Strategy: “Breakout Bounce” – Buy the Retest, Ride the WaveHello Traders! BTC has broken out above $118K–$120K after a strong uptrend. Now it’s pausing, and a short-term pullback looks likely. Instead of buying the top, we wait for the price to retest previous resistance (around $112K–$114K), which could turn into support.

MY PLAN:

Wait for pullback to $112K–$114K zone.

Look for a bullish candle (daily or 4H) to confirm entry.

Target: $122K short-term or trail stop if trend continues.

Stop loss: Below $108K to manage risk.

Tip: Don’t chase. Be patient, follow the setup, and use proper risk management.

Please leave a comment and don't forget to support a fellow trader! Also, you can leave in the comments your target and plan ideas!

Have a great day y'all!

-Neo

Bitcointrading

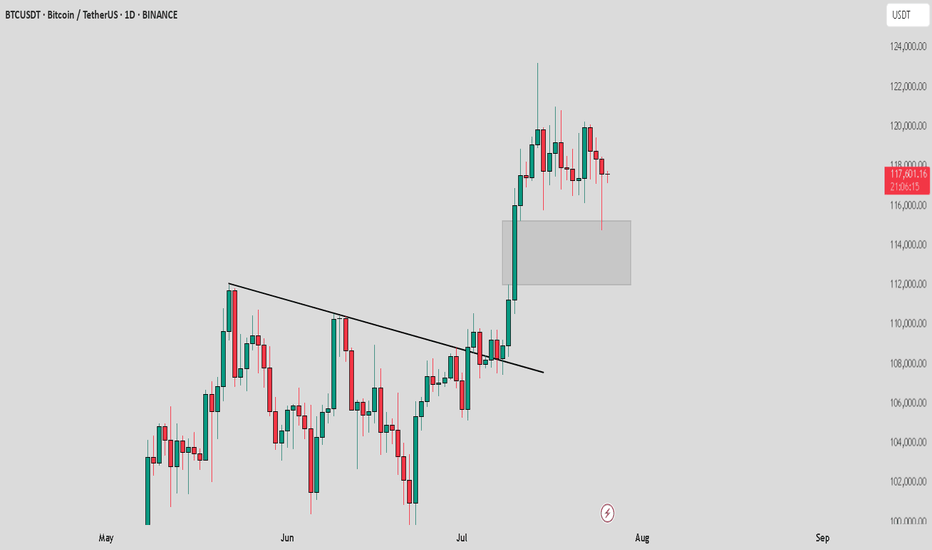

Bitcoin BTC price analysis by the end of 2025🕯 July is coming to an end, with 3 weeks of OKX:BTCUSDT consolidation between $117k–121k.

Tomorrow begins the last month of summer — and it promises to be "hot" as, according to our earlier published calendar Trump's administration plans to send letters with new, increased tariffs to "all countries" on 01.08.

💰 Also, take a look at Bitcoin Monthly Returns. In our view, 2025 resembles 2020 the most.

What do you think?

👉 According to this dynamic, the real "hot" may come not in summer, but late autumn.

💰 We've also tried to find a price fractal for #BTCUSD that fits the current structure — and for now, it looks plausible:

◆ In the coming days, CRYPTOCAP:BTC should not rise above $121k.

◆ A low of correction might hit mid-September around $93k.

◆ A cycle top for #BTC could arrive to the end of 2025, near $147k.

📄 Now that you've seen our version — share your forecasts on future #BTCUSDC price action in the comments 👇

Here’s Why Bitcoin Price Could Rewrite History in AugustBINANCE:BTCUSDT price is currently hovering at $118,938, within a consolidation range between $117,261 and $120,000 . While this range has held steady, the possibility of breaking through $120,000 is high if investor sentiment remains strong.

The current sell-side risk ratio for BINANCE:BTCUSDT is at 0.24, well below the neutral threshold of 0.4 and closer to the low-value realization threshold of 0.1. This suggests that the market is experiencing consolidation, with investor behavior indicating a pause in large sell-offs.

Historically, August has been a bearish month for BINANCE:BTCUSDT , with the median monthly return sitting at -8.3%. However, given the current accumulation trend and the low sell-side risk, Bitcoin may defy its historical trend this year. If Bitcoin can secure $120,000 as support, it would likely push past $122,000 and move toward the ATH .

However, there remains a risk that the market could turn bearish if investors shift their stance due to unforeseen market factors. In this case, BINANCE:BTCUSDT could lose support at $117,261 and slide to $115,000, reversing the bullish thesis.

