BTC | ALT Season, then BEARISH CYCLE BeginsBitcoin is likely moving in to the beginning of a bearish cycle.

I'm not saying this is immediate, we first need to see altseason - however, if BTC increases it may not go any higher than the last high of $123k. We could easily see the price hover around this zone with a few small increases and decreases for the next few weeks as alts make their respective moves.

I have been talking about the 2021 fractal for a couple of months, where BTC took its time to correct and then made another ATH which was only slightly higher.

We already see a similar pattern playing out in the monthly timeframe if we overlay bars pattern from 2021:

Although Bonce zone 3 may only be in several months, these are the major support zones where BTC could bounce from. Ideal for a swing:

____________________

BINANCE:BTCUSDT

Bitcoinprice

Bitcoin Continues Uptrend as USD Weakens📊 Market Overview:

Bitcoin is currently trading around $119,100, after reaching a peak of $122,242 in yesterday’s session. This price surge is supported by President Trump’s executive order establishing the National Bitcoin Reserve, along with strong buying demand from corporations and ETF funds.

📉 Technical Analysis:

• Key Resistance: $122,000 – $123,000

• Nearest Support: $118,000 – $118,500

• EMA09: Price is currently above the EMA09 on the H1 timeframe → short-term uptrend is maintained.

• Candlestick Pattern: Strong bullish momentum with long green candles; RSI above 70 indicates a possible short-term correction.

📌 Outlook:

Bitcoin may continue to rise if it holds above the $118,000 support level and no negative news emerges. However, caution is advised as RSI remains above 70, signaling potential short-term pullback.

💡 Suggested Trading Strategy:

BUY Bitcoin/USD at: $118,500 – $118,000

🎯 TP: $120,000 – $122,000

❌ SL: $117,500

SELL Bitcoin/USD at: $122,000 – $123,000

🎯 TP: $120,000

❌ SL: $123,500

Bitcoin Soars Past $122K, But a "Digital Fort Knox" Threat LoomsThe cryptocurrency market is in the throes of a historic rally, a tidal wave of capital and confidence that has propelled Bitcoin beyond the formidable $122,000 mark. Now trading within 1% of its all-time high, the world’s premier digital asset is riding a powerful current shaped by two monumental events: a surprisingly favorable executive order from the White House and a relentless cascade of inflows into spot Bitcoin ETFs. This surge has ignited euphoria across the financial world, with even the second-largest cryptocurrency, Ether, touching highs not seen since its 2021 peak.

Yet, beneath the glittering surface of this bull run, a profound and unsettling question is taking shape. As institutional giants and corporate treasuries embrace Bitcoin, some of its most astute observers are sounding an alarm. They warn that this corporate adoption boom is creating a path that looks eerily similar to the one gold traveled in the 20th century—a path that ended with its effective nationalization and centralization in the vaults of Fort Knox. This growing concern posits that Bitcoin’s greatest triumph, its integration into the mainstream financial system, could become its ultimate vulnerability, presenting a new and potent centralization threat that challenges the asset's very soul. The market is now caught between the thrill of unprecedented price discovery and the chilling possibility that it is witnessing the rise of a digital Fort Knox.

The Anatomy of a Rally: A Perfect Bullish Storm

The recent price explosion was not a random event but the result of a powerful confluence of factors that have systematically validated Bitcoin’s role in the global financial landscape. The market sentiment has been overwhelmingly positive, driven by a one-two punch of regulatory encouragement and undeniable institutional demand.

First, a landmark executive order from the White House sent a clear signal that the United States is moving towards a framework of integration rather than opposition for digital assets. The order, widely seen as pro-crypto, has initiated a formal exploration of how to safely incorporate cryptocurrencies into the bedrock of American wealth: 401(k) retirement plans. For years, regulatory uncertainty has been the single greatest barrier holding back a true institutional deluge. This directive acts as a powerful de-risking event, providing a level of clarity and legitimacy that large-scale investors have been desperately seeking. The potential to unlock even a small fraction of the trillions of dollars held in retirement accounts has sent a jolt of optimism through the market, assuring corporations and funds that they are investing in an asset class with a government-acknowledged future.

