Bitcon

Bitcoin BTCUSDT – 4H Technical Analysis

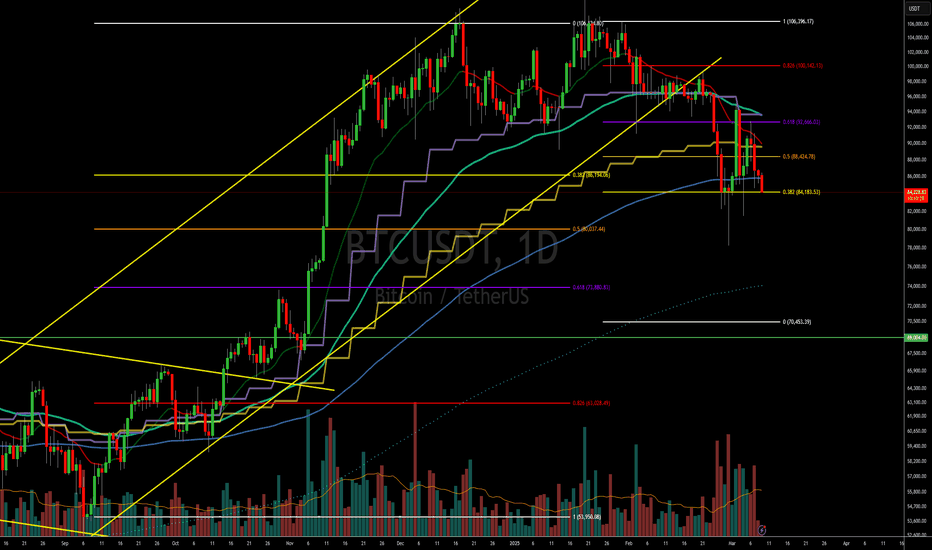

Bitcoin is currently approaching a key downtrend resistance line that has been respected several times since early February. The price action suggests a potential rejection from this level, which could lead to a move toward the lower boundary of the broader descending channel.

🔹 Bearish Scenario: If the resistance holds, we may see a continuation of the downtrend with possible targets near the $71K– FWB:73K region.

🔹 Bullish Invalidator: A confirmed breakout above the trendline would invalidate the bearish setup and could signal a shift in market structure.

⚠️ Watch price action closely around this level for potential rejection or breakout confirmation.

BTCUSD Daily View Based on your 15-minute BTC/USD chart, here’s a structured technical analysis for **April 10, 2025**:

---

### 🧠 **Chart Breakdown**

- **Break of Structure (BOS)**: Bullish BOS occurred earlier, indicating short-term upward momentum.

- **Strong High**: Marked at **$83,568** — this is a **liquidity point** that could act as a magnet if bullish momentum resumes.

- **Weak Low Zone**: Around **$81,451** — a key liquidity area that might be swept before any significant move up.

- **Current Price**: **$81,814**, sitting just above the weak low zone and in a minor consolidation phase.

---

### 🔍 **Market Context**

- After a strong impulsive move up, BTC started pulling back with lower highs and lower lows, indicating **retracement** or **distribution**.

- The price is holding slightly above the weak low, meaning:

- Smart money may be trying to **trap shorts or induce longs** before a deeper sweep or reversal.

- There's potential for **liquidity sweep below $81,451** before heading back up to test the strong high ($83,568).

---

### 🔮 **Today's Bias: Neutral-to-Bullish (Scalp or Swing)**

#### 🎯 **Bullish Scenario (Preferred if $81,451 holds)**

- Price holds above or sweeps $81,451 and **reclaims the zone quickly**.

- Expect a bounce toward:

- **$82,500** (intermediate resistance)

- **$83,568** (strong high / liquidity target)

#### 🛑 **Bearish Scenario (Only if clean break below $81,451)**

- Price breaks and holds below **$81,451** → retest failure = bearish.

- Target downside levels:

- **$80,500**

- Potentially **$79,500** if momentum is strong.

