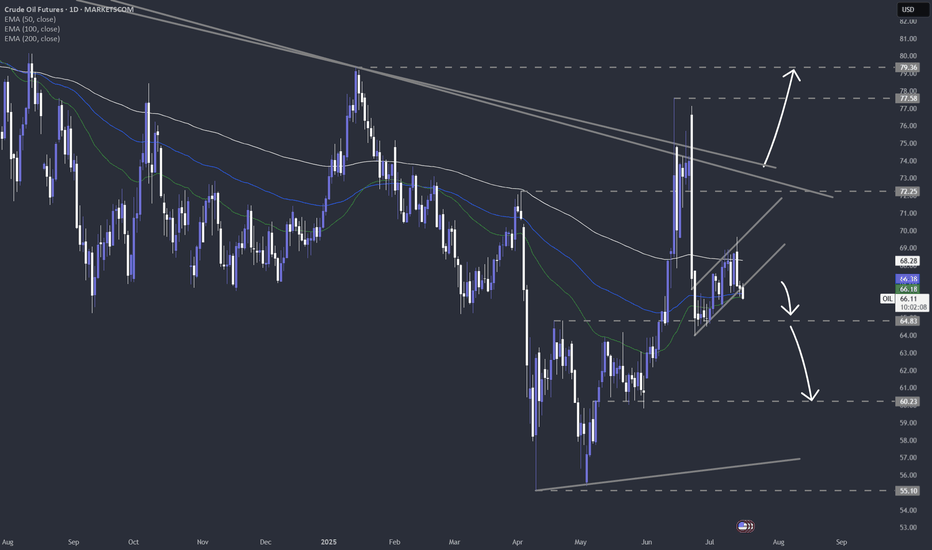

Could we see the WTI oil bears getting pleased any time soon?The technical picture of MARKETSCOM:OIL is showing a possible bearish flag formation, which may lead WTI oil to some lower areas. Is that the case? Let's dig in.

NYMEX:CL1!

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Blackgold

CL - Crude Oil confirmation and unwritten potentialHi guys, we are following up with probably one of our favourite assets to participate in. You guessed it right it's CL. Currently the Crude Oil is sitting in a very specific range , which has been traded since late August , until the end of October where we saw a big spike and got out of boundaries due to the escalation in Iran and Israel, of which after the cooling off we got back into the range of 73.00 as a strong resistance line , and 67.00 as a strong support. This range has made a lot of traders stay away from CL, but I do believe that there is potential to be caught.

Current analysis and entry :

Entry today at a level of 68.90 , with two targets of take profit :

Target 1: 71.52

Target 2: 72.92

Now this is the bold move if you don't want to miss out on the current opportunity and your Risk Tolerance is on the higher end.

If you want to be more protective and your Risk Tolerance is on the lower side, you can get a Pending Order at the level of 66.61 , and then enter 3 follow up targets

Target 1: 68.50

Target 2: 71.05

Target 3: 72.45

P.S. My current opinion is to go with a current entry because the missing out of opportunity is too high ,hence we are seeing more tensions in Israel&Gaza conflict, additionally the tightening of the situation in Ukraine&Russia adds more Fundamental Value, towards a swing on an upside of the Crude Oil.

Do let me know in the comments below or in my community what is your thought process and opinion about our favourite Black Gold!

Happy Trading!

Brent, It's Been Real Bruh - The Last Brent Chart You'll NeedThe macro formation of Brent's chart paints a potential dismal long term picture. Considering scientific estimations that the earth will run out of oil near 2050, maybe its not so farfetched after all?

My previous oil charts with macro bullish outlook should be considered null.

UKOIL Preps to Face a Res-Test Near $90UKOIL didn't have the strength to reach $94, but it seems that Bulls have not gotten the memo just yet. Perhaps a break above $90 reignites the path?

I'm doubtful, but we'll see. Failure to pass and hold levels above $90, will likely send UKOIL back to mid-high $70s (before the next major run).

