Btc-usdt

BTC/USDFor a long time we suppose BTC price turn up. We can see on chart down trend shows us bear flag formation. We saw 25500 area and bounce a bit on Daily. Bear flag formation still valid. As we see on chart 28546 area important to bounce 32K-33K. In long term we suppose 46K area.

*Please share your opinion on it, write in the comments. Dont forget some cheers bravo. "

Teşekkürler.

BTC scenario for next few monthsBTC recently broke the bear flag. In my previous analysis, I pointed out that this would happen, however I expected BTC to have relief rallies between the trendlines before finally falling to 28k. There is a wick to 25k which was possibly accentuated by the tether depeg.

The average crypto bear market from bull cycle top to bear cycle low is typically 1 year. If it works the same way this time, the low will be produced around November 2022- January 2023 before BTC will move upwards and then surge in the next halving for 2024. This scenario is in line with previous bear markets where BTC plummets, then chops sideways for months and finally capitulates to produce an absolute bottom near the 200 WMA. This has always coincided with an RSI of 30 or slightly less on the weekly, or an RSI of 43 on the monthly and BTC is currently close to these levels. We can expect BTC in this scenario to trade between 28-37k, perhaps until November where it could drop dramatically to 20-24k and finally find an absolute bottom. As usual past data is never an accurate predictor of future events, so this is just being put forward as a possibility.

If you agree or enjoyed this idea, please press the like button. Thanks.

bitcoin vis a vis USDT+USDC market cap. cause and effect.it is our belief that USDT and lately USDC issuing contributed to the expansion of bitcoin price, in the same manner that M2 / fed balance sheet did contributed to SPX rise since long. henceforth, its currrent shrinking should cause BTC prices to fall alongside.

MANA/USDT 1HR CHART UPDATE BY Domino Crypto!!Hello, community members welcome to this MANA/USDT 1hr chart update by Domino crypto.

Don’t forget to hit the like button if you find this update helpful because this motivates me to bring this kind of update on a regular basis.

Now, Let's get to the chart,

As we can see from the above-mentioned chart that MANA/USDT created an INVERSE HEAD & SHOULDER pattern which is a bullish pattern.

In the current scenario, MANA broke the neckline and currently trading at the price level of $1.2.

Now, here I am expecting a retest to the neckline which will be the confirmation of long MANA.

RSI also follows the trend line well and moves upward.

At some % below MANA also getting support from the blue MA, and in another case, MANA can come done at the blue MA to retest and can pump from that zone also.

ENTRY:

leverage:-5x to 7x leverage

entry:-$1.12,$1.15

target:-40% to 50%

stoploss:- $1.0

NOTE: This is not financial advice. This is for education purposes only. I am not responsible for the profits or losses you generate from your investments.

DO YOUR OWN RESEARCH BEFORE TAKING ANY TRADES.

Thank you.

BTC want to hit the target of SHS Double top and Elliot Wave FibHi there,

It looks like BTC wants to hit the target of SHS Double top and Elliot Wave Fibonacci retracements levels. Maybe it gonna hit 24K - 30K before changing the trend.

Check out my related charts. some from 8. December 2021.

Regards.

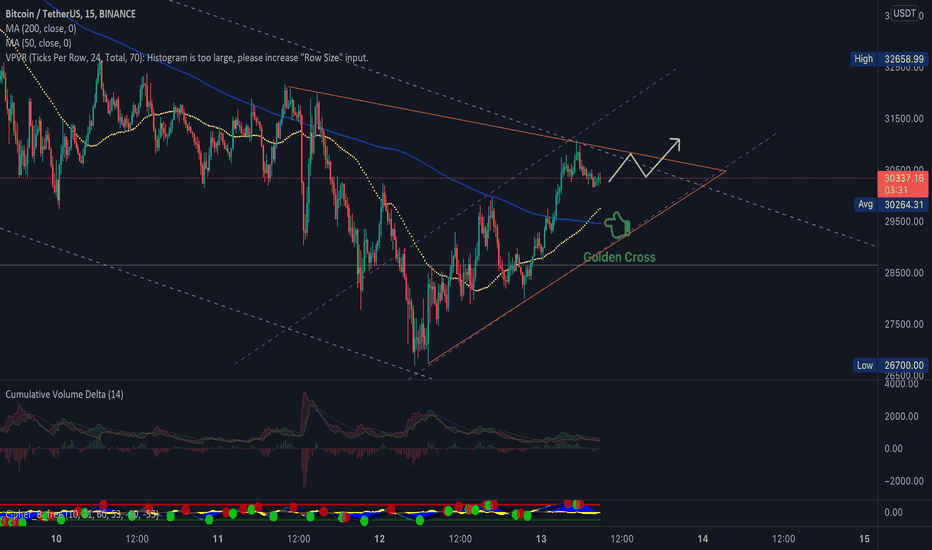

My trading strategy for the next week.Hello traders 👋

To elaborate a trading strategy it requires multiple factors such as The macro-factors : Covid-19 pandemic (lockdowns), supply chain (high transportation prices causing inflation), Ukrain war (causing gas fees to increase) .

The market factors such as The price action on Time Frames, some indicators !

__________________________

Points toward the bullish biasis 🐂 :

BINANCE:BTCUSDT

1)First of all we have btc at important on important trendline that only touched 2 times and kicked of an amazing rally ! and the only ones we have seen this year.

2) We have 2 bullish divergences on the rsi.

3) A bullish price action pattern is strong point for bulls such as double bottom, triple botom, inversed head and shoulder, losange, or any other trend reversel or bullish ones. espacially if it is associated with trend reversel candle stick formation.

4) BTC didn't make lower lows on the monthly TF and it is on

All these 3 points make on the VERY short term a valid long entry.

__________________________

Bearish biasis 🐻 :

1) This point is worth all the previous mentioned and those who will be cited next. This point is about interest rate and federal reserve decision ! If the outcome of their decision by rising more than investors expect will cause markets all around the world to crash (as if they already didn't😏). Actually, the reason of the begining of this crash is due to the first press declaration ( see the full article here ). On this Tuesday, the federal reserve has a meeting Tuesday 3rd may where they will decide how much they will increase. I expect the outcome will be more than investors preferences and this causes the markets to rally donward.

2) I thinks there isn't enough trading volume this may reflect the low interest of investors and these prices even though they're low and this will cause the prices to go down further !

3) Since the prices are lower than the 200 ema, it means that we're in a downtrend and basically we're in a bear market by definition. I will be looking for a trend continuation at the 15mn TF and profition from the pullbacks of this downtrend!

4) BTC below it's 50 EMA on the weekly !

____________________________

I hope you liked this Idea, if you want to show your appreciation for the efforts spent you can like this post !

At the end I wish you a profitable trading and Thank you !

Bitcoin Price Analysis - 4/5/22Crypto Markets have corrected by about 50% from all-time high and have been consolidating for a while, Price is at a vital support level and the price has to sustain above this level for any upside.

If BTC closes below the lower trendline, we can expect more bearishness and the price might slide towards 33000$ and 29000$ which are the next major support levels.

So plan your trades accordingly. Only for educational purposes. DYOR Before Trading or Investing.

Bitcoin in downward trend and expected to test major supports. BTC has fallen below the ascending channel and moving within the red channel. Eventually, it will be testing the thick yellow support which marked the bottom of the downtrends in 2021.

If it breaks and closes below the yellow support line at 36k, the chances of a bear winter increase significantly. Could drop down to 20k to retest the previous high.

NOT FINANCIAL ADVICE