Second, while the executive order provided the strategic tailwind, the tactical buying pressure has come directly from spot Bitcoin ETFs. These regulated financial products, which allow investors to gain exposure to Bitcoin through a traditional brokerage account, have been an unprecedented success. In a stunning display of demand over the last week, these funds have absorbed hundreds of millions of dollars in net inflows on consecutive days. To issue new shares, these ETFs must purchase the underlying Bitcoin from the open market, creating a massive and constant source of demand. This dynamic acts like a supply shock; as billions of dollars from mainstream investors flow through ETFs to chase a finite number of available coins, the price is algorithmically forced upward. The flow of funds into these products has become one of the most closely watched metrics, serving as a real-time indicator of institutional appetite and a direct driver of price action.

The Ghost of Gold: A Historical Warning for a Digital Age

Even as investors celebrate this new era of institutional acceptance, a chilling historical parallel offers a cautionary tale. The concern, articulated by prominent on-chain analysts, is that Bitcoin’s current trajectory is mirroring the centralization of gold that occurred in the United States, a process that ultimately subjected the precious metal to complete state control.

To grasp the gravity of this comparison, one must look back to President Franklin D. Roosevelt's Executive Order 6102, signed in 1933. Amidst the Great Depression, the order made it illegal for U.S. citizens to privately hold significant amounts of gold coins or bullion, compelling them to turn over their holdings to the Federal Reserve. The stated goal was to stabilize the economy, but the result was the mass transfer of a decentralized monetary asset from the hands of the people into the centralized vaults of the U.S. government. The nation's gold was consolidated, most famously at Fort Knox, giving the state absolute control over the physical supply.

Decades later, in 1971, President Richard Nixon delivered the final blow. With the "Nixon Shock," he unilaterally severed the U.S. dollar's convertibility to gold, effectively ending the Bretton Woods system that had anchored global finance. Having already secured control of the physical asset, the government was then free to change the rules of the system it underpinned.

The argument today is that Bitcoin could face a similar, albeit modern, fate. A 21st-century "nationalization" would not involve government agents seizing hardware wallets. It would be a far more sophisticated and systemic takeover, executed through the very financial instruments and institutions that are currently being praised for driving the bull market. The end result could be a scenario where a significant portion of the Bitcoin supply, while technically on a decentralized network, is effectively controlled by a handful of state-sanctioned entities.

This digital "Fort Knox" could be constructed through several vectors. The majority of Bitcoin purchased by ETFs and large corporations is not held in self-custody. Instead, it is entrusted to a small number of large, regulated custodians. These firms represent centralized points of control. A government could easily exert legal and regulatory pressure on these few custodians, compelling them to freeze, block, or even seize the assets they manage on behalf of millions of investors.

The ETFs themselves are a primary vehicle for this potential centralization. By concentrating hundreds of thousands of Bitcoin under the management of a few powerful financial firms like BlackRock and Fidelity, they make the asset supply vastly easier to regulate and control. It is far more efficient for a state to influence a handful of ETF issuers than to police millions of individual Bitcoin holders around the world.

Finally, the public companies that have famously added Bitcoin to their balance sheets are also part of this equation. As regulated entities, they must comply with government mandates. A state could enact policies that influence or dictate how these systemically important corporate treasuries are managed, effectively bringing them under state influence without ever formally seizing the assets.

Bitcoin’s Inherent Defense: Can Decentralization Hold the Line?

While the historical parallel to gold is compelling and sobering, it is not a perfect one. Bitcoin possesses unique technological attributes that provide a powerful defense against the kind of centralization that befell gold.

The most fundamental defense is the power of self-custody. Unlike gold, which is a physical object that is cumbersome to store and move securely, Bitcoin is pure information. An individual or entity that controls their own private keys holds a sovereign asset that is incredibly difficult to confiscate without their cooperation. This ability to "be your own bank" remains a powerful counter-force to the trend of custodial reliance.

