Bitcoin’s Game Has Changed: Fresh Support Zone, Targets Sky-HighHey Dear Friends,

Until recently, Bitcoin had been stuck in a range between 112,331 and 105,344 for quite some time. But that range has now been clearly broken. So, what does this mean? This zone, which used to act as resistance, is now expected to flip and act as support.

According to my weekly trading model, the long-term target levels I’m tracking for Bitcoin are: 127,818 – 137,000 – 146,000.

Since this is a weekly setup, it might take a while for these targets to play out. Even if we see pullbacks to the 112K, 105K, or even 100K levels, I expect to see strong buying pressure from that zone.

I’ll keep sharing regular updates as this setup develops.

To everyone who’s been supporting and appreciating my work—thank you, truly. Your encouragement means the world to me and keeps me motivated to keep showing up. Much love to all of you—I’m grateful we’re in this journey together.

BTC-D

#BTC Update #14 – Aug 02, 2025#BTC Update #14 – Aug 02, 2025

Unfortunately, Bitcoin has closed below its current channel and now appears to be retesting that level. If this retest confirms, I expect a pullback down to the $110,000 zone. However, if Bitcoin manages to re-enter the channel, its first target will be $118,800. Although it’s a descending channel, moving within it suggests a relatively stable market. Closing below it may not end well and could deepen the retracement. That's why I recommend caution with all coins right now.

Even though it seems like a distant possibility at the moment, don’t forget there’s also an imbalance zone around the $103,500 level. A sharp wick or a significant drop could bring Bitcoin back to revisit that area. The probability is currently low, but it can’t be ruled out completely. I don’t recommend rushing into any long or short positions at this stage.

Long-Term Technical Outlook: Critical Decision Point Approaching

The chart illustrates a long-term technical structure where the price has been following an ascending channel after a prolonged bearish trend. However, recent price action indicates a breakdown below the green ascending trendline, raising concerns about a potential shift in market sentiment.

Currently, the $117 level is acting as a pivotal support zone. A sustained breakdown below this level — and more critically, below the red lower trendline — would validate the bearish scenario. This could trigger a deeper correction phase, with downside targets aligned along the red projection path. Such a move may lead to significantly lower price levels in the medium to long term.

🔽 Bearish Scenario:

If the price fails to hold above $117 and breaks below the red trendline, this would confirm the start of a bearish leg. Based on historical structure and projected trajectories, this could result in a descent toward the $93 level initially, with the possibility of extending further downward depending on market conditions.

🔼 Bullish Scenario:

On the other hand, if the price manages to reclaim the green trendline and more importantly, stabilize above the $204 resistance zone, it would signal renewed bullish strength. Such a move would open the path toward higher highs, potentially re-entering the previous upward channel and continuing the macro uptrend.

🧭 The price structure is now approaching a decisive zone, where either a confirmation of bearish continuation or a bullish recovery will likely unfold. Both scenarios have been visually outlined — green lines indicating bullish continuation, and red lines representing bearish momentum.

📌 Note: This analysis is for educational purposes only and should not be interpreted as financial advice.

DAY UPDATE REI/USDT THE INCREASE CANDLE OF UP $0,03 - $0,05REI is an interesting coin since the update of Q4

We have seen that this coin was able to increase to $0,031 and until here $0,018 zone, a return to where we are now. There is a high chance that this coin can recover next 24H if this coin is able to confirm the confirmation $0,02 - $0,021

This coin, as before, was targeted at $ 0.02 and had low volume. We expect that if it comes back to $ 0.02, it will be confirmation of the volume, which can take the trend with a candle to up $0,03

REI CONFIRMATIONS ZONE

Higher time frame

When you look normally at this coin, then this coin is in a trend line of breakdown. This can change with the next confirmations. The question is, are we going to see again $0,02 the next 24h? If yes high chance of a break.

