BCOM headed lower as global metals,Natgas and oil falterOur CFTC prop research points out the Bloomberg commodity index is headed lower. This has a wide ranging effect on global indices and sectors that are heavy weighted trading or using Metals, Natgas and Oil.

Bloomberg

Apple China ChipApple took a major hit, along with many other companies, from the allegations of hardware infiltration. I believe AAPLE will rebound back to 225-227 before 11/16/2018 if the allegations are false. My diagram is just a visual of what I just said.

I have included

Time and Date Bloomberg released the story and you can see soon after that AAPL took the dip

Time and Date AAPL denied the allegations

My personal support and other information to be ignored

Important week on the Bloomberg Galaxy Crypto IndexI like to use the Bloomberg Galaxy Crypto Index (BGCI) to get an overall View on where the Crypto Market is heading in general. If you aren't familiar with this index, please visit:

data.bloomberglp.com

Please take the time to follow Cryptorae on Twitter if you like this chart :-)

TradingView chartsetup: Credit @Cryptorae on Twitter

This week is really important for the cryptomarket in general - Bitcoin volatility is down to a minimum and everybody is keeping their breath - hopefully we will get a major move upwards - but as always in Crypto: Be prepared for the worst!

FOMC Int Rate Decision - Potential SHORT on USD/CHFBloomberg stated that 1/3 of investors are expecting announcement of 4 rate hikes instead of 3 for the upcoming year.

Therefore, markets may be a bit overpriced, in the case of 3 hikers.

IF only 3 rates hikes are announced, we can expect a bearish US dollar. Trend confirmed when price will break the channel, multiple strong supports to watch for, depending on fundamentals over the next few days.

EURUSD : November OutlookIn the previous post about EurUSd -0.23% , we were expecting EurUsd -0.23% to make a mid-term high in October and tread lower from there onwards to a short-term low in the first week of November, thats already in place and we are now expecting Euro -0.23% to keep trading lower against the Greenback till Feb 2018.The intermediate low has been marked on the chart @ 29 November - along with the price target of 1.1371-1.1471.

Sterling : Life beyond the shackles Last year in June, United Kingdom's majority chose to leave the European Union. This year on March 29th Prime Minister Theresa May invoked Article 50 of the Lisbon Treaty, officially stamping the process to sever ties with the bloc.This brings to end a 44-year-old relationship that always had National political parties at odds, will the UK be better off without the Union or with.Most economists hold a negative view of the Brexit.They warned the public that a Leave win could have acute but serious consequences for UK economy, an immediate increase in unemployment, inflation etc. Their predictions were wide off the mark.Although inflation increased unemployment is at a record low since 1975.This is a good indication that separation from EU would be good for the UK economy in the long run.The UK once fully segregated from the Union and the regulatory burdens of trade policy could benefit immensely by adopting their own free trade policy with major world markets.

There are more than 2 million EU nationals working in the UK, a divorce would give British government control back over who it allows to live and work, hence more work opportunities for Britons.After Germany, Britain is the second biggest contributor to the EU budget, leaving EU would mean all that money would be used for the national budget.But what the UK actually stands to gain will depend on the terms of negotiating with EU.It might be possible that EU could force UK to keep contributing to EU budget if they want access to EU Single Market.There have been hints that Britain will have to pay a hefty exit fee to EU that could run into tens of billion Pounds.Whether Brexit will bring about economic gain or loss for the UK can only be speculated as of now.I am not an economist but an investor and a trader, from my standpoint the worst for GBP is over.

Pound in the midst of US Civil War in 1864 reached a value of $10. After the high of $10, its value started to drop and continued the downward slope for over a century against USD. A drop that started in 1864 halted in 1985, which almost brought it down to parity with the USD at 1.0438.I believe that the low of 1985 will remain to be a historical one as I do not see that low being taken out for decades.An unprecedented event like Brexit threw Sterling in a tizzy, it dropped over 1800 pips against the USD in one day after a Leave win was confirmed. And over the next few months, it kept trading lower and stabilized after hitting a low of 1.1980 in October 2016.Now it has started to get back up and is gearing to move upwards from here.The low of October 2016 will remain a very strong support for a long time to come.