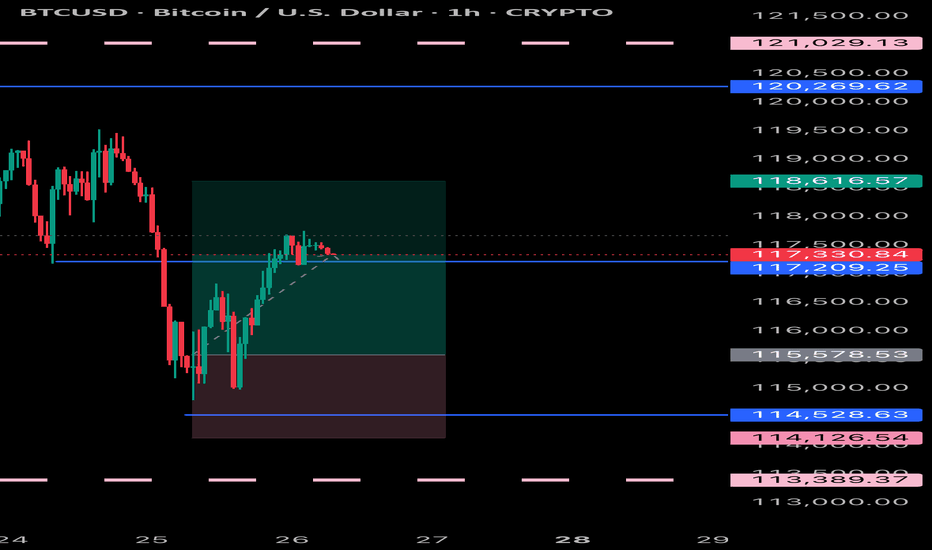

BTC /USDT : Getting support from FVG BTC Support from FVG - Bullish & Bearish Scenarios:

Bullish Scenario:

BTC is holding support from the FVG. As long as BTC stays above this zone, the market remains bullish. A bounce here could lead to further upside.

Bearish Scenario:

If BTC breaks below the FVG, it signals a potential downtrend. A breakdown may lead to more pain and further declines in the market.

Tips:

1. Wait for Confirmation: Look for a clear candle close above/below FVG for validation.

2. Risk Management: Set stops near the FVG to manage potential losses.

3. Monitor Volume: Strong volume during support retests increases bullish potential.

4. Stay Flexible: Be prepared for a market shift if BTC breaks the FVG support.

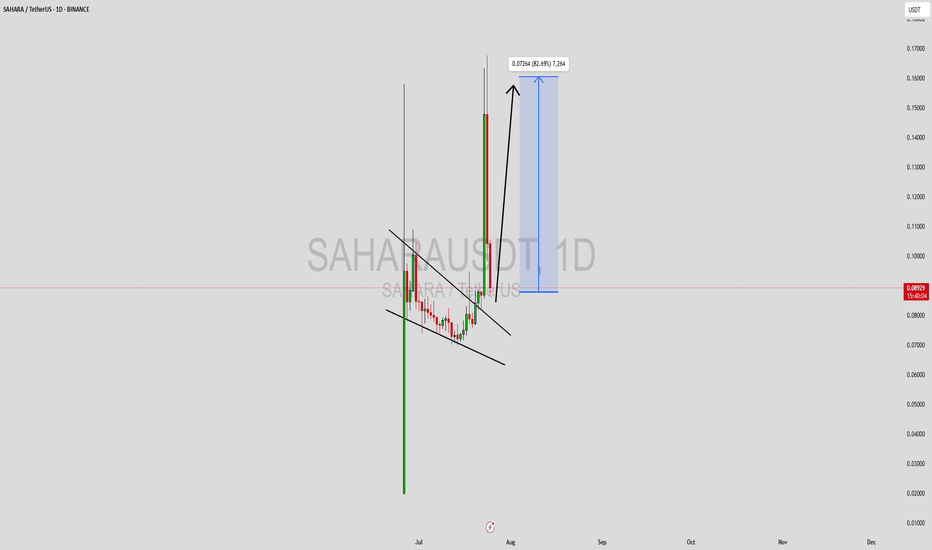

SAHARAUSDT Forming Bullish PennantSAHARAUSDT is currently forming a bullish pennant pattern, a continuation pattern that often signals the resumption of an upward trend after a brief consolidation. This pattern, combined with strong volume support, is a positive technical indicator suggesting the potential for a significant breakout. Traders are now watching for a confirmed move above the pennant resistance, which could propel the price to new short-term highs. Based on the pattern’s breakout projection, an 80% to 90%+ gain seems realistic in the coming sessions.

SAHARA has been gaining traction among investors due to its unique ecosystem and expanding real-world applications. With increased social media buzz and rising transaction volumes, sentiment around the project appears to be shifting toward the bullish side. This renewed investor interest could act as a fundamental catalyst to support the anticipated technical breakout.

Furthermore, the overall structure of SAHARAUSDT shows consistent higher lows forming into the apex of the pennant, reflecting growing buying pressure. The breakout from this structure, especially with increasing volume, typically indicates a strong follow-through move. With broader market momentum aligning and attention turning back to micro-cap altcoins, SAHARA may stand to benefit from speculative capital rotation.