We also have a cycle update 2025, check it here, expecting $0,90

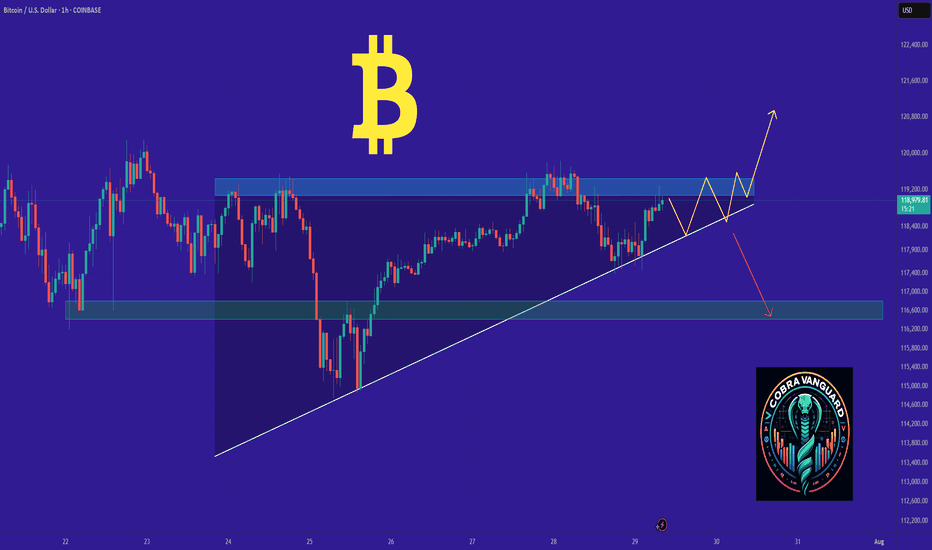

Reversal from Channel Bottom or a Real Breakdown? Identifying th

🎯 BTCUSDT - Analysis

🔹 Analysis Date: 1 August 2025

📉BTCUSDT:

Price is currently moving inside an ascending channel and has touched the bottom of the channel again, offering a potential buy opportunity.

However, for those seeking a low-risk entry, the zone around 118,000 could be ideal—if price returns to the channel and confirms support.

Although it seems the channel’s lower boundary might break, this could be a fake break to mislead traders before a rebound.

The support at 110,000 is a crucial short-term level; if it fails, a deeper correction toward 98,090 or even 94,000 is likely.

Our targets remain at the upper boundary of the channel.

⚠️ Risk Management Tip: Wait for confirmation near 118,000 if unsure, and always size positions based on overall volatility.

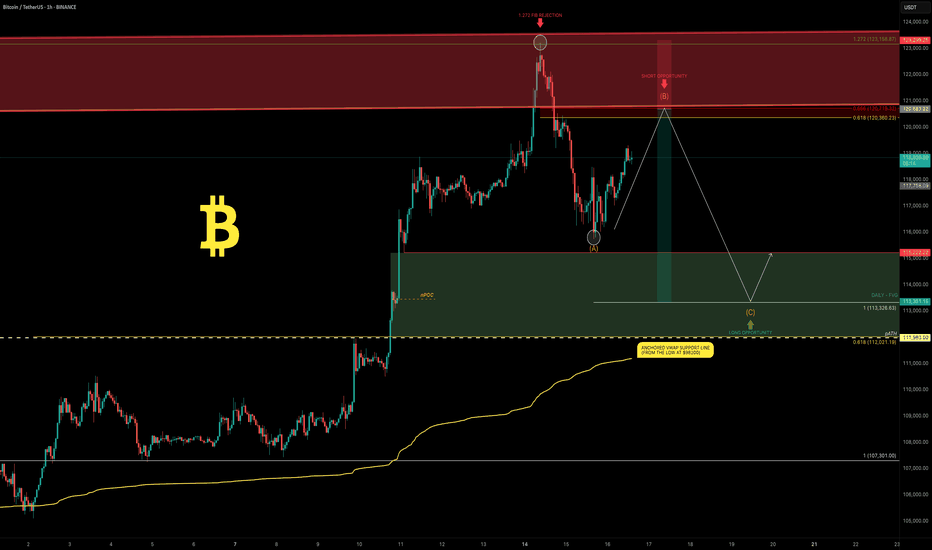

Bitcoin: New All-Time High — What’s Next?Bitcoin had an incredible run, breaking the old all-time high ($111,980) with strong bullish momentum and setting a fresh ATH at $123,218 (Binance). We just witnessed the first major corrective move of ~6% and a decent bounce so far — but the big question is:

What’s next? Will Bitcoin break higher over the summer or form a trading range here?

