Btcusdanalysis

BTC/USD Rising Wedge – Bearish Breakdown Ahead?Introduction: Understanding the Market Structure

This Bitcoin (BTC/USD) 4-hour chart presents a technical setup with a mix of bullish and bearish formations. The analysis focuses on key support and resistance zones, trendlines, and chart patterns to determine the next possible move.

🔍 The key takeaway? BTC has formed a Rising Wedge, a bearish reversal pattern, signaling potential downside unless a breakout invalidates the setup.

1. Market Structure & Current Trend Analysis

📌 Market in Curve Formation – The Accumulation Phase

Before the recent rally, Bitcoin was in a downtrend, making lower lows and lower highs, suggesting a period of price weakness.

However, price found strong support at around $77,600 - $80,000, forming a curved bottom structure—an early signal of an accumulation phase.

This bottoming pattern transitioned into a bullish uptrend, leading to the formation of a rising wedge.

🔹 Key Observations:

✔ Accumulation near $77,600 created a base for buyers.

✔ The gradual recovery curve suggests a shift from bearish to bullish momentum.

✔ Bitcoin later formed higher lows, confirming a temporary uptrend.

⚠ Shift in Momentum – The Rising Wedge Appears

The price rallied from the support zone but started forming a Rising Wedge pattern, which is typically a bearish signal.

A rising wedge indicates that although buyers are pushing prices up, they are losing momentum.

The narrowing price range suggests that sellers are entering at higher levels, weakening bullish strength.

2. Key Technical Levels to Watch

🔵 Resistance Zone ($92,000 - $94,957)

The shaded area near $92,000 - $94,957 is a major resistance level, where BTC previously failed to sustain a breakout.

This supply zone has been tested multiple times, reinforcing its strength.

The Stop Loss for short positions is placed above $94,957—any breakout above this level would invalidate the bearish setup.

🟠 Support Zone ($77,600 - $80,000)

The strong demand zone between $77,600 - $80,000 aligns with previous support levels.

If the rising wedge breaks down, this is the first major price target where BTC could find support.

A strong breakdown below $77,600 could lead to further declines toward $75,000 or lower.

3. The Rising Wedge Pattern – Bearish Warning!

🔍 What is a Rising Wedge?

A Rising Wedge is a bearish reversal pattern that forms during an uptrend when price moves within two converging trendlines.

It indicates that buyers are losing strength, and sellers are preparing to take control.

Once the lower trendline breaks, it confirms bearish momentum, leading to a price drop.

📝 Current BTC/USD Rising Wedge Analysis:

BTC has formed higher highs and higher lows, but the price range is narrowing.

The lower trendline is critical—a breakdown below this level could trigger a sharp decline.

The bearish target aligns with the support zone near $77,600.

4. Trading Plan – Possible Scenarios

📉 Bearish Breakdown Scenario (High Probability)

✅ Entry: Short BTC if the price breaks below the rising wedge (~$86,000 - $85,500).

✅ Stop Loss: Above $94,957 to protect against invalidation.

✅ Take Profit Target: $77,600 - $80,000 (first support level).

✅ Extended Target: If BTC drops below $77,600, watch for $75,000 - $72,000.

✅ Risk-Reward Ratio: Ideally 1:3 or higher for optimal trade management.

📈 Bullish Breakout Scenario (Low Probability but Possible!)

If BTC breaks and closes above $94,957, the bearish setup becomes invalid.

A confirmed breakout above resistance could push BTC towards $98,000 - $100,000.

Traders should wait for volume confirmation before entering long positions.

5. Risk Management & Final Thoughts

⚠ Risk Factors to Consider:

If BTC breaks the wedge with low volume, the move might be a false breakdown.

Macroeconomic events, such as interest rate decisions, can influence price behavior.

Watch for bullish divergences in indicators like RSI or MACD before shorting aggressively.

🔎 Conclusion:

The Rising Wedge pattern suggests a bearish reversal—a breakdown could send BTC toward $77,600.

Traders should wait for confirmation before entering trades.

If BTC breaks above $94,957, a bullish continuation could push it toward $100,000.

🔥 Bearish Bias Until Breakdown Confirmation!

