BTC dominance hinting at one last push?Hello everyone

We all are looking for a way how the BTC dominance can go down to 40% area. If we somehow can predict it correctly then we can make some money in the process.

Here is a (maybe not so) wild idea for medium term.

We are on a weekly chart.

Let's check some facts first:

- Stoch RSI is currently high (near 100).

- RSI is at 68

- Chart is making a new higher high - keep in mind previous dominance high (Feb 3rd) was a result of a flash crash of the market so I am referring to previous high as Nov 18th

So we are witnessing a bearish divergence (RSI making lower highs while chart is making higher highs). Hence drop in BTC dominance should just be a matter of time.

What if the universe aligns and following happens:

We are in economically unstable times. Markets are volatile, politicians are unpredictable so further drop in Crypto space is not impossible. BTC drops less then ALTs, BTC dominance reaches top somewhere between now and 67-68% area. In the meantime traditional markets also crash some more. After that the economic situation stabilises, we get Quantitative Easing and this drives price of ETH up, followed by other ALTs.

For reference: ETHBTC has reached strong support between 0.002300 and 0.001700 Satoshi, RSI is at 24 (same level as Sept 2019 when ETHBTC was at a longterm low).

This scenario would ignite Altseason, bringing BTC dominance down for a reset and start of a new cycle.

There are other bearish scenarios as well, keep that in mind. So trade safe and smart.

I am not predicting any of this, I am not even mentioning any possibilities for this to happen. I am just giving you some food for thought.

Good luck!

Btcdominance

TradeCityPro | BTC.D: Predicting Alt Seasons with Bitcoin Domina👋 Welcome to TradeCity Pro!

In this analysis, I want to discuss an important crypto index that can significantly impact our trading, known as BTC.D. First, I'll provide some explanations for those unfamiliar with this index, and then we'll dive into the analysis.

🤔 What is Bitcoin Dominance?

Bitcoin Dominance is a major indicator in the crypto market. It does not directly represent supply and demand and is not tradable; the chart you see is calculated by TradingView and does not exist physically.

⚡️ This index represents the strength of Bitcoin in the crypto market. It shows the amount of money in Bitcoin divided by the total money in the crypto market.

100x(Bitcoin MarketCap / Total MarketCap) = Bitcoin Dominance

✔️ For example, if the total money in crypto is 1 trillion dollars and 500 billion dollars of that is in Bitcoin, then Bitcoin's dominance would be 50%.

✔️ Or, if the total money in crypto is 1 trillion dollars and 300 billion dollars of that is in Bitcoin, then Bitcoin's dominance would be 30%.

Now that we know what Bitcoin dominance is and how it is calculated, let's see how it can help us in trading and where it can be useful.

🤔 How is Bitcoin Dominance useful?

When we trade, we often encounter situations where both Bitcoin and an altcoin (for example, Ethereum) are triggered simultaneously according to our strategy. There are several ways we can open positions in these situations. Some open positions simultaneously on both, increasing the risk of the trade and doubling the potential loss if the market moves against us. Others may randomly choose between the two positions, which could result in taking a position on Bitcoin and hitting a stop-loss while Ethereum moves towards your target. But how can we determine which one is likely to be more profitable?

🔹 As mentioned, Bitcoin dominance indicates the strength of Bitcoin relative to the rest of the market, and there are three scenarios to consider for its analysis.

📈 In the first scenario, if the market is bullish, Bitcoin dominance can be bullish, bearish, or range-bound. If Bitcoin dominance is bullish, it means more money is entering Bitcoin, so if both Bitcoin and Ethereum are triggered simultaneously, Bitcoin is likely to rise more than Ethereum. If Bitcoin dominance is bearish, less money is entering Bitcoin relative to altcoins, so altcoins like Ethereum are likely to rise more. If Bitcoin dominance is range-bound, we analyze the market candle by candle and pay more attention to short-term momentum, deciding based on the current trend of Bitcoin dominance.

📉 In the second scenario, if the market is bearish, Bitcoin dominance can again be bullish, bearish, or range-bound.

✔️ Before explaining this scenario, let me tell you how it's possible for the market to be bearish while Bitcoin dominance increases even though Bitcoin's price is also falling. As I mentioned, Bitcoin dominance is a ratio and is shown in percentage terms, so if the market is crashing, it might be that Bitcoin is selling less than altcoins. For example, Bitcoin might sell for 10 million dollars and altcoins for 20 million dollars. Even though Bitcoin is being sold and its price is falling, it is being sold less than altcoins, so its dominance increases.

🔹 Now, let's examine the second scenario. If Bitcoin dominance is bullish, less Bitcoin is being sold compared to altcoins, so altcoins like Ethereum will have a greater drop and are better for short positions. If Bitcoin dominance is bearish, Bitcoin is being sold more than altcoins, so a short position on Bitcoin would be more suitable. Lastly, if Bitcoin dominance is range-bound, like in the first scenario, we analyze candle by candle and focus on short-term momentum.

📊 In the third scenario, if the market is range-bound, I first suggest not opening any positions because many strategies do not work well in range-bound markets, and it's better to wait for a breakout of the range's floor or ceiling before opening a position. However, if you do decide to open a position in this phase, short positions fall under the second scenario, and long positions fall under the first.

⭐ So, with Bitcoin dominance, we can optimize the positions we open and choose the best option between Bitcoin and the selected altcoin. If we look at Bitcoin dominance in higher time frames and not just as a confirmation for futures positions in lower time frames, we can identify alt seasons.

🤔 How to identify alt seasons and alt parties with Bitcoin Dominance?

