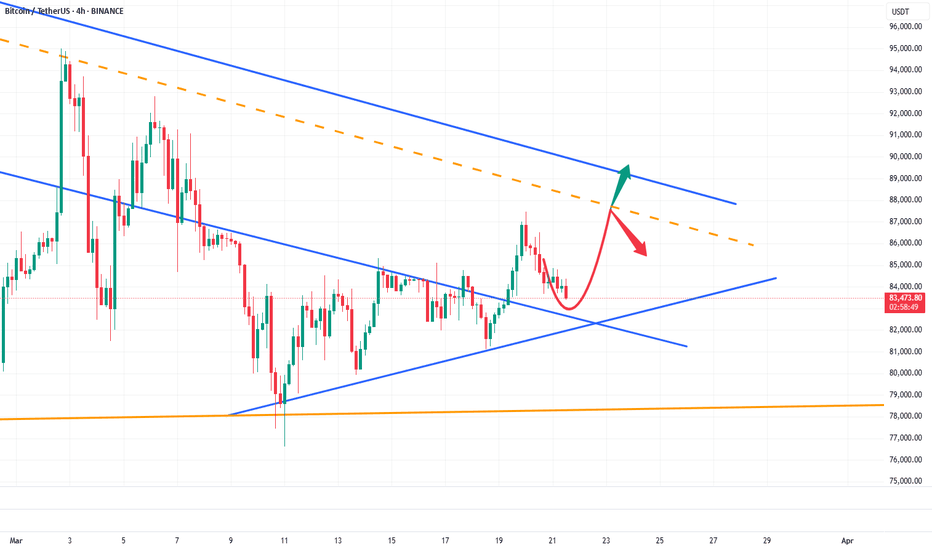

Where are we with BITCOIN ? 4hour, Daily and Weekly charts tell I am hearing so many people shouting about "This is it, we are on the way"

It may turn out to be right BUT for me, It seems people are looking at the smaller Time Frames only.

Sure, the main chart here is a 4 hour chart, has been climbing from around 76K ( Told you we would go there )

Looks Lovely and Bullish, though a return to 80K is very possible on the lower trend line

Lets Look at the Daily.

And there it is, Even though on a shorter Time Frame, we seem to be climbing, and we are, it is in fact, all with in a DESCENDING channel

But do not worry, a Bullish sign is that PA does appear to have broken over that Upper trend line of resistance.

We need to wait , probably till next week, to see if this remains Bullish or not.

It is Wise to take note of that Fib Circle that we are coming to in the next couple of weeks. If we get trough, we will hit resistance increasingly from 91K

And so now the weekly - this is a different chart to the Daily

The Bigger picture ALWAYS tells us the reality of the situation. and that is simply that PA is currently on a line of strong Local support (dashed line )

Should this fail, we have strong support below, all the way to 70K.

Be fully aware, this COULD FAIL. We are Mid channel, MACD is still falling Bearish and at current rate of descent, will arrive at Neutral near end of April

The Bullish note is we are still above the 2.272 Fib extension. Sentiment is rising, Selling is Slowing

So in conclusion, we are in a Good place.

PA is becoming stronger and we have support below and PA has remained in "channel" for 3 weeks.

That is NOT Bearish

But we are also NOT in a Bull Run yet.

But, for me, I think we are certainly getting ready/.

As I have said, April may see Volatility, March looks like it may Close GREEN but htis has a week to go yet...

Bullish Caution is what I say - And so expect anther Drop out of this rising channel.

It would present excellent Buying opportunity and reset MACD quicker.

