BLRX falling wedge: pending breakoutFollowing my previous idea on NASDAQ:BLRX we're now forming a wedge with a local bullish divergence. First target would be range high around $0.19. If we break it and retest that level, we can aim for a (partial) gap fill and a local bullish trend. First we need a break from the wedge.

To be continued, but remain of opinion that this is an area of good value, given its trading well below the latest funding round of $0.20 per share.

BPTH

BPTH could be in for a bull market in 2025!One new low cap stock pick with my research described below, please do your own research aswell and remember these are risky moves - thus small allocation. I will be back with many crypto charts for next year as well, don't worry!

Bio-Path Holdings (BPTH) Overview: Bio-Path Holdings, Inc. is a biotechnology company focused on developing nucleic acid cancer drugs using its proprietary DNAbilize antisense RNAi nanoparticle technology. This technology allows for the development of drugs that can be administered through intravenous transfusion, targeting specific genes associated with cancer.

Last week, Bio-Path Holdings announced preclinical results for their drug candidate BP1001-A. The study demonstrated that BP1001-A enhances insulin sensitivity, suggesting its potential as a treatment for obesity in patients with Type 2 diabetes.

In 2025, Bio-Path Holdings plans to initiate a first-in-human Phase 1 clinical trial for BP1001-A, focusing on validating its safety, measuring pharmacokinetics, and establishing dosing for potential pivotal trials. This trial is aimed at further exploring BP1001-A's potential as a treatment for obesity and related metabolic diseases in patients with Type 2 diabetes.

A successful trial would likely lead to a significant increase in Bio-Path Holdings' stock price. The news of positive clinical results would be seen as a validation of the drug's potential, attracting more investor interest and possibly leading to partnerships or buyouts from larger pharmaceutical companies.

SPECULATION:

Estimating the yearly revenue potential and a fair valuation for Bio-Path Holdings (BPTH) based on BP1001-A's market entry involves several speculative assumptions, as we lack specific data on market penetration, pricing, competition, and long-term efficacy. Here's a theoretical breakdown:

Revenue Potential:

Market Size and Share:

Obesity and Type 2 Diabetes Market: The global market for treatments of obesity and Type 2 diabetes is substantial. For context, the global diabetes market alone was valued at approximately $51.1 billion in 2022, expected to reach $81.6 billion by 2030, growing at a CAGR of around 6.5% (). However, BP1001-A would be competing in a segment of this market focused on novel treatments or those with a unique mechanism like insulin sensitivity enhancement.

Assumed Market Share: Assuming BP1001-A captures a niche segment, let's speculate it achieves a 1% to 5% market share due to its novel mode of action and targeting a specific subset of Type 2 diabetes patients with obesity.

Pricing and Usage:

Drug Pricing: New diabetes drugs, especially those with innovative mechanisms, can be priced high. For instance, if we assume a yearly cost per patient of $10,000 (considering the high cost of biologics and similar therapies),

Patient Population: If we estimate that 1% of the diabetic population globally (approximately 537 million adults in 2021 according to IDF) could benefit from this drug, that's about 5.37 million patients. At 5% market share, this would mean 268,500 patients.

Revenue Calculation:

Annual Revenue: If 268,500 patients use BP1001-A at $10,000 per year, the potential annual revenue would be approximately $2.685 billion. For a 1% market share (53,700 patients), it would be around $537 million.

Valuation:

DCF Approach: A Discounted Cash Flow (DCF) analysis would be the traditional method to value BPTH if BP1001-A were to generate such revenues. Here's a simplified speculative approach:

Cash Flow: Assuming 50% of revenue translates into gross profit (considering R&D, marketing, and other costs), a 1% market share would yield $268.5 million in gross profit, and 5% would yield $1.3425 billion.

Discount Rate: Biotech companies often have high discount rates due to risk. Let's assume a 15% discount rate for this speculative valuation.

Growth & Terminal Value: Assume growth stabilizes after initial high growth years, with a terminal growth rate of 2% post-patent exclusivity period (which might be around 20 years from patent to market).

Valuation Calculation:

With a 1% market share scenario:

Present Value of Cash Flows for first 10 years (assuming rapid growth then stabilization): $268.5M * Annuity Factor at 15% = $1.4 billion (very roughly).

Terminal Value (Gordon Growth Model) = $268.5M * (1+0.02)/(0.15-0.02) = $2.14 billion.

Total Equity Value = PV of cash flows + Terminal Value = $3.54 billion.

With a 5% market share scenario:

Present Value of Cash Flows for first 10 years: $1.3425B * Annuity Factor at 15% = $7 billion (again, very roughly).

Terminal Value = $1.3425B * (1+0.02)/(0.15-0.02) = $10.7 billion.

Total Equity Value = $17.7 billion.