With the chart structure supporting bullish continuation and volume confirming underlying demand, SAHARAUSDT is shaping up to be a strong candidate for aggressive upside potential. It's a setup that technical traders and short-term swing investors may want to keep close on their radar.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

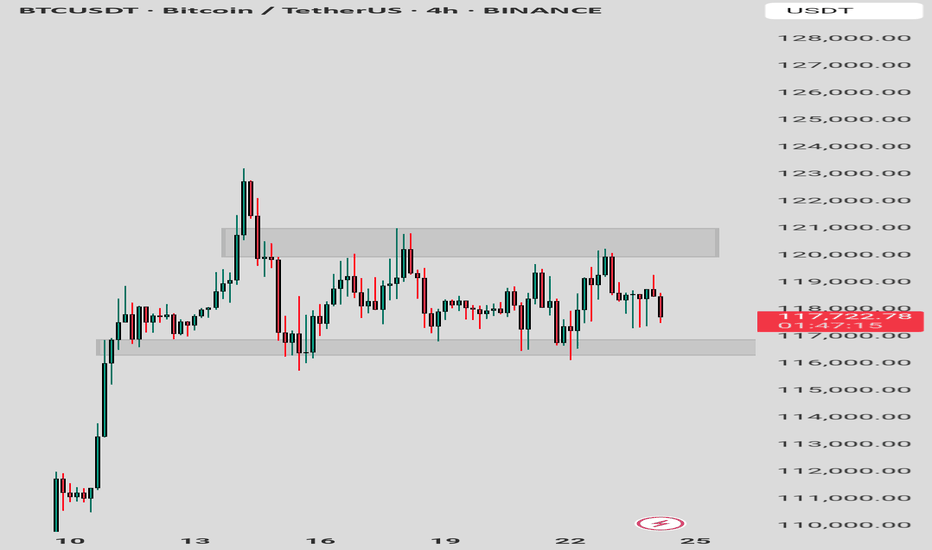

BTC market update Bitcoin Market Update:

Bitcoin is currently consolidating, and the market is indecisive. It's better to watch closely for a breakout or breakdown before making any trades.

Bullish Scenario:

Breakout above resistance could lead to a strong bullish rally. Target: Next resistance level.

Pro Tip: Confirm with high volume for a valid breakout.

Bearish Scenario:

Breakdown below support could trigger strong selling. Target: Next support level.

Pro Tip: Watch for confirmation with increased selling volume to avoid fakeouts

Conclusion:

Wait for clear breakout or breakdown to trade. Avoid entering blindly.

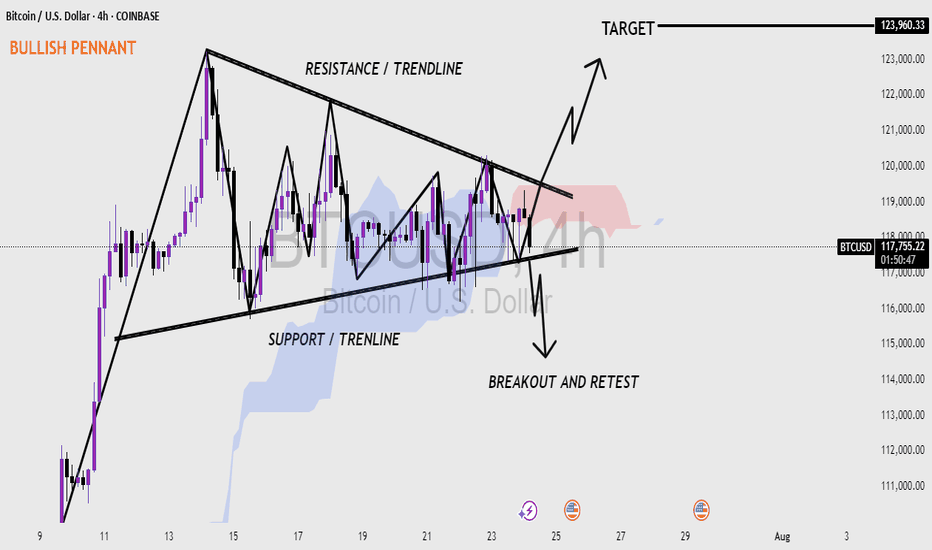

Bitcoin (BTC/USD) 4H CHART - BULLISH PENNANT PATTERN 📊 Bitcoin (BTC/USD) 4-Hour Chart – Bullish Pennant Formation

Bitcoin (BTC) forming a bullish pennant pattern on the 4-hour timeframe.

A bullish pennant often appears after a strong upward move, followed by a period of consolidation, and usually signals a continuation to the upside.

🔍 Key Highlights:

Pattern: Bullish Pennant – a continuation pattern that forms after a strong rally (flagpole), followed by a tightening price range.

Resistance Trendline: The upper black line showing lower highs — where price has repeatedly faced selling pressure.

Support Trendline: The lower black line showing higher lows — where buyers have been stepping in.

Breakout Zone: Price is nearing the apex of the pennant. A breakout above the resistance line would likely confirm the bullish move.