Furthermore, the Bitcoin network is a globally distributed system. Miners, nodes, developers, and users are spread across dozens of countries, operating under a multitude of legal jurisdictions. No single government can unilaterally control the network or dictate its rules. An attempt by one major nation to implement draconian controls would likely trigger a mass exodus of capital and talent to more favorable jurisdictions, a powerful economic disincentive against overreach. The current global competition among nations to become "crypto hubs" demonstrates that governments are aware of this dynamic and are incentivized to create attractive, rather than punitive, regulatory environments.

This tension may ultimately lead to the bifurcation of the Bitcoin market. One tier could consist of the regulated, "paper" Bitcoin—held in ETFs and by public corporations, fully compliant, but subject to the rules and potential control of the traditional financial system. The other tier would be the sovereign, "physical" Bitcoin—held in self-custody by those who prioritize censorship resistance and decentralization above all else.

A Future Forged in Conflict

As Bitcoin knocks on the door of a new all-time high, the market is caught in a powerful paradox. The institutional adoption that has legitimized Bitcoin and driven its price to stratospheric levels is the very same force that introduces a systemic risk to its core principles. The celebration of the current rally is, in essence, a celebration of the construction of the very infrastructure that could be used to co-opt it.

The journey to $122,000 was paved with institutional capital and regulatory acceptance. The journey forward will be defined by a fundamental conflict: the battle between mainstream financial integration and the preservation of the decentralized ethos that made Bitcoin a revolutionary technology. The future of the world's most important digital asset will be forged in the crucible of this tension, determining whether it remains a truly sovereign asset for the people or becomes another tool in the arsenal of the centralized systems it was designed to disrupt.

BMT/USDT – Major Rebound Potential from Accumulation Zone?🔍 Overview

BMT/USDT is currently trading at a critical support zone after a prolonged downtrend from the local peak at 0.32529. The 0.075 – 0.083 range, highlighted in yellow, has acted as a strong price defense area from March to August 2025.

The structure indicates a potential reversal pattern if the price can break above key resistance levels.

---

📈 Pattern & Technical Structure

Main Pattern: Potential Double Bottom or Accumulation Base on the daily chart.

Key Support:

Accumulation zone: 0.07500 – 0.08277

Final support: 0.06934 (lowest price of the year)

Layered Resistance Levels:

R1: 0.09637 → First psychological resistance

R2: 0.12859 → Short-term profit-taking area

R3: 0.14472 → Mid-term resistance

R4: 0.16288 → Major resistance before a strong rally

R5: 0.27013 → Long-term bullish target

---

🚀 Bullish Scenario

If the price breaks and sustains above 0.09637 with significant volume:

Short-term target: 0.12859 (+55% from current price)

Mid-term target: 0.14472 – 0.16288 (+74% to +96%)

Long-term major breakout target: 0.27013 (+226%)

Additional Confirmation:

RSI climbs above 50 and continues to strengthen

MACD forms a golden cross

Gradual increase in buying volume

---

⚠️ Bearish Scenario

If the price fails to hold above 0.075 and breaks 0.06934:

Potential downside targets:

S1: 0.06500 (-21%)

S2: 0.05700 (-31%)

Additional Confirmation:

Surge in selling volume

Daily candlestick closes below 0.06934

RSI breakdown below 40

---

🎯 Strategy & Risk Management

Buy at Support Strategy:

Entry at 0.082 – 0.083, SL below 0.06934, Target 0.12859 → Risk:Reward ± 3.4

Breakout Buy Strategy:

Entry after daily close above 0.09637, SL below 0.082, Target 0.14472 → Risk:Reward ± 2.24

---

📌 Conclusion

BMT/USDT is at a make-or-break zone: a successful breakout could trigger a strong rally, while a breakdown would extend the bearish trend. This is a decision point for swing and position traders to monitor closely.