So far, we've seen how dominance in different states and positions can help us in trading. Now, if we analyze Bitcoin dominance over a longer term, we can determine whether the money in the market will move more towards altcoins or Bitcoin in the coming weeks or months.

✔️ For example, if Bitcoin dominance is bullish in the weekly time frame and has a strong upward trend, naturally, more money will enter Bitcoin over time, making Bitcoin a better investment than altcoins. However, if Bitcoin dominance undergoes a correction for a few days or weeks during this bullish trend, altcoins can experience significant growth during that short time frame, which we call an alt party.

💥 On the other hand, if Bitcoin dominance completely changes trend and is bearish for several weeks or months, altcoins will naturally grow much more and will be a better investment option until Bitcoin dominance turns bullish again, which we call an alt season.

🔹 An important note about alt seasons is that Bitcoin's trend during this time must be bullish or range-bound; if Bitcoin is bearish, neither an alt season nor an alt party will occur. So, be sure to first understand the overall market trend using indicators like Total and Total2, and then look for an alt party.

Now that we've examined how this index works, let's move on to a technical analysis of the chart.

📅 Monthly Time Frame

As you can see in the monthly time frame, Bitcoin dominance had a very long range above the 95% area between 2015-2017, which was because the crypto market was still very small at that time, and many investors thought it was a scam. Thus, if anyone wanted to invest in crypto, they only bought Bitcoin.

✨ But in 2017, during Bitcoin's bull run when it reached the 20k ceiling, altcoins also entered the game, and Bitcoin dominance began to fall, spreading the crypto money among other coins. This downward movement continued down to the 40% area, and after it consolidated around this area, Bitcoin dominance started rising again, correcting the severe downturn it had experienced.

🔍 At the start of the next bull run in late 2020, Bitcoin dominance reached its peak and formed a range between 57.13 and 71.04 until the end of the bull run. After Bitcoin's bull run, in the second leg when the price moved towards the 69k area, Bitcoin dominance broke the 57.13 support and moved down to the 40% support, leading to a major alt season.

🎲 In early 2023, coinciding with the start of Bitcoin's bullish trend from the 16k bottom, Bitcoin dominance broke the 47.80 area, which was the ceiling of its box, and its upward movement restarted. Currently, Bitcoin dominance has also broken the 57.13 area and is near 64%. As long as Bitcoin dominance remains bullish, Bitcoin will still be a better buy, and altcoins will not be able to grow significantly.

💥 If Bitcoin dominance finally confirms a trend change and turns bearish, if Bitcoin's trend remains bullish, we will witness another major alt season like in 2021. For now, we confirm the change in trend in Bitcoin dominance on the monthly chart by breaking 57.13, and for a better and more accurate analysis, it's better to move on to the weekly time frame.

📅 Weekly Time Frame

In the weekly time frame, after breaking the 47.46 area, an ascending trend has formed within an ascending channel, and the price has been in this channel for about two years.

🧩 The next resistance for Bitcoin dominance is 65.59, which it is moving towards, and the main ceiling for Bitcoin dominance is 71.04. If the upward trend continues, more money will enter Bitcoin, and altcoins will not be good investment options.

🔽 For a trend change and a bearish turn in Bitcoin dominance, breaking the 60.50 area is suitable, and if Bitcoin dominance records lower highs and lows below this area, we will confirm the trend change. Breaking the channel will also be one of the most important confirmations.

📅 Daily Time Frame

In the daily time frame, we can analyze the price movement with more detail.

💫 Currently, the 62.23 area has been broken, and Bitcoin dominance is performing another bullish leg, having reached the channel ceiling. If the channel ceiling breaks, we can expect a move to the 65.59 area.

📉 For a trend change in this time frame, it's better to wait for the channel to break, but besides the channel, the 62.23 and 60.50 areas are also significant, and breaking them will confirm it.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | Bitcoin Daily Analysis #56👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. Today, as usual, I will review the New York futures session triggers.

✔️ Yesterday, the short trigger we discussed was activated, and the price moved downward to the area of 74760.

👀 Today, the market conditions are favorable for opening positions, both long and short.

⏳ 1-Hour Timeframe

As I mentioned yesterday, the price executed another downward leg after pulling back to the 80595 area, activating our trigger at 78913 and moving to the main support floor. Today, I have adjusted this area, and we will explore why this adjustment was made.

📚 Positions like the one yesterday, which are opened for scalping, I usually set with a risk to reward ratio of 2 or 3, and I don’t leave them open for long, opting instead to secure profits. If you also open such positions, I recommend not holding them long term.

💥 However, today, as you can see, the price is forming more structure and giving us more logical triggers. The SMA99 indicator is nearing the price, and the RSI is showing divergence compared to the first bottom that the price made at 74650, which was accompanied by divergence.

🔼 For the divergence in RSI to activate, it needs to break the area of 59.87. If this happens, we can say that the divergence is active, and we can look for a price trigger for a long position.

⚡️ The first trigger for a long position is the 77735 area, which is considered risky, and with the breaking of this area, you can open a scalping position. The main long trigger is the breaking of 80595, which, if broken, activates a Double Bottom pattern that could change the market trend.

⭐ Keep in mind, there is currently no Double Bottom, and only if the 80595 area breaks will this pattern form.

📉 For a short position, the 74760 trigger is still appropriate, and you can enter a short position if this area breaks. However, it is important to note that this area is very close to the 71779 area, and opening a position on the break of 74760 will be risky.

👑 BTC.D Analysis

Let's now analyze Bitcoin dominance, which continues to range between the areas of 63.30 and 63.50. Breaking this box could define the positions we open today.

