Why is Eth Falling? ETH/BTC Ratio Hits All-Time Low Since 2020Why is Ethereum Falling? ETH/BTC Ratio Hits All-Time Low Since 2020

The cryptocurrency market is a volatile landscape, constantly shifting and evolving. Recent data has revealed a significant development: the Ethereum to Bitcoin (ETH/BTC) ratio has plummeted to an all-time low since 2020. This stark decline, currently resting at a mere 0.02 has ignited a wave of speculation and concern within the crypto community, raising questions about Ethereum's current standing and future trajectory.

The ETH/BTC ratio serves as a crucial metric for comparing the relative performance of Ethereum against Bitcoin. When the ratio falls, it indicates that Bitcoin is outperforming Ethereum, and conversely, a rising ratio suggests Ethereum's ascendancy. The current dramatic drop highlights a significant divergence in the fortunes of these two leading cryptocurrencies.

The backdrop to this decline is multifaceted. Bitcoin, often seen as the “digital gold” of the crypto world, has exhibited remarkable resilience and strengthened its position. This consolidation is likely driven by several factors, including increased institutional adoption, regulatory clarity in some jurisdictions, and its established reputation as a store of value. These factors have contributed to a sense of stability and confidence in Bitcoin, attracting capital and bolstering its market position.

Ethereum, on the other hand, has faced challenges in maintaining its momentum. While it remains the leading platform for smart contracts and decentralized applications (dApps), it has struggled to keep pace with Bitcoin's surge. Several factors contribute to this relative underperformance.

Firstly, regulatory uncertainty surrounding Ethereum and its classification has cast a shadow over its future prospects. The evolving regulatory landscape, particularly in major economies like the United States, has created a sense of unease among investors. The lack of clear guidelines and the potential for stricter regulations have dampened enthusiasm and limited institutional investment.

Secondly, Ethereum has faced competition from emerging layer-1 blockchains that offer faster transaction speeds and lower fees. These “Ethereum killers,” as they are sometimes called, have attracted developers and users seeking alternatives to Ethereum's perceived limitations. While Ethereum has undergone significant upgrades, such as the transition to proof-of-stake (The Merge), the benefits have not yet translated into a sustained surge in its relative value.

Thirdly, the overall market sentiment has played a role. Bitcoin's narrative as a safe haven and store of value has resonated strongly during periods of economic uncertainty. In contrast, Ethereum, with its focus on innovation and development, is perceived as a riskier asset. When market volatility increases, investors often gravitate towards the perceived safety of Bitcoin.

The decline in the ETH/BTC ratio raises several critical questions. Is Ethereum in trouble? Is this a temporary setback or a sign of a more fundamental shift in the crypto landscape?

While the current situation is concerning, it is essential to consider the long-term potential of Ethereum. Its robust ecosystem, driven by a vibrant community of developers and innovators, remains a significant asset. Ethereum's role in powering decentralized finance (DeFi), non-fungible tokens (NFTs), and other emerging technologies positions it as a crucial player in the future of the internet.

Furthermore, Ethereum's ongoing development efforts, including layer-2 scaling solutions and future upgrades, aim to address its scalability and efficiency challenges. These improvements could potentially revitalize Ethereum's performance and restore its competitive edge.

However, the current market dynamics suggest that Ethereum faces an uphill battle. To regain its footing, it needs to overcome regulatory hurdles, address its scalability issues, and effectively communicate its value proposition to a broader audience.

The cryptocurrency market is notoriously unpredictable, and past performance is not indicative of future results. The ETH/BTC ratio could rebound, or it could continue its downward trajectory. The outcome will depend on a complex interplay of factors, including regulatory developments, technological advancements, and market sentiment.

In the meantime, the low ETH/BTC ratio serves as a stark reminder of the dynamic nature of the cryptocurrency market. It underscores the importance of diversification and the need for investors to consider the risks and potential rewards of each asset carefully.

