BITCOIN's 1D MA50 Flip = GREEN LIGHT for the NEXT BIG PUMP!Bitcoin (BTCUSD) closed Saturday's 1D candle above the 1D MA50 (blue trend-line) for the first time in more than 2 months (since February 03)! The 1D MA50 got tested and rejected the price 6 times since then. At the same time, the price marginally broke above the Lower Highs trend-line that started on the January 20 All Time High (ATH).

This is the most powerful short-term bullish combination as it was staged on a Bullish Divergence 1D RSI, which is on Higher Lows against the bearish trend's Lower Lows. Technically such break-outs immediate Target is the 2.0 Fibonacci extension, which now happens to be just below the $100k mark at $99500. In not such a coincidental fashion, that is he last Resistance level that run through February 05 - 21 before BTC's strong tariff sell-off.

So do you think the 1D MA50 break is the green light for a $99500 rally? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoinsignals

BITCOIN Can it start an insane rally on CHEAP MONEY??Bitcoin (BTCUSD) seems to be at a point where it last was at the beginning of its current Bull Cycle in October 2022. And that's the point where the Global Liquidity Cycle Indicator (black trend-line) bottomed and started rising, confirming the more on Higher Lows.

This huge buy formation has been present on every BTC Cycle, usually at its bottom (but on the 2015 case, a little after) and signaled the huge monetary supply into the global markets, which translates into rising prices and rallies.

This is the first time we see the same rising liquidity formation twice in a Cycle. Can this be the driving force that BTC needs for its final and strongest parabolic rally of the Cycle towards the end of the year?

Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin Short-Term Setup: Watch $79K Resistance!!!Bitcoin ( BINANCE:BTCUSDT ) started to fall again ,as I expected in the previous post .

This post is also a short-term analysis and is on the 15-minute time frame .

Bitcoin is moving near the Potential Reversal Zone(PRZ) .

In terms of Elliott Wave theory , Bitcoin appears to have completed a 5-wave downtrend on the 15-minute timeframe.

I expect Bitcoin to continue its upward trend in the coming hours , at least to the Resistance zone($79,350-$78,540) .

Note: If Bitcoin falls below $75,470, we can expect further declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BITCOIN Are we back in business?Bitcoin (BTCUSD) made a miraculous comeback yesterday as it rebounded with force almost +12% from its session Low, following the 90-day tariff pause news. This rebounded has been performed on both the 1W MA50 (blue trend-line), which has been the key long-term Support of this Bull Cycle, but also on the previous High line, which is the trend-line coming from the previous Higher High of the Bull Cycle that has now turned Support.

As you see, during every Bull Cycle correction, this previous High line held both times before and it is doing so this time also. This justifies the incredible symmetry of this Bull Cycle but it doesn't only stop on the uptrend structure but goes back to the downtrend structure of the Bear Cycle. As you see, the extension of those previous High lines intersect the Lower Highs of the Bear Cycle. Symmetry at its very best.

At the same time, back to the current Bull Cycle, we see that the Vortex Indicator (VI) has already diverged, which has been consistent to both previous bottoms.

As far as what the target of this potential rebound/ rally can be, both previous main rallies hit at least the 1.618 Fibonacci extension. That sits now at $175000.

So do you think this Double Support rebound combo is putting BTC back in Bull Cycle business for a rally to $175k? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

