Trend Exhaustion Detected – Bearish Structure AheadUS100 (NASDAQ) 30-minute chart as of July 26, 2025, with technical insights based on the visible elements.

🔍 1. Trend Analysis

Primary Trend: Uptrend (bullish structure)

The price has been respecting a rising parallel channel, marked by:

Ascending support (lower boundary)

Ascending resistance (upper boundary)

Market structure shows:

Higher Highs (HH)

Higher Lows (HL)

✅ This indicates continuation of bullish momentum until structure breaks.

📐 2. Market Structure Elements

Structure Type Label on Chart Price Zone (approx.)

Break of Structure (BOS) BOS (center-left) ~22,950

Higher Low (HL) HL (2x) ~22,700 (1st), ~23,050 (2nd)

Higher High (HH) HH (2x) ~23,150 and ~23,300

Resistance Labelled ~23,300–23,320

Demand Zones Labelled ~22,450–22,700

🔁 Break of Structure (BOS)

The BOS occurred after a prior swing low was broken, followed by a new higher high, confirming a bullish shift.

🧱 3. Support / Resistance Analysis

🔼 Resistance Zone

The price is testing strong resistance around 23,300–23,320

Multiple rejections in this area

Trendline resistance also aligns here

A rejection arrow is drawn, indicating potential bearish reaction

🔽 Support Zone (Immediate)

23,180–23,220: highlighted green box is a local support block

If broken, likely to revisit 23,000–23,050, or even down to 22,900 range

🟩 4. Demand Zones

Zone 1:

22,450–22,600: Strong bullish reaction historically — likely to act as a key demand if a deeper pullback occurs

Zone 2:

22,850–22,950: Validated with prior accumulation & BOS event

🧠 5. Key Observations

Price is at a critical inflection zone:

Testing a resistance zone

At the upper trendline of an ascending channel

A bearish reaction is projected (black arrow)

Possibly targeting the green support zone around 23,180–23,220

If that fails, demand at ~23,000 will likely be tested

Ichimoku Cloud:

Currently price is above the cloud → still bullish

Cloud is thin → potential weakness or upcoming consolidation

⚠️ 6. Trading Bias & Setup Ideas

✅ Bullish Bias (if price holds above ~23,180)

Long entries can be considered on bullish reaction from support

Target: retest of 23,300–23,350 or even breakout continuation

❌ Bearish Bias (if breakdown below support)

Short entry valid below 23,180 with:

TP1: 23,050

TP2: 22,900

A breakdown from the ascending channel would signal trend exhaustion

🔚 Conclusion

Current Price: 23,298.4

Trend: Bullish, but at resistance

Next move: Watch for reaction at resistance and support box below

Bias: Neutral-to-bullish unless the structure breaks below ~23,180

Breakofstructure

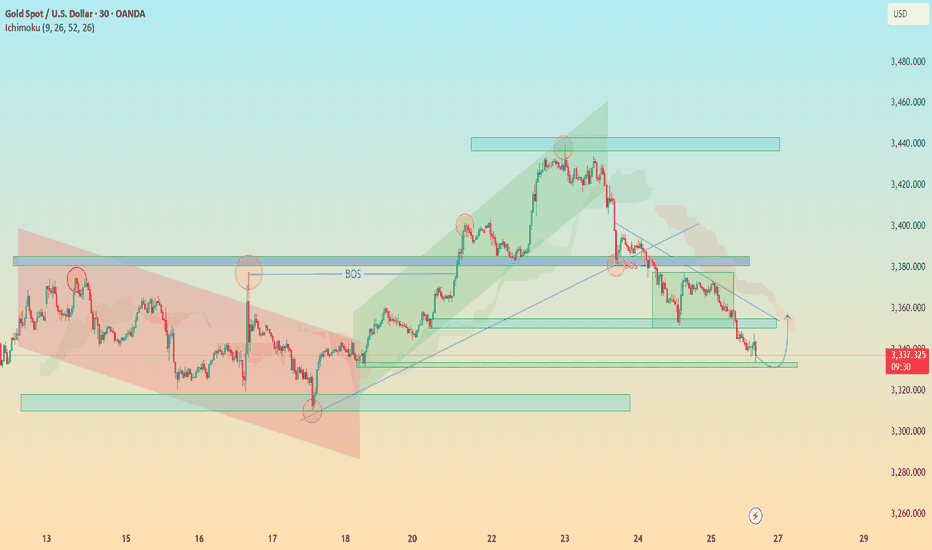

XAUUSD: Demand Rejection or Breakdown? All Eyes on 3,300 ZoneChart Analysis Breakdown (30m TF – Gold/USD)

1. Market Structure Overview

Bearish Trend Dominance:

The price has shifted into a bearish structure after a Break of Structure (BOS) to the downside, indicating bearish control after failing to sustain higher highs.

Lower Highs & Lower Lows:

A consistent formation of LHs and LLs confirms bearish momentum.

2. Key Zones & Reactions

🟩 Demand Zone (~3,300–3,310):

Current price is reacting from a clearly defined demand zone.

Strong buying wick indicates interest and potential short-term bounce.

This zone has historical significance — previous reversal point.

🟥 Supply Zone (~3,420–3,445):

Price reversed sharply from here.

This is a key liquidity zone; expect heavy resistance if price retraces.

🔵 BOS Areas Marked:

Confirmed transitions in structure:

Bullish BOS followed by a bearish BOS — great illustration of shift in control.

🟨 Consolidation Blocks:

Highlighted ranging periods show distribution/accumulation phases before breakouts.

3. Trendlines & Channel Patterns

📉 Descending Trendline:

Acts as dynamic resistance.

If price retraces to this level (around 3,330–3,340), expect potential rejection unless broken cleanly.

📈 Previous Bullish Channel (Broken):

Price moved out of a bullish ascending channel, confirming bearish intent.

4. Ichimoku Cloud Context

Price is below the Kumo cloud, suggesting bearish bias remains intact.

Future cloud is bearish.

However, short-term pullback into cloud possible (especially if demand zone holds).

📊 Forecast & Trade Idea

Scenario 1: Bullish Rejection from Demand

Price may bounce towards 3,340 (previous S/R + trendline retest).

Watch for reaction at this level.

Scenario 2: Clean Break of Demand Zone

Opens path toward deeper downside (e.g., 3,280 or even lower).

Could trigger liquidity grab before reversal.

"XAU/USD Hits Major Demand – Is a Relief Rally Brewing?"🟡 XAU/USD (Gold) – Demand Zone Rejection in Play | Bullish Correction Ahead?

Timeframe: 30-Minute | Date: July 25, 2025

Created by: AllyPipsExpert

Indicators: Ichimoku Cloud, BOS (Break of Structure), Dynamic S/R, Trendlines

---

🔍 Technical Analysis & Key Insights:

🔸 1. Market Recap – Distribution & Downtrend Confirmation:

After the Break of Structure (BOS) near 3385, gold confirmed a bearish reversal following the distribution phase at the top resistance zone around 3445–3460.

Bearish momentum was sustained by a descending trendline, paired with a bearish Kumo (Ichimoku cloud) crossover.

🔸 2. Major Zone Tagged – Key Demand Area Tested:

Price has now reached the critical demand block at 3320–3340, a zone that previously initiated bullish impulse on July 18–19.

The current bullish projection (in blue) reflects potential short-term recovery or correction phase, following oversold conditions and historical support strength.

🔸 3. Bullish Reversal Potential – Short-Term Retracement?

The blue arrow reflects a likely bullish retracement toward 3360–3380, aligning with trendline retest and potential Kumo rejection.

Expect sellers to re-enter if price retests former BOS/imbalance zone, creating scalp or swing sell setups on confirmation.

---

🔧 Confluences & Technical Highlights:

Confluence Point Description

Demand Zone Strong previous accumulation at 3320–3340

BOS Retest Area Key liquidity level now acting as resistance

Ichimoku Cloud Price below cloud = bearish bias maintained

Descending Trendline Reinforces bearish structure unless broken

Price Action Rejection wick at demand + potential short squeeze

---

🎯 Trade Outlook:

🧭 Bias: Short-Term Bullish Rebound → Long-Term Bearish Continuation

🟩 Support: 3320 – 3340

🟥 Resistance: 3360 – 3385 (BOS & Trendline zone)

🔁 Scenario: Bounce → Retest → Continuation lower (unless breakout confirmed)

---

📘 Why This Chart Could Be Featured:

✅ Multi-layered Analysis: BOS, zones, cloud, price action, and psychological zones used together.

