Bitcoins has slipped back under Long Term resistance. CAUTION

It is VERY clear to see and some just do not want to see it

That Blue Arc, Arrowed, is an Arc that has rejected EVERY ATH since Bitcoin began rising from its early Low.

And also understand, that arc is not just a random line, It is Calculated and is part of a Fibonacci Spiral.

ANYWAY, as we can see on the chart. PA is heading to a Squeeze with this Arc and a rising line of support below.

This line of support has NEVER failed since PA crossed over it.

So we have a n arc of Resistance that has Never been broken.

We have a line of support that has Never been Broken.

One of these two line Has to break.

The Apex of this Squeeze us Dec this year and, as we all know, PA always react before the Apex.

So, How accurate is the placement of this Arc ?

Lets see the Daily chart

Here we can see that PA has for most of this year, been trying to break over and, in July, succeeded, only to fall back below a week ago.

To many extents this played along Very well with the monthly Candle Colour patterns I been posting.

But the fact remains, we are once again BELOW a HUGE powerful line of resistance that we MUST break above and stay above.

We do have many lines of Support below, Local and some, longer term.

We can close on the 4 hour just to see where we are in a more local time frame.

Here, we can see that 105K is a very possible line of support initially that we need to watch and see what happens. Hopefully, we range above this level and let RSI cool off.

The RSI is always a great gauge to watch here and the daily offers some hope of remaining in this current PA range

It must be said that RSI could still drop lower, though we have room to rise before PA becomes OverBought on the Daily.

But the weekly shows us a longer term CAUTION flag.

While we have not been OverBought on the weekly for a long time, we ARE up high, leaving the potential for a Drop.

But with the Daily in good shape, this could be postponed. In this cycle, previous times we got overbought, PA ranged while RSI dropped.

This could repeatover and over........But PA needs to rise OVER that line of resistance and turn it into Support.

This is NOT a choice//it is a MUST HAPPEN if Bitcoin is to continue its rise higher.

The current Price line of this Blue Arc is around 116K.

What we realy need to understand about this Arc is that once we pass December 2025, that arc begins to DROP.

And if PA is below it still, PA will get dragged down with it, into an ever decreasing price model.

So, there we have it

Simple as that.

Bitcoinpattern

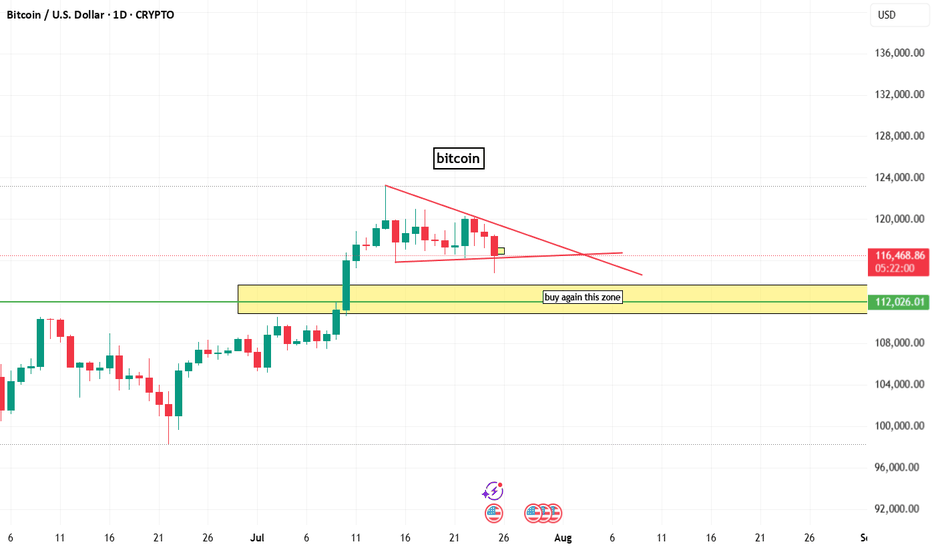

Bitcoin (BTCUSDT): Trade Wave 5—Next Stop $127,000?Bitcoin’s current structure is lining up for a classic Elliott Wave fifth wave scenario, and the setup could offer a high-reward trade as we look for a measured push toward the $127,000 area. Here’s what’s standing out in the recent price action:

What the Current Structure Shows (Primary Scenario)

Wave 4 Correction Complete: After peaking in wave iii near $124,000, BTC pulled back and has potentially completed a wave iv correction. Price respected the Fibonacci retracement zones bouncing near the 38.2% retracement at $117,116.

Preparing for Wave 5: With support confirmed, price action is stabilizing and looks primed for a final motive push—wave 5—to the upside. The target projection for wave 5 is around $127,000, in line with both the 61.8% extension of the previous swing and the common equality projection for wave 5 vs. wave 1 when wave 3 is extended.

Why the Count Is Labeled This Way

The advance from early July kicked off with impulsive movement, subdividing cleanly into smaller waves that align with classic Elliott structure.

Wave iii is the clear standout—steep, extended, and carrying most of the move’s energy, which checks the box for a strong third wave.

The cluster of Fibonacci and previous resistance/support near $127,000 offers strong technical confluence for the next objective.

