BMW

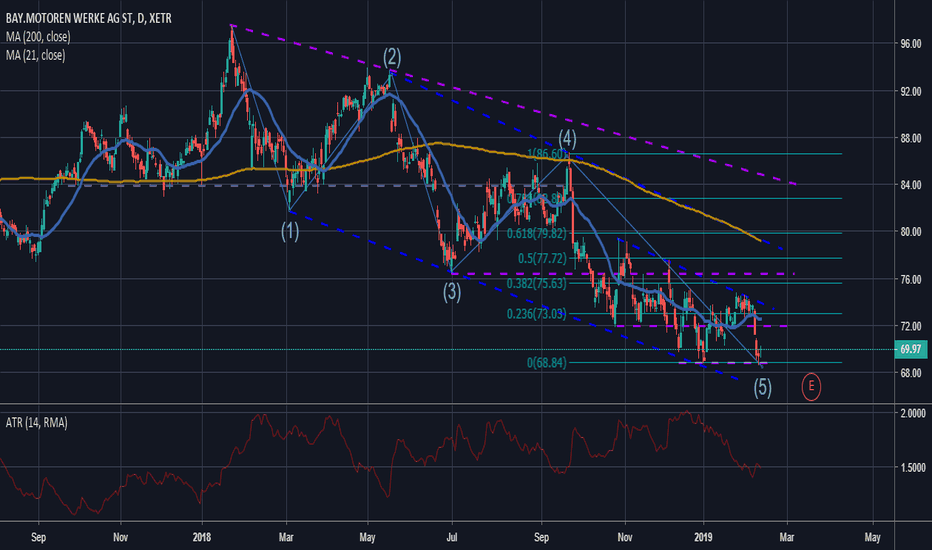

Time to buy BMW? Day before ex-dividend dateBMW entered a bullish trend back in 13 May 2016, when it paid the dividend of 2016. Yesterday was at minimums of 2013 if we do not take into account Brexit effect on 2016. Today is the day before the ex-dividend date of 2019 and it offers a dividend yield of 5.12%. Nonetheless, it's worth reminding that BMW's 2018 Earnings where -16.9% YoY so in case you happen to buy shares today, do not hold them for long. A positive point for the auto sector is that Trump will delay tariffs on autos 6 months from now. Therefore, we might expierence some volatility with BMW stock and it could have a trend reversal right from today up to levels of 74-75€. So the final conclusion would be: Buy today, seize the dividend this month and sell in 5-6 months time depending on market news.

BMW, end of cycle fadeIn Europe and Japan car makers are leading the advance on the stock market today. A new concern for automakers is Car Sharing which has taken off in cities like Moscow. BMW and Daimler are joining forces to combat ride hailing software and car sharing. DMW’s DriveNow unit which is their version of Car Sharing together with Daimler operate a total of 20,000 vehicles in 20 large international cities. Each company owns 50% in the new venture, but they remain rivals in their core business.

The reason we are presenting this trade is that global macro indicators are on the rise. A change in sentiment is approaching and BMW is a cyclical stock. Meaning it fluctuates in very wide price moves and we have currently come up against a very strong level of support. Last time these levels were in play was 2016, and the reversal from these levels was quick and strong.

BMW is at the bottom of a weeklong descent due to difficulties around Brexit and the slowing economy in Germany. We are looking for something called the “fade”. Markets move in wave formations and we expect a correction up to 72.00. For this quick long trade we put a stop loss order around 68.50 and enter the market at 69.80-70.00. The average true range of the stock is currently around 1.5€. The Fibonacci level of 38.2% is too far away, currently if we reach 72.00 this week, we can expect a retest of the 23.6% Fibonacci level at 73.00. This is not a buy and hold strategy, move your stop loss up after price breaks 71.00.

BMW make it or break it After the big hummer for german auto industry last year, we escaped downtrend. The recovery however is shaky and for the better part of the year we were under mid of the pitchform.

Earnings might help BMW above the redline or break below the pitchfork range. Keeping an eye on general DAX preformance too.

Good luck and happy trading.

VEN potential reversal, finallyMACD about to reverse to bullish on the 4hr, rsi is hitting the historical reversal zone, and it respected the bearish pennant that is drawn in lighter orange. We would really need a good push with volume, which is definitely possible with VEN's new BMW partnership announcement. However, we did just have the rebranding event, and I feel like everyone who wants to own ven, already does, so this is where we may run into issues with the volume. I will update when we break up, down, or sideways from the triangle.

BMW Sell IdeaD1 - Price broke out at the bottom of the daily range. We can look for sells, if this breakout doesn't turn into a false break.

H4 - Price has created lower lows.

H1 - Bearish divergence has formed wait for a double wave correction and once the break out of the most recent trend line happens, look for sells.

BMW - VW (Correlation)Comparing the BMW chart to the VW chart it is striking that both price developments are strongly correlated to each other. Given the current spread between the two price changes in percentage, determined by using the closing price of the first day after going public, subtracting it from the current stock price and then subsequently deviding it through the first closing price, this offers us to greatly take advantage of their correlation. Obviously, it is likely that both prices are going to cross again in the future which means that all we have to do is shorting the BMW stock and buying some VW stocks in order to benefit from the decreasing spread between both prices. If we now charge both positions with the same amount of money and then close them when prices cross again, we are going to end up with 16.43% in profit.

BMW NEXT LEG HIGHER COULD BE COMING SOONI am having BMW on my watchlist for quite a while and i am reading alot of positive fundamental news about the company and their car-sales, for example they are expecting 2017 to be their 6th consecutive record year etc.. The chart technical picture is lining up more and more with the fundamental view. I am expecting the 5th wave higher to start pretty soon.

However, i will await Trumps speech tomorrow before considering to buy but its a stock to keep an eye on and maybe add to the portfolio if it fits your checklist.

I am currently looking at 2 options to play this:

1. Buy on dips between 84 and 81 with a stop at 78.50 or so.

2. Wait for the breakout of the golden falling trendline it will indicate a high probability of the end of the corrective phase and enter.

In either case i am targeting the magical 100 mark plus the Risk:Reward looks pretty good.

Trade wisely and with care.

Blessings to you all.

long BMW @ daily @ trading capability until january`17Take care

& analyzed it again

- it`s always your decission ...

(for a bigger picture zoom the chart)

This is only a trading capability - no recommendation !!!

Overnext month i`ll confirm or change my opinion about this SetUp :)

Buying/Selling or even only watching is always your own responsibility ...

Best regards

Aaron

MBLY Is Starting To Form A HeadNYSE: MBLY is looking to form a head within the next 3-4 months. This head could form early as today (LOW HEAD), or could form later in the month of September (HIGH HEAD). Check it out.

BMW Double Bottom - Buy SignalBMW has formed a double bottom as shown on the weekly chart along with a decreasing volume which suggests a lack of selling pressure. We are now waiting for a confirmation signal from the RSI to break through its trendline before opening a position on this stock. We expect price to test the upper trendline of the triangle before breaking through should the UK decide to remain in the EU as UK is a huge importer of BMW cars. It was also reported a few days ago that BMW plan to accelerate plans to innovate driverless cars by partnering with technology companies and acquiring start up companies. On the long side, we expect this pair to head towards the €100 level. Alternatively, if the fundamentals send price down, we expect it to target the €50 level.