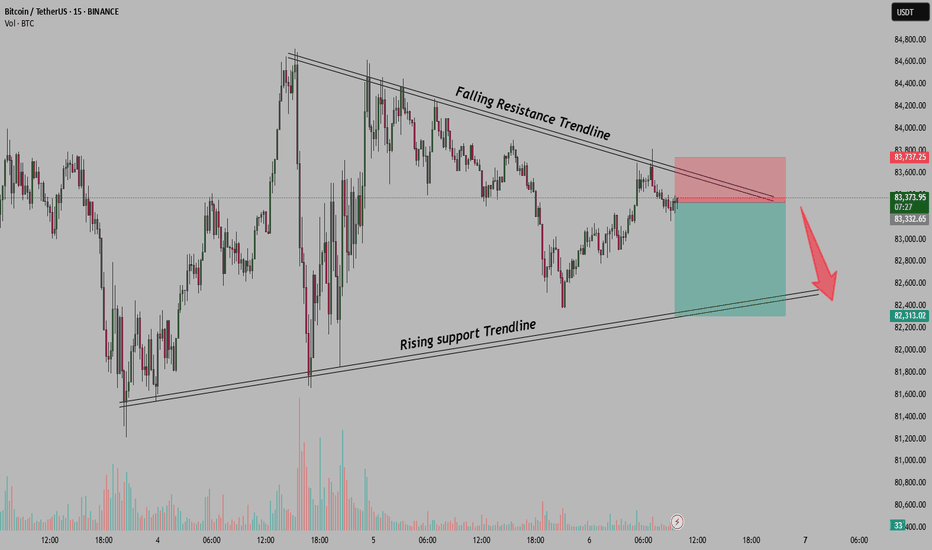

Bitcoin's Symmetrical Triangle – a short trade possible here!Bitcoin is currently forming a symmetrical triangle on the 15-minute chart, with a falling resistance trendline and a rising support trendline. This setup is a classic indication of consolidation, and the price is likely to move for downside soon as it is reversing from upper band now. If Bitcoin manages to break above 83,737, we could see a breakout of this symmetrical triangle, On the flip side, if it breaks below the rising support, 82,313 could breakdown for downside and we can see further downside then, but now we are playing inside the symmetrical triangle only and we will try to book profit once price reaches lower band of the symmetrical triangle pattern.

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.

If you Found this helpful? Don’t forget to like, share, and drop your thoughts in the comments below.

Bitcoinpriceaction

Bitcoin accurate bottom and top zones

BINANCE:BTCUSDT

This is my market mood indicator. Accurate determine the bottoms and top of cycles.

Based on this analysis on BLX chart and Monthly timeframe we can find something interesting

- Marked Monthly green zones.

- We never seen white color disbeliefe zones.

- Previews 3 times when we saw BLUE color it was a bottom (I was impressed how accurate it play out!!!)

- Now it looks like 2018-2019 period (green box-blue-green)

- So now no euphoria on market. Need to see yellow, orange and top will be again at extreme red

- Hard to say about timing but most likely we will test trendLine at 35-36 (maybe with fake out to 41)

- Then we will see yellow and orange color on indicator and drop to covid trendLines again 21-19 and continue move forward till 2025 March to extreme RED zones and end of cycle.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

worried about BTC? watch thisThis is not financial advice, but it is therapy. That's better, right?

Points I mentioned:

- The price dipping down is just a pullback, it is not a crash. Relax.

- There is a double bottom and I am watching 91.5k to see if it breaks down. If it does I am eyeing 85-88k area to enter a long.

- I believe we are experiencing profit taking and a pull back as we have seen dips like this before.

- We're not bad trader's, just greedy.

The Mother Of All Trades 🙏🏽 Billions Will Be Made!Imagine a world, where The Crypto Weather Channel had its own bank. That bank stored a large amount of its capital reserves in Bitcoin at the start of the Bull Market. This is what that would look like.

#Long

Take Profit: $66,442 (5th Halving Price)

Entry: $26,976 (CAT 1 Price)

Stop Loss: $15,473 (Market Cycle Low)

Bitcoin - what is its cost production value, really?!I want to touch on the topic of bitcoin's cost production value. This is a rather important matter as it gives a better understanding of its price's cost bottom. Many miners talk about 15-20 thousand USD as its cost production value. They are right! When it comes to individual mining, then this is most likely to be the case. However, based on the above evaluation, many home miners and investors believe that the price of bitcoin cannot go any lower.