#BMTUSDT #CryptoAnalysis #Altcoins #TechnicalAnalysis #PriceAction #Crypto #BreakoutTrading #SupportResistance #CryptoSignal #AltcoinSeason

BTC Bitcoin Among My Top 10 Picks for 2025 | Price TargetIf you haven`t bought BTC Bitcoin before the recent breakout:

My price target for BTC in 2025 is $125K, driven by the following fundamental factors:

Regulatory Developments Favoring Adoption:

The anticipated regulatory shifts in the United States are expected to create a more favorable environment for cryptocurrencies. With the potential for pro-crypto policies under a new administration, including the establishment of Bitcoin as a strategic reserve asset by major nations, investor confidence is likely to increase significantly. Analysts suggest that such developments could drive the total cryptocurrency market capitalization from approximately $3.3 trillion to around $8 trillion by 2025, with Bitcoin poised to capture a substantial share of this growth.

Increased Institutional Demand through ETFs:

The launch of Bitcoin exchange-traded funds (ETFs) has already begun to transform the investment landscape for Bitcoin, making it more accessible to institutional and retail investors alike. Following the successful introduction of multiple Bitcoin ETFs in 2024, analysts project that inflows could exceed $15 billion in 2025, further boosting demand for Bitcoin. This increased accessibility is expected to drive prices higher as more investors seek exposure to the asset class.

Supply Constraints from Halving Events:

Bitcoin's supply dynamics are fundamentally bullish due to its halving events, which occur approximately every four years and reduce the rate at which new Bitcoins are created. The most recent halving in April 2024 has led to a significant reduction in supply inflation, creating scarcity that historically correlates with price increases. As demand continues to rise while supply becomes more constrained, this fundamental imbalance is likely to support higher prices.

Growing Adoption as a Store of Value"

As macroeconomic conditions evolve, including persistent inflationary pressures and potential monetary policy easing, Bitcoin is increasingly viewed as a viable store of value akin to gold. This perception is bolstered by its finite supply and decentralized nature, making it an attractive hedge against inflation. Analysts suggest that as more investors turn to Bitcoin for wealth preservation, its price could see substantial appreciation

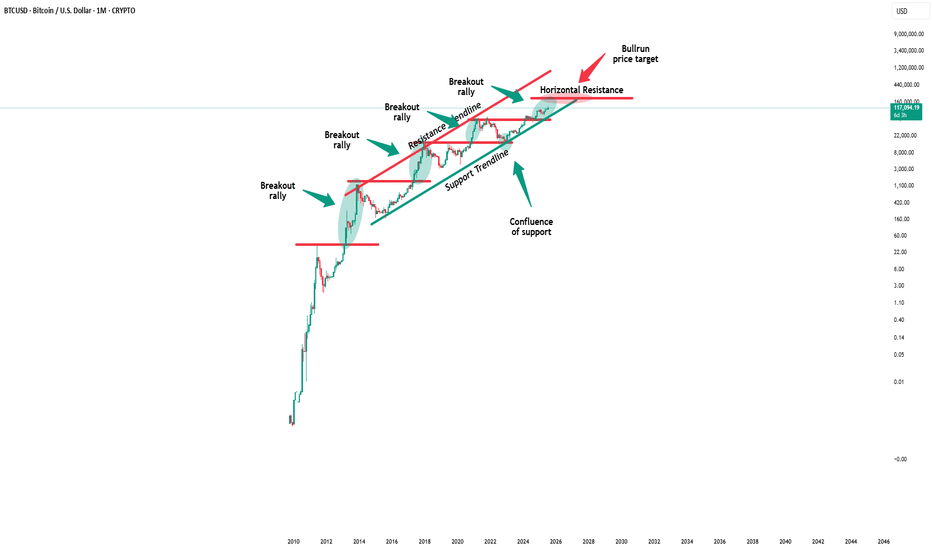

Bitcoin - The cycles are playing out!⚔️Bitcoin ( CRYPTO:BTCUSD ) just repeats another cycle:

🔎Analysis summary:

Following all of the previous all time high breakouts, Bitcoin will now further extend the rally. After some simple calculation, we can see that Bitcoin will rally another +50% in order to reach the overall price target. However there will be volatility along the way so make sure to remain calm.

