Market Structure - The Chart analysis (simplified!!!)Using Market Structure to identify entries in the FX market has been a life changing technique for me. Through this video, i described my process of entering trades using MS without a single indicator in sight!!!

You'll see the following :

1. How to draw support and resistance.

2. How to identify the trends in a market ? What is a Break of Structure ?

3. Avoiding fake outs using the Law of 2's (by waiting for two consecutive HH's and HL's | LH's and LL's).

4. What is a Major Level ? Is it really useful to my analysis?

5. How to determine Take Profit using MS.....etc

Breakofstructure

Update on Long NZDCADPrice pulled back and tested the break of structure, which correlated with the neckline of the double bottom, and the 61.98 fib level (if you drew a fib from the new low to the new high on the 4hr timeframe.)

I am expecting price to to ultimately test the previous higher low, which also correlates with the daily resistance and the 61.8 fib level.

Take a look at the original analysis

Shorting NZDJPY I am looking to short NZDJPY.

Originally price was making a higher highs and higher lows.

Price then entered the monthly/weekly resistance supply zone.

Price than formed what appears to be a double top, and price has been unable to break through.

Also a double top at the end of an uptrend can serve as a bearish reversal pattern. That along with price respecting the supply zone is a strong

confluence.

Price made a bearish move out of the monthly/weekly supply zone and formed a new low. This is known as a break of structure, price is expected to reverse it's trend.

When a break of structure occurs, price is expected to retrace to at least the 50.0 fib level to confirm this break of structure. Price ended up retracing to the 61.8 fib level and formed a doji candlestick (this also signals a possible reversal), ultimately forming a Lower high.

Now I am price to make another move to the downside.

$ETH - Bullish Buy Entry Since Break Of Structure (1496)Since the most recent low of 1293, we have surpassed an intermediate high signifying a break of structure, hopefully turning a bit more bullish although I fully expect ETH to go sideways for quite some time due to gas fees and Cardano and PolkaDot taking up market share. Nevertheless, Etheereum is still in a class of it's own. I am expecting a pull back below current sell-side liquidity points but not lower than the bounce at 1420 or else that would shift the market structure bearish again in which you should be out of the trade anyway. Exit strategy would be to aim for equal highs where there are around 1605, 1677, and the last spike up around 1715. The third target is at the 162% extension which is a great confluence with this trade. These are my take profit zones.

Checking on the 4 hour time frame is where I derived most of this idea. However there is a small gap that it could reach if it does get past the stop loss. 1398 -1413 is the "NO, But if Yes Entry" Zone. I don't want to see it get here but if it does I will reluctantly enter a trade once it EXITS this zone, not while it is entering it as it could drive down even further.

Let me know your thought's. And Good Luck!

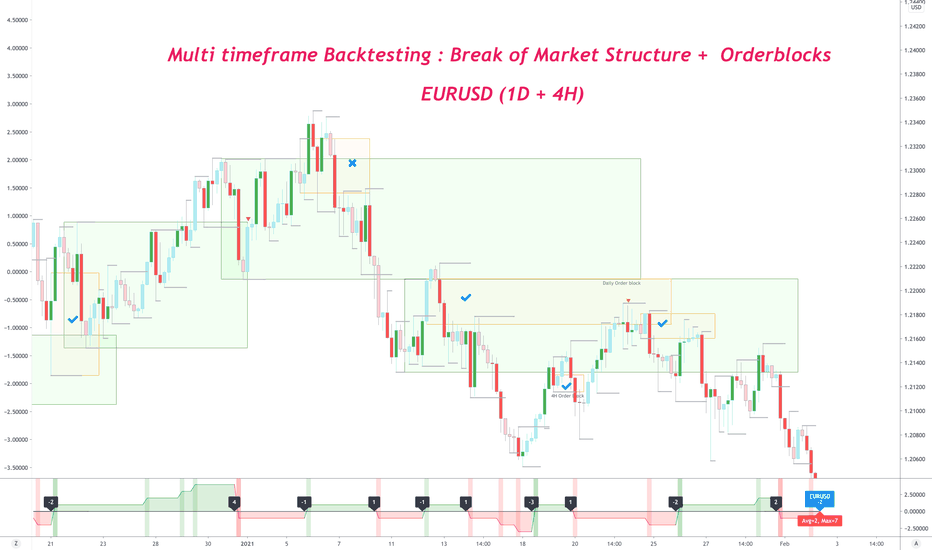

Backtesting retest Break of Market Structure on Multi TimeframeStrategy

Create a zone from the order block which created break of market structure on 1D timeframe