💫 If the 63.30 area breaks, dominance might temporarily decline, allowing more capital to flow into altcoins. Conversely, if the dominance breaks upwards at 63.50, more capital will flow into Bitcoin. Soon, we will have a comprehensive analysis of Bitcoin dominance that I highly recommend not to miss.

📅 Total2 Analysis

Moving on to the analysis of Total2, yesterday the Total2 trigger at the 896 area was activated, and altcoins, like Bitcoin, declined, causing this index to drop to the area of 860.

🔍 Today, for a short position, breaking the 860 area is appropriate. However, for a long position, I recommend seeking confirmation from Bitcoin itself and its dominance.

📅 USDT.D Analysis

Finally, for the Tether dominance analysis, this index activated its upward trigger at the 5.84 area and performed an upward leg to 6.13.

📊 Currently, confirmation for the next upward leg in dominance will be with the breaking of 6.13, and the confirmation for a downward turn remains at the 5.73 area.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

BTC DOMINANCE is fading - the altcoin wave is coming (3D)This analysis is an update of the analysis you see in the "Related publications" section

First of all, you should know that the time frame is large. the 3-day chart which means altcoins could remain bullish for 1 to 3 months. We should be looking for buy/long positions on altcoins that have strong setups.

We expect a drop from the red zone or even from the current price to complete wave f of this diametric pattern.

Targets have been marked on the chart.

A daily candle closing above the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

TradeCityPro | Bitcoin Daily Analysis #55👋 Welcome to TradeCity Pro!

Let's delve into the analysis of Bitcoin and key crypto indices, focusing today on the New York futures session triggers as usual.

🔄 Yesterday, the market was in a corrective phase of a downward trend, coinciding with news about the date of a meeting between Iran and the USA, which caused a slight upward movement in the market.

📊 As I mentioned, due to the low market volume, any news from the USA can significantly impact the price. The news was that Iran and the USA have scheduled a meeting for Saturday to negotiate an agreement.

📰 However, a more significant news item that the whole world is waiting for is China's reaction to the 35% tariffs imposed by the USA. Trump has declared that if China does not accept these tariffs within the next few days, he will increase them to 50%.

🎲 If this happens, the next downward leg in price might begin. However, if news comes out that these two countries are nearing an agreement and are ready to negotiate tariffs, the market will undoubtedly move upwards, and this news could even be the start of a new bullish trend.

Let's move on to the chart to find the technical triggers.

⏳ 1-Hour Timeframe

As I said yesterday, with the breaking of the 50 area in the RSI, the price underwent a deeper correction and moved upwards.

⭐ It appears that an ascending structure is forming, and the price is steadily moving upwards. However, this movement doesn't have much upward momentum, and its volume isn't very high.

🔽 Today, for a short position, we can open a position in line with the trend at a high risk with the break of the 78913 area. The price has corrected to a reasonable extent and has pulled back near the SMA99. If the price moves towards this SMA and gets rejected, the importance of breaking 78913 will increase.

📉 The main trigger is currently the 74760 area, which is the market's primary floor. However, in general, I believe that the market structure isn't yet in a state where we should open major positions, and we should wait for more structure to form. This way, we can open more secure and precise positions, which would allow us to take higher risks and ultimately make more profit.

💫 If you want to open a short position with the break of 78913, the RSI moving below the 50 area could be a good confirmation, but be careful not to involve too much risk.

👑 BTC.D Analysis

Let's move to the analysis of Bitcoin dominance, which is still ascending and has created a temporary support floor at 63.30. If this area breaks, we might temporarily confirm a decline in dominance.

🚀 Keep in mind that the dominance trend is bullish in all market cycles, and breaking this area does not mean a bearish trend. However, if it breaks 63.30, dominance might pull back to 63.07 and could enter a correction phase for a few days, which would impact our position choices.

✔️ If dominance is supported from this area, the likelihood of its continued growth increases.

📅 Total2 Analysis

Moving on to the analysis of Total2, as you can see, with the slight correction of Bitcoin dominance, this index has performed slightly better than Bitcoin and has currently reached a similar peak at 920.

📉 The short trigger I gave on Bitcoin at 78913 is a better trigger compared to Total2, where the 896 area has not yet been tested and is riskier than Bitcoin.

🔼 For long positions, you can open one with the break of 920, but I do not recommend it because the market is in a downward trend, and there is a downward momentum in the market, and since I do not trade against the trend, I also do not recommend that you take a long position against the downward trend.

📅 USDT.D Analysis

Finally, the analysis of Tether dominance is performing similarly to Total2 and is currently fluctuating between 5.73 and 5.84.

✨ Both of these areas could be used as triggers, but as I mentioned, it's better to wait for the market to create more structure and reveal the main triggers.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

crypto downtrend exhaustion indicatorsA couple facts:

1) usdt.d is above 5.60% for ~two days. This is a major fact. We have an early bull market end confirmation, or at least the end of an impulse structure of intermediate degree. There is a probability that the structure of the current bull market will be either extended or will end with the final diagonal.

2) usdt.d below 5.60% is confirmation of current dump exhaustion.

3) Crossing down one of the trend lines at BTC dominance chart will mean start of alt season. The target for the mini alt season is ~53% at BTC.D;

4) The terminal target for upcoming Dogecoin rally is range between 0.5 - 1.37 USD. Beware pullback, i look at whole crypto market structure and anticipate one.

XRP could flip Bitcoin again at the end of this cycle around Sepothers.d is ready to bounce after 5 red monthly candles. Just like December 2016.

while Bitcoin Dominance looks like this under Trump 2.0 trolling the economy on a much grander scale while XRP has already given us a tease of what's to come this cycle reaching a historic new ATH. And tether on the other hand, unstoppable! They are about to print so much money they could at some point flip Ethereum while Ethereum finally goes home.