✅ Forward-Looking: Projects the next logical market reaction instead of just explaining the past.

✅ Clean, Structured, Educational: Layout and visuals guide the viewer through logical trade steps.

✅ Value-Packed: Provides actionable levels and flexible scenarios — helpful to traders of all levels.

XAU/USD Bearish Retest in Motion – Watch 3340 for Breakout 🔍 XAU/USD (Gold) – Bearish Reversal Outlook

Timeframe: 30-Minute

Date: July 25, 2025

Indicators Used: Ichimoku Cloud, BOS (Break of Structure), Trendlines, Support & Resistance Zones

---

⚙ Technical Breakdown:

1. Previous Market Structure – Accumulation to Expansion:

Descending Channel (Red Box): Market moved within a bearish channel until the breakout occurred.

Key Break of Structure (BOS) around 3365 level signaled the beginning of bullish momentum — a textbook shift from accumulation to expansion phase.

Rally towards 3445 zone: Strong impulsive wave followed by higher highs and higher lows within a green rising channel.

2. Bull Trap and Structural Breakdown:

At the 3445-3460 resistance zone, price failed to maintain momentum and formed a double top / distribution setup.

The second BOS near 3385 confirmed a shift from bullish to bearish market structure.

Ichimoku Cloud also flipped bearish — price is now trading below the cloud, signaling potential continued downside.

3. Current Consolidation and Bearish Retest:

Price is now trapped in a bearish flag / rectangle pattern between 3360 – 3380.

Recent rejections from the descending trendline and overhead supply zone indicate weak bullish attempts and presence of strong selling pressure.

4. Anticipated Move – Bearish Continuation:

The projected red path suggests a retest of the diagonal resistance, followed by a breakdown toward key demand zone at 3340 – 3320.

If that zone fails, we may see a deeper move toward 3280.

---

📌 Key Technical Zones:

Zone Type Price Level (Approx.) Description

Resistance 3445 – 3460 Double Top / Strong Supply

Support 3340 – 3320 Historical Demand Zone

Short-term Resistance 3375 – 3385 BOS Retest + Trendline

---

🎯 Trading Insight:

📉 Bias: Bearish

⚠ Invalidation Level: Break above 3385 with volume

📊 Potential Target: 3340 → 3320

🧠 Trade Idea: Look for short entries on weak retests near descending trendline or cloud rejection.

---

🏆 What Makes This Chart Unique for Editors’ Picks:

✅ Multiple Confluences: Structural shifts (BOS), trendlines, Ichimoku, and classic patterns (channels, flags).

✅ Clear Visual Storytelling: Logical flow from bearish to bullish and back to bearish structure.

✅ Forward Projection: Predictive outlook based on strong technical context — not just reactive analysis.

✅ Educational Value: Useful for beginners and intermediate traders alike to understand structure transitions and key levels.

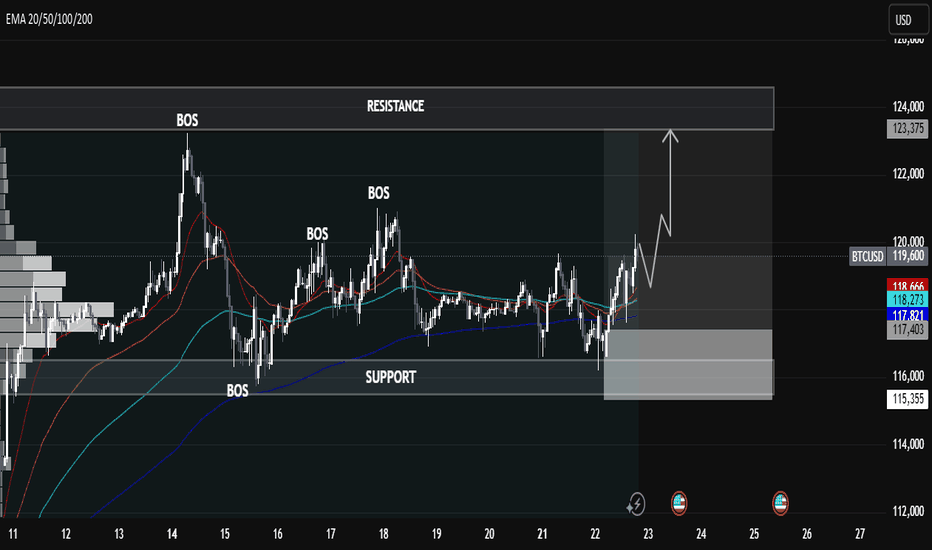

BTC/USD Technical Analysis — Educational BreakdownBTC/USD Technical Analysis — Educational Breakdown

🧠 Key Observations:

🔹 Market Structure: Break of Structure (BOS) Confirmations

The chart highlights multiple BOS points, showing clear transitions in market structure – a strong indication of bullish momentum building up after prior consolidation and retracements.

🔹 Support Zone (Demand Area): 115,355 – 117,403

This area has acted as a liquidity pool where buyers previously stepped in, forming the base for new BOS formations. A retest of this level could offer a high-probability long entry.

🔹 Resistance Zone (Supply Area): 123,375 Region

This marked level is a prior high and expected profit-taking or potential short-trigger zone. Price is likely to target this level if bullish momentum continues.

⸻

📈 EMA Analysis (20/50/100/200)

• Stacked Bullishly: EMAs are layered with the shorter-term EMAs (20/50) above the longer-term ones (100/200), suggesting trend continuation to the upside.

• Price reclaiming above all EMAs signals momentum is shifting from accumulation to expansion.

⸻

🔮 Potential Scenario:

1. Bullish Retest Play

A pullback toward the demand/support zone (116k–117.4k) can present a high-RR entry.

2. Continuation Toward Resistance

If price holds above the EMAs and structure, we could see a push toward 123,375, where profit booking may occur.

⸻

📌 Market Sentiment Bias: Bullish

• Structure: Bullish BOS

• Momentum: Above all EMAs

• Volume Profile: High acceptance near

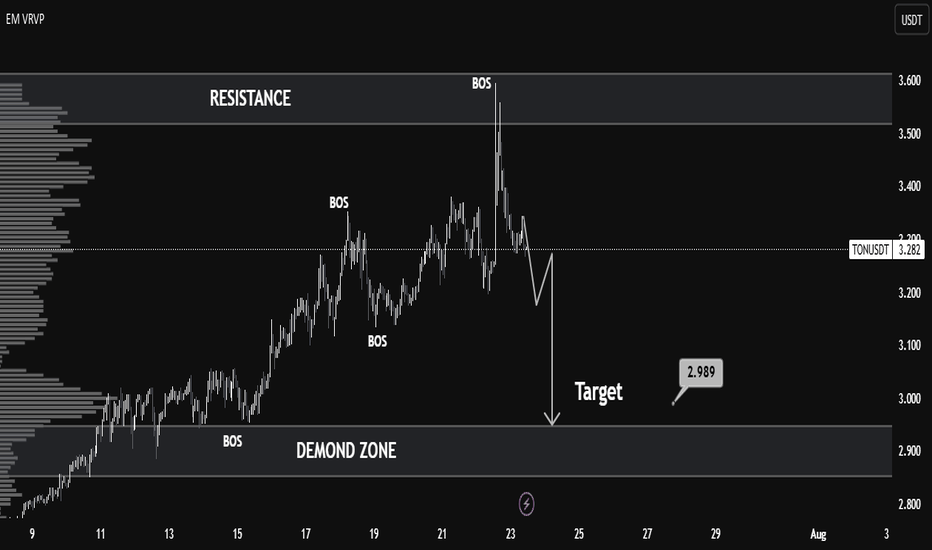

TONUSDT Technical Analysis – Bearish Shift with Clean TargetMarket Context:

TONUSDT recently showed strong bullish momentum, breaking multiple structure levels (noted as BOS – Break of Structure), indicating a clear uptrend. However, the most recent price action reveals a sharp rejection from the resistance zone around 3.55–3.60, marking a significant trend reversal.

Key Levels:

Resistance: 3.55 – 3.60

Price tested this zone and was strongly rejected, forming a potential top.

