Bitcoin Dominance Is About To Finish The Growth CycleHello, Skyrexians!

Time to update our main chart CRYPTOCAP:BTC.D and today we will take a look at 4h time frame to make sure that everything is going according our global scenario.

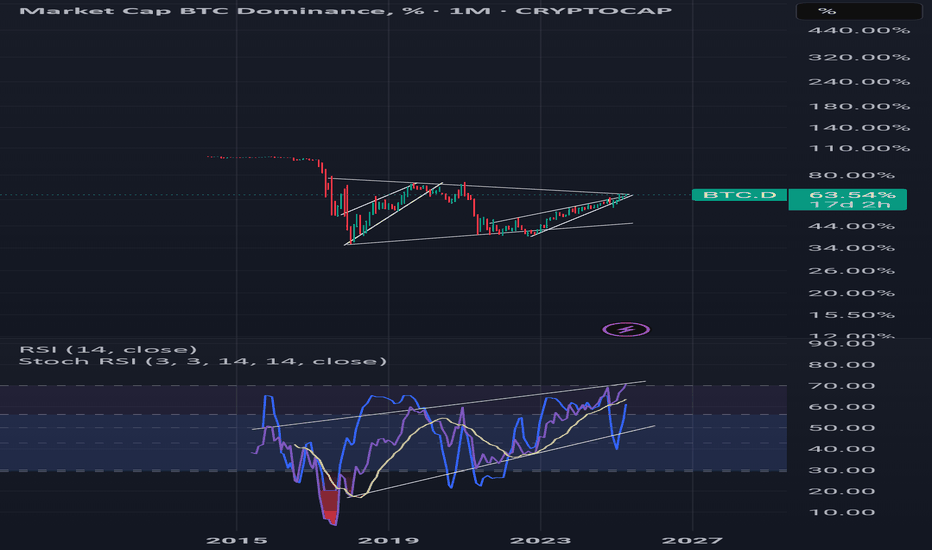

Today we consider wave 3 in 5 into the global 5. It has been almost done with the potential double divergence and ending diagonal at the top. The next wave is higher degree wave 4. It has the target at 0.38 Fibonacci at 63%. From this point we expect final wave 5 to final target at 66%.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Btcdominance

BTC Dominance – Are We Near the true Altseason?BTC Dominance – Are We Near the Altseason?

BTC dominance has been rising recently, and many believe the real altseason will begin once BTC.D reaches 71%, just like in the previous cycle.

However, it might happen sooner than expected.

On the 1W timeframe, several signs are flashing:

RSI is showing a bearish divergence that’s about to play out.

Since January 2023, the MACD has been in overbought territory.

Each time RSI peaked above 70%, we saw a rejection of 8–10%. It's currently at 68% and nearing that level again.

On December 2nd, 2024, the structure was broken, but it has since re-entered its rising channel.

🔗

On the Daily chart:

BTC.D is approaching its cycle peak around 65%, which should act as a resistance and potential reversal point.

Since the structure was already broken once, another downside break is highly probable.

🔗

On the Monthly chart, it’s pretty clear we’re nearing the end of the BTC dominance cycle, and a rotation of capital is likely to follow soon.

Now, there are 2 possible scenarios:

Altseason starts at 65% in this cycle.

Altseason starts again at 71%, mirroring the previous cycle.

When you look at the Monthly chart, it’s easy to see that this cycle is different. With an overbought RSI, and a potential break of structure, a long-awaited MACD correction could be the trigger for the real altseason.

🚨 DYOR (Do Your Own Research) 🚨

TradeCityPro | Bitcoin Daily Analysis #67👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indicators. In this analysis, as usual, I want to review the New York futures session triggers for you.

✔️ Yesterday, the price was rejected from the 85,550 area, and today could be a sensitive and important day for the market.