Let’s dive into the technicals.

🧩 Higher Timeframe Structure

May–June Range:

BTC was stuck between $110K–$100K, forming an ABC corrective pattern. Using trend-based Fib extension (TBFE) from A–B–C:

✅ C wave completed at $98,922 (1.0 TBFE)

✅ Upside target hit at $122,137 (-1 TBFE)

Full Bull Market TBFE:

➡️ 1.0 → $107,301 → previously rejected

➡️ 1.272 → $123,158 → recent rejection zone

Pitchfork (log scale):

➡️ Tapped the upper resistance edge before rejecting.

Previous Bear Market Fib Extension:

➡️ 2.0 extension at $122,524 hit.

2018–2022 Cycle TBFE:

➡️ 1.618 at $122,011 tapped.

Macro Fibonacci Channel:

➡️ Connecting 2018 low ($3,782), 2021 ATH ($69K), 2022 low ($15,476) →

1.618–1.666 resistance band: $121K–$123.5K.

✅ Conclusion: Multiple fib confluences mark the $122K–$123K zone as critical resistance.

Daily Timeframe

➡️ FVG / Imbalance:

Big daily Fair Value Gap between the prior ATH and $115,222 swing low.

BTC broke the prior ATH (pATH) without retest → a pullback to this zone is likely.

Lower Timeframe / Short-Term Outlook

We likely saw a completed 5-wave impulse up → now correcting.

The -6% move was probably wave A, current bounce = wave B, next leg = wave C.

➡ Wave B short zone: $120K–$121K

➡ Wave C target (1.0 TBFE projection): ~$113,326

➡ Confluence at mid-FVG + nPOC

Trade Setups

🔴 Short Setup:

Entry: $120,300–$121,000

Stop: Above current ATH (~$123,300)

Target: $113,500

R:R ≈ 1:2.3

🟢 Long Setup:

Entry: Between Prior ATH and $113,000

Stop: Below anchored VWAP (~$110,500)

Target: Higher, depending on bounce confirmation.

🧠 Educational Insight: Why Fibs Matter at Market Extremes

When markets push into new all-time highs, most classic support/resistance levels disappear — there’s simply no historical price action to lean on. That’s where Fibonacci extensions, channels, and projections become powerful tools.

Here’s why:

➡ Fibonacci extensions (like the 1.272, 1.618, 2.0) help estimate where trend exhaustion or profit-taking zones may appear. They are based on the psychology of crowd behavior, as traders anchor expectations to proportional moves from previous swings.

➡ Trend-Based Fib Extensions (TBFE) project potential reversal or continuation zones using not just price levels, but also the symmetry of prior wave moves.

➡ Fibonacci channels align trend angles across multiple market cycles, giving macro context — like how the 2018 low, 2021 ATH, and 2022 low project the current 1.618–1.666 resistance zone.

In short:

When you don’t have left-hand price history, you lean on right-hand geometry.

That’s why the $122K–123K zone wasn’t just random — it’s a convergence of multiple fib levels, cycle projections, and technical structures across timeframes.

⚡ Final Thoughts

Bitcoin faces major resistance around $122K–$123K backed by multiple fib and structural levels. A retest of the prior ATH zone (~$112K–$113K) looks probable before the next big directional move. Watch lower timeframe structure for signs of completion in this corrective phase.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

$BTC CME Gap + Bad Bart = Easiest Short EverCME Gap + Bad Bart is like taking candy from a baby 👨🏻🍼

Look at that textbook bounce off the .382 Fib 🤓

Pain ain’t over folks.

RSI still shows room on the downside 📉

Global Liquidity drain on the 4th.

Looking like the 50% Gann Level is next ~$111k

Get those bids in 😎

And never forget the BullTards who were telling you about the “Bollinger Band Squeeze” and UpOnly season 🫠

USDT Dominance – Potential Wave F Reversal?

