levels to watch out The bulls will claim it's on an upward trajectory, while the bears will argue it's heading south. As I see it, we're in a tricky spot, with the markets currently in a no-man's land.

It's respecting the channel, but it lacks clear direction, which means it could swing either way—ultimately pleasing one side while bruising the ego of the other.

If the neckline at 91,000 breaks, we could see the market push towards 108,000 potentially even reaching 125,000. On the flip side, as long as 91,000 holds, we might still see a move towards 71,000 and if that breaks, there's a possibility of the market heading down to 40,000.

Btc-bitcoin

JUST IN: Bitcoin Reclaims $88K, Eyes $100K Breakout!The Price of Bitcoin shocked sceptics surging nearly 4% today, reclaiming the FWB:88K pivot- now setting its coast for $100k breakout amidst a bullish symmetrical triangle Pattern.

On the daily time frame, CRYPTOCAP:BTC has formed 2 bullish candlesticks, should a third identical candlestick evolve, it will lead to a breakout of the ceiling of the symmetrical triangle formed- placing CRYPTOCAP:BTC in the $90,000 - $96,000 range. A break above this pivots would cement the the move to $100k and beyond.

Similarly, should the asset faced selling pressure into making it dip below the $81k range, a selling spree could emerged.

Bitcoin Price Live Data

The live Bitcoin price today is $88,452.78 USD with a 24-hour trading volume of $29,835,452,540 USD. Bitcoin is up 3.95% in the last 24 hours, with a live market cap of $1,755,025,651,822 USD. It has a circulating supply of 19,841,384 BTC coins and a max. supply of 21,000,000 BTC coins.

BITCOIN 4H - 8th time lucky? The 200 EMA is a great indication of the environment a certain asset is currently in. If the 200 ema is not being respected as neither support nor resistance then generally the market environment is rangebound. If an asset is in a trending environment then the 200 ema is often being respected, as in the moving average acts as a key support in an uptrend or as resistance in a downtrend.

What we have seen from BTC is a clear shift from rangebound PA where it seems as though the 4H 200 EMA has no effect on price and is sat relatively neutral with no gradient, to a clear downward gradient capping off any attempt for the bulls to move higher. Eight separate occasions the bulls attempted to flip the moving average and failed each time, until now?

Having ended last week strong with a reclaim of $86,000 an early Monday push has seen BTC close a 4H candle above for the first time in 7 weeks. It is important to note that when the MA is still sloping downward it is still seen as a resistance level, a retest as new support while the slope levels out is always a possibility.

I am now interested in the question of, if Bitcoin reclaims the 4H 200 EMA, does it flip to a bullish trend or another rangebound one? That's where the $91,000 S/R comes in, as a reclaim of that level would put BTC into a LTF rally and therefor bullish trend, rejection off that level would see the MA level-out and becomes less important and therefor rangebound.

Comment with your thoughts on this idea.

Bitcoin (BTC/USD) Analysis – Daily Timeframe

Trend Overview

Bitcoin (BTC/USD) remains in an uptrend, with price holding above the ascending trendline support. The long-term bullish structure remains intact, characterized by a series of higher highs and higher lows since 2023.

Key Support and Resistance Levels

Primary Support:

$80,000 - $85,000 (Trendline support zone)

$75,000 (Psychological and historical support)

Primary Resistance:

$90,000 - $95,000 (Recent local highs)

$100,000 (Major psychological level)

Technical Indicators

Stochastic RSI is in the overbought zone, suggesting potential short-term consolidation or a pullback before resuming the trend.

MACD shows a bullish crossover, indicating positive momentum remains strong.

Volume analysis suggests buying pressure is still present but needs to increase to sustain further upside.

Market Outlook

Bitcoin continues to respect its long-term uptrend. As long as price remains above the trendline, the bullish outlook remains valid. However, a confirmed break below $80,000 could signal a deeper correction. If Bitcoin breaks above $90,000, the next major resistance is around $100,000.

