Waves Coin Analysis 14/03/2021Waves is a multi-purpose blockchain platform which supports various use cases including decentralized applications (DApps) and smart contracts.

Launched in June 2016 following one of the cryptocurrency industry’s earliest initial coin offerings (ICO), Waves initially set out to improve on the first blockchain platforms by increasing speed, utility and user-friendliness.

The platform has undergone various changes and added new spin-off features to build on its original design.

Waves’ native token is WAVES, an uncapped supply token used for standard payments such as block rewards.

As one of the first offerings in its field, Waves set out to improve on the early blockchain platforms and products.

From the outset, it aimed to appeal to prospective business clients looking to use blockchain to improve processes or create new services.

Waves supported smart contract and DApp development, ensuring that speeds and ease-of-use surpassed competition at the time.

Since then, other products have appeared, including Gravity, a cross-chain and oracle network, and decentralized finance (DeFi) focused platform Neutrino. Waves DEX is a decentralized cryptocurrency exchange.

In 2020, Waves announced that its platform would be interoperable with the Ethereum network by releasing the WAVES token as an ERC-20 standard asset.

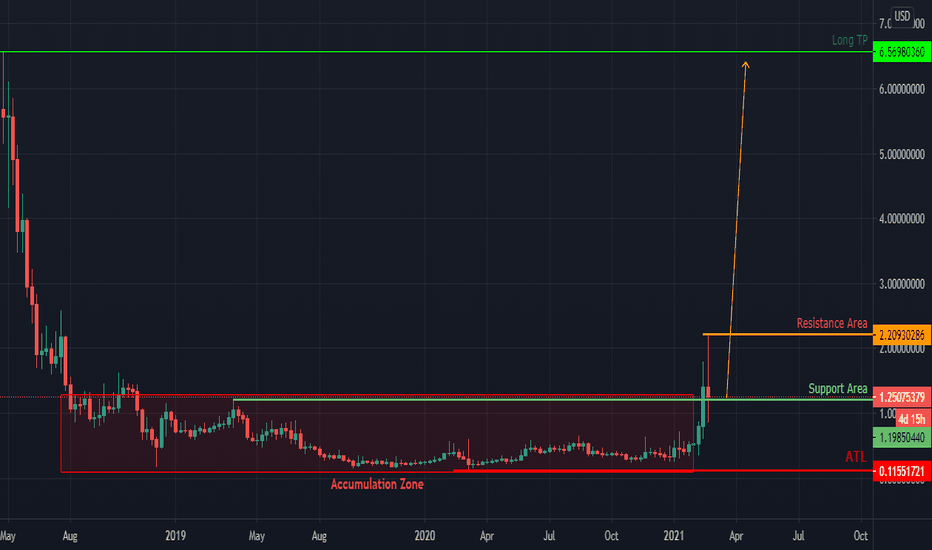

Technical Analysis:

the price started to Show reactions on the PitchFan earlier so we draw it again and we have specified 3 Targets based on Fibonacci Projection where we get out 3Targets Confirmation as soon as the price triggers our 2 Target followed by some price Correction or retracement.

Biton

Civic Token (CVC) Analysis 08/03/2021Civic is a blockchain-based identity management solution that gives individuals and businesses the tools they need to control and protect personal identity information.

The platform is designed to change the way we think about identity verification by giving users more control over their personal data, while allowing them to access a wide range of services without needing to fork over excessive amounts of personal information.

Civic's identity verification solution uses distributed ledger technology to authorize identity usage in real time, and is used to sparingly share information with Civic partners after authorization by the user.

Unlike some other identity management services, Civic users store all their sensitive data on their mobile device. Users are able to authorize the sharing of specific personal data by providing a biometric signature through the Civic app.

The Civic ecosystem is enabled by a unique utility token known as the Civic token (CVC), which is used for the settlement of identity-related transactions between Civic participants — such as between a customer and service provider.

Users can earn CVC tokens for completing a variety of tasks, such as signing up for a service through the platform or introducing new users, while validators can earn CVCs for validating documents for service providers.

Civic was launched in 2018, following a sell-out initial coin offering (ICO) the year prior.

Founders of Civic:

Civic was co-founded in 2015 by Vinny Lingham and Jonathan Smith.

Vinny Lingham is a serial entrepreneur who appeared on Shark Tank South Africa in 2016, and has co-founded several prominent firms, including a South Africa-based investment fund known as Newtown Partners and Gyft — a Google ventures-backed digital card platform. Lingham is Civic’s CEO.

