EUR_CHF BEARISH BREAKOUT|SHORT|

✅EUR_CHF broke out

Of the bearish wedge pattern

So we are locally bearish

Biased and we will be

Expecting a further

Bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Breakout

Euro will rebound from support area and continue to move upHello traders, I want share with you my opinion about Euro. This chart illustrates how the price entered an upward channel and immediately broke below the 1.0500 support level. After trading for some time within the buyer zone, it dropped to the support line. Following this move, the Euro reversed and started climbing, eventually reaching the 1.0500 level again, breaking above it, and making a retest. The price then continued to rise and later reached the current support level, which coincided with the support area and the channel's trend line, where it traded for a while. Soon after, the Euro broke through the 1.0805 level and remained within the support area for an extended period before climbing to 1.0945. At that point, it reversed and started declining. The Euro quickly dropped to the support line of the channel and then bounced back up. However, it recently fell again to the support line of the channel, where it has been gradually moving higher since. Given this setup, I expect the Euro to decline to the support area before rebounding and continuing its upward movement within the channel. Based on this, my TP is set at 1.1150. Please share this idea with your friends and click Boost 🚀

HelenP. I Gold will continue to move up in upward channelHi folks today I'm prepared for you Gold analytics. Looking at the chart, we can see that the price entered the channel and began moving higher along the trend line. Soon, it climbed to Support 2, which aligned with the support zone, broke this level, retested it, and then continued its upward movement. Later, Gold reached Support 1, which also coincided with a support zone. Shortly after, it broke this level as well, reaching the resistance line of the channel before making a correction to another support zone. The price traded around this area for some time before making a corrective move below Support 1, even briefly breaking the trend line in a false breakout. However, it quickly resumed its upward movement within the channel. Gold then broke through Support 1 again, retested it, and rebounded from the support zone. Based on the current structure, I expect XAU/USD to make a corrective move toward the trend line before continuing its growth inside the upward channel. Given this scenario, my goal is set at 3070 points. If you like my analytics you may support me with your like/comment ❤️

Orbs to provide a 20x?Welcome back dearest reader!

Today we will analyse another project called Orbs. Looking at their website the fundamentals look great! But other than that, the chart also looks fantastic!

When looking at past performance its clear orbs has been in a massive flag formation since march 2021, it has broken out in october 2023 and has just now touched a very important support zone! Expecting upside momentum from here untill august.

Target: 0.40$

Stoploss: 0.0145$

EUR/GBP Technical Analysis - 4H Chart

📌 Pair: EUR/GBP

📈 Current Price: 0.84092

Key Levels:

🔹 Support Zone: 0.83766 - A key area where price has previously bounced.

🔹 Resistance Zone: 0.84400 - A strong resistance level where price has faced rejection.

🔹 Target Level: 0.85004 - Potential bullish target if price breaks above resistance.

Market Structure & Trade Idea:

EUR/GBP has shown strong bullish momentum, breaking above the support zone (0.83766).

Currently, price is testing the resistance level. A slight pullback toward support could provide a new buying opportunity.

A break above resistance would confirm bullish continuation toward 0.85004.

Trading Plan:

✅ Bullish Scenario: Wait for a pullback to 0.83766 before entering long, targeting 0.85004.

✅ Bearish Scenario: If price breaks below 0.83766, a deeper retracement to 0.82652 may follow.

🔍 Watch for:

Breakout confirmation above resistance.

Strong rejection from support before entering a trade.

GBP/USD Market Outlook & Analysis (Bullish)**GBP/USD Market Outlook & Analysis**

**📊 Price Action & Key Levels**

- **GBP/USD trades around 1.29300** in a narrow range, struggling for momentum.

- Last week’s **high of 1.29900** remains a key resistance level.

- **Key Support Levels:**

- **1.29000 (Psychological level)** → A breakdown may trigger more downside.

- **1.2850 (Next key support)** → Watch for buying interest.

- **Key Resistance Levels:**

- **1.2990 (Last week's peak)** → A breakout could open doors for **1.3050+.**

**🌍 Fundamental Drivers**

- **USD Weakness:**

- Fears that **Trump’s tariffs could slow the US economy** weigh on the dollar.

- Weak US inflation and a **cooling labor market** increase **rate cut expectations** for 2024.

- University of Michigan’s **Consumer Sentiment Index fell** to a 2.5-year low, fueling bearish sentiment.