Bitcoin’s Next Move – Another Attack on Resistance zone?Bitcoin ( BINANCE:BTCUSDT ) fell to $83,400 as I expected in the previous analysis , the question is whether Bitcoin will continue to decline or not.

Please stay with me.

Bitcoin is moving in the Support zone($84,120_$81,500) and near the Support lines . The way Bitcoin has moved and decreased since yesterday until now has been such that it seems that Bitcoin can attack the Resistance zone($87,100_$85,800) at least once more.

In terms of Elliott Wave theory , given Bitcoin’s movements over the past few hours, it appears that Bitcoin is completing a microwave B of the main wave Y .

I expect Bitcoin to be able to attack the Resistance zone($87,100_$85,800) once again and if it breaks, I have marked the next targets on the chart .

Do you think Bitcoin can touch $90,000 again?

Note: If Bitcoin goes below $81,800, we can expect more dumps.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BTC/USD – BIG ESPRESSO SHOT–is the breakout of the decade ahead?On the Bitcoin (BTC/USD) daily chart, we observe a potential bullish scenario based on the well-known Cup and Handle formation.

Between November 2021 and November 2024, Bitcoin formed a classic Cup and Handle pattern.

The "cup" part (marked as 1-2-3) is characterized by a rounded bottom, indicating a correction phase, accumulation, and gradual recovery of bullish momentum.

Then, in the second half of 2024, the "handle" (marked as 4-5) formed as a short-term consolidation in the shape of a triangle, which was followed by a breakout that led to a peak around $109k in January 2025. A correction followed, pushing the price down to approximately $76.5k in March 2025.

Currently, the price is making a pullback, testing the key zone around 87K–$93k from below.

To confirm the bullish scenario, we need a strong hold above the $75k–$76k support and a clear breakout above the local resistance zone at 87K–$93k.

As of now, this retest has not yet been confirmed and requires further observation, as there is still a risk of a fake breakout and potential drop to lower support zones — such as $66k or even $50k.

This formation suggests strong upside potential for Bitcoin in the medium to long term, and if confirmed, may signal a continuation of the uptrend with a target around $127k–$130k.

WATCH CLOSELY

BITCOIN vs GOLD History will be repeated.Bitcoin has often been described as the digital Gold. And with good reason as it posseses the scarcity attribute of Gold like no other asset.

More often than not, we've seen Bitcoin replicate Gold's trading pattern and why not, as market psychology under certain set of conditions tend to be similar.

What better patterns to repeat than the long term ones. And on these charts you seen those.

Bitcoin's current Cycle is a Cup and Handle pattern, similar to Gold's formation after its former September 2011 ATH following the amazing rally after the launch of its ETF in the early 2000s.

Once Gold crossed above its MA50, it never broke back below it, in fact is provided support for its Handle twice.

Bitcoin is on a similar situation right now having held its MA50 last week, the 2nd time it supports it since the Handle did in August 2024.

Based on this Gold fractal, this is the best time to buy BTC again for its final rally of the year.

Follow us, like the idea and leave a comment below!!

Bitcoin in coming days ...frankly, Bitcoin will reach $89000 in the coming days.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Bitcoin at Key Resistance – Will Bears Take Control?Bitcoin ( BINANCE:BTCUSDT ) started to rise as I expected in the previous posts .

Bitcoin is moving near the Resistance zone($87,100_$85,800) , the upper line of the Ascending Channel , and the Time Reversal Zone(TRZ) .

In terms of Elliott Wave theory , Bitcoin appears to be completing microwave C of the main wave Y .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks .

I expect Bitcoin to start declining from the Resistance zone($87,100_$85,800) again, the first target could be $83,400 and the second target can be the CME Gap($80,760_$80,380) filling.

Note: If Bitcoin breaks the Resistance zone($87,100_$85,800) we can expect more pumps.