Would you like an indicator-based analysis (e.g., RSI, MACD, or Moving Averages)? 🚀

My BTC long idea 26/03/2025This is linked to my NAS idea where the market is slowly shifting to a Risk-on environment. I see a nice potential for a bullish BTC price action shift. We may have found the bottom for the new bull run.

Technical observation:

1. We recently formed a cup and handle.

2. A visible head and shoulder on the cup and handle.

3. Exit on the bearish trend channel with the formation of a new bullish trend channel.

4. 50% fib level looks promising.

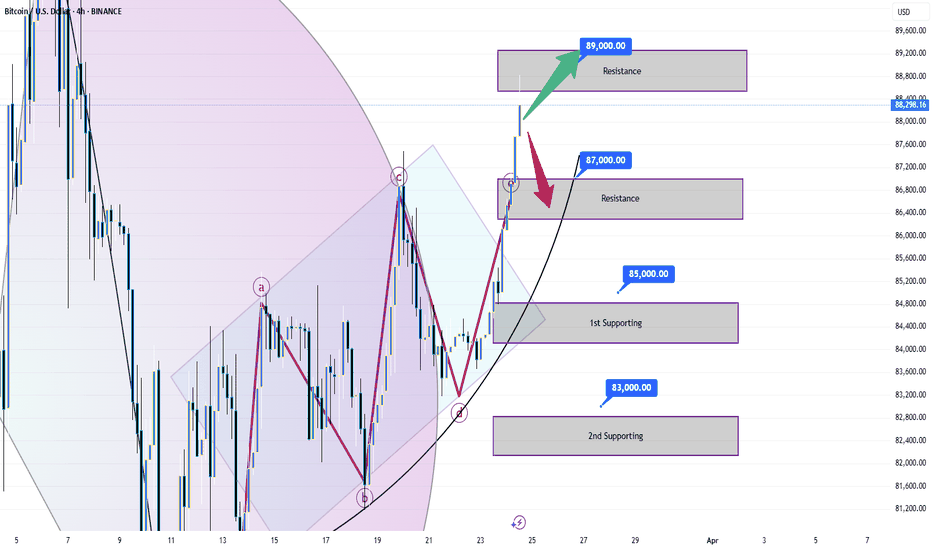

BTC:BTC is expected to continue to rise to 95000BTC has built a perfect upward structure in an oscillating upward manner, and has continuously strengthened the bottom support during the oscillation process. BTC is expected to continue to rise. However, BTC is facing the 88500-89500 resistance area, so BTC needs to accumulate energy to break through this resistance area, so we should focus on the 86500-85500 area support below. Once BTC touches this area and stops falling and rebounds, BTC is bound to break through the 88500-89500 resistance area and is expected to continue to 95000.

So in terms of short-term trading, if gold pulls back to the 86500-85500 area, we can go long on BTC.I will make more detailed trading plans and trading signals every day according to the real-time market situation, which is also the testimony of every successful transaction and profit of mine; the article has a certain lag, if you want to copy the trading signals to make a profit, or master independent trading skills and thinking, you can choose to join the channel at the bottom of the article

Title: Bitcoin Targeting $56,000? Fibonacci Shows the Way!

On a specific timeframe, it’s clear that the 50% retracement level from Fibonacci has not been tested yet. By applying the Fibonacci retracement tool to the recent downward impulse, we can see that after testing this level, Bitcoin could potentially move toward the 161% extension, which aligns with a target of $56,000 per BTC.

The price dropped impulsively, yet the recovery has been slow and weak. However, in my opinion, this target remains achievable. What do you think? Will Bitcoin reach this level? Share your thoughts in the comments!

Continue to wait for BTC to break through 89,000Currently, Bitcoin is in a strong upward trend. It has soared directly from a sideways movement at 84,000 to the resistance zone near 89,000.

If BTC maintains a stable sideways movement between 87,000 and 88,000, the bulls can gradually accumulate upward momentum. Once ready, BTC will undoubtedly break through 89,000.

💎💎💎 BTCUSD 💎💎💎

🎁 Buy@85500 - 86000

🎁 TP 87000 88000 89000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Bitcoin Price Analysis: Potential Bullish Breakout Towards $89khello guys!