Aere we en-route to the New ATH ? We are getting Near but I still say the stronger probability for The CYCLE TOP ATH that is Early Q4

Btctrade

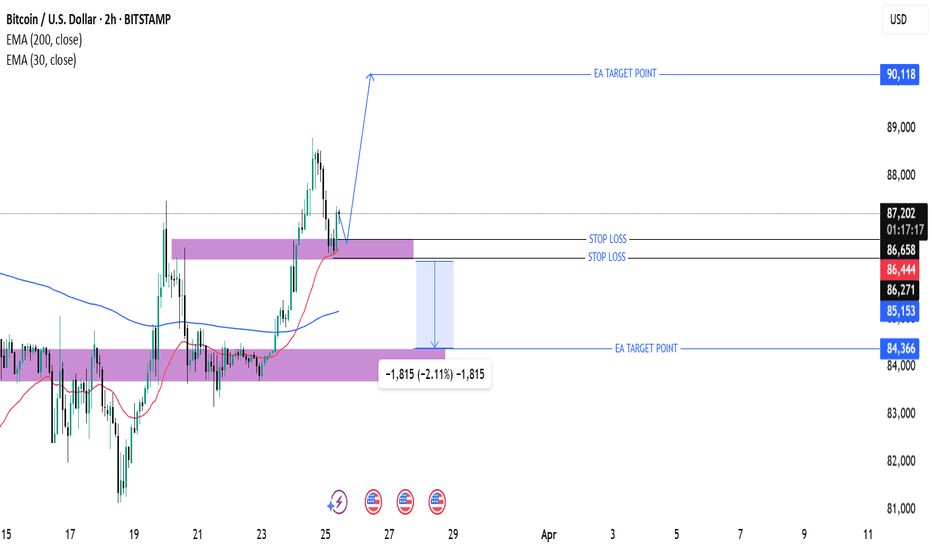

Bitcoin (BTC/USD) 2H Analysis: Potential Bullish Continuation or30 EMA (Red, 86,440): Indicates short-term momentum.

200 EMA (Blue, 85,153): Represents long-term trend support.

Support and Resistance Zones

Support Zone (Purple Box - ~86,271 to 85,153): Price is likely to bounce from here.

Resistance Zone (~87,149 and above): Breakout above this could push price higher.

Trade Setup

Entry Consideration: The price is currently testing a demand zone (purple) after a pullback.

Target (Take Profit - 90,118): Expecting a bullish move.

Stop Loss (~86,658 or lower): To manage risk.

Potential Price Action

If Bitcoin holds above the purple demand zone and 30 EMA, it could rally to 90,118.

A breakdown below 86,271 could push it toward 84,366 or lower.

Conclusion

Bullish Bias: If price holds above the support level.

Bearish Risk: If it breaks below the purple zone.

Recommendation: Monitor support at 86,271 and 85,153, as a bounce from these areas could confirm an uptrend.

BTC IMF Tracking, Liquidation Frenzy, and Market PredictionsBitcoin's recent price action has been a rollercoaster, marked by significant gains, dramatic liquidations, and a confluence of macroeconomic factors that are shaping its trajectory. From the International Monetary Fund (IMF) officially tracking Bitcoin in cross-border finance to speculative predictions of a potential $87,000 surge, the cryptocurrency remains a focal point of intense market scrutiny.

One of the most noteworthy developments is the IMF's increasing recognition of Bitcoin's role in global finance. While the IMF previously issued warnings to El Salvador regarding its Bitcoin adoption, its decision to now track Bitcoin in cross-border financial flows signals a tacit acknowledgment of the cryptocurrency's growing significance. This shift reflects a broader trend of institutions grappling with the reality of digital assets, forcing them to incorporate these assets into their analytical frameworks.

Simultaneously, the Bitcoin market has witnessed a surge towards the $87,000 mark, triggering a wave of short liquidations. This phenomenon occurs when traders who have bet against Bitcoin's price are forced to close their positions at a loss as the price rises. The sheer magnitude of these liquidations, exceeding $110 million in a short period, underscores the volatility and the inherent risks associated with leveraged trading in the cryptocurrency market. The total market liquidations surpassing $200,000 in 24 hours only highlights the dramatic price swings and the vulnerability of short positions.