Imagine if XRP and tether flip Bitcoin together (relax! it wouldn't be the 1st time. XRP did in Jan 2018 if only for a moment)

Looks promising now that Europe offered 0 to 0 tariffs. 1929 scenario could take years since dedollarization takes years to develop. (it's not going to happen overnight.)

Spring is finally here. Buy others like VeChain (the next xrp this cycle)

TradeCityPro | Bitcoin Daily Analysis #54👋 Welcome to TradeCity Pro!

Let's delve into the analysis of Bitcoin and key crypto indices. As usual, I will review the New York futures session triggers for you.

⚡️ The market has experienced a drop since yesterday, and I had identified the triggers for this drop in the previous analysis. Let's analyze today to see what we can do in the market.

⏳ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, the price made a downward move after the triggers at 82633 and 81473 were activated, even breaking the important support at 79120 and now has rebounded from the area of 74760.

✔️ If we draw a Fibonacci from this downward leg, we can find potential resistance levels. A few moments ago, there was also a fake news report from Trump stating that he would give 90 days to all countries except China to start tariffs, which, although fake, had a significant impact on the market.

📊 The market volume is very low, which makes it susceptible to such short and small news about tariffs to react this way.

📰 If such news continues and the market acts emotionally, the technical analysis I perform for you will not be very reliable, and the price will move more emotionally.

🔼 However, if these emotional moves end and the price stabilizes in these areas, the potential resistances we have are the Fibonacci levels of 0.5, 0.618, and 0.786, where the 0.5 and 0.786 areas overlap with static price resistances, and the 0.618 area, being the golden Fibonacci, could prevent further price drops.

💥 The RSI oscillator, after a sharp fall and being mostly in Oversell yesterday, has finally exited this area and now reached around 50. If this area is broken in the RSI, the likelihood of a deeper correction will increase.

📉 Today, for a short position, we only have the break of the 74760 area, which I also suggest not opening a position with this trigger because the market has recently moved and needs to create a new structure.

📈 For long positions, according to the strategy I have, it does not make sense for me to open a position in this trend that has so much downward momentum. The best analogy is that when a knife is falling, you shouldn't try to catch it mid-air because it might cut your hand; you should wait for it to fall to the ground so you can pick it up safely without risk.

Let's look at the indices to take a look at the situation with altcoins.

👑 BTC.D Analysis

Bitcoin dominance has made another upward move after breaking 63.07. This caused altcoins to fall more than Bitcoin during this drop, and short positions on altcoins would have given us more profit compared to Bitcoin.

🚀 In the analyses of Bitcoin and altcoins, I've repeatedly told you that for buying altcoins, we should wait until Bitcoin dominance starts to drop. That hasn't happened yet, and it still has a strong upward trend, so today if the market gives a short trigger, altcoins would be more logical.

📅 Total2 Analysis

As you can see, this index has fallen much more than Bitcoin, experiencing a very sharp downward leg upon activating the trigger at 965.

⭐ Currently, I've only added the 949 line to the chart, which overlaps with the 0.786 Fibonacci of this downward leg, and I haven't added any other lines and am waiting for the price to create its structure.

✨ The nearest support the price has is 816, which is very important, and there is nothing else notable about Total2 yet, and we need to wait until a structure is created that can be analyzed.

🎲 The only opinion I can give for now is that the 816 area is very important, and reaching this area in Total2 could end its downward trend, which is more like a prediction than an analysis and is a gut feeling and currently has no logical reason.

📅 USDT.D Analysis

Let's move on to the analysis of Tether dominance, which is very similar to Total2 but seems like a reverse of it.

👀 Yesterday, the trigger at 5.53 activated simultaneously with 965 in Total2, and the dominance moved upward. There's not much I can analyze about this chart, and the main resistance is in the area of 6.34, which acts like the 816 in Total2.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

BTC dominance will stay high and maybe go higher! last 2 monthly candles closed pointing at revisiting last high and I that's about to happen as bitcoin dominance is ~2% from last wick's top. Break 64.4% and it can go from 65.5 to 69%. Meaning altcoins will probably bleed bad! Wait for bottom and buy crypto!

Monthly chart confirms

TradeCityPro | Bitcoin Daily Analysis #53👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. As usual, I want to review the New York futures session triggers for you.

💥 If you missed yesterday's analysis, I highly recommend checking it out. I cleared all the lines from all charts yesterday and redrew them from scratch, and now we have new areas that are optimized compared to before.

⏳ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, there was a symmetrical triangle that has broken downwards, and now it's ready to activate its trigger if it breaks and move downwards.

⚡️ So, for opening a short position, you can enter upon breaking the short-term support at 82633. Preferably, keep a small stop loss so that if the price reaches 81473, the target of the position becomes active.

🎲 Although the triangle has broken, no significant selling volume has entered the market yet, and it's evident that the price is waiting for a good volume to enter to bring momentum.

📊 If no selling volume enters the market, the price could potentially move upwards towards the trigger at 83555. This trigger is risky for a long position, and breaking this area, we can open an early long position.

👑 BTC.D Analysis

Moving on to the analysis of Bitcoin dominance, as you know from yesterday's analysis, we concluded that the dominance trend is upward, and recently, with the breaking of 62.24, the next leg has started.

✔️ Currently, in this timeframe, a ranging box has formed between 62.65 and 63.07, and breaking the top of this box could continue the upward trend. On the other hand, breaking the floor at 62.65 could disrupt the upward trend for now, but as long as this doesn't happen, I still think the dominance has an upward trend.

📅 Total2 Analysis

Moving on to the Total2 analysis, this index is on a very important support floor in the area of 965B, and given the downward momentum that this index has had before, there is a possibility that this area might break.