In the 4-hour Bitcoin/USDT chart from Binance, a clear ascending trendline supports price movement, indicating a potential bullish structure. Here are the key observations:

Technical Analysis

1- Ascending Trendline Support

The price is respecting an ascending trendline, which has provided multiple touches and acted as a dynamic support level.

A bounce from this trendline around the $83,000-$83,500 range suggests strength in buyers.

2- QML (Quasimodo Level) Formation

A QML (Quasimodo Level) pattern is visible, which typically signals a strong reversal zone.

Price has already reacted to this level, indicating it could be a key turning point before further upside movement.

3- Major Support Zone

A larger support area is identified around the $76,900-$77,600 range that support the price before!

The upper boundary of the ascending channel and the psychological resistance at $89,621 serve as the next major target.

The price could test this level in the coming sessions, provided it maintains its bullish momentum.

_____________________________

Conclusion

Bitcoin appears to be in an uptrend within a rising channel, with bullish momentum building. If the ascending trendline continues to hold, the next significant target would be around $89,000. However, a break below the QML zone could lead to a retest of lower support near $77,000. Traders should watch for confirmation of trend continuation before entering long positions.

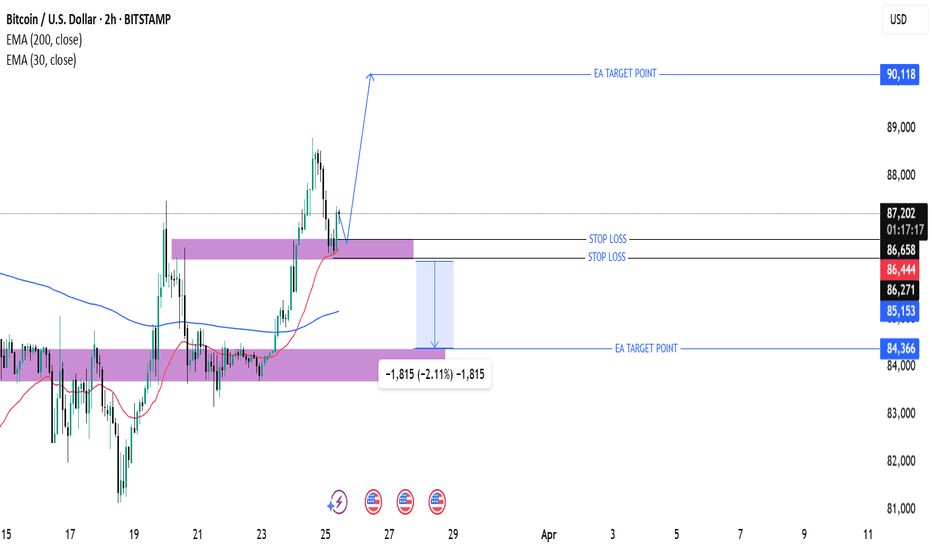

Bitcoin (BTC/USD) 2H Analysis: Potential Bullish Continuation or30 EMA (Red, 86,440): Indicates short-term momentum.

200 EMA (Blue, 85,153): Represents long-term trend support.

Support and Resistance Zones

Support Zone (Purple Box - ~86,271 to 85,153): Price is likely to bounce from here.

Resistance Zone (~87,149 and above): Breakout above this could push price higher.

Trade Setup

Entry Consideration: The price is currently testing a demand zone (purple) after a pullback.

Target (Take Profit - 90,118): Expecting a bullish move.

Stop Loss (~86,658 or lower): To manage risk.

Potential Price Action

If Bitcoin holds above the purple demand zone and 30 EMA, it could rally to 90,118.

A breakdown below 86,271 could push it toward 84,366 or lower.

Conclusion

Bullish Bias: If price holds above the support level.

Bearish Risk: If it breaks below the purple zone.

Recommendation: Monitor support at 86,271 and 85,153, as a bounce from these areas could confirm an uptrend.

Bitcoin (BTC/USD) – Rising Wedge Breakdown & Trading Setup 📊 Chart Overview & Market Context

The provided chart represents Bitcoin's (BTC/USD) price movement on the 1-hour (H1) timeframe, highlighting a Rising Wedge pattern. This pattern is generally bearish and signals a potential reversal or breakdown.