Market Multiples: If we use industry multiples (PE ratios for biotech can be very high, especially for novel treatments), with a PE ratio of 20-30 for a company with significant growth potential, the valuation based on earnings from BP1001-A alone would range from:

1% Market Share: $5.37 billion (20 * $268.5M) to $8.055 billion (30 * $268.5M).

5% Market Share: $26.85 billion (20 * $1.3425B) to $40.275 billion (30 * $1.3425B).

Fair Valuation:

Given these speculative numbers, a fair valuation for BPTH based solely on BP1001-A's potential would be somewhere in the middle of these ranges, adjusted for the company's current financials, other pipeline drugs, and market conditions. Considering the above, a conservative estimate might place BPTH's valuation in the range of $3 billion to $10 billion, depending on market penetration optimism, with the understanding that this is highly speculative and subject to countless variables including regulatory approval, actual market acceptance, and competitive landscape.

CONCLUSION & TA:

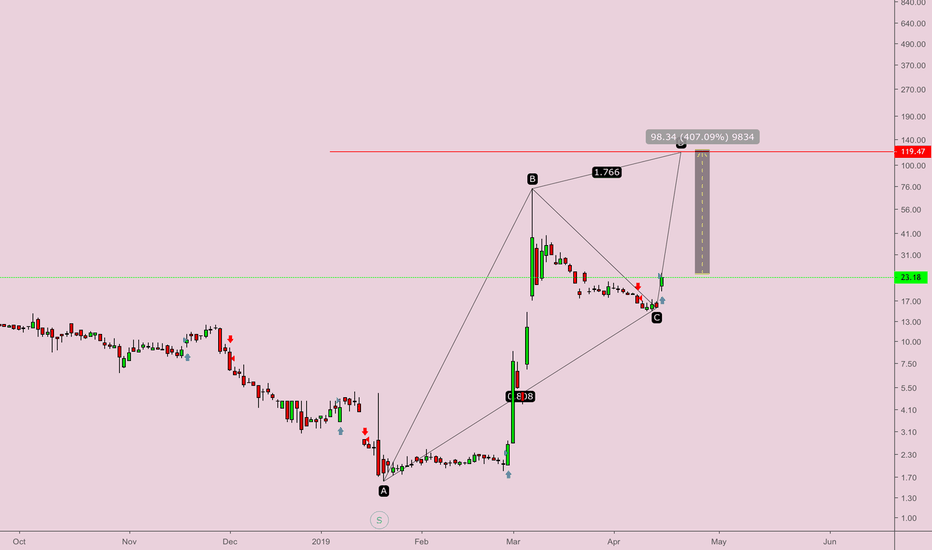

This simply means, IF(!) this drug is succesfull the market cap of this company would significantly rise. Currently we're sitting at a 5.43 million market cap (at close, so lower now), thus its a 100 to 1000x potential or it drops to zero. Last note, price needs to stay above $1 to stay compliant with Nasdaq rules or else there could be an inverse stock split 2 to 1 for example or they face delisting by the end of Q3 2025. I'm not too worried because this is the same as SEALSQ faced before it 10x'd in the last few weeks.

TA wise: we're retesting previous resistance and the bull market support band. Chart has been down only for years, capitulation after capitulation thus chance of a rebound should be there. I grabbed a small allocation to sit out for 2025, if the clinical trials are successful, we'll in for a big bull market. If not succesfull, we'll likely lose our money. A very decent risk / reward ratio of you invest an amount you can afford to lose and not more than 5% of your portfolio.

This is one of my low cap stock picks, next to LAES (10x since entry) and MOBX (entry last week, flat pa for now). I will be scouting for more but for now, happy holidays!

