BTCDOM : Near to breakout from trendline resistanceBitcoin dominance is nearing a breakout from trend line resistance. Keep a close watch as a breakout from here could lead to a short-term market correction, negatively affecting altcoins. Stay cautious with your long positions and use proper stop loss strategies.

KEEP A CLOSE WATCH ON IT

Btcdominancechart

Final Breakdown from Rising Wedge – Alts About to Run?BTC dominance has been rising steadily inside a rising wedge, but now it looks like the structure is giving up.

Price just broke below the wedge, a move many traders watch as a potential shift in momentum.

If this breakdown holds, it could be the final breakdown before altcoins start gaining serious strength.

Eyes on alts, the rotation might be starting.

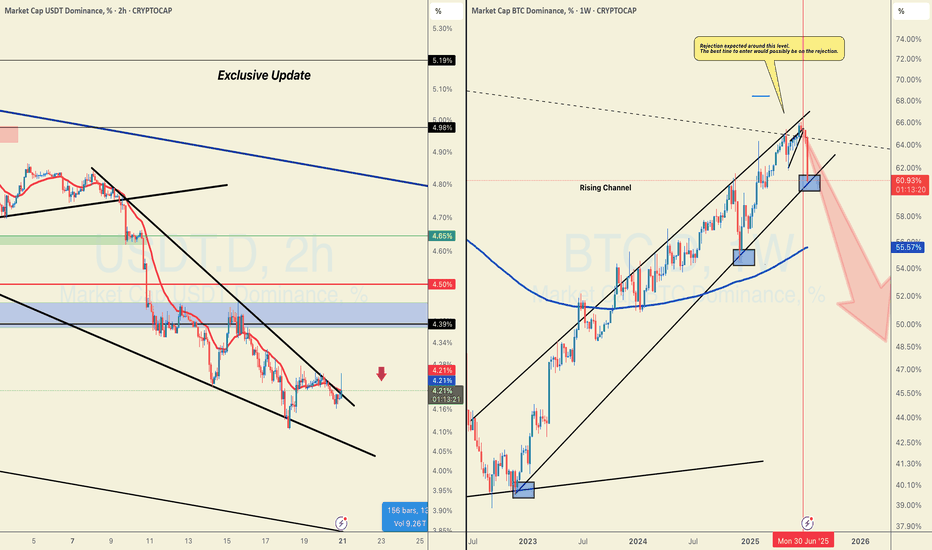

#BTC.D Just Hit the DAILY SUPPORT, WILL THERE BE A PULLBACK?CRYPTOCAP:USDT is breaking out on LTF while BTC.D just hit support that looks ready to break down.

Not a short call, but if you've been trading well, this is when you reduce margin and cut leverage.

Although I could be wrong about USDT here but profit-taking matters.

We will probably get a pullback this week to enter again.

It's better to watch coins rise a few more waves without you than to give it all back in a few reckless trades.

Spot bags? HODL and DCA.

Futures? Trade cautiously.

DYOR. NFA.

Do show your support with your likes if this post adds any value, and hit the like button.

Thank You

#PEACE

Dominance & Altcoins- This graph is purely based on fibonacci law.

- 61.8% is the core of the system ( check rectangles in graph to get it )

- Most of long term traders not even look at the price.

- they just wait the good time to buy using Fibo.

- in 2016 BTC was almost 100%. Altcoins were inexistant. (less than 2% of the market with ETH)

- in 2021 BTC Dominance pushed to 75% (altseason followed the push)

- in 2024 we could see BTC dominance knocks 60% ish ( Altseason will follow )

- BTC is maturing.

- Cryptos are growing.

- Don't look too much at your altcoin wallets.

- Most of the time the story repeats itself.

- Respect the cycle, be patient and eat noodles!

Happy Tr4Ding !

BTC.D – Distribution Confirmed. Is the Final Altseason Next?Over the past couple of months, I’ve been tracking the development of a potential high time frame (HTF) Wyckoff distribution range forming on BTC Dominance (BTC.D), and it’s now looking like that structure is starting to break down.

Back on June 14th, I noted that while we hadn’t confirmed a trend shift yet, BTC.D was showing strength and likely to push into the 65% region, with altcoin weakness to follow. The very next day, I shared my idea of a potential Wyckoff distribution forming — and since then, it’s followed that path almost perfectly.