Target Projection: If the breakout is successful, the target is around $123,960, based on the height of the flagpole.

Breakout and Retest: The chart also shows a possible retest of the trendline after breakout, which is common and can offer a second entry point for traders.

Volume Watch: A valid breakout usually comes with increased volume. Monitoring this can help confirm the move.

📉 Downside Possibility:

If the price fails to break out and falls below the support trendline, it could invalidate the pattern and lead to a bearish move — possibly retesting the $110,000 area.

---

The market is at a decision point. If BTC breaks above the resistance and retests successfully, it could push toward $123K. However, traders should watch for both breakout confirmation and false moves.

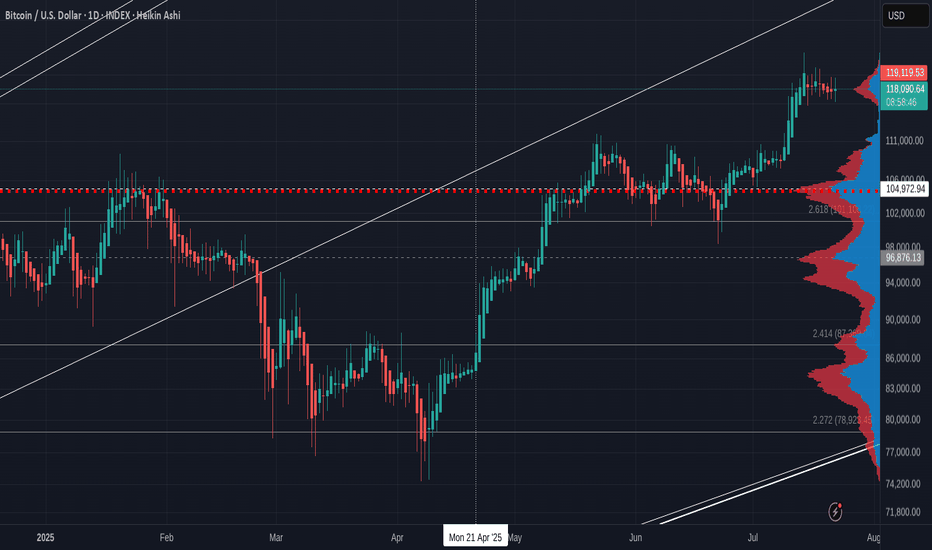

BITCOIN daily Heiken Ashi chart - potential trend reversal ?

There are aq number of things to see here.

The main chart shows us PA raning in a tight range, with possible support on the VPVR on the right

The dailu MACD Shown below

Is turning bearish BUT could we see the same as the arrow ?

Maybe but the ADX shown below does lead to some caution being required

The Daily ADX is up high and could Very easily turn down

REMEMBER, ADX direction does NOT show Trend ditection, Only trend Strength

So, we may see a weakening of the trend, That cuold lead to a dip in price, OR it may not But caution is now require.d

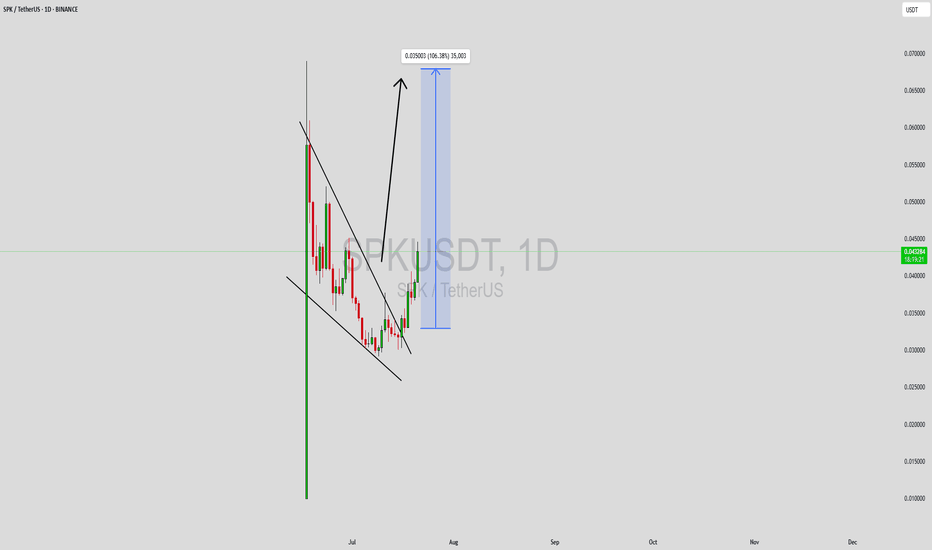

SPKUSDT Forming Falling WedgeSPKUSDT is currently forming a well-defined falling wedge pattern on the chart, a setup often associated with strong bullish reversals. This pattern suggests that the ongoing downward momentum is losing strength, and buyers may soon take control. The tightening price range within the wedge, combined with good volume activity, adds conviction to the breakout potential. Historically, such formations signal the end of a corrective phase and the beginning of an impulsive bullish wave, positioning SPK for a sharp upside move.