- **GBP Struggles Despite BoE Expectations:**

- **UK GDP contracted by 0.1% in January**, capping the pound’s upside.

- However, **expectations that the BoE will cut rates more slowly than the Fed** provide support for GBP/USD.

**📅 Key Events to Watch**

- **Monday:** US **Retail Sales & Empire State Manufacturing Index**.

- **Wednesday:** **FOMC meeting** → Market expects no rate change but will closely watch guidance.

- **Thursday:** **BoE meeting** → If policymakers signal slower rate cuts, GBP could strengthen.

**📈 Trading Strategy & Takeaways**

- **Bullish bias above 1.29300** if the dollar remains under pressure.

- **Break above 1.29400** could see GBP/USD testing **1.3050** in the short term.

- **If 1.29000 breaks,** watch for a potential dip toward **1.28500** before buyers step in.

- **Major volatility expected midweek** with FOMC & BoE—trade cautiously!

📢 **Final Word:** GBP/USD remains in a tug-of-war between a weak USD and soft UK data. Stay patient and wait for confirmation before making moves! 💹🔥 #Forex #GBPUSD

EUR-CHF Bearish Wedge Pattern! Sell!

Hello,Traders!

EUR-CHF was trading in an

Uptrend but the pair has formed

A bearish wedge pattern so

IF we see a bearish breakout

From the wedge we will be

Expecting a bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD/USD Long Setup – Breakout Confirmation & Smart Money SupportTechnical: NZD/USD has broken above 0.5572 resistance, confirming a bottom. This level should now act as support on any pullbacks. Look to enter between 0.5762 – 0.5572, with an upside target of 0.5870. Place a stop loss at 0.5730 to manage risk.

Fundamental: The U.S. dollar is seeing continued selling pressure from commercial participants, while NZD is being accumulated—suggesting smart money positioning for further upside.

Seasonal: Historically, NZD/USD has risen 66.67% of the time between March 17 – April 12, with an average return of 1.31% over the past 21 years.

Trade Idea:

Entry: 0.5762 – 0.5572

Stop Loss: 0.5730

Target: 0.5870

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BNB/USDT: BREAKOUT SETUP!!🚀 Hey Traders! Ready to Ride the BNB Breakout? 👋

If you’re hyped for this setup, smash that 👍 and hit Follow for elite trade ideas that actually deliver! 💹🔥

🔥 BNB Breakout Alert – Big Move Incoming! 🔥

BNB is looking strong and bullish, breaking out from a bull flag formation on the 4H timeframe. If it holds above the flag, we could see a massive 40% surge! 📈

💰 Trade Setup:

📍 Entry Range: $588 - $600

🎯 Targets: $628 / $688 / $746 / $794 / $844

🛑 Stop-Loss: $566

⚡ Leverage: Low (Max 5x)

🔎 Strategy: Enter with low leverage now, add more on dips, and ride the momentum to higher levels!

💬 What’s Your Take?

Are you bullish on BNB’s breakout potential? Share your analysis, predictions, or strategies in the comments! Let’s secure those gains and ride this wave together! 💰🚀🔥

PIPPIN/USDT: LONG TRADE SETUP!!🚀 Hey Traders! PIPPIN Breakout Alert – Big Move Incoming? 👀🔥

If you’re excited for this setup, smash that 👍 and hit Follow for high-quality trade ideas that actually deliver! 💹🔥

🔥 PIPPIN Breakout & Retest – Time to Pump?

PIPPIN has broken out of a falling wedge on the 2H timeframe and is now retesting the breakout level. If this retest holds, we could see a strong rally ahead! 🚀

💰 Trade Setup:

📍 Entry: CMP, add more up to $0.019

🎯 Targets: $0.0225 / $0.0252 / $0.0294 / $0.0334

🛑 Stop-Loss: $0.018

⚡ Leverage: Low (Max 5x)

🔎 Strategy: Enter with low leverage now, scale in on dips, and ride the momentum to key targets!

💬 What’s Your Take?

Are you bullish on PIPPIN’s breakout? Drop your thoughts, analysis, and predictions in the comments! Let’s secure those gains and ride this wave together! 💰🚀🔥

AUD-CHF Move Up Expected! Buy!

Hello,Traders!

AUD-CHF made a bullish

Breakout of the key horizontal

Level of 0.5576 and the

Breakout is confirmed

Because the daily candle

Closed above the key level

So on the market open

We will be expecting a

Local pullback and then

A strong move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_CAD WILL FALL|SHORT|

✅GBP_CAD broke the rising

Support line after trading in an

Uptrend for a long time so

We will be awaiting a long

Overdue correction and a

Move down on Monday

Towards the target of 1.8500

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

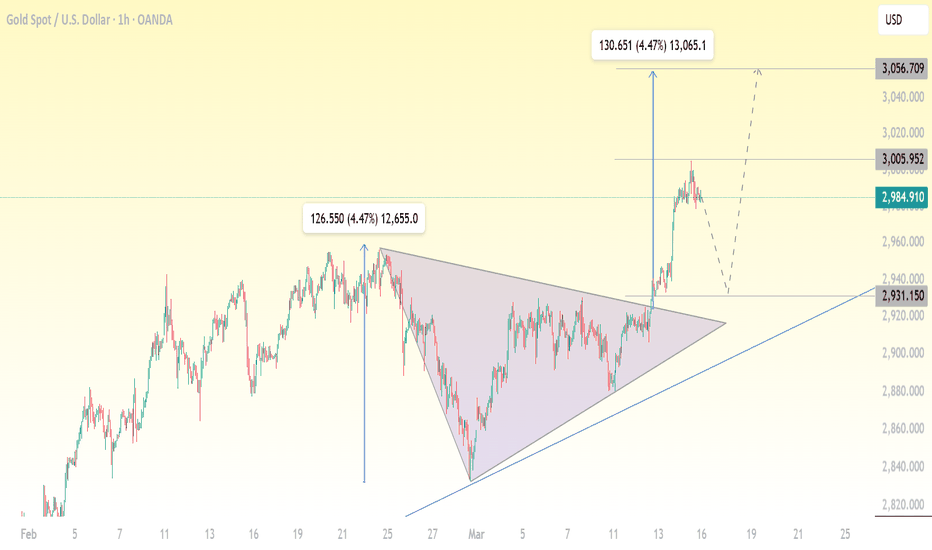

XAU/USD Breakout – Trend Continuation or Pullback?Gold (XAU/USD) has recently broken out of a symmetrical triangle pattern, signaling strong bullish momentum. This breakout was accompanied by a price surge of approximately 4.47%, pushing the price towards the $3,005 resistance level.

The question now is: Will gold continue its bullish trend, or will we see a pullback before the next move?

📊 Technical Analysis:

1️⃣ Symmetrical Triangle Breakout

The symmetrical triangle pattern formed over several weeks, with price consolidating within the narrowing structure.

A clear breakout above the triangle confirms the bullish momentum, suggesting further upside potential.

2️⃣ Measured Move Target

The breakout's measured move (equal to the height of the triangle) projects a potential target near $3,056.

This level aligns with a historical resistance zone, making it a key level to watch.

3️⃣ Key Support & Resistance Levels

✅ Resistance:

$3,005 – Recent high where price is currently facing resistance.

$3,056 – Next major upside target, based on the breakout projection.

✅ Support:

$2,931 – Previous breakout zone; a retest could confirm support before another rally.

Ascending Trendline – Acting as dynamic support for the ongoing uptrend.

📉 Potential Scenarios to Watch:

✅ Bullish Case: Trend Continuation

If the price consolidates above $2,984-$2,931, buyers may push gold towards $3,056 and beyond.

A strong breakout above $3,005 with volume confirmation will likely signal further bullish strength.

❌ Bearish Case: Pullback Before Rally

Gold may retrace towards $2,931 (previous resistance turned support) before resuming its uptrend.

A break below $2,931 could lead to deeper retracement, possibly testing the ascending trendline.

🔍 Trading Strategy & Considerations:

📌 Bullish Traders: Watch for support at $2,931 and a break above $3,005 for confirmation of the next bullish leg.

📌 Bearish Traders: Look for a failed breakout above $3,005 or a rejection at $3,056 for short-term pullback opportunities.

💡 Final Thoughts:

Gold remains in a strong uptrend, with bullish momentum intact. However, a pullback before the next leg up remains a possibility. Traders should monitor key levels and price action confirmations for the next move.

🚀 What’s your outlook on gold? Drop your thoughts in the comments!

Momentum Trading Strategies Across AssetsMomentum trading is a strategy that seeks to capitalize on the continuation of existing trends in asset prices. By identifying and following assets exhibiting strong recent performance—either upward or downward—traders aim to profit from the persistence of these price movements.