---

### 🧭 **Action Plan for Today**

| Type | Strategy |

|-------------|----------------------------------------------------------|

| Intraday Long | Buy near $81,451 zone with tight SL below $81,200 |

| Confirmation Entry | Wait for 15m bullish engulfing / BOS above GETTEX:82K |

| Short Setup | Only valid on clear 15m breakdown + retest below $81,451 |

---

BTC - 4 Different Wider Looks at BTC1️⃣ Weekly EMA 55. Many legit touches.

2️⃣ Possible Elliot Wave in Log chart.

3️⃣ 4H EMA 200.

4️⃣ A valid Pitchfork since Dec 2024

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

BTCUSDT, We were moved like ...Hello everyone

According to the chart that you can see the price movement was exactly moved to our route but at this time we expect because of the reason in world and US Reciprocal Tariffs at this time Gold movement is important after the Gold start the corretion wave the smart money comes to the cryptocurrency market and we expect the excitement movement.be patient until ...

Be Lucky

AA

Short Position EOS/USDT#Singal

EOS/USDT

🔴 Short Position

🎲 Entry @ 0.6990

✅ Target1@ 0.6664

✅ Target2 @ 0.6220

✅ Target3 @ 0.5476

✅ Target4 @ 0.4856

✅ Target5 @ 0.4263

❌ Stop Loss @ 0.8509

Leverage: 5X_15X

Margin: 10% of Wallet Balance

⚠️"Take Care of Risk Management for Your Account"

Bitcoin in Ascending Wedge?Looks like a rising wedge guys - I'm not a charting TA expert but would love to here your thoughts. Many bears keep posting a drop to $70K level.. I guess that drop is written in some prophecy somewhere, and they believe (or hope) it MUST happen, before we go for new ATH. Maybe so... however can anyone explain WHY that must play out like that? A couple of weeks back i was in that camp but after I see the slow and steady Bitcoin recovery, I have changed my mind.

2 Paths for Bitcoin in this 60-Day CycleThere are two possible scenarios for the rest of this cycle:

1️⃣ Bearish Scenario (Most Likely)

Bitcoin hit a cycle low at $78,000 on February 28th.

It initially showed strength but quickly reversed, forming a failed cycle.

This suggests a lower low is likely before the cycle ends.

If holding BTC, the best strategy is to sell at the next 3-day Cycle high (message me if you don’t have access to the Cycle indicators), expected next week.

2️⃣ Bullish Alternative

If the recent drop was caused by macro factors rather than natural cycle movement, we could still see a higher high before the cycle ends.

The 1-week Cycle (red line) is forming a bottoming pattern, which could indicate upside potential toward $90,000+.

How I’m Approaching This Cycle

I purchased BTC below the current price and plan to hold through this cycle. My reasoning:

We are currently at the bottom of the mid-term trend, and I expect a strong rally in the near future.

As mentioned in my previous newsletter, it’s crucial to combine the 60-day cycle with other timeframes:

2-week, 1-week, 3-day, and 1-day cycles all provide additional confirmation.

BTCUSD - A fresh look on the current supportIf you understand the mechanics of the Medianlines aka Pitchfork, then you understand the projected movement of the markets.

Whatever you measure with them, the same principal applies.

In the prior analysis, the framework of the Medianlines pointed us in the right direction.

Now it's time to reassess this product.

The 0 to 5 Count:

It's often a good indication when the last sprint happens. After P5, the count starts again from 0, up to 5 again. Here we see that the P5 was reached and we get the bounce, down to the Center-Line aka Medianline, where it finds support.

Could it move upward again? Absolutely, even if it where just for a pullback and the a further continuation to the downside. In fact, I even expect it to bounce up to the red resistance zone.

This would mark P2 before a harder drop down to P3, cracking the Centerline.

Most often after the Centerline is breached, we see a test/retest to it. (P3-P4), an exhaustion of the buyers and then the final hit on the head with a target at P5. In between P4 and P5, there's also the 1/4 line, where we often see a sudo-support. But it's not often that price starts to turn again and negating P5. It's mostly just a try, before the last drop to P5.

So there you have my coffee-ground reading.