🔑 If this support breaks, the next downward leg can start. Conversely, the same reason might cause this support to become so strong that it doesn't break.

📈 If the price is supported from this area and moves upward, the first risky trigger for long is at 989B, and the main trigger will be at 1.02T.

🔽 For short positions, as I mentioned, the 965B area is very important, and breaking this area could open a long-term position.

📅 USDT.D Analysis

Moving on to the analysis of Tether dominance, this index is dealing with an important resistance in the area of 5.53, and breaking this area would be akin to breaking the 965B in Total2.

☘️ For confirmation of a long position, 5.41 is suitable.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #52👋 Welcome to TradeCity Pro!

Let's delve into the analysis of Bitcoin and the key cryptocurrency indices. Today, we have a detailed analysis on hand, and I want to start from scratch by drawing all the lines for Bitcoin and other indices so we can get informed about the higher time frames without drawing unnecessary lines.

🔍 Let's get into the analysis, where the charts will be examined in weekly, daily, and 4-hour time frames.

🦁 Bitcoin Analysis

📅 Weekly Time Frame

Let's explore the weekly timeframe. As you can see, the market trend is bullish, and since the price reached the low of 16,000, a bullish structure has formed, and the price has moved upward along a curved trendline. The trendline isn’t very clear on the chart, so I'll put another chart below for you if needed.

✔️ Currently, after two powerful bullish legs that occurred after breaking 31,000, the price has reached the resistance of 104,000 and has entered a corrective phase. The price was moving up with high momentum and no divergence until it reached 71,000, but the next peak at 104,000 was accompanied by divergence, and now the RSI is near triggering this divergence.

⚡️ Overall, the price is in a very critical and sensitive area, and breaking the 44.83 area on the RSI could activate the divergence, and simultaneously, the price may also break the curved trendline, which is not a good sign for the bullish trend and could indicate a trend reversal.

🔼 We must consider that the last bullish leg from 54,000 to 104,000 was much shorter compared to the leg from 31,000 to 71,000. However, I personally see the trend as bullish until the price drops below the 71,000 area, and until a lower high and low are seen below this area, the trend will remain bullish.

📊 If the price sharply falls, breaking 54,000 will confirm a trend change. However, we can get confirmation of a trend change sooner in lower time frames, which I will discuss in the continuation of the analysis.

💥 But everything is set for Bitcoin to rise. The RSI oscillator is at its main bottom, and in this bullish cycle, each time the RSI reached this area, the next bullish leg started. On the other hand, the price has reached the curved trendline, and there is positive news like Bitcoin's strategic reserves in the US, so conditions are ripe for a rise.

📈 Thus, with a break of 104,000, we can confirm the next leg and buy Bitcoin targeting a new ATH.

🎯 To find the target, we can use Fibonacci Extension. As you see, the price has moved up to the 0.618 Fibonacci level and reached the 104,000 area, currently in a corrective phase to 0.382. If it can rise above 0.618 again, the next targets are 0.786, 1, and 1.272, which correspond to areas 123,000, 154,000, and 204,000, respectively.

👀 Let’s go to the daily timeframe to observe the price details more closely.

📅 Daily Timeframe

In the daily timeframe, as you can see, in the bullish leg that occurred after breaking 71,000, the price moved upward and reached 106,000 and, after breaking the 0.236 Fibonacci overlapping with 92,000, went into a deeper correction to 0.5.

⭐ In this corrective leg, the price has created a descending trendline that has been touched several times by the price and is now still engaging this area. If it can break this trendline, the correction will end, and we could see a price increase again.

🧩 In the RSI oscillator, a resistance has formed at 52.26, and breaking this area could bring bullish momentum into the market, which increases the likelihood of breaking the trendline and activating its trigger.

⚡️ There is also a temporary support in the area of 82,124, and if the price gets rejected from the trendline, the likelihood of breaking this support increases, and the price could undergo another bearish leg down to areas 76,000 or 71,000.

🛒 Currently, for buying Bitcoin in spot, the first trigger is the breaking of 87,740, which is a trendline trigger and will be activated after the trendline is broken. The main trigger will be after breaking 106,546, which is the ATH, and a new bullish phase could start.

☘️ The next trigger for Bitcoin is further falls and reaching lower support areas. If the price reaches areas 76,000 or 71,000 and forms a structure there, with the break of the ceiling of the structure, we can carry out a spot purchase, and if this happens, I will specify its triggers in future analyses.

⏳ 4-Hour Time Frame

Let's go to the 4-hour timeframe to review the triggers for Bitcoin futures.

🎲 As you see in this timeframe, a descending triangle has formed, and the price is moving inside it. The dynamic line of this triangle is the daily trendline, and the static line of this triangle is the 81,509 area, which both are important areas and can have a significant impact on the price.

✔️ We are currently in the latter half of the triangle, which is why behaviors and irrational fluctuations have increased, and as you can see, the price has once broken the ceiling of this triangle but couldn’t reach the trendline break trigger and has returned to the triangle.

📈 Currently, for a long position with the break of 84,414, you can enter a position. This position is risky because the trigger is inside the triangle and will be a prelude to breaking the daily trendline. The next main trigger will be after breaking the trendline and activating the 88,344 trigger.

🔽 For a short position, the bottom 81,509 is a very important floor, and with the break of this area, the price can move towards the triangle's target and the 78,620 support.

👑 BTC.D Analysis

📅 Weekly Time Frame

Let's move on to the analysis of Bitcoin dominance. In the weekly timeframe, as you see, a slow and steady bullish trend has been created after breaking 47.33, moving upward along with a bullish trendline, and has once broken this trend from below but has returned above this dynamic area.