Demand Zone: 2.88 – 2.99

This zone provided previous accumulation and serves as a probable liquidity area and downside target.

Target: 2.989

The chart marks this as the near-term bearish objective, aligning with the volume node and prior demand.

Technical Signals:

Multiple BOS (Break of Structure):

Confirmed bullish structure earlier, but the latest BOS downward indicates a possible trend reversal.

Volume Profile (VRVP):

Shows high volume nodes around 3.00, suggesting strong market interest at lower levels — acting as a magnet for price.

Bearish Market Structure:

After the peak, the lower highs and lower lows pattern reflects short-term bearish dominance.

Liquidity Grab & Selloff:

The spike above resistance likely induced liquidity before a rapid selloff — classic distribution behavior.

Outlook:

If the market fails to reclaim levels above 3.35, a bearish continuation toward 2.989 remains likely.

The demand zone (2.88–2.99) is a critical area where buyers may re-enter — look for reversal signals here.

Conclusion:

TONUSDT has shifted from bullish to bearish in the short term. A clean rejection from resistance and strong structural breaks suggest a move toward the 2.989 demand zone. Traders should watch for confirmation of support or continuation upon reaching this level.

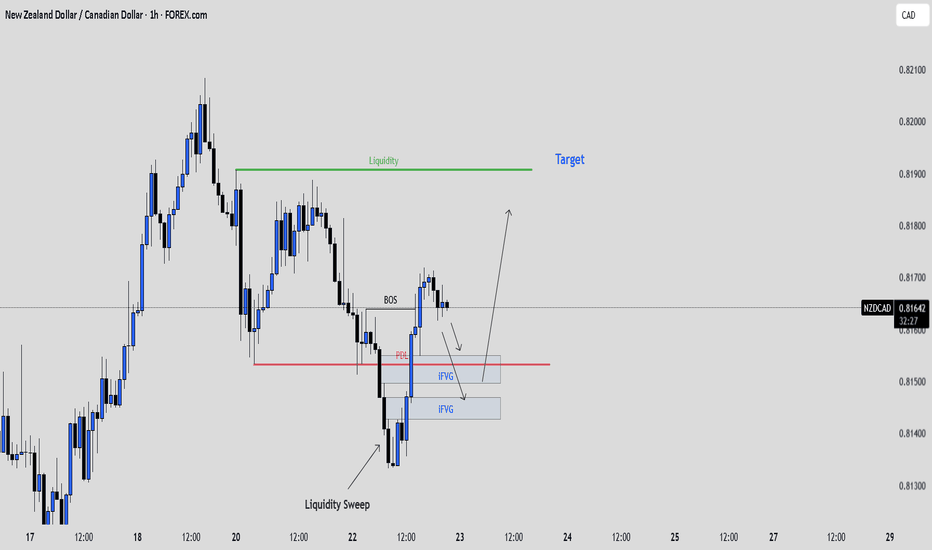

NZDCAD: Patience Before the PushNZDCAD on the 1H chart just completed a clean liquidity sweep below the previous day’s low. That long wick aggressively took out resting sell stops before price sharply reversed.

We’ve now seen a break of structure to the upside, showing a possible shift in market direction. Price is currently pulling back toward two visible imbalance zones (iFVGs), both sitting just below the previous day’s low.

If price trades into these iFVGs and gives us a clear bullish confirmation like a bullish engulfing candle, a rejection wick, or a strong break of structure on lower timeframes, we could look for continuation toward the liquidity above the highs.

📌 Key Levels

• Liquidity sweep below PDL

• Bullish break of structure

• iFVGs aligning as potential entry zones

• Final target: liquidity resting near 0.81900

🧠 Psychology Tip

The best trades don’t need to be forced. Wait for confirmation. A setup without a signal is just a theory. Protect your capital, trade your plan, and trust the process.

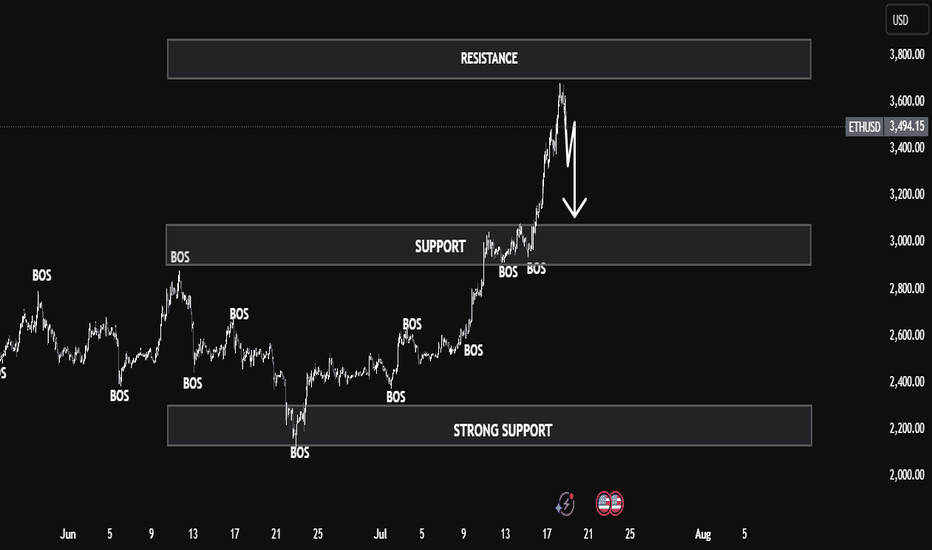

ETHUSD Smart Money Breakdown – Price Rejection from Premium ZoneEthereum has shown a strong impulsive rally after multiple Breaks of Structure (BOS) from early June, signaling a clear shift in market sentiment from bearish to bullish. Each BOS indicates that demand zones have been respected and liquidity has been efficiently used to fuel higher prices — a classic signature of institutional involvement.

🧠 Smart Money Insight

As price aggressively rallied into the resistance zone ($3,600–$3,800), the market entered a premium pricing area, where smart money typically offloads positions and hunts liquidity from late buyers. This area has historically been a high reaction zone — and as seen on the chart, ETH shows signs of buyer exhaustion, suggesting a possible short-term reversal.

🔁 Anticipated Market Behavior

A corrective move is likely from this resistance, and the first target for retracement lies in the support zone around $3,000–$3,200. This level aligns with:

Previous BOS retest area

Fair value imbalance fill

Mid-range equilibrium

If momentum continues downward, the next zone of interest will be the strong support region at $2,200–$2,400, which served as a major accumulation zone. That’s where large orders previously entered the market — and a strong reaction is expected again.

📊 Market Structure Summary:

BOS Confirmations: Validated bullish structure

Liquidity Grab: At resistance – potential sweep and reversal

Premium Zone Rejection: Smart money short opportunity

Discount Zone Targets: Support & strong support zones

✅ Conclusion

ETH is at a critical decision point. If price holds below resistance with continued bearish pressure, a retracement is not only healthy — it's expected. Traders should wait for confirmation of lower timeframe structure breaks before entering shorts, and target the $3,000 zone first, with eyes on $2,200 if momentum persists.

TON/USDT Monthly Structure Flip – Smart Money Targets $3.30+ Aft🔍 Key Observations:

Current Price: 2.974 USDT

Support Zone (Demand Area):

Strong demand zone around 2.870 - 2.800 USDT.

Price previously reacted multiple times from this zone, showing strong buyer interest and BOS confirmations.

Resistance Zone (Supply Area):

The next significant resistance lies in the range of 3.306 - 3.400 USDT.

This zone previously caused a BOS to the downside, making it a critical level to monitor for potential profit-taking or reversals.

Market Structure:

Price is currently consolidating just above the demand zone after a bullish BOS.

Recent BOS confirms a shift in structure from bearish to bullish bias.

Potential Price Path:

If price sustains above the 2.870 support, a bullish move targeting the 3.306 level is likely.

Expect short-term retracements within the structure but with a medium-term bullish bias.

Liquidity Mapping:

Liquidity is likely resting above the 3.088 local highs and the 3.306 major resistance.

Smart money may push price to these levels to mitigate orders or engineer exit liquidity.

📈 Educational Perspective:

This chart is a strong representation of Smart Money Concepts (SMC), particularly the use of BOS as confirmation for directional bias. Traders can look to:

Use the demand zone for potential long entries.