📝Levels to watch:

$200.000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

BITCOIN PREDICTION: THIS FIBONACCI SPIRAL WILL BLOW YOUR MIND!! Yello Paradisers! I've revealed to you the secret Fibonacci spiral target. We have been going through multi-timeframe analysis as professional traders. We have been going through the high timeframe chart. We have understood that we are trading inside of that ABC zigzag. Right now, we are in the C wave and we are creating the five moves that are upside. That might take us towards $135,000.

We are right now in the first wave of that fifth wave. We are having bullish divergences on the high timeframe chart. All important indicators like stochastic RSI, RSI, and MACD are having bullish signs, and we have successfully reclaimed the volume profile point of control from resistance into support.

Then, we are turning our focus on the medium timeframe. We are again going through the Elliot wave. We are taking a look at the contracting triangle; the deviation there happened, we are seeing the bullish divergence, and we are updating the Fibonacci spiral. Then we are moving our focus to the low timeframe where we are concluding the Elliot wave count of smaller waves and understanding that the fifth one might be extended.

Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

ID/USDT — Final Battle at the Multi-Month Downtrend Line!📌 Market Structure Overview

Since peaking in late 2024, ID/USDT has been trapped under a relentless multi-month downtrend line lasting almost 10 months. Every rally attempt has been shut down at this descending wall.

Now, the market is at a critical inflection point — price is pressing right against the trendline and sitting in the decision zone between 0.190–0.205.

A breakout here would not only be a technical victory for the bulls but could also trigger a shift in market psychology from seller dominance to buyer control.

---

📊 Key Levels to Watch

Major Resistances: 0.2049 → 0.2475 → 0.2665 → 0.3180 → 0.3641 → 0.4874 → 0.6742

Supports: 0.177–0.180 → 0.165 → 0.134–0.145 (major demand zone)

---

📐 Pattern & Sentiment Analysis

The dominant structure is a classic Descending Trendline Resistance, showing consistent lower highs under seller pressure.

However, there’s an early sign of sentiment shift — a higher low compared to the July bottom, suggesting that buyers are stepping in earlier and absorbing supply.

If price can close a daily candle above the trendline and 0.2049, we could see the start of a trend reversal rally toward higher resistance levels.

---

🚀 Bullish Scenario

1. Trigger: Daily close above the trendline + 0.2049.

2. Confirmation: Retest of 0.19–0.205 holds as new support.

3. Upside Targets:

Initial: 0.2475

Mid-term: 0.2665 → 0.3180

Extended: 0.3641 (psychological zone)

4. Invalidation: Closing back below 0.190 or losing 0.177–0.180.

---

📉 Bearish Scenario

1. Trigger: Sharp rejection from the trendline/0.19–0.205 zone.

2. Downside Targets:

First: 0.177–0.180

Next: 0.165

Extreme: 0.134–0.145 (historical low)

3. Invalidation: Sustained breakout above 0.205 with strong volume.

---

⚖️ Perspective & Risk Management

This is a “make or break” moment for ID/USDT.

Don’t rely solely on intraday spikes — wait for a confirmed daily close to avoid fakeouts.

Use the above S/R levels as tiered take-profit zones and for placing protective stops.

#IDUSDT #ID #Crypto #PriceAction #TechnicalAnalysis #DowntrendBreak #Breakout #SupportResistance #CryptoTrading

OXT/USDT — Accumulation Before a Breakout or Further Decline?📌 Overview

OXT/USDT is currently at a critical stage on the weekly chart, consolidating within the strong demand zone at 0.0465–0.0650 (yellow box) that has been tested multiple times since mid-2023. This area acts as the last line of defense for buyers before price enters uncharted multi-year lows. The macro structure remains in a long-term downtrend since the 2021 peak, but the base formation in this low zone opens up a significant opportunity for a medium-term relief rally if a breakout is confirmed.

---

1. Key Technical Levels

Main Support / Demand Zone (yellow box): 0.0465 – 0.0650

→ This is the “floor” that has been holding price for nearly two years.

Minor Support: 0.0500 (psychological & repeated reaction level)

Layered Resistance Levels:

0.0731 → 0.1078 → 0.1555 → 0.2275 → 0.3208 → 0.4268 → 0.6620 → 0.8305

---

2. Structure & Patterns

Macro Trend: A sequence of lower highs since 2021 → indicating the primary trend is still bearish.