Over the past few trading sessions, BTC has been moving inside an ascending wedge formation, making higher highs and higher lows. However, this movement is narrowing, indicating weakening bullish momentum. As BTC approaches a critical resistance level, sellers appear to be gaining control, increasing the likelihood of a sharp decline.

This chart outlines a well-structured bearish trading setup, identifying key areas of resistance, support, stop-loss placement, and potential downside targets.

📌 Technical Analysis & Key Levels

🔹 1. Chart Pattern: Rising Wedge (Bearish Reversal Signal)

A Rising Wedge is a technical pattern characterized by:

✔ Two upward-sloping trendlines, converging over time.

✔ Diminishing bullish momentum, as higher highs become weaker.

✔ Breakdown expectation, where price typically falls below the lower support trendline.

📉 Why is this pattern important?

The rising wedge signals that buyers are losing strength and that a reversal is likely.

When price breaks below the lower boundary, selling pressure increases, leading to a strong downward move.

Traders often anticipate a breakdown from this pattern to enter short positions.

🔹 2. Resistance Level (Key Rejection Zone)

📌 Zone: 88,500 - 89,500 USD

This area has acted as a strong resistance, preventing further upside movement.

Sellers stepped in, causing the price to reject and start declining.

A confirmed rejection from this level adds bearish confluence to the setup.

🔹 3. Rising Wedge Support (Breakdown Level)

📌 Zone: 85,000 - 84,500 USD

This is the lower boundary of the wedge pattern.

If BTC closes below this level with strong volume, it confirms the breakdown.

A retest of this level as resistance after a breakdown would provide an ideal short entry.

🔹 4. Key Support Levels & Bearish Targets

Once BTC breaks down, the next areas of interest are:

📌 First Bearish Target: 80,500 - 79,500 USD

A previous demand zone where buyers previously pushed prices higher.

BTC could pause here before continuing lower.

📌 Final Target (Full Breakdown Projection): 76,802 USD

If the wedge pattern fully plays out, BTC could drop toward this level.

This aligns with a major historical support zone, where significant buying interest could emerge.

🔹 5. Stop-Loss & Risk Management

📌 Stop-Loss: 90,483 USD

If BTC moves above this level, it invalidates the bearish setup.

Keeping a tight stop-loss ensures controlled risk while maximizing potential rewards.

📉 Trading Plan: How to Trade This Setup?

✅ Short Entry Strategy:

Enter a short trade once BTC breaks below 85,000 USD, confirming the wedge breakdown.

If BTC retests the broken support (now resistance), it offers a second entry opportunity.

✅ Stop-Loss Placement:

Place a stop-loss above 90,483 USD, in case of a bullish breakout.

✅ Take-Profit Levels:

First Target: 80,500 - 79,500 USD (Support zone)

Final Target: 76,802 USD (Full wedge breakdown projection)

📌 Key Takeaways & Market Sentiment

🔸 Bearish Structure Formation: BTC is losing momentum inside a rising wedge, signaling a potential downturn.

🔸 Breakdown Confirmation Needed: A close below 85,000 USD with volume confirms the bearish trade setup.

🔸 Risk Management is Key: The stop-loss above 90,483 USD protects against invalidation.

🔸 Watch for Retests: If BTC retests the breakdown level, it can provide an ideal entry point.

🚨 Bitcoin is showing early signs of a bearish reversal! If the rising wedge breaks down, a significant decline toward 76,802 USD could follow. Traders should monitor price action carefully and execute the setup accordingly. 🚀

BTC READY TO EXPLODE? POTENTIAL 1H ENTRY!Hi traders! , Analyzing Bitcoin on the 1H timeframe, spotting a potential entry :

🔹 Entry: 87,509 USD

🔹 TP: 92,003 USD

🔹 SL: 81,206 USD

BTC is respecting the trendline and maintaining its bullish momentum. If this support holds, we could see a continuation toward 92K. RSI is overbought, but price action remains strong.

⚠️DISCLAIMER: This is not financial advice. Trade responsibly.

Position Open in BTC! Ready for TakeoffHi Traders ! Bitcoin has reached a key support zone, where it has historically shown bullish reactions. Additionally, the RSI at oversold levels (21.66) reinforces the possibility of an imminent rebound.