Jonathan Smith is the current CTO of the platform and has more than 15 years of experience in the banking industry. Prior to his role at Civic, Smith held various managerial roles at prominent firms, including Deloitte MCS Limited and HSH Nordbank, and was the global head of Platforms at Genpact Headstrong Capital Markets.

In addition to the founders, the Civic team includes a host of highly successful individuals, including COO Chris Hart, who has two decades of experience in senior finance, and previously held the role of CFO at Guidebook and Nextag.

The official Civic LinkedIn page currently lists 38 employees, many of which are based in the San Francisco Bay Area.

What Makes Civic Unique?

Civic is built to make it easy for users to verify their identity with service providers, while still retaining full control over their personal information.

It allows businesses to onboard users faster using its AI-powered verification system, which when combined with human review helps businesses cut down on fraud and stay compliant with AML regulations and OFAC rules.

As of December 2020, Civic has two main products: the Civic wallet and Health Key.

The Civic wallet is a mobile cryptocurrency wallet that can be used to store a handful of popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and USD Coin (USDC). The app doubles as a digital identity management solution, and benefits from a $1 million Bitcoin insurance plan provided by Coincover.

Health Key is Civic’s newest product. This is an app that allows employers to securely verify the health status of employees, to ensure they are healthy enough to return to the workplace after an infection with COVID19 — such as if they test positive for antibodies or have been vaccinated. This is achieved without compromising the privacy of the employee.

Technical Analysis:

as we can see this Token has done its accumulation and started its rally.

there exist a hidden bullish Divergence which is the sign of trend Continuation and it can be a good confirmation for our Price Action Analysis.

we can target 3 TPs based on Fibonacci Projection of the past impulsive wave.

the 3 TP gets its confirmation if the 2 TP gets triggered by an impulsive wave followed by a retracement to parallels leg of the same Fibonacci projection.

Curve DAO Token (CRV) Analysis 07/03/2021earlier we have analyzed this token by Price Action Techniques and we capitalized on it,

now we are updating it...

we are opening new position on it again and there are total of 3 TPs specified by Fibonacci Projections.

the 1 Tp is the Immediate one and very easy to achieve,

we get the 3 TP confirmation, if the 2TP gets triggered by one impulsive wave and some retracement or price correction.

we can trill our stop loss after the 8 USD birched.

Zcash (ZEC) Analysis Updated 07/03/2021this is an update of Zcash Analysis which we did on 01/02/2021

as we can see our Hidden Bullish Divergence Implemented, price made a rally and higher high, touched the TP Zone Green Box, where we had our 161.8% level Fibonacci projection Triggered.

price corrected itself and retraced down to the past ATH and Top of our Ascending Channel, so we got our confirmation for the 261.8% level of the same Fibonacci Projection, which is our new higher TP (250USD)

as of now we have total of 3 targets where the 1 TP is the 161.8% of the same Fibonacci Projection where it is very obvious and 2 TP is also well confirmed now.

we can target the 3 TP (315USD), after a retracement from 2TP or if the Bull pressure was high, we can simply Trill our Stop Loss and target our ultimate Target.

i have linked the previews analysis too.

QTUM Analysis 07/03/2021Qtum (QTUM) is a Proof-of-Stake (PoS) smart contract blockchain platform and value transfer protocol. In PoS, node operators are rewarded for validating transactions. Qtum is built on Bitcoin's UTXO transaction model, with the added functionality of smart contract execution.

The live Qtum price today is $6.34 USD with a 24-hour trading volume of $395,258,518 USD. Qtum is up 2.88% in the last 24 hours. The current CoinMarketCap ranking is #92, with a live market cap of $622,646,747 USD. It has a circulating supply of 98,181,101 QTUM coins and a max. supply of 107,822,406 QTUM coins.

As you can see there are total of 3 TPs specified where we can be sure about the 3TP if the 2 TP gets trigried on an impulsive wave with some correction

but remember all TPs will Triger ultimately.

Synthetics (SNX) Analysis 07/03/2021Synthetix is a decentralized finance (DeFi) protocol that provides on-chain exposure to a wide variety of crypto and non-crypto assets. The protocol is based on the Ethereum (ETH) blockchain and offers users access to highly liquid synthetic assets (synths). Synths track and provide returns on the underlying asset without requiring one to directly hold the asset.

The platform aims to broaden the cryptocurrency space by introducing non-blockchain assets, providing access to a more robust financial market.

The network was launched in September 2017 by Kain Warwick under the name Havven (HAV). About a year later the company rebranded to Synthetix.