Potential Pattern:

Base / Accumulation Range near multi-year lows → resembles an early rounding bottom, but not confirmed yet.

Possible spring pattern: brief drop below main support followed by a sharp reclaim.

Volume (not shown here): Often decreases near the bottom range, signaling sellers may be losing strength.

---

3. Bullish Scenario (Relief Rally Potential)

💡 Conservative confirmation:

Break & weekly close above 0.0731.

Step-by-step targets: 0.1078 → 0.1555 → 0.2275.

0.1078 is the key breakout pivot; clearing it could trigger large-scale short covering.

⚡ Aggressive setup:

False breakdown below 0.0465 (spring) followed by a quick weekly close back above 0.050–0.055.

Initial target: 0.0650, then 0.0731 if momentum continues.

Best suited for swing traders aiming for high risk/reward.

---

4. Bearish Scenario (Trend Continuation)

Clean weekly close below 0.0465 + failed retest (0.0465 turning into resistance).

Downside targets: 0.0400 then 0.0320.

Failure to break 0.0731 and forming another lower high would also indicate sellers remain in control.

---

5. Strategic Notes

The 0.0465–0.0650 zone is the final battleground between long-term buyers and sellers controlling the macro trend.

Patience is required on this 1W timeframe; valid breakouts may take several weekly candles to confirm.

Aggressive traders may consider entries within the yellow box with tight stops below 0.0465, while conservative traders can wait for a confirmed breakout above key resistance.

---

6. Key Takeaway

As long as price holds inside or above the yellow box, relief rally potential remains alive.

Breaking 0.0731 will be the first major signal of sentiment shift.

A breakdown below 0.0465 opens a new chapter in the long-term downtrend.

#OXT #OXTUSDT #OrchidProtocol #CryptoAnalysis #PriceAction #WeeklyChart #SwingTrade #SupportResistance #BreakoutSetup #CryptoTrading

Declining 2-Year US Treasury Yields Could Fuel Bitcoin’s BullishThe follow chart is a comparison between Bitcoin CRYPTOCAP:BTC Daily Chart and the US 2 years Treasury Bonds TVC:US02Y .

The graphic shows the 2-year US Treasury yield declining from 3.7684% to 3.7308% on August 12, 2025, following a steep drop after CPI inflation in July stabilized at 2.7%. This underscores market expectations that the Federal Reserve will lower interest rates, driving up demand for bonds as a safe haven asset.

The potential on Short-Term Impact on the Bitcoin Market:

Positive: Falling rates and expectations for rate cuts weaken the US dollar, boosting capital flows into riskier assets such as Bitcoin. BTC may gain in the immediate term, testing the $130,000 resistance level, aided by new liquidity from stablecoins.

Risk: While falling yields can support Bitcoin’s bullish momentum, they may also signal recession fears. If investors interpret the decline as a warning of economic slowdown, BTC could face selling pressure—potentially dropping to $111,939. Volatility remains elevated, especially after the recent liquidation of leveraged long positions. Keep an eye on upcoming economic data for confirmation of market direction.

BTC Update: Still Trapped in the Exhaustion ZoneBTC Update: Still Trapped in the Exhaustion Zone

Yes… we're all exhausted. And right on cue, BTC prints a second Exhaustion Candle on the daily. That’s not bullish.

A dip before a rip? Very likely.

—

🔍 The Setup

BTC still behaving strong overall — this would be a counter-trend dip if it comes.

Shorting here is playing defense, not offense.

📌 Key Level to Watch:

The 2025 High Trendline — drawn from Jan to May highs — is now likely acting as support, not resistance. Expect aggressive buyers there if price drops.

—

🐻 If Bears Claw Through That Line…

• First stop = May ATH (~112K)

• This time, don’t expect the bulls to hold it as easily

• If that cracks, next stop = the downward sloping trendline — the one that's quietly caught every breakdown since this zone began.

—

📌 The Alpha View

The second exhaustion candle is a warning shot.

This dip might be brief — but if bulls fail to show strength at the right level, it could spiral.

