How much can bitcoin go up and still be bearish?I tried to decide if I want to make this a "short" idea or a "neutral" one, but i decided to make it short because btc still hasn't passed the major resistance that it needs to pass to signal clearly that it's going to test new highs, and as long as it doesn't break that line at 12.2k I will not be expecting a retest of the highs for btc. to make a long story short just look at the chart and you can see the whole point- btc hasn't proven it's going up yet- but even if it will break that line and go up, even if it goes all the way up to 19k, as long as it's in that rising wedge- it would just be another up-leg in an over extended rally, and it would essentially just be going up to go back down again afterwords, probably to another 30% - 40% down from the peak at least.

Broadening

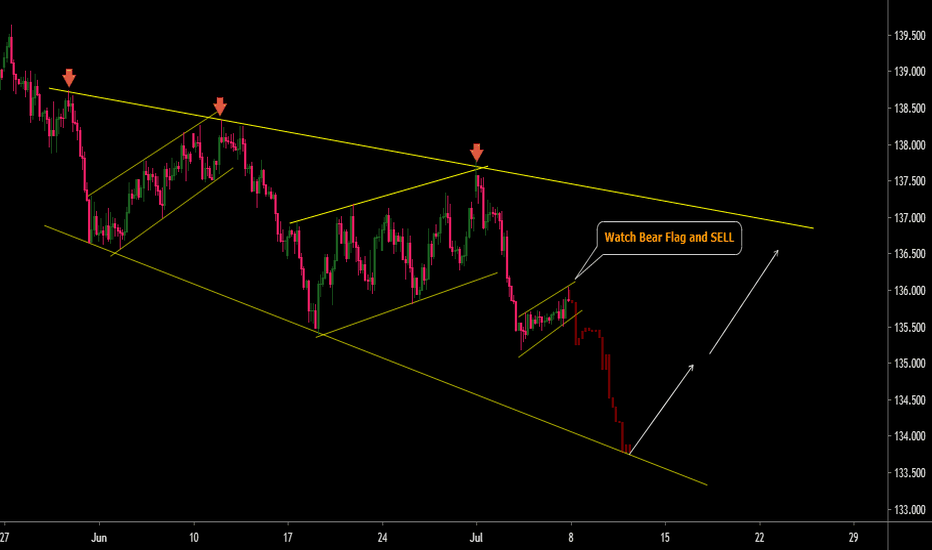

GBP/JPY : Buy and Sell Trade Setups Big Expanding descending Channel or Brod Formation of structure making in GBPJPY. Currently making a Bear flag to Short Term SELL Opportunity .

Buy on Third touch of structure after Confirmation in Lower Time frame -

Let See What Will be Next Move -

Warning- I m Not a Financial Advisor this idea Only For Educational Purpose Only.

Thank You !!

with earnings around the corner...can it finally break its resistance?

or will it fall back into its broadening formation?

A Right-Angled and Descending Broadening FormationsPeople are over exited about Inverted H&S formation or Small Triangle formations but they forget the bigger pattern makes the direction of market.

In daily chart I see this " Right-Angled and Descending Broadening Formations " which it can be Bullish or Bearish but in a down trend must of the time it breaks out bullish.

As I see it can breakout upward now but because the length of RADB pattern is short the breakout will not have enough energy to move up the price too much.

But if it not breakout and go down then it will touch the down trend line between 2.2K to 1.8k $.

For more information about RADB pattern read this page:

Right-Angled and Descending Broadening Formation

BTC breaks up from diamond; finds resistance at broadening wedgeSo its now looking like the diamond pattern may indeed be a diamond bottom rather than a bearish continuation diamond as we have broken bullishly upward...however 2 big resistance lines stand in its way that may be powerful enough to send it back down and create a bull trap. The top trendline of the falling broadening wedge(in green) and the 1 day 50ma just above that (not shown on the 4hr chart) these have both been very steady resistance and there's a chance one or the other have enough resistance power behind them to knock this pattern back downward. I would be more comfortable thinking the upward break is legit if we see price action rise above the head on the 1hr charts head and shoulder pattern and invalidate it...currently where price action has seen resistance is at the exact same height as the peak of the right shoulder which may be enough to trigger a double top on smaller time frames. This idea is being left neutral because although it looks pretty good for the bulls on the 4hr chart there' also plenty of resistance and bearish possibilities that could change that...if we can close the daily candle this high up and follow on the next 4hr candle with a big bullish surge then the bull break is legit if not there' is still time to fall..but considering there's no more room in the diamond I think we will need to see a bearish break below it this candle close instead of next. As always not financial advice just my own personal understanding of the current price action. I think a bull break takes us to 4.1k and a bear break to around at least 3.6k but either are currently possible with probability now currently favoring the bull break slightly more.