Trade Setup: Riding Wave 5 to $127,000

Entry Zone: Consider longs on breakouts above the current consolidation, ideally after confirmation of support holding near $117,100–$116,000.

Stop Loss: Place stops just below $113,300 (the 61.8% retracement), or tighter for risk management depending on your position size and timeframe.

Target: $127,000—where wave 5 projects to equal the length of wave 1 and aligns with multiple Fibonacci targets.

What to Watch Next (Confirmation or Invalidation)

Confirmation: An impulsive move above the interim high at $120,000–$121,000 with strong volume would confirm wave 5 is underway and that bulls have regained control.

Invalidation: A break below $110,500 would invalidate this setup and suggest a more complex correction is taking shape.

Final Steps: Monitor for impulsive character in the rally—wave 5s can sometimes truncate, so don’t get complacent at resistance.

Alternate Count

If price fails to hold support and breaks down, BTC could still be in an extended or complex fourth-wave correction—possibly a running flat or triangle—before wave 5 eventually resumes.

Bitcoin Faces Impending Drop to Mid-30,000sAs of July 02, 2025, Bitcoin’s price chart, crafted by "RoadToAMillionClub" on TradingView, paints a concerning picture. Currently hovering at $107,831, the cryptocurrency appears to be teetering at the edge of its upper channel, signaling potential trouble ahead. The recent 0.51% dip may be just the beginning of a more significant decline.

The long-term upward trend, marked by a supportive orange line since 2018, has been a beacon for bulls. However, the green trend line projecting a drop toward the mid-30,000s range, around $37,932, suggests a looming correction. This level, a historical support zone, could become the next battleground as selling pressure mounts.

Market indicators point to overextension, with the price hitting a 4-day and 14-day high of $107,831 before the recent pullback. The speculative fervor that drove Bitcoin to these heights seems to be waning, increasing the likelihood of a bearish turn. Investors should brace for volatility, as the cryptocurrency may struggle to maintain its current altitude, potentially sliding toward the mid-30,000s in the coming months.

#BTCUSDT Big Pump Next Hour - Bitcoin, BTCUSD, BTCUSDT 📉 Double Bottom Pattern Forming – Potential Reversal Setup

The current price structure is showing signs of a Double Bottom – a classic bullish reversal pattern. After an extended downtrend, this pattern suggests that the market may be preparing for a trend reversal from this key demand zone.

🔹 Trade Setup

Entry, Targets, and Stop Loss (SL) are marked on the chart.

Entry: Upon breakout confirmation above the neckline.

Stop Loss: Just below the recent swing low to manage downside risk.

Targets: Calculated using the measured move method from the bottom to the neckline .

🔹 Risk & Money Management (Professional Approach)

To maintain consistent profitability and protect capital, strict risk management is essential. For this setup:

🔸 Position Sizing: Based on a fixed % of total capital (typically 1–2% of account equity per trade).

🔸 Risk-to-Reward Ratio: Minimum of 1:2, ideally higher.

🔸 Stop Loss Discipline: No arbitrary changes after entry. SL only adjusted for breakeven or trailing stops once price moves favorably.

🔸 Trade Management: Secure partial profits at key levels, trail stops as structure forms.

🔸 Capital Allocation: Avoid overexposure. Trade fits within overall portfolio strategy.

💬 Let the setup come to you. React, don’t predict.

🔁 Like, comment, or share your thoughts below!

BINANCE:BTCUSDT BITSTAMP:BTCUSD COINBASE:BTCUSD BINANCE:BTCUSDT.P INDEX:BTCUSD CRYPTOCAP:BTC.D CRYPTO:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSD

BITCOIN - under resistance since 2011-Birth of a new cycle soon

The Chart Clearly explains itself

Since before Bitcoin PA went into its current channel, it was under a Huge Arc that resisted any move higher...strongly, Every single ATH, Every one, even the most recent

This is Easily seen by the Blue Arc

And as you can see, maybe THIS is the real reason why PA is struggling to break higher....It just cannot break over that Arc.

The main chart is Monthly, Lets look at the weekly.

You can clearly see what happened in 2021, rejected twice and again this cycle.

And you can see how, by December This year, 2025, PA will be squeezed very tight.

And PA usually moves before the APEX>

And, if we are going to repeat the previous cycle moves, the 1st year after a New ATH usually sees a decline in price, as can be seen by the red boxes.

But PA needs to break OVER that Arc first. and then remain ABOVE IT.

This would then create a new cycle pattern.

And we need it.

Currently, we can go back to Lows of 88K before we loose support on that lower trendline but from there, we need to break over.

A Strong move in SEPTEMBER / OCTOBER would be Ideal

Just saying

Bitcoin Monthly Candle Colour Close since 2011 - looking forward

May Closed GREEN, and We are currently on a Very small Green candle for the month open.

Last month, in this series of monthly charts posts, I mentioned this..

"On only 2 occasions have we had a GREEN JAN, RED FEB, RED MARCH, GREEN APRIL

And Both of them were on the way to ATH. ( Arrows )

On both those occasions we had a GREEN MAY, though the gains were minimal and one was followed by a Green June and the other by a Red June."