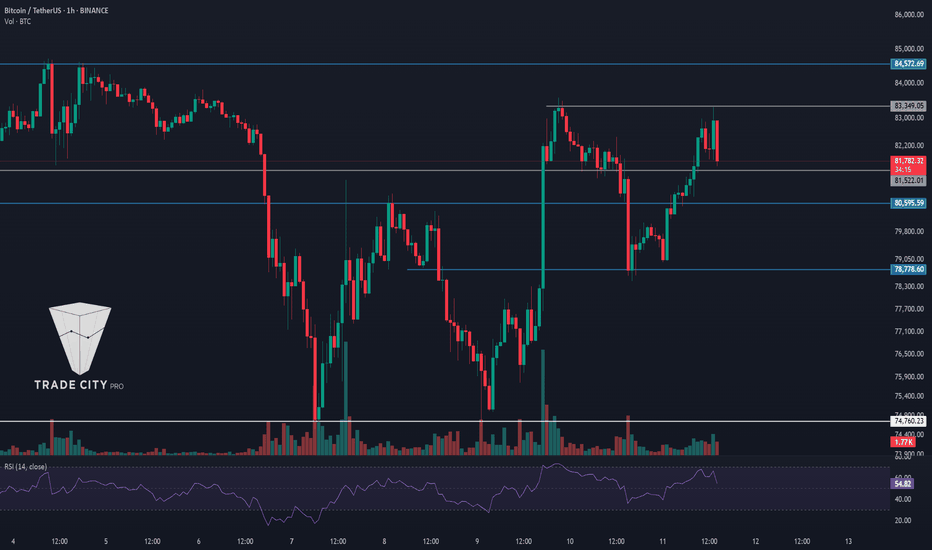

⏳ 1-Hour Timeframe

In the 1-hour timeframe, I mentioned yesterday that the 85,126 trigger had been activated and if the price pulled back to this area and broke above 85,550, we could witness a bullish move and the start of an upward wave. But that didn’t happen—the price was rejected from the 85,550 high and started moving downward.

👀 Currently, with the price stabilizing below the 85,126 area, selling volume has entered the market, and the price is moving down. The last candle closed below the 84,363 area, and the RSI has entered the oversold zone. If the move continues, the price could experience a bearish leg and move down to 83,233.

🔽 In that case, a break below the 83,233 area could be a good short position trigger, as it would give us confirmation of a trend reversal. But if the move doesn’t continue, this level could turn out to be a fake-out, and the price might head back toward the 85,550 high.

🎲 So today, you can enter a short position with a break of 83,233, and a long position with a break of 85,550. Pay attention to volume and RSI, as they can provide many confirmations for the next price trend.

👑 BTC.D Analysis

Let’s look at Bitcoin dominance. Yesterday, dominance dropped another leg and broke the 63.76 low, but now it has returned to this area and is stabilizing above it.

📈 For a bullish confirmation, dominance needs to stabilize above the 64.12 area, and for a bearish one, it needs to stabilize below 63.12.

📅 Total2 Analysis

Now for the Total2 analysis. This index was rejected from the 965 area yesterday and is now stabilizing below 954. If the bearish momentum continues, the next support level that could hold the price is 932.

🔼 To turn bullish, a break above 965 is required, with the main trigger being 980.

📅 USDT.D Analysis

Let’s look at Tether dominance. Yesterday, it made an upward move and was supported at the 5.44 level. It has now reached 5.52.

✨ If 5.52 is broken, we’ll have confirmation of a bullish trend in dominance. If 5.44 is broken instead, we could anticipate a bearish move and potentially a break of 5.39.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #66👋 Welcome to TradeCity Pro!

Let’s dive into the analysis of Bitcoin and major crypto indices. As usual, I’m going to review the New York futures session triggers for you in this analysis.

⌛️ 1-Hour Timeframe

Yesterday, the 85126 trigger was activated, but the price hasn’t started its move yet and is still ranging above this level. As I previously mentioned, this trigger is an early entry trigger, and the main trigger for a long position is the breakout of the 85550 level.

✔️ So if you haven’t opened a position on the early trigger, don’t worry, because the main trigger hasn’t been activated yet. If the price moves upward, you can still open a position on the breakout of this main trigger.

Therefore, our long position trigger for today is the 85550 level, and breaking this level could start a new bullish wave.

📊 Make sure to keep an eye on the volume. If the volume increases simultaneously with the price approaching 85550, it would be a positive sign for the bullish trend. Entry of RSI into the overbought zone is another confirmation that could bring bullish momentum.

🔽 For a short position, the main trigger is still the breakout of 83233. However, if you’re looking for an earlier entry, the breakout of 84363 is also suitable.

📚 Overall, be cautious today since it’s Saturday and most market participants are off, but considering that Bitcoin is near a key level, we might still see movement.

👑 BTC.D Analysis

Let’s move on to the Bitcoin dominance analysis. As you can see, dominance has undergone a corrective downward move and has reached the 63.76 level and found support there.

💫 If dominance holds at this support, the next key resistance overhead is 64.12, and breaking this level would initiate the next bullish leg for Bitcoin dominance.

💥 Breaking the 63.76 level would give a temporary confirmation of bearishness in dominance. The next support levels are 63.61 and 63.23.

