BTC | BEARISH Cycle Begins | $71KThere are a few tell signs that BTC has entered the bearish market.

If the price fails to maintain closing daily candles ABOVE the 70k area, there is a likelihood for a nasty Head and Shoulders pattern to form.

A key point to watch are the Bollinger Bands, which gives you an indication of the next possible zone to watch.

_____________________

BINANCE:BTCUSDT

Bitcoinusd

BTC Tightening Up – Key Support & Resistance in Focus!📝 🚀 BTC/USD – 4H Price Action Masterclass | Breakout Brewing Between $71.2K & $72K!

Bitcoin is currently consolidating in a high-tension zone on the 4-hour chart, forming a classic range-bound structure between two key levels:

🔹 Support at $71,200 – a previous resistance now acting as short-term demand

🔹 Resistance at $72,000 – a strong psychological barrier that price has failed to close above

This tightening range is setting the stage for a high-impact move, and the market is showing signs of compression. No indicators, no noise — just clean structure and price action clarity.

🔍 Detailed Technical Breakdown:

📌 $71,200 – Flip Zone:

Recently flipped from resistance to support after a breakout. Price is now retesting this level with precision, suggesting potential accumulation — but failure here may trigger strong selling pressure.

📌 $72,000 – Critical Resistance:

This level has held price down for multiple sessions. If bulls manage to close above it on strong volume, we could see a push towards FWB:73K +, where liquidity clusters await.

⚔️ Battle of the Zones – What to Expect Next?

Bullish Scenario: A breakout above $72,000 on strong bullish candles could ignite a move toward the next resistance at $73,500–$74,000.

Bearish Scenario: If $71,200 breaks down, expect a sharp drop toward $70,400, possibly extending to the $69K handle.

This setup offers a textbook example of how support/resistance zones act as battlegrounds for short-term market control.

🔥 Why This Chart Matters (No Indicators Used):

Clean price action = clean decision-making.

Ideal for breakout traders & range scalpers.

High probability setup with defined risk levels.

Easy to read & replicate — especially for beginners learning PA.

💬 What’s YOUR take?

Are we about to see a bullish explosion, or is this a trap before a deeper drop?

👇 Drop your analysis in the comments – let’s build a real traders’ conversation below!

📈 If you found this chart helpful, don’t forget to like & follow for more clean setups.

Bitcoin Lost 50 SMA overnight, what next ? - still BULLISH.In a week where I am still expecting the beginnings of a bounce, we saw a Major Drop overnight.

This has pushed PA below the 50 SMA that I was hoping PA would bounce off, as it had previously.

So, Whats Next ?

It is not as bad as it may appear but CAUTION is a Very Very good idea.

There are a number of lines of support below and if we do not find any soon, 73K is the next line of Support. then down to 71K and ultimately, the long term line at 64K, though I still doubt we will get that low.

But FEAR is BIG...be a Vulture..Buy the remains of people Fear...Bitcoin IS a Scarce asset and people Still want it.

The Weekly MACD

The MACD is now in the bounce Zone. Yes, it may drop below neutral if this "Tariff Fear" continues. But Technically, We now have the ability to bounce once sentiment turns

On a slightly more bearish side is the fact that Histogram has dived deep and Red. The Bears are biting and has momentum

The RSI Relative Strength Index

Like the MACD, the RSI is now in an area where it has bounced in the past and yet, it can still drop further before we reach Neutral ( 30 line ) . It has to be said, the RSI is a bit behind the MACD in that it has a later date when it could reach Neutral. There is no guarantee that Neutral will hold RSI up....

Other Markets are struggling also

The DXY $ has had a sustained drop but is near an area of support. I am watching this closely.

Normaly, we see DXY and BTC move in opposite directions but we have seen both Recover at the same time, The lines between the teo are getting blurred.

GOLD - has been doing well for some omnths

However, in th elast 2 weeks, Gold has been selling off also and saw a steep drop towards the end of last week. Will be very interesting to see where this goes this week

The fact that Gold was selling, shows that investors were comfortable to leave a safe haven.

Lets see if that changes this weel

Conclusion for BITCOIN HOLDERS

This could all sound a little scary for Bitcoin and it should be taken as a HUGE Warning that we Lost the 50 SMA Support. This does open up the possibility of further drops and it may well happen

We are currently heading towards major support at 73K

This is an area I said we could hit a few weeks back and so I am not in a bad state of mind just yet.

If we Loose 71K, I will get uncomfortable.

The Lower timeframes are very much heading to OVERSOLD and so we shold get some support here and then we wait to see if Fear takes hold further.

This week, we Get the FOMC minutes and then Inflation data coming out of the USA

Thsi could Tip the balance either way, depending on the data

For me, I am NOT Selling Just yet.

I imagine many Short term holders will be and these coins will be snapped back up

We wait to see how today plays out

BUY THE DIP

BTCUSDT, We were moved like ...Hello everyone

According to the chart that you can see the price movement was exactly moved to our route but at this time we expect because of the reason in world and US Reciprocal Tariffs at this time Gold movement is important after the Gold start the corretion wave the smart money comes to the cryptocurrency market and we expect the excitement movement.be patient until ...

Be Lucky

AA

Why is Eth Falling? ETH/BTC Ratio Hits All-Time Low Since 2020Why is Ethereum Falling? ETH/BTC Ratio Hits All-Time Low Since 2020

The cryptocurrency market is a volatile landscape, constantly shifting and evolving. Recent data has revealed a significant development: the Ethereum to Bitcoin (ETH/BTC) ratio has plummeted to an all-time low since 2020. This stark decline, currently resting at a mere 0.02 has ignited a wave of speculation and concern within the crypto community, raising questions about Ethereum's current standing and future trajectory.

The ETH/BTC ratio serves as a crucial metric for comparing the relative performance of Ethereum against Bitcoin. When the ratio falls, it indicates that Bitcoin is outperforming Ethereum, and conversely, a rising ratio suggests Ethereum's ascendancy. The current dramatic drop highlights a significant divergence in the fortunes of these two leading cryptocurrencies.

The backdrop to this decline is multifaceted. Bitcoin, often seen as the “digital gold” of the crypto world, has exhibited remarkable resilience and strengthened its position. This consolidation is likely driven by several factors, including increased institutional adoption, regulatory clarity in some jurisdictions, and its established reputation as a store of value. These factors have contributed to a sense of stability and confidence in Bitcoin, attracting capital and bolstering its market position.

Ethereum, on the other hand, has faced challenges in maintaining its momentum. While it remains the leading platform for smart contracts and decentralized applications (dApps), it has struggled to keep pace with Bitcoin's surge. Several factors contribute to this relative underperformance.

Firstly, regulatory uncertainty surrounding Ethereum and its classification has cast a shadow over its future prospects. The evolving regulatory landscape, particularly in major economies like the United States, has created a sense of unease among investors. The lack of clear guidelines and the potential for stricter regulations have dampened enthusiasm and limited institutional investment.

Secondly, Ethereum has faced competition from emerging layer-1 blockchains that offer faster transaction speeds and lower fees. These “Ethereum killers,” as they are sometimes called, have attracted developers and users seeking alternatives to Ethereum's perceived limitations. While Ethereum has undergone significant upgrades, such as the transition to proof-of-stake (The Merge), the benefits have not yet translated into a sustained surge in its relative value.

Thirdly, the overall market sentiment has played a role. Bitcoin's narrative as a safe haven and store of value has resonated strongly during periods of economic uncertainty. In contrast, Ethereum, with its focus on innovation and development, is perceived as a riskier asset. When market volatility increases, investors often gravitate towards the perceived safety of Bitcoin.

The decline in the ETH/BTC ratio raises several critical questions. Is Ethereum in trouble? Is this a temporary setback or a sign of a more fundamental shift in the crypto landscape?

While the current situation is concerning, it is essential to consider the long-term potential of Ethereum. Its robust ecosystem, driven by a vibrant community of developers and innovators, remains a significant asset. Ethereum's role in powering decentralized finance (DeFi), non-fungible tokens (NFTs), and other emerging technologies positions it as a crucial player in the future of the internet.

Furthermore, Ethereum's ongoing development efforts, including layer-2 scaling solutions and future upgrades, aim to address its scalability and efficiency challenges. These improvements could potentially revitalize Ethereum's performance and restore its competitive edge.

However, the current market dynamics suggest that Ethereum faces an uphill battle. To regain its footing, it needs to overcome regulatory hurdles, address its scalability issues, and effectively communicate its value proposition to a broader audience.

The cryptocurrency market is notoriously unpredictable, and past performance is not indicative of future results. The ETH/BTC ratio could rebound, or it could continue its downward trajectory. The outcome will depend on a complex interplay of factors, including regulatory developments, technological advancements, and market sentiment.

In the meantime, the low ETH/BTC ratio serves as a stark reminder of the dynamic nature of the cryptocurrency market. It underscores the importance of diversification and the need for investors to consider the risks and potential rewards of each asset carefully.

The current situation also highlights the need for Ethereum developers and community members to focus on the core values of the project, and to continue to innovate and improve the technology. Ultimately, the success of Ethereum will depend on its ability to adapt to the changing landscape and deliver on its promise of a decentralized and equitable future.

In conclusion, while the record low ETH/BTC ratio raises concerns about Ethereum's current standing, it is premature to declare its demise. The cryptocurrency market is constantly evolving, and Ethereum's long-term potential remains significant. However, the current challenges demand a proactive and strategic approach to ensure its continued relevance and success in the years to come.

Bitcoin will reach $180,000 this yearBitcoin’s trajectory is unstoppable—analysts are calling for a climb to $180,000, fueled by institutional adoption, limited supply, and global economic uncertainty. With halving cycles tightening the squeeze and mainstream acceptance soaring, BTC isn’t just a store of value—it’s the financial revolution we’ve been waiting for. Buckle up, the bull run’s coming.

Ada is far from deadLooking at strictly block orders and rsi the 4 day timer shows ADA landing on top of its new buy zone.

.658 was the discounted by zone and it has bumped from there.

The battlegrounds (buyers vs sellers) will be around the price point of : .7120 and .7180

This could be a potential exit for buyers right now at those ranges. If it can break rhe 7180 zone we could see numbers raise as high as : .7650 and .7750

Bitcoin 1-Year Pattern- The art of trading lies in analyzing the past to anticipate the future.

On the yearly timeframe, BTC has consistently followed this cycle:

- 1 year of bearish decline.🟥.

- 1 year of consolidation and bottoming out.🟩.

- 1 year of steady growth.🟩.

- 1 year of explosive upward movement.🟩.

based simply on that :

- 2025 is poised to be a breakout year for BTC.

- 2026 should be the next bear market.

- Everything changes, nothing lasts forever, but as a trader, you must stay on course.

- Don't let market noise shake your confidence.

Happy Tr4Ding !

Bitcoin in Ascending Wedge?Looks like a rising wedge guys - I'm not a charting TA expert but would love to here your thoughts. Many bears keep posting a drop to $70K level.. I guess that drop is written in some prophecy somewhere, and they believe (or hope) it MUST happen, before we go for new ATH. Maybe so... however can anyone explain WHY that must play out like that? A couple of weeks back i was in that camp but after I see the slow and steady Bitcoin recovery, I have changed my mind.

Bitcoin (BTC/USD) Analysis – Daily Timeframe

Trend Overview

Bitcoin (BTC/USD) remains in an uptrend, with price holding above the ascending trendline support. The long-term bullish structure remains intact, characterized by a series of higher highs and higher lows since 2023.

Key Support and Resistance Levels

Primary Support:

$80,000 - $85,000 (Trendline support zone)

$75,000 (Psychological and historical support)

Primary Resistance:

$90,000 - $95,000 (Recent local highs)

$100,000 (Major psychological level)

Technical Indicators

Stochastic RSI is in the overbought zone, suggesting potential short-term consolidation or a pullback before resuming the trend.

MACD shows a bullish crossover, indicating positive momentum remains strong.

Volume analysis suggests buying pressure is still present but needs to increase to sustain further upside.

Market Outlook

Bitcoin continues to respect its long-term uptrend. As long as price remains above the trendline, the bullish outlook remains valid. However, a confirmed break below $80,000 could signal a deeper correction. If Bitcoin breaks above $90,000, the next major resistance is around $100,000.

BTCUSDT , we near to bullish runHello everyone

According to the chart that you see , we were in correction wave from the top until now , but the wave of correction is weakness and we think that the price wanna re-check the downward trendline and after that is ready to start bull run.

if you have any question and need help for managing your portfolio send us messages

Thank you

AA

Bitcoin BTC price analysis, FOMC 19/03 - FED rateOur previous idea for OKX:BTCUSDT worked out 10 out of 10

Well, let's try to hit it again !)

Yesterday, CRYPTOCAP:BTC price showed growth despite the fact that the Fed left the rate unchanged yesterday #FOMC

In short, Powell said that he was "hesitant" to cut the rate now because it is not known how the economy will be affected by the new "economic tariffs and economic wars" that come into effect in early April. In the US, one "grandfather" does not know what to expect from the other "grandfather" ))

Nevertheless, #BTCUSD price has every chance of reaching $94k in the coming days.

And then, I would like to see a decline in BTC.D and USDT.D, which in turn will allow altcoins to "stop collapsing", and some low-liquid ones, which are easier to pump, will show good growth, such as X Empire.

👀 In general, the last 2 months have been: "not about making money, but about surviving and keeping the deposit, even with a drawdown", but the next 3 months may be very much about making money.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

$9.4M Bitcoin Short Squeeze and its Market ImplicationsThe volatile nature of the cryptocurrency market is a well-established fact, but the sheer scale of some trades can still send ripples across the entire ecosystem. Recently, a Bitcoin whale executed a masterful maneuver, closing a $516 million short position with a staggering 40x leverage, pocketing a cool $9.4 million profit in just eight days. This event, occurring shortly after a lower-than-expected Consumer Price Index (CPI) reading, highlights the intricate interplay between macroeconomic indicators, market sentiment, and the strategic actions of large players.

The whale's decision to close the short position immediately following the CPI release is particularly noteworthy. The lower-than-expected inflation figure signaled a potential easing of monetary inflation concerns, a development that is generally viewed favorably by Bitcoin investors. This optimistic signal likely triggered a shift in market sentiment, prompting the whale to capitalize on the impending price surge.

The use of 40x leverage amplified both the potential gains and the risks associated with the trade. While it allowed the whale to generate a substantial profit in a short period, it also exposed them to significant losses if the market had moved against their position. This high-risk, high-reward strategy is characteristic of whale activity, where large players leverage their capital and market insights to execute impactful trades.

The timing of the trade also underscores the importance of macroeconomic indicators in shaping Bitcoin's price trajectory. The CPI reading, a key measure of inflation, directly influences monetary policy decisions by central banks. Lower inflation can lead to a more dovish stance, potentially resulting in lower interest rates and increased liquidity, both of which are conducive to asset price appreciation, including Bitcoin.

Interestingly, Tuesday has emerged as Bitcoin's most volatile day in 2025.2 This heightened volatility can be attributed to the release of key economic data, including the CPI, as well as the influence of global economic trends. Market participants anticipate increased activity on Tuesdays, making it a crucial day for traders and investors to monitor market developments.

Despite the recent correction, Bitcoin's long-term outlook remains a subject of intense debate. While some analysts believe the bull run is over, citing on-chain metrics and expecting up to 12 months of bearish or sideways price action, others maintain a more optimistic perspective, predicting a potential rally to over $200,000.

The recent whale trade, coupled with the resumption of Bitcoin accumulation after three months of distribution, suggests that underlying demand for Bitcoin remains strong.3 This accumulation, particularly by long-term holders, can act as a stabilizing force, mitigating the impact of short-term price fluctuations.4

The "Bitcoin Price Prediction 2025: BTC Eyes Breakout, But Sellers Still In Control" sentiment accurately reflects the current market dynamics. While the potential for a breakout remains, the presence of significant selling pressure cannot be ignored. The interplay between bullish and bearish forces will continue to shape Bitcoin's price trajectory in the coming months.

The notion that the "Bitcoin bull cycle is over" is supported by some on-chain data, which can reveal information about investor behavior and market trends. However, interpreting on-chain metrics requires a nuanced understanding of the underlying data and its limitations. While these metrics can provide valuable insights, they should not be the sole basis for investment decisions.

Bitcoin's resilience in the face of market corrections is a testament to its growing adoption and acceptance as a mainstream asset. Despite the current correction, the cryptocurrency's ability to outperform global assets post-Trump election further reinforces its potential as a long-term investment.

The whale's $9.4 million profit is a reminder of the potential for substantial gains in the cryptocurrency market. However, it also highlights the inherent risks associated with high-leverage trading. Investors should exercise caution and conduct thorough research before engaging in such strategies.

In conclusion, the Bitcoin whale's strategic short squeeze and the subsequent market reactions underscore the complex interplay of factors influencing Bitcoin's price.

Macroeconomic indicators, market sentiment, and the actions of large players all contribute to the cryptocurrency's volatile nature.5 While the long-term outlook remains uncertain, the resumption of Bitcoin accumulation and the potential for a breakout suggest that the market is far from stagnant. Investors should remain vigilant, closely monitoring market developments and adapting their strategies accordingly. The story of the whale's successful trade is a potent reminder of the fortunes that can be made, and lost, in the dynamic world of cryptocurrency.

The current BTC chart, incorporating my 'flash-crash' thesisThis chart illustrates the current Bitcoin pattern, with my 'April flash crash thesis.'

I believe we will see another thrust lower into the green box ranges before a spring into the fifth wave. However, the fifth wave will be a "false breakout," as a flash crash in mid to late April is likely to occur, intentionally designed to sweep liquidity by liquidating overleveraged positions and triggering stop losses—driving price past the previous low set in the green box, only for the market to recover shortly thereafter and continue its breakout to the upside. This breakout will likely push beyond the pattern, taking out the all-time high, and setting a new high somewhere in the 20K to 25K range.

There could be some opportunities in the next 4 to 6 weeks, but with opportunity comes risk. Always use a proper risk management strategy suited to your skill level and wallet size.

Good luck, and always use a stop loss!

$BTC to the moonWhen analyzing BTCUSD, I believe it has found its bottom. We have several confluences indicating a potential bullish move, including the mitigation of a monthly key level in a discounted region, an SMT swing low with ETH, and liquidity strategically positioned to act as fuel. Given this, I genuinely think the next stop is the moon. Let's go, BTC! 🚀

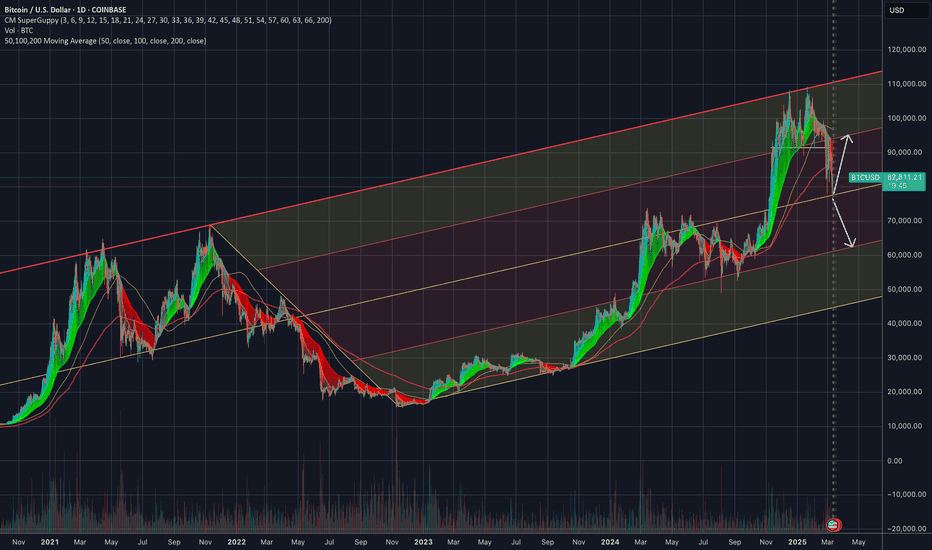

2 Options, Keeping it simpleBTC is currently within its long-term ascending channel but has shown strong rejection at the upper boundary (~$100K).

A pullback toward the mid-channel support (~$70K-$75K) seems likely, aligning with historical retracement patterns.

Indicators Show Weakness:

RSI Divergence suggests a slowdown in momentum.

MACD hints at a potential bearish crossover.

📉 Key Levels to Watch:

Resistance: $95K - $100K (Upper trendline)

Support: $75K (Mid-channel), $60K (Lower trendline)

📈 Scenario 1: BTC consolidates and regains strength for a new ATH attempt.

📉 Scenario 2: A deeper correction to the lower trendline before continuation.

Needs to really break $95k first.

Bitcoin BTC price analysis😕 Yesterday's news of a higher-than-expected CPI increase seems to have been "digested" by the market.

We liked that most of the alts held up quite well (all compared to last week) - there was no more panic.

1️⃣ On the one hand, the CRYPTOCAP:BTC price is being pushed to the “critical triangle” below which the OKX:BTCUSDT price may go to close the CME GAP formed last year.

But BTC.D is also dropping, albeit reluctantly, a little bit.

2️⃣ On the other hand, maybe it's time to stop focusing on that bourgeois #Bitcoin ).

It's time for the altcoins to take "the pitchforks" into their own hands!)

😱 Some #CAKE and #Bake are showing good growth and even the “heavy” CRYPTOCAP:BNB is climbing despite them.... and all because #CZ decided to return to the “big” game and will present a photo of his dog in a few hours....

We are re-reading this sur and our eyes are twitching.... but these are the realities of the crypto world now...)

⁉️ So, what do you think, which memecoin from СZ will blow up the information space and pull all the market liquidity to itself in the coming hours/days?)

BTC Major Pullback - Before Huge Upside PotentialI anticipate a significant retracement in Bitcoin over the next 12 to 24 months. If the price falls below $50,000, it may decline further to around $25,000, followed by a period of consolidation.

Renewed interest from new investors and institutional funds could ignite the next bull run.

What are your thoughts?

BTC - are we about to bounce?Hi All,

So just a thought and observation - let me know what you guys think. We have had 4 bounces

off this bottom green support trend line since 2023. Each time BTC shoots back up for a solid run.

Is the end near?

Am I hoping for an end to this blood bath correction which just dipped into the $79K range. Is there more to come, the chart says we should be done - or damn near the end.

Let me know your thoughts!!