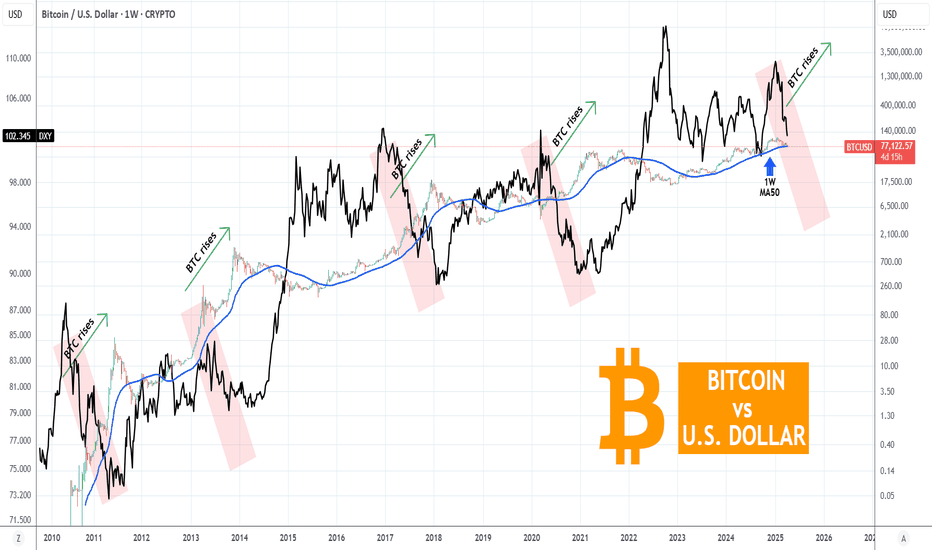

BITCOIN Can a USD sell-off save the Cycle?Bitcoin (BTCUSD) is hanging on its 1W MA50 (blue trend-line) amidst the market chaos and especially following last night's stronger 104% trade tariffs to China from the U.S.

This is a simple yet powerful classic chart, displaying Bitcoin against the U.S. Dollar Index (DXY, black trend-line). This shows the long-term negatively correlated pattern they follow on their Cycles.

Every time DXY entered an aggressive sell-off in the final year of the 4-year Cycle, Bitcoin started its final parabolic rally of its Bull Cycle. This time the DXY peaked exactly at the start of the year (2025) and is on a selling sequence up until today but due to the ongoing Trade War, BTC not only didn't rise but is on a correction too.

Can an even stronger DXY sell-off save the day and complete the 4-year Cycle with a final rally? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

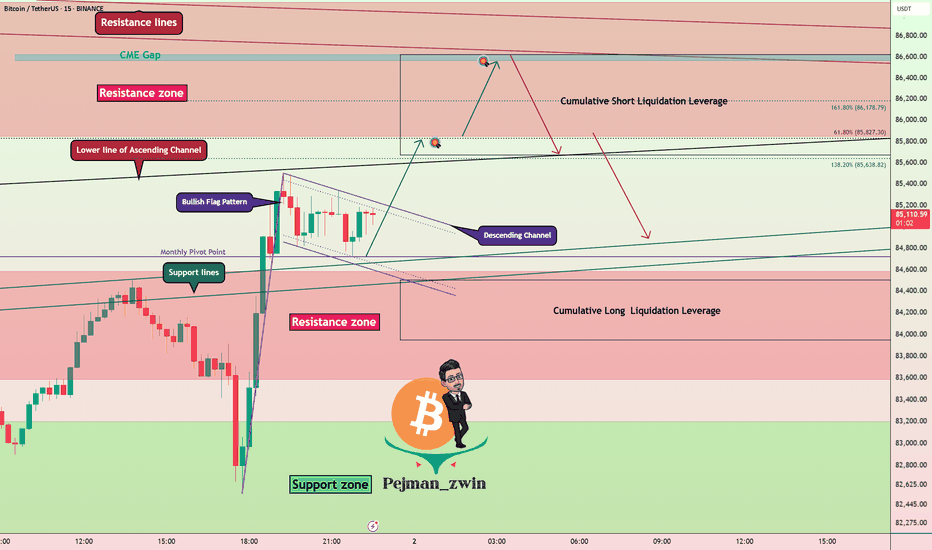

Bitcoin Pullback Complete – Bears Gearing Up for Round Two!!!First of all, let me say that the market has been very excited these past few days, so be more careful with your capital management.

Also, these days, Bitcoin ( BINANCE:BTCUSDT ) has a high correlation with the US stock market indices , and one of the most important of them is the S&P 500 Index ( FOREXCOM:SPX500 ).

Today, I published the following analysis for the S&P 500 Index , which I used as a result of that analysis for Bitcoin .

Bitcoin is trading near the Resistance zone($81,610-$79,800) , the Yearly Pivot Point , the Daily Pivot Point , the important uptrend line (broken) , and the Cumulative Short Liquidation Leverage($81,500-$79,677).

Overall, it seems that this uptrend in Bitcoin over the past few hours was a pullback to the broken Important uptrend line and the liquidation of short position s. Do you agree with me?

