write about the results of the trade here in the comments! So subscribe to us so you don't miss any updates!

BTC to fall to $23.2k before final move to $37.2kThe last couple of months have definitely been difficult to trade. If you've made money, congrats.

We've just been stuck in a lot of chop and I think the chop will continue until around early July before we see a trending move higher.

Even though we've had a pump higher in the last couple of days, I still think we're in the process of a complex correction. So if you missed this move, be patient.

I think the move higher in BTC will stall out somewhere in the grey box - somewhere between $28.3k-$23.7k. If we can't break that resistance, then I think the next move is going to shake a lot of people out.

If you look at the chart, you can see that $23.2k is a level that still hasn't been tested as support, and I think that level will need to be tested before we can move much higher from here. I think the most likely scenario is that over the course of the next 3-7 days, BTC will test this level higher and alts will rally a little bit to bait in new longs. Then I think at some point next week, BTC will dump back to $23.2k.

That's where I'll want to be long BTC ($23.2k) because I think there's significant upside there in a relatively short amount of time. I think we'll see a relatively fast move higher into the $30k range from that level (60% upside to final target). The first resistance being $32.8k, and the next and final resistance being $37.3ishk. Once we hit that 37k level, that's where I'll exit all of my longs, because I believe that after that, we'll see the continuation of the bear market below $10k.

Be cautious trading alts over the next week or two. If you do, set tight stops and take gains while you have them. Because if we do see that dump to $23.2k, I think it's going to get very ugly for alts.

BITCOIN BACK TO 19999 SUPPORT?We don't know when the ETF from BlackRock will be approved so this is the worst possibility of COINBASE:BTCUSD if this ETF is not approved as soon as possible BINANCE:BTCUSD will return to 19999.19 usd support!

or if it is not strong enough to hold the support at 19999 it will return to 16778, I hope next month it will be approved by the SEC.

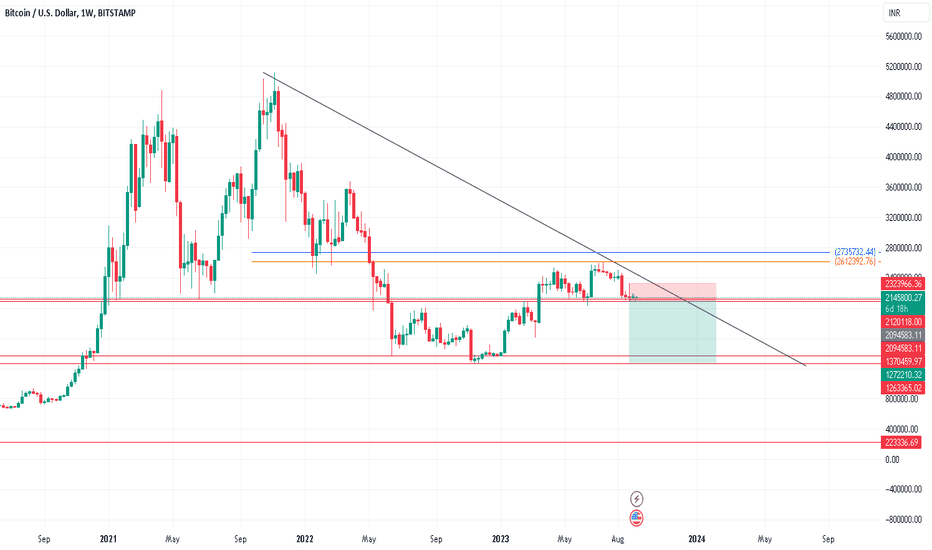

BitcoinWe may see 1270000 again if breaks the support.

Careful upside is very limit as resistance is strong and retested to further fall from here.

Best buying may come next year Jan/Feb 2024..

Stay away from the bitcoin as per technical analysis.

Upside break should be very fast as of now or it will reject and fall in coming weeks or months.

#Bitcoin - thoughts out loud #7Good evening from Ukraine!

Dear colleagues, I am glad to welcome you!

Without logic, there is no way to fall further. For the current period of time.💸💸💸

Because this is my vision of the situation, because these are my thoughts out loud. Thank you.

Thank you all for your attention, I wish you success.

Sometimes you win/sometimes you learn.

P.S.

...Think positive)

#Bitcoin - thoughts out loud #5Good evening from Ukraine!

Dear colleagues , I am glad to welcome you!

Without a logical justification, the vision of the situation I show on the graph may not be realized. The position is set in the range of 25800 - 26300.

Thank you all for your attention, I wish you success .

Sometimes you win /sometimes you learn .

P.S.

...Think positive)

How Could Apple's Market Cap Impact Bitcoin and Crypto Markets?THE APPLE FACTOR

Introduction:

The crypto world is always abuzz with potential catalysts for market movements, and this time, it's not just crypto-related news making waves. Renowned crypto analyst Nicholas Merten, better known as DataDash, recently shared his insights on how a declining Apple market cap could have significant implications for Bitcoin and the broader cryptocurrency markets. In this TradingView article, we'll delve into Merten's analysis and explore the potential consequences for the crypto space.

The Apple Decline: A Cause for Concern?

Apple Inc., one of the world's largest tech giants, reached a milestone in July 2023 when its market capitalization hit an astounding $3 trillion. However, since then, Apple's market cap has experienced a decline, currently resting at $2.79 trillion at the time of writing. Merten argues that this downward trend in Apple's valuation could trigger a chain reaction in financial markets, including cryptocurrencies.

The Domino Effect on Crypto: A 60%+ Drop?

Nicholas Merten suggests that if Apple continues on this path and contracts from a $3 trillion company to a $1.5 trillion company, it could have profound consequences for Bitcoin. He argues that this impact could surpass even major crypto events like halving or the approval of a Bitcoin ETF.