And we just closed May with a minimal GREEN candle.

This is important to understand, This month, we have a 50/50 chance of repeating the Green June candle in this pattern.

Outside of this pattern, The previous MAY closes, 7 Green to 6 Red.

Of the 7 Green, 5 were followed by a Green June

With this, we have a higher % chance of a Green June

Of All previous June Closes, we had 7 Green to 6 Red.

Of those 7 previous Green June Closes, 3 were followed by GREEN July

Of the 6 previous RED Junes, ALL were followed by GREEN July

With this in mind, we maybe in a better position if we did close June with a small RED candle, as we did in the 2020 sequence ( right hand Arrow)

Should we close June RED, I will then expect a fairly level summer period with PA beginning to start moving again around September / October

Bitcoin PA is in an excellent position to move higher now though. It is also in an excellent position to move away from previous cycle patterns and begin creating new one.

We do have to remain vigilant as markets are moving everywhere and Macro conditions could change rapidly

But the one thing that seems to remain static is that it is a VERY GOOD IDEA to Buy Bitcoin and HOLD IT

Bitcoin could be SO close to take off - certainly shows Strength

Before we go anywhere with this, we MUST remember that a "TREND LINE " requires a minimum of 3 points of Contact to make it Valid. The more points of contact the better.

All of these Trend lines in this chart are therefore Valid.

But what needs to be questioned is maybe the PA trend between the lines......

And because of the Scale of this, we are using only 2 past Factual data sets and one expected.

So NOT a confirmed Trend

But I shall continue anyway as there are a number of things that make this idea a possibility.

So, on the chart we have the Upper and Lower day counts.

The Lower is number of days between ATH

2013 -> 2017 = 1491 days

2017 -> 2021 = 1431 days

2021 -> 2025 = ...............Expected anytime from October to Dec. This is IF we follow the "pattern"

50 day difference between the 2 sets of Past data

The Upper day count uses just ONE data point from the 2013 -> 2017 cycle. It is from the ATH to when PA made the BIG move to begin the climb to ATH. That was around 1277 days after the 2013 ATH and you can see the candle that rose off that line of support was substantial.

As many of you know, I am firmly in the belief that this run is mimicking the 2013 -> 2017 run in many ways

So, The same day count takes us past the First 2021 ATH, which I have always said was a "False" ATH in that PA was driven High, to early, by leveraged and hopeful gains.

However, if you look at the distance from the end of that day count to when the ATH was reached, it is similar to the 2017 ATH

So if we Project that same day count onto current PA, THIS MONTH is the month for take off.

And again, See the difference between the end of the day count and the projected ATH daye.

Similar to previous occasions.

This is also reflected on the Fractal, that arrives on the upper trend line in November.

One thing that makes me hesitate a little here is the projected ATH Price of Near 700K USD.

I am not sure that is going to happen....And so we wait to see what happens.

But I will watch this and see where we go

I have pointed out in another chart, how Bitcoin PA is under a Very long time Arc of resistance and this could be in play and if so, This chart Will become invalidated.

We Wait to see

Bitcoin is still following 2017 run. Surprising things to see

As many of you know, I have been referring This cycle of Bitcoin to that of the 2013 ->2017 bull run. And while PA has Fallen off and below the Fractal itself, we do still have one Very Major thing to see and it is a Good one.

So, the chart above has an arrow. This is pointing to Sep, Oct, Nov 2024.

See how PA pushed up to the "Neckline" of the Range and got rejected for 2 weeks.

A Red then Green Candles, on or below that "Neckline" and then Off it went.

We are currently just below the "Neckline" of this Range and we are currently printing a Red candle. It is early days but maybe we will repeat the same pattern.

There are reasons that I have explained in an earlier post today, that point towards a possible Red candle this week.

The other thing I want to show you on this subject is the MACD

This is a Daily MACD ( the main chart being Weekly) But while the actual PA of the MACD is different, I want you to see the Histogram. The Histogram shows us the % Difference between the MACD line ( yellow) and its Signal line ( Red)

Have a look at the the similarity the histogram pattern in 2024 ( arrow ) compared to this period Now.

The Large green Climb from a Low, the fall, the new smaller climb, the drop to Red and then a push higher.

OK, so the scale is different but, to me, it shows a similar pattern to the previous end of Ranging period.

We need to see if this pays out. If so, we will see a Red Histogram for a while..

This ties in with the ideas presented above on the PA patterns.

But overall this cycle, we do seem to be repeating patterns in a broad sense, with a larger scale currently. The larger scale of thispossible Red Histogram also plays into the idea mentioned at the end of this post.

So , what is the connection to the 2013 - 2017 Cycle.

Look at the upper trendline that has rejected PA since 2024. This is an OLD line of resistance from before 2017...

Lets look at a zoomed out chart

Look at that Arrow on the Left and that trend line.

It is the SAME LINE - Not only that, it rejected PA twice in late 2016 and 2017, before PA broke through and went on to reach a new ATH

So, Having seen this, I am happy to believe that we ARE Still following that 2013 -> 2017 Cycle pattern.

