"Bitcoin (BTC/USD) Price Analysis: Key Support Test & Potential This chart is a Bitcoin (BTC/USD) price analysis on a 1-hour timeframe from TradingView. Here are the key insights:

Technical Indicators:

Exponential Moving Averages (EMAs):

200 EMA (blue): 85,984 (indicates long-term trend support/resistance).

30 EMA (red): 85,705 (short-term trend direction).

Support & Resistance Zones:

Purple Zone (Support Area): This area has been tested multiple times and is expected to provide a strong buying zone.

Resistance/Target Levels:

Upper EA Target Point: 88,366 (potential bullish target).

Lower EA Target Point: 79,819 (potential bearish target).

Trade Setup:

Entry Point: Around 83,810 (current price near support).

Stop Loss Levels:

Conservative: Around 83,750

Aggressive: Around 83,184

Target Point: 88,366 (bullish) or 79,819 (bearish).

Market Outlook:

The price is currently testing a key support zone.

If the support holds, we may see a bullish reversal toward 88,366.

If the price breaks below the support, further downside to 79,819 is possible.

Btcusdanalysis

Bitcoin Daily UPDATE - something for the weekend sir ?Chances are we will see PA Drop over the weekend if what has happened today is anything to go by

As mentioned in apost this morning, Pa fgot rejected off the upper trend line of the descending channel and currently Sits on the POC ( point of control ) on the VRVP ( Vivible Range Volume Profile )

The Drop if we loose this support could be swift but we do have support lines below to try and hold up the fall

But again, as mentioned, a drop is NOT such a bad thing....unless we loose 73K, in which case I will seriously think again about what I Hold.

The 4 hour chart shows the current situation more clearly

If we do bounce of this, remain cautious....we need to get over and Hold 91K before we start screaming "ATH"

For me, I have opened anotehr Spot order at 74K

I go higher than the expected Low incase the visit to the low is a Very quick wick down and the order does not have time to fill.

DO NOT PANIC

Have a good Weekend

Alternatively, Bitcoin just Drops to 73K in the near future In a slight contradiction to my previous post - as I like to consider ALL options and present them to you, so YOU can make up your own mind.

I saya SLight contradiction, as 73K is Still the target here.

See this channel AP is in? The descending channel we been in for a while.

We seem to be getting rejected off the upper trend line.

The lower line crosses the 1 Fib extension and Hits the rising Long term support around 73K

We do have Support just below the Current PA position on the POC ( Point of control) of the VRVP

So, Hang on and we wait to see what happens.

If PA returns to 78K and then 73K - DO NOT PANIC

This would be SUPERB buying opportunities

So, Consider all the possibilities I have sugested today, Make up your own minds and, if you want to, please do leave a comment

Buy BTC,it still has the potential to reboundBTC experienced a sharp short-term decline, breaking lower; however, the downward momentum has significantly slowed. Importantly, the recent pullback has not disrupted the broader upward consolidation structure, with the 84500-83500 zone continuing to provide strong support.

Once the bearish sentiment fully subsides, I anticipate a relief rally or a technical rebound. Therefore, this pullback could present an excellent opportunity to go long on BTC.

Consider entering long positions around the 84500-83500 support zone, targeting an initial upside move toward the 86000-86500 range.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

How to Capture Market Turns with Market Anomaly Detector (MAD)Overview

The Market Anomaly Detector (MAD) Indicator effectively captures market reversals , trend shifts , and volatility cycles through its distinctive visual components—the Mainline ( blue ), Upper Band ( green ), and Lower Band ( red ). This idea explores the practical performance of the MAD indicator, emphasizing its clear signals during recent market movements.

How It Works

Mainline (Blue Line)

Static reference line used to visually represent general market sentiment.

Not directly used for generating trading signals, but provides contextual information.

Upper Band (Green Line)

Serves as a critical threshold for bullish signals.

When price closes above this green band, a buy signal is generated, and the background turns green, indicating bullish sentiment.

Conversely, if price closes below the green band after initially trading above it, a sell signal is triggered, highlighting a potential reversal.

Lower Band (Red Line)

Serves as an essential threshold for bearish signals.

When price closes below the red band, a sell signal is generated, accompanied by a red background, signaling bearish momentum.

Alternatively, if price closes above the red band after initially trading below it, a buy signal is produced, pointing to a possible bullish reversal.