In terms of Elliott Wave theory , it seems that the uptrend of the last few hours has been in the form of a Zigzag Correction(ABC/5-3-5) and we should expect another decline .

Based on the above explanation , I expect Bitcoin to resume its downtrend and approach the Potential Reversal Zone(PRZ) again ( after breaking the support lines ).

Cumulative Long Liquidation Leverage: $74,520-$73,244

If you want to see my overall view of Bitcoin on the weekly timeframe and further understand the significance of the Uptrend line(broken) , you can refer to the following idea:

Note: If Bitcoin can completely fill the CME Gap($84,475-$81,450), we should expect further increases.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

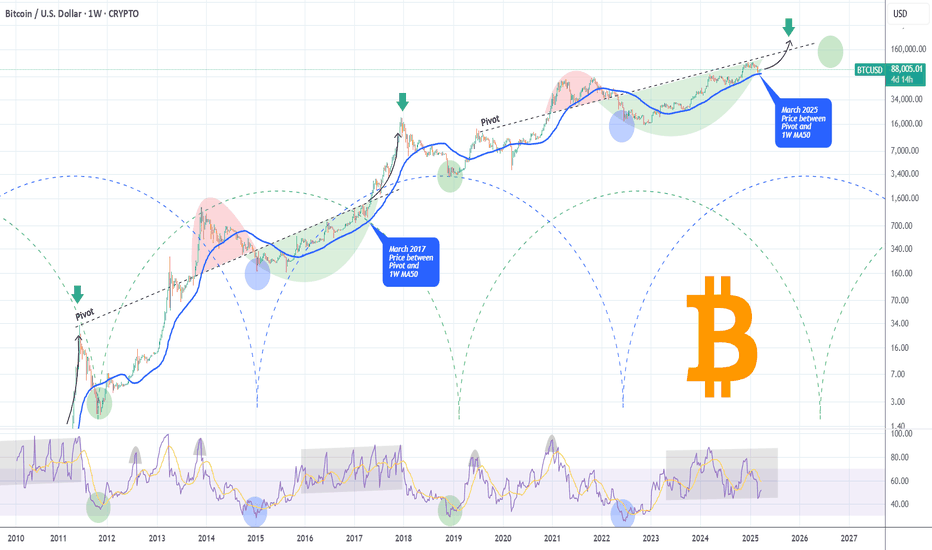

BITCOIN Is it still on track with past Cycles??Bitcoin (BTCUSD) saw a strong correction last week as well as early trade yesterday on Monday, along with all major stock markets, but had an equally impressive round on Wall Street opening, which keeps it so far above its key 1W MA50 on a potentially weekly closing.

So the critical question now is this: Will it continue the pattern of past Cycles and give one more major rally in 2025?

Well based on the BTC Rainbow Waves, it is still on track and actually in a similar situation as July 2013 when after a 3-month correction/ pull-back sequence, it got back to the Blue Buy Zone and near the Fair Value green trend-line.

As you can see all Cycles peaked on the Red Zone and so far on this Cycle we haven't even reached the 1st orange trend-line. Based on the Time Cycles, the next peak should be around November 2025 and if the price action confirms the Rainbow Wave model again, the closest level to the Red Zone by then would be around $180000.

Do you think that amidst the trade war chaos, that's a realistic expectation? Feel free to let us know in the comments section below!

P.S. I am attaching a snapshot below in case the waves aren't displayed properly on the chart above:

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

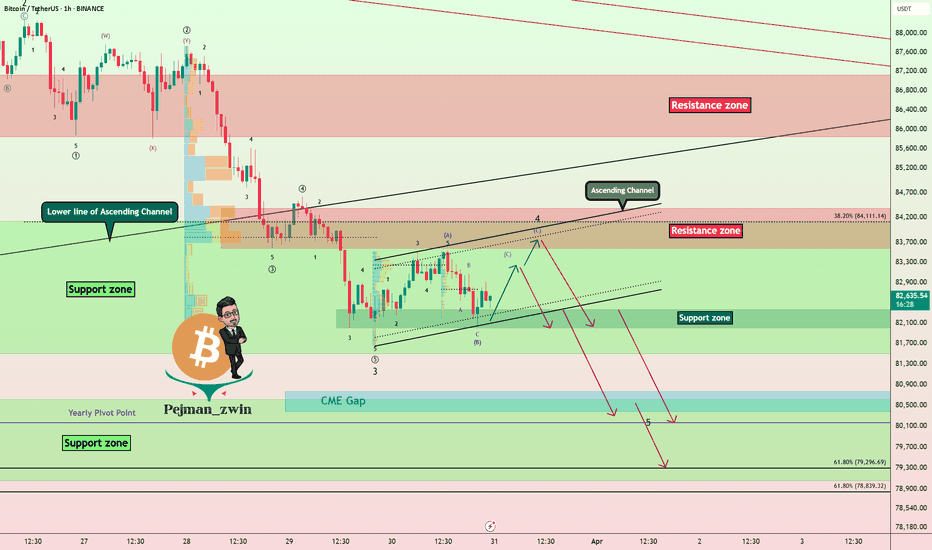

Critical zone for Bitcoin – Pump or Dump!(Mid-term Analysis)Today, I want to analyze Bitcoin ( BINANCE:BTCUSDT ) on a weekly time frame so that you can take a mid-term view of BTC. On November 12, 2024 , I shared with you another weekly analysis in which we found the All-Time High(ATH) zone well.

Please stay with me.

Bitcoin has been on an upward trend for the past 27 months , increasing by about +600% . Have you been able to profit from this upward trend in Bitcoin?

During these 27 months , Bitcoin has had two significant corrections , the first correction -20% and the second correction -33% (interestingly, both corrections lasted about 5 months ).

Another thing we can understand from the two main corrections is that the second correction is bigger than the first correction , and since Bitcoin is currently in the third correction , we can expect the third correction to be either equal to the second correction or greater than the second correction . Of course, this is just an analysis that should be placed alongside the analyses below .

It seems that the start of Bitcoin's correction can be confirmed with the help of the Adam & Adam Double Top Pattern(AADT) . Bitcoin also created a fake breakout above the Resistance lines .

Educational tip : The Adam & Adam Double Top (AADT) is a bearish reversal pattern characterized by two sharp, ^-shaped peaks at nearly the same price level. It indicates strong resistance and a potential trend reversal once the price breaks below the neckline between the peaks.

Bitcoin appears to be completing a pullback to the broken neckline .

According to Elliott's Wave theory , Bitcoin seems to have completed its 5 impulse waves , and we should wait for corrective waves . It is a bit early to determine the structure of the corrective waves , but I think it will have a Zigzag Correction . The structure of the corrective waves depends on the news and events of the coming weeks and months.

I think the Potential Reversal Zone(PRZ) will be a very sensitive zone for Bitcoin.

I expect Bitcoin to start correcting again when it approaches $87,000 or $90,000 at most, and fills the CME Gap($86,400_$85,595) , and at least approaches the Heavy Support zone($73,800_$59,000) AFTER breaking the uptrend line .

In your opinion, has Bitcoin finished its correction or created an opportunity for us to escape again?

Note: If Bitcoin goes above $90,500, we should expect further increases and even make a new All-Time High(ATH).

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), Weekly time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Will BITCOIN prove to be resilient amidst this market crash??Bitcoin (BTCUSD) just hit its 1W MA50 (red trend-line) for the first time since September 06 2024, while completing the first 1D Death Cross since August 09 2024. This is a critical double combo development as last time those conditions emerged it was a bullish signal.

Despite the theoretically bearish nature of the Death Cross, the last one on 1D was formed just four days after the market's previous major long-term bottom of August 05 2024. That bottom was exactly on the level that the market hit today, the 1W MA50.

The 1W RSI sequences among the 2 fractals are identical and if it wasn't for the abysmal negative market fundamentals regarding the back-and-forth tariffs, that would be an automatic long-term buy entry, the 3rd on of this Bull Cycle.

The only condition we can technically rely on right now, amidst the stock market crash, is for the weekly candle to close above the 1W MA50, as it did on August 05 2024. In that case and of course if and only if the trade war gets under control (and/ or the Fed makes an urgent rate cut), we can expect a new long-term Bullish Leg to begin towards $150k and above.

Failure to address those concerns and a 1W candle close below the 1W MA50, can result into a stronger sell-off towards $50000 and the next long-term technical Support level of the August 05 2024 Low (49150). That would also be a major Support cluster as the 1W MA200 (gray trend-line) is just below that level (and holding since October 16 2023) and by the time of the drop, the market may test that as well.

