Bitcoin's Natural Correction and the $141K Target Based on Fibonhello dear trader and investors

The cryptocurrency market is always accompanied by strong fluctuations and natural corrections. Bitcoin, as the market leader, requires corrections and liquidity accumulation after each significant rally to pave the way for higher price targets. In this article, we analyze Fibonacci structures and harmonic patterns to demonstrate that Bitcoin's next target could be $141K.

1. Bitcoin Corrections: A Natural Part of an Uptrend

Price corrections in bullish trends are a normal phenomenon that helps shake out weak hands and allows major players to accumulate liquidity. Historically, Bitcoin has experienced 20-30% corrections before resuming its upward trajectory. The current correction is no different and may serve as a base for the next strong move toward higher targets.

2. The $141K Target Based on Fibonacci

Fibonacci levels are among the most reliable tools for predicting price targets. Assuming Bitcoin's recent high was around FWB:73K and the ongoing pullback is a healthy retracement, we can use harmonic AB=CD pattern to project potential upside targets. Based on these levels, Bitcoin could reach $141K in the next bullish phase.

Confirmation Through Harmonic Patterns

Harmonic patterns like Butterfly and Gartley suggest that the current correction is forming a potential reversal structure. If this correction completes within the PRZ (Potential Reversal Zone), Bitcoin could see a strong continuation of its uptrend. The Fibonacci ratios in these harmonic structures indicate that the final price target for this bullish wave could be around $141K.

Volume and Liquidity: Key Drivers for the Rally

Bitcoin needs increased volume and liquidity inflows to reach higher levels. On-chain data shows that trading volumes are rising and large investors (whales) are accumulating rather than selling. This behavior typically precedes a strong bullish move.

Bitcoin's current correction is entirely natural, and technical structures suggest that it could be laying the foundation for a new bullish wave. Based on Fibonacci and harmonic pattern analysis, Bitcoin's next major target is around $141K. Traders and investors should consider these levels in their analysis and avoid emotional decisions during market corrections

good luck

mehdi

Bitcon

BTC- Following the TrendLine since YEARS, ExactlyYear on Year , each cycle BTC is adhering to this trend line, and also hit the 2 FIB EXACTLY for now - rejected there. It must cross this to test higher levels, but that may need a few weeks more of sideways moves. Keep a watch cause another rejection at this trend line will probably indicate we are not going higher.

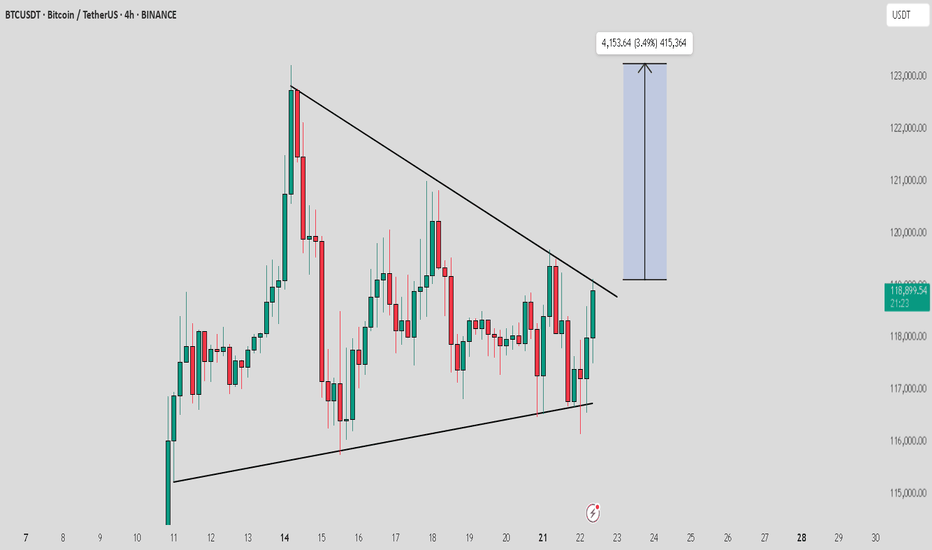

Strategy: “Breakout Bounce” – Buy the Retest, Ride the WaveHello Traders! BTC has broken out above $118K–$120K after a strong uptrend. Now it’s pausing, and a short-term pullback looks likely. Instead of buying the top, we wait for the price to retest previous resistance (around $112K–$114K), which could turn into support.

