BTC USDBITFINEX:BTCUSD

This current four hour Ichi cloud will likely fail and we see some decent downside but there is always that chance we respect the cloud and finish heading towards 131k.

Looking at the daily/weekly tf's I'm assuming one more move higher before we sell off relatively soon within the weekly time frames narrative so within some months.

Btc-e

BTC highs in, new lows coming soon?~$122.5k was the top of the range. Now we'll need to go test the lows before we can continue higher.

Alts are clearly not confirming a trend change .

Many still bearish on HTFs (including ETH), I think the reason is because Bitcoin goes lower before we see a continued run and that will drag down alts with it. I think people holding alts here with hopes for new highs (in the near future) are about to have their hopes crushed, that also goes for people long crypto miners.

I don't think the real run starts until end of 2025 or 2026.

Time will tell.

Bitcoin Rejected Near $120K – Bears Wake Up!First of all, I have to say that Bitcoin’s movements over the last 12 days have been a bit difficult to trade , generally, the hardest market to make a profit in is the range market with a swing movement .

Bitcoin( BINANCE:BTCUSDT ) is currently trading near the Resistance zone($121,000-$119,500) , Cumulative Short Liquidation Leverage($121,336-$120,000) , and the upper line of the descending channel .

Since Bitcoin has lost support lines , we can consider this increase in Bitcoin over the last two days as a pullback to the support lines(broken) . Do you agree with me!?

In terms of Elliott Wave theory , it appears that Bitcoin is still completing the main wave B. The main wave B is a Regular Flat(ABC/3-3-5) . The structure of the microwave B of the main wave B was a Double Three Correction(WXY) .

Additionally, the SPX 500 index ( SP:SPX ), which Bitcoin is correlated with , is poised for a correction in my opinion, which could also impact Bitcoin .

Also, unlike previous Mondays, MicroStrategy has NOT purchased Bitcoin , and the company currently holds 607,770 BTC .

Old Bitcoin wallets also seem to be waking up to the fact that they can create movements in the crypto market . " In recent days, 471,867.8 BTC worth $56.39 million have been transferred from old wallets from 2012 to 2017 . ".

I expect Bitcoin to decline to at least the Support zone($116,900-$115,730) and fill the CME Gaps in the coming hours .

New CME Gap: $119,500-$118,295

CME Gap: $115,060-$114,947

Cumulative Long Liquidation Leverage: $117,401-$116,615

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

TON Swing Trade – Support Zone in FocusTON is holding a major support level, setting up for a potential bounce. With structure intact, this offers a favorable long entry for swing traders looking to capitalize on the next leg up.

📌 Trade Setup:

• Entry Zone: $3.20 – $3.35

• Take Profit Targets:

o 🥇 $3.60

o 🥈 $4.00

• Stop Loss: $3.088

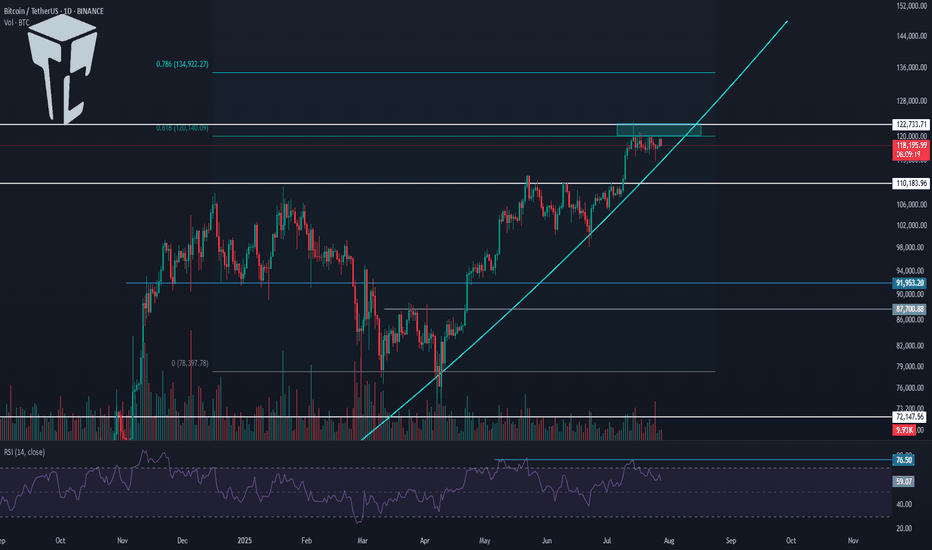

TradeCityPro | Bitcoin Daily Analysis #139Welcome to TradeCity Pro!