Performance in This Case Study

Signal Accuracy & Market Reactions

Buy signals consistently appeared after price closed above the upper (green) band, accurately predicting bullish expansions.

Sell signals were reliably produced when the price closed below the lower (red) band, accurately forecasting bearish trends.

Reversal signals, generated when the price crossed back below the upper band or above the lower band, successfully indicated shifts in market sentiment.

Volatility Dynamics

Contraction of bands during sideways market phases clearly indicated reduced volatility and market indecision.

Expansion of the bands provided timely alerts of upcoming sharp market movements.

Effective Reversal Indications

The MAD indicator clearly marked points of market exhaustion at upper and lower band extremes, providing timely entry and exit signals.

The signals effectively filtered out false breakouts by ensuring clear price action beyond band thresholds.

Key Takeaways

✅ Upper Band (Green Line): Closing above signals bullish entries; closing back below indicates bearish reversals.

✅ Lower Band (Red Line): Closing below indicates bearish entries; closing back above highlights bullish reversals.

✅ Mainline (Blue Line): Provides visual market sentiment context but is not used directly for signal generation.

✅ Band Behavior: Contraction signals low volatility periods; expansion indicates imminent significant moves.

✅ MAD Indicator demonstrated accurate and reliable market reversal and momentum shift detection in the case study provided.

Bearish on Bitcoin (BTC) – Target Price: ~$70,000Technical Analysis:

The provided chart illustrates Bitcoin's (BTC/USD) current position within a descending channel, marked by red resistance and green support lines. The series of lower highs, indicated by the red arrows, reinforces the prevailing bearish momentum. A potential breakdown from the current trading level of approximately $85,079 could lead to a decline toward the green support line, aligning with a target price around $70,000.

Fundamental Analysis:

Recent developments provide additional context to this bearish outlook:

Market Sentiment: Betting markets suggest that Bitcoin has likely peaked for the year, hovering just above its January high of $109,000.

Macroeconomic Factors: Concerns over President Trump's tariff policies and broader economic conditions have contributed to Bitcoin's recent decline. Analysts warn of further downside risks due to ongoing uncertainties in global trade and inflation.

Trading Strategy:

Entry Point: Consider initiating a short position on BTC at the current price of approximately $85,079.

Target Price: Set a price target of $70,000.

Stop-Loss: Implement a stop-loss order at $88,000 to manage potential upside risk.

Bitcoin (BTC/USD) Trade Setup: Potential Reversal & Target Proje200 EMA (Blue): 86,960.21

30 EMA (Red): 86,149.39

The price is currently below both EMAs, indicating a short-term bearish trend.

Key Levels:

Stop Loss: 83,954.20 (marked in blue at the bottom)

Re-entry Level: 86,198.54 (near the 30 EMA)

Target Price: 89,056.91

Support & Resistance Zones:

Strong Support Zone: Around 83,954.20

Intermediate Resistance: Near 86,198.54

Major Resistance Zone: Close to 89,056.91

Trade Setup & Projection:

The chart suggests a potential reversal from the support zone.

The expected price movement shows a bounce from support, a breakthrough of the intermediate resistance, and a push toward the target price (89,056.91).

The expected gain is 4,509.86 points (5.34%).

Conclusion:

If BTC holds the support zone, an upside move is likely.

Breaking above 86,198.54 would confirm a bullish reversal.

Failing to hold support at 83,954.20 could lead to further downside.

Bitcoin (BTC/USD) Trading Analysis – Rectangle Pattern Breakdown1. Market Overview

The BTC/USD chart (1-hour timeframe) illustrates a trendline-supported uptrend that eventually transitioned into a rectangle consolidation pattern before breaking downward. The market displayed signs of buyer exhaustion near the resistance level, leading to a rectangle pattern breakdown, confirming a bearish shift.

This analysis will break down the chart structure, key technical levels, potential trade setups, and risk management strategies for traders looking to capitalize on this move.

2. Breakdown of the Chart Structure

A. Trendline Breakout & Shift in Market Sentiment

The chart initially exhibits an ascending trendline, acting as dynamic support for Bitcoin’s price.

As long as BTC/USD remained above this trendline, the uptrend was intact.

However, once the price broke below the trendline with strong bearish momentum, it signaled a significant shift in sentiment from bullish to bearish.

The breakdown of the trendline also coincided with the rectangle’s lower boundary breakdown, confirming bearish strength.