The current situation also highlights the need for Ethereum developers and community members to focus on the core values of the project, and to continue to innovate and improve the technology. Ultimately, the success of Ethereum will depend on its ability to adapt to the changing landscape and deliver on its promise of a decentralized and equitable future.

In conclusion, while the record low ETH/BTC ratio raises concerns about Ethereum's current standing, it is premature to declare its demise. The cryptocurrency market is constantly evolving, and Ethereum's long-term potential remains significant. However, the current challenges demand a proactive and strategic approach to ensure its continued relevance and success in the years to come.

Btcupdate

Continue to believe in BTCI. Technical Analysis

(1) Support and Resistance Levels

BTC has a strong support at $80,000. It’s withstood selling pressure multiple times. When the price dropped to $82,000, it rebounded, validating this support. $85,000 and $87,000 act as resistance levels. Failed attempts to break through these thresholds show strong selling above these price points.

(2) Moving Average System

While BTC short - term moving averages are down due to price drops, long - term ones stay upward. This means the long - term uptrend isn’t disrupted. A golden cross may form when short - term averages recover and cross long - term ones, supporting upward movement.

(3) Technical Indicators

RSI shows BTC is in oversold zone, hinting at excessive selling. Market recovery may trigger a price rebound. Although MACD gives a bearish signal, the bearish momentum is weakening, indicating a possible reversal.

💎💎💎 BTC 💎💎💎

🎁 Buy@80500 - 81000

🎁 TP 83000 84000 85000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Bearish Trend Meets Bullish Momentum: Is BTC Ready for a Rebound📉 Bitcoin is currently in a strong bearish trend on higher timeframes, but 📈 the 1-hour timeframe shows a break of structure and bullish momentum. This suggests a potential short-term pullback into the previous range, aligning with the 50% Fibonacci retracement level. 🔄 Additionally, there’s a bearish imbalance above that could be rebalanced. While this presents a possible buy opportunity, ⚠️ it’s a high-risk setup due to the overall bearish trend. Always trade with caution! 🚨

Disclaimer

⚠️ This is not financial advice. Trading involves significant risk, and you should only trade with funds you can afford to lose. Always do your own research and consult a professional if needed. 💡

Bitcoin's Rocky Quarter: Tariffs, Whales, and Volatility Loom

Bitcoin's first quarter of 2025 has concluded with a whimper, marking its worst Q1 performance since the tumultuous bear market of 2018.1 While gold has surged to record highs, fueled by geopolitical tensions and US trade tariffs, Bitcoin has struggled to maintain momentum, leaving traders bracing for potential further volatility. This week’s preview reveals a confluence of factors that could significantly impact Bitcoin's price trajectory.

A Disappointing First Quarter

The initial months of 2025 were anticipated to be a period of growth for Bitcoin, particularly with the anticipation surrounding the halving event. However, the cryptocurrency failed to deliver on these expectations. Instead, it experienced a period of stagnation and even decline, contrasting sharply with the robust performance of traditional safe-haven assets like gold.

Several factors contributed to this underwhelming performance. The escalating trade tensions, particularly the US tariffs, have injected uncertainty into global markets, diverting capital towards established safe-haven assets.

Tariffs and Trade Tensions: A Persistent Headwind

The US imposition of trade tariffs has emerged as a significant headwind for Bitcoin. These tariffs, designed to protect domestic industries, have disrupted global trade flows and created a climate of economic uncertainty.2 Investors, wary of potential market disruptions, have sought refuge in traditional safe-haven assets like gold, which has historically outperformed during periods of economic instability.

The impact of these tariffs extends beyond immediate market reactions. They signal a potential shift towards protectionist policies, which could have long-term implications for global trade and investment flows. Bitcoin, often touted as a decentralized and borderless asset, is particularly vulnerable to disruptions in global trade and capital flows.

Whale Activity and Market Manipulation

Adding to the complexity of the market is the activity of large Bitcoin holders, often referred to as "whales."3 These entities, possessing significant amounts of Bitcoin, can exert considerable influence on market prices through large buy or sell orders. Recent observations suggest increased whale activity, potentially contributing to the volatility and price fluctuations.