The technicals are aligning for a breakout with an expected gain of 90% to 100% or more. The confluence of strong support zones, oversold indicators, and increased trading volume points to growing investor confidence. Once SPK breaks above the wedge resistance with confirmation, it can trigger a significant rally, fueled by momentum traders and long-term investors entering the market. These conditions often attract attention across the crypto community, making SPK a high-potential short-term trade.

Market sentiment around SPK is also strengthening, with more traders discussing the project and its underlying fundamentals. As volume increases and the technical breakout setup matures, SPK could become one of the more explosive movers in the altcoin space. The falling wedge pattern’s reliability, combined with rising investor interest, makes this chart highly attractive for swing traders and breakout hunters alike.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

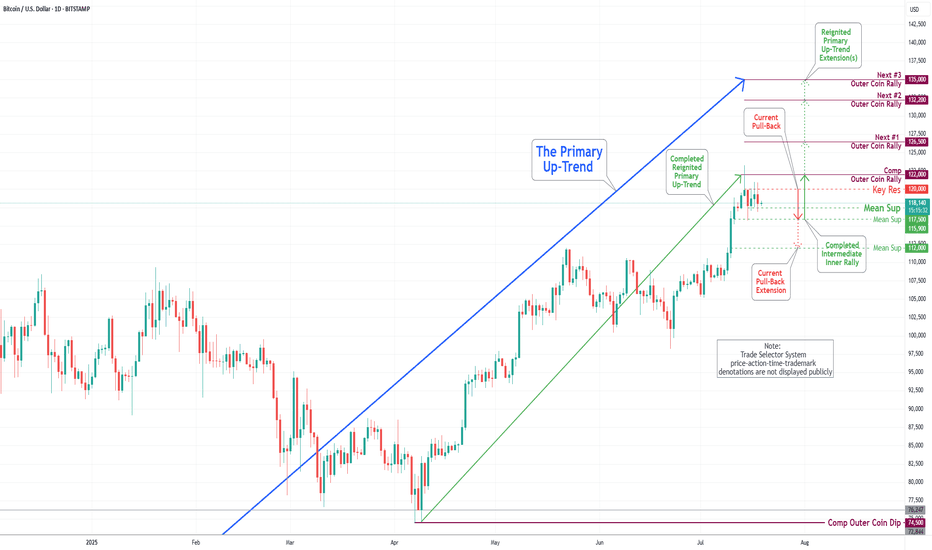

Bitcoin(BTC/USD) Daily Chart Analysis For Week of July 18, 2025Technical Analysis and Outlook:

In last week's trading session, we achieved a new historical high by completing our Outer Coin Rally at 122000. Following this milestone, the coin retraced, as expected, to the newly established Mean Support at 115900 and is currently trading at the Intermediate Mean Support at 117500. Presently, the coin is set to retest the Mean Support at 115900, with the potential for a further pullback to the Mean Support at 112000. This anticipated decline will necessitate a retest for the completed Outer Coin Rally at 122000. The designated targets for the renewed Primary Up-Trend are 126500, 132200, and 135000.

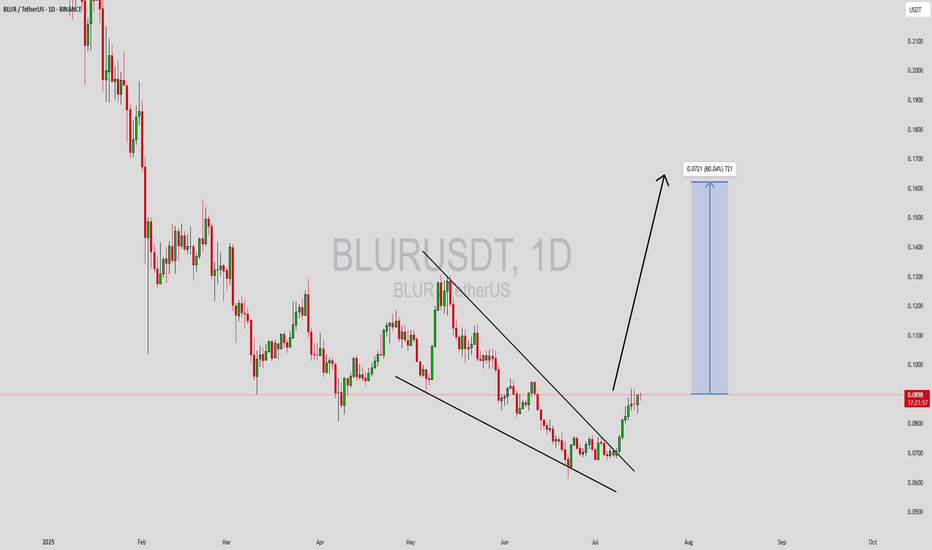

BLURUSDT Forming Bullish WaveBLURUSDT is currently shaping up a promising bullish wave that’s catching the eye of both swing traders and long-term crypto investors. With a strong surge in trading volume, this pattern indicates that fresh buying momentum is entering the market. Traders are watching closely for confirmation that BLUR can sustain this upward move, potentially delivering an impressive 80% to 90% gain if momentum continues to build over the next few weeks.