WTI/BRENT CORRECTION AHEADBrent futures rose by $4.89 (5.7%) to reach $90.89 per barrel, while U.S. West Texas Intermediate (WTI) crude increased by $4.78 (5.8%) to $87.69 per barrel, marking their most significant daily gains since April. Brent also saw a weekly rise of 7.5%, its largest since February, and WTI climbed 5.9% for the week.

Despite the Middle East conflict, global oil and gas supplies remain relatively unaffected since Israel isn't a major producer. However, market observers are monitoring the situation for potential regional supply impacts.

Residents in Gaza evacuated their homes after Israel ordered over a million people to leave the northern half of the territory within 24 hours, with Hamas advising against leaving.

Iran's Oil Minister, Javad Owji, predicted oil prices reaching $100 per barrel due to the Middle East situation.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

UKOIL Enters Slippery SlopeUnfortunately my last UKOIL prediction didn’t fair too well but using the science of Elliott Wave I think I’ve been able to identify previous mistakes and also a way forward.

I expect the $90-$91 range to send UKOIL back to $25 over the next 3 years or so. Based on what news? Who knows. We’ll see when it comes but the chart is always the first indicator :)

BP BEARISH SCENARIOFuel demand in Europe has been slow while consumption in China has been strong following the lifting of pandemic restrictions. BP's shares closed lower than 9% in London trading, their largest daily drop since the pandemic panic, after it said it would repurchase stocks worth $1.75 billion over the next three months, down from $2.75 billion in the past quarter. The black gold sunk from the 2nd of this month cloud driving BP even lower.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

WTI - ARCH TO TRIANGLE BULLISHWTI - Is forming a good-looking triangle pattern with a complete range June 10-12, if completed we are looking for a HKEX:10 upwards movement till May 24-26 and a HKEX:4 correction to HKEX:82 levels before the conclusion of the figure. This strictly technical analysis requires some push and there is only one player that can possibly play that card and this is OPEC+. We are currently standing around the previous levels when OPEC+ held a meeting over the weekend and we witnessed a HKEX:5 opening gap on the 3rd of April.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Natural GAS : LONGNatural gas bounced from a low of $1.95/MMBTU, where almost all producers lose money.

Since natural gas and crude oil are near or below breakeven levels, producers are reducing their drilling rate - likely lowering production levels given the lack of capacity.

The negative shift in weather, falling rig count, and potential export boost from Freeport may push natural gas back into a shortage over the coming months.

While natural gas spot prices appear likely bottoming, UNG's immense "contango" pressure remains a key investment rig factor.

Source : Seeking Alpha

WTI - GAP CORRECTIONThe Biden administration said the surprise oil output cuts announced on Sunday by Saudi Arabia and other OPEC+ countries were not advisable. The west is not excited by the price development and we can expect an answer to keep the black gold in a reasonable range. Mid-70s is working well to reduce inflation and keep the economy running, that's why a logical move is to boost production supply as a corrective measure.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

UKOIL Due for 4X Growth in Value Over 4 to 5 YearsBased on the macro wavemap for UKOIL, its fairly safe to assume that the value of this commodity will increase by 396% over the next 4 to 5 years. Seemingly in a Flat corrective wave, the new all-time high near $324 should send price to retest the $60 range (at the highest).

The situation with oil is getting worse and worse...Up until a few days ago I believed oil had a chance of getting back down to 75-95$. It can still get all the way down there, but for the price to get there it would need traditional markets to crash badly. The current production is too low, the underinvestment in production is massive and the oil industry isn't incentivized to drill for new wells. At the same time the problem is getting larger and larger as there aren't enough refineries that can use oil to create other products like gasoline, and many of these refineries can't just take any type of oil and use it to produce stuff. OPEC+ has been consistently missing its targets and is unable to increase production, oil released from the SPR isn't able to alleviate these issues, while a significant supply is lost from Russia, Syria, Libya, Iran and Venezuela due to sanctions, wars or other issues. The recent announcement from the EU that there will an oil embargo just makes the situation worse, while at the same time tensions are getting worse and worse as 1 Iranian oil tanker was 'seized' by the US in Greece, and 2 Greek oil tankers were 'seized' by Iran.