So what do you think? Will BTC turn out to be resilient amidst this market crash or will it follow suit and decline towards $50k? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin Faces a "Resistance Lines WALL" – Breakout or Breakdown?Bitcoin ( BINANCE:BTCUSDT ) started to rise as I expected in my previous post and hit all targets . Will Bitcoin continue the upward trend of the past two days!?

Please stay with me.

First of all, I have to say that Bitcoin is facing a Wall of Resistance lines ( intersection of at least 4 Resistance lines ). Do you think Bitcoin can easily break these resistance lines with a single attack?

Bitcoin is trading near the Resistance zone($87,520_$85,840) , Potential Reversal Zone(PRZ) , and a Series of Resistance lines .

In terms of the Elliott Wave theory , Bitcoin appears to have completed Corrective waves . The corrective wave structure in the Ascending Channel is a Double Three Correction(WXY) .

I expect Bitcoin to drop to $85,000 in the first step in the coming hours. The Second target is $84,333 , and if the Support zone($84,430_$83,170) is broken, we should wait for the CME Gap($80,760_$80,380) to fill.

Do you think Bitcoin can break the wall of the Resistance lines, or will it start declining again?

Note: Donald Trump's speeches over the next hours could also affect the market, so trade a little more cautiously during this hour.

Trump’s Speech & Potential Tariffs

In today’s speech, Trump is expected to discuss new tariffs on imports from China, Mexico, and Canada, possibly ranging from 20-25%. If confirmed, this could impact global markets, strengthen the USD, and increase economic uncertainty.

Note: If Bitcoin touches $89,000, we should most likely expect more pumping.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BITCOIN Bollinger squeeze and 1D Death Cross aiming at $150kBitcoin (BTCUSD) will complete today a 1D Death Cross (1D MA50 crossing below the 1D MA200). A technically bearish pattern in theory but in practice it has been one of the greatest buy signals during the 2023 - 2025 Bull Cycle.

** Bollinger Squeeze, 1D Death Cross, 1W MA50 **

As you can see, since the long-term Channel Up started with the November 21 2022 Bear Cycle bottom, we have had another two 1D Death Crosses. Both took place on the Channel Up bottoms (September 04 2023 and August 05 2024), serving as Higher Lows for the pattern. At the same time, the price had a test (or close) of the 1W MA50 (red trend-line), while the Bollinger Bands (blue cloud) have already started to squeeze.

This squeeze is critical as it was even present during the November 21 2022 Bear market bottom, having started a little earlier on October 31 2022. In fact the squeeze started earlier on all three bottom phases and even on the current price action we are seeing so far a Bollinger Squeeze since March 17 2025, a little after the near test of the 1W MA50.

** The Transition Month **

In typical cyclical manner, each year had one Channel Up bottom. This bottom process (consisting of the Bollinger Squeeze, 1D Death Cross and 1W MA50 test) technically appears once a year. We call this month 'Transition Month', which is the necessary phase that BTC spends to go from the bottom to the new Bullish Leg of the Channel Up. In 2022 that month was December, in 2023 it was September and in 2024 August. Since all bottom conditions have been met this time also, we expect April to be the 2025 Transition Month.

** What's next? **

As far as the next leg up in concerned, all 3 previous Bullish Legs rose by at least +100% from the bottom. Since March 10 was the close test of the 1W MA50, we can consider that the bottom from which to measure the +100% leg up. That suggests that BTC will hit at least $150000 on the next top.

But what do you think? Has this Bollinger Squeeze, 1D Death Cross, 1W MA50 Triple Combo just priced the new bottom? And if yes, will April be the Transition Month for the new Bullish Leg to $150k? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN is exactly where it's supposed to be.Bitcoin (BTCUSD) is under heavy pressure lately due to the trade tariffs but as long-term investors, we shouldn't let this volatility affect us.

The MVRV has been one of the most consistent cyclical Top (sell high) and Bottom (buy low) indicators giving only a maximum of two optimal signals in each Cycle and it shows that the market is nowhere near a Top.