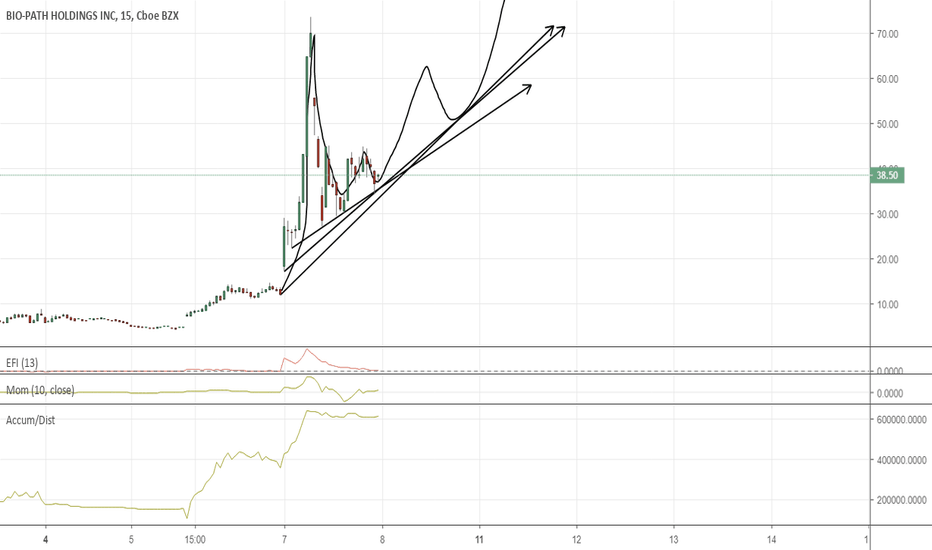

BPTHBio-Path Holdings Inc (NASDAQ:BPTH) I've covered this low floater in the past, and it appears the stock is getting attention again. I've always felt this stock has potential to rally. From a technical standpoint, it needs to break through $6.20 to really get going. A break of that figure brings $7.80 into focus. Keep a close eye on this one the next few days.

$BPTH Data presentation May 29th, time for the beast to reawakenIs it time for this beast to reawaken? May 29th we will find out!

BPTH - Good News in Dec = Enormous ProfitsBPTH, the ticker to the company Bio Path Holdings is currently trending down. This ticker has been a poor performer for the entire year with small time periods where day traders may make an easy 20-60 percent. Bio Path may seem like a decent day trading target where it follows the downward trending line and tends to bounce up a few days after coming into contact with it. If this continues, one can easily make short term gains and find value in this, but it will make much more sense to wait.

Bio Path will be releasing news on its number one drug, Prexigebersen for Acute Myeloid Leukemia (AML). This drug with good data has the potential of making Bio Path a multi billion dollar company. As you can see last year, Bio Path jumped from a startling ~$1 per share to ~$70 per share with one good news release. It is not easy to find these opportunities very often, that's why timing is the key.

Bio Medical companies tend to slowly decrease in value or, "bleed" waiting for positive news from the company. This is due to the companies being unprofitable and often seek financing deals creating stock dilution. The good news is what makes the stock relatively value because of the opportunity for day traders to capitalize on large percentage gains with a simple news release, but at the same time, you could also lose a large amount if it were negative.

Bio Path will release news on Prexigebersen this December and if you don't know enough about it, I recommend you do a little research on your own.

Any investment in this company is indeed speculation. Investing with small positions is the proper strategy with bio-med.

Cheers,

AC

$BPTH Posts Positive Phase 2 Trials for Leukemia DrugBio-Path released updated Phase 2 data for its lead candidate prexigebersen, codenamed BP1001, for treating acute myeloid leukemia, or AML, and also divulged a plan of action for taking the compound through clinical development toward registration.

Updated data from the Stage 1 of the Phase 2 study that evaluated the efficacy and safety of prexigebersen in conjunction with the low-dose chemotherapy regimen cytarabine in 17 newly diagnosed AML patients revealed that the proportion of patients showing a response increased from 47 percent when assessed in April 2018 to 65 percent.

Of the patients showing a response, 5, or 29 percent, showed a complete response compared to the benchmarked percentage of 7-13 percent.

AML: A Cancer Of Blood Cells:

AML is a form of blood cancer that develops in the bone marrow, where blood cells originate. It afflicts a group of white blood cells called myeloid cells that develop into mature blood cells such as red blood cells, white blood cells and platelets.

A patient with AML will see rapid accumulation of immature myeloid cells in the blood, resulting in a drop of other blood cell types.

BP1001's Mode Of Action:

Prexigebersen is a neutral-charge, liposome-incorporated antisense drug designed to inhibit protein synthesis of growth factor receptor bound protein 2, or Grb2.

Grb2 has a role to play in cancer cell activation via the RAS pathway.

Inhibition of Grb2 is found to halt cell proliferation and enhance cell killing by chemotherapeutic agents without added toxicity.

A Lucrative Market:

AML accounts for roughly 36 percent of all leukemias, with about 20,000 new cases diagnosed each year, Bio-Path said, citing National Cancer Institute estimates.

A critically unmet need exists for non-toxic therapies for older, fragile AML patients who are unfit or ineligible for high-dose chemotherapy or a stem cell transplant.

What's Next:

Bio-Path said it believes it now has a plan with definable paths to registration.

It plans to amend the Stage 2 prexigebersen + decitabine Phase 2 AML cohort in untreated new patients to add untreated high-risk myelodysplastic syndrome, or MDS, patients.

The company also intends to cancel the Stage 2 prexigebersen + LDAC Phase 2 AML cohort in untreated de novo patients.

It also plans to test a triple combo of prexigebersen + decitabine + venetoclax for untreated AML and high-risk MDS patients in a registration-directed trial to determine if more durable responses and longer survival are observed compared to patients treated with the decitabine + venetoclax combination.

The next major catalyst for Bio-Path will be the fourth-quarter results expected sometime in the next month.