B. Rectangle Pattern Formation (Consolidation Phase)

The price oscillated between resistance at $88,500 and support at $86,000, forming a rectangle consolidation pattern.

This pattern reflects a period of market indecision where buyers and sellers are in equilibrium.

Multiple failed breakout attempts at resistance signaled strong seller dominance, leading to eventual support failure.

The rectangle breakdown suggests that bears have gained control and a downward move is likely.

C. Breakdown Confirmation & Target Projection

The price broke below the lower support of the rectangle ($86,000) with increased selling pressure.

The bearish breakout was confirmed by strong red candles with high volume, reinforcing the downside move.

The height of the rectangle pattern provides a measured move target of around $83,797, aligning with previous support.

The momentum remains bearish, and price is likely to test this level before any reversal attempt.

3. Trade Setup & Risk Management

A. Ideal Trade Entry

Entry Point: After the price retested the broken rectangle support at $86,000, which now acts as resistance.

Confirmation: The rejection from this resistance with a bearish engulfing candle confirmed further downside.

Bearish momentum indicators, such as RSI and MACD crossovers, further validated the setup.

B. Stop-Loss Placement (Risk Management Strategy)

Stop Loss: Placed above the previous resistance zone at $88,969 to protect against false breakouts.

Rationale: If price moves back into the rectangle and surpasses resistance, the bearish setup becomes invalid.

C. Take-Profit Target & Risk-to-Reward Ratio

Target: $83,797, based on the rectangle pattern height projection and key support levels.

Risk-to-Reward Ratio: The setup offers a favorable risk-to-reward ratio, ensuring that potential gains outweigh potential losses.

4. Market Sentiment & Future Outlook

A. Bearish Continuation Outlook

The trendline failure, rectangle breakdown, and bearish candlestick patterns all suggest a continuation of the downtrend.

If price fails to reclaim support-turned-resistance ($86,000), further downside is expected.

Increased selling volume confirms bearish control.

B. Possible Bullish Reversal Scenarios

If BTC/USD bounces strongly from the $83,797 target zone, it could indicate buyer accumulation and lead to a bullish recovery.

A move back above $86,000 would invalidate the bearish outlook.

5. Conclusion

This BTC/USD analysis highlights a bearish rectangle pattern breakdown, reinforced by a trendline break and strong resistance rejections at $88,500. The breakout target is $83,797, where traders should monitor price action for further bearish continuation or potential reversal signs.

Traders should approach with caution, set appropriate stop-loss levels, and follow volume trends for confirmation of further price movements.

Bitcoin Short-Term Analysis: Ascending Channel HoldingBitcoin is currently trading at $87,201 on the 4-hour chart, consolidating within an ascending channel. Price action suggests that bulls are maintaining control, but a breakout in either direction could dictate the next major move.

Key Observations

Bitcoin remains in a short-term uptrend, forming higher highs and higher lows within the ascending channel.

Immediate support is around $86,000, where the lower trendline of the channel aligns.

If Bitcoin breaks below the channel, next support levels are at $79,112 and $76,597, where strong demand has previously stepped in.

On the upside, resistance levels to watch are around $90,000, where the upper trendline of the channel meets previous supply zones. A clean breakout above this level could push Bitcoin toward $94,000 - $99,526.

Volume & Market Sentiment

Volume has been decreasing, which may indicate an upcoming larger move once liquidity returns.

If Bitcoin remains within this structure, the trend favors the bulls, but a breakdown below support could trigger increased selling pressure.

Potential Trade Setups

Bullish Scenario: A breakout above $90,000 with strong volume could signal continuation toward $94,000 - $99,526.

Bearish Scenario: A breakdown below $86,000 could lead to a drop toward $79,000 - $76,500 before finding strong support.

Bitcoin's short-term direction will depend on whether the channel holds or breaks. A confirmed breakout with volume will provide the next high-probability move. Watching $86,000 as key support and $90,000 as key resistance will be crucial in the coming days.

Bitcoin Weekly Outlook: Critical Levels and Market SentimentBitcoin is currently trading at $87,350, showing signs of recovery after a significant pullback. The weekly chart highlights a crucial battle between bulls and bears as price approaches key resistance levels.

Key Levels to Watch

Resistance Levels

$89,067: Bitcoin needs to break above this level to regain bullish momentum. This has acted as both support and resistance in the past.