🧠 What’s Happened Since?

✅ Sweep of the HTF range high at ~65%

✅ Second deviation of the highs

✅ Volume divergence into supply — declining volume + strong rejection candles

✅ Formation of a UTAD (Upthrust After Distribution)

✅ 1D bearish market structure break after the sweep

✅ Price now back inside the range

This is textbook distribution behaviour — even if it doesn’t follow the Wyckoff schematic to the letter, the key elements are present: deviation, volume drop-off, and structural breakdown.

🔮 What Comes Next?

BTC.D is currently holding inside a prior unmitigated daily demand, but given the structural shift, I’m expecting:

A pullback to 65–65.5% (daily supply + range high retest)

Then a continuation bearish, targeting:

🔸 49% (prior accumulation range high)

🔻 46% (FVG fill + range breakout retest)

These lower targets align with where I expect altcoins to top out — so as BTC.D breaks down, I expect capital to rotate hard into ETH and alts, triggering the final phase of altseason before the macro cycle top.

⚠️ Why This Matters

This distribution range has been developing since late 2024, and with BTC.D now showing bearish market structure, combined with:

- ETH.D flipping bullish

- OTHERS.D pushing higher

- Stablecoin dominance pairs breaking down

…we’re seeing confluence across the board for a risk-on altcoin environment.

I believe this is the setup that leads to the final euphoric altcoin rotation before the 4-year cycle top prints later this year.

📌 Watch for the retest. Watch for the rejection. The breakdown will be fast.

This is the window — time to stay sharp.

Let me know in the comments if you’ve been tracking this too, or drop your altcoin rotation picks.

— Marshy 🔥

1D:

3D:

1W:

1M:

BTC Dominance Nearing Breaking Point – What It Means for Alts🚨📈 BTC Dominance Nearing Breaking Point – What It Means for Alts ⚠️🧩

Bitcoin Dominance (BTC.D) is climbing — and fast. As of now, we're at 64.13% , officially in the “ Bad for Alts ” zone. Historically, this level has meant one thing for altcoins: trouble ahead . But what if we go further?

🔵 The chart tells the full story:

Above 73% dominance, we're not just bad — it's disaster territory for altcoins.

The biggest alt bull runs in history started when BTC dominance reversed from these high levels .

But now? We're riding a rising channel with no sign of slowing, and a potential peak at 71.34% could be next.

📉 If dominance hits that upper wedge, altcoins may face an extinction-level drawdown — especially if meme coins, scams, and greedy behavior continue to dominate the space.

🧠 As the chart says:

“The END of Alts would be back here…” (not a valid scenario in my opinion but it exists)

Unless fundamentals and real utility make a comeback, we may be heading for a cleansing phase — where only the strongest survive . And that's Bitcoin only.

🔎 Key Zones:

>73% = 🚫 Disaster for Alts

64–73% = ❌ Bad for Alts

54–62% = ⚖️ Neutral / Good for select alts

<45% = ✅ Historically Great for Altcoins

💬 What do you think? Is this a final dominance pump before reversal? Or are we witnessing the long-awaited re-centralization of crypto around BTC?

One Love,

The FXPROFESSOR 💙

Altseason Ahead? BTC Dominance Cycle RepeatsBTC dominance is forming a pattern similar to the 2021 cycle, where dominance peaked after a long uptrend and then sharply declined, triggering a major altseason. Interestingly, that drop occurred after a 1,085-day rise, a time span we are once again approaching in 2025, projected to end around late August. If history repeats, BTC dominance could start declining from mid-Q3 2025, leading into a strong altcoin rally that may last through the end of Q4. This setup aligns with typical post-halving behavior, suggesting the final phase of the cycle could heavily favor altcoins.

CRYPTOCAP:BTC CRYPTOCAP:ETH CRYPTOCAP:XRP

renderwithme | BTC - Dominance about to hit resistanceBitcoin dominance (BTC.D), which measures Bitcoin’s market capitalization as a percentage of the total cryptocurrency market cap, is a key indicator of market sentiment and capital flow between Bitcoin and alt coins . As of July 5, 2025, recent data and technical analysis suggest Bitcoin dominance is at a critical juncture, with potential shifts in market dynamics for the upcoming week. Below is an analysis based on current trends, historical patterns, and technical indicators.Current State of Bitcoin DominanceCurrent Level: Bitcoin dominance is approximately 64.36% to 65.68%, based on recent data .