MY PLAN:

Wait for pullback to $112K–$114K zone.

Look for a bullish candle (daily or 4H) to confirm entry.

Target: $122K short-term or trail stop if trend continues.

Stop loss: Below $108K to manage risk.

Tip: Don’t chase. Be patient, follow the setup, and use proper risk management.

Please leave a comment and don't forget to support a fellow trader! Also, you can leave in the comments your target and plan ideas!

Have a great day y'all!

-Neo

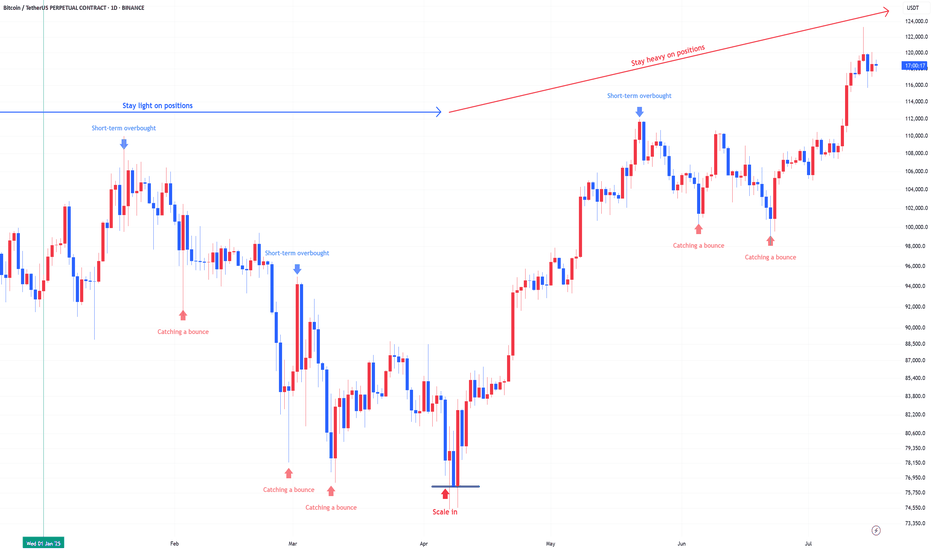

Bitcoin : Stay heavy on positionsApril was the scale-in zone:

Back in April, the US stock market flashed a split-entry buy signal—a classic zone for gradual accumulation.

That same setup applied to Bitcoin. Buying the fear worked again.

We’ve moved out of the fear zone:

Both Bitcoin and equities have left the extreme fear territory behind. Sentiment has shifted.

Short-term overbought now:

Bitcoin is currently in a short-term overbought phase. Some consolidation or cooling off is natural here, but no major trend reversal signs yet.

Stay heavy on positions:

I’m maintaining an overweight position in Bitcoin as long as the US stock market stays intact. The Nasdaq is holding up, so Bitcoin likely stays in risk-on mode.

Warning:

If US equities take a hit, expect Bitcoin to follow.

Negative moves in the stock market will likely translate directly into crypto weakness.

AVAX/USDT - H4 - Wedge Breakout (29.06.2025)The AVAX/USDT pair on the H4 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming Days.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 21.77

2nd Resistance – 24.35

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Bitcoin Breakout Fueled by Hidden Demand ZonesBTC just exploded out of consolidation — but the clues were all there. Price tapped the same demand zone three separate times, each time forming a higher low and respecting a clean rising trendline.