True, PA has fallen below the Fractel but we do seem to be repeating the Trend line Rejection, Dip, Rejection and........

You can also see how this same trend line, once crossed, is extremely strong support - infact we did not drop back below until July 2022, after another ATH

BUT, as ever, I look to BOTH sides and there is a chance we may see a stiffer rejection, IF we get rejected here again.

Should events dictate a further Drop in PA, we may see PA return to the next trend line below, around 82K. ( remember that Red Histogram pattern I mentioned earlier )

While this would Scare many, it would still play into the pattern we have been seeing.

2024 saw 3 major Rejections off its Neckline.

We have had 2 so far in 2025 and we are there right now, waiting to see what happens, with a RED candle. A Drop back to 82K would also reset the Daily MACD very nicely.

I remain Cautious and Bullish

what ever happens in the short term, I have little doubt about further pushes higher, maybe a LOT higher

Bitcoin gameplan - What to expect nextWith BTCs most recent move higher and the confirmation of a higher low within the current uptrend (the one that started Jan. 23) we have sufficient indication to assume a short term continuation of the current rally.

As next target I'm looking for 120k. In the very short term we might see a little corrective move (Scenario 2) or just power through the range high of the micro range to chase the set target directly. (Scenario 1) That highly depends on price reaction to the range high price level. (106k)

Either way, BTC looks great at the moment and I'm pretty confident that the bull market is far from over, especially with more inflation on the horizon.

Let me hear your thoughts!

Bitcoin and the 2013 - 2017 Fractal Update - Have we left it >?

For now, I am going to say YES but maybe not completely.

If we look at the shape of the Fractal and what BTC PA is currently doing, it could be said that we have just completed 2 ranges in one go..the little one that Took us below the fractal and the other one that is next up the Fractal line.

But it is the next 8 weeks that will define this fully and for now, so as to not get caught short, literally, I am looking to that Dashed Arrow that comes off the circle.

Noe, I drew that circle back in late Feb ( posted in March ) and PA has just entered it, as can be seen on this Daily version of the same chart ( but with candles and not a line)

The fact that we have even entered this area tells me that the dashed Arrow is the path PA will take as a route of least resistance and with a possible ATH in Dec of around 322K USD.

That ATH is on the line of resistance drawn from the 2017 ATH and has rejected every Cycle ATH since. ( The line shown on the chart irons out detail but be assured, that line passes throgh the 2021 Nov ATH )

The possibility does exist, thogh gettign slimer, that PA could climb back over the top of the Fractal, though the push to do that would take a LOT of investment... possibly to much now.

So, I will sit happy, looking forward to a 370K -> 322K ATH later in the year..

And it MUST be said, as I always say, Look on both sides. There is a possibility that PA could Drop back to the 80K - > 72K line though I feel this is highly unlikely but we are now entering a zone of strong resistance

Things may get Volatile Soon.

But I would just like to say "THANK YOU" to the 2013 -2017 Fractal. You have taken us on a ride since Nov 2021 and shown us how to do things properly.

And so now.........New Adventures and Horizons await........Onwards and upwards

BITCOIN Monthly Candle close patterns since 2011 - APRIL CLOSE

Again, we got the expected Monthly Close, This time GREEN

April is traditionally a Strong Green Month, now with 9 Green Closes to 5 RED - Nearly twice as many Green to Red.

MAY is a different story, Nearly 50 / 50 previous closes with GREEN having an advantage of 1.

BUT, With April closing Green after the previous months closes, things do look positive.

On only 2 occasions have we had a GREEN JAN, RED FEB, RED MARCH, GREEN APRIL

And Both of them were on the way to ATH. ( Arrows )

On both those occasions we had a GREEN MAY, though the gains weer minimal and one was followed by a Green June and the other by a Red June.

We have had 4 occasions with a MARCH RED, APRIL GREEN, MAY GREEN

Of the previous 9 GREEN April Closes, 5 were followed by a Green June

And of those 5, 2 were followed by consecutive Green candles closes for the following Months.

Though in 2020 sequence ( 2nd Arrow) after a GREEN May close, you can see the candles were not big and we had Red Green Green Red for 4 months then went Green consecutively.

Of the previous 7 Green MAY candles, 4 were Bigger than the previous month candle.

I am more inclined to look at the 2020 sequence in this for now and yet, at the same time, as posted in another chart, I am also still looking at the lead up to the 2017 ATH and for this to continue, we need a Bigger GREEN MAY close this month.

There is a very strong line of resistance just over head.

Currently, at time of writing, The opening MAY candle is GREEN but only just

This month is CRUCIAL

A Good Example of How Market Makers Manipulate BTC Price- As liquidation areas are visited, price drops back down, retraces back up just to fill the price imbalance before continuing to for a new low.

- The latest price action is similar to the previous, and there is a very good likelihood that the Bitcoin price will create another major new low

- Also take note of the fake out in the ascending channel to trap traders into placing long positions. The fake out was also able to trigger stop losses from short positions.

Let me know what you guys think and comment below.

Bitcoin 50 SMA time snaps and Low to ATH since 2014 - UPDATEIn a similar vein to the chart posted earlier today about the patterns between the 50 and 100 SMA, this post is using the 50 SMA ( RED) and the time spent above and below PA.

