Hawkish FOMC, new extension lower for BTC, or?Bitcoin analysis with FMOC to come

Today's focus: Bitcoin

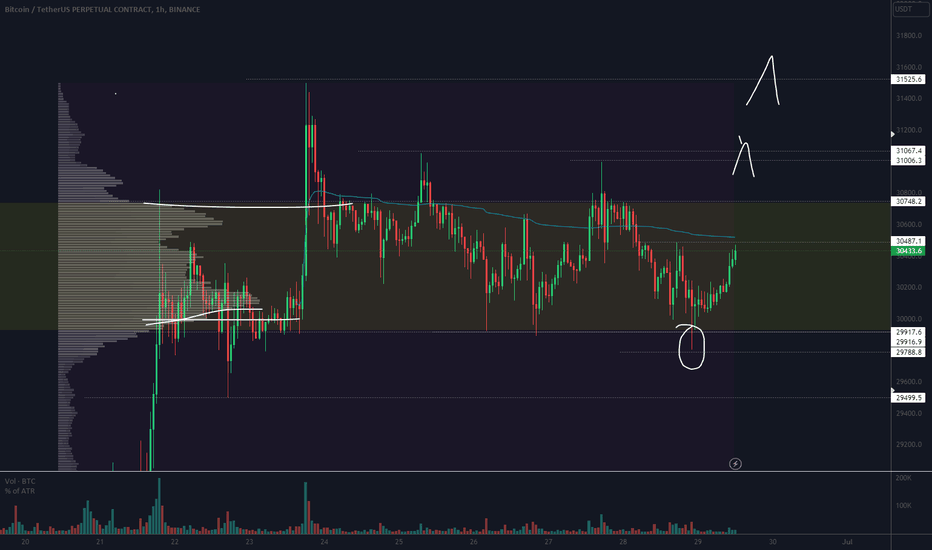

Pattern – Support break

Possible targets – 30,345 US – 27,500 DS

Support – 29,092 minor

Resistance – 30,344 – 31,360

With the FOMC coming out tomorrow morning and rates expected to rise by 25 points, will we see straight sets with the Fed still remaining hawkish? With Bitcoin looking rather vulnerable at the moment, could that set up a new push back to the main trendline?

Or if the Fed is more dovish, could that reignite buyer interests and move price back above the 30k level? Bitcoin broke support recently, and the worry for us is that the market could be looking for any reason to continue lower. A stronger USD could just be enough.

That’s the primary point of discussion in today’s video update, but we have also put in mentions of the USD index and gold as they both sit in inappropriate situations atm, with the USD starting to struggle in its comeback rally while gold continues to push at a new continuation.

Have a great day and good trading.

BTC-D

BRIEFING Week #30 : Central Bank Show !Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

BTC Bitcoin Technical Analysis and Trade IdeaIn this video, we closely examine Bitcoin, noting that it has been range-bound at a significant resistance level. The chart indicates that the trend is starting to display signs of potential weakness. Throughout the video, we delve into various elements of technical analysis, including the trend, price action, market structure, and other relevant factors. Towards the end of the video, we explore a potential trade idea. It's important to note that the information in the video should not be interpreted as financial advice.

🔔18k incoming? 🔔📈 Chart Analysis:

Quick update on the current slow sideways market

Recent Developments:

Small flag pattern on BTC break up would indicate 35k is next a break down would suggest that our mini bull run is over for now! BITSTAMP:BTCUSD KUCOIN:INJUSDT

INJ broke out of the flag and hit target 1 however showing very toppy signs with a double top in stage 3 that is still valid. it also is producing a small flag patten so if we break out of that it is likely that my topping theory will be invalidated!

🔔 Risk Management:

It's imperative to tailor your position size in accordance with your risk appetite. Employ astute risk management tactics, such as trailing stop losses, to safeguard your profits as the price advances in your favor.

⚠️ Disclaimer:

This analysis is for educational purposes only and should not be taken as financial advice. Always conduct your own research and consult with a financial advisor before making any trading decisions.