Let's go over Bitcoin's analysis. Today, Bitcoin is showing some signs regarding its next move, and today could be a critical day — especially considering that U.S. interest rate data is set to be released tomorrow.

4-Hour Timeframe

Today, there’s no need to switch to other timeframes — this 4-hour chart tells us everything.

Yesterday, the price was moving toward the 120041 area, which we intended to use as a long trigger, but that didn’t happen. The price failed to stabilize above this level, and RSI was rejected from the 61.67 zone.

Currently, the price has formed a lower high compared to 120041 and is now moving toward the support area around 116000.

Selling volume has significantly increased, which is not good for the bullish trend. If this support level breaks, deeper corrections to the 0.618 or even 0.786 Fibonacci levels could occur.

I’ll take profit on my long position that I opened from below 110000 if the price stabilizes below this zone, but I absolutely won’t open any short positions for now.

In my opinion, as long as the price is above 110000, any drop or correction is simply a better entry point for a long position. However, we shouldn’t buy during a falling market — we must wait for our triggers to activate.

Bitcoin is testing the boundaries of the triangle ┆ HolderStatBINANCE:BTCUSDT is printing higher lows along trendline support near $67,800. The price is compressing into a wedge below $69,000 resistance. A breakout would confirm continuation toward $71,000–$72,000. Momentum remains intact unless $67.5k is broken. The market is building pressure for the next impulsive move.

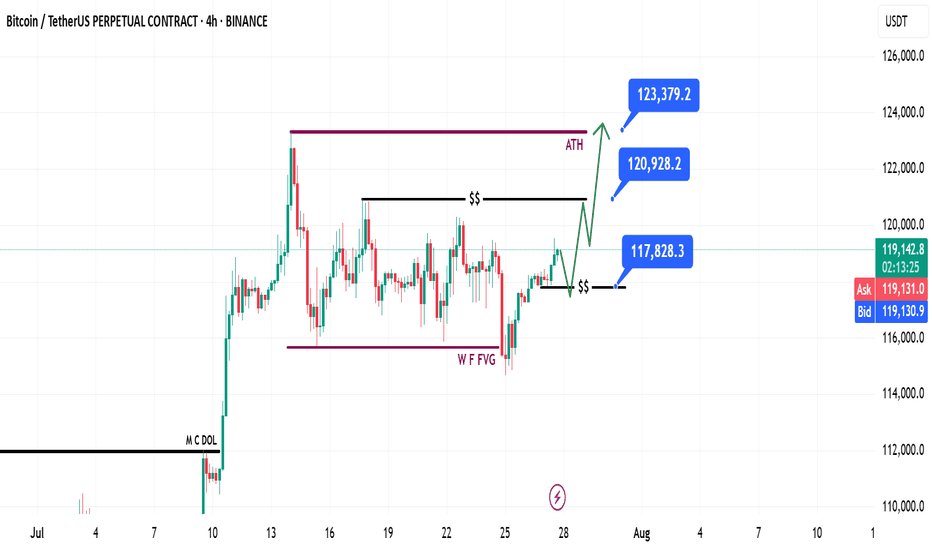

Bitcoin Weekly Recap & Gameplan | 27.07.2025📈 Market Context:

Bitcoin maintained its bullish momentum, driven by continued institutional demand and a supportive U.S. policy backdrop.

Last week’s gameplan played out well — solid profits were captured (see linked chart below).

🧾 Weekly Recap:

• Price made a bullish retracement into the Weekly FVG (purple line) exactly as projected in last week's post.

• From here, I expect continuation toward new all-time highs.