$92,247: If Bitcoin clears the previous resistance, this level becomes the next challenge.

$99,563 - $100,763: This is a major supply zone where sellers could take control. A strong breakout beyond this range could pave the way for new all-time highs.

Support Levels

$76,612: If Bitcoin faces more downside pressure, this level will be a critical area for buyers to defend.

$67,853: A break below the previous support could lead to a deeper correction, with this level acting as the next major demand zone.

Technical Overview

Bitcoin is in the process of recovering from a sharp decline. The price has bounced from a strong weekly support level, but it is still facing challenges in reclaiming key moving averages.

The 10-week moving average (yellow line) is acting as resistance. A sustained close above this moving average could indicate a shift in momentum toward further upside.

A descending trendline has been limiting Bitcoin's ability to make higher highs. A breakout above this trendline would signal renewed bullish strength.

Trading volume shows buyers stepping in, but confirmation is needed to validate the trend reversal.

Market Sentiment and Outlook

The overall sentiment remains cautious, with buyers attempting to regain control. A strong weekly close above $92,000 could trigger a push toward the $100,000 range. On the other hand, failure to hold $87,000 could lead to another retest of lower support levels.

The next few weeks will be crucial in determining Bitcoin’s direction. If resistance levels are broken with strong volume, the bullish trend could resume. However, if the price continues to struggle, a deeper correction remains a possibility.

Where do you think Bitcoin is headed next?

Bitcoin Stalls Below $90,000 as Buying Pressure WeakensThe last four trading sessions for Bitcoin (BTC) have been fairly neutral, with the cryptocurrency fluctuating by around 2% , staying just below the critical $90,000 resistance level. The current uncertainty in the market is mainly driven by the renewed trade war narrative, following Trump’s recent comments about imposing tariffs on cars and auto parts. These statements have once again elevated global economic concerns, prompting investors to avoid risk assets in the short term — a category that includes Bitcoin. As long as this uncertainty persists, this neutral behavior could remain a defining feature of BTC in upcoming sessions.

Key Bearish Channel in Play

Since January 20, a notable bearish channel has taken shape, favoring selling pressure and driving BTC down to $77,000 in recent weeks. At present, the price is testing the upper boundary of the channel, but recent buying attempts have not been strong enough to trigger a breakout.

RSI Indicator

The RSI line initially showed a strong upward slope, but this momentum has faded as the indicator approaches the neutral 50 line, suggesting a balance between buyers and sellers. This reinforces the resistance posed by the upper edge of the bearish channel.

MACD Indicator

A similar situation is developing in the MACD, where the histogram has begun to decline steadily, nearing the zero line. This behavior points to a lack of strength in the moving average trends and may indicate that neutrality could continue to dominate BTC price action in the near term.

Key Levels:

$98,900 – Distant resistance: This level sits near the mid-range zone of a large sideways range observed in previous weeks. A bullish move toward this area could revive the forgotten bullish bias and reestablish the importance of the broader lateral structure.

$90,000 – Major resistance: Arguably the most relevant resistance zone at the moment. It aligns with the Ichimoku cloud and the upper limit of the current bearish channel. A breakout above this level could jeopardize the prevailing downtrend and introduce a strong bullish momentum.

$78,600 – Key support: This level marks the recent low for BTC. If the price drops back to this zone, it could provide confirmation for the continuation of the bearish channel.

By Julian Pineda, CFA – Market Analyst

Buy@85500 - 86500Presently, Bitcoin is firmly ensconced within a robust upward trajectory. Having transitioned from a sideways trading phase at 84000 last week, it has executed a remarkable rally, surging directly into the resistance corridor in the vicinity of 89000. With the current trading price hovering at 87000, the market exudes a palpable sense of bullishness.

Should BTC sustain a stable sideways oscillation between 87000 and 88000, the bulls stand to methodically amass upward momentum. Once primed, a breakthrough of the 89000 threshold by BTC appears all but inevitable.

From a technical vantage point, Bitcoin has convincingly breached the sideways trading range. Its moving averages exhibit a distinct bullish configuration, with the 85000 level solidifying as a crucial support.

On the fundamental front, a confluence of factors—including the prevailing global economic uncertainties, the buoyant market sentiment, and the relatively permissive regulatory environment—collectively conspire to propel the continued ascent of its price.