Concerns about market manipulation have also resurfaced. The decentralized nature of Bitcoin, while a core strength, also presents challenges in terms of regulation and oversight. This lack of centralized control can create opportunities for manipulation, leading to price swings that are not necessarily reflective of fundamental market dynamics.

Bitcoin Bears Tighten Grip: Where’s the Next Support?

The recent price action indicates that Bitcoin bears are tightening their grip. The failure to sustain upward momentum has emboldened sellers, leading to a downward trend. Traders are now closely monitoring key support levels, anticipating potential further declines.

Identifying these support levels is crucial for understanding the potential trajectory of Bitcoin's price. Technical analysis, using tools like Fibonacci retracement levels and moving averages, can help traders identify potential areas of support where buying pressure may emerge. However, the volatile nature of Bitcoin makes it challenging to predict these levels with certainty.

Gold vs. Bitcoin: A Comparative Analysis

The stark contrast between gold's recent performance and Bitcoin's struggles has reignited the debate about their respective roles as safe-haven assets. Gold, with its long history and established reputation, has benefited from the current climate of uncertainty.

However, Bitcoin proponents argue that its decentralized nature and limited supply make it a superior store of value in the long term. The comparison between the two assets highlights the evolving nature of safe-haven assets and the growing acceptance of digital currencies. The quote "Gold has taken 26 years to 10X. Bitcoin has taken 4 years to 10X" shows the potential for rapid growth, but also its volatility.

Looking Ahead: Volatility and Uncertainty

The coming week promises to be a period of significant volatility for Bitcoin. Traders should brace for potential price swings, driven by a combination of factors, including:

• Continued Trade Tensions: The ongoing trade disputes and potential for further tariffs are likely to continue to impact market sentiment.

• Whale Activity: Large buy or sell orders from whales could trigger significant price fluctuations.

• Regulatory Developments: Any regulatory announcements or policy changes could have a substantial impact on Bitcoin's price.

• Macroeconomic Factors: Inflation data, interest rate decisions, and other macroeconomic indicators will continue to influence investor behavior.

•

In conclusion, Bitcoin's disappointing first quarter has set the stage for a period of heightened volatility. The confluence of trade tensions, whale activity, and market manipulation creates a challenging environment for traders. While the long-term potential of Bitcoin remains a subject of debate, the immediate future is marked by uncertainty and the need for caution.

Grasp the trend and analyze the full range of BTC longsTechnical analysis: Based on in-depth technical analysis, the current BTCUSD decline has slowed down, and there are signs of building double bottom support. The 50-day moving average and the 200-day moving average form a golden cross, the MACD indicator continues to strengthen and the bar chart continues to expand. As BTCUSD stops falling, market sentiment is gradually warming up, institutional funds continue to flow in, fundamental support is solid, and the upward momentum may gradually strengthen. It is the right time to go long.

BTCUSD operation strategy: Go long in the 82500-81500 area. Target 83000-84000

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions, operate according to your own operation plan, market information is complicated, and blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. During the transaction, we will continue to pay attention to news and technical changes, inform us in time if there are changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

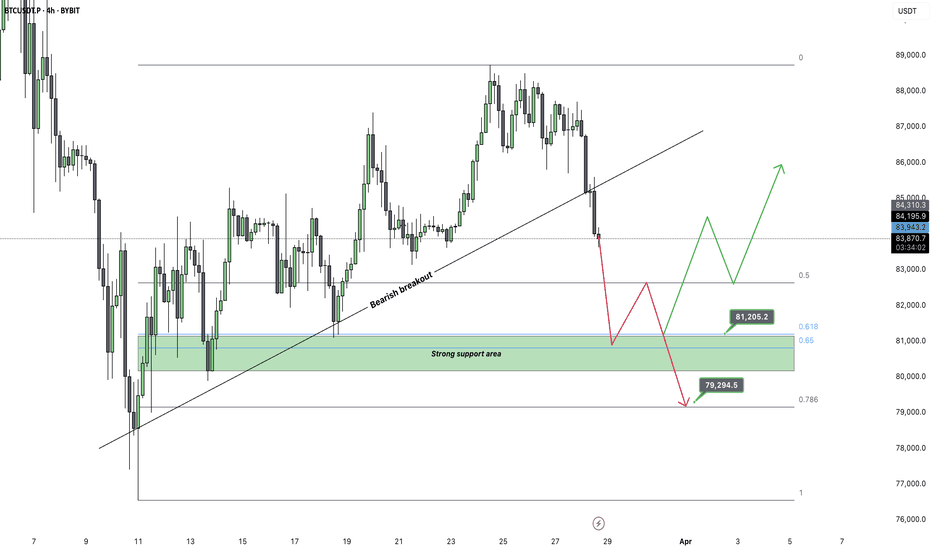

Bitcoin - Bulls in trouble: 81k next?BTC Loses Bullish Structure – What Comes Next?

Bitcoin has officially broken below the bullish trendline, closing underneath it for the first time in this recent uptrend. This is a key shift in market structure, as the ascending trendline had previously acted as strong dynamic support, keeping Bitcoin in a steady climb. Now that we have seen a clean break, the momentum appears to be shifting toward a deeper retracement, and the price is heading toward the next major support zone.

Whenever a trendline like this is broken, it signals that buyers were unable to maintain control at higher levels. Instead of continuing the pattern of higher lows, Bitcoin is now moving lower, seeking stronger levels where buyers might step back in. The question now is whether the golden pocket Fibonacci retracement zone, combined with a historically strong support level, will be enough to hold the price up and trigger a reversal.

Golden Pocket Support at $81.2K – A Key Bounce Zone

The next major area of interest is the golden pocket retracement zone, which aligns perfectly with the strong support around $81.2K. This is an area where Fibonacci traders and institutional buyers tend to look for entries, as the 0.618 – 0.65 Fibonacci levels have historically been some of the most reliable support zones during retracements.

What makes this level even more significant is the confluence of technical factors coming together at the same price range. Not only does this level align with the golden pocket, but it has also been a major historical support in previous price action. Every time Bitcoin has visited this range in recent weeks, we have seen strong buy-side reactions. If buyers step in once again, this could be the turning point for another leg to the upside.

If we see a bounce from this zone, Bitcoin could attempt a recovery back toward $ 83K – $85K, potentially regaining its footing and re-entering a more bullish structure. However, the strength of the reaction at $81.2K will be crucial in determining whether this is just a short-term relief bounce or the start of another major uptrend.

What If Bitcoin Fails to Hold $81.2K?

While the golden pocket is often a high-probability reversal zone, it’s important to consider the bearish scenario as well. If Bitcoin fails to hold this level, we could be in for an even deeper retracement. The next major downside target would be around $79.3K, which lines up with the 0.786 Fibonacci retracement.

A move to $79.3K would indicate that Bitcoin needs a larger correction before it can regain bullish momentum. This wouldn’t necessarily mean that the bull market is over, but it would suggest that the uptrend needs a deeper reset before resuming. A drop this low would likely shake out weak hands and allow larger players to accumulate before any potential reversal.

If Bitcoin does move down to this level, the market reaction will be key. A strong bounce from $79.3K could set up a powerful recovery, but a failure to hold would raise concerns about a larger trend shift. Losing this level would open the door for even deeper downside, meaning traders would need to be cautious about the broader market outlook.

Final thoughts

Now that Bitcoin has broken the trendline, all eyes are on how it interacts with this next major support zone. If the $81.2K level holds, we could see a strong reaction and a push back toward higher levels, reestablishing confidence in the market. However, if we lose this level, the next stop at $79.3K will become the last major line of defense before a more significant correction unfolds.

The next few 4-hour candles will be crucial in determining whether buyers are ready to step in or if we need to prepare for a deeper move down. Will the golden pocket be enough to stop the drop, or is Bitcoin setting up for an extended retracement? We’ll find out soon!

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Bearish Daily Setup - BTC/USD

### **📉 Bearish Daily Setup - BTC/USD**

**Bias**: Bearish

**Context**: Daily DR (Dealing Range) is broken, and price is rejecting premium level.

---

### 🧠 **Narrative:**

Price traded into a daily FVG (Fair Value Gap) near **premium zone**, then formed a lower high. The daily **DR (Dealing Range)** was broken to the downside, showing bearish intent. We also see rejection from a marked supply area (pink zone), confirming seller presence.

---

### 📌 **Entry:**

Sell entry around **84,600** (near retest of daily FVG & imbalance zone)

---

### 🎯 **Targets:**

- **TP1**: 76,555 (Recent low / liquidity pool)

- **TP2**: 74,000 (Clean imbalance area)

- **TP3**: 73,383 (Final liquidity draw)

---

### 🛑 **Stop Loss:**

Above recent high / supply zone

**SL**: 88,762

---

### 🔢 **RRR**: Approx. **1:4** (Excellent reward-to-risk)

---

### 🧩 **Extra Confluences:**

- Daily FVG (imbalance) filled and rejected

- Supply zone respected

- DR broken

- Momentum shifted bearish

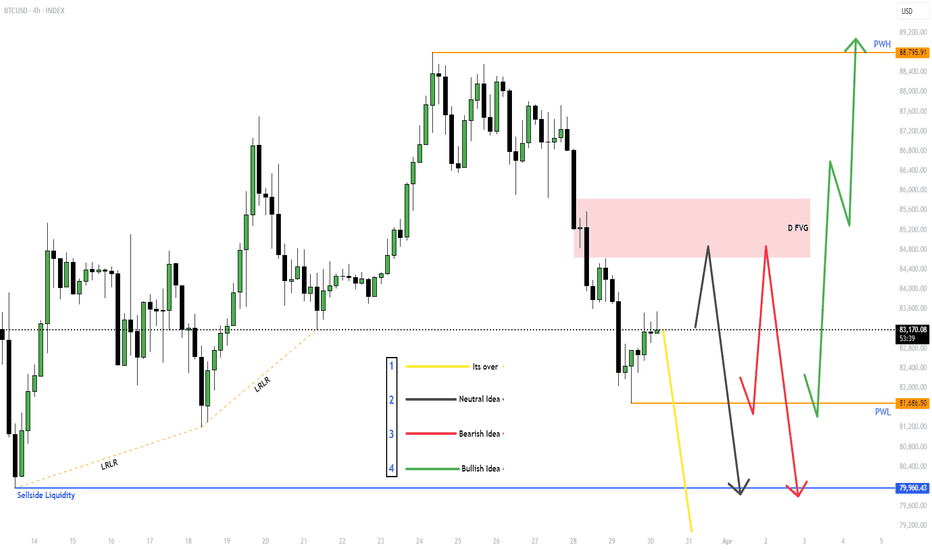

$BTC for Next week (31st March - 4th April)Given out all the ideas, Will react to the market based on which idea presents itself.

If Yellow line - Its better to stay out of the markets.

With the other wait for MSS (Market Structure Shift) and then take the trade and target the other side of the liquidity.

BITSTAMP:BTCUSD , BINANCE:BTCUSDT.P BINANCE:BTCUSDT

Overall I'm neutral on CRYPTOCAP:BTC but SEED_ALEXDRAYM_SHORTINTEREST2:NQ and NYSE:ES look bearish to me, and CRYPTOCAP:BTC could follow.