📅 Total2 Analysis

Let’s move on to the Total2 analysis. Due to the bearish movement in Bitcoin dominance, this index has seen a bullish move and has broken the 954 level.

✨ If the price pulls back to this level and resumes upward movement, and if you already have an open position, you can hold it up to the 980 level. If you missed out, the next trigger would be the breakout of the previous high and confirmation through Dow Theory.

📉 The bearish confirmation for Total2 would be the breakdown of 954.

📅 USDT.D Analysis

Now let’s take a look at Tether dominance. Yesterday, the 5.48 level was broken, and the price is now heading toward the 5.39 support.

🧩 If the 5.39 level in Tether dominance is broken, I strongly recommend having an open position, because this is a very significant support level. Breaking it could start a new trend in the market.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Bitcoin Dominance Quick UpdateThe high happened in February 2025. 7-April produced a lower high.

The session that produced the lower high is also a hammer. A hammer here can indicate an upcoming change of trend.

As long as BTC.D remains below 64% it has a very high probability of starting a descent.

If BTC Dominance moves and closes daily above 64%, this analysis and signals become invalid.

If the BTC.D hovers below 64%, the longer it stays below this level the weaker it becomes.

When this index goes down, everything Cryptocurrency grows, including Bitcoin.

It will be very interesting to see how it all develops. More and more signals are pointing toward an Altcoins market bullish wave developing now, not later. Do you agree?

Thank you for reading.

Namaste.

Altseason and a Weak Dollar — Will History Repeat in 2025?The altseason of 2017 started at the same time as the U.S. dollar index (DXY) began to fall. This likely helped bring more money into the crypto market. In 2020–2021, a similar thing happened: the falling dollar was followed by a strong rise in altcoins. But that time, altseason started closer to the end of the dollar’s decline.

A weaker dollar makes risky assets like crypto more attractive. In April 2020, the total crypto market cap was around $218 billion. Today, it’s about $2.63 trillion — around 12 times bigger.

However, to start a new altseason now, the market may need a lot more cheap money than in 2020. I’m not sure if the 2025 altseason can be as strong as in the past.

Now it seems that the only way to repeat that success is if a big part of the capital moves from Bitcoin into altcoins. This would need a sharp drop in Bitcoin dominance. But this brings new questions. After the launch of Bitcoin ETFs, the ownership structure has changed. Many people now own Bitcoin through investment funds, not directly. These funds may not be very excited to invest in altcoins.

What do you think about it? Share your opinion in the comments.

TradeCityPro | Bitcoin Daily Analysis #65👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indicators. In this analysis, as usual, I want to review the New York futures session triggers for you.

🔄 Yesterday, the market was range-bound again, and none of my triggers were activated. Today, a high has formed that could be suitable for opening an early position.

⏳ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, the price is within a box between 83,233 and 85,550, and market volume has decreased compared to yesterday. I recommend keeping an eye on the market today because the volume is very low, and the likelihood of a sharp move is high.

✔️ Today, we have a new trigger for a long position. In yesterday's analysis, I said that the price is creating a new high that could be used as a trigger if it reacts to this area again. As you can see today, the price reacted to this area and was rejected from it.

💥 So, considering that a sharp move is likely, it wouldn’t be bad to open a long position on the breakout of 85,126 so that if we can’t get a proper confirmation from the candle on the breakout of 85,550, we already have a position open.

⚡️ However, for a short position, the 83,233 trigger is still valid and this area is very important. If the price stabilizes below this support, the next supports the price could reach are the areas of 80,595 and 78,778.

👑 BTC.D Analysis

Let’s move on to Bitcoin dominance. As you can see in the chart, I told you yesterday that if the price is supported from the 63.87 area and breaks the previous high, the next bullish leg could begin. However, although dominance was supported at this area, it failed to break the previous high, formed a lower high, and is now again at the 63.87 support.

🔼 If this support is broken, we can temporarily confirm a bearish move in dominance. The next key supports for Bitcoin dominance are the areas of 63.61 and 63.23.

📈 For Bitcoin dominance to become bullish again, in my opinion, we need to wait for it to break the previous high at 64.12.

📅 Total2 Analysis

Let’s move on to the Total2 analysis. The condition of this index is very similar to Bitcoin, but because Bitcoin dominance is bullish, Total2 is one level lower than Bitcoin. Although Bitcoin is struggling with its main resistance, Total2 has moved away from the 980 area and has formed its box between 954 and 932.