💎💎💎 BTCUSD 💎💎💎

🎁 Buy@85500 - 86000

🎁 TP 87000 88000 89000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

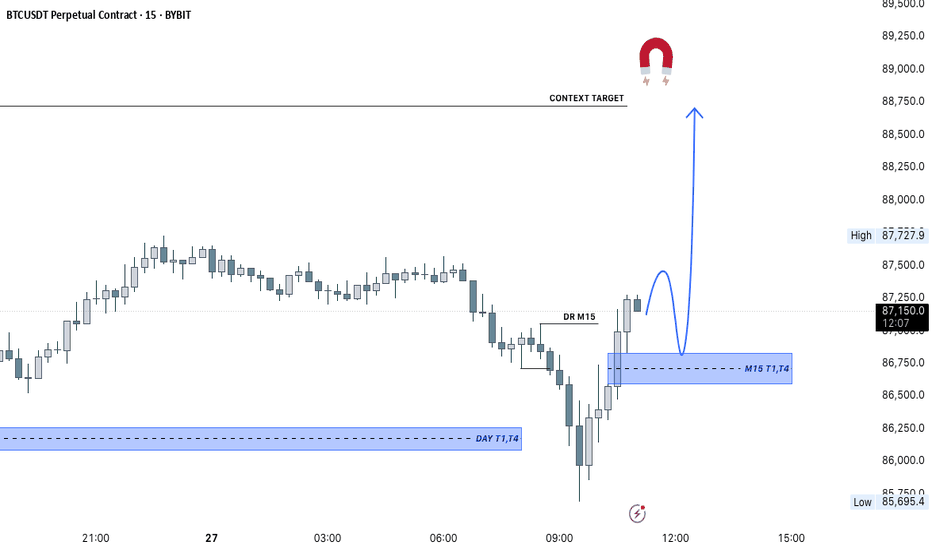

Trade Idea: BTCUSDT (15m Chart)Trade Idea: BTCUSDT (15m Chart)

Price has aggressively pushed up from the daily demand zone and is now forming a potential bullish continuation setup. A retracement into the M15 FVG zone is expected. If price respects this zone and forms a bullish reaction, a long opportunity aligns well with the context target above.

Bias: Bullish

Context: Price is targeting upside liquidity after reclaiming structure. Expecting continuation following a healthy retracement.

Trade with confirmation and risk management.

BTC(20250327) market analysis and operationYesterday, the small level broke through the previous low and then rebounded. Today, pay attention to 87000 points. If the 4-hour level can stand above this point, the correction will end and the market will continue to rise. Pay attention to the upper pressure levels near 88500, 90045 and 91250. If the 4-hour level falls below 87150 and cannot be recovered, the small rebound will be weak, and there is a high probability of sideways or retracement at a small level. Pay attention to the lower support levels near 86370, 85530 and 84775.

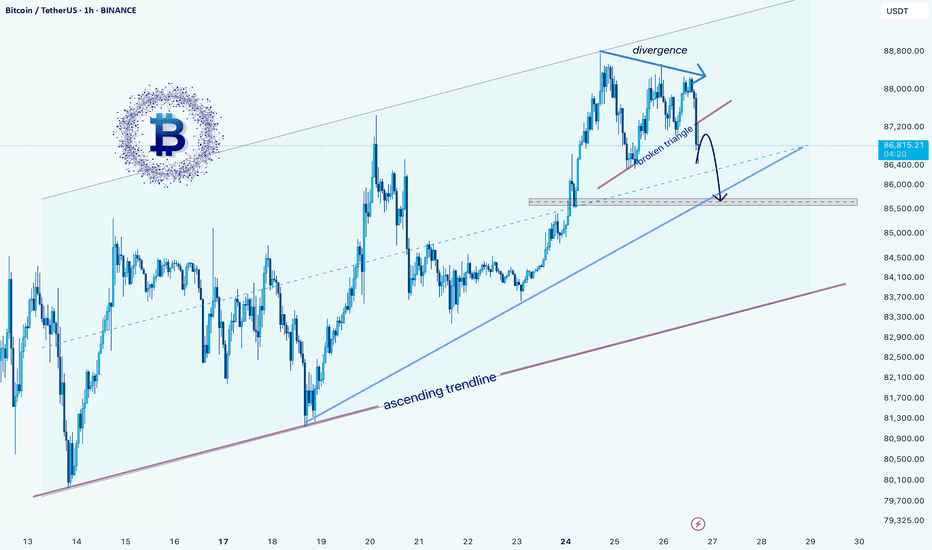

Bitcoin Price Analysis: Potential Correction Ahead?hello guys

The Bitcoin/USDT chart shows an ascending channel with recent price action forming a divergence at the top, indicating potential weakening momentum. A bearish breakout from a smaller triangle suggests a short-term correction. The price may test the ascending trendline around $85,400, where a key support zone exists. If this level fails, a deeper correction toward the major support area around $76,800 could follow. However, if Bitcoin holds above the trendline, the uptrend could resume.