🧲 As long as this index is bullish in the bullish legs of the market, Bitcoin will move up more than altcoins, and the increase in Bitcoin dominance causes altcoins to behave very similar to Bitcoin, and it is less likely that the trends of altcoins and Bitcoin diverge.

📚 You can see the impact of this trend inside the Bitcoin and altcoin charts. Bitcoin has registered its previous peak at 106,000 and has recorded a much higher ATH compared to 69,000, but most altcoins in this leg that the market had didn't even reach their previous peaks.

✨ The trend is still bullish without any weakness, and recently, an important ceiling in the area of 60.37 has been broken and has pulled back to it, and now it is moving towards the next resistance, namely 71.43.

💥 But I think dominance will fall before it reaches 71.43 because the dominance is very high right now, and any correction that Bitcoin has causes very severe falls inside the chart, and well, when altcoins fall enough, whales and major investors will enter the altcoin market, which naturally causes Bitcoin dominance to fall.

🔑 So to know when major investors and whales enter altcoins, we have to wait until Bitcoin dominance falls, and this event is currently happening in the weekly timeframe after breaking the trendline and confirming a trend change below this trendline, and until then, Bitcoin will be the capital for better purchases.

📅 Daily Timeframe

Let's move to the daily timeframe. As you can see, after breaking the resistance of 60.37, dominance created a box between 60.37 and 62.16, and now with the break of the box's ceiling, a new bullish leg of dominance has started.

✔️ I usually analyze dominances only with simple tools like support and resistance, but now because I can't get any targets out for dominance, I took help from Fibonacci, and as you see, the potential resistances of dominance are 63.31, 65.15, and 66.49.

🔍 Currently, there is no sign of weakness or trend change in this timeframe, but if for any reason dominance falls and returns below 62.16, we will take the main confirmation of trend change from 60.37.

😎 Let's go to the 4-hour timeframe to find suitable triggers for these dominance futures.

⏳ 4-Hour Time Frame

In this timeframe, we have a temporary ceiling in the area of 63.02, and if it is broken, the price can continue its bullish movement.

💫 For dominance to fall, we currently don't have any triggers in this timeframe and have to wait for a bearish structure to form.

📈 Total2 Analysis

📅 Weekly Timeframe

Let's move on to the analysis of Total2. In this chart, we can very clearly see the impact of Bitcoin dominance on altcoins.

👀 As you can see, the conditions of Total2 are very similar to Bitcoin and are converging, but Bitcoin in the last bullish leg it had registered a new ATH, and Total2 could not do this. On one hand, Bitcoin has just reached its curved trendline and is reacting to it, but Total2 has broken this trend line and has performed a bearish leg. For example, Bitcoin has not yet reached the 71,000 area, but Total2 has long broken 1.21T and is moving towards the bottom of 816B.

🔑 The reason for all these events is that Bitcoin dominance is bullish and causes more money relative to altcoins to enter Bitcoin, and this also makes the bullish trend of Bitcoin more powerful than this index.

🛒 For buying altcoins, the triggers of Total2 are areas 1.21T and 1.61T, but until Bitcoin dominance falls and its trendline is broken, do not pay attention to these triggers and enter the market with Bitcoin triggers while dominance is bullish.

📅 Daily Time Frame

Let's move to the daily timeframe. Concurrent with the fall of Total2, a descending channel has formed, which in Bitcoin was a descending trendline, but here, as you can see, Bitcoin is involved in breaking the trendline and starting an upward wave, but Total2 has long been rejected from the trendline and is involved in breaking the middle line of the channel, which overlaps with the 961B area, and with the break of this area, the next price leg can start.

⚡️ This is another example of the impact of Bitcoin dominance on the market. I mentioned these examples to get you to take dominances seriously and know how important they are and can help us in analysis.

🔽 The trigger for the fall and bearish turn of Total2, as I said, is the breaking of 961B, and if this area is broken, the price can move to the static supports of 816B and 683B. The dynamic support is the bottom of the channel, which can act as a support to prevent the price from falling.

📈 For bullishness and buying spot, breaking 1.1T is suitable. Again, I remind you that until Bitcoin dominance falls, these triggers are not very useful and do not initiate the trend of altcoins.

⏳ 4-Hour Time Frame

Let's move to the 4-hour timeframe to review the triggers for futures.

⭐ In this timeframe, I don't have much to say, and I just want to specify the triggers for you. For a long position, the area of 1.02T is suitable, but it is better that this happens after breaking the channel, which would turn it into a better trigger. The main long position will occur after breaking 1.1T.

📉 But for a short position, we have a very good and important trigger in the area of 961B, and I suggest that you definitely have a short position on an altcoin if this area is broken.

✔️ USDT.D Analysis

📅 Weekly Time Frame

In the weekly timeframe, Tether dominance has created a large box between 3.78 and 6.21 and has been moving between these two areas since early 2024.

💥 On the other hand, it has a descending trendline that the price has touched twice, and now it has reached it for the third time. A trendline that has been reacted to twice is not a very reliable trendline, but if the price returns from this area this time, we can confirm that this trendline exists and is a dynamic supply area.

☘️ Currently, with the range box that has formed, we have a very easy job for Tether dominance. With the break of 6.21, we confirm bullishness, and with the break of 3.78, we confirm bearishness.

📅 Daily Time Frame

Let's move to the daily timeframe, where we can witness more details.

🎲 As you can see, the price is very close to the trendline that was evident in the weekly timeframe and can activate its trigger.

⚡️ If the trendline is broken, a very important trigger exists in the area of 5.68, and with the break of this area, we can get confirmation of the bullishness of dominance at least until the ceiling of 6.34.