🔥 I have already entered long, expecting a bullish move toward the $85,500 - $86,000 zone, with a possible extension to $89,000 - $90,000 if it breaks the descending resistance.

📈 Key Factors to Watch:

✅ Confirmation of the bounce at support.

✅ Increase in buying volume.

✅ Break above the 20-period EMA.

Let’s see how this plays out! What are your thoughts? 🔥

⚠️ Disclaimer: This is not financial advice. I am simply sharing my analysis and personal trade. Always do your own research before trading!

BTC IMF Tracking, Liquidation Frenzy, and Market PredictionsBitcoin's recent price action has been a rollercoaster, marked by significant gains, dramatic liquidations, and a confluence of macroeconomic factors that are shaping its trajectory. From the International Monetary Fund (IMF) officially tracking Bitcoin in cross-border finance to speculative predictions of a potential $87,000 surge, the cryptocurrency remains a focal point of intense market scrutiny.

One of the most noteworthy developments is the IMF's increasing recognition of Bitcoin's role in global finance. While the IMF previously issued warnings to El Salvador regarding its Bitcoin adoption, its decision to now track Bitcoin in cross-border financial flows signals a tacit acknowledgment of the cryptocurrency's growing significance. This shift reflects a broader trend of institutions grappling with the reality of digital assets, forcing them to incorporate these assets into their analytical frameworks.

Simultaneously, the Bitcoin market has witnessed a surge towards the $87,000 mark, triggering a wave of short liquidations. This phenomenon occurs when traders who have bet against Bitcoin's price are forced to close their positions at a loss as the price rises. The sheer magnitude of these liquidations, exceeding $110 million in a short period, underscores the volatility and the inherent risks associated with leveraged trading in the cryptocurrency market. The total market liquidations surpassing $200,000 in 24 hours only highlights the dramatic price swings and the vulnerability of short positions.

Adding to the complexity of the market dynamics is the emergence of another CME gap in the $84,000–$85,000 range. Historically, these gaps, which represent discrepancies between trading prices on the Chicago Mercantile Exchange (CME) and other exchanges, tend to be filled, suggesting a potential pullback in Bitcoin's price. This pattern creates a sense of uncertainty, with traders weighing the potential for further gains against the possibility of a corrective downturn.

Furthermore, the surge in Bitcoin open future bets on Binance, with an increase of $600 million, indicates heightened price volatility. Open interest, which measures the total number of outstanding futures contracts, often correlates with price movements. A rise in open interest alongside a price increase typically confirms an uptrend, but it also signals the potential for sharp price swings as more capital enters the market.

Market analysts are divided on Bitcoin's future trajectory. Some predict a "brutal bleed lower," while others foresee a break towards new all-time highs in the second quarter. The critical level to watch is $93,000. If Bitcoin can reclaim this level as support, it would significantly reduce the risk of a fresh collapse. However, until this threshold is breached, the market remains vulnerable to downward pressure.

On a more positive note, the S&P 500's reclamation of its 200-day moving average provides a potential tailwind for Bitcoin. This technical breakout in equities, coupled with similar signals in the cryptocurrency market, could indicate renewed bullish momentum. The correlation between traditional financial markets and Bitcoin has become increasingly apparent, with positive developments in equities often translating to positive sentiment in the crypto space.

Adding another layer to the narrative is the potential softening of the stance on reciprocal tariffs by Donald Trump. Some analysts see this development as a potential catalyst for a Bitcoin bottom. Any relaxation of trade tensions could boost investor confidence and create a more favorable environment for risk assets, including cryptocurrencies.

Finally, the concept of tokenized US gold reserves, as proposed by NYDIG, presents an intriguing long-term prospect for Bitcoin. While gold and Bitcoin are fundamentally different assets, the tokenization of gold on a blockchain could enhance the overall legitimacy and infrastructure of digital assets. This increased institutional acceptance could indirectly benefit Bitcoin by further integrating blockchain technology into mainstream finance.