Traders should watch price action around the $85,400 level for confirmation of further downside or a potential bounce.

Bitcoin’s Next Move: Falling to $79K?This detailed technical analysis of Bitcoin (BTC/USD) on the 1-hour timeframe highlights a Rising Wedge pattern, key support and resistance levels, a trade setup, and projected price movements. The chart suggests a bearish breakdown, and traders can use this analysis to make informed decisions.

1. Understanding the Chart Pattern – Rising Wedge Formation

A Rising Wedge is a bearish reversal pattern that occurs when the price moves upwards within two converging trendlines. The slope of the lower trendline is steeper than the upper trendline, indicating weaker bullish momentum and an increasing probability of a downside breakdown.

📌 Key Observations:

The black solid trendlines outline the wedge pattern.

The price action remained inside this wedge from March 11 to March 26, 2025.

A breakdown has now occurred, confirming bearish momentum.

🔺 Why is this Bearish?

Rising Wedges are considered distribution patterns, meaning buyers are losing strength, and sellers are gradually taking control.

The price fails to make aggressive new highs and instead grinds upward weakly.

Once support is broken, a strong sell-off usually follows.

2. Key Chart Levels – Support & Resistance Zones

🔵 Resistance Level (Upper Bound of Wedge & Supply Zone)

The red arrow marks a strong rejection at $88,500 - $89,000, which acted as a major resistance level.

This zone has seen multiple failed breakout attempts, signaling that sellers dominate this area.

Stop-losses for short trades should be placed above this resistance zone.

🟢 Support Level (Lower Bound of Wedge & Demand Zone)

The wedge's lower boundary previously acted as strong support until it was breached.

The blue highlighted box represents a demand zone around $81,000, where buyers previously stepped in.

Losing this level could trigger a much stronger bearish move.

3. Breakdown Confirmation & Trading Setup

With the wedge broken to the downside, we now look for a confirmed bearish setup to enter a trade.

📉 Bearish Confirmation:

✅ The price broke below the wedge’s lower boundary, signaling a reversal.

✅ A retest of the broken wedge trendline confirms the breakdown.

✅ The price is now showing lower highs and lower lows, indicating a new bearish trend.

🎯 Trade Setup – How to Play This Move?

🔴 Entry for Short Position:

Enter short between $86,900 - $87,200 after confirming a rejection at the broken trendline.

🔵 Stop Loss:

Place a stop-loss above $89,282 to protect against a fakeout.

If BTC closes back inside the wedge, the short setup is invalidated.

🟢 Target 1: $81,000 – This is a key demand zone, and price might temporarily bounce here.

🟢 Target 2: $79,031 – This is the next strong support level, making it a final bearish target.

⚠ Risk Management Note:

Adjust position size based on risk tolerance.

Be mindful of short squeezes (where price temporarily spikes before continuing lower).

4. Expected Price Movement – Bearish Projection

🔮 The dashed black lines on the chart indicate a likely price pathway:

1️⃣ A breakdown below the wedge, followed by a minor retest of the broken trendline.

2️⃣ A continuation toward $81,000 (support level).

3️⃣ A small bounce before further decline.

4️⃣ The price reaching the final target of $79,031, where buyers may start accumulating again.

📌 If Bitcoin breaks below $81,000 with high volume, the bearish trend will likely accelerate.

5. Market Psychology & Trading Strategy

📌 Why This Setup Makes Sense?

The market exhibited exhaustion at the top of the wedge.

The break-and-retest confirms seller dominance.

The lower highs & lower lows show bearish momentum.

🚀 Alternative Bullish Scenario?

If BTC reclaims the wedge and breaks above $89,000, then the bearish setup is invalid.

A close above $89,500 would signal strong buying pressure and potential bullish continuation.