BTC broadening wedgeTo me, BTC seems to form a broadening wedge, a pattern that you rarely see on charts and that indicates rather emotional trading. I expect price to break the wedge to the downside soon, with a subsequent retrace to around 3750-3600, where it would find a lot of support (4h 200MA, Ichimoku cloud, VPVR). From there, there is a possible rally to around 4400 (resistance level and daily 50 EMA).

Let me know what you think, I'm new at this :)

And obviously, none of this is financial advice.

Dow Likely Entering Bear Market: Broadening Top; Bear Flag Ominous portents. Broadening top in September led to the microcrash in October and US Equities have been struggling since.

November usually one of the best months for stocks, has only been a down month in 3 years of past 20; those were in Bear Markets...

Some very fine textbook chart formations appearing over past few months. The Zig-Zag Correction has led to what appears to be the end of the Great Bull.

Fed will hike again next month and if they hike twice more we will get a recession starting in 2019. Earnings have already passed their halcyon days, look at Apple and NVidia, IBM and many other issues already entering bear markets. The power to drive this market to new heights has leaked out of the balloon, I'm afraid.

Spent a weekend reading Murphy's Technical Analysis of Financial Markets, Chapter 6: Continuation Patterns is a lovely read, quoted for your reading pleasure:

"The Broadening Formation is an unusual variation of the triangle and is relatively rare.... looks like an expanding triangle... also called a 'Megaphone Top.' In other triangular patterns, the volume tends to diminish as the swings grow narrower; in the broadening formation, volume tends to expand along with wider price swings. This situation represents a market that is out of control and unusually emotional. Because this pattern also represents an unusual amount of public participation, it most often occurs at major market tops. The expanding pattern, therefore, is usually a bearish formation. It generally appears near the end of a major bull market."

-Murphy, 1999 Revised Ed., pages 140-141.

"The flag and pennant represent brief pauses in a dynamic market move. One requirement... is they be preceded by a sharp, almost straight-line move. They represent pauses in which that market 'catches its breath' before running off in the same direction. Flags and pennants are among the most reliable continuation patterns and only rarely produce a trend reversal. ...Flags and pennants are said to 'fly at half-mast' from a 'flagpole,' as they appear at the midpoint of a major move. Pennants and flags on downtrends are completed very quickly, often in only 1-2 weeks, after which the breaking of the lower trendline in the pennant signals the resumption of the downtrend. The break down will take place on heavy volume, and the magnitude of the move is estimated by measuring the vertical distance of the preceding move from the breakout point of the pennant . Flags are small parallelograms that slope against the prevailing trend. Pennants resemble small horizontal symmetrical triangles."

-Murphy, 1999 Revised Ed., pages 141-145.

Well, this flag started flying on 14 Nov, I reckon it might snap off after the holiday week, maybe sooner, who knows? Expect it to fly a bit higher, to form a right shoulder which might be expected to occur around 25600 on Dow. We saw 25500 very briefly Friday on Trumptweet, another such tweet could top off the flag. Good luck!

As always this is an educational post for your amusement and does not constitute investment advice; trade at your own risk!

The Strat broadening formations on weekly scale.Following from the smaller scale charts posted previously, weekly scale shows 2 triangles in action from outside bars. Missed the smaller scale one which perfectly tagged the recent low but i've done some more studying and almost completed the strat course, so my eye is sharpening every day. Larger scale triangle still has lower edge to tag, as previously mentioned it aligns with yearly pivots.

LTC has bottomed out. Next target 75$LTCUSD pair has been trading in a descending triangle betwen 22.12.2017 and 10.6.2018. A break down from that triangle has happened at 12 Jun 2018. Since then, the bottom line (reddish color) is the new important resistance level.