**Key Components of Momentum Trading:**

1. **Trend Identification:** The foundation of momentum trading lies in recognizing assets with significant recent price movements. This involves analyzing historical price data to detect upward or downward trends.

2. **Diversification:** Implementing momentum strategies across various asset classes—such as equities, commodities, currencies, and bonds—can enhance risk-adjusted returns. Diversification helps mitigate the impact of adverse movements in any single market segment.

3. **Risk Management:** Effective risk management is crucial in momentum trading. Techniques such as setting stop-loss orders, position sizing, and continuous monitoring of market conditions are employed to protect against significant losses.

4. **Backtesting:** Before deploying a momentum strategy, backtesting it against historical data is essential. This process helps assess the strategy's potential performance and identify possible weaknesses.

5. **Continuous Refinement:** Financial markets are dynamic, necessitating ongoing evaluation and adjustment of trading strategies. Regularly refining a momentum strategy ensures its continued effectiveness amid changing market conditions.

**Tools and Indicators:**

- **Relative Strength Index (RSI):** This momentum oscillator measures the speed and change of price movements, aiding traders in identifying overbought or oversold conditions.

- **Moving Averages:** Utilizing short-term and long-term moving averages helps in smoothing out price data, making it easier to spot trends and potential reversal points.

**Common Pitfalls to Avoid:**

- **Overtrading:** Excessive trading can lead to increased transaction costs and potential losses. It's vital to adhere to a well-defined strategy and avoid impulsive decisions.

- **Ignoring Market Conditions:** Momentum strategies may underperform during sideways or choppy markets. Recognizing the broader market environment is essential to adjust strategies accordingly.

By understanding and implementing these components, traders can develop robust momentum trading strategies tailored to various asset classes, thereby enhancing their potential for consistent returns.

Source: digitalninjasystems.wordpress.com

$4 to $16 with power hour making +60% run $10 to $16It was consolidating for 4 hours after morning news that investor or group purchased at least 5% stake in the company and filled with SEC. This made the stock pop to +150% on the day as traders speculated it could be a big reputable firm or individual so they want to be in as well. After strong support it moved further to +300% area total on the day and I warned everyone on time to get ready for $10 and $11 buys for the vertical new highs.

Last hour brought easy money NASDAQ:RGC

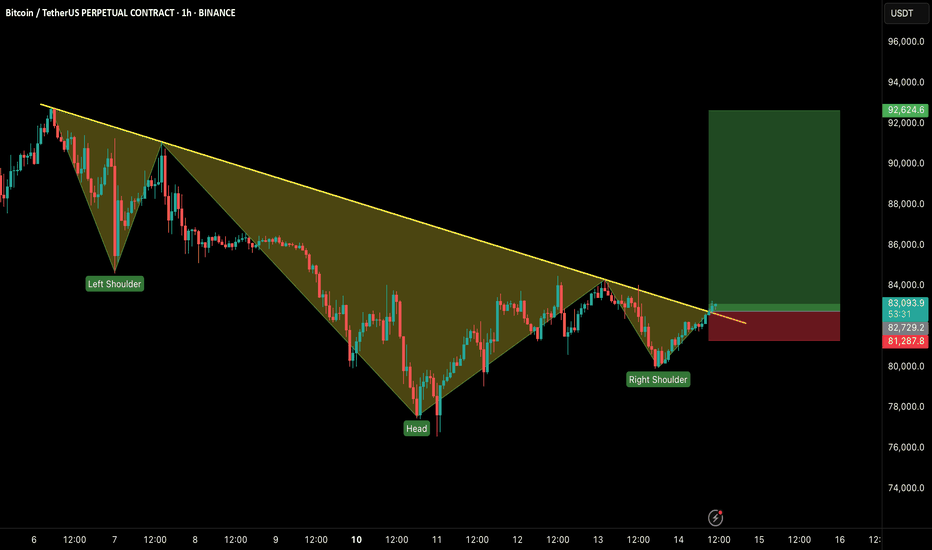

#BTCUSDT: BULLISH BREAKOUT IN LTF!!🚀 Hey Traders!

If you're finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver! 💹🔥

BTC is breaking out from an inverse head & shoulders pattern on the 1H timeframe, signaling strength! 📈 If it holds above the neckline, we could see a strong rally toward $90K– GETTEX:92K in the coming days! 🚀

🔹 Key Levels to Watch:

✅ Target: $90K– GETTEX:92K

❌ Invalidation: Close below $81,200

Momentum is building—can bulls take control? Let us know in the comment section.