This analysis is in line with the following analysis that I shared with you on the weekly timeframe. 👇

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

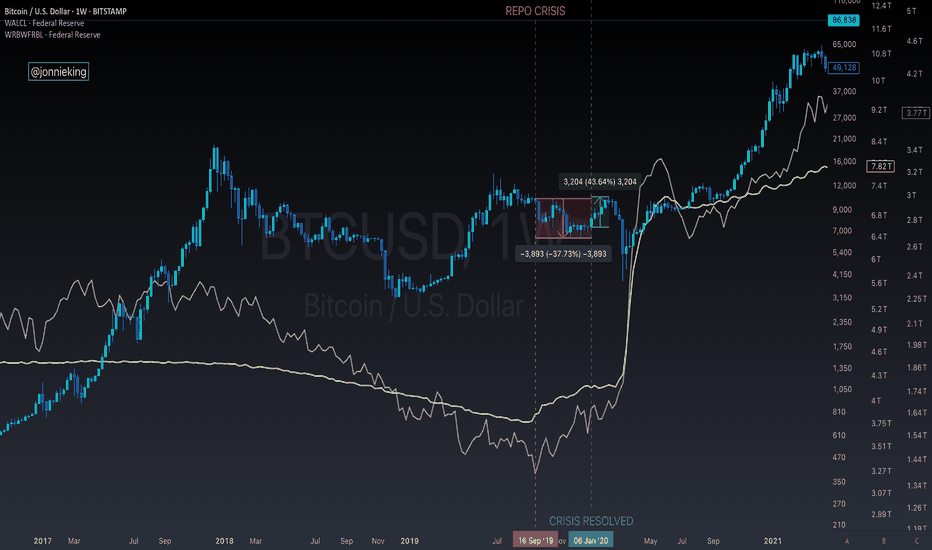

The Fed Cuts Balance Sheet Runoff by 80% - BULLISH!RISK-ON 🚨

I’m seeing so many people incorrectly analyzing the September 2019 emergency repo OMOs, which were short-term liquidity injections from the Fed, and then comparing it to the price of BTC going down, before QE officially started in March 2020 because of the pandemic.

Here’s what really happened.

September 15, 2019 was a tax deadline, pulling ~$100B out of markets as large corporations paid the IRS and funds flew into the TGA.

Meanwhile, the Treasury issued new T-Bills to rebuild cash reserves following the post-debt ceiling resolution in August, draining another $50-100B as big banks and institutions absorbed the securities.

During this time, the Fed continued reducing its balance sheet (QT) down to $3.76T, but the balance sheet did not leave enough slack for unexpected cash drains to the system, such as corporate taxes and Treasury issuance.

Unfortunately, the Fed was flying blind and did not have a hard number estimate for “ample reserves” in the banking system.

These reserves were largely hoarded by a few of the larger banking institutions due to Liquidity Coverage Ratio (LCR) rules and a higher IOER at 2.1% vs the ON RRP rate of 1.7% - a 40 bp spread.

This caused a liquidity crisis in the US repo market because bank reserves held at the Fed ($1.36T) were too low and repo lending dried up. Banks weren’t able to access each other’s reserves to fund daily operations.

SOUND FAMILIAR !?

The US just resolved its CR to avoid a government shutdown, and they will be refilling the TGA by issuing new T-Bills. The reverse repo facility is also nearly drained.

Today, we heard the Fed will be reducing its securities runoff from $25B - SEED_TVCODER77_ETHBTCDATA:5B on April 1st, an 80% adjustment.

One of the main drivers is they wanted to get ahead of another 2019-style repo crisis (although they won’t say this), rather than being reactive and having to perform emergency OMOs once again.

Now to go back to my original point with people saying the Fed reducing its balance sheet runoff is a big nothingburger based on BTC price action in 2019.

BTC dumped because of the repo crisis, NOT because markets needed QE.

By early 2020, the liquidity crisis was resolved, and BTC pumped ~45% before the pandemic hit in March and nuked the chart.

Proof is in the pudding - just look at the 2017 bull market.

QT started in October 2017, and the market ripped until early 2018.

The Fed reducing its balance sheet runoff by 80% is definitely a signal of risk-on for educated market participants, as it leaves more reserves in the financial system, which gives banks more liquidity to loan the market.

i.e. M2 go up.