📌 Technical Outlook:

→ First, I expect a short retracement and a 4H swing liquidity grab at 117,828$.

→ Then, a strong continuation move toward ATH targets.

🎯 Setup Trigger:

Watch for:

✅ 4H liquidity sweep

✅ 15M–30M bullish break of structure (BOS)

This is the confirmation zone for potential long setups.

📋 Trade Management:

• Stoploss: Below confirmation swing low

• Targets:

– 120,938$

– 123,400$

💬 Like, follow, and drop a comment if this outlook helped — and stay tuned for more setups each week!

BTCUSD 8H – Long Triggered on Cloud Flip, Can This Trend Keep?This BTC 8H setup highlights how the Enhanced Ichimoku Cloud Strategy V1 caught a +27% move using clean trend confirmation and a low-noise entry.

📊 Setup Breakdown:

Major Support Zone held 5+ times between March and April — confirming buyer interest.

Entry triggered once:

Ichimoku Cloud flipped bullish

Price crossed the 171 EMA

Strategy alignment confirmed by Ichi + EMA + Cloud filters

Entry candle: ~$93,400

Current price: ~$119,000 → +27% trend continuation.

📈 Strategy Logic:

This system combines:

Custom Ichimoku (7 / 255 / 120 / 41) for cloud confirmation

A 171 EMA filter to block noise

A trend-following “state memory” logic to avoid premature reversals

This BTC move is a textbook example of how the strategy avoids second-guessing and holds strong trends without constant recalibration.

⚠️ What to Watch Next:

Price is currently ranging near prior highs

Cloud remains bullish, but RSI and momentum divergence should be monitored

If support holds above ~112K, continuation is likely — break below could shift structure

✅ Backtest this strategy on your charts to see how it handles your favorite assets.

It’s best used on high-timeframe trends where precision and conviction matter most.

BITCOIN PREDICTION - MASSIVE CANDLE INCOMING!!! (WARNING) Watch this Bitcoin Prediction video now, you will love it!

Yello, Paradisers! Big warning sign: #Bitcoin is about to liquidate more traders soon if we get these confirmations that I'm sharing with you in this video. Loads of people will get wrecked again. Be careful not to get trapped into fakeouts.

In this video, I'm describing exactly what I'm seeing on Bitcoin, what patterns I'm waiting to form, and what confirmations I want to see before being able to say with 100% accuracy guaranteed that MARKETSCOM:BITCOIN is moving in that direction.

I'm sharing with you all the important targets and also how professional trading works: how risk-reward proper ratio trading works, and how high-probability trading depends a lot on how you choose to create your trades.

Watch this Bitcoin prediction to understand what I'm seeing right now on the chart and how I'm acting and making my decisions.

BTC Trade Plan: Watching for Break and Retest Above Daily Range🟠 Bitcoin (BTC) is currently trading range-bound on the daily timeframe ⏳📉📈. I’m monitoring price action for a bullish break and retest 🔓🔁 of the current range to confirm a potential long entry 🎯.

📍 Key levels are already marked on the chart 🗺️—

🛑 Stop-loss would sit just below the previous swing low,

🎯 Target aligns with the higher price zone marked out to the left of the chart 🔼👈.

This is a classic range breakout setup—patience and precision are key.

🧠 As always, this is not financial advice.

#BTC Update #11 – July 29, 2025#BTC Update #11 – July 29, 2025

Bitcoin continues to move within the channel and has completed several corrections of its last impulsive move. It is currently undergoing a correction within a correction. There was a liquidation zone around the $117,000 level, which was mostly filled, triggering a reaction.

From what we can observe now, Bitcoin is facing rejection from the upper boundary of the channel. If it manages to break out of the channel and continue its climb, I believe it will target the high liquidity zone near $122,000.

At this stage, Bitcoin is not in a suitable position for either long or short trades.

BITCOIN → Hunting for liquidity. Retest resistance before a fallBINANCE:BTCUSDT.P continues to consolidate after a strong rally. There is no strong driver yet, and Bitcoin is reacting weakly to economic data. There is a possibility of a continued correction...

