VEDANTA LTD KEY ZONE..This is the 1 hour chart of VEDL.

VEDL is currently trading near its pattern (Broadening) resistance zone in the 462–465 range.

The stock is trading with in a channel, with its support zone in the 440–445 and resistance zone 485-495 range on the hourly chart.

If this level is sustain,we may see higher prices in VEDL

If VEDL breaks below its support zone, we may see lower levels around 415-405 range .

THANK YOU !!

Broadening-formation

Trading the MegaphoneEuro is trending up while the dollar is heading lower. We're at the bottom of the broadening formation, a break in LTF structure is a good trigger for a long to the top of the megaphone, not that I believe in LTF structure breaks per se - I'm already long.

Trade will take 2 - 4 days I expect. You can take profit at the top of structure (BSL), at the top of the broadening formation or at the daily swing high all the way up at 1.236 :)

Bearish on Bajaj AutoBajaj Auto (NSE Ticker: BAJAJ_AUTO) is forming two back to back bearish patterns on the hourly chart.

First bearish pattern: Broadening formation

Second bearish pattern: Head & Shoulders

We see high probability of fall in price in the coming days toward measured move and 200SMA target of 4410.

📢 The Broadening FormationA technical chart pattern recognized by analysts, known as a broadening formation or Megaphone Pattern, is characterized by expanding price fluctuation. It is represented by two lines, one ascending and one descending, that diverge from each other. This pattern typically appears after a significant increase or decrease in security prices and is denoted by a sequence of higher and lower turning points. Normally this pattern is visible when the market is at its top or bottom. The greater the time frame is better the pattern will work.

🔹How to identify

Generally, the Broadening Formation consists of 5 different swings. But the swing has to have a minimum of two higher highs and two lower lows. A trend line is drawn by connecting point 1 and point 3 while points 2 and 4 are also joined together to draw a line.

These two lines create a shape that looks like a megaphone or inverted symmetric triangle. These swings’ highs and lows have to close above or below its pivot line and therefore they will create swing high as pivot high (R1, R2, and R3) and swing lows as pivot lows (S1, S2, and S3).

A breakout occurs when the line does not respect its support or resistance line and closes outside the shape after making the 5th swing.

🔹Volume

Volume plays an important role when it comes to the recognition of this pattern.

In the Broadening Top, volume usually peaks along with prices.

An increase in the volume, on the day of the pattern confirmation, is a strong indicator.

🔹Failures

This pattern also can be traded when it fails but is necessary to identify the failure perfectly.

A failure can be spotted when it fails to break the trend line (upper or lower as the case may be) after completing the 5th swing.

Suppose in a bull market condition, this pattern is formed and if it fails to break the upper trend line, traders go short when the price goes below 3rd swing high (R2).

Similar is the scenario, when the market is in a bear phase and it fails to break the lower trend line (S2), traders take a long position when the price closes above the 3rd swing high.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

PEOPLEUSDT broadening pattern in ActionThe price is testing the daily resistance inside a broadening pattern.

At the moment the price is testing the 0.5 Fibonacci level on the Daily timeframe.

How to approach it?

IF the price is going to have a clear breakout and retest the resistance as new support, According to Plancton's strategy , we can set a nice order

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ black structure -> <= 1h structure.

–––––

Follow the Shrimp 🦐

AAPL - Sign and ConfirmationThe long upper wick of the candle is a sign of price rejection.

The first bearish pin bar on November 22, followed by another higher high long upper wick candle on December 1, is a sign that the trend is about to bend. Confirming the two sign is followed by another higher high with Bearish Engulfing Candle, this candle pattern could be the confirmation that the upward trend is done.

And also, if you draw a line, you can see that there is a Bearish Broadening Wedge forming.

SNAP Broadening Formation BreakoutHere we see a right angle broadening formation, with the accumulation line on the bottom.

What appears to be an island reversal pattern appeared in the daily chart, marked by the yellow rectangle, which is typical of congestion patterns like this.

Broadening formations are typical of late stage bull markets and are accompanied by irregular volume throughout.

A majority of broadening formations carry bearish implications, and a breakout occured today in SNAP, although not by the generally "safe" 3% margin.

I would expect a throwback, but the pattern implies a -65% move to the downside to 17.5, although not necessarily soon.

USOIL PossibilitiesUSOIL is trading in a broadening pattern. It just tested the support zone. If it is able to hold the support then it is likely headed for the top of the pattern. All bets off if the pattern is broken downwards.

Disclaimer: Not a recommendation to buy or sell.

Long term chart is also posted here.

HSBA trending downwards, currently holding supportJust throwing some lines on HSBC (HSBA) .

We have a broadening channel, higher highs and lower lows on a 20 year timeframe.