Alongside this, we have the day counts for PA LOW to PA ATH since 2014

After 2013 ATH and once the 50 SMA dropped below PA, it spent 399 days below PA

After 2017 ATH and once the 50 SMA dropped below PA, it spent 329 days below PA

After 2021 ATH and once the 50 SMA dropped below PA, it spent 420 days below PA - This is an impressive stat as it includes the Deep Bear that we experienced after the Luna, 3 Arrows & FTX crashes, includes the raising of interest rates and the utter presecution by Banks and SEX in the USa.

The fact that the drop below PA was only extended by 35 days ( average) Max shows a strength in Bitcoin sentiment. It could NOT be broken

In 2015, once the 50 SMA has risen above PA, it remained there for 938 days

In 2019, once the 50 SMA has risen above PA, it remained there for 1001 days

In 2023, once the 50 SMA has risen above PA, we have been above for 756 days of an expected average projection of 966 days

This projects that PA will Drop Below the 50 SMA in about October 2015, After the ATH as previously.

This points towards an ATH in Q4 - this has some confluence with the previous post though open to suggestion.

Next is the simple PA LOW to ATH and Back to LOW day counts

2013 ATH to Cycle Low was 665 days then 847 days to Cycle ATH

2017 ATH to Cycle Low was 350 days then 1064 days to Cycle ATH

2021 ATH to Cycle Low was 378 days then, using the average of the two previous day Count from Low to ATH, gives us 952 days to Cycle ATH

This puts an ATH in JUNE 2025 !

I do not think this is realistic in anyway however, Anything is possible currently.

I do however think that June is about when PA could seriously begin to make Moves higher, with intent to reach a Cycle ATH.

The reason being, the weekly MACD will have reached Neutral by then ( if not in mid May )

So while this chart offers some confluence to other ideas, it also offers another ATH date that is way earlier than any previous cycle ATH - While I feel this is unlikely to happen, we Must keep open minds.. the adoption of BTC by main stream now may well accelerate the PA cycle.

We shall wait and find out.

Be prepared for ALL occasions....including the arrival of an early Bear. - THAT will be in another post, at some point soon

Stay safe

Bitcoin's Never Look Back AnalysisWhat's Bitcoin's never look back number?

What's that level that you want to stack your sats and always be in profit?

This analysis observes a distinct repeating pattern over everything BTC cycle that if continues to occur could be very effective in informing your investment position.

BTC Halving | Halving Mapping | Bull Run | Bitcoin Analysis

Timeframe: 1 Week (Halving Mapping)

This article focuses on three key aspects of Bitcoin’s halving, based on historical research:

Bull Market Moves

Bear Market Moves

Pre-Halving Moves

As you can see in the chart above, the previous halving events have been mapped out, providing a clear picture of Bitcoin’s price behavior. Historically, after each halving, Bitcoin enters a bull market, followed by a bear market. Additionally, I’ve observed and mapped a unique pattern that isn’t widely discussed: a pre-halving upward move that occurs before the halving event. This pre-halving move often provides significant returns, especially after a bear market phase.

For investors and long-term holders, this presents an opportunity to divide investments into two parts:

Pre-Halving Move: Capitalize on the upward momentum before the halving.

Post-Halving Bull Run: Benefit from the sustained bull market after the halving.

These strategies don’t require extensive technical analysis. A deep dive into historical data makes the patterns clear. Historically, after an uptrend, Bitcoin experiences a downtrend lasting between 1.5 to 2 years. Keeping these patterns in mind can help you craft effective investment strategies.

Current Market Bull Run Update

A common question among traders and investors is: Has the bull run ended? Is this the last exit point for Bitcoin?

Based on my research, the bull run is not over yet. While we may see a downward move in the near term, this is likely to be a manipulation phase, creating FOMO (fear of missing out) among traders who might believe the bull run has ended. However, Bitcoin is expected to make one final upward move, reaching a new all-time high. This final phase is likely to occur in the latter part of this year, with 2025 being entirely dominated by the bull run.

Looking at the 2020 halving chart, you can see a clear "M" shape pattern. At that time, the market experienced a similar phase where the "M" shape completed, and Bitcoin retraced significantly, creating FOMO. However, it eventually surged to a new all-time high in the final phase. Currently, I believe we are witnessing the formation of a similar "M" shape. Bitcoin is in the process of completing the first half of the "M," which could lead to a downward move. However, this is not a cause for panic. After this retracement, Bitcoin is expected to complete the "M" shape and reach a new all-time high later this year.

On-Chain Analysis Insights

From an on-chain perspective, it’s evident that major investors have not fully exited their positions. There’s a general sentiment among large holders to create FOMO, allowing them to buy back at lower prices. This aligns with my research, suggesting that the current market dynamics are part of a larger strategy.

Additionally, the recent delay in the bull run can be attributed to the rise of meme coins. These coins have created a frenzy, with politicians and influencers jumping on the bandwagon to launch their own meme coins. This has diverted attention and capital from Bitcoin, causing a slight delay in its upward momentum. However, once the meme coin hype subsides, Bitcoin is expected to resume its upward trajectory.

