BTCUSDT Technical Analysis

BTCUSDT Has broken above the resistance and got out of the symmetric triangle. There might be a small Pullback but the direction is up.

Leverage 10x 20X 25X 50X 75X

⬆️Buy now or Buy at 48486.67

⭕️SL @ 46965.21

✅TP1 @ 49200.00

✅TP2 @ 49700.00

✅TP3 @ 50150.00

✅TP4 @ 50700.00

✅TP5 @ 51200.00

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

Btcsignals

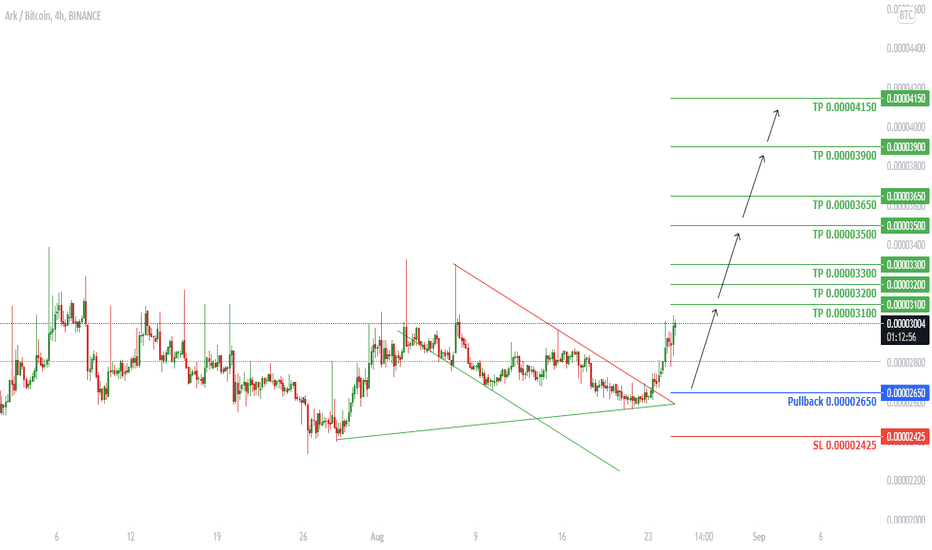

ARKBTC Technical Analysis

ARKBTC on H4 has broken above the Descending channel and triangle as well. It will go down for a pullback then it is expected to go higher.

⬆️Buy now or Buy at 0.00002651

⭕️SL @ 0.00002425

✅TP1 @ 0.00003100

✅TP2 @ 0.00003200

✅TP3 @ 0.00003300

✅TP4 @ 0.00003500

✅TP5 @ 0.00003650

✅TP6 @ 0.00003900

✅TP7 @ 0.00004150

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

FXSBTC Technical Analysis

FXSBTC on H8 had formed a triangle. After the breakout and pump it will go down for the Pullback. It ix expected to continue the Bullish move after the Pullback.

⬆️Buy now or Buy at 0.0001040

⭕️SL @ 0.0000680

✅TP1 @ 0.0001490

✅TP2 @ 0.0001600

✅TP3 @ 0.0001800

✅TP4 @ 0.029000

✅TP5 @ 0.030000

✅TP6 @ 0.033000

✅TP7 @ 0.0003900

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

WRXUSDT Technical Analysis

WRXUSDT on H4 has formed 3 Triangles. We had a breakout from the previous breakouts. Now the last recent triangle might extend but after the breakout it will go up. We might see a pullback before it goes up.

⬆️Buy now or Buy at 1.5360

⭕️SL @ 1.4444

✅TP1 @ 1.6875

✅TP2 @ 1.7518

✅TP3 @ 1.8500

✅TP4 @ 1.9200

✅TP5 @ 2.0000

✅TP6 @ 2.2000

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

TELUSDT Technical Analysis

Welcome back Traders, Investors, and Community!

TELUSDT on H4 has broken above the resistance by large green candles and it might go lower for a retest but finally It is expected to go higher.

⬆️Buy now or Buy at 0.02399417

⭕️SL @ 0.02050161

✅TP1 @ 0.03000000

✅TP2 @ 0.03175418

✅TP3 @ 0.03414272

✅TP4 @ 0.03743725

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

XMRBTC Technical Analysis

Welcome back Traders, Investors, and Community!

XMRBTC on H4 has broken above the resistance by large green candles and it might go lower for a retest but finally It is expected to go higher.

⬆️Buy now or Buy at 0.006050

⭕️SL @ 0.005540

✅TP1 @ 0.006660

✅TP2 @ 0.006900

✅TP3 @ 0.007700

✅TP4 @ 0.008150

✅TP5 @ 0.009000

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

BAKEUSDT Technical Analysis

Welcome back Traders, Investors, and Community!