Currently in a downward trend on the monthly, just about holding historical support.

This would probably be a good place to exit if we are expecting a market downturn.

"These formations are relatively rare during normal market conditions over the long-term" - Investopedia

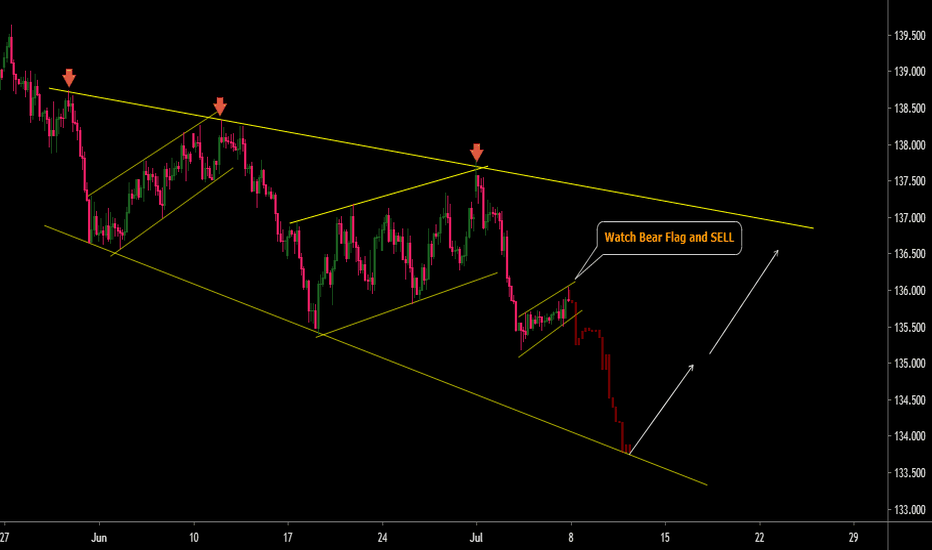

GBP/JPY : Buy and Sell Trade Setups Big Expanding descending Channel or Brod Formation of structure making in GBPJPY. Currently making a Bear flag to Short Term SELL Opportunity .

Buy on Third touch of structure after Confirmation in Lower Time frame -

Let See What Will be Next Move -

Warning- I m Not a Financial Advisor this idea Only For Educational Purpose Only.

Thank You !!

with earnings around the corner...can it finally break its resistance?

or will it fall back into its broadening formation?

The Strat broadening formations on weekly scale.Following from the smaller scale charts posted previously, weekly scale shows 2 triangles in action from outside bars. Missed the smaller scale one which perfectly tagged the recent low but i've done some more studying and almost completed the strat course, so my eye is sharpening every day. Larger scale triangle still has lower edge to tag, as previously mentioned it aligns with yearly pivots.

Bitshares Bullish Broadening Pattern...target Bullish bitshares broadening pattern shows the potential of a massive rise upon its next ascent...target to the $1.70+

CBRL Broadening Top and Upcoming Dividend! (Price target: ~$176)The Broadening Top pattern forms when the price progressively makes higher highs (1, 3) and lower lows (2, 4) following two widening trend lines. The price is expected to move up or down past the pattern depending on which line is broken first. A bit of a toss up since the broadening top formation appears much more frequently at tops than at bottoms, and therefore usually has bearish implications. In this case, however, we see a strong up-trend with an Average Directional Index just shy of the 25 mark. Set limit order above market price to be sure we are looking at a bull broadening top, or for added risk buy the retracement when RSI corrects below 70. For best results take 50% position at each. Consider stop-loss below breakout price.

Added confidence from the fact that Cracker Barrel is recording a $1.20/share dividend on Jan 11th, issued on Feb 5th. Dividend hunters could help drive this trend up. CBRL reports earnings 02/20 BMO and Estimize revenue expectations are 0.77% higher than Wall Street's.

Follow me on Twitter: twitter.com

$FB - The thumbs are pointing downwardThe FB daily shows a coil around the point of control in the 114s. A break north of the coil on weak volume, paired w/ a flat RSI, and MACD negative divergence indicate a potential reversal back into the coil. If the support in the 113s holds, the coil should then break north again. If it fails, it could result in a possible bow draw reversal of the coil, at which the next level of notable support is A move to that degree could result in a possible draw reversal to the lower support in the mid 109s.

Target area highlighted in yellow, which is also the .5 - .618 fibonacci levels.

FANGs - Wow. A lot goin on here.Busy chart, so bare with me. Bold call, but the more I look at the FANGs on a combined chart, the more I see an (incomplete) bump and run reversal (BARR) in blue.

A head and shoulders is present within a broadening formation in white, that gives room for the H&S to complete. Support in green, resistance in red.

Down.