In conclusion, Bitcoin's current market landscape is characterized by a blend of institutional recognition, intense trading activity, and speculative predictions. The IMF's tracking of Bitcoin in cross-border finance underscores its growing relevance, while the liquidation frenzy and CME gap highlight the inherent volatility of the cryptocurrency market. The interplay of macroeconomic factors, technical indicators, and speculative sentiment will continue to shape Bitcoin's trajectory, making it a fascinating asset to watch in the coming months.

BTCHello friends

You can see that after the price fell in the specified support area, the price was supported by buyers and caused the resistance to break, and now, when the price returns to the specified ranges, you can buy in steps and move with it to the specified targets, of course, with capital and risk management...

*Trade safely with us*

Asymmetrical Triangle (Neutral) or AB=CD (Bullish) for BTC?BINANCE:BTCUSDT has formed bullish divergence on Daily TF and continues its upward momentum. BTC has also formed two trading patterns:

1. Asymmentrical Triangle: This neutral pattern can break out in either direction

2. Bullish AB=CD: This continuation pattern on the weekly tf coupled with bullish divergence on daily tf indicates imminent continuation of the bullish trend.

Buy stop order on break of LH could be a good trading idea!

Bitcoin Price Analysis – Bullish Setup with Caution AheadThe short-term trend is bullish, as we observe:

- Price movement is above the short- and medium-term moving averages.

- The price is forming higher highs and higher lows.

- Support levels are steadily rising along the moving averages.

However, there is a noticeable loss of momentum in recent hours, which could signal a potential short-term correction or profit-taking phase.

Bullish Indicators

Moving Averages:

- The 10 EMA, 20 EMA, and 30 EMA are all indicating a Buy signal.

- The 200 EMA also reflects a Buy signal.

- This indicates that the price is trading above key averages, supporting the continuation of the bullish trend.

ADX = 29.49 (Buy): The strength of the current trend is still significant (above 25), which reinforces the continuation of the bullish movement.

MACD (Buy): The MACD has shown a positive crossover, which supports the bullish signal and continued upward momentum.

Bearish Indicators

Momentum = Sell (Value: 4,249.13): There is a noticeable slowdown in momentum, which may indicate the early stages of a correction or temporary weakness.

Some Long-Term Averages = Sell: The 50, 100, and 200 Simple Moving Averages are showing sell signals, suggesting the longer-term trend has not yet fully transitioned into a bullish phase. These may also act as resistance if the price continues to rise.

Stochastic RSI Fast = 90.56 (Overbought): This indicator is in the overbought zone, pointing to a potential near-term pullback.

RSI = 53.34 (Neutral to Overbought): Not yet in the overbought territory, but gradually approaching it, which should be watched closely.

2025 Performance Lagging: The latest chart shows that 2025 performance is currently at -6.46%, compared to a strong +111% in 2024. This discrepancy suggests a phase of ongoing profit-taking or broader consolidation.

Outlook

Short-Term (Hours to Days): There is a potential for further upside with key resistance levels at 88,500, 89,000, and 90,000.

The nearest support levels are at 87,500 and 86,800.

However, caution is advised due to signs of short-term exhaustion in indicators like Stochastic RSI and Momentum.

Medium-Term (Weeks): As long as the price holds above the 86,000–86,500 range, the uptrend is likely to continue. A breakout above 90,000 would be a strong bullish signal that could drive the market to new highs.

Recommendation

- For Short-Term Traders: Take advantage of the current move but remain cautious of sudden corrections.

Watch for potential buy zones near 87,000 and 86,500. Use a tight stop-loss strategy if these support levels are broken.

- For Medium/Long-Term Investors: Indicators show that the uptrend is starting to stabilize.

Consider partial entry now while closely monitoring the 90,000 level.

Avoid going all-in at current levels and keep capital aside to buy dips if the market corrects.

JUST IN: Bitcoin Reclaims $88K, Eyes $100K Breakout!The Price of Bitcoin shocked sceptics surging nearly 4% today, reclaiming the FWB:88K pivot- now setting its coast for $100k breakout amidst a bullish symmetrical triangle Pattern.

On the daily time frame, CRYPTOCAP:BTC has formed 2 bullish candlesticks, should a third identical candlestick evolve, it will lead to a breakout of the ceiling of the symmetrical triangle formed- placing CRYPTOCAP:BTC in the $90,000 - $96,000 range. A break above this pivots would cement the the move to $100k and beyond.