🔽 If the 954 area is broken and Bitcoin dominance is bearish, you can open a long position. But if dominance is bullish, Bitcoin will be a better choice.

🎲 If the 932 bottom is broken, you can confirm a bearish trend in altcoins. In this case, I think dominance will become bullish and altcoins will drop more than Bitcoin.

📅 USDT.D Analysis

Let’s look at Tether dominance. The entire market is waiting to see what Tether dominance does with the 5.39 area. If it is supported at this area and breaks the 5.59 high, we can say that dominance is bullish and the market may drop.

🔍 But if dominance can first break the 5.48 area and then the 5.39 area, the market could start a new bullish move and Bitcoin will definitely break the 85,550 high.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #64👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

⏳ 1-Hour Time Frame

Yesterday, the market continued to range within the same box and didn’t make any significant moves, but today we still have triggers and can open positions.

🔄 Yesterday I told you that after the fake breakout of the box top, strong bearish momentum could enter, increasing the likelihood of the box bottom breaking, and that we could enter a short position upon its break.

✔️ That’s exactly how it seemed—there was strong bearish momentum and the price tested the 83233 zone once. But it couldn’t break that area, and after a strong bearish candle, market volume dropped significantly, and the market became range-bound again, which still continues.

📈 Our key resistance remains the 85482 zone, and breaking this level could initiate the next bullish wave. So, we can enter a long position if this level breaks.

🔽 For a short position, the 83233 zone is still valid. As I mentioned, the price tested this level again yesterday, reinforcing its importance—so make sure to have a short position ready if this zone breaks.

👑 BTC.D Analysis

Let’s check Bitcoin Dominance. Today, dominance is in a corrective phase and has returned to the 63.87 zone and is retesting it.

💫 If this zone breaks and dominance continues its correction, we can consider dominance as bearish for now. But if dominance finds support here, it can continue its upward move and form a higher high.

📅 Total2 Analysis

Yesterday, the Total2 index had a fake breakout at the 932 zone, re-entered its box, and with the momentum that entered the market, moved upward. It has now broken the 947 zone and is retesting it.

🔍 If the price pulls back to this zone and is supported, it could start an uptrend and move toward 980.

💥 But if the price fails to stabilize above 947 and drops below it, we can confirm a bearish trend in Total2 with a break of 932 and open short positions on altcoins.

📅 USDT.D Analysis

Now for Tether Dominance: a small box has formed above the 5.39 zone, with the box bottom at 5.49 and the top at 5.59.

🎲 If the 5.49 zone breaks, we can confirm a bearish move in dominance down to 5.39. The main trigger for a bearish shift in dominance is the break of the 5.39 zone.

✨ For a bullish move in dominance, the 5.59 level is very important, and breaking it could begin a new upward trend for dominance.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #63👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

⏳ 1-Hour Time Frame

Yesterday, a short position could have been opened that might have already brought you good profit.

🔄 In yesterday’s analysis, I told you that if the price pulls back to the 85482 zone, gives a confirmation candle, and buying volume increases, you could open a long position. That didn’t happen—there was no confirmation candle, and the zone turned out to be a fake breakout.

👀 For a short position, I also mentioned that if the price fakes the breakout of this zone, you could enter a short position on lower time frames after the break of a short-term trigger, targeting 83233. This scenario played out exactly, and the price gave a trigger on lower time frames and dropped to 83233.

📉 But today we also have a trigger for opening a position, so don’t worry too much—you haven’t missed a lot. Yesterday’s position was opened in a risky context, and if you followed proper risk management, you shouldn’t have taken much risk on that position, and naturally, wouldn’t have made a large profit either.

🔑 A fake breakout of a box top indicates strong seller momentum, so currently, bearish momentum is stronger than bullish, and the price leans more toward decline. On the other hand, the 83233 zone is very significant, and the price has reacted to it several times, making it an important support zone.

📚 So, with that in mind, if the 83233 zone breaks, you can enter a short position. If, before breaking this zone, the price creates a lower high compared to 85482, we’ll have even more confirmation—because based on Dow Theory, when price fails to reach its previous high, it shows that buyers are weakening. So breaking the low, which overlaps with the 83233 support, gives us a very solid position.

💫 But an important point to consider is that the price formed several bullish legs before creating this box, so overall, the current market momentum is still more bullish, and all short positions carry more risk than long positions.

📈 For a long position, the 85482 zone remains a valid trigger, and if the price stabilizes above it, we might see the next bullish leg. Personally, I prefer that the price tests the 85482 zone once more so we can get a more accurate level, and then break it on a subsequent attempt, which would make opening a position easier.