🧲 On the other hand, if dominance is rejected from this trendline, with the break of 5.03, dominance can create another bearish leg down to 5.37 or 3.78.

💣 I have nothing else to say about Tether dominance because its trend is ranging, and its situation is clear for now, let's move to the 4-hour timeframe to review the triggers for futures.

⏳ 4-Hour Time Frame

In this timeframe, we can change the trigger for bullishness a bit and bring it to the area of 5.56. If this area is broken, dominance can start a bullish leg.

🧩 For Tether dominance to fall, we also have a riskier trigger in the area of 5.43, and the main trigger will still be the area of 5.03.

🚨 This was a complete analysis of Bitcoin and the indices. It had been a while since we had looked at the higher timeframes, so I decided to review all the symbols in three timeframes. I hope this helps you and you can use this analysis.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #51👋 Welcome to TradeCity Pro

Let's move on to the fiftieth analysis of Bitcoin and key crypto indices. In this analysis, as usual, I want to review the New York futures session triggers for you.

⏳ 1-hour timeframe.

As you can see in the 1-hour timeframe, after the news of US tariffs, the market experienced a drop to the support zone, and now, for the second time, it has penetrated this area.

🔍 If this range between 81520 and 82302 is broken, the price could start the next bearish leg, but another important support is located at 80105, which might prevent further decline.

🔽 For a short position, breaking this range is suitable. For a long position, it's better to wait until a new structure forms.

👑 BTC.D Analysis

Moving on to Bitcoin dominance, the 62.64 zone has also been broken, and dominance has pulled back to it and is now moving upward.

💫 I cannot determine a resistance level at the moment, and we need to wait until the price structure forms new resistance levels.

⚡️ For now, I see Bitcoin dominance as bullish, so it's better to choose Bitcoin for long positions and altcoins for short positions.

📅 Total2 Analysis

Moving on to the Total2 analysis, yesterday the price pulled back to 990 and has now reached 953.

✔️ If this zone is broken, the price could experience a sharp bearish movement and start the next leg. For a long position, like Bitcoin, we need to wait for a new structure to form.

📅 USDT.D Analysis

Moving on to USDT dominance, a very sharp upward move with strong momentum has occurred, and a higher low compared to 5.05 has been formed.

🧩 Currently, there is an important resistance at 5.56, and the price has reached this level. If this zone is broken, dominance will turn bullish.

💥 For a bearish move in dominance, like other indices, we need to wait for a new structure to form.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

BTC.D When ALT season?BTC Dominance (BTC.D) – Updated Technical Outlook

The BTC Dominance chart reflects Bitcoin's performance relative to the altcoin market. Here’s an analysis:

Key Levels and Observations:

1. Resistance at 58.47% and 61.31%:

- BTC.D attempted to breach the 58.47% resistance but faced rejection, leading to a pullback.

- The 61.31% level, marked as a key Fibonacci retracement, remains a significant hurdle for further upside momentum.

2. Support at 55.76% and 54.57%:

- The first notable support lies around 55.76%, aligning with a historical horizontal support zone and the yellow trendline.

- If this level is breached, the next support at 54.57% may come into play, potentially leading to increased altcoin strength.

3. Trendlines and Channels:

- BTC.D continues to respect the rising yellow trendline, indicating that the long-term bullish trend is intact.

- The dotted red channel lines act as a dynamic resistance zone for future attempts to reclaim dominance above 60%.

4. Volume Trends:

- Volume levels show declining momentum during the recent pullback, which could indicate temporary weakness rather than a full reversal.

- A volume breakout above 58.47% would confirm renewed dominance for Bitcoin.

5. Long-Term Perspective:

- BTC.D has maintained a higher-high, higher-low structure, suggesting bullish market sentiment for Bitcoin dominance over the medium term.

- However, consolidation between the 55.76% and 58.47% range could signal indecision before the next significant move.

Potential Scenarios to Watch:

1. Bullish Scenario:

- A breakout above the 58.47% resistance would open the door for BTC.D to challenge the 61.31% level.

- Sustained dominance above 61.31% would likely indicate Bitcoin outperforming altcoins across the board.

2. Bearish Scenario:

- If BTC.D loses the 55.76% support and breaks below the rising trendline, it could shift momentum in favor of altcoins.

- Key downside targets would then include 54.57% and the stronger support zone at 52.97%.

BTC Dominance Chart Analysis. 50-day MA: 61.94% (Notable Support Level)

200-day MA: 59.21% (Strong Support)

Trend: The chart shows a bullish trend in BTC dominance since the beginning of the year, with higher lows forming.

Resistance Level: A key resistance area lies around 63%, which the price is currently testing.

Support Level: The 50-day and 200-day moving averages provide solid support below current levels.

Update Points

Short-term outlook: If BTC dominance stays above 62%, it could reach 63% resistance.

Long-term indicators: Continued support at the moving averages suggests bullish sentiment if BTC can maintain its position.

Market Conditions: Monitor fluctuations in altcoin performance, which could impact BTC's dominance positively or negatively.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC Dominance is Bullish (4H)On the chart, we have consecutive trigger lines that have been broken, and after the SW L, we see a bullish iCH and higher Ls, which are bullish signals.

However, considering the Bitcoin dominance chart, buying altcoins or taking long positions on altcoins is risky. It is better to look for short setups on altcoins instead.

Targets are marked on the chart.

The closure of a 1-day candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

#BTC Dominance: This is when ALTS will start Rallying!!BTC Dominance Update by Cryptorphic

🚨 Crossover Alert 🚨

Looking at the current BTC Dominance chart, we can see that the 21 WMA (Blue) and the 50 WMA (Red) are moving almost parallel to each other. A key moment to watch for is when the 21 WMA crosses below the 50 WMA. This will be a strong confirmation of a potential trend reversal.