We are tracking a NeoWave Diametric formation (7-leg corrective structure: A–B–C–D–E–F–G) on the USDT Dominance chart. Recently, price reached the projected resistance zone of wave E, and early signs of reversal are emerging.

⸻

🧠 Structural Analysis:

• The structure has developed with alternating legs in price and time, consistent with the symmetrical diametric rules.

• Wave E has likely completed, reacting from prior supply and resistance.

• A pullback from here can mark the beginning of Wave F, which in diametrics tends to retrace significantly toward the internal balance of the structure.

⸻

🔍 What to Watch:

• Confirmation of bearish intent via a break of internal supports or lower-timeframe BOS.

• Possible retracement targets: 4.2% → 3.95%, depending on momentum.

• A decisive break below 4.00% would reinforce the wave F scenario.

⸻

⚠️ Implications for the Crypto Market:

A drop in USDT Dominance typically indicates rotation into risk assets (alts/BTC/ETH). However, context matters — if the drop happens during a general market sell-off, it may reflect risk-off unwinding into fiat, not risk-on rotation.

⸻

🔄 Strategy Note:

• Avoid premature shorts or longs; wait for structure to confirm.

• Watch for smart money traps (e.g., false breakouts or liquidity grabs) around the recent highs.

⸻

📌 This is a high-risk zone for entering long USDT.D — be cautious with stablecoin bias.

📊 Analysis by CryptoPilot – Precision through structure.

BITCOIN 2025 TOP PREDICTION!This chart represents the M2 Money Supply / BTCUSD correlation with an 84-day delay.

You can see that the M2 Money Supply has formed a double top (with a lower high) in late September.

The price of bitcoin tops out 525–532 days after the halving in every cycle.

What does this mean?

In my opinion, bitcoin will continue to follow the direction of M2 in a highly correlated manner. This would mean that BTC's top is only 2 months away.

What price will bitcoin top?

That I'm not entirely sure of yet. The M2 / BTC correlation can be placed in a plethora of different scales. However, it currently looks like the top will be BELOW $200,000.

I hope to be proven wrong, but as of right now, bitcoin is following previous cycles perfectly (excluding the fact that we created a new ATH prior the halving, this was because of ETFs).

Given diminishing returns (and assuming that "supercycle" is not reached), $135,000 - $190,000 top in late September makes sense.

BITCOIN PREDICTION: NOBODY IS WATCHING THIS PATTERN !!!(warning)Yello Paradisers, I'm updating you about the current Bitcoin situation, which is extremely dangerous for crypto noobs that will get rekt again very soon!

It's going to be a big move soon. I'm telling you on a high timeframe chart we are doing multi-time frame analysis and on a high timeframe chart I'm updating you about the RSI indicator, the bearish divergence, the moving average reclaim, and the channel reclaim that we are having right now.

We are observing a shooting star candlestick pattern, which is a reversal sign, and I'm telling you what confirmations I'm waiting for to make sure that I can say with the highest probability that we are going to the downside. On a medium timeframe, I'm showing you two patterns: one is a head and shoulders pattern, then a contracting triangle, and on a low time frame, I'm sharing with you the ending diagonal because on a high time frame chart, we are either creating ABC or impulse, and I'm telling you what the probabilities are for the zigzag, which is a corrective mode wave, or the impulse, which is a motive mode wave.

I'm sharing with you what's going to happen next with the highest probability. Please make sure that you are trading with a proper trading strategy and tactics, and that's the only way you can be long-term profitable.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

BITCOIN CRASH PREDICTED! HERE’S WHAT HAPPENS NEXT! (scary)Yello Paradisers, Bitcoin crashed exactly as we predicted in the previous videos that it will happen with the highest probability.

In this video I am explaining to you what's gonna happen next.

Head and shoulders, neckline, is be breaking to the downside, we need a clear confirmation of a reclaim Our channel on high timeframe is getting breakout to the downside and confirmation was that a reclaim was already successful.