Stay sharp. Stay regulated.

Let the structure speak — not your emotions.

BITCOIN BULLS ARE GONNA DO THIS NOW!!!! (Fakeout Wick) Yello Paradisers! In this video, I've been updating Bitcoin price action and the Elliot Wave theory. I've been doing lots of advanced technical stuff. We've been going through channeling and updating ourselves about the most important support and resistance levels. We've been taking a look at the MACD histogram, the RSI, and the stochastic RSI. We've been professionally analyzing the volume; we've understood who is in power right now and what's going to happen next with the highest probability.

We've also been taking a look at what kind of confirmations we are waiting for in order for us to be able to open long or short positions.

Paradisers, make sure that you are trading with a professional trading strategy. Wait for confirmations, play tactically, and focus on long-term profitability, not on getting rich quick.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

Bitcoin, Ethereum Breakout: 401(k) funds & the next "Altseason"Bitcoin is up 10% in August, driven by strong ETF inflows and a game-changing executive order allowing 401(k) retirement funds to invest in cryptocurrencies, potentially bringing trillions of dollars into the sector.

Technically, Bitcoin and Ethereum are breaking out toward multi-year highs, with BTC leading and ETH close behind—setting the stage for a possible "altseason" if these levels hold and capital rotates into altcoins.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

BITCOIN has broken Free - The Next cycle type begins- WHY ?

I have been talking about the Blue Arc of resistance for a while now.

The ARC that has rejected EVERY ATH since Bitcoin began its true rise in Value back in 2011.

I am not going to get to technical right now as I have had only 1 coffee..lol..

Lets begin

I have 3 charts with this Arc on , all slightly different so as to allow for small errors in plotting or calculation.

ALL charts now show PA Above the Arc.

Why is this so important ?

As previously explained, that Blue Arc is a part of a Calculated Fibonacci Spiral.

Calculated from Each ATH to the next and using the difference as a part of that calculation, I was able to pinpoint the centre of this Arc.

And here is the Full picture.

What I am finding a little interesting is how that centre is on MARCH 2020 - That Sudden and worrying COVID CRASH !

But that is a subject for another time.

The Two important things to take of here is how PA began rising on this spiral as soon as PA entered it ( Left ) and unless we broke out of it now, PA would have been dragged back down by December. The time spent inside this spiral are the cumulative years of Bitcoin.

It is also very interesting how the 3 "Cycles " we have had in this channel. have ended perfectly at that intersection of the Blue Arc and the underlying line of support, that PA has not dropped below since we entered the channel back in 2012

To me, that is more than just a coincidence.

And if we look at a smaller time frame, we can see that PA has broken over this Arc, with strength.

The Daily chart above does show us that we do still have challenges ahead.

For instance, there is that line of local resistance just above, that could , under the right circumstances, push PA back down with vengeance should the Bears take over.

But I do not think that will happen yet but it would be nice if we could climb over that and use it as support.

We have done on 2 previous occasions this cycle but each time, we got pushed back under.

3rd time lucky ?

The 4 hour chart gives hope.

Here we can see how that Blue Arc was used as support but once it failed, the Bulls were Quick to get back over.

To me, this shows us that the Bulls have every intention of keeping Bitcoin High and above that Blue Arc.

But the longer we wait to get over that local line of resistance above, and use as support, the further away it Gets.

Currently, the Target to get over that lline is around 140K

Near Term projections of PA, in a bullish run, are around 160K -> 180K

This would give PA that underlying line of support.

So, we wait to see how this plays out but THE MOST IMPORTANT THING ?

We Must remain above that line, the Blue Arc....that currently sits around 115 -118K

The Next Few weeks are VITAL and I remind you..August has nearly twice as many RED monthly closes as Green..Unless it is in a Bull run....;-)

The Daily RSI has room to move still but is High

The Weekly RSI is Similar in hieght, with room to move.

So, We could be in a good position to start that New Cycle type, out of the Spiral that Created Bitcoin as we now know it. The 4 year Flow could change as mass adoption takes pace and People simply do not Buy / Sell as we used to do.

But it is impossible to really know whats coming.