Always remember, that even with such an accurate TA-Framework, we only shall trade what we see.

Many thanks to the loyal followers and all likes and sharing. I always love your feedback and constructive criticism. §8-)

Bitcoin's Natural Correction and the $141K Target Based on Fibonhello dear trader and investors

The cryptocurrency market is always accompanied by strong fluctuations and natural corrections. Bitcoin, as the market leader, requires corrections and liquidity accumulation after each significant rally to pave the way for higher price targets. In this article, we analyze Fibonacci structures and harmonic patterns to demonstrate that Bitcoin's next target could be $141K.

1. Bitcoin Corrections: A Natural Part of an Uptrend

Price corrections in bullish trends are a normal phenomenon that helps shake out weak hands and allows major players to accumulate liquidity. Historically, Bitcoin has experienced 20-30% corrections before resuming its upward trajectory. The current correction is no different and may serve as a base for the next strong move toward higher targets.

2. The $141K Target Based on Fibonacci

Fibonacci levels are among the most reliable tools for predicting price targets. Assuming Bitcoin's recent high was around FWB:73K and the ongoing pullback is a healthy retracement, we can use harmonic AB=CD pattern to project potential upside targets. Based on these levels, Bitcoin could reach $141K in the next bullish phase.

Confirmation Through Harmonic Patterns

Harmonic patterns like Butterfly and Gartley suggest that the current correction is forming a potential reversal structure. If this correction completes within the PRZ (Potential Reversal Zone), Bitcoin could see a strong continuation of its uptrend. The Fibonacci ratios in these harmonic structures indicate that the final price target for this bullish wave could be around $141K.

Volume and Liquidity: Key Drivers for the Rally

Bitcoin needs increased volume and liquidity inflows to reach higher levels. On-chain data shows that trading volumes are rising and large investors (whales) are accumulating rather than selling. This behavior typically precedes a strong bullish move.

Bitcoin's current correction is entirely natural, and technical structures suggest that it could be laying the foundation for a new bullish wave. Based on Fibonacci and harmonic pattern analysis, Bitcoin's next major target is around $141K. Traders and investors should consider these levels in their analysis and avoid emotional decisions during market corrections

good luck

mehdi

Why did stocks and crypto crash, and when will they rebound?At the beginning of March 2025, markets experienced a significant decline due to several key factors. One of the main reasons was increased economic uncertainty following the introduction of new U.S. trade tariffs against China, Mexico, and Canada. As a result of the trade wars initiated by Trump, the world’s wealthiest individuals lost over $40 billion since the beginning of the year. From March 7 to March 10, 2025, shares of leading tech companies and the Nasdaq 100 index (#NQ100) suffered a sharp drop: Tesla’s stock (#Tesla) plunged by 15%, Apple’s shares (#Apple) declined by 4.9%, Nvidia’s stock (#NVIDIA) fell by 5.1%, and the #NQ100 index dropped by 4%.

In the digital asset market, the downturn accelerated after investors failed to see the expected government support for cryptocurrencies. Initial regulatory announcements, which initially sparked optimism, turned out to be vague, leading to disappointment and profit-taking. Finally, fears of a potential recession, fueled by statements from the U.S. president, further eroded investor confidence in both the stock and crypto markets. Collectively, these factors led to a broad market decline and heightened volatility. As a result, Bitcoin dropped nearly 15% between March 7 and March 10, 2025, reaching $77,500.

Despite the current challenges, several factors could contribute to market recovery and growth in 2025:

Advancements in technology and artificial intelligence: Companies specializing in AI and high-tech development continue to attract investments. Giants like Microsoft (#Microsoft) and Google (#Google) are expected to strengthen their positions by expanding AI applications in business and daily life.

Growth in the healthcare and biotechnology sectors: Pharmaceutical and biotech companies remain resilient to economic downturns due to sustained demand for healthcare and innovative treatments. Companies researching cancer and autoimmune disease treatments are expected to draw increasing investor attention.

Transition to green energy: Renewable energy companies are showing steady growth. Tesla (#Tesla) remains a key player, and 2025 is expected to see further expansion in solar, wind energy, and battery technology companies.