Kain Warwick is the founder of Synthetix and a non-executive director at the blueshyft retail network. Prior to founding Synthetix, Warwick has worked on several other cryptocurrency projects. He also founded Pouncer, a live auction site exclusive to Australia.

Peter McKean, the project’s CEO, has over two decades of experience in software development. He previously worked as a programmer at ICL Fujitsu.

Jordan Momtazi, the COO of Synthetix, is a business strategist, market analyst and sales leader with several years of experience in blockchain, cryptocurrency, digital payments and e-commerce systems.

Justin J. Moses, the CTO, was the former director of engineering at MongoDB and deputy practice head of engineering at Lab49. He also co-founded Pouncer.

What Makes Synthetix Unique?

Synthetix is a decentralized exchange (DEX) and a platform for synthetic assets. The protocol is designed in a way that exposes users to the underlying assets via synths, without having to hold the underlying asset.

The platform allows users to autonomously trade and exchange synths. It also has a staking pool where holders can stake their SNX tokens and are rewarded with a share of the transaction fees on the Synthetix Exchange.

The platform tracks the underlying assets using smart contract price delivery protocols called oracles. Synthetix allows users to trade synths seamlessly, without liquidity/slippage issues. It also eliminates the need for third-party facilitators.

SNX tokens are used as collateral for the synthetic assets that are minted. This means that whenever synths are issued, SNX tokens are locked up in a smart contract.

Since launch, the protocol has transitioned to the Optimistic Ethereum mainnet to help reduce the gas fees on the network and lower oracle latency.

How Many Synthetix (SNX) Coins Are There in Circulation?

The maximum supply of SNX is 212,424,133 coins, of which 114,841,533 SNX is in circulation as of February 2021.

At the seed round and token sale stages, Synthetix sold more than 60 million tokens and was able to raise $30 million. Of the total 100,000,000 coins issued during the ICO, 20% was allocated to the team and advisors, 3% to bounties and marketing incentives, 5% to partnership incentives and 12% to the foundation.

How Is the Synthetix Network Secured?

The SNX token is compatible with Ethereum’s ERC20 standard. The Synthetix network is secured through proof-of-stake (PoS) consensus. Synthetix holders stake their SNX and earn returns from the network fees.

Another way for SNX stakers to earn rewards is via the protocol’s inflationary monetary policy, known as staking rewards.

Total of 3 TPs with Fibonacci Projection

if 2 TP triggered then 3 TP is confirmed

easy trade it is

USDCAD Bullish Divergence Analysis 07/03/2021as we can see the price is in a wedge where it has Bullish Divergence with MACD and there exist a MACD crossover which can be interpreted as the trend reversal

we can see some changes in DXY also which may confirm the bullish ness of this instrument

there are 2 TPs to capitalize on

AUDUSD Analysis 06/03/2021as you can see the price was centrally range bounding in an ascending parallels channel where it has shown Bearish Divergence with MACD and there exist a cross below of MACD and Signal line (in yellow Circle) on MACD Indicator, which is the sign of trend reversal, and price retracement or correction.

by using Fibonacci Retracement tool ,we can see currently the price is at 38% level and if this immediate support stands, then we can target 2TP directly, and if not, and price falls to Fibonacci Golden Zone and it stands then 1 TP is very feasible.

if fib 61.8% did not stand, then we can short it and target the low of the wave easily...

what do you think about it?

Dow Jones Industrial Average Index (DJI) Analysis 05/03/2021as we can the there is a bearish divergence between Price and MACD, which is the sign of trend reversal and we can predict the 61.8% of Fibonacci retracement as one of our TPs

so soon we shall face an other recession

how big this time. we shall see.

if 61.8% Fibonacci retracement stands then we may go for a bullish rally and if not and braked down then a huge recession and history will be repeated again...

Silver (XAGUSD) Analysis 04/03/2021this is a 2 Day Candle Chart

as we can see the Price is up Ranging in a Yellow Ascending Parallel Channel where currently it is trying to break the lower bond.

there exist a Fibonacci golden zone of the smaller impulsive wave, which can show Support and if the price bounces from it then we can target the 1TP, which is Fibonacci Expansion -27% level of the main Bullish Wave.

the Red Box (Fib Confluences Level IMPORTANT) is the confluences of the 76.4% Fib Retracement of Smaller Impulsive wave and 38.2% Fib Retracement of the main bullish wave, where if the price falls and it stands as a support and bounces the price, then we can target the 2TP, which is the -61.8% Fibonacci Expansion Level of the main Bullish Wave.

there are 2 Vertical Lines which Shows the Speculated Dates for Achieving the Specified Targets, they are specified by Trend-Base Fibonacci Time,

there are total of 2 TPs Specified

1TP=35$

2TP=41$

please comment your Opinions...

Bitcoin Diamond (BCDUSDT) Analysis 04/03/2021as we can see the coin has done its accumulation phase and started its Rally where as we can predict 3 TPs by Fibonacci projection.

the 1 TP is the immediate Target if the current Resistance area breaks and turns to Support,

if on the same impulsive wave after the 1 TP, we Triger the 2TP which is the extension level i.e. 161.8%, then we can be optimistic about the 3 TP which is the 261.8% of the same

AMBUJA CEMENTS LTD Analysis 04/03/2021as we can see the price is renege Bounding in an ascending Paralleled Chanel where as the Fibonacci Projection shows some confluences with the Top Red Trendline which is the long term trend line and can be used as a resistance area.

we can be optimistic about 1 TP , which is 161.8% i.e Extension Level of the same Fibonacci projection and if triggered and show some candle pattern and the resistance turned to Support, then we can target the 261.8% of the same which is 3TP

Celer Network Analysis 04/03/2021as we can see the price has already done its accumulation and established its initial journey,

we can target the parallels legs of Fibonacci projection and if on the same impulsive wave we triggered the extension zone of 161.8% which is our 2 TP then we can be more confirm about the 3TP which is the 261.8% of the same Fibonacci projection.

there are total of 1 TPs and 1 Ultimate Target we have specified here where as the 1 TP is very close to achieve and rest may take some time but alternatively all will be triggered

GBPJPY 3D Analysis 03/03/2021the price has broken the Top Boundary of the Ascending Channel and can continue its rally up to the provided TPs

as we can see the price has confirmed its rally by touching Fibonacci projection extension level 161.8% so we can target the 261.8% of the same Fibonacci projection level

EURJPY analysis with 2 TPs 03/03/2021as we can see this instrument was up trending in an ascending Parallels channel and there are no majeure resistances on its way,

so we can speculate 2 TPs where we may have some Resistance so we can capitalize our positions there.

one of the most important confirmations are that the price has touched the Fibonacci projection 161.8% extension level and there is a convention that, once the price touches this level there are over 85% of chances that the price will continue its rally to 261.8% of the same Fibonacci projection, where it has confluences with our Price Action defined 1 TP.

Reliance Industries Analysis 24/02/2021the price seem to be retracing from its long term rally and now it is falling up to 61.8% of the Fibonacci retracement

if the price started to rally from the place where it is now we can target 3290 directly but if it retraces to lower supports then we can target 1 TP after the retracement

Ripple is Rallying, worth of Longing Now 24/02/2021we may have some retracement to the support areas but yet this Coin is doomed to be bulled

we have specified total of 3 TPs

1TP is the parallels leg of the Fibonacci projection and

2TP is the extension level of the same Fibonacci projection and if the 2 TP triggered then we can expect the 3 TP to be followed

please comment your opinon

PIVX is Very Good to HODLed 24/02/2021PIVX is a decentralized autonomous organization (DAO) that is self-funded and community-driven. It is a third-generation privacy coin and uses a modified version of Dash’s masternode architecture. It also uses Zcoin’s Zerocoin privacy protocol. Its transaction capacity can reach up to 1000 transactions per second through the usage of the SwiftxX payment protocol.

PIVX also uses a proof-of-stake consensus mechanism that involves two parties: the masternodes and the validators.

Masternodes are responsible for voting on development proposals that are put forward by the PIVX community and validating the transactions on the blockchain with a single confirmation. 10,000 PIVX is the minimum requirement to run a masternode. Each masternode gets 1 vote and is not involved in the mining of new tokens.

Validators are responsible for mining PIVX. They have a chance of generating a block proportional to the number of PIVX they have staked. 500 PIVX can generate a single block, which is completed within a 60 second time period. When a block is generated, it brings a reward of 6 PIVX coins, two of which go to the validator and three to the masternode, while one is allocated to the PIVX treasury.

If a user wants to store PIVX, they can do so in three ways: on the Ledger hardware wallet, the PIVX desktop and mobile wallets, or the Coinomi desktop and mobile wallets.

PIVX was announced on November 25, 2015. PIVX is short for Private Instant Verified Transaction Cryptocurrency and is a privacy-centric proof-of-stake cryptocurrency that was forked from DASH. It focuses on community governance and decentralization.

PIVX is building a digital means of exchange with the main focus on minimizing the transaction times and fees while maintaining privacy and security. PIVX was launched on January 31, 2016, by James Burden.

PIVX did not have an initial coin offering and instead, 60,000 PIVX were pre-mined to allow for 6 masternodes to operate on the initial network. After the initial setup, these coins were burned as soon as the PIVX community grew to the point where it became self-sustainable.

ames Burden is the founder of PIVX. Aside from this project, he is also the founder of VEIL. Burden used to be a senior technician at IBEW 357. He graduated from the College of Southern Nevada.

Burden has over 20 years of experience working as a hardware technician and has been an active cryptocurrency developer since as early as 2012. He stepped away from PIVX in April 2019.

Cartesi is now Worth to be Longed 24/02/2021Cartesi is taking smart contracts to the next level. It is solving the urgent problem of scalability and high fees on blockchains by implementing a variant of optimistic roll-ups. Most notably, Cartesi is revolutionizing smart contract programming by allowing developers to code with mainstream software stacks. Noether is Cartesi's side-chain that’s optimized for ephemeral data, providing low-cost data availability to DApps.

What gives Cartesi a competitive edge as a layer-2 and optimistic rollups solution is that it allows developers to code their smart contracts and DApps directly with mainstream software components and Linux OS resources. That represents more than an incremental improvement to decentralized applications. It is a necessary step toward the maturity of the whole blockchain ecosystem. Allowing mainstream programmability means that DApp developers have an entirely new expressive power to create from simple to rather complex smart contracts. It also means opening the doors for extensive adoption of regular developers who have never programmed for blockchain, as they will create decentralized applications with a coding experience similar to desktop or web.

Cartesi is a layer-2 infrastructure for blockchains that allows developers to code highly scalable smart contracts with mainstream software stacks on a Linux VM. Cartesi uses a combination of rollups and side-chains.

Mainstream programmability: Developers create smart contracts with mainstream software stacks, taking a productive leap from the limited programmability of blockchain-specific VM's to coding with software components supported by Linux.

Scalability: Cartesi enables million-fold computational scalability, data availability of large files and low transaction costs. All while preserving the strong security guarantees of the underlying blockchain.

Privacy guarantees: Cartesi allows for decentralized games where players conceal their data and Enterprise applications that run on sensitive data, preserving privacy on DApps.

Portability: Cartesi is blockchain-agnostic and will run on top of the most important chains. The current implementations already support Ethereum, Binance Smart Chain, Matic (Polygon), with Elrond coming soon.

CTSI is a utility token that works as a crypto-fuel for Noether.

Stakers receive CTSI rewards by staking their tokens and participating in the network. Node runners are selected randomly according to a PoS system and gain the right to create the next block. Users of the network pay CTSI fees to insert data on the side-chain.

CTSI also plays a role with Descartes Rollups.

CTSI will be used by DApps to outsource the execution of verifiable and enforceable computation to entities running Descartes nodes.

there are totally 3TPs which you can capitalize one and if the 2 TP got triggered you ca be sure about the 3 TP too

GasToken.io will shows Beautiful Performance, Long IT 23/02/2021GasToken is a new, cutting-edge Ethereum contract that allows users to tokenize gas on the Ethereum network, storing gas when it is cheap and using / deploying this gas when it is expensive. Using GasToken can subsidize high gas prices on transactions to do everything from arbitraging decentralized exchanges to buying into ICOs early. GasToken is also the first contract on the Ethereum network that allows users to buy and sell gas directly, enabling long-term "banking" of gas that can help shield users from rising gas prices.

Gas is a fundamental resource in the Ethereum network. Every transaction on the network must include some gas, and the fee paid to miners for each transaction is directly proportional to the gas consumed by a transaction. GasToken allows a transaction to do the same amount of work and pay for less gas, saving on miner fees and costs and allowing users to bid higher gas prices without paying correspondingly higher fees. Using GasToken on an eligible transaction, you can save money on the Ethereum network today.

Gas prices on Ethereum are hard to predict; they can be as cheap as 1 gwei or less at off-peak hours, while some transactions pay into the hundreds of gwei to buy into that juicy ICO or hit an order on EtherDelta before any other players. Users who need to be mined quickly or first often engage in fierce bidding wars, bidding wars in which using GasToken provides an enormous advantage by letting you perform the same transactions while spending less gas.

Compounding this effect, Ethereum blocks are starting to fill up, making block space ever more coveted.

GasToken price today is $234.51 with a 24-hour trading volume of $1,769,926. GST2 price is up 45.7% in the last 24 hours. It has a circulating supply of 14 Thousand GST2 coins and a max supply of 13.7 Thousand. Bilaxy is the current most active market trading it.