Coming to the analysis I'm expecting GBPUSD to make a short-term high in last week of October or first week of November. Then a low in last week of November to the first week of December. high in the first week of January and a major low around the first week of February. Then major high around last week of February or first week of March. Highs should be higher highs unless a low is broken, and lows to be higher lows as well.

As always, will update as and when changing dynamics necessitates so.

Gold - October Outlook 2017U.S Federal Reserve hinting another possible interest rate hike in December has changed our time target for Gold. Earlier we were expecting the yellow metal to halt the uptrend in last week of September, instead, we are now looking for that High to come in late by almost two weeks. The current drop should terminate here and Gold should resume the uptrend. Going back to the Gold chart, the price hit 1357.50, just $2.50 shy of our lower-end target of $1360. We still have the same target level of $1360 to $1380.

Trump Fears Seen Benefiting Gold BullsQuoted from Bloomberg

Bullion has climbed 8 percent this year as a weaker dollar combined with investor concerns over Trump’s presidency. Gold’s rally this week took it above its 100-day moving average, a sign to some traders and analysts who study chart patterns that prices may rise further.

Traders are “seeking some safety in gold,” Jeffrey Nichols, a senior economic adviser to Rosland Capital, said in a telephone interview. “Initially the market thought Trump would be a big plus in terms of corporate profitability with a reduction in regulations and a more positive attitude toward big business. Now some are starting to change their minds.”

“The momentum is behind gold at the moment,” Bernard Sin, head of precious metals trading at refiner MKS (Switzerland) SA, said by phone from Geneva. “The trend from a technical perspective is healthy and there is a lot of demand globally.”

What will happen in the Netherlands and deflation or inflation?CHARTDESCRIPTION

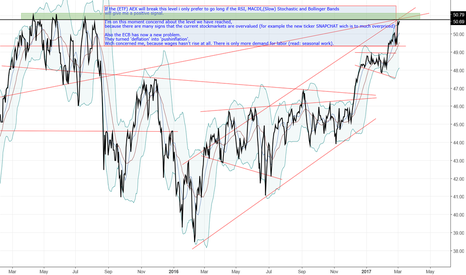

If the (ETF) AEX will break this level i only prefer to go long if the RSI, MACDI,(Slow) Stochastic and Bollinger Bands

will give me a positive signal.

I'm on this moment concernd about the level we have reached,

because there are many signs that the current stockmarkets are overvalued (for example the new ticker SNAPCHAT wich is to much overpriced)

Also the ECB has now a new problem.

They turned 'deflation' into 'pushinflation'.

Wich concerned me, because wages hasn't rise at all. There is only more demand for labor (read: seasonal work).

GBP/USD Range OutlookWhile GBP/USD swiftly bounced from it’s brief foray below $1.20, price has once again been capped by the range that you can clearly see in the daily chart

The upper level of the range is definitely acting as resistance and the way it held again back in the first week of February puts Cable in play for shorts. Just keep in mind that it’s a 700 pip range and we’re already 250 pips off the highs. If that’s too close to the middle and not playing the edges for you, then fair enough. But as always, I would then look to zoom into an intraday chart and find an area of short term support turned resistance to manage risk around

Maby some correlation between Gold, Diamonds, S&P500 and NASDAQ?If we look at the figure we are seeing some high correlation between the Forex Gold and Diamond versus the Futures S&P500 and Nasdaq.

Prediction: this month Gold, Diamonds, S&P500 are going down

Prediction: this year Gold, Diamonds, S&P500 and NASDAQ are going up

How is it possible that there is some correlation between them? (my opinion)

You mostly find gold and diamnonds in the same country, mostly concentrate in Africa, South-America.

The S&P500 is correlated to Diamond and Gold companys because the S&P500 is a comparing of company's that are the most important in the US. If stocks of dollars and euro's are fall we can predict that the stocks of forex in Gold are rising, and because we know also that Gold is correlated to Diamonds we can assume that Diamons are going to be more value in the market.

Now we have one thing to understand: why the NASDAQ is correlated between these markets?

The answer at this could be something like: ''the NASDAQ is correlated because, we know that The S&P500 is a combination and comparing between the most important company's in the US. The US has some of the most powerfull and valuefull Electronic Company's. So When the S&P500 is rising (or falling) there is always some correlation in the market between them.

information: Bloomberg terminal, Wiki, is correlation one of the most important things in trading?