Recent Trends: Dominance has been testing a multi-year resistance zone between 66.5% and 69.5%

Historical highs in this range (e.g., 64.34% in early 2025) have often preceded pullbacks or altcoin rallies.

Chart indicate bearish signals, such as weekly bearish divergences and potential reversal candles, suggesting a possible decline.

Technical Analysis for Next WeekResistance and Support Levels:Resistance: The 66.8%–67.2% zone is a critical resistance level, aligning with Fibonacci extensions and a long-term descending trend line. A failure to break above this could signal a reversal.

Support: Key support levels are at 61.90%–62.20%, with a potential drop to 58% if bearish momentum accelerates.

Chart for your reference

Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

Altseason isn’t cancelled, it’s just delayed. Here's WHY!CRYPTOCAP:BTC Dominance Update:

Altseason isn’t cancelled, it’s just delayed.

The key zone to watch is 69.5%–73% dominance. That’s where we’re likely to see a strong rejection if it doesn't start soon, which seems unlikely given the current circumstances.

The longer it takes to reach that level, the stronger the altcoin rally will be once it hits.

This isn’t hope, it’s exactly what the charts are showing.

Historically, 70% dominance has acted as a major reversal zone.

If there are signs of reversal before this level, I'll let you know beforehand.

So follow me if you don't and share this chart with your crypto friends.

Do not forget to keep cash/stables!

Let me know what you think in the comments.

Thank you

#PEACE

BTC.D - Could it be Wyckoff Distribution DevelopingJust toying with ideas of what may be developing here so dont take the chart as what i think will happen perfectly as shown.

With the strength seen from BTC.D atm, it looks more and more likely it may go for the highs again and into the higher levels above 65%.

I still see this as a very large range from the february high and lows that got put in and the prior high was a deviation of the larger range resulting in the reaction we seen.

We could expect to see a further deviation of the range highs and this wouldn't be uncommon in the development of a wyckoff distribution range.

Im still looking for a HTF reversal bearish from these supply levels and my bias doesnt change right now as we continue to develop this range until proven otherwise.

That being said, we could see some further weakness in altcoins until this tops out and gives us the right confirmations of a trend shift bearish.

1D:

BTC dominance next move (maybe) looking at this BTC Dominance chart, we’re currently sitting around 64.13%, and price just tapped into that red zone marked as “FVG” — that’s a fair value gap, basically an area where price moved too fast before and didn’t fill orders properly as you see this is my take on BTC Dominance and i think its going to the order block that its around 58%

this is just my take, not financial advice. No one can predict the crypto market with certainty. It's wild and full of surprises, so always do your own research and stay sharp.

Bitcoin Dominance Important UpdateHello, Skyrexians!

CRYPTOCAP:BTC.D showed rapid decrease and as a result we have some changes in the analysis. Hope you remember the yellow Elliott waves cycle which according to my previous analysis was not finished. But now looking at the Awesome Oscillator I changed my mind and now we in the higher degree wave 4.

We will switch from 12h time frame to the daily and can see that wave 4 is already in progress. This wave is going to be ABC shaped and in my opinion reach 0.5 Fibonacci level at 61% or even lower to 60%. Then the final wave 5 will reach 67%. Wait for the update I will tell you when wave 4 is finished.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

BTC Dominance: Approaching Major Resistance!!BTC.D is nearing a major 66%-68% resistance zone within a long-term ascending channel (since 2018). Historically, this area has triggered BTC.D pullbacks, often leading to altcoin rallies. The chart itself anticipates a rejection from this level.

If BTC.D rejects, a move towards the 53-54% lower channel support is likely, potentially bullish for alts. Watch for bearish weekly candle closes and increased selling volume as confirmation. Altcoin price action should also be monitored for signs of strength. This key resistance zone presents a significant point for the broader crypto market. Exercise caution and await.

If you find this analysis helpful, please hit the like button to support my content! Share your thoughts in the comments, and feel free to request any specific chart analysis you’d like to see.

Happy Trading!!

No Altseason Until BTC.D Hits 70%?Bitcoin Dominance (BTC.D) is currently climbing and approaching a major resistance zone between 71.38% and 73.06%. This area has proven to be a strong turning point in the past, acting as a top back in December 2017, September 2019, and again in 2021. These repeated rejections suggest that this zone is likely to remain a key resistance.

