BTC – Final Push Before the Top? Here's What I’m WatchingBeen getting a lot of questions recently about where I think BTC tops this cycle, so I figured it’s time to lay out what I’m seeing on the higher timeframes and what could be coming next.

First off, I want to stress this again — USDT.D will be the key chart for spotting the top. It’s been one of the most accurate indicators across the board for understanding tops and bottoms. But it’s even more powerful when used alongside broader structure and confluence, which is what I’m doing here.

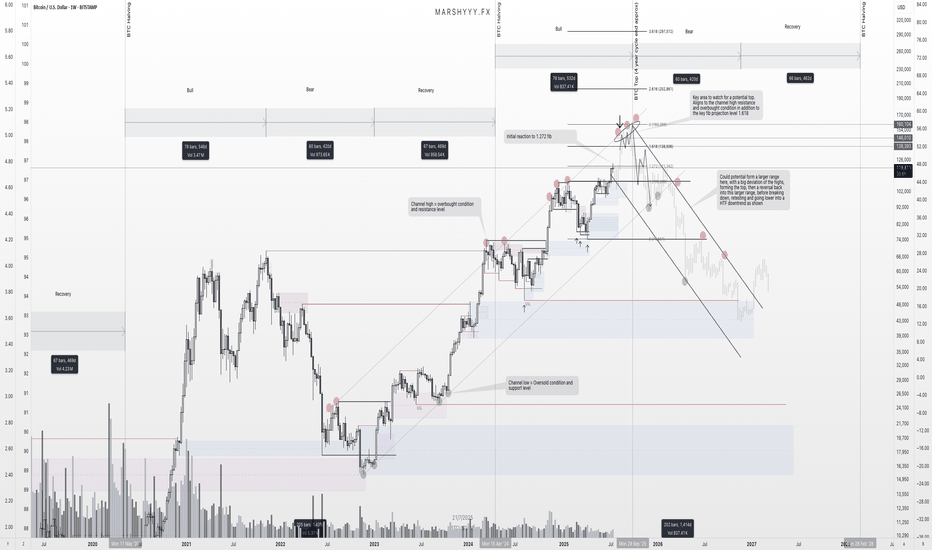

Looking at BTC’s high timeframe structure, I’ve been tracking this ascending trend channel since 2023 — and we’ve remained within its bounds beautifully. Every leg up has been met with a reaction near the channel highs, while each major correction has tapped into the lower channel support or just below midline before continuing the trend.

Right now, price is pushing back up toward that upper channel resistance, and if it behaves like it has previously, I’d expect it to act as a major magnet again. That aligns with a projected range of $140,000 to $160,000, depending how deep the wick runs or how extended this move gets from the channel midline.

On top of that, fib extensions from the previous high to low give us another layer of confidence. We’ve already seen a reaction at the 1.272 level, which paused price temporarily. The next big fib? The 1.618 — which sits right around $138k — adding confluence with the top of this HTF trend channel.

What makes this even more interesting is that this move is aligning near-perfectly with the 4-year cycle structure, which suggests a potential cycle top around September 2025. That’s roughly two months away, and it fits the pattern of previous cycles where BTC tops approximately 18–20 months post-halving.

As we approach this zone, I’ll be watching for the usual signs: slowing momentum, bearish divergence, volume anomalies, and rejection candles into resistance. But I won’t just be relying on the BTC chart alone. I’ll be stacking confluences from other key indicators too — USDT.D, BTC.D, macro risk indicators, and stablecoin flows — to confirm if this is truly the top or if there’s one more leg left in the tank.

Once the top does form, whether it's $138k or $160k or somewhere in between, I think we move into the distribution phase that begins the next macro downtrend. The next few years will be about preservation and accumulation again, and I’m already eyeing zones like $49k and below as potential long-term HTF demand levels when that time comes.

For now, we’re in what I believe is the final bullish leg of this cycle. I’m positioned, prepared, and watching closely for signs of exhaustion as we move into this zone of confluence.

Let the market do its thing — just make sure you’ve got a plan for when the music stops.

Btctopprediction

BTC Roadmap predictionsI have market out the BTC halvings, and taken a FibTimeZone with the 0.382 and 0.618 zones marked out.

You will notice how the tops and the bottoms are quite closely timed to the tops at the 0.382 and the bottoms at the 0.618 ratios.

This means that the next top should be around October 2025.

The fib zones above give us some targets to watch out for, and the green line shows a potential btc trajectory till we hit the top of the next cycle.

Note I based this off the last cycle - but we had the C19 scare, so the chances of it falling below the rising blue trend line after it confirms it are slim i feel.

BTC Blow Off Top?Looking at history and the old ATH we saw a similar structure forming for the Bitcoin price. A big consolidation range at the 30k area forming demand before marking up and forming a classic Wyckoff Distribution back down to that same area. Things are looking pretty similar now where we had the same consolidation at 40k forming a big demand area for Bitcoin. Looks like we might have had the buying climax for Bitcoin and are moving to stage two of the Wyckoff Distribution which is the upthrust. Now there is ofc no guarantee in any of this but I thought it would be nice to share to keep in mind.