We can only watch and learn. We may well end up having the 4 year cycles again.

After all, that gave us superb profit making opportunities.

Or will Bitcoin become the Store of Value, the Digital Gold ?

Time will tell.

Have a good week and stay safe

BITCOIN- Charging Towards 122k Momentum Building BTC/USD Long Setup – Targeting 122K 🔥

Bitcoin is holding strong above 118500, signaling bullish momentum.

✅ Price broke key resistance & forming higher lows.

🟢 Current structure favors buy-side continuation with next major target at 122000.

Support Zones:

🔹 117800 – intraday bullish retest

🔹 116500 – strong demand zone

Resistance Ahead:

🔸 120200 – short-term reaction

🔸 122000 – major target

🚀 Expecting bullish wave continuation.

If momentum sustains above 118K, 122K breakout highly probable!

#BTC #Bitcoin #CryptoSetup #BTCUSD #CryptoTrading #BTC122K #ChartAnalysis #BullishBreakout

BTCUSDT 111k first then UPHi fellow traders,

Here’s my current BTCUSDT view on the 4H chart, based on Elliott Wave principles.

After a corrective structure, we’ve seen a strong bounce, and price is now approaching a key area of interest. I’ve marked the zones I’m watching for potential buys and sells:

🟨 Lower box: Potential buy zone if price pulls back with a corrective structure.

🟨 Upper box: Area of interest for taking partials or looking for potential short setups, depending on how price reacts.

If momentum continues, we could see BTC pushing into the 125K region, which aligns with fib extensions from previous swings.

As always, I’m waiting for confirmation before making any entries.

Let me know what you see on your end!

ME/USDT (2D) — Last Stand at the Support Zone!ME/USDT is now at a make-or-break moment. After a prolonged downtrend since the start of the year, price action has formed a Descending Triangle — a combination of a falling trendline pressing down from above and a strong horizontal support between 0.65 – 0.85 USDT.

📌 Why this zone matters:

This yellow zone has repeatedly absorbed heavy selling pressure.

A breakdown below it could open the door to a much deeper fall.

Conversely, a breakout above could be the first sign of a trend reversal.

---

🔍 Pattern Analysis

Descending Trendline Resistance

Every rally attempt since the yearly top has been capped by this dynamic resistance, keeping lower highs intact.

Horizontal Support Zone (Yellow Box)

This area acts as the “last wall” for buyers. While it holds, the bullish case is alive.

Descending Triangle Structure

Statistically, this pattern tends to break down if formed after a strong downtrend — but in crypto, sudden sentiment shifts or fundamentals can flip the script.

---

📈 Bullish Scenario

1. Strong Breakout: A 2D candle close above the descending trendline and 0.98 USDT.

2. Successful Retest: Price retests the breakout zone and holds above it.

3. Upside Targets:

Target 1: 1.214 USDT (+57%)

Target 2: 1.921 USDT (+149%)

Extended Target: 2.699 USDT if momentum surges.

4. Volume Confirmation: Without strong volume, breakouts risk being fakeouts.

---

📉 Bearish Scenario

1. Breakdown: A 2D candle close below 0.65 USDT (bottom of the support zone).

2. Failed Retest: Price attempts to reclaim support but gets rejected.

3. Downside Targets:

Initial Target: 0.50 USDT

Extreme Target: 0.30 USDT (lowest point shown on chart).

4. Acceleration Risk: Strong volume + weak market sentiment can accelerate the drop.

---

📊 Key Levels to Watch

Resistance: 0.98 | 1.214 | 1.921 | 2.699 | 5.416

Support: 0.65 (major) | 0.50 | 0.30 (extreme low)

---

💡 Trader’s Notes

Descending triangle + strong support = high-stakes setup.

Wait for confirmed 2D candle closes and volume spikes before entering.

Always manage risk with clear stop-loss levels & proper position sizing (risk < 2% capital).

Watch for news catalysts or shifts in broader market sentiment.

#ME #MEUSDT #Crypto #TechnicalAnalysis #DescendingTriangle #Support #Resistance #Breakout #Breakdown