Right now, BTC.D is sitting around 64.66% and still has room to push higher. However, if it enters the resistance zone again, there’s a strong chance it may face selling pressure and start reversing. The white arrow on the chart shows the possible move into resistance, while the red projection outlines the expected rejection and potential decline back toward the 54.63% level—another important support zone from the past.

In simple terms, BTC dominance might be nearing its peak, and once it reaches the upper zone, we could start seeing altcoins gain more strength as dominance falls. This chart helps anticipate when the market might shift from BTC-led rallies to altcoin outperformance.

Bitcoin Dominance Update (4H)It appears that Bitcoin Dominance is preparing for one final upward move.

I believe this could be the last dominance rally before a major bullish breakout across the broader market.

For a more detailed perspective, please refer to my previous analyses on Bitcoin Dominance and the "Others" market cap.

— Thanks for reading.

Bad News From Bitcoin Dominance: Pain AheadHello, Skyrexians!

I got sick for these 5 days that's why has not shared updates, but market was very boring so we didn't miss any significant move. CRYPTOCAP:BTC.D concerns me now because to end this trend we need to see any significant correction, but we didn't. On the 12h Awesome oscillator was not able to cross zero line and reversed to the upside, so our main change is that daily time frame measures the wave 3 inside the major impulse.

If we count waves inside this impulse price is approaching 1.61 Fibonacci level at 65.3% and trust me it's much better to see it's reaching before the drop. When this wave will be finished, wave 4 will happen. It can bounce significantly to 61%. This is strong target area and I am sure we will be there soon. Wave 5 can be extended, can be not. The max target is 71%! Sounds awful. The likely target at 66-67%, to make it more precise let's wait for wave 4 finish.

I plan to close in profit those part of trades which has been opened after Feb 3 dump on this potential bounce to have money to add on the last huge shakeout. People believe in altcoins too much, very unlikely to have altseason now. Ready for hate!

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

BTCDOM at the threshold of a strong impulseA very interesting situation is now observed on such a ticker as BINANCE:BTCDOMUSDT.P - bitcoin dominance index released by Binance. It differs from CRYPTOCAP:BTC.D in that it shows bitcoin dominance to the top 20 altcoins.

On the weekly chart of BINANCE:BTCDOMUSDT.P there is a very old AMEXP model from June 5, 2023, which essentially describes the entire current uptrend on this index. So within this model there was a target value of 100% level (2625.1), which has been a resistance for 112 days and during this time there were 4 attempts to test it.

In case we see a breakout, there may well be a very strong impulse, which will be accompanied by great volatility in the market.

What two scenarios could work at this point?

1️⃣ Index growth will be due to the fact that the top 20 altcoins will stand still/fall on the background of INDEX:BTCUSD growth.

2️⃣ Index growth will be due to the fact that the top-20 altcoins will fall faster than INDEX:BTCUSD will fall.

Bitcoin Dominance Is About To Finish The Growth CycleHello, Skyrexians!

Time to update our main chart CRYPTOCAP:BTC.D and today we will take a look at 4h time frame to make sure that everything is going according our global scenario.

Today we consider wave 3 in 5 into the global 5. It has been almost done with the potential double divergence and ending diagonal at the top. The next wave is higher degree wave 4. It has the target at 0.38 Fibonacci at 63%. From this point we expect final wave 5 to final target at 66%.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

XRP could flip Bitcoin again at the end of this cycle around Sepothers.d is ready to bounce after 5 red monthly candles. Just like December 2016.

while Bitcoin Dominance looks like this under Trump 2.0 trolling the economy on a much grander scale while XRP has already given us a tease of what's to come this cycle reaching a historic new ATH. And tether on the other hand, unstoppable! They are about to print so much money they could at some point flip Ethereum while Ethereum finally goes home.

Imagine if XRP and tether flip Bitcoin together (relax! it wouldn't be the 1st time. XRP did in Jan 2018 if only for a moment)

Looks promising now that Europe offered 0 to 0 tariffs. 1929 scenario could take years since dedollarization takes years to develop. (it's not going to happen overnight.)

Spring is finally here. Buy others like VeChain (the next xrp this cycle)