In this video I'm sharing with you Elliott Way theory on low timeframe and what needs to be done for confirmation perspective in order for us to continue to go to the downside or have a reversal to the upside.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

TradeCityPro | Bitcoin Daily Analysis #141👋 Welcome to TradeCity Pro!

Let’s dive into Bitcoin analysis. Yesterday, the exact bearish scenario I told you about happened. Let’s see what opportunities the market is offering us today.

⏳ 4-Hour Timeframe

Yesterday, I mentioned that the price had tested the 116829 zone too many times and that this area had become very weak. I also said that if the price made a lower high than 120041, deeper corrections would be likely.

✔️ Another perspective I have on the market is that sometimes certain support and resistance levels simply aren’t strong enough to continue the trend.

🔑 For example, in this case — despite Bitcoin being in an uptrend across all cycles — the 116829 support couldn’t hold, and the price broke it to reach a stronger support zone, one that might be capable of continuing the trend.

📊 Right now, this is what might be happening again. Support levels like 0.5, 0.618, and 0.786 Fibonacci retracement zones could be where the next bullish leg begins.

✅ At the moment, price has reached the 0.5 Fibonacci level, and the previous strong bearish momentum has slightly weakened. If you look at the volume, momentum is still in favor of sellers, but based on the long lower wicks on the candles, we can say the bearish trend is showing signs of weakness.

💥 On the other hand, RSI is approaching 30, and in an uptrend, when RSI nears the Oversold zone, it can often be a good entry point for a long. However, we’re not acting on this yet — we’ll wait for more confirmations before opening any positions.

⭐ For now, there’s no trigger for a long position on this timeframe. A break below 115000 could act as a short trigger, but given the trend Bitcoin is in, I’m not opening any short positions at the moment.

⏳ 1-Hour Timeframe

The price has dropped down to 114560, and I believe today we might enter a corrective phase. However, if the price stabilizes below 114560, the correction could continue. The next targets would be the Fibonacci levels from the 4-hour timeframe.

🔽 I won’t open a short position with the break of 114560, and I suggest you don’t take that short either.

📈 If this move turns out to be a fakeout, the first trigger we have now is at 118736, which is quite far from the current price. For this trigger to activate, we’d need to see a V-pattern form.

🔍 There are no other triggers right now. But if more range structure forms, we might consider opening a risky long on the breakout of the range top.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

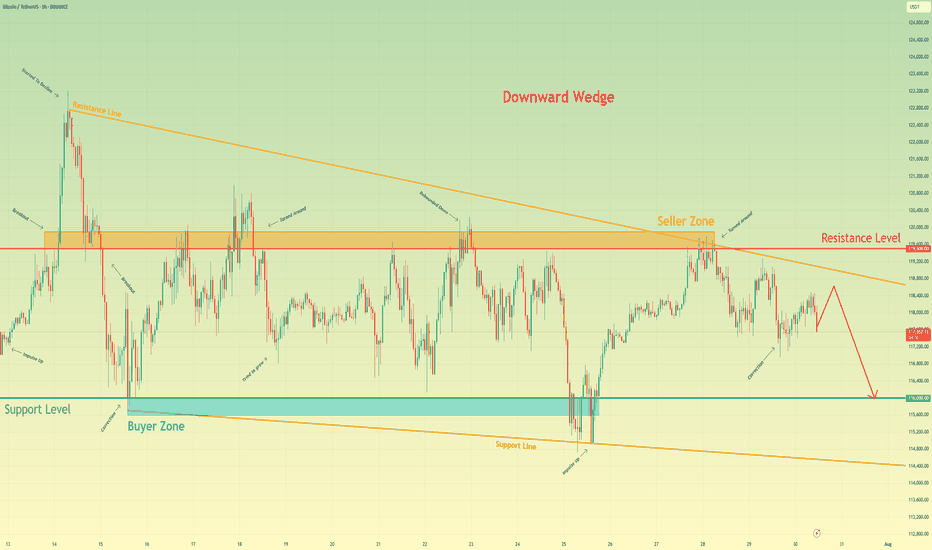

Bitcoin will continue to decline to support levelHello traders, I want share with you my opinion about Bitcoin. Following a period of a broad downward trend, bitcoin's price action has been channeled into a large downward wedge, a pattern that signifies converging volatility and a period of consolidation before an eventual decisive move. This market action is taking place between two critical, well-established zones: a major seller zone capping rallies around the 119500 resistance level and a significant buyer zone providing support near 116000. Recently, an upward rebound attempted to test the upper boundary of this wedge but was met with strong selling pressure from the seller zone, confirming its validity as a formidable barrier. The price is now correcting downwards after this rejection. The primary working hypothesis is a short scenario, anticipating that the bearish momentum from this recent failure will continue to drive the price lower. While a minor bounce or retest of local resistance is possible, the path of least resistance within the pattern's structure is now towards its lower boundary. Therefore, the TP is strategically set at the 116000 level. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Bitcoin Monthly · Parabolic Rise ContinuesLast month Bitcoin produced its best numbers ever. The highest wick and close, a new all-time high at $123,226.

Bitcoin is not exhausted on the monthly timeframe but there is room for a retrace before the month ends. Think of the first part of the month being mixed, neutral or even bearish while the second half becomes full time bullish.

The levels that are relevant are $122,000 on the bullish side and $102,000 on the low. Right now the action is happening close to the middle so anything goes.

In 2020 Bitcoin produced 7 monthly candles growing and this was repeated again in 2023. In 2025 we have so far four green candles which means that Bitcoin can easily continue to grow. It has been known to produce more than four months green many times but there can be exhaustion at some point.

Bitcoin has been moving within a strong uptrend and is likely to continue rising. Bullish until the chart says otherwise. We are going up. Short-, mid- and long-term.

As Bitcoin consolidates near resistance, the altcoins will continue to build strength in order to grow. Remember, we are still looking at bottom prices across thousands of altcoins. Only a few moved ahead and are trading at all-time highs, the rest will catch up. The time is now, late 2025. The best is yet to come.

Namaste.

Simple Psychology Tips Using Volume for Better TradingMany newer traders assume that when someone says "psychology" in trading, they are referring to mindset.

It is also widely believed that trading is about the BEST entries.

Now, think of it this way. It is not about winning trades, it is actually about managing losses well to allow you to take the winners over and over again. You might think that a 3 to 1 risk-to-reward strategy is boring, you might have gone all in on your favourite crypto project. But what makes the difference between gambling and trading is actually very, very simple. So simple, in fact, many overlook it or simply ignore it.

Most seek a silver bullet - high win rates and perfectly timed entries, then they overleverage and move stops on the one "good trade" they are seeking to make.

Whilst doing this, they tend to overload the 6 monitors they have purchased to trade with a thousand indicators, which they don't really need.

The candlesticks tell a story, volume supports that story. When you learn any technique from Elliott Waves to Wyckoff, they all have a dependence on volume - even if the correlation is not apparent.

Look at this first image.

Price had moved down since the vertical line, the AD line also moved down - sell-off, in full swing. But then volume starts to shift before the AD line starts to increase.

Now, look at what happens next...

As we move forward and the new vertical line shows where volume spiked, the AD line starts to decrease as the price continues to rise.

This is enough of a story to start your analysis.

We then get a move with a lower high formed.

As this plays out, the sell-side volume rises, creating momentum for the short position.

Look a little closer and you will see, that the volume on the move up just before the drop was also decreasing. Making a divergence to price.

You might feel that the market is against you, or that the big players are single-handedly seeking your stops. But the truth is, the psychology in moves such as this one shown is where most retail traders either have greed that markets will only go up for ever or the fear that they are missing out on a market that only goes up forever.

It is that herd mentality that generates the liquidity for the professionals.

Losing 1% on a trade, is part of the process, risking 80%> on a single move will make you paper rich for about 10 minutes before the real losses set in.

This is where the psychology and the basic techniques such as risk management and understanding what candlesticks and volume bars are telling you, will make a world of difference to your results.

A/D line and volume are free on @TradingView and to be fair you don't need to overcomplicate it more than that!