The final push broke through prior supply, flipping it into support and kicking off the breakout leg. These demand zones acted as hidden fuel for the move, offering clear entries for traders tracking structure.

📊 Demand respected at ~$104K, ~$107K, and ~$111K

📈 Breakout confirms rising structure and trendline strength

🧠 Key lesson: Strong moves are often born from clean structure, not noise

#BTCUSD #BitcoinBreakout #SmartMoneyMoves #PriceAction #TradingView #QuantTradingPro

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

Bitcoin has once again failed to break above its previous high and entered a corrective phase. The price is now moving within a channel and is approaching the lower boundary of that channel.

The correction is expected to continue toward the support zone and the bottom of the channel, where we may see buying interest and a bullish reaction.

If Bitcoin breaks above the channel resistance and key supply zone, it could trigger a strong upward move and lead to new all-time highs.

Key Note:

Price action near the channel support and demand zone will be crucial. A successful rebound from this area may signal the start of the next bullish leg.

Will Bitcoin hold the channel and bounce higher, or is a deeper correction ahead? Share your thoughts below! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

BTC / ETH / SOL / XRP / HYPE: Potential Trend StructuresIn this video, I share my current daily and weekly analysis on the trend structures of BTC, ETH, SOL, XRP, and HYPE, highlighting key support and resistance zones to watch in the coming sessions.

Charts featured in the video:

BTC

ETH

SOL

XRP

HYPE

Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re tracking feel free to ask in the comments (just don’t forget to boost the idea first 😉).

BTCUSD · 3D — Bearish Divergence + Volume Drop Suggest Pullback

🧠 Setup Overview

Bitcoin is showing signs of exhaustion after a parabolic rally:

Bearish divergence is visible on the 3D RSI — price made higher highs while RSI made lower highs.

Volume is shrinking with each push up, suggesting buyer momentum is fading.

Price is pressing into all-time highs without conviction, signaling potential for a pullback.

🔻 Downside Targets

Target 🎯 Level Why It Matters

Target 1 $92,300 (50% Fib) Midpoint of last impulse + first strong demand area.

Target 2 $82,500 (61.8% Fib) Volume-profile support + key confluence zone.

🔎 What Confirms the Setup?

Breakdown below $108K structure

Daily close below $105K with increasing volume

RSI losing midline support = momentum shift confirmed

❌ Invalidation

Daily close > $112K with strong volume = idea invalid

Would suggest continuation toward blue-sky breakout

✅ Summary

Bearish divergence + volume drop = classic topping signals

Risk is well-defined, with Fib-backed targets offering clean R:R

Trade cautiously — momentum is fading, not gone yet

📛 Disclaimer: This is not financial advice. Do your own research and manage risk according to your plan.

#Bitcoin #BTC #CryptoAnalysis #BearishDivergence #RSI #VolumeProfile #Fibonacci #TradingView

BTCUSD · 3D — Bearish Divergence + Volume Drop Suggest Pullback

🧠 Setup Overview

Bitcoin is showing signs of exhaustion after a parabolic rally:

Bearish divergence is visible on the 3D RSI — price made higher highs while RSI made lower highs.

Volume is shrinking with each push up, suggesting buyer momentum is fading.

Price is pressing into all-time highs without conviction, signaling potential for a pullback.

🔻 Downside Targets

Target 🎯 Level Why It Matters

Target 1 $93,300 (50% Fib) Midpoint of last impulse + first strong demand area.

Target 2 $82,500 (61.8% Fib) Volume-profile support + key confluence zone.

🔎 What Confirms the Setup?

Breakdown below $108K structure

Daily close below $105K with increasing volume

RSI losing midline support = momentum shift confirmed

❌ Invalidation

Daily close > $112K with strong volume = idea invalid

Would suggest continuation toward blue-sky breakout

✅ Summary

Bearish divergence + volume drop = classic topping signals

Risk is well-defined, with Fib-backed targets offering clean R:R

Trade cautiously — momentum is fading, not gone yet

📛 Disclaimer: This is not financial advice. Do your own research and manage risk according to your plan.

#Bitcoin #BTC #CryptoAnalysis #BearishDivergence #RSI #VolumeProfile #Fibonacci #TradingView

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

In our previous outlook, we anticipated a pullback to the channel bottom followed by a bullish move, and so far, price has followed that scenario perfectly.

Bitcoin is now approaching the channel top and a major resistance zone. At this point, we are watching two potential scenarios:

Scenario 1 – Pullback Before Continuation:

If price rejects the resistance, a correction toward the midline of the channel (which aligns with a key support level) may occur. This could offer a strong entry point for the next bullish wave.

Scenario 2 – Breakout and Retest:

If Bitcoin breaks above the channel and resistance zone, we can look for buy opportunities on the pullback to the broken level, with potential targets at higher levels.

Price action in this area is crucial. Both a midline pullback and a resistance breakout could provide valuable trading setups.

Is Bitcoin gearing up for a breakout, or is another correction coming first? Share your view below! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

₿itcoin: Continuing B WaveBitcoin has recently reclaimed the key $106,000 level. Under our primary scenario, we anticipate continued increases into the blue Target Zone between $117,553 and $130,891 – where green wave B is expected to conclude. From that corrective peak, we project a significant move lower in wave C, which should ultimately pull prices into the lower blue Target Zone between $62,395 and $51,323. This range is expected to mark the completion of orange wave a. We then foresee a brief corrective rally before wave (ii) completes its broader correction with a final sell-off.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

BTC/USD 4H Trade Setup – Demand Zone Reversal Play🔵 1. Demand Zone 🧲💎

📍 Range: 100,418.83 – 102,253.51

🟦 Strong support zone

💡 This is where buyers are expected to step in

📉 Price is currently testing this zone — potential reversal area

🚀 2. Entry Point 🎯

📍 Zone: 102,232.52 – 102,264.33

✅ Just above demand zone for safe entry

🧘♂️ Wait for bullish confirmation (wick rejections, engulfing candles)

🛑 3. Stop Loss 🔻

📍 Zone: 100,498.77 – 100,538.74

🔒 Below demand zone — protects you from false breakouts

⛔ Invalidates setup if price breaks below this level

🎯 4. Target Point 💰

📍 Target: 108,800.00

🧱 Major resistance zone

📈 Offers a solid Risk/Reward setup (approx. 1:4)

🪜 Possible take-profit scaling around 108,656.78 – 109,256.50

🔁 5. CHoCH – Change of Character 🔄

📍 Confirmed structural break above a lower high

🕵️♂️ Indicates shift from bearish to bullish

🔁 Needs confirmation with higher low near demand zone

📏 6. EMA 70 (Exponential Moving Average) 📉

📍 Level: 106,849.30

🔴 Price is currently below EMA = short-term bearish

🧗♂️ Reclaiming the EMA will strengthen the bullish bias

✅ Quick Summary with Emojis

📌 Plan:

🔵 Buy near: 102,250

🛑 Stop Loss: 100,500

🎯 Take Profit: 108,800

📊 Trend:

🔻 Bearish short-term (below EMA)

🔁 Potential reversal from demand zone

⚠️ Watch For:

🔍 Bullish confirmation at demand zone

🔄 Reclaim of EMA (106.8k)

🧱 Resistance near 108.8k

$BTC - Top Down BYBIT:BTCUSDT.P Top Down (10/06/25)

V-Levels Bias

Weekly = Bullish

Daily = Bullish

10-Hour = Bullish

1-Hour = Bullish

V-Levels Momentum

Weekly = Bullish

Daily = Bullish

10-Hour = Neutral

1-Hour = Neutral

Analysis & Insights

DeCode Market Breakdown

Macro Context

Overall, the Weekly structure remains bullish — both in bias and momentum. We’re trading below a key level at $111,968.0, and continuation is likely unless we see a clear Failed Auction at that level.

That would trigger some serious red flags and force a reevaluation of the directional bias.

Daily Chart

Daily structure is extremely bullish at the moment.

The price recently showed a Failed Auction around the $102,000.0 V-structure Higher Low — indicating aggressive absorption and buyer strength.

As long as price holds above that area, the priority is to stay on the long side.

⸻

10-Hour Chart

Still holding a bullish structure overall.

One thing I’ll be watching closely: the price reacting to the previous High at $110,660.8.

If we get a rejection + Failed Auction at that level, that opens up the possibility for intraday shorts; as a short-term shift in momentum and local resistance kicks in.

1-Hour Chart

📈 Long Setup: Waiting for a clean entry from an OTE / Fib zone + Over/Under structure.

📉 Short Setup: Watching for a sweep of the current highs + a clear Failed Auction (ideally with footprint confirmation).

There’s visible compression between $104k and $105k, so price might look to grab liquidity there first before any real move upward.

10-Min Chart

Currently, no clear trade setups on the 10M.

The 1H hasn’t reached optimal trade zones yet. I’ll be watching closely for any structure shifts or setups aligning with the macro bias.

⸻

🔍 Trading Plan Summary

Bias: Bullish (Weekly + Daily)

Look for longs aligned with HTF support + intraday confirmation

Short opportunities only if we get clear rejection from $110,660.8 + footprint signals

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

Bitcoin entered a corrective phase after a liquidity hunt above the recent highs and is currently in a short-term pullback.

We expect this correction to extend toward the identified support levels, after which a new bullish wave may begin, potentially leading to fresh all-time highs.

The broader trend remains bullish, and the current correction could offer a buy-the-dip opportunity in line with the ongoing uptrend.

Don’t forget to like and share your thoughts in the comments! ❤️

Ethereum Is Not DEAD ... WHY ??? Because BlackRock Says SoMartyBoots here , I have been trading for 17 years and sharing my thoughts on ETH here.

ETH Is Not Dead — It’s Just Getting Started

Narrative of ETH being “dead” is short-sighted. Here’s why:

1. Ethereum Is Still Younger Than Bitcoin

• Ethereum launched in 2015, a full 6 years after Bitcoin.

• BTC had over a decade of network effect, price discovery, and global trust before ETH even got its first DApp.

• On the charts, ETH still has room to mature, just like Bitcoin did pre-2020.

• Fundamentally, Ethereum is still evolving — from PoW to PoS, scaling solutions (L2s), and now modular chains.

You’re not late to ETH — it’s just halfway through the marathon.

⸻

2. BlackRock’s BUIDL Fund Is a Massive Signal

• The BlackRock BUIDL fund, launched on Ethereum, already has $3B in AUM — and it’s growing.

• It shows that legacy institutions aren’t ignoring ETH — they’re building directly on it.

• This isn’t speculative hype. It’s tokenized real-world assets backed by the biggest asset manager on earth.

• Smart money is moving into ETH, not away from it.

The narrative is shifting. Institutions aren’t betting on meme coins — they’re betting on Ethereum rails.

Final Thought

ETH is not dead. It’s undergoing the same early-stage skepticism BTC did in its early years. With foundational upgrades and institutional validation, ETH might be the most undervalued top asset in the market today.

⸻

Watch the chart. Track the fundamentals. And don’t sleep on ETH.

#Ethereum #ETHUSD #Crypto #fundamentals #BUIDL #BlackRock #OnChainData #NotDead #TradingView

Watch video for more details

USDT Dominance Looks BullishHello all dear friends.👋

According to the chart that USDT Dominance shows, we have an upward trend up to 4.70%. Of course, we may have a slight downward trend before moving up. Based on this, there is also a downward trend ahead for Bitcoin .

❗Please be careful that this is an analysis and opinion.