Adding to the complexity of the market dynamics is the emergence of another CME gap in the $84,000–$85,000 range. Historically, these gaps, which represent discrepancies between trading prices on the Chicago Mercantile Exchange (CME) and other exchanges, tend to be filled, suggesting a potential pullback in Bitcoin's price. This pattern creates a sense of uncertainty, with traders weighing the potential for further gains against the possibility of a corrective downturn.

Furthermore, the surge in Bitcoin open future bets on Binance, with an increase of $600 million, indicates heightened price volatility. Open interest, which measures the total number of outstanding futures contracts, often correlates with price movements. A rise in open interest alongside a price increase typically confirms an uptrend, but it also signals the potential for sharp price swings as more capital enters the market.

Market analysts are divided on Bitcoin's future trajectory. Some predict a "brutal bleed lower," while others foresee a break towards new all-time highs in the second quarter. The critical level to watch is $93,000. If Bitcoin can reclaim this level as support, it would significantly reduce the risk of a fresh collapse. However, until this threshold is breached, the market remains vulnerable to downward pressure.

On a more positive note, the S&P 500's reclamation of its 200-day moving average provides a potential tailwind for Bitcoin. This technical breakout in equities, coupled with similar signals in the cryptocurrency market, could indicate renewed bullish momentum. The correlation between traditional financial markets and Bitcoin has become increasingly apparent, with positive developments in equities often translating to positive sentiment in the crypto space.

Adding another layer to the narrative is the potential softening of the stance on reciprocal tariffs by Donald Trump. Some analysts see this development as a potential catalyst for a Bitcoin bottom. Any relaxation of trade tensions could boost investor confidence and create a more favorable environment for risk assets, including cryptocurrencies.

Finally, the concept of tokenized US gold reserves, as proposed by NYDIG, presents an intriguing long-term prospect for Bitcoin. While gold and Bitcoin are fundamentally different assets, the tokenization of gold on a blockchain could enhance the overall legitimacy and infrastructure of digital assets. This increased institutional acceptance could indirectly benefit Bitcoin by further integrating blockchain technology into mainstream finance.

In conclusion, Bitcoin's current market landscape is characterized by a blend of institutional recognition, intense trading activity, and speculative predictions. The IMF's tracking of Bitcoin in cross-border finance underscores its growing relevance, while the liquidation frenzy and CME gap highlight the inherent volatility of the cryptocurrency market. The interplay of macroeconomic factors, technical indicators, and speculative sentiment will continue to shape Bitcoin's trajectory, making it a fascinating asset to watch in the coming months.

BTCHello friends

You can see that after the price fell in the specified support area, the price was supported by buyers and caused the resistance to break, and now, when the price returns to the specified ranges, you can buy in steps and move with it to the specified targets, of course, with capital and risk management...

*Trade safely with us*

the price of BTC has gone upIn the recent analysis of the cryptocurrency market, I have continuously been optimistic about the price trend of BTC. Since the last analysis, the price of BTC has steadily climbed from around 84,000 to the current 85000, further verifying the previous upward expectations.