✔️ Of course, even if the zone is broken on the first try, I’ll open a long position, but if it's broken on the second or third attempt, we can enter with more confidence and take more risk.

📊 After the range box was broken, market volume has been declining, and only a few candles have significant volume—these are considered outliers and can be ignored. So the most important thing is that if a trigger is activated, the volume should align with that direction and support the price move, showing convergence.

👑 BTC.D Analysis

Let’s take a look at Bitcoin dominance. It’s still bullish and, after breaking above 63.87, has continued its new bullish leg.

🧩 As a reminder, as long as BTC Dominance hasn’t changed trend or turned bearish on higher time frames like the daily or weekly chart, buying any altcoin isn’t logical. We need to wait for a trend change. For now, we see dominance as bullish, so long positions on Bitcoin and short positions on altcoins are suitable choices.

📅 Total2 Analysis

Now for Total2 analysis: yesterday, both short triggers I gave were activated, and the price moved downward.

🧲 Currently, a low has formed around the 932 zone, and if this zone breaks, the price could continue its downtrend. On the other hand, if the 947 zone breaks and the price moves back above it, we can consider opening a short-term long position in lower time frames.

📅 USDT.D Analysis

Let’s look at Tether dominance. Yesterday, I mentioned that dominance was interacting with the 5.39 zone and that if it breaks, the market could move upward.

🚀 But that didn’t happen—instead, the price moved upward and even broke above the 5.53 ceiling. Currently, it’s returning to its range box again and may head back toward the 5.39 level. If that zone breaks, we can still take it as a confirmation of a bearish shift in dominance.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Altcoin Season in May/June 2025First proper Altcoin Season -> 1 Year, -62% for BTC Dominance (Alts Crush BTC)

Second proper Altcoin Season -> 6 months, -44% for BTC Dominance (Alts Crush BTC again)

Third proper Altcoin Season (upcoming) -> 2-3 months, -20-25% for BTC Dominance (Alts will outperform BTC)

Diminishing returns for Altcoins, because there is not much utility for Altcoins as of now

ETH -> underwhelming performance in the last 2 years, thus gthe eneral altcoin market suffers

Mantra, memecoins, Luna, FTT , and many other scams affect the market, More people just buy BTC and forget and don't touch alts

TradeCityPro | Bitcoin Daily Analysis #62👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, the price has a bullish structure that is still ongoing, and currently, one of the resistance levels at 85482 has been broken, and the probability of a bullish price move is high.

✔️ If you already have a position from the break of 85482, you have likely hit neither the target nor the stop-loss yet. The target for this position could be the 88502 zone.

✨ But if you don’t have an open position and are looking for a trigger, a price pullback to the 85482 zone with confirmation, or even a break of one of the short-term resistances in lower time frames, can be a suitable trigger for a short position.

📉 For a short position, if the price fakes the breakout of the 85482 resistance and moves downward, with confirmation in lower time frames and a break of the Fake Breakout trigger, we can enter a short position. The main short trigger is the break of the 83233 zone.

👑 BTC.D Analysis

Let’s take a look at Bitcoin dominance. As you can see, dominance has started another bullish leg and after breaking 63.61, it reached 63.80, and now with the break of 63.80, it's ready to carry out its main bullish move.

🔼 For now, we see the trend in dominance as bullish, so long positions on Bitcoin and short positions on altcoins are suitable.

📅 Total2 Analysis

Let’s take a look at the Total2 analysis. As I mentioned, since dominance is bullish, Bitcoin is moving more than altcoins. Right now, we can also see this in Total2, where momentum is less than Bitcoin and it has moved slightly away from its top, while Bitcoin has broken its high.

🔍 For a long position, the break of the 980 zone is still valid, and if it breaks, the price could move up to the 1.2 zone. For a short position, we have two triggers.

📉 The first trigger is the 956 zone, which is a good entry point but risky, and the chance of hitting stop-loss is high. The second trigger is the 947 zone, which is a more reliable trigger, but if it breaks, opening a position will be harder and we might not get a solid confirmation candle.

📅 USDT.D Analysis

Let’s move on to Tether dominance. You could say the entire market is waiting for Tether dominance to move, and even Bitcoin, despite breaking its resistance, hasn't moved yet because the 5.39 zone in dominance hasn't broken.

🎲 This zone is a very important one, and if it breaks, we could see a bearish leg down to the 5.24 zone, which would push the market upward. The bullish trigger for dominance for now is the break of 5.53.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Bitcoin Dominance Is Printing The Last Shakeout Hello, Skyrexians!