BAKEUSDT on H4 has broken above a major resistance. After the breakout it is expected to go higher.

⬆️Buy now or Buy at 2.9381

⭕️SL @ 2.5061

✅TP1 @ 3.5000

✅TP2 @ 3.7000

✅TP3 @ 4.1000

✅TP4 @ 4.4000

✅TP5 @ 4.6000

✅TP6 @ 5.0000

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

EOSUSDT Technical Analysis

Welcome back Traders, Investors, and Community!

EOSUSDT on H4 has broken above the resistance and also the triangle. It may go lower for a retest and pullback before it goes up.

⬆️Buy now or Buy at 5.3000

⭕️SL @ 5.1000

✅TP1 @ 5.7900

✅TP2 @ 5.9000

✅TP3 @ 6.2000

✅TP4 @ 6.5000

✅TP5 @ 6.8000

✅TP6 @ 7.0000

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

ADAUSDT Technical Analysis

Welcome back Traders, Investors, and Community!

ADAUSDT on H4 has broken above a significant Resistance and has been moving along the Bullish channel. The more Bullish move is expected.

⬆️Buy now or Buy at 2.5970

⭕️SL @ 2.3655

✅TP1 @ 2.9500

✅TP2 @ 3.0000

✅TP3 @ 3.2000

✅TP4 @ 3.4000

✅TP5 @ 3.6000

✅TP6 @ 3.8000

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

LITUSDT Technical Analysis

Welcome back Traders, Investors, and Community!

LITUSDT on h4 has broken above the resistance and also has broken above the triangle which is a Bullish sign. It might go for a retest before it goes up.

⬆️Buy now or Buy at 4.9862

⭕️SL @ 4.5936

✅TP1 @ 6.1800

✅TP2 @ 6.6000

✅TP3 @ 6.8500

✅TP4 @ 7.5000

✅TP5 @ 9.0000

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

AUDIOUSDT Technical Analysis

Welcome back Traders, Investors, and Community!

AUDIOUSDT on H1 has broken above the resistance and also the triangle. It is expected to go higher.

⬆️Buy now or Buy at 2.8219

⭕️SL @ 2.5585

✅TP1 @ 3.2245

✅TP2 @ 3.4382

✅TP3 @ 3.6594

✅TP4 @ 3.8174

✅TP5 @ 3.9649

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

AUDIOUSD Technical Analysis

Welcome back Traders, Investors, and Community!

AUDIOUSD on H1 has broken above the resistance and also the triangle. It is expected to go higher.

⬆️Buy now or Buy at 2.81834426

⭕️SL @ 2.55720239

✅TP1 @ 3.21761628

✅TP2 @ 3.42949998

✅TP3 @ 3.64888021

✅TP4 @ 3.80558038

✅TP5 @ 3.95183387

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

OXTUSDT Technical Analysis

Welcome back Traders, Investors, and Community!

OXTUSDT on H4 in an uptrend has broken above the resistance and also has broken above the triangle. So it is expected to go higher after the retest.

⬆️Buy now or Buy at 0.3725

⭕️SL @ 0.3550

✅TP1 @ 0.4500

✅TP2 @ 0.4600

✅TP3 @ 0.4800

✅TP4 @ 0.4900

✅TP5 @ 0.5700

✅TP6 @ 0.6500

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

BITCOIN completed 5 straight green weeks! Dead-cat or new Bull?So BTC managed to turn the scene completely around since the May-July bleeding and has completed 5 straight green weekly (1W) candles. As you see on the chart, such bullish streak is mostly associated with aggressive runs during Bitcoin's parabolic phases of Bull Cycles.

Since the December 2018 Bear Cycle Bottom we've had four (4) streaks of 5 or more straight green weeks. Similarly in the previous Bull Cycle after the January 2015 Bottom, we've had ten (10) such streaks.

The only time BTCUSD made 5 or more straight green weeks while in a Bear Cycle, was in April 2018 (5 week streak) and in June 2014 (6 week streak). Common characteristic of those sequences with the current streak, is that on all three occasions, the streak started after the price bounced on the 1W MA50 (blue trend-line). It is important to mention here that in the first Bear Cycle of 2011, there was no such bullish 1W streak (notably it only posted 2 straight green weeks once), as shown on the chart below:

The difference between the current streak and those of the past 2 Bear Cycles, is that during those the price never broke above the 0.618 Fibonacci retracement level, while now BTC is trading comfortably above the 0.618 Fib. That is maybe the strongest indicator telling us that this is not a Bear Cycle "dead-cat" bounce on the 1W MA50, but a continuation of the Bull Cycle that started on the December 2018 Bottom. Also the RSI this time (compared to the Bear Cycle bounces) is much stronger.

So what does this 5 straight green weeks streak mean to you? Is it a Bear Cycle bounce or a Bull Cycle continuation to new All Time Highs? Feel free to share your work and let me know in the comments section!