Analysis of Bitcoin’s Price MovementsI. Technical Analysis

(1) Support and Resistance Levels

BTC has formed a strong support level at $80,000. Judging from past market performances, this price level has successfully withstood selling pressure multiple times, demonstrating the market's recognition of its value at this price. When the price dropped to $82,000, a certain degree of rebound occurred, indicating the presence of buying support below. This also indirectly confirms the effectiveness of the $80,000 support level. As a resistance level, $87,000 restricts the upward movement of BTC. The failure of this attempt to break through $89,000 indicates that selling pressure is relatively strong above this price level.

(2) Moving Average System

Although the short - term moving averages of BTC have turned downward to some extent due to price declines, the long - term moving averages still maintain an upward trend. This indicates that, in the long run, the upward trend of BTC has not been completely disrupted. Short - term price fluctuations may just be normal market adjustments. When the short - term moving averages gradually recover and cross above the long - term moving averages again, a golden cross is expected to form, providing technical support for the upward movement of BTC.

(3) Technical Indicators

The Relative Strength Index (RSI) shows that BTC is currently in the oversold zone, which means there may be excessive selling in the market. Once market sentiment recovers, the price of BTC is expected to rebound. In addition, although the MACD indicator shows a bearish signal, the bearish momentum is gradually weakening, suggesting that the market may be on the verge of a reversal.

💎💎💎 BTC 💎💎💎

🎁 Buy@80500 - 81000

🎁 TP 83000 84000 85000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Bitcoin at a Crossroads – Two Paths, One TruthThe market is at a breaking point. Retail traders are still guessing. The real players already know. This isn’t just about price action—it’s about power.

Scenario 1 – The Bullish Illusion? 🚀

BTC is breaking out of a falling wedge on the weekly timeframe—a textbook bullish signal. If momentum holds above $90K, we could see an explosive push to new all-time highs. Liquidity is there. Whales are positioning.

✅ LONG ENTRY: $81,000 – $85,000

🎯 Targets:

Short Term: $117,983

Mid Term: $134,291

Long Term: $148,822 🌍💥

🔻 STOP LOSS: $78,000 – Because risk management isn’t optional.

But here’s the problem… the game is never that simple.

Scenario 2 – The Elite Trap 🩸

If BTC fails to reclaim $90K, this is a setup. Fake breakouts exist for one reason—to trap retail and liquidate late longs. If smart money decides to pull the plug, BTC gets dumped straight into the liquidity void below.

📌 What to Watch:

Failure to hold $90K = Bull Trap.

Liquidity below $78K = Liquidation Cascade Incoming.

And guess what? Scenario 2 is already in motion.

Retail FOMO’d in.

We shorted the top.

🚨 Bitcoin Short Printing Money – Precision Over Emotion 🚨

📉 SHORT ENTRY: $85,000 – $85,250

🎯 Targets Hit So Far:

✅ $83,800 – Cleared

✅ $83,000 – Cleared

✅ $82,700 – Cleared

✅ $82,000 – Cleared

💰 Massive profits already banked—but the real move is still unfolding.

🔻 Remaining Targets:

🎯 $81,150 → Next Stop

🎯 $79,100 → Breaking Structure

🎯 $77,000 → Liquidity Grab

🎯 $73,900 → Elites Accumulating

🎯 $69,100 - $68,100 → The Real Target Zone

🚨 The Final Move – The True Target? 🚨

A rising wedge successfully broke out on the 1D chart on February 6, 2025. It’s playing out perfectly, and the last target sits at $50,500.

The Only Question Left: When?

Retail keeps chasing the dream. The elites are already cashing in.

🚨 This isn’t speculation—it’s precision. This isn’t emotion—it’s control. The system plays the masses, but we play the system. 🚨

Bitcoin Dump Perfectly Predicted ! What's Next? 76k ?🚨 DID EVERYONE REMEMBER ? 🚨

🔥February 14th – I told everyone loud and clear SHORT or SELL because BTC was about to DUMP. Look at where we are now another perfect prediction, another massive win. 🚀

Hope all my real ones remembered and stayed safe in this move. We are still valid in our analysis, deep in profits, and absolutely killing this trade.