🎁 Buy@83500 - 84000

🎁 TP 86000 - 87000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

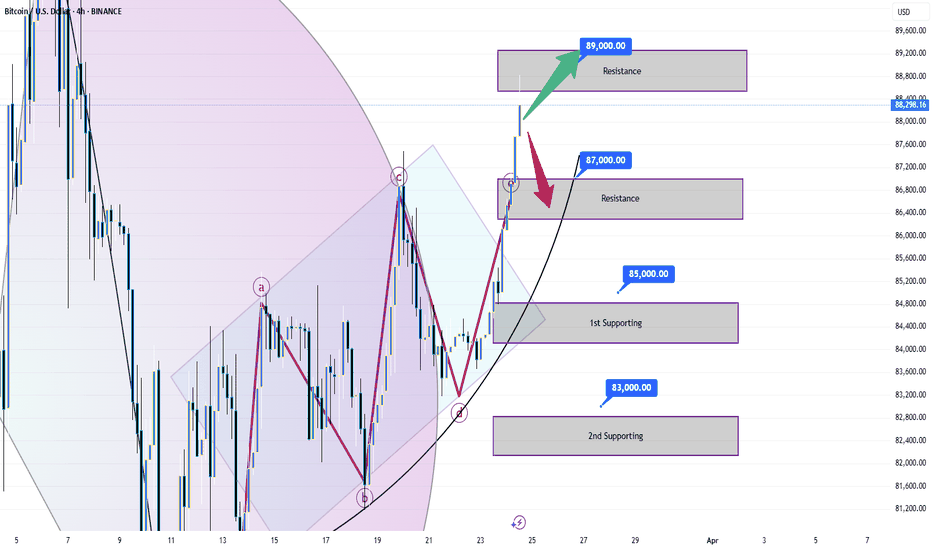

BTC encountered strong resistance 89000I made an analysis this morning. I said that if the price of Bitcoin breaks through the resistance level of 87,000, it's very likely to rise all the way to 88,000 in one go, and then it will encounter the resistance level at 89,000. Look, my analysis has been verified now. It has been proven that the resistance level at 89,000 is indeed effective.

At present, it's not advisable to engage in short - selling. Instead, one can consider taking long positions again at the support level.

💎💎💎 BTC 💎💎💎

🎁 Buy@85000 - 86000

🎁 TP 88000 - 89000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

BTC (20250324) market analysis and operationTechnical analysis of BTC on March 24: Today, the large-cycle daily level closed with a small positive line yesterday. The K-line pattern is still a single negative and a single positive. The price stands on the MA30 daily average line. The attached indicator is running in a golden cross, but the fast and slow lines are still below the zero axis. According to the current trend, when the current fast and slow lines touch the zero axis horizontal line, the time consumption space is almost the same, and the second large downward trend will come, so we have to wait in terms of time and trend; the short-cycle hourly chart continues the rebound trend of yesterday today. It is currently in the European session time, and the price begins to be under pressure. In addition, the probability of shock on Monday is relatively high, so the US market will first retreat in the evening.

Therefore, today's BTC short-term contract trading strategy: sell at the current price of 87,500 area, stop loss at 88,000 area, and target the 86,500-86,000 area;

AVAX / AVAXUSDT | 1H | Avax will be the rocketHey there;

I have prepared avax analysis for you. All I ask from you is to support this analysis with your likes.

My Avax target level is 22.62 and my stop level is 17.37.

This analysis has a win rate of 2.00

Guys I will update this analysis under this post

Now let's just follow this analysis and see if my analysis is correct or not.

Thank you very much to everyone who has been kind and supported me with their likes.

Thanks to your support, I am constantly preparing special analyzes for you.

I love all my followers very much.

BTC Today's analysisDuring the recent continuous and close tracking of the cryptocurrency market dynamics, I have always maintained an optimistic view on the price trend of BTC.

As it turns out, this prediction has been strongly validated by the market. Since the last market analysis, the price of BTC has shown a strong upward momentum, steadily climbing from an initial price of around 84,000 to the current remarkable 85,200.

💎💎💎 BTC 💎💎💎

🎁 Buy@83500 - 84000

🎁 TP 86000 - 87000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Bitcoin at a Critical Juncture – Breakout or Breakdown? 📉 BTC is at a key decision point! After pulling back from recent highs, it's now consolidating within a range, sitting right in the middle of the previous price swing. I'm keeping a close eye on this zone—if price breaks out, a high-probability trade opportunity could emerge.

🎯 In this video, we dive deep into price action and market structure, breaking down a potential trade setup—if the market aligns with our strategy.

🚨 Trade smart, manage risk—this isn’t financial advice! 🚀🔥

Let's always put our trust in BTC, mate.Bitcoin Market Analysis

BTC price hovers around 84,000 in consolidation. Bulls and bears battle at this price.