The BLUR token, known for its role in the decentralized NFT marketplace ecosystem, has been gaining traction as new developments and integrations add value to its use case. This increased investor interest is translating into healthy market activity and supports the idea that BLURUSDT could maintain its upward trajectory. The growing NFT sector remains one of the hottest trends in crypto, and BLUR stands to benefit as it continues to expand its user base and ecosystem.

From a technical analysis perspective, the bullish wave pattern suggests a strong push toward higher resistance levels if buyers can defend key support zones. Watching for consolidation and a series of higher lows will be essential for traders looking to ride the next leg up. If the crypto market remains favorable and Bitcoin stays stable, BLUR could hit its projected targets with relative ease.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

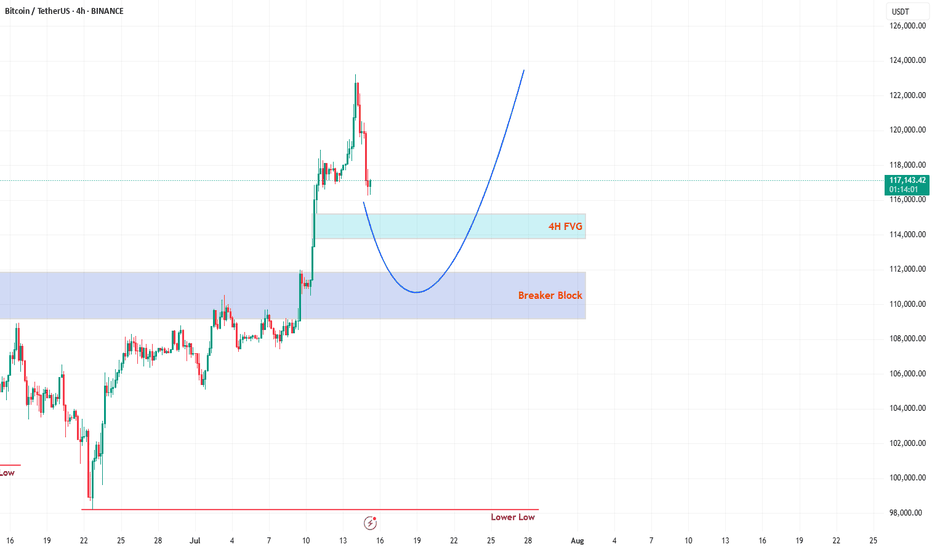

Bitcoin’s Wild Ride to New ATHs: What’s Next for Traders?Hello, TradingView warriors! 👋

Have you caught Bitcoin (BTC) smashing through a new all-time high (ATH) this Monday? 🎉 If you blinked, you might’ve missed it! But don’t worry, the crypto king isn’t done with its rollercoaster ride just yet. After soaring to new heights, BTC has pulled back for a retracement—not a full-on reversal, so hold your horses! 🐎 Whales are playing their usual games, setting traps for unsuspecting traders. Don’t fall prey to their tricks! 🦈 Let’s break down the key levels to watch and stay one step ahead. 💡

🔍 Key Levels to Watch on the Chart

1️⃣ 4H Fair Value Gap (FVG)

This 4H FVG is a thing of beauty—my personal favorite! 😍 But let’s be real, Bitcoin doesn’t care about aesthetics. This FVG is likely to act as the first resistance level. Here’s the plan:

If respected, expect BTC to use this level as a springboard to catapult back toward the ATH. 🚀

If broken, BTC might slide toward the stronger resistance below. Keep your eyes peeled for how price reacts here! 👀

2️⃣ Daily Breaker Block (PD Array)

This is the big one—a rock-solid resistance zone on the daily timeframe. I’m leaning toward BTC dipping into this Breaker Block to clear out liquidity before making its next big move to retest the ATH. 🏦 This level is a magnet for price action, so don’t sleep on it! 😴

🛠️ Trading Strategy: Stay Sharp!

Patience is your best friend right now, traders. 🙏 Don’t rush into trades without confirmation. Watch how BTC interacts with these two levels:

4H FVG: Look for rejection or a breakout to gauge short-term direction.

Daily Breaker Block: If price dips here, it’s likely hunting liquidity before the next leg up.

Wait for clear price action before jumping in—let the market show its hand! 🃏 Stay disciplined, avoid the whale traps, and let’s ride this BTC wave together. 🌊

📚 Want More? Follow Me!