✅ Book partial profits – Lock in those gains.

✅ Move SL to entry – No risk, stress-free ride.

We move smart, calculated, and ahead of the market. Now, let’s analyse

the next move.

🔍BTC Technical Analysis What’s Next ?

Bitcoin followed the bearish rejection from key resistance and is continuing its downtrend. We saw a weak consolidation before another breakdown, and structure still favors further downside.

📊 Key Levels to Watch

🔻 Support: $68,500-$70,000 – If this level breaks, BTC could accelerate lower.

🔺 Resistance: $85,000-$86,000 – A reclaim of this zone would invalidate further downside.

🔮 Potential Scenarios

1️⃣ If BTC holds above $75,000-$76,000, we could see a short-term bounce before another drop.

2️⃣ If BTC loses $70,000, expect further downside targeting $68,500 or lower.

3️⃣ Bulls need a strong reclaim above $85,000 to flip structure bullish again.

📉 We remain bearish until BTC shows clear strength. Manage risk, stay disciplined, and ride the trend.

💬Drop a comment and follow if you caught this move & let’s stay ahead of the game!🚀

Bitcoin 1-Year Pattern- The art of trading lies in analyzing the past to anticipate the future.

On the yearly timeframe, BTC has consistently followed this cycle:

- 1 year of bearish decline.🟥.

- 1 year of consolidation and bottoming out.🟩.

- 1 year of steady growth.🟩.

- 1 year of explosive upward movement.🟩.

based simply on that :

- 2025 is poised to be a breakout year for BTC.

- 2026 should be the next bear market.

- Everything changes, nothing lasts forever, but as a trader, you must stay on course.

- Don't let market noise shake your confidence.

Happy Tr4Ding !

Bitcoin (BTC/USD) Trade Setup – Potential Reversal & Target Leve🔵 Entry Point:

🔹 Around $83,678.04 – The suggested buying zone.

🛑 Stop Loss:

🔻 $82,998.62 – The price level where the trade will be exited if it moves against the plan.

🎯 Target Points:

✅ TP1: $84,144.23 – First profit target.

✅ TP2: $84,787.10 – Second profit target.

🏆 Final Target: $85,560.84 – The ultimate goal for the trade.

📈 Technical Overview:

🔹 The price is at a support level, with a potential reversal to the upside.

🔹 Risk-Reward Ratio is favorable, with a clear uptrend target.

🔹 DEMA (9) at $83,776.52 indicates a possible trend shift.

"Bitcoin (BTC/USD) Price Analysis: Key Support Test & Potential This chart is a Bitcoin (BTC/USD) price analysis on a 1-hour timeframe from TradingView. Here are the key insights:

Technical Indicators:

Exponential Moving Averages (EMAs):

200 EMA (blue): 85,984 (indicates long-term trend support/resistance).

30 EMA (red): 85,705 (short-term trend direction).

Support & Resistance Zones:

Purple Zone (Support Area): This area has been tested multiple times and is expected to provide a strong buying zone.

Resistance/Target Levels:

Upper EA Target Point: 88,366 (potential bullish target).

Lower EA Target Point: 79,819 (potential bearish target).

Trade Setup:

Entry Point: Around 83,810 (current price near support).

Stop Loss Levels:

Conservative: Around 83,750

Aggressive: Around 83,184

Target Point: 88,366 (bullish) or 79,819 (bearish).

Market Outlook:

The price is currently testing a key support zone.

If the support holds, we may see a bullish reversal toward 88,366.

If the price breaks below the support, further downside to 79,819 is possible.

Bearish on Bitcoin (BTC) – Target Price: ~$70,000Technical Analysis:

The provided chart illustrates Bitcoin's (BTC/USD) current position within a descending channel, marked by red resistance and green support lines. The series of lower highs, indicated by the red arrows, reinforces the prevailing bearish momentum. A potential breakdown from the current trading level of approximately $85,079 could lead to a decline toward the green support line, aligning with a target price around $70,000.