This is not the case!

The break-even point depends primarily on 2 factors: the efficiency of the equipment and the price of electricity or hosting. Globally, individual mining does not in any way affect the price action or its cost bottom.

Why is that?

This is because there is an industrial scale of mining by companies such as: Poolin & Bitmain from China, Crypto Scientific from US or BitBaza, BitRiver, CryptoUniverse from Russia, etc. where infrastructure investments range from 10 to 150 million USD. Bitcoin's cost for the mining giants is around 3,000-5,000 USD for the following reasons:

1. Equipment purchases are made in bulk directly from the manufacturers. Some companies, for example, like Bitmain produce their own ASICs.

2. The average efficiency of the equipment is around 40-45 J/TH. More advanced mining farms have even better equipment working at 60 J/TH.

3. Currently electricity's price for industrial use in the US is about 6-7 cents per kWh. Poolin, for example, offered 4 cents on its electricity contract in Texas. The price for electricity in Kazakstan and Russia's Irkutsk is around 2 cents - the two locations where some Chinese miners have been moving over the last six months. There are also examples of mining farms that are directly connected to power plants like Greenidge Generation. Such companies generally work without intermediaries.

Therefore, bitcoin's cost bottom price is not 15,000 USD at all, but is around 3,000-5,000 USD.

Can the price go below the cost production price?

Undoubtedly! Gold, oil and bonds - all of them had negative yields more than once over the past 60 years. A striking example is 20 April 2020, when the price of WTI crude oil fell below zero to -37 USD. Therefore, bitcoin's short-term drop to 1,500 USD is feasible and may well materialize.

Keep in mind that price action is fundamentally dependent on macroeconomic factors and the expectations of large speculators. Media feeds are always made for the crowd! As the saying goes, what every taxi driver knows - is no longer the news.

Bitcoin🦍Gorilla On BTC Next Shocking Dump($66k Fakeout Loading?"Trade what you see not what you think" is one of my most favorite quotes even though I don' know the origin, The current market in its state is not a clear one just yet. My last analysis call for 40k is still in play, though I see some chance rising for The bull to attempt breaking the Current resistance of 60k but what are the chances of loosing money if you buy this breakout ?

In my opinion, base on the current BTC price action I see the 60k to 62k resistance action as a very strong resistance to over come, But Then I see a strong possible rejection coming.

From This above daily chart we see price respecting the Daily chart Support that I made mention of in my last analysis that we will get a bounce to 56k to 60k. but the problem why I don't see this crossing 80k is because of what I am seeing on the weekly chart where we have a buyers line support at 42k to 38k area which in my opinion is a better buy entry point but will require good patient.

How about shorting the market Bitcoin 🦍Gorilla, Is it a good time to short since its at a resistance?

I see Tomorrow likely to be a red day in my opinion to 54k down move and hopefully we don't break 50k this time.

If you have been following my update, Our Target on this channel has been 68k since Jan, I have been warning about this 60k to 68k coming dump and Now This next rejection can be a deadly hit on BTC as we are currently heading back to that resistance of 60k to 62k.

I am always open minded, So the chances of my 68k target is there but I am still seeing the weekly chart screaming 40k and I am a price action trader that base most of my decision making on weekly and daily chart, therefore I wont be

Good patient trader will get 40k entry and a strong one will get 20k, This is my second month talking about this incoming dump plan, It will hit like a film trick......Be warned, This is no financial advice so please do more research thank you.

$RIOT PT 100 and higherRiot Blockchain, Inc., together with its subsidiaries, focuses on cryptocurrency mining operation in North America. The company primarily focuses on bitcoin mining. As of December 31, 2020, it operated a fleet of 7,043 miners. The company was formerly known as Bioptix, Inc. and changed its name to Riot Blockchain, Inc. in October 2017. Riot Blockchain, Inc. was incorporated in 2000 and is based in Castle Rock, Colorado.