Support Level

Support is in 81,000 - 82,000. Strong buying emerges there. It stopped drops in past corrections. Dense holdings mean many cost - bases are in this range, propping up support.

Resistance Level

Resistance at 87,000. K - lines show heavy selling near it. Past break - throughs failed. Trapped or profit - taking positions sell as price nears, creating resistance.

Bullish Outlook

I'm bullish. Global recovery raises risk appetite for BTC. More institutions hold BTC, boosting price. Positive sentiment on long - term prospects, due to blockchain growth, helps. Upward - diverging moving averages show uptrend. Lower volume in consolidation, but activity stays. New positives may push price to resistance.

💎💎💎 BTC 💎💎💎

🎁 Buy@83500 - 84000

🎁 TP 86000 - 87000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Global Tensions, Market Manipulation, and BTC Uncertainty The cryptocurrency market, a realm notorious for its volatility, is currently grappling with a confluence of factors that are forcing investors to reassess their strategies. Global trade tensions, macroeconomic uncertainties, and the intricate dance of market manipulation are all contributing to a complex and unpredictable landscape. Specifically, Bitcoin, the flagship cryptocurrency, is experiencing a period of intense scrutiny, with analysts offering a range of perspectives on its potential future.

A recurring theme in recent analyses is the notion of "whale manipulation." Reports suggest that large holders, or "whales," are engaging in strategic trades on exchanges like Binance to influence Bitcoin's price. This "liquidity massaging" is seen as a deliberate attempt to create artificial price ceilings, with some analysts predicting that Bitcoin's upward momentum could be capped below $90,000, and more conservatively, $87.5K. Such manipulations introduce uncertainty, making it difficult to discern genuine market sentiment from artificially inflated or deflated prices.

Adding to the complexity is the debate surrounding retail investor participation. Contrary to the prevailing narrative of retail investors being absent, some crypto executives argue that they are already actively involved. This perspective challenges the notion that a surge in retail interest is needed to propel Bitcoin to new heights. If retail participation is already significant, the anticipated catalyst for a bull run may have already materialized, leaving investors to wonder what new catalyst is needed for further price appreciation.

Data from Bitcoin's Realized Cap and UTXO (Unspent Transaction Output) analysis is also signaling a "major shift." These metrics, which offer insights into the actual value stored within the Bitcoin network and the movement of coins, are crucial for understanding the underlying health of the market. Changes in these indicators can foreshadow significant price movements and shifts in investor behavior. Traders are closely monitoring these metrics for clues about Bitcoin's future direction.

However, despite recent attempts to pare losses, Bitcoin is struggling to maintain a consistent uptrend. This instability has led some traders to adopt a bearish stance, with predictions of a potential drop to as low as $65,000. These bearish sentiments are fueled by the inability of Bitcoin to decisively break through resistance levels and the persistent volatility that characterizes the current market.

Conversely, some analysts are finding bullish signals by examining indicators that also correlate with the Nasdaq. The correlation between traditional financial markets and the cryptocurrency space has become increasingly evident, and analyzing these relationships can provide valuable insights. If the Nasdaq shows signs of strength, it could potentially buoy Bitcoin's price. However, this correlation is not always consistent, and the inherent volatility of both markets can lead to unpredictable outcomes.

The performance of U.S. spot Bitcoin ETFs is another critical factor influencing market dynamics. The collapse of the "cash-and-carry" trade, a popular arbitrage strategy, has had significant implications for investors. The stagnation of inflows into these ETFs, compared to the initial surge earlier in 2024, has raised concerns about the sustainability of institutional interest. While there have been recent reports of net inflows returning, questions remain if this is a temporary blip, or a sustained uptrend. This fluctuation in ETF inflow signals a wavering confidence from institutional players.

The combination of these factors creates a challenging environment for investors. Global trade tensions, which can disrupt economic stability and investor sentiment, add another layer of uncertainty. Fluctuations in traditional markets, geopolitical events, and regulatory developments can all have a ripple effect on the cryptocurrency market.

In this tumultuous landscape, investors are advised to exercise caution and adopt a diversified approach. Relying solely on technical analysis or market sentiment can be risky. Instead, a comprehensive strategy that incorporates fundamental analysis, risk management, and a deep understanding of market dynamics is essential.

The current situation highlights the inherent volatility and complexity of the cryptocurrency market. While Bitcoin remains a dominant force, its future trajectory is far from certain. The interplay of whale manipulation, retail participation, technical indicators, and macroeconomic factors creates a dynamic and unpredictable environment. Investors must remain vigilant, adapt to changing conditions, and prioritize risk management to navigate this challenging terrain successfully.

BTC: Accumulate energy for the rise and soar into the sky!📍BTC's volatility has narrowed, with selling pressure showing signs of weakening. Throughout the choppy price action, the 84000-83500 zone has established itself as a critical support area in the short-term structure. This level now serves as a key defensive line.

📍Following this consolidation phase, BTC may stage a rebound from this support region. If the price manages to break through the resistance around 84800 with strength, further upside momentum could drive it towards the 90000 level.

🔎Trade Idea:

BTCUSD:Buy at 83500-83000

TP:84500-85000

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Bitcoin, interest rate effects, Macro events since 2021 - UPDATEThere is one very simple takeaway for me from this chart and that is simply that raises and Lowering of interest rates had Very little Effect on Bitcoin

It is more the effect it had on other organisations and the sentiment that followed Bitcoin and the traders.

For instance, From Jan 2023, when we saw Bitcoin begin its recovery, interest rates continued to rise.....and had NO effect on the Bitcoin recovery

And I think this continues to this day.

After the First push higher by Bitcoin in 2023, PA went into a Long range...in this time, interest rates began remaining at a static level. Bitcoin did not rise because of this.

When BTC was ready, it made a push higher again, interest rates were static and remained so while BTC entered another long range in 2024

It could be said that BTC PA rose once Rates were reduced but PA leveled out again even while the next rates decision was to reduce.

Bitcoin has its own agenda, it is NOT dependant on the USA to control its choices

On Each range, the MACD on the weekly timef rames was OVERBOUGHT.

And it is currently resetting having been overbought again.

This s NOTHING to do with interest rates.

MACRO events do have an impact though and we need to pay attention this this

But over all, Bitcoin is GOOD, BULLISH and getting ready for its next push

Have a Nice day now

BTC Breaks Structure - Key Levels to Watch PLUS Trade Idea!Bitcoin has broken structure to the upside on the daily timeframe, confirming a bullish trend 📈. I’m considering a buy opportunity, but only if the key conditions discussed in the video align.

Right now, BTC is in a strong uptrend, with a well-defined higher highs and higher lows structure on the 4-hour timeframe 🔍. In this video, we break down the trend, price action, market structure, and other essential aspects of technical analysis to navigate this setup effectively.

⚠️ Not financial advice.

BTC: Capture buying opportunities accurately📍Fundamentals: From a macro perspective, with increased government endorsement, cryptocurrencies are gaining greater credibility and popularity in the market.

📍Technical Analysis:The downward momentum of BTC is showing signs of exhaustion, with multiple rebounds forming a structural bottom that provides strong support. Overall, the bullish trend remains intact. The key support zone to monitor is 83000-82000.

📌If BTC fails to break below this level in the short term, a rebound is likely, with upside potential targeting the 88000-89000 range.

🔎Trade Idea:

BTCUSD: Buy at 83000-82000

Target (TP):88000-89000

Stop Loss (SL):Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

BTC Current situationCurrently BTC has not reached the resistance point of 85000, we can directly choose to go short。

BTC

🎁 Sell@84900 - 85000

🎁 SL 86000

🎁 TP 83900 - 83500

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates

(BTC/USDT) Analysis: Supply Zone Rejection & Potential Drop to SSupply Zone (~85,296 - 84,835):

The price has reached a supply zone, which is acting as resistance. A rejection from this area could push BTC down.

Support Zone (~82,260 - 81,977):

This is a demand area where buyers might step in if the price declines.

Indicators:

EMA 30 (Red Line - 83,553.82): Short-term trend indicator.

EMA 200 (Blue Line - 83,743.52): Long-term trend indicator, currently above the price, indicating potential resistance.

Price Action & Prediction:

The price has touched the supply zone and is showing signs of rejection.

The blue projected path suggests a potential pullback followed by a drop toward the support zone (~82,260).

If price breaks below the support zone, further downside could be expected.

Potential Trade Idea:

Short Setup: If rejection at the supply zone continues, a short position could target the 82,260 support zone.

Long Setup: If price reaches the support zone and shows bullish reactions, a long position could aim for a rebound toward resistance.

A possible scenario for Bitcoin over next 2 monthsI do think this has a Strong possibility of happening

MARCH will close as a RED Candle and the statisical expectation is that April will close GREEN and yet there are many reasons why Bitcoin Cannot rise a lot in April to make that Green

SO, We may see March drop down to the 74K area to end the month

This Gives PA the ability to Rise, hit that trend line and still Close the month GREEN and then take off in May.

Why May ?

Because that descending trend line perfectly matches the Weekly MACD decent and the date is when MACD reaches Neutral. Begining of May.

This is also why PA will likely be rejected from the Trend line before MAY

Should PA remain where it is now, it doesn't give a lot of room for April to close Green.

This really is just an Idea so we just need to see if it happens.

I do have a SPOt buy order sitting at 74779 just in case lol

BTCUSD Analysis StrategyBitcoin prices are currently hovering around $84,000 as the market's bull-bear struggle intensifies.

In the short term, Bitcoin remains in a sideways consolidation and base-building phase. Traders are advised to remain nimble and adjust strategies based on the actual breakout direction.

Bitcoin Trading Strategy

sell @ 87000

buy @ 81500,78500

Finally, I'd like to remind every investor that the cryptocurrency market is inherently highly volatile, and every decision you make may have an impact on your investment returns.

you can visit my profile for free strategy updates every day.

Bitcoin Weekly SMA are finally into Sequential order -and now ?A nice simple post here.

As you can see, in Late January, the 5 main SMA ( Simple Moving Averages) finaly got into sequential order Under PA

This is a sign that PA is bullish.

As you can see, in September 202, this happened and PA began its rise after a sharp drop just before hand.

It is a bit different this time in that we have dropped AFTER that SMA order was made.

But it is still a Good sign

HOWEVER - what is important to note, is how PA has fallen below that 21 and we are currently hitting off the 50, searching for Support again.

I remain BULLISH and I am sure that within a few weeks, we shall move back over that 21.

From were the SMA went into order in 2020, it took about 6 months to reach the first ATH in 2021

PA is rising Much slower than in that cycle but If that repeats, we can see a New Real ATH around July / August

I would say that is too early to be honest and so I expect larter. As I said, PA is rising slower this time around.

But, anyway, Good News that the SMA have remained in order so far...

Something to look forward to

BITCOIN TRENDS with Heiken Ashi candles & Trend indicator ADX Why HEIKEN ASHI Candles ?

Heikin Ashi is a charting technique that can be used to predict future price movements. It is similar to traditional candlestick charts. However, unlike a regular candlestick chart, the Heikin Ashi chart tries to filter out some of the market noise by smoothing out strong price swings to better identify trend movements in the market. ( Source TradingView )

What is ADX ?

The ADX indicator measures trend strength without indicating direction. It is derived from the Positive Directional Movement (+DI) and Negative Directional Movement (-DI):

+DI (Positive Directional Index): Measures upward price movement.