Fundamental Analysis:

Recent developments provide additional context to this bearish outlook:

Market Sentiment: Betting markets suggest that Bitcoin has likely peaked for the year, hovering just above its January high of $109,000.

Macroeconomic Factors: Concerns over President Trump's tariff policies and broader economic conditions have contributed to Bitcoin's recent decline. Analysts warn of further downside risks due to ongoing uncertainties in global trade and inflation.

Trading Strategy:

Entry Point: Consider initiating a short position on BTC at the current price of approximately $85,079.

Target Price: Set a price target of $70,000.

Stop-Loss: Implement a stop-loss order at $88,000 to manage potential upside risk.

Buy@85500 - 86500Presently, Bitcoin is firmly ensconced within a robust upward trajectory. Having transitioned from a sideways trading phase at 84000 last week, it has executed a remarkable rally, surging directly into the resistance corridor in the vicinity of 89000. With the current trading price hovering at 87000, the market exudes a palpable sense of bullishness.

Should BTC sustain a stable sideways oscillation between 87000 and 88000, the bulls stand to methodically amass upward momentum. Once primed, a breakthrough of the 89000 threshold by BTC appears all but inevitable.

From a technical vantage point, Bitcoin has convincingly breached the sideways trading range. Its moving averages exhibit a distinct bullish configuration, with the 85000 level solidifying as a crucial support.

On the fundamental front, a confluence of factors—including the prevailing global economic uncertainties, the buoyant market sentiment, and the relatively permissive regulatory environment—collectively conspire to propel the continued ascent of its price.

💎💎💎 BTCUSD 💎💎💎

🎁 Buy@85500 - 86000

🎁 TP 87000 88000 89000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

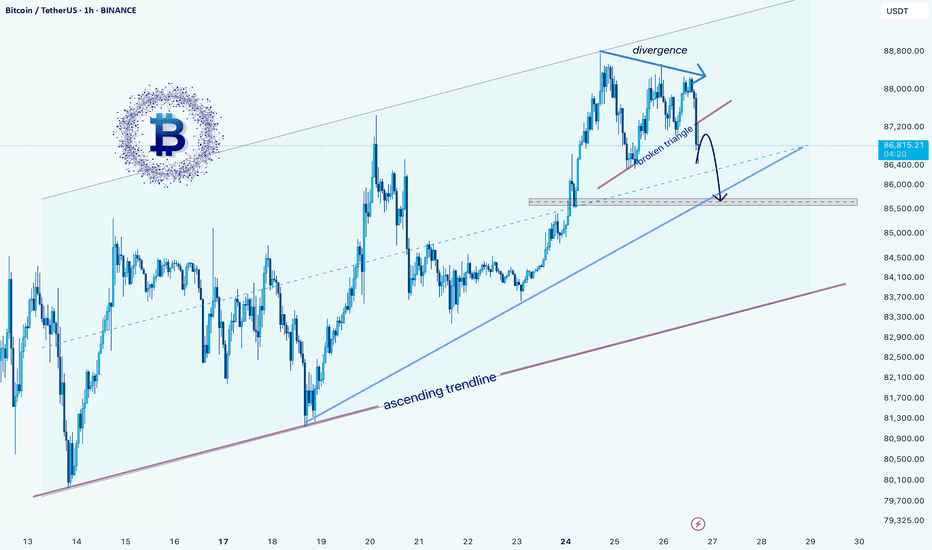

Bitcoin Price Analysis: Potential Correction Ahead?hello guys

The Bitcoin/USDT chart shows an ascending channel with recent price action forming a divergence at the top, indicating potential weakening momentum. A bearish breakout from a smaller triangle suggests a short-term correction. The price may test the ascending trendline around $85,400, where a key support zone exists. If this level fails, a deeper correction toward the major support area around $76,800 could follow. However, if Bitcoin holds above the trendline, the uptrend could resume.

Traders should watch price action around the $85,400 level for confirmation of further downside or a potential bounce.