Bitcoin is still in correction, but is rebounding from the local low of 117.4, formed during the pullback, and is heading back up towards the zone of interest at 119.8-120.1, which it did not reach during the main upward movement. I see no fundamental or technical reasons for the correction to end and for growth beyond 121K. I expect a rebound from the resistance zone towards 115-114K. However, in the medium term, I expect the market to attempt to close half or all of the gap between 112K and 114.8K, thereby expanding the key trading range.

Resistance levels: 119.77, 120.1K, 120.8K

Support levels: 117.4, 116.37, 115.68

Technically, a false breakout (liquidity capture) of key resistance and price consolidation in the selling zone could trigger bearish pressure on the market, which in turn would lead to a correction.

Best regards, R. Linda!

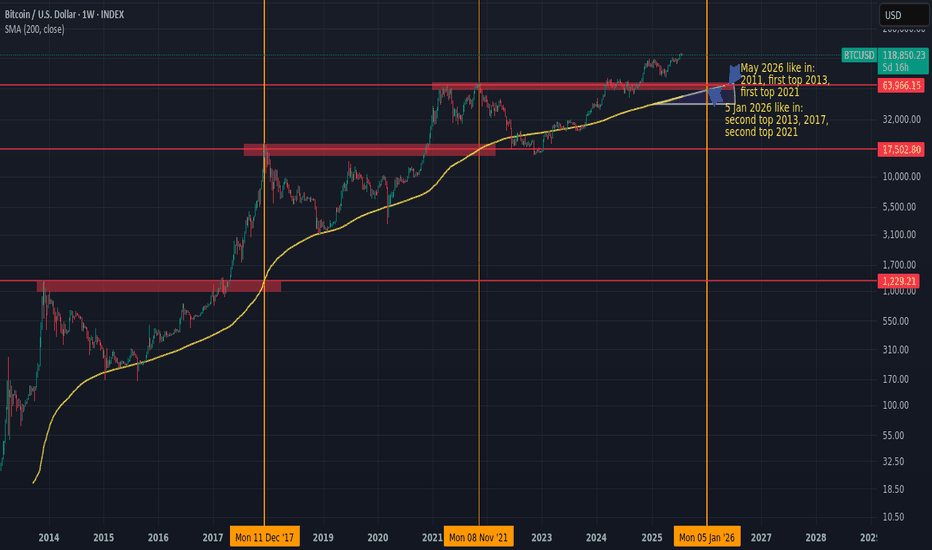

Next BTC topHistorically, BTC/USD has tended to peak when the 200-week simple moving average (200W SMA) approaches or crosses the high from the previous market cycle.

If this pattern holds, and assuming the 200W SMA continues rising at its current pace, the next top could occur sometime between January and May 2026.

If BTC accelerates earlier, the moving average would steepen, potentially shifting the timing forward.

Something worth watching to manage risk and position sizing accordingly.

Rectangle Consolidation + Bull Trend = BTC Setup for ATHYesterday, Bitcoin dipped and recovered again, following last week's sharp spike down, triggered by the $9B Galaxy Digital sale on behalf of a Satoshi-era investor.

________________________________________

🧠 Why is this important?

Despite being one of the largest BTC sales in history, the move only caused a temporary spike down.

That’s a clear sign of market strength and strong interest on dips.

________________________________________

📉📈 Current Technical Context:

• If we ignore the spike, price is consolidating in a tight rectangle

• That’s typically a continuation pattern

• The broader trend remains strongly bullish

📌 Put all of that together, and we have at least 3 reasons to expect upside continuation

________________________________________

🎯 Key Levels:

• Break + daily close above $120K → likely leads to a new ATH and a potential test of $130K

• Invalidation only comes with a break below $114K

________________________________________

Conclusion:

BTC just absorbed a massive $9B sell without blinking.

As long as $114K holds, I'm bullish and expecting continuation.

Next leg could (and I hope it will) be explosive. 🚀

Bullish bounce off swing low support?The Bitcoin (BTC/USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 115,415.51

1st Support: 113,466.96

1st Resistance: 120,573.43

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

BTC MACD Liquidity Tracker Strategy – High Timeframe Long CallsThis BTC 8H chart shows how the MACD Liquidity Tracker Strategy has tracked trend structure cleanly across multiple long signals — each aligning momentum and EMA bias on the mid-to-high timeframe.