Summary

Halving Mapping: Three key phases were discussed – the bull run, bear market, and pre-halving upward move.

Current Chart Structure: Bitcoin is forming a half "M" shape, which may lead to a downward move before completing the pattern and reaching a new all-time high later this year.

2025 Outlook: The entire year of 2025 is expected to be dominated by the bull run.

Note

My goal is to simplify the chart and help you understand the price action clearly. I avoid overloading the chart with unnecessary indicators or creating confusion. My analysis focuses on keeping the chart clean and straightforward.

Thank you!

BTCUSD Weekly Double TopsAs I analyse CRYPTOCAP:BTC - it is now at a crossroads. If in the upcoming week the price doesn't go up, it can possibly be bearish. However, we have a strong support around $92-93k, and if that's broken, we have to be careful.

Notice how it looks like a double top on the weekly - the second wick is manipulation before distribution. Trust me, Im bullish on BTC, but I will be taking some profits and monitor the price closely.

Trade well, and stay safe!

All you need for Bitcoin to see top, bottom or a crash.These charts show everything you will ever need to buy and sell Bitcoin.

5 day BTC chart.(right chart)

Orange vertical lines on chart show when the RSI touches the pink horizontal line after it touches the top red horizontal line. This indicates a bear market.

Yellow vertical lines on chart show when RSI rose above orange line after touching the blue line but failed to touch the red horizontal line before hitting the pink horizontal line. This indicates a crash is coming.

The green arrows on chart show whenever the blue EMA8 goes below the yellow MA55 after being above it.

This indicates either BTC has entered a bear market or a crash like setup similar to covid. If we get another green arrow you will know what to do as it will be a crash or bear market.

The green trendlines on chart show each bull run Bitcoin touches this trendline 3 times or more before it has a parabolic move. The anamoly being the covid crash. So far this bull run it is only twice that Bitcoin has touched the green trendline.

On the LMACD the green vertical lines show everytime the 5day LMACD crosses down (blue LMACD line going under orange LMACD line) when it is above the horizontal yellow line. This has happened 21 times with only 1 time (red vertical line) where price did not drop to the EMA21 (orange moving average line) on the chart.

BTC just did this cross on LMACD so it has a 95% chance of moving down to touch the orange EMA21.

Based off all this clear evidence it is easy to see that you sell Bitcoin when RSI hits red horizontal line. Confirmation of bear market is as per indicators mentioned above.

You buy when RSI touches blue horizontal line.

You won't sell the exact top or buy the exact bottom but very close to it. You would need a different chart to calculate the exact top.

This chart will stand the test of time if history keeps rhyming for Bitcoin.

Monthly BTC chart.(left chart)

On the monthly chart the orange vertical lines indicate whenever the Stoch RSI went above the green horizontal line. The yellow vertical line on the chart shows the covid crash as the Stoch RSI did not stay above the green horizontal line for very long.

The green arrow on the Stoch RSI shows when it fell straight through the red horizontal line after being above the green horizontal line. This indicated a bear market.

The pink arrows on the Stoch RSI show the crossover of the Stoch RSI (blue RSI line crosses under orange RSI line) after it fell below the green horizontal line and bounced off the blue or red horizontal lines. This indicated the top and a bear market.

After seeing this current information on the Stoch RSI (bounce off blue line) it looks like the upcoming crossover will be a pink arrow.

These arrows indicate time to exit the market as you can see.

From Moonboys to Bag Holders: The Bitcoin SagaAh, the Anatomy of a Mania , the chart that keeps on giving! Bitcoin chilling at GETTEX:97K in the ‘New Paradigm!!!’ zone? 🚀💎🙌 Translation: everyone’s sipping on hopium smoothies and thinking they’re financial geniuses. Spoiler alert: they’re not. 😏

Next up? Bull Trap Boulevard—where FOMO warriors jump back in screaming ‘TO THE MOON!’ 🌕 only to realize they just bought the top... again. 😬 Then we head straight to Capitulation Carnival, where wallets cry louder than the people who said ‘I’ll never sell!’ 🤡 And let’s not forget the VIP afterparty at Despair Dungeon—population: bag holders. 😭

But hey, don’t let me stop you. Ride that red line, champ! 📉 I’ll be waiting at the mean reversion party with my popcorn. 🍿😎

Bitcoin in 2024: Key Trends, Recent Developments, and Future OutBitcoin in 2024: Key Trends, Recent Developments, and Future Outlook

H ello,

Bitcoin, the world’s first and most prominent cryptocurrency, continues to dominate the digital asset landscape in 2024. Amid a rapidly changing environment shaped by regulatory updates, technological advancements, and shifting market dynamics, Bitcoin remains at the forefront for investors, institutions, and blockchain enthusiasts. Here, we explore the key trends, recent developments, and risks influencing Bitcoin’s journey.

Market Trends and Sentiment

Bitcoin’s performance in 2024 has been marked by volatility and resilience. Following a period of price consolidation in 2023, renewed interest in Bitcoin has surged this year, fueled by macroeconomic factors like inflation concerns, geopolitical tensions, and increasing institutional adoption. This renewed focus propelled Bitcoin to a new all-time high of over $103,000 in December 2024, reflecting both strong demand and fluctuating investor sentiment.