LTC has the first break up attempt (you can see on the chart) which was NOT successful because of the lack of volume which also means that lack of interest of investors.

But here comes the second one. I think that will be successfull because whales cannt hide their foot prints , volume.

Volume made a HigherHigh at 27 Sep '18 and I predict that price will follow it.

LTC's first target is 75$ levels and stay above it

Second one is 110$ levels. After then new ATH.

Please share your ideas with me and hit the like button :D I appreciate that.

Thanks for stoping by and reading my post . Trade safe, stay happy

BTC BROADENING BOTTOM- BULLISHInteresting find, I see a broadening bottom in BTC's current pattern. Below is an image of what a broadening pattern looks like.

Bullish Points:

- Broadening Bottom Pattern

- RSI showing higher lows

- Stoch RSI showing higher lows

Example of Broadening Bottom: excellenceassured.com

Bitshares Bullish Broadening Pattern...target Bullish bitshares broadening pattern shows the potential of a massive rise upon its next ascent...target to the $1.70+

rising wedge still valid; 4hr srochrsi reset.As I had said an idea or so ago we will likely fake a breakout once or twice to reset rsi and stochrsi levels before w have enough momentum to break above the neckline of the inverted head & shoulders pattern. What was once looking like your average bull flag has morphed into a sort of small falling broadening wedge and now are 4hr stoch rsi is ready to go up again. I was also able to widen the bottom trendline of the rising wedge slightly and still maintain it's trend validity. So unless we see a big surge in bear volume here we are still inside the rising wedge and also found support at the wedge. If we do break down from the lavender wedge we may drop all the way back down to retest the bottom trendline of the symmetrical triangle. I think probability favors the uptrend still especially with the recent 4hr golden cross but need to anticipate the opposite happening as well. Just my opinion and not intended as financial advice. Good luck out there and thanks for reading.

7263 seems like it could be the handle bottom. I was thinking any lower than 7350 would greatly decreases the odds of our cup and handle pattern because usually the handle does not go down further than half the height of the cup. However a cup and handle as wella s the double bottom for that matter is not truly invalidated until the price action has dipped well below the bottom of that patter so with are current low of $7263 (which is not all that far from $7350) We still very much have a chance of triggering this cup and this double bottom if we can go upwards from here. You'll notice the price action is currently inside a falling broadening wedge which is inside another falling broadening wedge..those patterns tend to break upwards..Of course we must keep in mind that the head and shoulders pattern we broke down from the other night should have sent us to the 6300s and hasn't reached that price drop target yet meaning there's still a chance that could happen. I hope not because it would essentially invalidate the Adam and eve double bottom we've been following since April if it dipped that far but we must still be prepared if that were to happen. Bulkowski gives the head and shoulders pattern a 55% chance of meeting it's price target so this could also just be one of the times where it is in the 45% and doesn't meet it's target. If so now is a great time to get a discount and add to your position but I would wait until we see the next clear break one way or the other then choose what to do as far as exiting or adding goes. One other positive sign that I think will ultimately bring us up out of this mess is that on the 1day chart(not shown here), the 200MA is finally starting to turn downward and change its trajectory while the 50ma is on it's way up...if the 200ma and 50ma maintain or increase these trajectories we should finally get our golden cross on the 1 day chart within the next 2 weeks which should jumpstart the market again and allow us to climb back up to the adam and eve neckline which currently sits in the 9400s and because of its downward slant, is going to be easier to reach as each day passes. So despite us going below $7350 I'm still confident we can find a way to validate the cup&handle, and the adam and eve double bottom, but also fully prepared if the head and shoulders reaches its projected target. I hope you are too in whatever path you choose, and that choice will be yours alone as this is not financial advice. Best of luck and thanks for reading!

btc now inside an ascending broadening wedge.The rising wedge it appeared we had broken down from simply morphed into an ascending broadening wedge which also tends to break downward. We are currently near the top trendline of that wedge and with the other resistance lines teaming up with that wedge line of the 4hr 200ma (in blue) and the top trendline of the descending channel odds are good the price will be heading back downward to retest at least the 4hr t-line(in yellow) or also likely it could go back down and test the bottom trendline of the ascending broadening wedge. I was hopeful that when we turned things around before reaching a lower low that we had formed a higher low on the 4hr chart which would be a very positive sign, but once it became clear that we were still just consolidating inside an ascending broadening wedge pattern that higher low is really just considered inside bar consolidation and not a higher low after all. For now, even though ascending broadening wedges tend to break downward, I'm flipping my stance to neutral because all it will take to break upward is some sort of mega bullish news from the Consensys meeting currently underway. . .and we've already heard that Microsoft plans on using the lightning network.

Head & Shoulder, Ascending broading wedge, and 4hr golden cross.On the 4 hour chart here you can see the head and shoulders so far has avoided being triggered after the 4hr candle price action rose back up above the head and shoulder neckline before 3 closes..However on the current 4hr candle, it is now dipping back below the neckline so odds are good it will eventually still break down from the current broadening ascending wedge wedge which when it comes to ascending broadening wedges 76% break out in the same direction as that leading to the pattern which in our case is downward...so currently probability favors more downside but as you can also see we just now on this candle have an official 4hr golden corss of the 50MA moving above the 200MA...such a cross is more effective when it happens on the 1 day chart but it also typically allows for some more bull momentum when it happen ons the 4 hr chart as well just not quite as effectively. Because of this golden cross I think it's very likely that zone could act as strong asupport when the price action breaks down to it and could provide enough of a bounce/rebound back upward that we get back above the head and shoulders neckline before having a chance to trigger it for more downside...becoming instead a bear trap. We could also still dip below that and instead find support at either the ascending grey trendline, or ultimately the pink eve curved trendline....we could dip to those and also rebound back up before triggering the head and shoulders....however if the head and shouldersdoes trigger its projected fall could easily break nudner the pink eve trendline....then again since that trendline is somewhat of a projected line it can be adjusted a bit...possibly even enough to account for the projected fall of a head and shoulder trendline...however I'm fairly confident based on all the previous candle body touches that have verified that trendline up until now that its trajectory is pretty close if not spot on. For now I am going short expecting a fall at least to the 50ma, but also being prepared to pull right back out if it goes down further to get in at the pink eve trendline. You choose your own path of course because this is not meant to be financial advise. Thanks for reading and best of luck! I'm only short here for the short term...and think there's still a chance to avoid this head and shoulders.

Same Idea as previous just with updated price targetsJust realized I updated my last idea without updating the price movements of the 50ma, 200ma, ascending grey trendline, and pink eve trendline...I also pointed at the golden cross a littlebetter. Please refer to my last idea for more in depth analysis on all these things. I am short term short, but still long term long. Good luck thanks for reading I will post a link to the previous idea below.

BTCUSD Bullish after Declining broadening wedge, buy&sell quickHi Guys, quick Analysis,

i spotted a declining broadening wedge on BTC USD. After H&S formation the support couldnt even be broken by the downtrend after H&S, now trend switches probably and goes for formation target at the first highest high of formation @ 15300 USD after breaking declining broadening wedge top-line.

Wait for confirmation and once it breaks the falling trendline on top buy for quick profits with sell order at 15300 or close below.

Formatino confirmed by 2 touches on each line !!

CBRL Broadening Top and Upcoming Dividend! (Price target: ~$176)The Broadening Top pattern forms when the price progressively makes higher highs (1, 3) and lower lows (2, 4) following two widening trend lines. The price is expected to move up or down past the pattern depending on which line is broken first. A bit of a toss up since the broadening top formation appears much more frequently at tops than at bottoms, and therefore usually has bearish implications. In this case, however, we see a strong up-trend with an Average Directional Index just shy of the 25 mark. Set limit order above market price to be sure we are looking at a bull broadening top, or for added risk buy the retracement when RSI corrects below 70. For best results take 50% position at each. Consider stop-loss below breakout price.

Added confidence from the fact that Cracker Barrel is recording a $1.20/share dividend on Jan 11th, issued on Feb 5th. Dividend hunters could help drive this trend up. CBRL reports earnings 02/20 BMO and Estimize revenue expectations are 0.77% higher than Wall Street's.

Follow me on Twitter: twitter.com