On the contrary the MVRV has spend the first 3 months of the year correcting from the 0.382 Fibonacci level to the 0.236. This is the exact same score it had i March 2017. Even in the other two Cycles that wasn't this low on Fibonacci levels, it still made a correction, flashing a red signal.

As the 1W MA50 (blue trend-line) continues to support, there are far more greater probabilities that the market will recover, turning the recent trade volatility into the best buy opportunity of 2025.

As far as a Cycle Top is concerned, it has always been an excellent exit signal when the MVRV hit the 0.786 Fib.

So do you think that will be the case? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin Breaks Resistance – Bullish Flag in Play(Short-term)!!!Bitcoin ( BINANCE:BTCUSDT ) started to rise and pump after '' the Mastercard Plans to Enable 3.5 Billion Cardholders to Transact with Bitcoin and Crypto, " and the US indexes movements and managed to break the Resistance zone($84,380_$83,580) .

Bitcoin is moving near the Monthly Pivot Point and Support lines .

Bitcoin seems to be completing the Bullish Flag Pattern .

I expect Bitcoin to reach the Targets I have outlined on the chart in the coming hours and most likely fill the CME Gap($86,620_$86,565) .

There is a possibility that Bitcoin will fall again after this increase. What do you think!?

Note: The Crypto market is full of excitement. Please pay more attention to capital management than before.

Note: This analysis could be a short-term Roadmap for Bitcoin .

Note: If Bitcoin falls below $83,500, we should expect further declines, possibly heavy declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Bitcoin- Short term recovery?As you know, I am bearish on Bitcoin in the long term. However, in the short term, the cryptocurrency could see a recovery.

Yesterday, the price tested the 81,000 support zone once again and rebounded from that level. Now, Bitcoin is pushing against the 83,500 resistance, and I believe a breakout is likely.

If that happens, we could see further gains, with 86,500 as the next key target for the bulls.

In conclusion, I’m bullish on BTC in the coming days and will be looking to buy dips.

BITCOIN This is where the most aggressive part begins.Bitcoin (BTCUSD) has turned sideways amidst the tariffs implementation today and on the longer picture (1W time-frame) it remains supported just above the 1W MA50 (blue trend-line). On this chart we display our Parabolic Growth Channel (PGC), which is the long-term Zone where BTC is a buy opportunity.

Throughout the market's historic Cycles, the time when BTC was supported above the 1W MA50 but still within its PGC was known as an Accumulation Phase (blue ellipse) before the final parabolic rally of the Cycle and its eventual Top (green Arc).

Based on this model, so far we haven't seen any such rally, despite the undoubtedly strong rallies of October 2023 - March 2024 and October 2024 - December 2024. Only the March 2024 and then the recent Tops can be counted as marginal breaches above the PGC and it's been no surprise that the market corrected back inside the Buy Zone but remained supported by the 1W MA50.

As long as it does, the probabilities of that final, most aggressive Cycle rally get stronger. On the last Cycle the peak was priced just above the 1.618 Fibonacci extension. That is currently a little below $170k and that is why our final Target is just below at $160000. Also right now we are marginally below the 0.618 Cycle top-to-top Fib, which is in line to where all previous final Cycle parabolic rallies started.

So do you think the 1W MA50 will now push BTC to its final Cycle rally? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

CME Gap Target: Is Bitcoin Headed for $80K!?Bitcoin ( BINANCE:BTCUSDT ) is moving in the important Support zone($84,120_$81,500) , and on the 1-hour time frame , Bitcoin is moving near the Support zone($82,360_$82,000) and the lower line of the ascending channel (small) .

Overall, Bitcoin has started another downtrend after breaking the lower line of the ascending channel (big) .

Since trading volume is generally low on Saturdays and Sundays , it is unlikely that the important Support zone($84,120_$81,500) will be broken before the financial markets open .

In terms of Elliott Wave theory , Bitcoin appears to have completed the main wave 3 at $81,644 and is currently completing microwave C of the main wave 4 . The main wave 4 will most likely have a Zigzag Correction(ABC/5-3-5) .

In general, the financial markets and US indices such as TVC:DJI , SP:SPX CME_MINI:NQ1! were not in a good state last week , and this trend will most likely continue next week . The tariffs that Donald Trump is imposing on countries around the world, as well as the turbulent situation in the Middle East , will all lead to the possibility of a fall in Bitcoin and other financial markets in the coming days.

I expect Bitcoin to make at least a temporary increase to $83,200 and then next target the Resistance zone($84,380_$83,580) and the upper line of the ascending channel before starting to fall and attack the important Support zone($84,120_$81,500) and also fill the CME Gap($80,760_$80,380) .

Note: If Bitcoin breaks above the Resistance zone($84,380_$83,580), we can expect more pumping.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BITCOIN This is why it will make new ATH this year.The simplest explanation is perhaps sometimes the best. In this context, this is a simple yet powerful Bitcoin (BTCUSD) chart, showing why the Bull Cycle hasn't peaked yet and why a new All Time High (ATH) is coming by the end of 2025.

So, this is the 12M time-frame, essentially each BTC candle represents 1 whole year (12 months). If you are familiar with BTC's 4-year Cycles, which we've been discussing regularly and in-depth on this channel, then it makes perfect sense to see the market peak, then decline for 1 year and then spend the remaining 3 making a Bull Cycle that will ultimately peak on the 4th year.

Practically each Cycle so far had 1 year of Bear Cycle and 3 years of Bull Cycle with the 3rd one always making a new All Time High (ATH) towards the end.

1 red candle followed by 3 green ones. Simplistic yet delivering a powerful message that since we are currently on Year 3 of the Bull Cycle, there are far more greater probabilities to end this 12M (1 year) candle in green as well and with a new ATH.

So what do you think? Ae we getting this fat green 2025 yearly candle or this time will be different? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin’s Next Move – Another Attack to Heavy Resistance Zone!!!Bitcoin ( BINANCE:BTCUSDT ) was successful in three moves , as I expected in my previous post . I still think Bitcoin will NOT stop trying to break the Heavy Resistance zone($93,300_$89,200) .

Bitcoin is moving near the Support zone($87,100_$85,800) and Cumulative Long Liquidation Leverage($86,376_$85,411) .

Regarding the Elliott Wave theory , Bitcoin appears to be completing microwave C of the main wave 4 . The structure of the main wave 4 is a Zigzag Correction(ABC/5-3-5) .

If we look at the USDT.D% ( CRYPTOCAP:USDT.D ) chart on the 4-hour time frame , USDT.D% is pulling back to the Uptrend line and is currently in the Resistance zone(5.30%-5.15%) . There is a possibility of completing the Bearish Flag Pattern .👇

I expect Bitcoin to rise again in the coming hours and attack the Heavy Resistance zone($93,300_$89,200) , Potential Reversal Zone(PRZ) , Resistance lines , Monthly Pivot Point , and 50_SMA(Daily) .

Note: If Bitcoin falls below $85,400, we can expect more dumps.

Market Developments:

GameStop announced BTC adoption as a treasury asset, signaling growing corporate interest.

Trump Media partnered with Crypto to launch crypto ETFs, adding institutional momentum.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BITCOIN Is it owed a parabolic rally based on the GoldBTC ratio?Bitcoin (BTCUSD) has been trading on a highly structured manner within a Channel Up for the entirety of its Bull Cycle since the November 2022 bottom. We've discussed before how this is the smoothest Cycle of all.

What we didn't bring into the mix before was the Gold/BTC ratio (black trend-line), naturally negatively correlated to Bitcoin, which has been trading within a Channel Down since its January 2023 Top. As you can see it posts the same pattern on every Cycle: Channel Down (blue), followed by its bearish break-out and a huge drop (red ellipse) that prices the Bull Cycle Top on BTC.

So far every BTC Cycle had its parabolic rally (green ellipse) when the Gold/BTC ratio broke downwards. Does the market owe one this time also? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN Say goodbye to low prices if this level breaks. Bitcoin (BTCUSD) has turned sideways the past couple of days following the strong bullish reaction on the 1W MA50 (red trend-line). The reason it that it is about to face the most common Resistance of this Cycle, the 1D MA50 (blue trend-line).

Within the current (2023 - 2025) Bull Cycle, BTC always started its new rally near or on the 1W MA50 but the most important development to confirm that was a break above the 1D MA50. On both previous correction/ accumulation phases, the 1D MA50 break coincided with a 0.618 Fibonacci retracement break.

The bottom of each phase is formed when the 1W MA50 gets tested on a Double Bottom, which we've had on March 11 2025, September 06 2024 and September 11 2023. Among those fractals, their 1D RSI patterns post identical sequences.

As a result, once the price breaks above the 1D MA50, we can claim that the most optimal buy opportunity of the past 6 months will cease to exist and then you'll have to chase a rally all the way to at least a +97% rise (late 2023 rally, the late 2024 was even stronger at +106%). That gives us a minimum target estimate of $150000.

Do you think that would be the case? Break above the 1D MA50 and off to the races with no looking back? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin’s Next Challenge – Can BTC Break the Heavy Resistance?Bitcoin ( BINANCE:BTCUSDT ) started to rise from the Support zone($84,120_$81,500) as I expected in the previous post . The question is, can Bitcoin break the Heavy Resistance zone($93,300_$89,200) and Resistance lines ?

Please stay with me.

Bitcoin appears to have broken through the Resistance zone($87,100_$85,800) and is preparing for its first attack on the Heavy Resistance zone($93,300_$89,200) .

In terms of waves, Bitcoin appears to be completing microwave 4 of microwave C of the main wave Y . The waves structure inside the Ascending Channel appears to be of the Double Three Correction(WXY) .

I expect Bitcoin to prepare for its first attack on the Heavy Resistance zone($93,300_$89,200), the upper line of the ascending channel , the monthly pivot point , 50_SMA(Daily) , and the Resistance lines after completing the pullback to the Resistance zone($87,100_$85,800 ) and fill first CME Gap($86,640_$86,520) . I think the Potential Reversal Zone(PRZ) could be the zone to start a new decline for Bitcoin.

I chose the label of this analysis ''SHORT'' because I think Bitcoin is in a bit of a risky zone for a LONG position, what do you think?

Note: If Bitcoin goes over $91,000, we can expect more pumps.

Note: If Bitcoin falls below $85,200 before hitting the Heavy Resistance zone($93,300_$89,200), we can expect further declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BITCOIN Mega Cycle starting the final Parabolic Rally.This is not the first time we review the Mega Cycle Theory on Bitcoin (BTCUSD). This states that in reality BTC's Cycle's since the beginning aren't 4 as traditional models suggest but 2. And in fact instead of the 4th, we are currently on just the 2nd BTC Mega Cycle.

Well this Theory has for sure a better gel with the stock market trend in the past 15 years but what's more important is that the price is now (March 2025) within the underlying Pivot trend-line and the 1W MA50 (blue trend-line), which is the same level it was coming toward the end of the 1st Mega Cycle. That was when it broke above the Pivot and started the hyper aggressive Parabolic Rally.

This Pivot trend-line is essentially the level that starts after the initial Cycle rally and acts as a Resistance turned Support and then Resistance again until the Cycle's final Parabolic Rally. Practically the Cycle mapping is more effectively viewed on the 1W RSI sequence. We are now at the stage when the 1W RSI ranges for the past 2 years between overbought (80.00) and neutral (45.00) like it was in 2016 - 2017.

In any case, this is yet another study showing that Bitcoin's Top can be at around $150k, which is currently marginally above the Pivot and as we head towards the end of 2025, the bar is raised to as high as $200.

So do you think we are just starting the final year Parabolic Rally to at least $150k? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

S&P500 This is the buy opportunity of the year for a 7000 TargetThe S&P500 index (SPX) is in the process of posting its 2nd straight green 1W candle, following a streak of 4 red weeks since the February 17 peak. That streaκ was technically the Bearish Leg of the 1.5-year Channel Up and as you can see, it made a direct contact with its bottom (Higher Lows trend-line).

As the same time, the 1W RSI almost touched the 40.00 Support that priced the October 23 2023 Low, which was the previous Higher Low of the Channel Up. The similarities don't stop there as both Bearish Legs had approximately a -10.97% decline, the strongest within that time-frame.

The Bullish Leg that followed that bottom initially peaked on a +28.85% rise, almost touching the 2.236 Fibonacci extension. Assuming the symmetry holds between the Bullish Legs as well, we can be expecting the index to start the new Bullish Leg now and target 7000 by the end of the year, which is marginally below both the 2.236 Fib ext and a potential +28.85% rise.

This may indeed be the best buy opportunity for 2025.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