The more oil output that is lost, the worse the situation is getting, despite the fact that we already have significant demand destruction. If oil stayed around 110 while China had big parts of its population under strict lockdown, what is going to happen as it slowly re-opens? At some point things are going to get very ugly and the high oil prices are going to damage the global economy beyond repair, something that will force oil prices to come down. In some of my previous analysis I did mention some of the potential targets for oil, which could be at 200-300$, but for now the key target remains the 2008 ATH at 140-150$. In my opinion the market will take some time to break that level, but the financial melt down won't come until it gets around 250$. If we take inflation into account, the price of the dollar, as well as the growth of money supply and that of the global stock market capitalization, the 150$ peak in 2008 is now close to 200-250$, however the 150$ peak has psychological significance.

As oil is now cheaper than back in 2008-2011, as the market has closed above the 2011 highs and as the structure is very bullish across all contracts is very bullish, the price of oil could go much much higher from here. Gasoline making new ATHs and has turned the 2008 ATHs into support. December contract formed an SFP but not that bearish. The average price of the next five months had a very strong close and there is nothing really bearish to see. Hence my first target for now is 145$, the second target after some consolidation below 145$ is 195$, and the final one where I'd start exiting and potentially shorting oil would be 245$.

long oil, long $OIHThe well-defined channel seems to be intact while RSI is bottoming out and MACD is beginning to curl up.

I believe oil has seen the majority of its bad performance in the past week. After this greenflation will kick into gear. People won't be able to resist investing in energy knowing that they'll be taking advantage of huge profit margins while the commodity becomes more scarce as companies stop drilling and consumers switch to EV's

Screw gold! It's all about that black gold. and that was the final flush we needed to take the next leg higher.

AMEX:OIH

Oil to 90$It is as simple as that. Not much more to be said than that, the chart says it all. Too many touches on the resistance and we had the most insane capitulation in 2020. The production of oil has taken a big hit and the price will keep rising as demand comes back. That's bad for growth, but we are here to make money. Hedge your fuel expenses and go long Oil!

go long OIHAfter almost 7 years of bearish price action, oil services will be essential in the transition to electric vehicles and clean energy. Most automakers are shooting for 2025 to have an entire EV fleet or mostly EV fleet. That's a 4-7 year runway for a bull run; assuming that it will take time to transition and for all automakers to be on the same page. Freight and travel will only increase with time further improving demand for oil and oil services.

Tom Lee from Fundstrat gave this oil services ETF a price target of $740 if oil hits $80 a barrel which seems extremely likely with the macroenvironment. Playing this trend through an ETF is the safest way to play it because you are taking out the idiosyncratic risk of being tied solely to a single company.

The top ten holdings of OIH are:

SLB: 22.46%

HAL: 13.21%

BKR: 5.84%

FTI: 5.22%

CHX: 4.97%

TS: 4.63%

LBRT: 4.57%

NOV: 4.37%

HP: 4.13%

RIG: 4.00%

Weekly Chart:

Daily Chart with Golden Cross:

UKOil (Bearish Bat) Here on Brent Oil we have a bat pattern (much cleaner than West Texas) the Grey Box indicates some areas of confluence. the middle of the box is the .886 of the XA leg. the low side of the box is the 1.618 Fibo Extension of the ABC legs of the pattern and the top range of the box is 2.0 range of the BC leg. this area has proven on the left to be quite powerful printing an 88 point swing point. look for a violent rejection out of this zone for a minor reaction. Look of a "M" pattern for a more substantial reversal. I think this is more of a corrective move of the much larger picture so be prepared to see an ABCD pattern bringing price back up for the longer haul.