The bullish outlook is largely driven by institutional adoption. Major financial institutions have expanded their Bitcoin offerings, including exchange-traded funds (ETFs), custody solutions, and Bitcoin-backed loans. The U.S. Securities and Exchange Commission (SEC)’s approval of several spot Bitcoin ETFs earlier this month has been a game-changer, attracting traditional investors and enhancing Bitcoin’s accessibility. Conversely, bearish sentiment arises from persistent regulatory uncertainties, particularly in the United States, where stricter scrutiny of exchanges continues to cast a shadow over the market.

Regulatory Landscape

Regulation remains a pivotal yet contentious aspect of Bitcoin's growth. In 2024, several countries introduced comprehensive cryptocurrency frameworks, offering much-needed clarity for the industry. For instance, the European Union’s implementation of the Markets in Crypto-Assets (MiCA) regulation has set a benchmark for crypto governance within the bloc, increasing investor confidence.

Meanwhile, emerging markets such as India and Brazil have embraced Bitcoin as a tool for financial inclusion, fostering widespread adoption. However, not all regulatory developments have been favorable. The U.S. SEC’s cautious approach has delayed approvals for certain cryptocurrency innovations while increasing oversight on exchanges. This dichotomy between proactive and restrictive regulatory environments will continue to shape Bitcoin’s adoption and growth.

Technological Advancements

Bitcoin's technological foundations have seen notable progress in 2024, reinforcing its utility and appeal. The Lightning Network, a second-layer solution designed to enable faster and cheaper transactions, has gained significant traction. This technology enhances Bitcoin’s potential to function not only as a store of value but also as an efficient medium of exchange.

Sustainability has also become a focal point in Bitcoin mining. Renewable energy now powers a significant portion of mining operations, addressing previous criticisms about Bitcoin’s environmental impact. These advancements reflect a broader industry shift toward greener practices, appealing to environmentally conscious investors.

Adoption Trends

Bitcoin’s integration into both institutional and retail financial systems continues to deepen. Institutional adoption has reached unprecedented levels, with leading asset managers incorporating Bitcoin into their portfolios and major banks offering Bitcoin-related services. Retail adoption has also grown, with more merchants and platforms accepting Bitcoin as a payment method.

The rise of Bitcoin-backed financial products, including derivatives and tokenized assets, highlights its maturation as a financial instrument. Bitcoin’s increasing prominence in traditional finance signals its evolution from a niche digital asset to a key player in the global economy.

Recent Developments Influencing Bitcoin’s Price

Spot Bitcoin ETFs: U.S. approval of spot Bitcoin ETFs in December 2024 was a watershed moment, enabling easier access for traditional investors and driving Bitcoin’s price to new highs.

Regulatory Clarity in Europe: The EU’s MiCA regulations have bolstered confidence among European investors and institutions, fostering a secure environment for Bitcoin operations.

Emerging Market Adoption: Nations like Brazil and India have integrated Bitcoin into their financial systems, viewing it as a means of promoting financial inclusion.

Geopolitical Instability: Tensions in global markets have reinforced Bitcoin’s role as “digital gold,” attracting investors during times of uncertainty.

Sustainability Efforts: Renewable energy adoption in mining has improved Bitcoin’s environmental profile, drawing in environmentally conscious stakeholders.

Risks and Challenges

Despite its progress, Bitcoin faces significant challenges. Regulatory uncertainty in jurisdictions with restrictive policies remains a key risk. The SEC’s ongoing scrutiny in the U.S. underscores the hurdles Bitcoin must overcome in certain markets. Market volatility continues to deter risk-averse investors, while competition from other cryptocurrencies and blockchain platforms could dilute Bitcoin’s dominance.

Security remains another area of concern. While Bitcoin’s blockchain itself is highly secure, vulnerabilities in exchanges and wallets expose users to hacks and fraud. Education on best practices and enhanced security measures will be critical to maintaining trust within the ecosystem.

Looking Ahead

The future of Bitcoin in 2024 and beyond will depend on its ability to address these challenges while capitalizing on its opportunities. Key developments to watch include further regulatory evolution, ongoing advances in scalability and energy efficiency, and the continued integration of Bitcoin into traditional finance.

Bitcoin’s journey from a niche digital asset to a globally recognized financial instrument underscores its resilience and adaptability. As decentralized finance and digital currencies continue to evolve, Bitcoin remains at the forefront, shaping the future of the cryptocurrency landscape.

Regards,

Ely

What a Daily BTC Update looks like Thank you for reading my post! I appreciate the time you have taken to stop by, please leave me a comment.

Every day for nearly 10 years, I have updated BTC in the various groups I have owned or worked for.

Follow as I post them here for the next 7 days!

BTC UPDATE 21/12/2024

BTC has shown resilience, bouncing successfully in the current region with a successful retest, indicating strong buying interest. However, we’re not out of the woods yet—the market remains cautious, and confirmation is still needed for the next bullish leg.