Recently we pointed out that CRYPTOCAP:BTC.D is in the last bullish wave which has a target approximately at 66% and the bear market on altcoins is almost over. Today we will look in details on this wave inside and try to predict the most precise scenario.

Let's take a look at 12h time frame. Here we can see the wave 1 and 2 and now price is in wave 3. Fibonacci extension levels 1 and 1.61 is the target for wave 3. Looking at the current wave we can say that it's not over, so it will likely to see 64.7% in this wave before the correction. Correction is going to be subwave 4 which will likely be finished at 63% then we have the last wave which can be equal to wave 1. In this case predicted earlier 66% will be reached at the end of April.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

$BTC.D to 66%, $TOTAL2 / BTC down to 0.43The final year of bitcoin halving year is usually a bullish year for the Altcoins. CRYPTOCAP:TOTAL2 is the measure of the Total Market Crypto Market CAP without $BTC. Today we are looking into a ratio chart of TOTAL2 vs BTC Market cap. The supposed strength in Altcoin is missing as is evident from the CRYPTOCAP:BTC.D chart and the ration chart between TOTAL2 vs BTC.

If we plot the Fib Retracement levels on the CRYPTOCAP:BTC.D from the last cycle lows to the highs, we see that in the current halving cycle the CRYPTOCAP:BTC.D is progressing towards 0.786 Fib retracement levels which is currently indicating a CRYPTOCAP:BTC.D of 66.2 %. The ratio of Toatal2 vs BTC Market cap fits surprisingly within the Fib levels and makes new lows every week in this weekly chart. The levels to watch on the ratio chart will be 0.43

What does this trend tell us. It might be possible that the Altcoins USD pairs are bullish, but the Altcoins are making new lows vs BTC. So, it's a better strategy to go long $BTC. The risk reward is very much in favour of CRYPTOCAP:BTC rather than Altcoins.

Verdict: Long CRYPTOCAP:BTC , CRYPTOCAP:BTC.D to 66%.

TradeCityPro | Bitcoin Daily Analysis #61👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

🔍 Yesterday, one of our short position triggers was activated. Let’s get into the analysis to see how we can open a position today.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, the trigger we gave yesterday at the 84382 level was activated and the price moved down toward the 82813 area. Today, I’ve adjusted the position of these lines since the price has created a better structure and the placement of the levels can change accordingly.

✔️ Currently, the price has formed a box between 83233 and 85482 and continues its ranging structure.

📈 For a long position, we can act if 85482 breaks. If this level breaks, since the trendline has also been broken, this time the price can move upward with more momentum, and the first target of this position would be 85482.

📊 Market volume is currently ranging, and we can’t extract specific data from this tool. But if volume increases along with an upward price movement, it would be a very good signal for the continuation of the bullish trend.

🔽 If that doesn’t happen and the price moves downward, the 83233 trigger is a very good one, and a break of this area gives us confirmation of a trend reversal, and the price can move further down.

👑 BTC.D Analysis

Let’s look at Bitcoin dominance. Dominance is still ranging and hasn’t moved much compared to yesterday.

⭐ A break of 63.61 would be suitable for a bullish move, and a break of 63.23 would be suitable for a bearish move.

📅 Total2 Analysis

Let’s move on to the Total2 analysis. This index is acting very similarly to Bitcoin and is currently near its long trigger.

🔼 For a long position, a break of 980 is suitable, and for a short position, a break of 947 is appropriate.

📅 USDT.D Analysis

Let’s check out Tether dominance. We’re still waiting for a break of 5.39, which is a very important level, and if it breaks, the price could have a long-term bearish move.

💫 For a bullish move in dominance, breaks of the 5.53 and 5.59 levels are also suitable.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #60👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

🔍 Yesterday, both of the long triggers I gave were activated, and the price moved upward. Today is also an important day, and we can look for both long and short positions.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, our long triggers from yesterday — the 83899 and 84572 levels — were activated, and the price moved up to the 85552 zone.

✔️ If the position you opened had a small stop-loss, it likely already hit your target. But if you entered with a wider stop-loss, it probably hasn't reached the target yet, which is reasonable, as your position is longer-term.

⚡️ Now for today, as you can see, the price has broken its ascending trendline and it seems the trendline trigger is getting activated. If a candle closes below the 84382 level, the price is likely to move downward.

📊 The next support the price has is at 82813, and if this level breaks, we can say that the trend has changed and the price might head toward lower lows.