Similarly, should the asset faced selling pressure into making it dip below the $81k range, a selling spree could emerged.

Bitcoin Price Live Data

The live Bitcoin price today is $88,452.78 USD with a 24-hour trading volume of $29,835,452,540 USD. Bitcoin is up 3.95% in the last 24 hours, with a live market cap of $1,755,025,651,822 USD. It has a circulating supply of 19,841,384 BTC coins and a max. supply of 21,000,000 BTC coins.

the price of BTC has gone upIn the recent analysis of the cryptocurrency market, I have continuously been optimistic about the price trend of BTC. Since the last analysis, the price of BTC has steadily climbed from around 84,000 to the current 85000, further verifying the previous upward expectations.

🎁 Buy@83500 - 84000

🎁 TP 86000 - 87000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

$BTC FINALLY BULL RALLY ON CHART NOW & 2nd TAKE PROFIT DONEJUST IN NEWS : BTC Bear Market To Last 90 Days, Analyst Predicts, as Trade War Fears and Whale Activity Impact Prices

Bitcoin has entered a bear market, with its price dropping over 20% from its all-time high. Market analyst Timothy Peterson expects the downturn to last 90 days, arguing that this decline is weaker than most past bear markets. He noted that out of the 10 previous downturns, only four—2018, 2021, 2022, and 2024—have been worse in terms of duration. Peterson does not see BTC sinking far below $50,000 but says a slide in the next 30 days could be followed by a 20-40% rally after April 15. He believes this could trigger renewed buying interest and push Bitcoin higher.

Investor sentiment has been affected by global trade war concerns following tariffs imposed by U.S. President Donald Trump and retaliatory measures from multiple trading partners. The uncertainty has led to a decline in speculative investments. The Glassnode Hot Supply metric, which tracks BTC held for a week or less, has fallen from 5.9% in November 2024 to 2.3% by March 20, signaling reduced short-term trading activity. A CryptoQuant report also suggests that most retail investors are already in the market, countering expectations that a surge of new traders would drive prices up.

Ether has also struggled, losing over 51% in three months since peaking above $4,100 on December 16, 2024. Analysts say ETH must reclaim the $2,200 range to gain upward momentum. “If price can generate a strong enough reaction here, then #ETH will be able to reclaim the $2,196-$3,900 Macro Range (black),” wrote crypto analyst Rekt Capital in a March 19 X post. Despite positive regulatory developments, such as the U.S. Securities and Exchange Commission dropping its lawsuit against Ripple, ETH has yet to see significant gains.

Market uncertainty remains high, with some analysts expecting economic pressures to last until at least April 2025. Despite short-term volatility, long-term projections remain optimistic. VanEck has predicted a $6,000 cycle top for ETH and a $180,000 peak for BTC in 2025.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

BTC encountered strong resistance 89000I made an analysis this morning. I said that if the price of Bitcoin breaks through the resistance level of 87,000, it's very likely to rise all the way to 88,000 in one go, and then it will encounter the resistance level at 89,000. Look, my analysis has been verified now. It has been proven that the resistance level at 89,000 is indeed effective.

At present, it's not advisable to engage in short - selling. Instead, one can consider taking long positions again at the support level.

💎💎💎 BTC 💎💎💎

🎁 Buy@85000 - 86000

🎁 TP 88000 - 89000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

BTC (20250324) market analysis and operationTechnical analysis of BTC on March 24: Today, the large-cycle daily level closed with a small positive line yesterday. The K-line pattern is still a single negative and a single positive. The price stands on the MA30 daily average line. The attached indicator is running in a golden cross, but the fast and slow lines are still below the zero axis. According to the current trend, when the current fast and slow lines touch the zero axis horizontal line, the time consumption space is almost the same, and the second large downward trend will come, so we have to wait in terms of time and trend; the short-cycle hourly chart continues the rebound trend of yesterday today. It is currently in the European session time, and the price begins to be under pressure. In addition, the probability of shock on Monday is relatively high, so the US market will first retreat in the evening.

Therefore, today's BTC short-term contract trading strategy: sell at the current price of 87,500 area, stop loss at 88,000 area, and target the 86,500-86,000 area;