-DI (Negative Directional Index): Measures downward price movement.

ADX Value: Higher values indicate stronger trends, regardless of direction.

( Source TradingView)

To summarise, Heiken Ashi candles filter out Noise and help identify Trend Direction

ADX shows you Trend Strength - NEVER the direction of Trend, using prince index.

OK, so now we ready. The main chart has 2 Vertical Bold lines that will be explained in a Bit but Note where they are on the Chart

The one on the left is near where the Rise in PA turns and becomes a Ranging PA- PA slowed right on that line.

The 2nd line is near the TOP and before the point where PA entered a descending channel that leads us to where we are currently

Note on the chart, the Orange dotted line. This is the BASIS line of the Bollinger bands. This is The Basis line and shows us the Average of PA and, as you can see, we are currently below Average. This shows a Negative Trend.

See how PA is above the basis line in a Positive Trend

Also note in the chart how the lines of candles are Smoother. Each New candle begins on the centre line of the previous and so it becomes a Lot easier to see if PA rises or drops from previous with out the Jagged Noise of traditional candles. - Taller candles show more Strength than previous;

So now to the ADX Chart

See those 2 Dashed Vertical lines and note how the ADX ( YELLOW ) changes direction at those points.

To remind you, the Left one was where BTC PA Slowed down from a Steep Rise, A BULLISH TREND, and turned to Ranging.

The Drop in the ADX at this point showed us that the previous trend was weakening. I remind you, it DOES NOT SHOW TREND DIRECTION even though, in this case, they follow each other.

PA Ranged horizontal on average till we met the Next line, where the previous Trend Strength had reached Neutral ( Note, this is around 20 on the ADX scale )

At the next dashed lime. ADX began rising. Trend strength was increasing.

Initially, we saw BTC PA rising to a New ATH and so, it was easy to assume that the Trend Was Bullish again. However, as we see now, it turns out it was a BEARISH trend.

So how do we know when this is going to end ?

The ORANGE line DI+ ( positive price action ) and the RED DI - ( Negative price action ) can help

These are Price Direction index. When DI + rises, this indicates a positive price action and Visa Versa for DI -

On its own, this is not easy But, for instance, notice how while we been in the descending channel, the DI+ dropped while the DI- has ranged along the 20 line on average.

This indicates a controlled Drop in PA and NOT a Full on Bearish capitulation. There is strength there in PA and this can be seen by the Slow rise of the ADX

On a shorter time scales, over the last 5 days we have seen PA rise in price.

this is reflected more in the DI- dropping ( Negative price action loosing strength ) more than in the DI + remainf horizontal.( NOT gaining Strength )

This could indicate that we are not finished Dropping yet - and yet, at the same time, we see the ADX weakening.

The Bears maybe getting Tired.

If we now return to the Chart

This fatigue we maybe seeing in the Bears could be reflected in the simple fact that we are now Near a long term Rising line of Support ( bold line) and that we are nearer the lower line of the descending channel ( also support) - We are also very near the 2.272 fib extension that has proved to be support previously.

The upper bollinger band is around 90K, which happens to be near Top of current range.

So, we may see a push higher soon but we need to understand that the Longer term still Looks like we will continue in the Range Bound for a Few more weeks.

I hope this helps but be prepared for anything

Bitcoin Reversal or Dead Cat Bounce? Here's My Trading Plan! Analyzing BTC on the higher timeframe, we observe a clear structural shift in the prevailing trend 📊. Dropping down to the 4-hour chart, there is a decisive bullish break 📈, leaving behind an imbalance following the initial move—an area that could serve as a retracement target 🎯. Notably, this imbalance aligns with a Fibonacci retracement into equilibrium 📐, adding confluence to the setup.

I am considering a long position 💰, but only if the key conditions outlined in the video materialize ✅. If those conditions fail to align, I will discard this trade idea ❌.

⚠️ Not financial advice.