Macroeconomic policy stabilization: The U.S. Federal Reserve is expected to adopt a more predictable monetary policy, potentially reducing market volatility and boosting investor confidence. In 2024, the Fed aggressively raised interest rates to combat inflation, which pressured stock markets and limited access to cheap money. However, by 2025, inflation has begun to slow, which could lead to a more accommodative monetary policy and possible rate cuts.

Institutional investments in cryptocurrencies: A crucial factor is the integration of blockchain technology into the financial sector. Companies like Visa (#Visa) and Mastercard (#Mastercard) are expanding their support for crypto payments, while PayPal (#PayPal) is actively incorporating stablecoins into its ecosystem. This trend is driving broader adoption of digital assets and their practical use in the real economy.

Despite the current challenges, there are significant chances for recovery and growth in both stock and cryptocurrency markets. Analysts at FreshForex predict a market rebound in the second and third quarters of 2025 — don’t miss out!

Our trading platform offers 270 instruments, including CFDs on stocks, cryptocurrencies, and indices with leverage up to 1:2000. Stay ahead of the market and capitalize on trading chances!

BTC shortFollowing this pullback, my prediction suggests a further decline with a target at $70,000, marking the first Fibonacci extension level in this sequence. This $70,000 target is particularly significant as it closely aligns with Bitcoin’s previous all-time high of around $69,000, reached in November 2021.

Russel 2000 Compared to General MarketTVC:RUT has continued to sell off since my last couple posts and I believe we could see a huge market correction this year if price doesn't look to stop selling.

The next play on RUT I would like to see price pullback to the last breakout zone ($2,200) to confirm a continuation in trend

This play also looks very familiar to the 2022 selloff with equal highs to our current price structure. Seeing that AMEX:SPY is at a higher high tells me there is market-wide divergence and a topping pattern could be in play.

Now when we add CRYPTOCAP:BTC and $OTHER to the mix we can see bitcoin actually tops out first while Alts and SPX look to make one more leg up before crashing out.

The Trend Reader at the lower tab has topped out and has a bearish crossing in the overbought zone indicating we can see a long term play to the downside.

Alright let's do this $BTCT!Exciting news for crypto enthusiasts! A new state strategic reserve for digital assets that features five top cryptocurrencies, with Bitcoin and Ether front and center. Bitcoin, the undisputed heavyweight of the crypto world, saw an impressive 8% surge to about $90,800 following the announcement NASDAQ:BTCT

BTCUSDT, Bearish Scenarios for upcoming days ...Hello Traders, Hope you're great.

for Upcoming days, I anticipate 2 Bearish scenarios :

In First Scenario, I expect price does an upward correction to the nearest broken support level that became to an important supply zone around 91-93K and after that starts to drop.

in Second scenario, I expect price does a further upward correction and goes to the supply zone around 95-97K and after that start a major downward movement.

Targets are 85K, 82K and my final target is 77K.

Don't forget to use proper risk management.

And finally tell me what do you think about BTCUSDT, UP or DOWN ? comment your opinion below this post.

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

Bitcoin sharply dropped to the identified support level and the bottom of the drawn channel after breaking the $94,000 support zone.

In this area, we expect a bounce toward the next resistance level an the top of the channel.

After reaching this resistance, price action should be closely monitored to determine whether Bitcoin can break above or face rejection.

A short-term recovery is likely, but the key decision point will be at the resistance level, where we need to assess the strength of the bullish move.

What’s your view on Bitcoin’s next move? Will it break through resistance

Don’t forget to like and share your thoughts in the comments! ❤️

BTC CME MMBM is over If we use data like Market Maker for the purchase, then perhaps we have completed it, now MMSM has worked

We see that December was aсamulation, January - manipulation and February - distribution with the completion and withdrawal of monthly liquidity for January, now we are in the zone of immediate inefficiency, 82-88k + emptiness at 77-80k

I will consider NWOG for 23 feb as resistance and a search for a short entry if the price goes there due to weekly inefficiency