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> nevada999

--------------------------------------------------------------------------------------------------------

Btc scalpingbest trading strategy scalping

DISCLAIMER*

DO NOT take this video as financial advice! I am not a financial advisor and this video was only made for entertainment purposes. I am not liable for any losses you may incur so always do your own research before making any investment/financial decision.

This information is what was found publicly on the internet.

HBARUSDT Technical Analysis

Welcome back Traders, Investors, and Community!

HBARUSDT on H4 has broken above the resistance and the triangle. The price might go lower to retest the previous resistance but then it is expected to go higher.

⬆️Buy now or Buy at 0.23499

⭕️SL @ 0.22442

✅TP1 @ 0.25550

✅TP2 @ 0.26500

✅TP3 @ 0.27777

✅TP4 @ 0.28500

✅TP5 @ 0.29500

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

XLMUSDT Technical Analysis

Welcome back Traders, Investors, and Community!

XLMUSDT on h4 has the potential to go higher after the break above the resistance and the triangle. It might go down for a Pullback

⬆️Buy now or Buy at 0.35622

⭕️SL @ 0.33505

✅TP1 @ 0.39500

✅TP2 @ 0.40000

✅TP3 @ 0.40900

✅TP4 @ 0.42500

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

XRPUSDT Technical Analysis

Welcome back Traders, Investors, and Community!

XRPUSDT has broken above the resistance and the triangle. It will go down for a retest and Pullback then it will go up.

⬆️Buy now or Buy at 1.1900

⭕️SL @ 1.0800

✅TP1 @ 1.2900

✅TP2 @ 1.3400

✅TP3 @ 1.4000

✅TP4 @ 1.5600

✅TP5 @ 1.7500

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

Btc scalping 2

How to trade bitcoin with pitchfork

*DISCLAIMER*

DO NOT take this video as financial advice! I am not a financial advisor and this video was only made for entertainment purposes. I am not liable for any losses you may incur so always do your own research before making any investment/financial decision.

This information is what was found publicly on the internet

Btcusd uptrend

The cryptocurrency is recovering in price and continues to grow after exiting a prolonged neutral range.

Ahead is a strong level, the pressure of the bulls is strong enough, there is a huge infusion of funds, therefore,

I think that this level will be broken quickly enough and an increase will follow to the next resistance level - 50525

———————

9 / 9 last BTCUSD ideas come TRUE

BITCOIN This cheatsheet has the next top at 300k. Dream or not?I have posted this chart a while ago but with Bitcoin breaking and closing the day above the 1D MA200 yesterday, it may be now more relevant than ever.

So as you see I've classified the historic price action into 3 Cycles:

* Cycle 1 starts on the All Time High (ATH) at the time on Fib 1.0, bottoms on Fib 0.0, makes the 1st post ATH High on the 1.618 Fib and makes a new ATH on the 2.272 Fib.

* Cycle 2 starts on the ATH 2.272 Fib, bottoms on the 1.618 Fib (which previously was where the 1st post ATH High of Cycle 1 was made), makes the 1st post ATH High on the 2.618 Fib (1.0 Fib higher than the 1st post ATH High of Cycle 1) and makes a new ATH on the 3.272 Fib (1.0 Fib higher than the previous ATH).

* Cycle 3 starts on the ATH 3.272 Fib (which is 1.0 Fib higher than the previous ATH), bottoms on the 2.618 Fib (which previously was where the 1st post ATH High of Cycle 2 was made) and makes the 1st post ATH High on the 3.618 Fib (1.0 Fib higher than the 1st post ATH of Cycle 2).

If the above sequence continues to hold then the next ATH for Cycle 3 should be on the 4.272 Fib, which will be 1.0 Fib higher than the previous. That value is roughly at $300k. Is that realistic to expect under the current macro-economic circumstances even by 2022? Feel free to share your work and let me know in the comments section!

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> pablito1986z

--------------------------------------------------------------------------------------------------------

BTC Strong Supply Zone at 48k-50kGuys be very careful at this zone 48k-50k range. overall bitcoin is bullish but even btc crossed 45k we did not see any profit booking so the whales are still holding on to their btc there is chance that a huge sell of will take place follow good stoploss and trade safe.

Bitcoin Entries + ExitsLong awaited :)

How To Play The Chart Entries/Exits:

Buy at green support entry, if it breaks by -35 pips (count it out) then enter a sell and ride to TP1, 2 and 3. Trail stop at each TP which means place your stop loss in profit but with enough room to be able to continue the sell if it continues. Same thing at resistance, sell but if broken by 30 pips then enter the buy and ride to TP1. Each TP is a support or resistance zone , so you could then even take a sell after TP1 for the buys have been hit and if it breaks out then just repeat.