💥 The 50 level on the RSI is also significant, and if the break of 84382 coincides with a break below 50 on the RSI, strong bearish momentum could enter the market.

👑 BTC.D Analysis

Let’s look at Bitcoin Dominance. This index is in a range box between 63.23 and 63.80. There’s also a mid-range level at 63.51 — breaking it would give us temporary confirmation of a bullish move in dominance.

🔽 For bearish confirmation, breaking 63.23 would be suitable.

📅 Total2 Analysis

Now onto Total2: this index hasn't fully stabilized below its trendline yet and still shows slightly more bullish momentum compared to Bitcoin.

📉 For a short position, we have a 966 trigger, but it’s quite risky. Personally, I wouldn’t open my main position with this trigger — I’d wait for confirmation using Dow Theory with a lower high and lower low.

🔼 For a long position, the trigger is clear: we can enter if the 980 level breaks.

📅 USDT.D Analysis

Let’s check Tether Dominance. This index has made a bearish move and dropped to 5.39.

⭐ The next drop trigger is the same 5.39 level, which is a very good one. For a bullish scenario, we currently need to wait for a new structure to form.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | ARB: Key Levels in DeFi Coin’s Descending Channel👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ARB coin for you. It's one of the DeFi coins, currently ranked 54 on CoinMarketCap with a market cap of $1.41 billion.

⏳ 4-Hour Time Frame

In the 4-hour time frame, as you can see, we're witnessing a downtrend within a descending channel, and the price is moving downward.

✔️ There is a very important support at the 0.2501 level, which is the main support, and the price has already reacted to it once, bounced from the bottom of the channel, and is now positioned above the channel’s midline.

🔽 If the price fails to reach the top of the channel and gets rejected from lower levels such as the 0.3172 resistance, the probability of the channel breaking to the downside increases, and more bearish momentum may enter. When the price gets rejected before reaching the channel top, it indicates weakening buyer strength.

✨ So, if the price gets rejected from the 0.3172 resistance, we can open a suitable position. The lower the rejection, the higher the probability of a drop. A rejection from the channel top or even a fake breakout can also act as a valid trigger.

📉 The main trigger for a short position is the break of the 0.2501 level, which is a very strong support, and its break can lead to a significant bearish leg.

⚡️ For a long position, the first trigger is the break of 0.3172, which is a good area but very risky, because just above it lies the channel ceiling, and the price might get rejected from there and move downward.

🔼 Therefore, it's better to wait for the channel to be broken first and then look for a long trigger. Currently, the most reliable trigger for a long position after a channel breakout is at 0.4018, but this level is quite far. So, for a long position, we can also enter on a pullback to the channel or after getting confirmation from Dow Theory.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | Bitcoin Daily Analysis #59👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. In this analysis, as usual, I’ll review the futures session triggers for New York.

🔄 Yesterday, one of the long triggers was activated, and the price moved up to the 83899 zone. Let’s see what triggers we can identify from today’s price action.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, the price broke through the 83349 level yesterday and moved up to 83899. However, the candles weren’t strong enough to break this zone, and the price reached the resistance range between 83899 and 84572, then got rejected.

✨ An ascending trendline that started from the 74760 low has been accompanying the price, and each time the price has touched this trendline, the following bullish leg has been shorter, indicating a gradual weakening in bullish momentum.

✔️ Currently, the price is near the trendline, and if bearish momentum enters the market and selling volume increases, breaking the trendline trigger can give us a short position.

💫 The current trendline trigger is at 83813, and if it breaks, the price could open positions down to 80595 or even 78778.

💥 As mentioned, there is a resistance zone above the current price, which seems quite strong. The first trigger to break this resistance is 83899, and the second is 84572. The first trigger is riskier and more likely to hit the stop-loss. The second trigger, being higher, might not give a good candle setup, making it harder to enter a position, but it’s more reliable.

📊 If buying volume increases, a bullish move toward 88502 is likely. If selling volume increases, the likelihood of the trendline breaking also rises.

🔑 The RSI oscillator is also oscillating in the upper half. Entering the overbought zone could be a signal for long positions, while a break below 50 would be suitable for shorts.

👑 BTC.D Analysis

Let’s take a look at Bitcoin Dominance. Yesterday, BTC.D had a bullish move up to 63.80 but got rejected from that area and has now returned to the range between 63.30 and 63.50.

⭐ Today, a bearish confirmation for BTC.D comes with a break below 63.30, while a bullish continuation is confirmed with a break above 63.50.