Buyers will win this War! Bitcoin Sellers be Warned!🦍Like And Subscribe(😊 Thanks in advance)

Should you still Hold, Buy more or sell you Bitcoin at this current price of Bitcoin? you may be asking after bitcoin recent price actions.

I am sincerely more than happy😳 to welcome our new subscribers.

My analysis are always multi-timeframes, so please do expect a full week play out of my predictions.

as a result of my busy hectic schedules, I will be making only weekly analysis every weekends on what to expect from the market through out the new week before a new weekend.

I will do my best to try to constantly update the posts during the week, to keep you updated incase we have any sudden incoming changes in price action that could affect our results.

Thanks for your constant supports and understanding.

Bitcoin bulls did successfully break the sellers resistance area and not just that , but they also allowed price to retest the sellers down trending resistance area and currently, trying to turn it into a new buyers support area (resistance broken and automatically turning into support).

Just like I said it , this was going to happen in my last weekend analysis on Bitcoin last week. Bitcoin demand power(bulls or buyers strength) held down the 32k support Like real bulls would💪🏾 .

this war between buyers and sellers on what direction price should move next lasted through out the week and was filled with anxiety and massive stop loss hunt by the buyers as they out numbered sellers like I said..

Now the current situation is that the bulls are tired of being held down and could explode again to the upside, the 32k support down to 28k push was hard crack but bulls survived the sellers back to back attack, the pump will be explosive as the second breakout move clock is already ticking tick! tock!

Because support and resisitance is an area not a line, price was finding buyers as it goes down leading to bounce after each push . we see BTC buy pressure growing by the mints above the 32k support all the way to 33800.this range seems to give buyers strength as they are lined up in number on this zones.

therefore my Target of 54k to 60k range target is a measured move of the previous buyer power before the pause(sideways price move occur)

This is no financial advice on what so ever, it is just my opinion on the market in terms of what the next move possible for bitcoin price direction to make good profit than loss.

we are like about to see big pumps and BTC shooting to the moon for a 60k win win😍 ride.

Good profit for bulls and good short profit range for bears, all the way down to 20k to 16k range💩.

But that will be after a sweet run to 50k min is accomplished.

look at the current weekly chart, the bar about to close in the next 24hrs has successfully created a new high.

from the daily chart , it shows that the buyers demand is likely to keep growing, leading to price attempting 38k again before the end of 24hrs.

BITCOIN - 5 Bullish Price Action Criteria!!Hi followers and other TradingView users! As usual, to unlock this text You have to hit the LIKE button ;)

Currently, the BTC' price could make an important move upwards if the candle gets a close above the grey trendline - the triangle upper trendline.

FIVE Bullish signs from the chart:

1. Possible bullish "Inverted Head and Shoulders", the neckline is the well-known strong resistance area $6,460

2. Price has made short-term Higher high (HH) and higher low (HL). Higher low has formed on the same area as the right shoulder.

3. The right shoulder and the new higher low has formed exactly on the short-term trendline retest area. We had a breakout and now we have a retest!

4. We have multiple bullish candlesticks from different low levels, which will indicate that the buyers want to see higher prices and that's why those patterns have occurred.

5. On the 4H chart, we have 8 & 21 EMA golden cross which will indicate - IF we get a candle close above the grey trendline - that the momentum may continue.

So, those are the criteria which will guide us to the higher prices if You see a candle close above the grey trendline and above the $6,460 which is also the H&S neckline.

The first three criteria happen very rarely Together(!).

Considering bearish price action at USDT then it could be mean something because Tether takes a little hit at the moment. It needs to be stable and the volume has to come from pure buyers, not from USDT dropping!

Remember to trade cautiously because those are the short-term higher high and higher low, not the long-term! Long-term, the trend is bearish but that's why we make those TA's because of the good entry points and because of the signs!

The current momentum and some patterns change into neg. when the price drops below the $6,400. Inverted H&S becomes invalid, EMA cross becomes invalid and etc.

As always I try to keep You posted!

Hopefully, this breakdown helps You out a little bit to confirm Your own analysis!

Please, don't forget to LIKE, COMMENT & FOLLOW!

Thank You for your support, I really really appreciate it!

Have a nice day!

*This information is not a recommendation to buy or sell. It is to be used for educational purposes only!