In his own words, Merten states, "If that scenario plays out, you can easily see Bitcoin coming down here to new lows at around $10,000 to $12,000." While he emphasizes that it's not a guarantee, it's a scenario that traders and investors should take seriously.

Why Does Apple Matter?

The significance of Apple's decline goes beyond its sheer size. Apple's market cap decline has a cascading effect on other equities, including tech giants like Microsoft and the famous FANG stocks (Facebook, Amazon, Netflix, and Google). Additionally, it could impact the broader stock market and, crucially, the cryptocurrency space, from Bitcoin to various altcoins.

As Merten puts it, "Those small percentage declines, while they seem small, are magnified when you consider Apple’s valuation and the weighted impact it’s going to have on other equities."

Conclusion: Navigating Potential Storms

The crypto market is no stranger to volatility, and external factors often play a significant role in shaping its trajectory. Nicholas Merten's warning about the potential repercussions of Apple's market cap decline is a stark reminder that the crypto world is interconnected with the broader financial ecosystem.

While it's essential to stay informed and heed expert advice, it's equally crucial for traders and investors to maintain a diversified portfolio and be prepared for various scenarios. The relationship between Apple's fortunes and Bitcoin's fate is a fascinating topic to watch, and its evolution may offer valuable insights into the future of both traditional and crypto markets. As always, the key to success in trading and investing is a combination of vigilance, knowledge, and adaptability.

BTC September Spike then Slump! Probable death-cross retestsGm crypto fam.

This is a simple, yet powerful chart showing two MAJOR death crossed lining up.

One is a Bitcoin lifetime first (!), the 20-month crossing down on the 50-month (grey/black).

The other one is our classic 50/200D (light blue/dark blue).

Green dots show where crosses are forming. Ready to be retested on a spike.

September Spike then Slump!?

Brought to you by:

PIK analyst team at EXMO Study

Starting to buy bitcoin again on a possible diamond bottomStarting to re-add to bitcoin here around 25700 in what could be the beginnings of a diamond bottom formation on the hourly charts (which is a reversal patten bottom indicator after a bear downtrend).

The larger technicals are showing a higher low on the weekly chart here still so its worth adding here and see what happens, stop loss is nice and tight at the bottom of the diamond.

Weekly nice and oversold so its worth trying to go long here imo

BTC Hits New Support Level at $24800Introduction:

In the ever-volatile world of cryptocurrency, Bitcoin (BTC) has recently encountered a significant shift as it reached a new support level at $24800. This sudden development has raised concerns among traders, prompting a need for caution and careful evaluation of the market conditions. In this article, we will delve into the implications of this support level and emphasize the importance of waiting for clarity before resuming Bitcoin trading.

The Importance of Support Levels:

Support levels play a crucial role in technical analysis, indicating a price point at which an asset is expected to find buying interest and reverse its downtrend. They act as a safety net, preventing prices from plummeting further. The recent establishment of a support level at $24800 for Bitcoin suggests a potential stabilization in its value. However, it is essential to remember that these levels are not guarantees but indications of possible reversals.

The Concerning Tone:

Traders, we find ourselves in uncertain times. The cryptocurrency market has always been known for its volatility, and the recent developments surrounding Bitcoin only add to the confusion. As we navigate through uncharted waters, it is crucial to approach this situation with a concerned tone. Instead of hastily jumping into trades, we must exercise patience and wait for clarity to emerge.

Why Pause Bitcoin Trading?

Given the current circumstances, it is prudent to pause Bitcoin trading until we understand the market's direction. Here are a few reasons to consider:

1. Market Sentiment: Establishing a support level at $24800 is a positive sign but does not guarantee an immediate upward trend. Assessing market sentiment and observing traders' reactions to this new support level is crucial before making any hasty decisions.

2. Volatility and Risk: Bitcoin's recent volatility has left many traders on edge. Sudden price swings can result in significant losses if not approached with caution. We can minimize the risks associated with uncertain market conditions by pausing trading.

3. Clarity is Key: Waiting for clarity is essential to make informed trading decisions. It allows us to evaluate the market trends, monitor price movements, and analyze the impact of external factors that may influence Bitcoin's trajectory. We can avoid impulsive actions driven by fear or uncertainty by exercising patience.

The Call to Action:

Traders, in these uncertain times, must prioritize caution and prudence. It is crucial to continue pausing Bitcoin trading until clarity emerges and a clear upward trend is established. By doing so, we can mitigate potential risks and make informed decisions based on market stability.

Remember, the cryptocurrency market is highly unpredictable, and impulsive actions can lead to significant losses. Take this opportunity to educate yourself, stay updated with market news, and seek guidance from trusted sources. Together, we can navigate this challenging period and position ourselves for success when the market stabilizes.

In conclusion, let us exercise patience and restraint until the market provides a more straightforward path. We can make informed decisions and protect ourselves from unnecessary risks by waiting for clarity to show a definitive upward trend. Stay informed, stay cautious, and most importantly, stay resilient.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your research and consult a professional before making investment decisions.

BTC Bitcoin Technical Analysis and Trade IdeaBitcoin is presently positioned within critical daily, weekly, and monthly price levels. An evident trend on the chart indicates that Bitcoin has been subjected to significant bearish pressure, prompting us to consider the potential for a selling opportunity. Nevertheless, there are noteworthy chart elements that demand our careful scrutiny, and these have been thoroughly examined in the accompanying video. In the video presentation, we conduct a comprehensive analysis of the prevailing trend, price fluctuations, market structure, and other essential facets of technical analysis. It is worth reiterating that our video provides lucid explanations, but it is imperative to underscore that the information presented should not be misconstrued as financial advice.