Watch for confirmation (like bullish engulfing or internal BOS) within the zone.

Manage trades toward the premium zone near 3.3 for a favorable risk-reward.

EURJPY Weekly Analysis (MMC + SMC) - Trend Expansion + Target🧠 Contextual Overview:

EURJPY has been on a strong long-term bullish rally, fueled by institutional demand and consistent volume expansion patterns. This pair is approaching a critical macro resistance/reversal zone around the 175–176 level, where historically large players have shown interest in redistributing or taking profit.

This analysis uses the MMC (Market Mechanics Concept) integrated with SMC (Smart Money Concepts) to provide a complete perspective on price structure, order flow, and volume behavior.

📊 Structural Breakdown:

🔹 1. Volume Expansion as a Leading Indicator

Volume precedes price — this is a foundational MMC principle.

The recent aggressive impulse to the upside is backed by clear volume expansion visible on higher time frames.

This type of movement indicates smart money accumulation and commitment, rather than retail-driven volatility.

A key insight: Volume Expansion typically signals trend continuation, not reversal—unless a liquidity grab or divergence shows up in reversal zones.

🔹 2. Break of Structure (BOS) Confirms Trend Continuation

A clear BOS occurred when price violated previous swing highs around the 165–167 range.

This BOS suggests a new bullish leg is forming, confirming the market has transitioned from consolidation (accumulation) to distribution (markup phase).

🔹 3. Current Price Path: Heading into a Key Reversal Zone (175–176)

This zone has been mapped based on previous supply imbalances and historical resistance.

Price may tap into this zone before we see either:

A clean continuation above (indicating absorption of supply), or

A rejection or smart money sell-off pattern (distribution, divergence, or exhaustion candles).

Institutions tend to execute significant moves in these areas — watch for liquidity sweep traps and break-of-structure (BOS) on lower timeframes for confirmation.

🧱 Support Zones & Safety Net:

🔸 Major Support: 155–157 Zone

This is a historically significant demand block, respected multiple times since 2023.

A drop into this region could offer a prime long-term swing entry, should price reject the reversal zone.

Also acts as invalidity for current bullish structure. A weekly close below this would signal a potential trend shift or deeper correction.

📉 Technical Patterns & Confluences:

Trendline Breakout + Retest occurred from 2024 into early 2025. This is a classic break-and-retest continuation pattern, confirming bullish interest from smart money.

Price consolidated (reaccumulation) and exploded upward with volume expansion, aligning with Wyckoff theory’s markup phase.

Strong candles with minimal upper wicks = clear sign of institutional commitment.

🎯 Trade Strategy & Scenarios:

🟢 Bullish Continuation Scenario:

If price breaks above 176.000 with volume and closes weekly bullish, expect continuation toward 180.00+ in coming months.

Watch for:

Clean BOS above the reversal zone

Volume expansion confirmation

Retest of breakout level (176–174) for safe re-entry

🔴 Bearish Rejection Scenario:

If price rejects the reversal zone with bearish engulfing or divergence, expect a retracement back toward 165–162 short-term, and possibly 157–155 long-term.

Lower time frame structure shift (BOS to the downside) will confirm early exit from bulls or reversal setups for bears.

🧠 Psychological Perspective:

Smart Money uses reversal zones to entice late buyers before triggering liquidity grabs.

Reversal zones serve as liquidity magnets, often leading to false breakouts before true direction is revealed.

Retail traders often buy into strength at these levels, providing liquidity for institutional exits.

📌 Summary:

✅ Trend: Strong bullish

✅ Structure: Clean BOS with volume confirmation

✅ Next Key Level: 175–176 (Reversal Zone)

✅ Strategy: Monitor for rejection/continuation; align with volume + structure

✅ Volume Behavior: Expansion supports trend continuation

🔖 Final Thoughts:

The EURJPY pair presents a highly educational and strategic opportunity. Whether you trade intraday or swing, this zone (175–176) will define the market direction for the next few months. Use volume, structure shifts, and institutional behavior to guide your trades, not just candlestick patterns.

What Is a Change of Character (CHoCH) and How Can You Trade It?What Is a Change of Character (CHoCH) and How Can You Trade It?

Navigating the nuances of Smart Money Concept (SMC) trading requires a keen understanding of market signals like the Change of Character (CHoCH). This concept can help traders detect and react to potential trend reversals. Today, we’ll delve into the mechanics of CHoCHs, explaining how they manifest in different market conditions and how they can be strategically leveraged for trading decisions.

Understanding Breaks of Structure

Understanding Breaks of Structure (BOS) is essential for traders before delving into concepts like Change of Character (CHoCH). A BOS in trading signifies a continuation within the current trend and is marked by a clear deviation from established swing points that indicate previous highs and lows.

In the context of an uptrend, a BOS is identified when the price exceeds a previous high without moving below the most recent higher low. This action confirms that the upward momentum is still strong and likely to continue as buyers push the market to new heights.

Similarly, in a downtrend, a BOS occurs when prices drop below a previous low without breaking the prior lower high, suggesting that sellers remain in control and the downward trend is set to persist.

By recognising these points where the market extends beyond its former bounds, traders can confirm that the current trend is robust and act accordingly. This foundational concept of BOS not only helps in assessing trend strength but also sets the stage for understanding more complex patterns like CHoCH, where the focus shifts from trend continuation to potential trend reversals.

CHoCH Trading Meaning

In trading, a Change of Character (CHoCH) signals a potential shift in market dynamics, often indicating a reversal from the prevailing trend. This concept is particularly valuable as it helps traders discern when the momentum is shifting, offering a strategic point to consider adjusting their positions.

A CHoCH occurs when there's a noticeable deviation in the market's price trend. For example, in a bullish trend characterised by a series of higher highs and higher lows, a CHoCH is indicated by the price failing to set a new high and subsequently falling below a recent higher low. This suggests that buyers are losing control, and a bearish trend could be emerging.

Similarly, during a bearish trend marked by lower highs and lower lows, a bullish CHoCH would occur if the price unexpectedly breaks above a recent lower high. This break indicates that sellers are losing their grip, and a bullish trend may be starting.

The Significance of CHoCHs Across Timeframes

The fractal nature of financial markets means that patterns and behaviours recur across various timeframes, each providing unique insights and implications for trading. Understanding CHoCHs in different timeframes is crucial for traders to effectively align their strategies with both short-term opportunities and long-term trend shifts.

In intraday trading, where decisions are made on lower timeframes (like minutes or hours), a CHoCH can signal a possible short-term trend reversal. For example, if a currency pair in a downtrend on a 15-minute chart suddenly posts a higher high, this could indicate a weakening of the bearish momentum, suggesting a potential bullish reversal.

Traders might use this information to close short positions or to consider a long position, capitalising on the emerging upward trend. These short-term CHoCHs allow traders to respond quickly to market changes, potentially securing returns before larger market shifts occur.

Conversely, CHoCHs observed on higher timeframes, such as daily or weekly charts, are particularly significant because they can indicate a shift in the broader market trend that might last days, weeks, or even months. Such changes can then be used by both long and short-term traders to adjust their positioning and directional bias.

How to Identify a CHoCH

The initial step to identify a CHoCH in trading involves clearly defining the existing trend on a specific timeframe. This is done by marking the significant swing highs and lows that delineate the trend's progress. These points should represent somewhat meaningful retracements in the price, providing clear markers of trend continuity or potential reversal points.

According to the Smart Money Concept (SMC) theory, the integrity of an uptrend is maintained as long as the price does not trade through the most recent significant higher low. Conversely, a downtrend is considered intact if the price does not surpass the most recent significant lower high. Therefore, traders focus their attention on these critical points.

To identify a CHoCH, traders watch for a break in these crucial high or low points. For instance, in an uptrend, a bearish CHoCH is indicated when the price achieves a higher high but then reverses to descend below the previous significant higher low.

Similarly, in a downtrend, a bullish CHoCH occurs when the price drops to a lower low before reversing to break above the previous significant lower high, setting a new high. Both types of breaks signal a potential reversal in the trend direction.

How to Trade a CHoCH

When trading a CHoCH, it’s essential to recognise that it should be integrated with other aspects of the SMC framework to get the best results. This includes the use of order blocks and imbalances, which are key components in identifying potential reversals.

Order Blocks and Imbalances

An order block is essentially a substantial consolidation area where significant buying or selling has occurred, and prices often revisit these zones before reversing. These blocks can be seen as levels where institutional orders were previously concentrated.

An imbalance, also known as a fair value gap, occurs when the price moves sharply up or down, leaving a zone that has not been traded extensively. Price often returns to these gaps to 'fill' them, establishing equilibrium before a potential reversal happens.

In practice, traders can look for a sequence where the price first approaches an order block and begins to fill any existing imbalances. This setup increases confidence in a potential reversal. As the price meets these criteria and a CHoCH occurs, this indicates that the influence of the order block is likely to initiate a price reversal.

Practical Example on GBP/USD

Consider the 4-hour chart of the GBP/USD pair above. We see the pair encounter an order block on the left, one that’s visible on the daily chart. As the price interacts with this block, it begins to retrace, attempting to fill the imbalance but moves away. Eventually, the price completes the fill of the imbalance and meets the previously established order block.

Switching to a 1-hour timeframe, this scenario unfolds similarly. After reaching the order block on the 4-hour chart, another CHoCH occurs, signalling the start of a new uptrend. This lower timeframe CHoCH, following the meeting of the order block, corroborates the potential for a reversal initiated by the higher timeframe dynamics.

This example illustrates how CHoCHs can be effectively utilised across different timeframes, tying back to the fractal nature of markets discussed earlier. By recognising these patterns and understanding their interaction with order blocks and imbalances, traders can strategically position themselves to capitalise on potential market reversals, aligning their trades with deeper market forces at play.

CHoCH vs Market Structure Shift

A Market Structure Shift (MSS) is a specific type of Change of Character that includes additional signals suggesting a potential trend reversal. Unlike a straightforward CHoCH that typically indicates a trend is shifting but may also be a false break, an MSS can be seen as a higher confluence CHoCH. An MSS occurs after the market first makes a key movement contrary to the established trend—forming a lower high in an uptrend or a higher low in a downtrend—without plotting a higher high or lower low.

Following these preliminary signals, an MSS is confirmed when there is a decisive break through a significant swing point accompanied by a strong displacement (i.e. impulse) move, creating a CHoCH in the process. This sequence not only reflects that the prevailing trend has paused but also that a new trend in the opposite direction is establishing itself.

Due to these additional confirmations, an MSS can offer added confirmation for traders, indicating a stronger likelihood that a new, sustainable trend has begun. This makes the MSS particularly valuable for traders looking for more substantiated signals in their trading strategy.

The Bottom Line

The concept of a CHoCH is instrumental in navigating the complexities of SMC trading. By identifying these crucial market signals, traders may align their strategies to capitalise on market movements efficiently.

FAQs

What Is CHoCH in Trading?

In trading, CHoCH is a technical observation that signifies a change in the trend's character, where the price movement breaks from its established pattern of highs and lows, suggesting a potential reversal or substantial shift in the market's direction.

What Is CHoCH in SMC Trading?

In Smart Money Concept (SMC) trading, a Change of Character (CHoCH) refers to a clear shift in market behaviour that indicates a potential reversal of the prevailing trend. This concept is used by traders to detect early signs of a momentum shift that might lead to significant changes in price direction, enabling strategic adjustments to their trading positions.

What Is a CHoCH in the Market Structure?

A CHoCH in market structure is identified when there is an observable deviation from established price patterns — specifically when new highs or lows contradict the current trend. It signifies that the previous market sentiment is weakening, and a new opposite trend may be starting, prompting traders to reassess their strategies.

How Do You Identify a CHoCH?

Identifying a CHoCH involves monitoring significant swing highs and lows for breaks that are contrary to the existing trend. For instance, in an uptrend, a CHoCH would be indicated by a failure to reach a new high followed by a drop below the recent higher low, suggesting a shift to a bearish outlook.

What Is ChoCH vs BOS in Trading?

While both CHoCH and Break of Structure (BOS) are critical in assessing market dynamics, they serve different purposes. CHoCH indicates a potential trend reversal by highlighting a significant change in the price pattern. In contrast, a BOS indicates a continuation of the current trend by showing the price surpassing previous significant highs or lows, reinforcing the ongoing direction.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

They Had to Take Before They Could GivePrice swept below the previous day’s low (PDL), triggered liquidity, and gave us a clean BOS. This isn’t random, it’s intention.

Now, we wait to see if the market delivers the follow-through into that FVG below.

Your job isn’t to chase price. Your job is to recognize its story.

Mitigation Block in Forex Trading: What It Is and How to Use It?What a Mitigation Block Is, and How You Can Use It When Trading Forex?

Understanding specific market mechanisms like mitigation blocks may enhance strategic decision-making. This article delves into the concept of mitigation blocks, detailing their definition, function, and practical application within forex.

Definition and Function of a Mitigation Block

A mitigation block in forex trading refers to a specific order block on a chart that indicates where previous movements have stalled and reversed, marking it as a potential area for future market turns. This concept within the Smart Money framework is crucial for traders looking to manage their positions by taking advantage of strategic entry and exit points.

The idea behind these areas is rooted in the dynamics of supply and demand within forex. When a currency pair reaches a level where buyers or sellers have previously entered the market in force, causing a reversal, it suggests a potential repeat of such actions when the price returns to the area.

Characteristics and How to Identify a Mitigation Block

Mitigation blocks can be bullish or bearish, each with distinct characteristics:

- Bearish Mitigation Block: This type forms during an uptrend and is identified by a significant peak followed by a decline and a failed attempt to reach or surpass the previous high, creating a lower high. When prices drop below the previous low, the order block above the low becomes mitigation. It may be characterised by an increase in selling volume as the price approaches the level, signalling resistance and a potential downward reversal.

- Bullish Mitigation Block: Conversely, a bullish type is established during a downtrend. It is characterised by a significant trough, followed by a rise to form a higher low, and a failure to drop below the previous low. As the pair moves up, the order block below the high marks mitigation one. This area often shows an increase in buying volume as the price approaches, indicating support and a potential upward reversal.

Mitigation Block vs Breaker Block

Mitigation and breaker blocks are both significant in identifying potential trend reversals in forex trading, but they have distinct characteristics that set them apart. A mitigation block forms after a failure swing, which occurs when the market attempts but fails to surpass a previous peak in an uptrend or a previous trough in a downtrend. The pattern indicates a loss of momentum and a potential reversal as the price fails to sustain its previous direction.

On the other hand, a breaker block is characterised by the formation of a new high or low before the market structure is broken, indicating that liquidity has been taken. This means that although the trend initially looked set to continue, it quickly reverses and breaks structure.

In effect, a breaker appears when the market takes liquidity beyond a swing point before reversing the trend. A mitigation appears when the price doesn’t move beyond the trend’s most recent high or low, instead plotting a lower high or higher low before reversing the trend.

How to Use Mitigation Blocks in Trading

Areas of mitigation in trading can be essential tools for identifying potential trend reversals and entry points. When they align with a trader's analysis that anticipates a reversal at a certain level, it can serve as a robust confirmation for entry.

Traders can effectively utilise these zones by simply placing a limit order within the area once it is considered valid. Validation occurs after a new peak or trough is established following the initial failure swing that forms the mitigation area.

If a liquidity void or fair-value gap is present, the trader may look for such a gap to be filled before their limit order is triggered, potentially offering a tighter entry. Stop losses might be placed beyond the failure swing or the most extreme point.

Furthermore, if a mitigation block is identified on a higher timeframe, traders can refine their entry by switching to a lower timeframe. This approach allows for a tighter entry point and potentially better risk management, as it offers more granular insight into the momentum around the area.

Common Mistakes and Limitations

While these blocks are valuable for forex trading, they come with potential pitfalls and limitations that traders should know.

- Overreliance: Relying solely on mitigation blocks without corroborating with other trading indicators can lead to misjudged entries and exits.

- Ignoring Context: Using these zones without considering the broader market conditions may result in trading against a prevailing strong trend.

- Misinterpretation: Incorrect identification can lead to erroneous trading decisions, especially for less experienced traders.

- False Signals: Mitigation blocks can sometimes appear to signal a reversal but instead lead to a continuation of the trend, trapping traders in unfavourable positions.

The Bottom Line

Understanding mitigation blocks offers traders a strategic edge in navigating the forex market. They can be vital for recognising potential price reversals and improving trading outcomes.

FAQs

What Is a Mitigation Block?

A mitigation block in forex trading is an order block that identifies potential reversal points. It signals where a currency pair has previously stalled, indicating strong buying or selling pressure, suggesting a potential for similar reactions in future encounters with these levels.

How Do You Identify a Mitigation Block?

Mitigation blocks are identified by analysing charts for areas where previous highs or lows were not surpassed, leading to a reversal. Traders look for a sequence of movements, including a swing high or low followed by a retracement that fails to exceed the previous swing.

What Is the Difference Between a Breaker Block and a Mitigation Block?

While both indicate potential reversals, a breaker block forms when the price makes a new high or low before reversing, suggesting a temporary continuation of the trend. In contrast, a mitigation block forms without creating a new extreme, indicating a direct loss of momentum and an immediate potential for reversal.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Did You Catch the Sweep & Shift on GBPAUD?Sometimes the market whispers its intentions before making a move — and this was one of those moments. This GBPAUD setup was built on the core principles of Candle Range Theory (CRT):

Sweep of the Previous Day’s Low (PDL)

Break of Structure (BOS) confirming a shift in momentum

Entry retracement into the Fair Value Gap (FVG)

What stood out here was the precision of the sweep and how price reacted cleanly after BOS, tapping into the FVG zone and immediately pushing toward the high-probability target.

No indicators, no noise, just clean market structure and smart money behavior.

The temptation to enter early was real, but the edge came from waiting for price to validate itself. A textbook example of how patience and plan adherence outweigh prediction .

Did Gold Just Sweep the Low for a Reversal?After a clean sweep of the Previous Day’s Low (PDL) on XAUUSD, price reacted sharply, grabbing liquidity and signaling a possible shift in order flow. This forms the first pillar of my CRT model (Candle Range Theory) : Sweep, Break, Retest .

Following the sweep, we observed a strong Break of Structure (BOS) , indicating bullish intent. We will then wait for price to retrace back to a FVG at a discount, and then execute the trade.

The stop loss was logically placed just beneath the PDL sweep and FVG zone, protecting against deeper liquidity hunts. Take profit targets the next high where resting buy-side liquidity is likely to be engineered.

This setup checks all the boxes:

Sweep of PDL ✅

BOS confirming shift ✅

FVG retest for refined entry ✅

Solid RR and clean narrative ✅

This is a great example of how patience and a structured approach can create high-probability setups.

BTC Short Setup! Break of Structure + OB + 70.5% Premium TapBitcoin (BTCUSD) | 30-Min Chart – Clean Bearish SMC Setup

BTC just delivered a textbook Break of Structure (BoS) to the downside, and price is now retracing into a high-confluence premium zone packed with Smart Money signals: a bearish Order Block (OB), Fair Value Gap (FVG) alignment, and multiple Fibonacci retracement levels. This setup is precision-crafted for patient traders who wait for institutional footprints before striking.

🔍 Trade Breakdown:

🔺 Market Structure Shift:

Price broke decisively below the internal range, forming a clear BoS (Break of Structure). The lower low confirms bearish intent. Any retracement into premium is now a potential short opportunity.

📉 Bearish Order Block:

Marked just above the 61.8% Fib

Originated the strong bearish impulse that created the BoS

This is where Smart Money likely entered the move — we look to join them

🟣 Fair Value Gap (Imbalance Zone):

Gap within the OB

Price is likely to rebalance this inefficiency before continuing the bearish trend

📐 Fibonacci Levels (Swing High to Low):

50%: 103,617 (current price)

61.8%: 103,963

70.5%: 104,800

79%: 105,200

This premium zone (104,400–104,951) overlaps with the OB and FVG — massive confluence.

🧠 Smart Money Playbook:

🔹 Entry Zone:

From 103,963 to 104,951 — OB + FVG + 61.8–70.5% retrace = sniper entry window

🔻 Stop Loss:

Above 105,000 (protect against OB invalidation and final liquidity sweep)

📉 Take Profit:

100,464 — aligned with the low of the full fib swing and prior liquidity pocket

⚖ RRR:

Over 1:4 — clean sniper risk-reward with clear structure validation

📉 Bearish Continuation Expectation:

Price enters OB → taps imbalance → reacts at 70.5% level

Expected move: Sell-off toward the discount zone + full swing completion

Look left — no major support zones until the 100,400–100,600 level, making it a liquidity magnet and realistic TP zone.

💬 Ninja Wisdom:

Structure + Liquidity = Foundation

OB + FVG + Fib = Precision Tools

Trade where Smart Money enters — not where retail hopes. 🥷💸

📍 Save this chart – this setup could play out fast

🔁 Share your thoughts: will BTC respect the OB or break above?

👣 Follow @ChartNinjas88 for daily sniper-level BTC/ETH/Gold trades

Is This the Optimal Entry After a PDL Sweep and FVG Retest?A clean structural development on CHFJPY (1H TF)

After sweeping the Previous Day’s Low (PDL), price created a bullish Break of Structure (BOS) to the upside , shifting short-term sentiment. This BOS was followed by a precise retest into a Fair Value Gap (FVG), suggesting possible continuation as liquidity shifts from weak hands to strong.

🧠 Educational Notes :

CRT Sweep Logic: Market often sweeps the previous day's high or low before making its true move. In this case, a clean PDL sweep was followed by a strong bullish reaction.

Break of Structure (BOS): Confirmed bullish intent after the sweep, validating a shift in order flow.

FVG Retest: Institutional pricing inefficiency filled — a classic SMC continuation behavior.

Entry Thesis: Based on reaction from FVG + BOS confirmation, with invalidation below the swept low and TP near the previous swing high.

This setup is not financial advice, but a clear visual case study for traders applying SMC + CRT logic.

XAUUSD Mind Mapping Breakout – MMC Strategy + Target📍 Overview:

In today's Gold (XAUUSD) 30-minute chart, we’re witnessing a flawless execution of MMC (Mind Mapping Concept) strategy combined with SMC (Smart Money Concept) principles. This is a perfect case study for traders who want to understand how psychology, curve-based support, and structural mapping come together to create a high-probability bullish setup.

🔍 Full Breakdown of the Chart

1. Initial Market Behavior: Liquidity Grab & Structural Shift

The market begins with a bearish drop, clearing liquidity below the previous consolidation.

This is followed by a QFL zone (Quick Flip Level), which acts as a smart money accumulation point.

Shortly after, price rebounds from the SR Interchange zone, where resistance transforms into support—a key MMC signal for upcoming structural shift.

🧠 Key Concept: Smart money often grabs liquidity before making a move. These zones are critical for identifying market reversals.

2. Black Mind Curve Support – Dynamic Trend Logic

The Black Mind Curve is a dynamic support curve, not a traditional trendline. It represents how the market naturally flows, mapping out the collective psychology of buyers.

Price respects this curve multiple times, forming higher lows—each one stronger than the last.

This is where patient MMC traders build their positions, aligning entries with psychological market rhythm.

🔥 Why It Matters: While static lines may break under pressure, dynamic curves breathe with the market, providing more accurate structure support.

3. Structure Mapping – Tracking Market Intentions

Structure Mapping is one of the core MMC techniques—tracking the "story" price action is telling through:

BOS (Break of Structure)

QFL traps

SR interchanges

Internal higher-highs and higher-lows

The Major BOS line indicates a key shift in market direction from bearish to bullish, a confirmation point for trend-followers.

📌 Lesson: Once BOS is confirmed, the probability favors continuation rather than reversal.

4. Ellipse Trap – The Psychological Kill Zone

This blue-highlighted ellipse zone marks where retail traders often get manipulated—buying false breakouts or shorting fake reversals.

Price consolidates inside this ellipse before launching upwards.

MMC refers to this phase as the “After Effect”—where true momentum begins after psychological traps are triggered.

🎯 Insight: Never enter a trade inside the ellipse unless you clearly understand market context—it’s where the market “confuses the masses.”

5. VIP Zone – The High-Probability Entry Window

The VIP zone is a small but powerful price area where risk is minimized, and reward is maximized.

It aligns with the curve, inner structure support, and BOS retest. This is your ideal entry zone, especially for those using curve-based confirmations.

🔑 Pro Tip: This is the sniper entry for MMC traders. Small SL, big reward. Enter after internal confirmation like pin bars or bullish engulfing.

6. Target Zone & Next Reversal Area

After the explosive breakout, price hits the projected target marked clearly on the chart.

The move aligns with prior imbalance zones and market inefficiencies, filling previous gaps.

The market is now approaching the Next Reversal Zone, highlighted in blue—this is where MMC traders start watching for signs of exhaustion.

📉 What to Watch:

Slowing bullish candles

Bearish divergence on RSI or momentum indicators

Sudden spikes in volume with no further upside

📚 Key MMC Concepts in This Chart:

Concept Description

QFL Zone Quick Flip Level; a liquidity trap zone before reversals.

Black Mind Curve Curved support line reflecting psychological market flow.

Structure Mapping Tracking HH/HL and BOS to define clear market bias.

Ellipse Trap Market maker zone used to trap and reverse retail traders.

VIP Entry Zone The safest and most efficient entry after structure confirmation.

Next Reversal Zone Anticipated resistance based on confluence of previous S/R and imbalance.

🧠 Strategic Conclusion:

This analysis perfectly illustrates how combining SMC with MMC enhances your trading edge. It’s not about predicting price, but understanding structure, reading psychology, and entering at high-probability points.

Whether you're a scalper, day trader, or swing trader, using curve-based mapping like the Black Mind Curve gives you a fluid understanding of price, beyond rigid lines and lagging indicators.

💡 Final Thoughts:

📈 Follow the Story, Not the Noise.

📉 Enter Where It Makes Sense, Exit Where Others Get Emotional.

⚡ Use MMC to Read What the Market is Really Saying.

✅ Action Plan:

🔍 Monitor price in the Next Reversal Zone.

📉 Look for exhaustion signals before considering shorts.

🟢 If bullish continuation holds above target zone, next micro-level target would be derived from 1.618 Fibonacci extension.

EURUSD Weekly Analysis (MMC) – Bearish Path to Target Zone📈 Market Narrative – Understanding EURUSD's Path with MMC

The EURUSD pair is currently navigating a critical phase in its macro price structure, aligning closely with the Mind Market Concept (MMC) methodology — a trading framework rooted in institutional price behavior, psychological arcs, and structured market mapping.

This chart reveals a story of accumulation, expansion, manipulation, and rebalancing — classic smart money behavior playing out on the higher timeframe. The current move is not just price action — it's a strategic delivery of price toward imbalance, guided by volume vacuums, liquidity zones, and engineered traps.

🧩 Phase-by-Phase Technical Analysis

🔷 1. Arc Accumulation Zone – The Beginning of Institutional Positioning

In the latter half of 2024, EURUSD entered a rounded arc formation, which marks a textbook accumulation phase.

This "bowl-like" curve represents gradual absorption of sell-side liquidity by institutions.

The lows became progressively higher, indicating demand stepping in while supply weakened.

Volume during this time was suppressed — another smart money tactic to accumulate without causing price spikes.

📌 Why This Matters: Arcs often precede explosive breakouts, particularly when aligned with time-based liquidity cycles (quarterly/yearly rebalancing). This zone gave birth to the breakout that followed.

🔷 2. The Central Zone – Consolidation Before Expansion

Once the arc base was complete, price broke out impulsively, then pulled back into what is labeled the Central Zone.

This zone acts as a mid-range liquidity pocket — where orders are stacked and reaccumulation occurs.

It also became the launchpad for the final markup wave that tapped the previous target around 1.1250.

🔍 This move was the realignment phase, where smart money took price above key highs to:

Hit their internal targets.

Trap breakout traders.

Induce euphoria before distribution.

🔷 3. Major BOS – Break of Macro Structure

The breakout through 1.1150–1.1200 confirmed a Major Break of Structure (BOS).

This BOS acted as a signal for:

Trend reversal confirmation for many retail traders.

A "green light" to buy — which was anticipated and exploited by institutions.

But here’s the twist:

Price rejected the SR Interchange Zone (support turned resistance), signaling that the breakout was engineered to trap liquidity.

🔷 4. Distribution & Manipulation – The Trap Layer

The chart clearly shows two critical supply areas:

Minor Resistance (around 1.1400s)

Major Resistance (around 1.1550–1.1600s)

Price briefly approached these zones but failed to hold, forming a complex distribution range.

This is where:

Smart money distributed their long positions.

Retail buyers got trapped.

Volume increased during sell-side preparation.

📌 The rejection from these zones sent price into a clean markdown, forming lower highs and confirming the bearish structure mapping.

🔷 5. Structural Mapping – Downtrend Control

Price action is now clearly in a bearish delivery phase, as shown by:

Lower highs & lower lows

Repeated rejections from minor resistance

Large red candles with little retracement (showing momentum)

This phase is often misunderstood by retail traders. But within MMC, it’s identified as the delivery to imbalance — a controlled descent into unmitigated demand.

🔷 6. Target + Reversal Zone – Where the Real Opportunity Begins

We are approaching the most important area on the chart:

🟡 Target + Reversal Zone (around 1.0950–1.1000)

This zone is not randomly drawn:

It's the origin of the arc breakout, a high-volume node.

It's a discounted price level where institutions may re-engage.

It’s untapped demand from the earlier accumulation — meaning no major reaction has occurred here yet.

If price slows down here, forms a liquidity sweep, or gives a bullish engulfing on the lower timeframe — this could be the reversal point.

But:

If price slices through with strong momentum, it may signal macro weakness, opening room to test the 1.0800 region.

🧭 Trade Plan & Execution Guide

Setup Type Actionable Guidance

📉 Bearish Pullback Entry Short entries near 1.1300–1.1350 with stop above minor resistance

🟡 Demand Reversal Watch Wait for reaction in 1.0950–1.1000, assess volume & candle response

📊 Structure Confirmation Use lower timeframe BOS for entry alignment

🛡️ Risk Management Keep risk below 1% per trade, avoid chasing mid-zone prices

💬 Key Takeaways

EURUSD has completed its accumulation → expansion → manipulation cycle.

We are now entering the rebalancing phase, where the market returns to fair value (demand).

Smart money flow is visible — from engineered highs to controlled selloffs.

The Target + Reversal Zone will likely dictate the next macro direction.

$BTC – Breaking Out of the Pattern?📈 Bitcoin ( CRYPTOCAP:BTC ) is testing the upper resistance zone of a multi-month structure.

✅ Break of Structure (BOS) has already occurred, adding fuel to the bullish case.

🚀 Just a bit more upside and CRYPTOCAP:BTC could escape this consolidation pattern completely.

Key levels to watch:

Break above ~$110K area

Green trendline remains strong support

Eyes on higher timeframe close to confirm breakout

This could be a pivot point for Bitcoin’s next leg higher — or a trap if sellers step in hard.

BTCUSD – 5M Premium Zone Rejection | Short Setup Activated🧩 BTCUSD – 5-Minute Breakdown | May 4, 2025

The BoS has happened, but don’t let it fool you — price just entered the danger zone. This is where Smart Money loves to trap late longs and send price tumbling.

🧠 SMC Playbook:

🔨 BoS Identified: Minor bullish BoS after initial reaction from the previous low.

🟥 Supply Zone (Entry Area): 79%–100% retracement zone from the latest swing high to low.

🔄 Reversal Point: Entry just above the 79% zone (95,499–95,629).

🎯 Target: Weak Low = 95,200

🧼 Stop-Loss: Above 95,629 (structure invalidation)

📏 RR Ratio Potential: 1:3 to 1:4+

🔎 Narrative:

Price is engineered to grab liquidity before making the real move. The Strong High acts as protection — Smart Money is defending this area. Once the premium fills, we expect a clean breakdown back into the discount zone.

📊 Key Observations:

❌ Buyers are likely trapped.

📍OB tapped + Fibonacci 79–100% = High confluence.

💥 Expecting liquidity sweep → sharp sell-off.

⏰ Execution timeframe = M1/M5 confirmation (engulfing, CHoCH, etc.)

📣 How to Trade It:

Monitor price action inside red zone (79–100%).

Wait for lower timeframe confirmation (e.g. bearish engulfing, M1 CHoCH).

Short from ~95,500 with SL above 95,630.

TP at Weak Low → potential extension to 94,800 if momentum kicks in.

🧠 Chart Ninja Tip:

“Don’t chase price — trap it. Let price come to you and confirm. The premium zone is where trades go from good to god-tier.”

💬 Drop a 🧠 if you’re watching this level too.

📈 Save this chart for your next sniper entry.

🔁 Share it with your SMC crew and ride the liquidity wave!

BTCUSD 15M | Order Block Slam + Channel Break | 1:4+ RRR Setup🧠 BTC/USD Breakdown — Smart Money Style | May 17, 2025

This one’s textbook bearish premium reaction — the kind of move that wipes out late buyers and fills institutional orders. Let’s zoom into this juicy setup ⬇️

🧩 1. Smart Money Context

Price climbs inside a rising wedge structure

Enters premium zone and taps a defined 🔮 Order Block (OB)

OB rejection confirmed with:

Liquidity grab

Bearish engulfing

Channel break 🚨

🎯 2. Trade Details

Entry: 103,500 – 103,800 (OB zone)

SL: 103,850

TP Zones:

TP1: 103,000 (OB base)

TP2: 102,500

TP3: 101,420.70 (full breakdown completion + imbalance fill)

Risk-to-reward: 1:3 to 1:4.5+ depending on your exit style.

🔍 3. Why This Setup Works

Order Block marks institutional selling zone

Liquidity sweep triggers false breakout trap

Channel break with volume confirms momentum shift

Final candle closes with strength — this ain’t no fakeout

This is how smart money loads up and leaves retail chasing ghosts 👻

📉 Missed the initial entry? Watch for a pullback to the OB for a possible second chance!

🔥 Final Note:

The weekend price action often moves erratic, but this setup shows institutional control — wait for confirmation and let price do the heavy lifting 🧘♂️

💬 Drop your thoughts: bullish retest or straight dump incoming?

📲 Follow @ChartNinjas88 for clean, no-BS smart money analysis every day!

Market Structure Shift Meaning and Use in ICT TradingMarket Structure Shift Meaning and Use in ICT Trading

In ICT (Inner Circle Trader) trading, understanding Market Structure Shifts (MSS) is crucial for accurately interpreting market trends and making informed trading decisions. This article delves into the significance of MSS, its distinct indicators, and how it integrates with other trading elements like Breaks of Structure and Changes of Character.

Understanding Breaks of Structure and Change of Character

Comprehending the dynamics of Breaks of Structure (BOS) and Change of Character (CHoCH) can be crucial for analysing market trends. A Break of Structure occurs when price levels move beyond established support or resistance areas, indicating a potential continuation or acceleration of the current trend. For example, in an uptrend, a BOS is identified when prices break above a previous resistance level, suggesting further upward movement.

Conversely, a Change of Character signifies a possible shift in the market's direction. This occurs when the price action breaks against the prevailing trend, challenging the recent high or low points that served as market barriers. A CHoCH often raises a red flag about the sustainability of the current trend. For instance, in a sustained uptrend, a CHoCH would be marked by a significant downward breach that violates a previous low point, hinting at a weakening of bullish momentum.

Both BOS and CHoCH are pivotal in the ICT (Inner Circle Trader) methodology, where they are used to gauge market sentiment and potential shifts in trend dynamics. Traders monitor these patterns to adjust their strategies, whether to capitalise on the continuation signalled by a BOS or prepare for a trend reversal suggested by a CHoCH.

What Is a Market Structure Shift?

MSS, meaning a Market Structure Shift, is an indicator of a significant change in the prevailing trend, marked by a series of patterns that suggest a reversal is imminent. An ICT MSS is more than a simple Change of Character (CHoCH); it includes additional signals that strengthen the case for a directional change.

The process begins with a shift in market structure that fails to sustain the ongoing trend. For example, during an uptrend, the market might fail to make a new higher high, instead forming a lower high. This initial deviation raises a caution flag about the trend’s strength.

The confirmation of an MSS in trading occurs when there is a decisive break of a significant swing point, accompanied by a strong impulse move that deeply penetrates through this point, known as a displacement. This displacement is critical—it’s not merely a slight breach but a robust move that clearly indicates a shift.

In essence, an MSS signals that the current market momentum has not only paused but is likely reversing. For traders, this is a pivotal moment: the lower highs in an uptrend or the higher lows in a downtrend prior to the break suggest that a new opposite trend is starting to take shape.

How to Use a Market Structure Shift in Trading

An MSS ultimately serves as a directional tool. It helps traders understand when a potential trend reversal is underway, enabling them to align their strategies with the new market direction.

To effectively use an MSS in trading, traders often follow these steps:

- Observing Current Market Structure: They start by analysing the existing trend direction and key price levels. Understand whether the market is in an uptrend, downtrend, or sideways movement by identifying patterns of higher highs and higher lows or lower highs and lower lows.

- Watching for a Break in Key Levels: The core of an MSS is the break of an important high or low, combined with a sharp price movement that breaches a significant swing point (displacement).

- Confirming with News Releases: MSS often coincides with major economic announcements or news releases that can affect market sentiment significantly. For example, if there's a report indicating unexpectedly high US inflation rates, and this correlates with a sharp downward movement in EURUSD, it provides additional confirmation of the MSS. A stronger dollar against the euro, in this case, would signal a clear shift in market direction towards favouring the dollar.

By recognising these elements, traders can more confidently anticipate and adapt to changes in market direction. A well-identified MSS not only indicates a pause in the current trend but also the establishment of a new trend.

Using Market Structure Shifts With Other ICT Components

Using Market Structure Shifts with other Inner Circle Trader methodology components like break of structure, order blocks, and fair value gaps may enhance a trader's ability to interpret and react to market dynamics.

Integrating MSS with ICT Market Structure

An MSS identifies a potential reversal in the market’s direction. When an MSS occurs, it often leads to the formation of a new high-low range in the direction of the new trend. For example, if a bearish MSS results in a new lower high and lower low, traders can watch for a BOS of this range. A retracement back inside of the new range can signal a decent area to search for an entry to ride the trend that’s just beginning.

Utilising Order Blocks and Fair Value Gaps

However, there are scenarios where the price doesn’t establish a new high-low range but instead returns to the area where the original displacement occurred. This displacement often leaves behind a fair value gap and an order block.

- Fair Value Gap: This is a price range that the market skips over quickly during a displacement, leaving it untested by typical market trading. It often acts like a vacuum, drawing the price back to fill in the gap at a later stage.

- Order Block: An order block is typically a consolidation area that precedes a strong price move and is considered a footprint left by institutional traders. It represents levels where significant buying or selling occurred, potentially acting as support or resistance in future price movements.

If the price returns to fill a fair value gap and enters the order block, this scenario can provide a potent setup for a reversal. Traders might look for confirmatory signals at these levels to enter trades that anticipate the market returning to its previous course or extending the reversal initiated by the MSS.

The Bottom Line

The insights provided on MSS and its application within the ICT trading framework can be instrumental for any trader seeking to navigate the complexities of the market effectively. To put these strategies into practice and potentially improve your trading outcomes, practice a lot and learn more about ICT trading.

FAQs

What Is a Market Structure Shift?

A Market Structure Shift (MSS) indicates a potential reversal in market trends, marked initially by a lower high in an uptrend or a higher low in a downtrend, followed by a displacement—a significant and rapid price movement that decisively breaks through a key market level.

How to Identify Market Structure Shift?

Identifying an MSS involves observing for early signs of trend weakening (lower highs or higher lows) and waiting for a subsequent displacement that confirms the shift. This displacement should significantly penetrate a key swing point, clearly indicating a new direction in market momentum.

What Is the ICT Method of Trading?

The ICT (Inner Circle Trader) method of trading is a comprehensive approach that utilises various trading concepts such as market structure, order blocks, and fair value gaps, focusing on how institutional traders influence the market. It emphasises understanding and leveraging these components to align trading strategies with probable market movements.

What Is the Difference Between MSS and BOS in ICT?

In ICT, a Market Structure Shift (MSS) refers to a potential trend reversal, confirmed by a lower high/higher low followed by a displacement. A Break of Structure (BOS), however, simply indicates the continuation or acceleration of the current trend without necessarily suggesting a reversal, marked by the breach of a key high or low point within the ongoing trend direction.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.