BRIEFING Week #28 : SPX Breadth & BTC Dominance tradesHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

BRIEFING Week #27 : SPX WTI SILVER BTC ETH AltseasonHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

BTC - Still Inside A Range 📹Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #BTC.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC - DONT ARGUE📛 It's BULL SEASONHi Traders, Investors and Speculators of Charts 📈📉

After a sudden breakthrough of the resistance zone at FWB:29K , BTC is looking ready for more upwards price action.

The technical indicators in the daily timeframe are screaming bullish as we're about to witness the bullish cross that happens just before periods of parabolic upwards price action.

IF the weekly candle can CLOSE above the resistance zone as pointed out, it will form three white soldiers - a bullish candlestick pattern.

The next major stop based on supply zones and Fibonacci Retracement is FWB:42K (macro outlook).

_______________________

📢Follow us here on TradingView for daily updates and trade ideas on crypto , stocks and commodities 💎Hit like & Follow 👍

We appreciate your support !

CryptoCheck

_____________________

BITSTAMP:BTCUSD COINBASE:BTCUSD INDEX:BTCUSD BITFINEX:BTCUSD CME:BTC1! CRYPTOCAP:BTC BYBIT:BTCUSDT KUCOIN:BTCUSDT

🔥 MODIFICATION: BTCUSD 🔥 POSITION TRADERESISTANCE @ 64050

TP3 @ 54460 (closing ALL Buy Orders)

-SL @ 48000

SLO1 @ 45000 ⏳

TP2 @ 43250 (closing ALL Buy Orders)

TP1 @ 35350 (shaving 50%)

BLO2 @ 28450 ⏳

+SL @ 27750 🚫 +202 pips (or +0.73%)

BLO1 @ 27548 📈 Net Equity @ +3109 pips (or +11.29%)

SUPPORT @ 13450

TECHNICAL ANALYSIS

— Supply Zone, an institutional selling range

As you can see from the P2P INDi, we have Price Action (PA) moving upward from Support towards Resistance, but only after it retraces from the Supply Zone(s) formed on the 3D/5H/50m, respectively.

~46760 (35m)

~45815 (5H)

~45525 (3D)

TECHNICAL ANALYSIS

— Oscillators @ NEUTRAL

Oscillators measure momentum, and when an oscillator is NEUTRAL, the security is neither overbought nor oversold. This measurement can be a signal that the security is in a period of consolidation or a potential reversal in the trend.

— Moving Averages @ STRONG BUY

A STRONG BUY signal on a moving average means that the price of the security has crossed above a moving average and is likely to continue to rise. This indication is usually seen as a sign of strength in the trend and can be an excellent signal to buy the security or continue to hold your long position.

SUMMARY @ BUY

In this case, PA reflects consolidation, as the Moving Averages indicate a STRONG BUY signal.

⚠️ I'm holding my long positions, in anticipating of PA pulling back to 28450 (3D) for another buying opportunity.

Massive resistance ahead! 18k or 35k where next? Chart Analysis:

Recent Developments:

The chart has recently exhibited a classic 'Cup and Handle' pattern which broke out and evolved splendidly. Following this, there was a pullback to the breakout level, which culminated in an impeccable falling wedge, as we had anticipated in our preceding video. Subsequently, there was a remarkable breakout, and we successfully reached our initial target - the apex of the falling wedge. This has brought us face-to-face with the most formidable resistance encountered since the inception of the bear market. Will we break through? Only time will tell.

What Lies Ahead?

At this very moment, the chart is forming yet another colossal 'Cup and Handle' pattern, and we are teetering on the brink of a breakout. Should this breakout materialize, we can anticipate a continuation of the upward trend until any signs of faltering. It's crucial to remain vigilant for indications of potential reversals. Conversely, if this attempt is unsuccessful, the chart could potentially plummet to the 18k level before the halving. It's advisable to proceed with caution and employ stop losses.

Risk Management:

It's imperative to tailor your position size in accordance with your risk appetite. Employ astute risk management tactics, such as trailing stop losses, to safeguard your profits as the price advances in your favor.

Disclaimer:

Please note that this analysis is intended solely for educational purposes and must not be construed as financial advice. It's of paramount importance to undertake your own due diligence and seek counsel from a financial advisor prior to making any trading decisions. BITSTAMP:BTCUSD BITSTAMP:ETHUSD BITSTAMP:BCHUSD KUCOIN:INJUSDT