Key Weekly Pivot to Watch: $100,831

The weekly pivot at $100,831 is the critical level to reclaim.

A close above this pivot would signal renewed bullish momentum and confirm the bounce as more than a relief rally. There may still be one more retest in the lower region, but a more condensed corrective pattern would reflect the support as holding.

Scenarios to Prepare For

Bullish Case: Close Above $100,831

A weekly close above this pivot could open the door to:

Testing resistance zones around $105K to $108K.

Reaffirming BTC’s macro uptrend and restoring market confidence.

Bearish Case: Failure to Close Above $100,831

If BTC fails to hold or close above this region:

Expect a potential revisit to support around $95K to $94K.

Increased sell pressure could lead to deeper retracements, possibly targeting $85K as a more substantial support zone.

Key Indicators to Monitor

Watch RSI and MACD for signs of overbought or oversold conditions near key levels.

Volume: A strong breakout above $100,831 should be accompanied by increasing volume, signalling conviction from buyers.

Daily and Weekly Candle Closes: Focus on higher timeframes (daily and weekly) for confirmation of direction.

Momentum Indicators: Watch RSI and MACD for signs of overbought or oversold conditions near key levels.

Bitcoin Bulls Beware: The "Mother of All" Head & Shoulders Is LuOh, Bitcoin. The gift that keeps on giving—and by giving, I mean serving up enough drama to rival a reality TV show. 🎭 Right now, the charts are screaming something that no bull wants to hear: “Head & Shoulders Incoming!” Yep, the "Mother of All" Head & Shoulders patterns is staring us dead in the face. 👀 So let’s talk about it—before you YOLO your life savings into the next parabolic trap. 🚀💸

The Head & Shoulders: Bitcoin’s Drama Queen Moment 👑

Let me break it down for the bulls who are too busy chanting “TO THE MOON!” 🌕 to notice the iceberg ahead. ❄️

The Head & Shoulders pattern is the chart equivalent of a red flag 🚩. Imagine this:

🟢 Left Shoulder: A confident high—Bitcoin strutted its stuff back in 2021, reaching new heights.

🟢 The Head: Fast forward to now, where we’ve hit $95,000 and everyone’s acting like Bitcoin’s the next messiah. ✝️

🟢 Right Shoulder (Projected): Oh, honey, this is where it gets juicy. That weaker rally you’re about to see? It’s Bitcoin saying, “I’m tired. Let me rest.” 🥱

And the neckline? That’s the last thread holding this fragile rally together. Snap it, and we’re not just falling—we’re BASE jumping without a parachute. 🪂

Why This Pattern Is a Bull Killer 🐂🔪

The Neckline is the Guillotine:

If Bitcoin breaks below the $68,000-$72,000 zone (the neckline), it’s game over. 🎮 Expect the bears 🐻 to drag prices down faster than a meme stock crash. Think $12,000-$16,000. Ouch. 🩹

Parabolic Moves Always End Badly:

Every bubble in history starts with euphoria and ends with tears. 🥲 Remember 2017? Yeah, me too. If your strategy is “buy high, pray higher,” consider this your intervention. 🙏

Smart Money is Already Exiting:

While retail investors are busy chanting, "HODL!" 🗣️, the big players are already cashing out. You’re not buying the future; you’re buying someone else’s exit strategy. 🏃♂️💸

The Bull Arguments (and Why They’re Hilarious 🤡)

Let’s address the hopium-filled arguments Bitcoin bulls love to make:

“Bitcoin’s going to $1 million!”

Sure, and my grandma’s starting a TikTok empire. 🙄 Hyperbolic targets are fun until you realize they’re marketing tactics for bag holders. 🎒

“This time is different!”

Yes, this time is different—it’s a bigger bubble with more memes. 🐸💥 The math doesn’t care about your feelings.

“Buy the dip!”

At $12,000, you’ll be wondering, “Which dip were they talking about?” 🕳️ Spoiler: It’s not this one.

What’s Next? The Wild Ride Ahead 🎢

So, what should you do while Bitcoin flirts with financial disaster? 🤔

For the Bulls: Tighten those stop losses! If you’re still screaming “HODL,” you’d better enjoy emotional rollercoasters. 🎢

For the Bears: Grab some popcorn 🍿 and wait. When the neckline breaks, it’s gonna be a feast.

For Everyone Else: Stop trading like you’re gambling in Vegas. 🎲 Learn some strategy, or better yet, join our Road to a Million Club 🚦 where we teach you how to trade smart and avoid emotional wreckage.

Final Word: Don’t Be the Greater Fool 🧠

Bitcoin’s meteoric rise is mesmerizing. But remember, meteors burn out. 💥 This Head & Shoulders pattern is the market’s way of saying, “Party’s over.” 🎉 You can keep pretending the moon 🌕 is within reach, or you can wake up and start playing the game strategically.

Join the Road to a Million Club 🌟 if you’re ready to stop chasing dreams and start creating real wealth. Because when Bitcoin decides to tumble, it’s the prepared who’ll walk away richer. 💼💎

Stay sharp, stay sarcastic, and don’t let the bulls take you down with them. 🐂💔