Stay safe, have a great weekend all!!!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Bitcoin willIt hold if we stay above $115k ?? Fixing up last post I’ve deleted now as image was not good. Anyway simple RSI and Auto Fib Retrace with only general CRYPTOCAP:BTC market understanding backing this. This isn’t finacial advice at all. It’s pure speculation this post and anything related to it. I’m

Not a finacial advisor and I will not be held accountable for anyone’s actions that I didn’t do.

#BTCUSDT – Healthy Correction, Not the End!Bitcoin is currently experiencing a healthy pullback after an impressive run, testing the neckline of the Inverse Head & Shoulders breakout on the 1D timeframe.

🔹 Current Market View:

BTC is retesting the neckline of the IHS pattern, which now acts as a strong support zone.

Price is holding near $113K–$115K, which is crucial for maintaining bullish momentum.

This dip is a healthy correction, flushing out over-leveraged positions and preparing for the next leg up.

🔹 Key Levels:

Support Zone: $113,000 – $115,000

Immediate Resistance: $120,000 – $122,500

Breakout Target: $165,000+ on the next bullish wave

🔹 Market Sentiment:

Holding above the neckline keeps the bullish structure intact.

If the support holds, we can expect continuation to new highs once buying pressure returns.

A daily close below $112K would signal caution and delay the next rally.

💡 Tip: Don’t panic on these red candles. Healthy corrections are part of a sustainable uptrend.

BitcoinBitcoin/TetherUS (BTC/USDT) Trading Analysis - Jul 15, 2025

Key Observations:

Price Movement:

Current Price: $117,692.46

24h Change: -2,148.72 (-1.79%)

Range: Low of $116,250.00 to High of $119,940.83

The price is currently near the lower end of the day's range, indicating bearish pressure.

Support and Resistance:

Support Levels:

Strong Support: $112,000.00 (marked as S/L)

Intermediate Support: $113,500.00 and $110,000.00

Resistance Levels:

Immediate Resistance: $119,900.00

Higher Resistance: $120,000.00 and $122,500.00

Profit Levels:

The "Profit" section lists potential take-profit targets, with the highest at $135,000.00.

The price has recently dipped below the $120,000.00 psychological level, suggesting weakening bullish momentum.

Trend Context:

The chart spans from June to September, but the current price action (July) shows consolidation after a potential pullback from higher levels.

The presence of multiple support levels ($112K–$116K) suggests a critical zone for buyers to defend.

Actionable Insights:

Bearish Short-Term: The price is below key levels ($119,900–$120,000) and has broken below $118,250.00. A retest of support at $112,000.00 is plausible.

Bullish Reversal Signal: If BTC holds above $112,000.00 and reclaims $120,000.00, it could target $122,500.00 or higher.

Risk Management: A break below $112,000.00 (S/L) may trigger further downside toward $110,000.00 or lower.

Conclusion:

The market is currently in a corrective phase. Traders should monitor the $112,000.00 support for potential reversals or breakdowns. A close above $120,000.00 would shift bias to bullish.

#BTC Update #13 – Aug 01, 2025#BTC Update #13 – Aug 01, 2025

Bitcoin has approached the lower edge of its current channel and received a reaction from there. However, in the current timeframe, the ongoing candle seems willing to pull back again. The MA200 band held the previous candle well, which also represented the bottom of the current channel. There is high liquidity between the $113,200 and $121,000 zones. I believe Bitcoin will continue to move by sweeping through this region. Therefore, I think Bitcoin’s current target is to reach around the $118,000 level with a 3% push move.

If Bitcoin does not make this move and chooses to pull back instead, it may go as far as filling the imbalance at the $110,000 level. The last impulsive move was made around 20 days ago, and since then, the chart has been progressing with a correction of a correction. As long as there’s no close below $107,500, the uptrend will remain intact in the long term. However, if the $107,500 level is broken with a strong candle, we can say that Bitcoin has turned bearish on the 4-hour timeframe. For now, this doesn’t seem very likely. I believe Bitcoin’s next move will target the $118,000 region, continuing to clear out the liquidity accumulating in the upper ranges. However, this channel will need to break at some point.