📅 Total2 Analysis

Moving on to Total2: today this index continued its bullish movement and even broke the 957 trigger. If this move continues up to 989, altcoins could experience significant growth—especially considering the weakening momentum in BTC Dominance.

🧲 Today, there is no long trigger for Total2, but if this move turns out to be a fakeout, the 934 zone will be a good trigger for a short position.

📅 USDT.D Analysis

Now for Tether Dominance: its short trigger has been activated. The next support level is at 5.41, and if this zone breaks, we could see a sharp downward move.

⚡️ For a bullish reversal in dominance, the first trigger is the 5.59 area, and if dominance stabilizes above this level, we can consider opening short positions on Bitcoin and altcoins.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Bitcoin Dominance Update (1D)Bitcoin dominance is currently showing signs of weakness and appears to be losing momentum for another upward move.

If we see a breakdown below the 62% level, a sharp decline toward 57% is likely.

During this phase, it may feel like an altcoin season is approaching, but in reality, most altcoins will likely just be retracing previous losses rather than entering true price discovery.

Still, for those who buy the dips, it can present a profitable rally opportunity—especially in short to mid-term cycles.

— Thanks for reading.

Bitcoin Dominance, We Are Waiting For You!Hello, Skyrexians!

We are changing color according to the new upcoming market cycle phase, hope our forecast will be realized and it's time to be bullish. CRYPTOCAP:BTC.D is about to flash the reversal signal, while altcoins dominance and USDT dominance are already did it, but we don't also forget about disaster targets.

Let's take a look at the daily chart. Earlier we told that this is final wave 5 and now we are trying to catch its top. We mentioned that dominance will enter into 63-66% target area and it did it. Now we have to be focused on the reversal signals. For example Bullish/Bearish Reversal Bar Indicator has already printed the red dot at the top. Moreover Awesome Oscillator started reversing. You can say that this is the top, be our intuition tell us that some small move to the upside will be continued to 65%. Also we need to mention about nightmare wave 5 extended target at 70%, but this scenario is unlikely because it will break the divergence on the daily chart.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

TradeCityPro | Bitcoin Daily Analysis #58👋 Welcome to TradeCity Pro!

Today, we'll delve into the analysis of Bitcoin and key crypto indices. As usual, I want to review the triggers for the New York futures session.

🔄 Yesterday, the price broke through the support zone between 80,595 and 81,522, retracing down to 78,778. Let's see what triggers the market could offer us today.

⌛️ 1-Hour Timeframe

On the 1-hour timeframe, as you can see, after breaking the 78,778 level, the price quickly recovered and climbed back above the 81,522 zone. Currently, it is hovering near 83,349.

🔍 Today, for a long position, we can consider opening a trade upon breaking the 83,349 resistance. The next resistance level at 84,572 could act as the following trigger point.

🔽 For short positions, we need to wait for a new market structure to form and observe whether the 81,522 or 80,595 zones can serve as our triggers.

⭐️ The RSI oscillator is near the Overbought zone, and a breakout above 70 into Overbought territory would provide good confirmation for a long position.

📊 Market volume has been increasing since the bullish leg started from 78,778. If this volume growth continues, the probability of breaking through the 83,349 resistance will rise.

👑 BTC.D Analysis

Now, let's move to Bitcoin Dominance (BTC.D). Yesterday, the 63.50 resistance was broken, and as Bitcoin's price climbed, its dominance also rose. This has caused altcoins to underperform compared to Bitcoin.

🔼 Currently, the next resistance for BTC.D is at 63.86. A break above this level would confirm the next bullish leg in Bitcoin Dominance.

📉 For a bearish move in dominance, the Futures triggers are at 63.50 and 63.30. However, for a confirmation in spot trading, we would need a break below 62.65.

📅 Total2 Analysis

Moving on to the Total2 (altcoin market cap excluding Bitcoin), I've slightly adjusted the zones and updated the triggers for altcoins.

✨ As I mentioned in the Bitcoin Dominance analysis, altcoins have been lagging behind Bitcoin. Even though Bitcoin reached 83,349, Total2 failed to retest its previous highs and instead formed a lower high.

✔️ For long positions on altcoins, a break above 940 would be ideal. For short positions, you can look for confirmation if 903 is broken.

📅 USDT.D Analysis

Finally, let's analyze USDT Dominance (USDT.D). Yesterday, it bounced from the 5.53 support level, climbing to 5.84 before starting a new downtrend, now approaching 5.53 again.

⚡️ To continue the bearish move, a break below 5.53 would be significant. Conversely, for a bullish move, the first trigger is at 5.84.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.