First long: Triggered at ~64,565 and exited near 99,560 as momentum peaked

Second long: Re-entry at 83,419 after reclaiming structure, closed near 111,958

Third long (active): Triggered at 108,342 and currently holding above 117,000 with trend still intact

Color-coded bias (blue/pink) helps confirm context at a glance. The combination of MACD momentum shifts + 60/220 EMA filters prevents early entries and helps capture large legs without excessive noise.

Want to explore or customize the strategy?

Search “MACD Liquidity Tracker Strategy ” and run your own backtests to refine parameters per asset.

TradeCityPro | Bitcoin Daily Analysis #138👋 Welcome to TradeCity Pro!

Let’s get into the Bitcoin analysis. Today is the start of the week, and it’s very important to begin our trading week with the right analysis and outlook.

📅 Daily Timeframe

On the daily timeframe, as you can see, not much has changed compared to the previous analysis, and the price is still ranging near the supply zone.

✔️ The fact that no price correction has occurred so far shows the strength of the buyers, and even if a correction does happen, as long as the price stays above 110183, the trend will still be considered bullish.

🧩 The main trigger for trend continuation is either the price reaction to the curved trendline or the break of 122733. We can find more optimal triggers in the lower timeframes.

⏳ 4-Hour Timeframe

In this 4-hour timeframe, after a fakeout below 116829, the price corrected down to the 0.5 Fibonacci level and now has returned again to the box between 116829 and 120041.

🔍 The fakeout trigger is 120041, and I’ll try to have at least two positions open in the market when this level breaks — whether on Bitcoin or altcoins.

📈 The main trigger for the next bullish leg is 122733.

If RSI also breaks the 61.67 resistance alongside 120041, the likelihood of the move continuing will increase.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Very important Economic Calendar 28.07–01.08: FOMC, BTC, tariffsThis Week (July 28 – August 1) — the final week of the month is packed with key events.

Save this post and forward it to 3 friends 😉

📋 High volatility ahead — as the Fed’s key "threelemma" (inflation, labor market, tariffs) comes into focus.

Several important macro releases are scheduled — each one matters on its own, but combined, they can move markets sharply.

🗓 Monday (July 28)

▪️ 12:30 UTC – QRA (Part 1): upcoming US Treasury borrowing needs

▪️ 16:00 UTC – 2Y & 5Y bond auctions – key indicator of market expectations ahead of FOMC

🔗 Strong demand = stronger rate cut expectations

🗓 Tuesday (July 29)

▪️ 12:30 UTC – US GDP (Q2 estimate)

▪️ 16:00 UTC – 7Y bond auction

🗓 Wednesday (July 30)

▪️ 12:15 UTC – ADP employment report – early signal ahead of NFP

▪️ 12:30 UTC – QRA (Part 2): breakdown of Treasury borrowing

▪️ 18:00 UTC – FOMC rate decision (no change expected – 4.5%) + Powell’s press conference

🗓 Thursday (July 31)

▪️ 12:30 UTC – PCE inflation (June) – Fed’s favorite inflation gauge

🗓 Friday (August 1)

▪️ 12:30 UTC – Nonfarm Payrolls (employment)

▪️ 13:00 UTC – ISM Manufacturing Index (July)

▪️ 13:00 UTC – Univ. of Michigan Consumer Sentiment Index

▪️ All day – July auto sales data

🚨 LIBERATION DAY 2.0

Potentially the most impactful event of the week: the Trump administration will begin sending “tariff letters” to ~200 countries.

This marks the end of the temporary tariff relief (April 8 – August 1).

Markets expect a new wave of global trade tension — timing is still uncertain.

💡 Summary:

Every day brings a new potential driver.

Markets are nervous and highly reactive — sharp moves are likely...

CRYPTOCAP:BTC is currently being held above $117K, but Wednesday and Friday bring high risk of "news bombs".