But keep listening to your favorite large accounts who are all of a sudden macro gurus, what do I know 🤓

Bitcoin at the D-Point of a Bullish Gartley – What’s Next?Bitcoin ( BINANCE:BTCUSDT ) is currently trading near the Support zone($80,600_$79,000) and Potential Reversal Zone(PRZ) and Support line .

Bitcoin appears to be completing the Bullish Gartley Harmonic Pattern .

Educational Note : The Bullish Gartley is a harmonic pattern that signals a potential reversal in an uptrend after a corrective move. It consists of five points (X-A-B-C-D) and follows specific Fibonacci retracements, with the D-point acting as a key buying zone.

Regarding Elliott wave theory , Bitcoin is completing the microwave B of the main wave Y .

Also, we can see the Regular Divergence(RD+) between Consecutive Valleys .

I expect Bitcoin to rise at least to Cumulative Short Liquidation Leverage . If the Resistance zone($84,130_$81,500) is broken, we can expect further increases in Bitcoin .

Note: If Bitcoin breaks below the Support zone($80,600_$79,000), we can expect further declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Inverse Head & Shoulders in Play – Bitcoin’s Bullish Setup!!!Bitcoin ( BINANCE:BTCUSDT ) touched $84,500 as I expected in my previous post (even higher).

Right now it seems like Bitcoin has managed to break the Resistance zone($84,130_$81,500) and the 200_SMA(Daily) . The formation of the classic pattern , the Inverse Head and Shoulders Pattern , could be a sign that Bitcoin is preparing to break the Resistance zone($84,130_$81,500) .

Another Classic Pattern that we can see on the one-hour Bitcoin chart and hope for an increase in Bitcoin is the Fan Principle at the Bottom Pattern .

Educational tip : The Fan Principle at the Bottom is a bullish reversal pattern where the price forms a series of downward trendline breaks, signaling weakening bearish momentum. As each trendline is broken, buying pressure increases, leading to a potential uptrend.

According to Elliott Wave theory , with the resistance zone broken, we can expect Bitcoin to enter the next impulsive wave , which will likely continue to at least $86,300 .

Also, Today's U.S. economic data release could significantly impact financial markets, including Bitcoin :

UoM Consumer Sentiment : 57.9 (Forecast: 63.1 | Previous: 64.7) – A sharp decline, indicating consumer pessimism about the economy.

UoM Inflation Expectations : 4.9% (Previous: 4.3%) – A worrying increase, which could push the Fed toward a more hawkish stance.

Declining consumer sentiment may pressure the Fed to adopt a more accommodative stance, which is positive for risk assets like Bitcoin.

Rising inflation expectations could increase demand for inflation-hedge assets like Bitcoin.

However, if the Fed sees inflation rising as a concern, they may maintain a tighter policy, which could weigh on markets.

Today's data presents mixed signals, but falling consumer confidence and rising inflation expectations could ultimately fuel Bitcoin's next leg up.

Based on the above explanation , I expect Bitcoin to rise to at least the upper resistance zone($87,000_$85,820) after completing its pullback and complete the mission of filling the CME Gap($86,400_$85,595) . Of course, a CME Gap($80,760_$80,380) has also formed.

In your opinion, has Bitcoin finished its correction or created an opportunity for us to escape again?

Note: If Bitcoin falls below $81,300, we should expect further declines.

Note: If Bitcoin goes above $87,800, we should expect further increases.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

$BTC Bitcoin at critical point... Head and shoulder Pattern!CRYPTOCAP:BTC Bitcoin is at a critical point

Current price: 91000

Bitcoin has retraced over 16% from an all time high of 108k, Price action is currently forming a head and shoulder pattern which is usually a bearish pattern!

#btc needs to remain supported around 90.5k to continue its uptrend to all time highs at 119k

If MARKETSCOM:BITCOIN price action loses support at 90.5k then expect prices to retest supports at 85k and then 80k.

Definitely a critical point to watch! What do you think?