Wait for it to be tested on 4H timezone => which will create new 4H order block

Trade the retest of that 4H order block

Color coding & icon use

Green boxes : 1D order block zone

Yellow boxes : 4H order block zone

Tick icon : Trade won on 4H

Cross icon : Trade lost on 4H

Circle with cross icon : Trade in breakeven

Win / loss assumptions

Win : 3R movement without breaking -1R

Loss : -1R movement

Breakeven : 1R movement, followed by -1R movement

Risk Management

50% TP @ 1R

25% TP @ 2R

25% TP / Trade closure @ 3R

RR achieved = 3R

Net R achieved = 1.75R

Strategy results

Testing duration : Jan 2020 - Jan 2021

Wins = 16

Loss = 7

Breakeven = 4

Non-losers = 74%

Absolute Winners = 59%

Net RR = 21

Avg R/Win = 1.31R

Avg R/Trade = 0.78R

$ETH - Be Wary - One Final "Drop" May Happen Before the Big PushI'm Bullish on Ethereum all the way. Now yesterday I made a call and so far we're still in profit from that call. However, there was a drop in the middle of the night (London session) That made me take a step back and look at it from another perspective. One thing I do is I usually don't measure wicks on the fib for entries to trades. However, this could be a different scenario to where that may play out. Why? Because there are equal lows right around 1152 that happened on January 15-16 GMT .

Just below that is a Bullish Order Block. I jumped into the 5 min Chart to find this one. It's in the red Elipse just below the Liquidity/Support Level.

Which is also right at the 70.5% of the retracement from that deep low to the current high.

Also if you look at It from a 4HR view, There are no bearish 4 hr candles, possibly suggesting this is the overall correct fib.

Keep in mind there has been a break of structure that happened yesterday which is suggesting that the price will most likely be going higher. This of course will be nullified if the price breaks and stays below a significant low. But instead, I think we may see something like this to where it get's close but it will just wipe out the liquidity resting near that 1152 level and hit somewhere between 1133 and 1142 before it bounces back up and we see a new high again.

I pulled from another exchange for these prices and the equal low/liquidity level ended up being the same (1152), the Bullish order block ended up being the same (1133 - 1142) But the biggest difference was the spike down where we would draw the fib low or 100% level. The one in the examples low is 1072. The low in the Coinbase level was 1065. But of a difference there, which is why I said I don't like using wicks to measure these things. So just be wry of those price levels and don't be so worried about the Fibonacci entry.

Good Luck and Happy Trading

AUDCAD - 4H is finally making a move for a possible LL.4H - its been a week that ACAD is looking to form LH and we are at major zone where it could reject the heavy volume of buyer. Our first sign of sellers is on 15m.

15m-Double top + Breakout of the trendline + Break of structure making a LL. Right now waiting for the LL to LH move and take a short.

Follow us for more ideas and setups.

Sam

Determine Trend Reversal Using RSI Indicator With Price Action1. Price created lower low and RSI higher low (tight divergence - oversold).

2. Reversed on demand zone with candlestick pattern.

3. Broke down trend structure with retest as confirmation.

4. Price went above 200 EMA and used it as support.

USD/CAD LONG Looking for a intraday/swing to the projection of 134.800. It is NFP week so markets tend to bounce however it wants to bounce. We haven't broken structure to the change the sentiment of the overall trend as of yet so this would be my counter. Project lines up with a QP and resistance area on the daily chart.