BSE

Indian stock market acting strong...The indian stock market index is at the brink of breaking out massively here, in this currency adjusted chart. If it manages to move over this trendline resistance it can confirm a quarterly timeframe trend pointing to a large advance in the coming 12 quarters, as shown on chart. Emerging market stocks become interesting with potential weakness in the dollar going forward, and rising oil prices. The big slump in energy prices certainly helps equities going forward, with a delated effect, as explained by @timwest in his publications, since transportation and energy are one of the key inputs of the economy.

I'd keep an eye on it and look for good valuation indian companies, if there's a breakout in this chart.

Cheers,

Ivan Labrie.

TITAN DOUBLE TOP IN DAILY TIME FRAMETITAN DOULE TOP IN DAILY TIME FRAME..

TARGET FOR THIS MONTH IS 1162..

NECKLINE LONG TERM TARGET 997 BUT IT TAKES MORE MONTH TO ACHIEVE

MY RECOMMENDATION IS DO THIS TRADE IN OPTION..DON'T TRADE IN FUTURE DERIVATIVE DUE TO MORE RISK..

PREFER OCT 31 1200 PE

CLOSE THIS TRADE IF IT CLOSE ABOVE 1350 ONLY

THANK YOU!!!

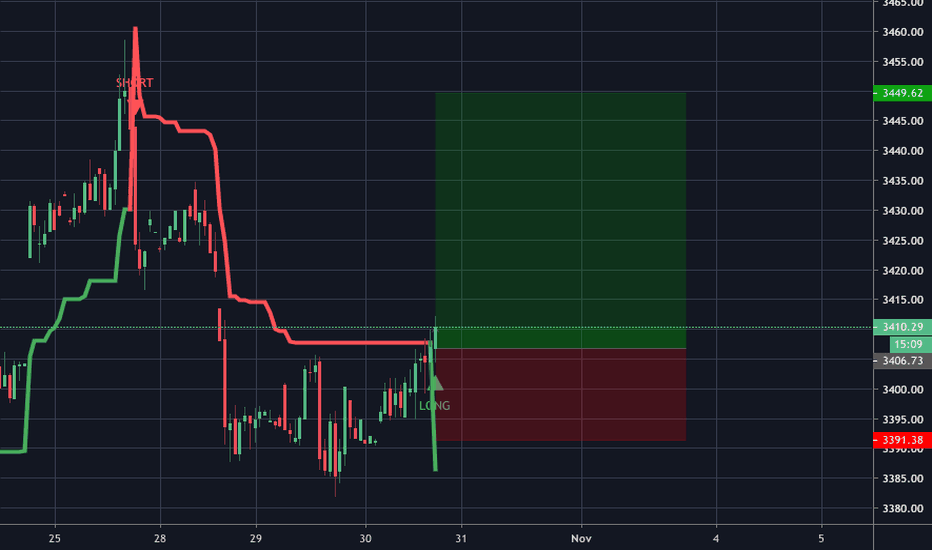

Positional Trade - 7.5R opportunity on #TATAMTRDVR #Stock - Bounce from Support

- Breakout & Retest of falling Down Trendline confirmed

- SL / invalidation level 1ATR below recent LOWs.