If you’re hungry for more technical analysis insights and market updates, hit that follow button! 📈 I share tips, tricks, and breakdowns to help you navigate the markets like a pro. Let’s level up your trading game together! 💪

What’s your take on BTC’s next move? Drop your thoughts below, and let’s discuss! 💬 Happy trading, and may the profits be with you! 📈

NFPUSDT Forming Descending ChannelNFPUSDT is starting to attract significant attention as it shows signs of reversing its downward trend with a promising technical setup. This crypto pair has recently broken out of a descending channel, indicating that selling pressure might be subsiding while buyers are stepping in. The price structure suggests a clear path for a potential bullish continuation, and the projected target hints at a strong gain of around 90% to 100%+. Technical traders are closely watching this level for a confirmed breakout and a sustained rally.

The volume on NFPUSDT remains good, showing that liquidity is healthy and there’s active participation from traders and investors. This is a critical factor in validating the breakout — when volume aligns with price action, the odds of a strong move increase. Many crypto traders rely on these confirmation signals to enter early positions, capturing the momentum as it picks up. With the market sentiment slowly shifting, NFPUSDT could see an influx of new interest in the coming weeks.

Investors are increasingly taking interest in this project, not just from a technical perspective but also due to its fundamentals and community engagement. As the crypto market looks for solid setups in a sea of volatility, pairs like NFPUSDT stand out for their clear patterns and realistic upside potential. Keep an eye on support levels holding firm and whether the breakout candle closes above resistance with strength.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

SCRUSDT Forming Descending TriangleSCRUSDT is catching the attention of smart traders as it shows signs of a strong bullish setup supported by increasing trading volume. This pair has recently seen consistent accumulation phases, which often precede significant price moves. With expectations for a potential 90% to 100%+ gain, SCRUSDT could deliver impressive returns for investors who position themselves early. Traders who are tracking fresh breakout opportunities should keep this crypto on their watchlist as buying interest grows across key support levels.

The underlying fundamentals of the SCR project are also becoming more appealing, helping fuel this recent investor interest. As the team behind SCR continues to develop its ecosystem, more market participants are gaining confidence in its long-term growth potential. The robust on-chain activity and positive community sentiment further add to the bullish outlook. It’s encouraging to see that the volume profile supports the price action, indicating that this isn’t just a speculative pump but rather a move backed by solid participation.

Technically, SCRUSDT is forming a reliable base that could launch the next leg up once a breakout above the recent resistance levels is confirmed. Traders should watch for strong bullish candles and increasing volume near breakout points to validate the move. Risk management remains key—placing stop-losses under nearby swing lows can help manage downside risk while targeting the anticipated upside potential.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share mo

HUMAUSDT Forming Falling WedgeHUMAUSDT is displaying a promising falling wedge pattern, which is widely recognized by traders as a powerful bullish reversal setup. This pattern suggests that the coin may be nearing the end of its consolidation phase, setting the stage for a potential breakout with significant upside. Backed by good trading volume, this scenario looks increasingly likely, with price targets pointing to an impressive gain potential of 140% to 150% in the medium term.

The Huma project is steadily gaining traction among crypto investors due to its innovative use cases and expanding community. As the DeFi ecosystem evolves, projects like Huma that focus on human-centric decentralized solutions are getting more recognition. With growing investor confidence, HUMAUSDT could become one of the standout performers in the altcoin market, especially if the current technical structure plays out as expected.

From a technical perspective, the falling wedge pattern is characterized by descending resistance and support lines converging towards a breakout point. When price finally breaches the upper trendline with convincing volume, it often sparks a rapid upward move as short positions get squeezed and new buyers jump in. Traders should watch for a daily close above resistance and monitor volume levels to validate the breakout.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#BTC Update #6 – July 11, 2025🟠 #BTC Update #6 – July 11, 2025

Bitcoin has surged nearly 9% from the supply zone and is currently trading around the $119,000 level. However, looking at the current volume, the momentum seems to be fading.

If a correction takes place, the potential support zones are:

✨First stop: $114,000

✨Second stop: $113,000

✨Third stop: $111,500

After a pullback, the next target may be around $122,000. However, macroeconomic risks are rising. The U.S. is considering a 500% tariff on Russia imports, and in the past, even a 100% tariff triggered a sharp drop in Bitcoin.

Since BTC has already made a significant move up, I don’t think opening a Long or Short position is wise at the moment. Just observing for now.

REIUSDT Forming Falling WedgeREIUSDT is showing an encouraging technical setup that could pave the way for a potential price breakout. The pair has recently formed a classic falling wedge pattern, which historically signals a bullish reversal. Backed by healthy trading volume, this setup suggests that investors are positioning themselves early for what could be a significant upside move. With an expected gain of 60% to 70%+, REIUSDT is attracting the attention of traders who look for hidden gems in the altcoin market.

The REI Network project continues to gain recognition for its focus on creating a lightweight and high-performance blockchain, appealing to developers and users who value efficiency. This growing ecosystem and its active community are contributing to increased buying interest and renewed confidence in its long-term potential. Such fundamentals, combined with supportive technical signals, make this pair a strong candidate for swing trades in the coming weeks.

Technically, traders should watch for a decisive breakout above the wedge resistance line, which could trigger rapid price action towards the projected targets. Monitoring volume spikes and daily closes will be crucial in validating the strength of this breakout. As momentum builds, REIUSDT could deliver solid gains for traders who are prepared and patient with their entries.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

MDTUSDT Forming Bullish ReversalMDTUSDT is currently capturing the attention of crypto traders who are searching for high-risk, high-reward setups in the altcoin market. The chart shows MDTUSDT forming a clear falling wedge pattern that has now been broken to the upside, indicating a strong bullish reversal signal. With good volume supporting this breakout, the technical structure suggests that a massive price move could be on the horizon if momentum continues to build.

What’s particularly interesting about MDTUSDT is the significant upside potential traders are targeting, with an expected gain in the range of 190% to 200%+. This aligns with the measured move from the wedge pattern, giving bulls confidence that the current breakout could translate into sustained upward price action. As more traders recognize this setup, we could see increased buying pressure pushing MDTUSDT higher.

Investors are also showing renewed interest in the MDT project, adding a layer of fundamental support to the technical outlook. This blend of solid technicals and growing investor confidence makes MDTUSDT a compelling pick for anyone looking to catch a strong altcoin rally. Keep a close eye on follow-through volume and key resistance levels to confirm the strength of this breakout move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

WIFUSDT Forming Breakout Descending ChannelWIFUSDT is showing an exciting technical setup as it breaks free from a prolonged downward channel and consolidates near a strong support zone. This breakout pattern signals that the coin could be on the verge of a significant trend reversal, supported by healthy trading volume and renewed investor confidence. With buyers defending key levels and pushing the price above resistance, WIF is capturing the attention of traders looking for high-momentum plays.

Looking at the chart, WIFUSDT’s recent price action suggests that the base has formed well within the highlighted demand zone, providing a solid foundation for a sharp upward move. The breakout from the descending channel is a classic sign of trend change, and this technical shift is further reinforced by steady volume and bullish sentiment across social platforms. Traders should keep an eye on retests of the breakout zone for potential entry opportunities, as these could offer excellent risk-to-reward setups.

The potential gain of 140% to 150%+ makes WIFUSDT a top pick for those scanning the market for trending coins with breakout potential. The meme coin community remains highly active around WIF, and this fresh surge in interest could propel the coin to test its next major resistance levels in the coming weeks. As always, risk management and closely monitoring price action will be key to riding this bullish wave successfully.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

TOKENUSDT Forming Bullish WaveTOKENUSDT is currently displaying a promising bullish wave pattern that is catching the attention of traders looking for steady and reliable gains in the crypto market. The pair has shown consistent volume, indicating strong market participation and growing investor interest. While the expected gain of 10% to 20% may seem modest compared to some high-flying altcoins, this setup offers a more stable opportunity for those who prefer lower-risk trades with a clear technical structure.

The current price action suggests that TOKENUSDT is forming higher highs and higher lows, which is a classic sign of a bullish wave continuation. Many traders appreciate this pattern for its clear entry and exit levels, making it easier to manage risk and lock in profits. As the crypto market remains volatile, having a well-structured pair like TOKENUSDT in your watchlist can help diversify your trading portfolio and balance out more aggressive plays.

With a healthy support zone and steady upward momentum, TOKENUSDT has the potential to break through minor resistance levels and deliver the projected gains in the near term. Investors should watch for confirmation candles and spikes in buying volume to validate this bullish scenario. This crypto pair’s relative stability and clear pattern make it an appealing choice for swing traders and trend followers alike.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Something for the weekend? Bitcoin Daily-last for 2 weeks

PA has finally risen above that Fib circle ( falling diagonal arc) that has rejected us since Early June.

PA is currently retesting this as support now and we will hopefully manage to remain above.

Should this fail, we have the lower trendline of the newly formed rising channel to use as support.

Should that fail, we have the 236 Fib circle (Red) and the next rising support line around 102k, depending on sharp the drop is.

If we find support where we are now, we have a good run back to the current ATH line ( Blue Dash line)

The real test is that 236 Fib circle that is dropping form around 114K

99% of the Time, a 236 Fib circle is resistance and if it rejects PA, the Current ATH line is very close below.

This will either create a bounce or a sharp drop. If we get stuck between the 2, we have that APEX around 25 July..PA always reacts BEFORE the Apex

And I am back on the 19th Jully, just in time I hope ;-)

So, The MACD is currently above neutral on the Daily (Below)

The weekly is much the same but on the 4 hour, we are currently dropping towards Neutral and Tomorrow ( sunday) will tell us if it bounces or not.

We are early in July, As mentioned in the monthly report I posted earlier this week, we could see a larger Green candle by month end, though is is not a promise obviously.

But the MACD could support this idea

We just have to wait and, for me, that is what we will do until around Q4

We could still see smaller gains over the summer period but the Bigger moves are in Q4

That is what I am waiting for....and yet, at the same time, I am ready if it comes earlier

stay safe