6. Conclusion – What to Watch Next?

🔎 Key Points to Monitor:

✔ Retest & rejection at $87,000 – $88,000 (confirming bearish momentum).

✔ Break of $81,000 to signal continuation toward the target.

✔ Stop-loss protection above $89,000 to manage risk.

📊 Final Thoughts:

The Rising Wedge breakdown suggests a shift from bullish to bearish sentiment.

This is a high-probability short trade with well-defined entry, stop-loss, and targets.

Traders should wait for price action confirmation before entering trades.

Would you like any refinements, or do you need further trade ideas? 🚀📉

Bitcoin Looking Bullish on 4 hour - printing a bull FlagBitcoin is certainly looking Bullish on the lower time frames and, in my opinion, continur to fall in the Flag till we get near that lower Trend line of Ascending channel we been making since the Low around 76K

The 4 hour MACD is falling Bearish and support the idea of a continues Drop to lower Trend line

I think the Margins are too tight to do any day trading

Just Sitting, waiting.

Longer term, I am still prepared to see another Drop Lower but maybe not to the 76K range again.

The Monthly candle for March is currently Green off an expected RED.

It has Long wicks above and Below, showing a good fight between Bulls and Bears.

The Body of this candle is not Big but it would take a serious drop out of range to turn it red

So, RELAX

We should be OK

Is BTC Bitcoin Overextended? My Bias Is Bullish With Conditions!This 30-minute chart 🌟 shows Bitcoin consolidating within a descending channel after a recent bullish breakout 🚀, with a potential bullish structure forming. The price is currently testing the upper boundary of the channel near $87,500 🛡️. If the price breaks below the channel and retests the equilibrium support, it could present a strong buy opportunity 💰 . Considering the broader analysis 🌍, a break above $87,926 with strong volume 🔥 would confirm bullish momentum toward $90,000 🎯 . Not financial advice. ✨

BTC/USDT 1H: Double Top Reversal – Short Setup Below $88KBTC/USDT 1H: Double Top Reversal – Short Setup Below FWB:88K

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence Level: 8/10):

Price at $87,146, showing bearish momentum following a confirmed double top formation.

Hidden bearish divergence on RSI, with lower highs while price made equal highs—classic SMC signal.

Market Makers appear to be distributing in the $88,000 – $88,250 resistance zone.

Trade Setup (Short Bias):

Entry: Current price around $87,146 is optimal for short positions.

Targets:

T1: $86,250 (-1%)

T2: $85,500 (-1.9%)

Stop Loss: $88,300 (+1.3%) above resistance zone.

Risk Score:

7/10 – High-volume rejection at resistance supports this setup, but RSI nearing oversold adds some short-term bounce risk.

Key Observations:

Strong resistance cluster at $88,000 – $88,250.

RSI at 40, approaching oversold, but divergence signals outweigh reversal for now.

Smart Money activity shows clear signs of short positioning with large bearish wicks and volume spikes.

Recommendation:

Short positions favored with tight risk management.

Consider scaling out at each target level to lock in profits.

Monitor price action closely at $86,250 for signs of absorption or bounce.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

#BTC/USDT Update! This is the only Bullish trigger point!#BTC has reached our key resistance zone, the exact area I've been highlighting since last week.

So far, we've seen a clear rejection from this level.

Bitcoin still needs more momentum to break above this zone convincingly.

As long as we remain below this range, it won’t be smooth sailing for BTC or altcoins.

📊 I’ll be sharing some important altcoin charts later today.

Stay tuned!

Please hit the like button to support my content and share your views in the comment section.

Thank you

#PEACE

When will BTC break through 89,000?Currently, Bitcoin is in a strong upward trend. It has soared directly from a sideways movement at 84,000 to the resistance zone near 89,000. Now, with the price at 86,000, the market sentiment remains bullish.

If BTC maintains a stable sideways movement between 87,000 and 88,000, the bulls can gradually accumulate upward momentum. Once ready, BTC will undoubtedly break through 89,000.

Technically, Bitcoin has broken through the sideways range, and its moving averages show a bullish alignment. The 85,000 level has emerged as a significant support.

Fundamentally, factors such as global economic uncertainties, exuberant market sentiment, and a relatively relaxed regulatory environment are jointly driving the continuous upward movement of its price.

💎💎💎 BTCUSD 💎💎💎

🎁 Buy@85500 - 86000

🎁 TP 87000 88000 89000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates