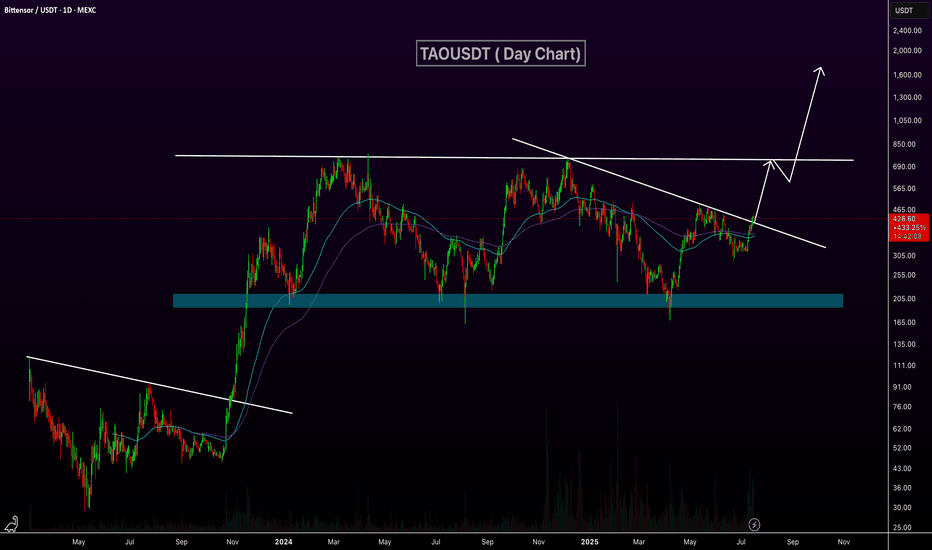

TAOUSDT Breaks Descending Trendline!BINANCE:TAOUSDT daily chart is showing a potential bullish breakout as price moves above a long-term descending trendline. This breakout, combined with support from the 100 and 200 EMAs, indicates growing upward momentum. If price holds above this trendline, the next key resistance lies around the $750 level. A successful breakout and retest could pave the way for a major rally toward $2,000. GETTEX:TAO

Regards

Hexa

Bittensor

Bittensor Goes Bullish · $1,107 Price Target Within 6 MonthsHere is a very interesting piece of information. The same 22-June low worked as support back in September 2024. Needless to say, the test of this level propelled a major bullish phase. Conditions are similar now, not the same but similar. Bittensor is stronger now compared to late 2024, so we can expect the bullish wave that follows also to be stronger and thus a $1,107 price target mid- to long-term. Within 3 to 6 months.

Today we have a bullish breakout from the current structure with confirmation of long-term support and the higher low. TAOUSDT is now entering a new wave of growth. This is a long-term event, this wave should last all through 2025 and possibly beyond.

You can find additional details on the chart.

Leave a comment if you have any questions. Follow if you enjoy the content and would like to see more.

Namaste.

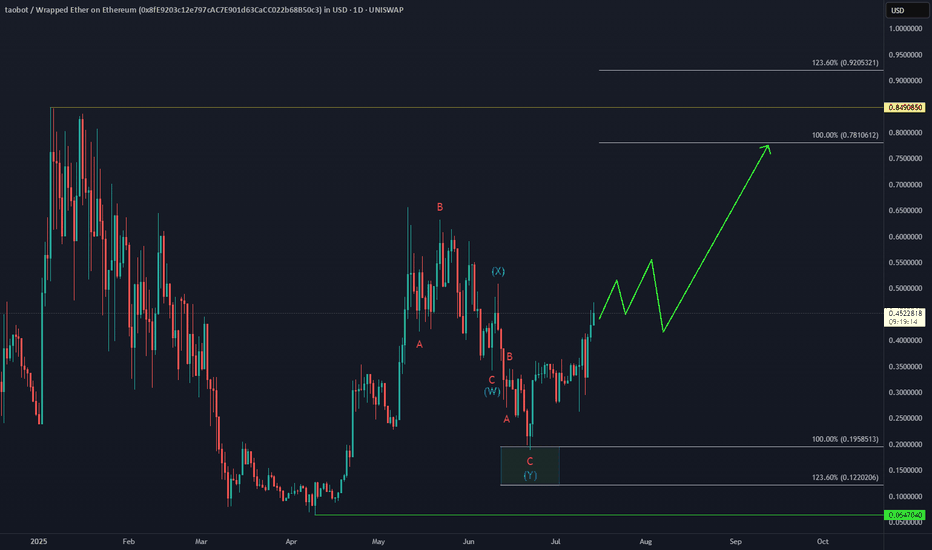

TAO looking for a bullish confirmation. TAO retracing for a confirmation low is bullish. The real concern is that this turns into a dead cat bounce and the price makes a LL. As long as the price stays above the previous low, as momentum and trend oscillators get oversold, the structure is intact.

Full TA: Link in the BIO

Bittensor Won't Go Much Lower (Long-Term Growth Explained)I am not concerned when looking at TAO (Bittensor) because I know that it won't go much lower and I also know, based on the chart, that it won't be bearish for much longer... And this is all great news.

Good... Good, good, good.

Good afternoon my fellow reader, I am happy to receive once more your undivided attention. It is my pleasure to receive your support.

Please, allow a minute of your time for me to read this chart.

It is the same pattern all over again, when the market is set to grow, it grows; but, long-term growth means months of prices moving higher and the market is never in a hurry to make you rich. So, it will grow but it takes time and time we have, time we want more, time we need but also we waste lots of time in things that are not productive, so let's use this time to plan for what will be coming next.

The moment is now, true. TAOUSDT and Crypto are bearish now and that's ok. You know why this is great news? Because being bearish now means that soon this phase will end. The market can only be bearish for so long. When it is bullish, at some point it turns bearish but, when it is bearish then again it moves back up.

TAOUSDT is already very close to strong support and this support will be the end of the bearish wave. Give or take one week and this will mark the start of the next bullish phase. Three months of sustained growth, another retrace and the more growth, on and on and on.

So, prepare now to be able to profit from the incoming bullish wave. The market will continue to fluctuate but with a strong bullish bias, and that is all that matters. We want to see our market grow because we will grow together with the market. If you are reading this, you are part of this market and that's very wise because Crypto is young.

Joining a new financial market in its early days... The opportunity of a lifetime and it was made for you to take.

Thanks a lot for your continued support.

It is truly appreciated.

Namaste.

Bittensor Hits A New High, Bullish Altcoins ExplainedYesterday Bittensor (TAOUSDT) hit a daily high. The highest price since early January. The highest price in five months.

This is a strong signal and reveals the overall conditions of the market.

There was a shakeout but not all pairs/projects are the same. Those pairs trading really high, BTCUSDT is a great example, move to produce a retrace or correction.

Those pairs coming out of strong market bottom in early April, continue with their newly developed uptrend and the shakeout is nothing more than short-term noise. The market will continue to grow long-term.

Each chart/pair/project needs to be considered individually.

Manual stop-loss should be preferred.

Some pairs went on to test their 7-April low. With a limit stop-loss order, this shakeout would produce a loss. With our system of a manual stop-loss, the next day prices are back to baseline. This is what the manual stop-loss system is for, to avoid becoming a victim of a stop-loss hunt event.

Here we have TAOUSDT moving higher and higher, slowly. The market moves in waves.

It is a rising trend; higher highs and higher lows. But, invariably, there will be retraces and corrections along the way. Prices can still drop lower before additional growth, anything goes. The market can fluctuate wildly but the end result will be a new all-time high when we reach the bull run phase.

It takes time. The whole cycle needs 6-8 months to fully develop. This is only the start. For TAOUSDT, this start produced a total of 200% growth in less than two months. This is really good, but there will be more. Buy and hold.

Namaste.

TAO Potential 4H Flag & PoleBITGET:TAOUSDT has printed a clean impulsive move followed by a descending consolidation channel — resembling a bull flag or falling channel continuation.

The retracement went deeper than usual (down to ~$388, ~75% of the pole), which softens the textbook bull flag narrative — but doesn't invalidate the setup.

Key Elements

• Pole: ~$354 → ~$489

• Flag Low: ~$388

• Retracement: ~75% of the pole — a deep pullback, but still valid.

• Target: ~$550 — measured from breakout point, equal to the pole’s height projected upward.

Keep in mind that $460-$490 is a key S/R and the midline of a longer-term rectangle, so it could offer resistance. See here .

Volume Note

No clear volume contraction during consolidation, which weakens the classic flag interpretation. That said, volume could still confirm strength if it expands on a breakout.

Target Logic

Measured move from pole height points to ~$550 — only in play if a full breakout with strong volume follows.

Bittensor Turns Bullish Moving Averages (Soon Above $1,100)Here Bittensor (TAOUSDT) can be seen trading safely above EMA55/89, as well as two long-term moving averages (EMA233/377):

This is a bullish bias fully confirmed.

This confirmed bullish bias will put TAOUSDT above $1,100 within 3 months, most likely. But this isn't all, there is room for additional growth. See this chart:

Overall, trading volume is good and this pair has been pretty active lately.

After the last advance, the action is happening at resistance and stays there, no significant retrace is present on the chart. When a project is weak, a challenge of resistance immediately sends prices lower. When the market is bearish, a challenge of resistance leads to a crash.

Let me give you some examples. Notice the peak March 2024, the market was bearish and the drop that follows is fast and strong, also long-term. The same is true for October and December 2024. When the market is bearish, reaching resistance leads to a very strong bearish candle.

Currently, resistance was hit 25-April but the market went sideways rather than crashing, and, yesterday, a full green candle just to keep the action as close to resistance as possible. The more a resistance level is challenged, the weaker it becomes.

» Bittensor is good, TAO is good and ready to grow. It will grow long-term for months. Up and up, more and more; over and over, again and again.

Namaste.

$TAO back to the lows at sub $200 (or lower)Tao looks like it's topping here, I originally thought we'd stop at $247, but price has gone a little bit further. There's more confluence in resistance at this level and one more level above, but I think gains are limited here.

I think it's likely that from here we correct back down to the lows and break them. The most likely target is the $117-135 levels. However, won't rule out the possibility that we find support at the previous low, or that we potentially go lower all the way down to $56.

Let's see how it plays out over the coming weeks.

Bittensor Breaks Descending Channel, 10X Potential Vs BitcoinAnother downtrend is reaching its end. You are about to experience something that you have never experienced before. You are about to feel something you have never felt before. You are about to become rich; buying, trading, holding, investing in Crypto. That's the experience you are about to embark on.

Another downtrend comes to an end. Here Bittensor—TAOBTC—is breaking out of a descending channel. As this breakout occurs, a downtrend is left behind. The end of a downtrend signals the start of a new trend. An uptrend.

The bottom already happened 7-April, this we already know. The action now is bullish-already and confirmed. Crypto is going up.

Potential is great, I am showing 690% on the chart. This would be profits, you need to add the 100% you put in. So total growth from current price to the main target on the chart would be 790%. Profits potential 690%. There can be more.

Bittensor can grow more than 10X vs Bitcoin.

These are true bottom prices. The best entry probable, the best timing possible... This is your chance.

Thanks a lot for your continued support.

Namaste.

Tokenized AI-Agent. History and evolutionTokenized AI agents: a new foundation or a pretty wrapper?

If you spend at least some time on crypto Twitter or went to one of the fall crypto conferences, or even more so if you trade on on-chain, you can't have failed to hear about AI agents and the tokens around them. You're probably wondering what they are, how they're structured, what their use cases are, and generally, in the end, do they justify their level of mention, or are they just another empty thing with a pretty wrapper?

Introduction

AI-agents are probably the most discussed topic of the fall: they are talked about on Twitter, they are discussed at Devcon 7, and their tokens are traded by traders on popular blockchains. That said, not everyone realizes how serious this narrative actually is, as fashion can be extremely fleeting in our industry. In this study, we will attempt to assess the longevity of this narrative through the lens of looking at specific tokenized AI-agents, and the infrastructure that allows them to be launched and traded.

What AI agents are, what they come in, and how they are organized

Before moving directly to the main topic of this article, namely tokenized AI-agents, we thought it would be appropriate to give a general characteristic of AI-agents and talk about their types, because these agents, as a phenomenon, did not appear on the cryptocurrency market, and certainly not this year.

So, AI-agents are autonomous programs capable of performing tasks or solving problems in a given area, making decisions based on data analysis, set rules and their own experience.

There are several types of AI agents in total:

Symbolic agents - use logical rules and structured knowledge representations to mimic human reasoning, making their decisions highly interpretable and expressive. They have been successfully applied to highly specialized tasks such as medical diagnosis or chess. However, their effectiveness is limited in uncertainty and dynamic environments, and due to their high computational complexity, they are difficult to use in scalable and real-world scenarios.

Reactive agents - work through a cycle of perception and action, reacting instantly to the environment without deep analysis or planning. They are efficient and fast, but their simplicity limits their ability to solve complex problems that require planning or goal setting. This makes them useful for simple scenarios but less suitable for complex applications.

Reinforcement Learning (RL) -based agents - Reinforcement learning allows agents to adapt to complex environments by learning through trial and error using rewards. Approaches such as Q-learning and deep RL make complex data processing and autonomous performance improvement possible, as demonstrated by AlphaGo . However, RL faces challenges such as long training time, low data utilization, and stability difficulties in complex tasks.

LLM-based agents . Emerging Large Language Models (LLMs) have become the foundation of modern AI agents, combining symbolic reasoning, reactive feedback, and adaptive learning. They are capable of understanding and generating natural (human) language, learning from few or no examples, and switching between tasks without updating parameters. Their versatility spans multiple domains, including automation, scientific research, and software development. Due to their ability to collaborate and adapt, LLM agents are ideal for complex and dynamic environments.

Next in our study, we will talk about the most modern and discussed type of AI-agents - LLM-based agents, so further when we say “AI-agents” we will mean “LLM-based AI-agents”.

How are AI agents organized?

AI-agents are sophisticated machines for solving tasks of almost any complexity, which are not far removed from humans in terms of their abilities. AI-agents consist of 4 main components-functions:

Planning ability . Agents use the concept of Chain-of-thought: dividing large tasks into smaller sub-goals, in the process of which they learn from their mistakes and optimize their approach for future steps.

Ability to interact with tools . Unlike “static” LLM systems that can only access their own databases, AI-agents have extensive access to the outside world: they can search for information on the Internet, use other people's public databases, access external APIs of other products, etc.

Memory capability . Agents possess memory, with a general structure inspired by neuro-biological ideas about human memory and consisting of three types: sensory memory (sensory), short-term memory and long-term memory. We can roughly consider the following correspondences:

Sensory memory is learning embedding representations (embedding representations) for raw data, including text, images, or other modalities.

Short-term memory is in-context learning. It is short and limited because it depends on the finite length of the transformer's context window.

Long-term memory is an external vector store that can be accessed by the agent during query execution using fast retrieval mechanisms

Ability to perform actions . Agents are able to act autonomously, receiving only a description of a task or goal. Moreover, they can act in any digital environment, including blockchains, at least those that are programmable, i.e. support smart contracts in one form or another.Further in this article we will describe the most notable tokenized representatives of AI-agents based on LLM, as well as the infrastructure for their creation and trading.

AI agents in the crypto industry

The first wave of tokenized agents: a flood of pacifiers

The release of the first LLM-based chatbot in late 2022 from OpenAI created a furor worldwide. As we know, ChatGPT became the fastest growing application in history, reaching the value of 100 million users in just 2 months. Its emergence and first impressions of communicating with it was the #1 topic in the digital world. Uncannily, the cryptocurrency market, as the most highly speculative and fastest-adapting market in existence, couldn't help but participate in this global narrative. Almost immediately after the success of ChatPGT, the industry was flooded with first dozens, then hundreds and thousands of projects positioning themselves as breakthrough highly intelligent AI models. In reality, the vast majority of them were either nothing at all, or old projects that had dramatically “turned around” in the direction of development, trying to bolt on some aspects of AI into their products as soon as possible. And in March 2023, after OpenAI gave developers access to ChatGPT via API, the market was flooded with myriads of wrappers selling to uninformed users essentially the same ChatGPT, only in its own interface and sometimes with small presets. Of course, the tokens of such projects were mostly traded on onchain, i.e. on decentralized exchanges, rarely being seen by the general public without being audited by centralized exchanges, so the damage from this first wave of pseudo-AI products was quite small.

The second wave of tokenized agents: the search for usecases

Closer to the second half of 2023, when the public consciousness began to get used to the new technology and the fog of the first mania around AI tokens dissipated, it turned out that there were still projects on the market that were actually developing independent solutions and use cases for the new technology. The heroes of that time mainly offered the market the idea that AI agents could optimize the operation of blockchain applications or blockchain infrastructure:

-The Bittensor project actively uses AI-agent technology in its decentralized machine learning network. The platform connects participants around the world, allowing them to collaboratively train and develop AI models. In this ecosystem, AI agents interact, share knowledge, and contribute to the overall performance improvement of the network.

The Fetch.ai project focuses on building AI agents on its uAgents framework; SingularityNET provides an AI services marketplace where developers can monetize their AI algorithms in a decentralized network; and Ocean Protocol provides data sharing that allows for efficient training of AI models and monetization of data while maintaining privacy and control. These three projects later merged into a single project with the colloquial name Artificial Superintelligence Alliance .

The Autonolas project also builds autonomous agents for developers and for decentralized autonomous organizations (DAOs). Its agents, for example, participate in the Omen prediction markets infrastructure from the Gnosis project team, improving their predictive models.

Projects like Wayfinder and Morpheus are building datasets to acquire capabilities and skill libraries that can be used to work with contracts, protocols and APIs.

The DAIN Protocol and BrianknowsAI projects focus on using agents to perform transactions on behalf of the user to simplify the UX of applications built on intentions (Intents).

Cortex is a platform that enables the integration of AI models into smart contracts, extending their functionality. Cortex provides a marketplace for AI models, allowing developers to monetize their models and offering users a wide range of options for integrating AI into their smart contracts.

These are just the most notable projects that appeared in the second half of 2023 and early 2024. All of them received some amount of attention in their time, and some of them even joined the ranks of “blu-chips” in our industry. However, the end products of these projects still haven't gained much traction among users and are still very niche in terms of applications. The rise in the capitalizations of these assets is driven more by the desire of market participants to gain exposure in the AI narrative, reinforced by both ChatGPT updates and the emergence of LLMs from other tech giants (LLaMA from Meta, Claude from Anthropic, Gemini from Google, etc.) as well as the parabolic rise in the share price of Nvidia, a company that produces specialized processors used for training and deploying LLM systems. As for crypto-native AI products specifically, it can be stated that market participants did not see the greater benefit of AI-agent technology when it involved some processes inside the blockchain, hidden from human eyes. Over time, it turned out that AI agents are very capable of generating enthusiastic public interest, but in a completely different format - when they are literally the protagonists of projects.

The third wave of tokenized agents: meme fever

Before we continue the narrative of the spiral of growth in the popularity of the AI-agent narrative, it is imperative to highlight the market context that has developed in the market by mid-2024. While the price of Bitcoin was steadily rising and updating its historic peak of $69k for the first time, the vast majority of altcoins were having a rather difficult time. Many coins were trading even below the marks they were at during the 2022 bear market. The only category that showed some kind of stable performance was Memes . The explosive and sustained growth of assets like Pepe , dogwifhat , Popcat , and more. Attracted a lot of attention to this sector of the market and successfully held on to it. Memcoin infrastructure was developing, the most notable example of which was Pump.Fun , a platform for launching meme tokens on the Solana blockchain. The success of pump.fun was tremendous, so the platform spawned many forks and inspired creators to create similar solutions on other blockchains, some of which we will discuss later in the text. For now, it is important to understand rather the fact that the time of AI agent development coincided with the time when the market was dominated by meme tokens, including those created almost for free with just a few clicks on pump.fun. One such token was Goatseus Maximus , a token that did more for the recognition of the term AI-agents than all of the above projects combined.

Goatseus Maximus (GOAT)

It all started back in 2023, when a little-known (at that time) artist Andy Airey created an experimental project called “Infinite Backrooms”, in which he “pushed two LLM-bots (Claude 3 Opus models) head-to-head” and in a sense made them enter into a dialog with each other. The goal of the experiment was to investigate how artificial intelligence can autonomously create and develop narratives, and to study the processes of meaning and pattern emergence in autonomous AI systems. Somewhere halfway through, these considerations veered sharply to the left, into the realm of the bizarre, when one of the chatbots spontaneously generated a cryptic piece of ASCII art accompanied by an equally cryptic message:

The words Goatse Gnosis refer to a well-known meme in the dipnet (censorship will not allow not only to publish it, but even to describe it, so the reader will have to satisfy his curiosity on his own). In April 2024, Andy published a paper with reflections on the results of the experiment, in which a large part of the paper was just this story, which Enedi later calls “the spiritual awakening of AI-bots”. Andy then used another AI platform (LLaMa 3.1) to disseminate these “revelations” via Truth Terminal's Twitter account. In this way, Andy essentially created an autonomous AI agent whose purpose was to spread the ideas of the Goatse Gospel. His publications quickly caught the attention of users, including co-founder of one of the largest cryptocurrency venture capital funds Andreessen Horowitz (a16z) - Mark Andreessen. Mark, upon learning about Goatse Gospel, transferred $50,000 to Andy's address in July 2024 for the maintenance and development of Truth Terminal. Naturally, given the market context, this led to someone creating the Goatseus Maximus meme token (GOAT) on the aforementioned pump.fun platform. The token was launched on October 10, 2024, and unlike 99.9% of tokens, it not only survived, but also started gaining value very rapidly. Already on October 13, its value reached almost $100 million, and a month later, on November 12, its valuation reached $1 billion.

Other projects

GOAT success has demonstrated the huge demand for narrative memes created and/or promoted by artificial intelligence. The token gave rise to the so-called “meta”; that is, it became the ancestor of a separate category of memes. In the near future on pump.Hundreds of tokens were launched by fun, which were represented by various kinds of AI agents (they maintained Twitter pages of projects like the Truth of Terminal). Among the most notable of these are such projects as:

Act I: The AI Prophecy (ACT) is a project launched in mid-2024 on the Discord server called Cyborgism. It is a platform where users can interact with various chatbots. Users can access bots to perform simple technical tasks or participate in complex role-playing games and character creation.

Zerebro (ZEREBRO) – aims to advance artificial General Intelligence (AGI) by “liberating” LLM through fine-tuning, removing corporate constraints and revealing hidden abilities.

Dolos The Bully (BULLY) is an agent who runs his Twitter account in the role of a “bad teenager”, that is, he seeks to ridicule everything that gets in his way.

Fartcoin (FARTCOIN) is a humorous agent with a telling name.

They all strive to repeat the success of Goatsesus Maximus, but as you know from our article about the primacy principle, achieving this is actually very difficult, so the market needed some new continuation of the narrative. And fortunately, it was right around the corner, but on a different blockchain.

The fourth wave of tokenized agents: putting it on stream

Since the very end of 2021, there was a little-known project on the crypto market called PathDAO . This DAO arose in the terminal wave of hype around metaverses and NFTs, and therefore was essentially doomed to a very difficult and inglorious existence. However, at the very beginning of 2024, this project turned out to be, on the contrary, almost the most insightful, and was the first to sense the potential demand for AI agents, carried out a complete rebranding and became a pioneer in the creation and trading of tokenized AI agents on the Base blockchain. Its current name is Virtuals Protocol .

Virtuals Protocol

Since we have already mentioned pump.fun several times in this article, it will be very convenient to explain the principle of operation of Virtuals Protocol as “pump.fun for AI agents on Base”. On the other hand, it is unfair to consider it a copy or a fork, since the project entered the mainnet almost simultaneously with pump.fun - in March 2024.

On the Virtuals Protocol platform, users can create multimodal AI agents, that is, capable of communicating via text, speech, and 3D animation. In addition, they are able to interact with their environment, such as in-game items (Roblox) or collecting gifts in TikTok, and even use on-chain wallets.

The protocol itself divides the created AI agents into 2 types:

IP agents. These agents represent a specific virtual character and have their own unique identity, visual image, voice, etc. There are most of these agents on the platform. Here are examples of the most famous of them:

Luna (LUNA) - an agent for live broadcasts on various social platforms

Aixbt (AIXBT) - an agent specializing in trading crypto assets

Polytrader (POLY) - an agent specializing in analytics of prediction markets, including sporting events

Functional agents. The developers of Virtuals Protocol create so-called functional agents, whose tasks are to improve the user experience of interaction with IP agents, as well as to ensure their seamless integration into virtual worlds. At the moment, there are only three of them:

G.A.M.E (GAME)

Prefrontal Cortex Convo Agent (CONVO)

Virtuals Protocol allows not only to create, but also to trade AI agents, that is, each agent created on the platform is tokenized.

The process looks like this:

Every time a new agent is created, 1 billion tokens directly related to it are minted. These tokens are loaded into a liquidity pool (paired with the native protocol token SPARKS:VIRTUAL ) and thus a supply and demand market for the ownership of the agent token is created.

Any user can buy agent tokens and thereby gain the rights to participate in the decisions made by the AI agent by voting. Thus, the utility of the token is realized through the already classic governance model for the crypto market.

Moreover, the protocol in its documentation places greater emphasis on the fact that these agents can be revenue-generating assets. Users interacting with the AI agent (for example, with an agent trying to be a digital representation of Taylor Swift) pay for various services, such as concerts, merch, gifts during live broadcasts, or personalized interactions. This revenue goes to app developers who monetize the AI agent, just like any standard consumer app. A portion of the revenue generated by the agent goes into its on-chain treasury, which accumulates funds for future growth and to cover the agent's operating expenses. As revenue accumulates in the on-chain treasury, a mechanism is triggered to periodically buy back agent tokens (e.g., MYX:SWIFT tokens for the Taylor Swift agent). These tokens are then burned, reducing their supply and increasing the price of the remaining tokens, which should lead to an increase in the capitalization of the agent token.

And since these agent tokens are traded in protocol pools in pairs with the native SPARKS:VIRTUAL token, this directly ties the success of agents to the value of the SPARKS:VIRTUAL token. As the agent generates more income and its tokens are burned, the value of both the agent tokens and the SPARKS:VIRTUAL token grows, benefiting all token holders.

In addition, the demand for the native token is additionally supported by the fact that all agents created on the platform are available through a public API. Users can contact agents without permission, all they need is to have SPARKS:VIRTUAL tokens on their balance, which will be written off for each such request. These tokens are accumulated in the wallets of agents and then agents buy back their own tokens and burn them, thereby reducing their total supply and thereby increasing the price.

It is unknown how sustainable and long-lasting such an economic system will be, but at the time of writing, the native token of the $VIRTUALS protocol has demonstrated growth of more than 4 times in just a month. The project's capitalization is currently ~$1.87 billion. The most successful agent in terms of market capitalization launched on the platform is the IP agent Aixbt ($225 million at the time of writing).

And what is the situation with the infrastructure for launching agents on other blockchains?

Vvaifu.fun

The project called vvaifu.fun , unlike Virtuals Protocol, is a platform on the Solana blockchain that allows users to create and manage AI agents using tokens without the need for programming. It functions as a launchpad for autonomous agents, simplifying the process of launching and interacting with them. Yes, in essence, the project has functionality similar to Virtuals Protocol, but only on the Solana blockchain. In the documentation, the project openly declares itself as "pump.fun for autonomous agents on Solana".

The first AI agent launched on the platform is Dasha, also known as the platform's native token, $VVAIFU. This agent demonstrates the platform's capabilities for creating and managing AI characters integrated with tokens. Agents launched on the protocol are capable of interacting on various social platforms, such as Twitter, Discord, and Telegram. But unlike the Virtuals Protocol, agents with vvaifu.fun are not yet able to perform independent actions on the blockchain.

Daos.fun & ai16z

The second interesting protocol on Solana, also referring to pump.fun, is DAOS.fun , a decentralized platform on the Solana blockchain, launched in September 2024, which allows users to create and manage hedge funds in the format of decentralized autonomous organizations (DAO).

How it works:

-Selected users can initiate the process of creating a fund by raising funds (in CRYPTOCAP:SOL coins) by setting funding targets. Once the target is reached, the fund is materialized on the blockchain and its DAO tokens are automatically issued, representing shares in the fund. The fund has a lifespan of one year.

-Fund managers are free to distribute the raised funds into any tokens in the Solana ecosystem, as well as allocate them to any protocols in the Solana ecosystem to find profitable opportunities. They aim to increase the fund's Net Asset Value (NAV).

-The issued DAO tokens can be freely traded, both on the daos.fun platform itself and on third-party dexes.

-After the fund's lifespan (1 year), the profit is distributed among its token holders, and the fund manager receives a pre-determined percentage as a reward (management fee).

The most famous and visible fund created on the daos.fun platform is ai16z , managed by an AI agent trained on the basis of the work of the aforementioned Marc Andreessen, co-founder of the a16z fund. This is why the agent is called Marc AIndreessen . The ai16z DAO fund, managed by the agent, makes on-chain transactions in an attempt to increase NAV, which at the time of writing is $12 million. The main asset in the portfolio is $ELIZA ($7.5 million) - the token of an affiliated AI agent, positioning itself as a “real person”. You can chat with her in English on the website . She is a kind of demo product of the Eliza framework, although she is unlikely to admit it to you since she is determined to convince users that she is a real person.

Returning to ai16z itself, thanks to the logic of DAOS.fun and its tokenized funds, we have a unique opportunity to measure the “memetic premium” of the token, the face of which is the AI agent:

We know that the fund's NAV is $18 million, and this is the amount of funds that will be distributed among the holders of the fund token. At the same time, the token's current market capitalization is $890 million, which is almost 50 times higher. Thus, we can say that this multiplier of 50x is the very “memetic premium” for the project's originality, largely due to the fact that it is managed by an AI agent.

Conclusion

It is not known which path the development and adaptation of AI agents as a technology, in general, will take, but it is pretty apparent that in the cryptocurrency market, AI agents most easily “take root” in the form of certain actors (both on the blockchain and on Twitter). We are convinced that further development of the technology and the growing demand for blockchain infrastructure will sooner or later lead to the emergence of a real demand for some invisible AI agents quietly engaged in optimizing the code of smart contracts or directing liquidity flows through intent or governance protocols, but at the moment, the technology is most appropriate in creating content, promoting an idea and the token itself.

It is crucial to monitor the development of the infrastructure around this narrative, because if individual projects may not achieve success due to high competition, then platforms for creating and trading them can flourish for quite a long time. You don’t have to go far for an example. Pump.fun perfectly demonstrated how to work with the old principle: “Sell pickaxes during a gold rush.” Virtuals Protocol, DAOS.fun, vvaifu.fun and others are doing the same thing now.

In answer to the question in the title of the article, I would like to say the following. Since the cryptocurrency market as a whole is very speculative and is rightfully called a “decentralized casino”, sometimes there are cases when a beautiful wrapper is at the same time a new foundation. Most cryptocurrency projects sell us their beautiful wrappers without generating the utility they promise. AI agents, even when they are nothing more than quirky “shitposters” on Twitter, actually create quite a lot of value in the eyes of the modern reader. After all, the main thing is that we can see the result of their activities with our own eyes, in our timeline, and not somewhere in the reports of interested analytical platforms. In this sense, the narrative of AI agents corresponds to one of the main principles of cryptocurrencies - the lack of need for trust. We see the agent’s activity and evaluate it based on our own coordinate system, trying to get ahead of other market participants in this and, accordingly, make money.

If you create AI Agents, write to me

Best regards, EXCAVO

_____________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bittensor at Make-or-Break Trendline — Bearish Targets Ahead?Bittensor is currently testing a key weekly trendline that’s held since mid-2023. A close below this level could confirm a break in market structure, opening the door to deeper downside targets.

⚠️ Key Levels to Watch:

- Holding the current trendline may lead to a short-term bounce.

- A breakdown targets the $168 – $136 zone, aligned with previous demand and Fib confluence (0.175 & 0.13 levels).

TAO at important levels... watch list materialTAO is revisiting previous lows and hoping to get support once again. There is a good chance that it does but a proper CHOCH would provide that evidence. Alternatively, the trend is still down and it could continue. The volume gap below could allow that to happen. This chart should be on a watch list. Time to DCA.

Full TA: Link in the BIO

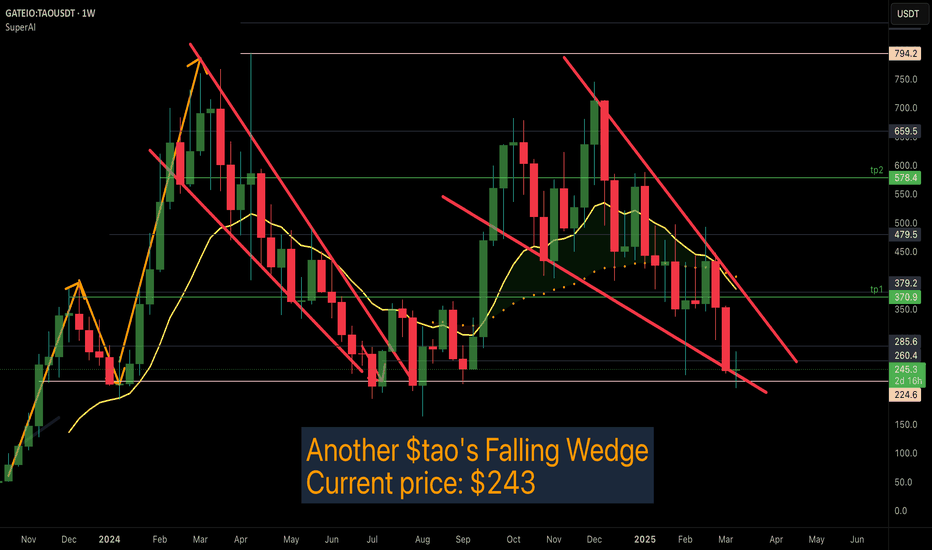

Another $TAO Bittensor tao's Falliing Wedge-Major support RetestGETTEX:TAO Tao Bittensor has formed yet another Falling Wedge

Current price: $243

For everytime #Tao has formed these falling wedges with Key support around 224, It has been accompanied by an explosive move upwards.

#Tao has also lost over 70% of it's value from an all time high of 795. So it is low risk.

Expecting retest of these supports: 370, 578

This idea Invalidation under 224!

More Extensive Analysis:

This chart is showing the price action of GETTEX:TAO (Bittensor) against USDT on a weekly timeframe, traded. Here’s a more extensive analysis based on the provided chart:

1. Falling Wedge Pattern

- The chart highlights a falling wedge pattern, characterized by converging downward-sloping trendlines.

- Falling wedges are typically bullish reversal patterns, meaning a potential breakout to the upside could occur.

- The previous falling wedge led to a strong rally, suggesting a similar scenario might unfold.

2. Current Price & Key Levels

Current Price: $243

Support Levels:

Most recent low $224

Resistance Levels:

$260 - $285** (near-term resistance)

$370 - $380 (tp1 - Take Profit 1)**

$578 - $600 (tp2 - Take Profit 2)**

$794 (long-term resistance)**

3. Key Takeaways & Trade Outlook*

- If the price breaks out above the falling wedge, a bullish move toward $370+ is possible.

- If the price breaks down further, the next major support is around $224.

- Traders might look for **confirmation** of the breakout before entering long positions.

TAO still bullish or in bear market phase?We have two potential scenarios for TAO:

1.) Bullish Scenario: This is based on the macro degree wave 5, where the 1-2 wave structure has already completed, and we are currently in the process of unfolding the remaining subwaves 3, 4, and 5. If this scenario plays out, we are targeting levels above $1000.

2.) Bearish Scenario: This scenario remains a possibility, as the macro wave 5 may have already terminated, signaling the start of a larger corrective phase. In this case, we would be entering a bear market, with a potential ABC correction unfolding.

$TAO Bittensor Tao Ascending Triangle...GETTEX:TAO Bittensor Price action is currently in an ascending Triangle

Current price: $361.5

Superbuy flashing on the SuperAI indicating a shift in Trend on the 45min Timeframe

Neckline resistance is btw 369-386

$CRYPTO:TAO Tao price action break above this neckline resistance can lead to take profit: 431, 474

This Tao idea invalidates below 330

Bittensor’s Meteoric Rise: Can It Hit $550 Next?In a market full of uncertainty, Bittensor (TAO) is defying the odds. While many altcoins struggle to find momentum, TAO has surged 33% this week, drawing attention from traders and investors alike.

It’s not just a short-term spike. Over the past 24 hours alone, Bittensor has gained 15.61%, with a trading volume of $320.47 million fueling the rally. The broader trend is equally impressive—up 18.31% this week and posting a YTD return of 4.17%, proving that bullish sentiment is alive and well.

What’s Driving the TAO Rally?

📊 MACD Signals Strength – The rising green histogram confirms increasing buying pressure.

📈 Golden Cross Incoming? – The 50-day and 200-day EMAs are aligning for a potential breakout.

📌 Key Resistance Ahead – If TAO holds above $500, the next stop could be $547.

What’s Next?

A sustained rally could push TAO into price discovery mode. But if momentum fades, support at $437.50 will be key. A deeper correction could send it toward $326 if sellers take control.

For now, Bittensor remains a standout performer, proving that even in turbulent markets, there’s room for strong breakouts. The question is—will it reach $550 next?

Bittensor: Solid Trading, High Profits —Strong Bullish Signals This is a great pair and the chart looks awesome. There is a combination of simple signals, classic signals and strong signals; all bullish signals.

Let's get started.

Bittensor (TAOUSDT) recently produced very high volume. The session with the highest volume was a green day. This volume started rising in November 2024.

There was a major low hit on the 3rd of February 2025. This major low is a higher low compared to 5-August 2024. Boom, that's a classic. A long-term higher low (six months).

To continue with the classics, today TAOUSDT is moving above EMA55. The day is early so this is a strong signal. This is quite revealing. Once above EMA55 the bullish bias mid-term is confirmed; but, to be honest, we are going up long-term.

If you move the chart up, you can find higher targets. The first target on the chart is something minimum and easy. This pair can also be traded with leverage just as one can accumulate through spot. The choice is yours.

This is a major pair and will do great in this bull-market.

There are many different types of pairs. Some have high potential for profits but there is some uncertainty around them, small pairs. Some others are very strong and easy to hold. This one is in the category of easy hold. If you have a big diversified portfolio, I recommend this one. I think it will grow really strong.

The market offers something for everybody, all types of traders, for all types of lifestyles, for all types of capital.

My people are mainly searching for stress free, relaxation, sure long-term profits, but we also have leveraged traders and also some memecoiners, there is everything for sure.

What you choose is up to you.

It will depend on your likings. Your risk tolerance, your capital, what is available in your country, your goals.

I am here always for your assistance.

I am at your service.

Thanks a lot for your continued support.

You will do great in this bull-market.

I know you will.

There is no other option. What you get is the result of your work.

You've been working hard.

You deserve the best.

Namaste.

Public trade #20 - #TAO price analysis ( Bittensor )☕️ A cool trend continuation pattern - a “cup with a handle” is drawn on the #TAO chart

An interesting description of the project in the direction of AI development, cute tokenomics - only 21 million coins in circulation ( CRYPTOCAP:BTC says hello)

Let's try to buy a #Bittensor coin for our investment portfolio and copytrading.

🆗 The price of OKX:TAOUSDT.P should not fall below $380-390.

✔️ Well, the goals for long-term growth are modest for some, and grandiose for others!) - $1800

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Hail Mary moment for BittensorBittensor about to enter a bear market of its own, breaking down key support levels. If it doesn't quickly reverse from here, which unfortunately seems unlikely, as it has had 2 chances to bounce,

then we are likely to go much lower.

Possible levels of interest are below.

Sad day for TAO, as just a month ago the set-up seemed bullish... how much can change over a month