🔴 Historical Context:

- The previous crossover led to a significant drop in BTC dominance, triggering altcoins to rally.

- The current market structure shows BTC dominance at a crucial resistance level. We are looking for a possible rejection at this level, which could signal an entry point for altcoins.

📈 Price Action:

- BTC Dominance is currently testing the upper boundary of the rising channel.

- A rejection around 64.25% to 65.66% is expected, and the best entry for altcoins would likely come on that rejection.

🚀 Next Move:

Keep an eye on the crossover between the 21 WMA and 50 WMA for confirmation. A downward crossover will likely signify the start of a broader altcoin rally.

If you like this update, please support it with your likes and share your feedback/requests in the comments section.

Thank you

#PEACE

BTC Dominance: We Warned You And It's HappeningHello, Skyrexians!

A lot of hating comments we received under our recent CRYPTOCAP:BTC.D analysis. Now we sure that market always go against the crowd. This is the super valuable experience and we want to say thanks to all haters. Now let's update this idea, try to understand the structure on the wave 5 drilling into lower time frame.

Let's take a look at 12h time frame. We can see that after the spike in the wave 3 price retraced with the ABC zigzag and started the new wave 5. Waves 1 and 2 inside this wave have been finished. Wave 2 reached exactly 0.61. Now we can measure wave 3 target. 1 and 1.61 are the potential target. The most realistic one is 64.7%. Then we expect the wave 4 and the last leg up into subwave 5. Always look at the divergence on the Awesome Oscillator to measure the trend end.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

TradeCityPro | Bitcoin Daily Analysis #50👋 Welcome to TradeCity Pro

Let's move on to the 50th analysis of Bitcoin and key crypto indices in this analysis as usual I want to review the New York futures session triggers for you

🫶 Before starting the analysis I want to thank you for all the support you have given us along the way so that we could reach the 50th analysis I hope that the number of these analyses increases much more and that we are always with you and that you also benefit from the analyses❤️

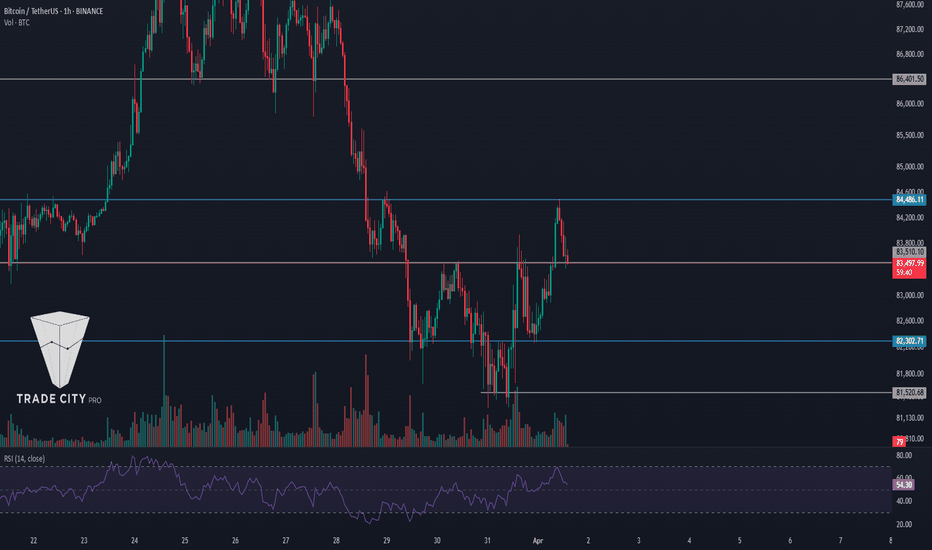

⏳ 1-hour timeframe

Yesterday Bitcoin rose from the 82302 zone and moved upward finally forming a base after the sharp and deep decline it had and even managed to go above the 83808 zone

⚡️ I slightly adjusted this zone and moved it to 83510 because the price reacted better to this zone

💫 Currently, we are witnessing a rejection from the 84486 zone which has pushed the price back towards 83510 if selling volume increases the price may drop further

✔️ If the price goes below the 83510 zone again in lower timeframes and with the activation of the fake breakout trigger we can open a short-term short position the main trigger is in the 82302 zone

🔼 For a long position breaking 84486 is suitable and with this breakout, the price can start the next bullish leg the entry of RSI into Overbuy will also be a momentum confirmation and can cause us to see large bullish candles

👑 BTC.D Analysis

Moving on to Bitcoin dominance today dominance faced a rejection from 62.35 which could cause dominance to decline

💥 The trigger for confirming this rejection and the downtrend is in the 62.06 zone and breaking this zone could move the price towards the 61.81 and 61.63 zones

📈 Stabilization of dominance above 62.35 will also confirm the uptrend again

📅 Total2 Analysis

Moving on to the Total2 analysis yesterday the 1.01 trigger was activated and the price has also pulled back to it but today we have a trigger for both long and short positions

🔽 For a short position breaking 990 and for a long position breaking 1.02 can confirm opening positions on altcoins

📅 USDT.D Analysis

Moving on to USDT dominance a Head and Shoulders pattern has formed where the neckline in the 5.41 zone has also been broken and the price is pulling back to it

📉 If the price is rejected from the 5.41 zone we will confirm the activation of this pattern and with the break of 5.33 we can confirm the downtrend of dominance

⭐ For an uptrend in dominance breaking 5.41 and invalidating the pattern can be a suitable trigger

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.