BTC/USDT Buy Setup – VSA & Demand Zone Reaction✅ Entry: Current price action near 117,297

🎯 Target: 119,078 (+1.22%)

🛑 Stop Loss (SL): 116,944 (below demand zone)

📊 Technical Insight (Volume Spread Analysis):

Stopping Volume at Lows:

The recent down move halted with a wide spread down-bar on high volume, followed by an immediate rejection. This indicates potential professional buying absorbing supply.

No Supply Confirmation:

After the stopping volume, several narrow spread candles on low volume formed, suggesting weak selling pressure and a lack of commitment from bears.

Bullish Reaction:

Price rebounded from the demand zone with increasing volume on up-bars, showing early signs of demand dominance.

The current consolidation just above the support is typical of absorption before a markup phase.

Risk-Reward Structure:

The setup offers a favorable 2.2:1 R:R ratio, with the stop placed just below the zone to avoid false breakouts while allowing the trade room to breathe.

📌 Trade Plan:

Bias remains bullish as long as price holds above 116,944.

A breakout above the minor resistance (117,828) with volume expansion would confirm the next leg up toward the 119,078 target.

If volume fails to support the move, reassess before committing additional capital.

Btcusdbullish

Bitcoin at the Edge of the Fibonacci Gate - Silent Strain.⊣

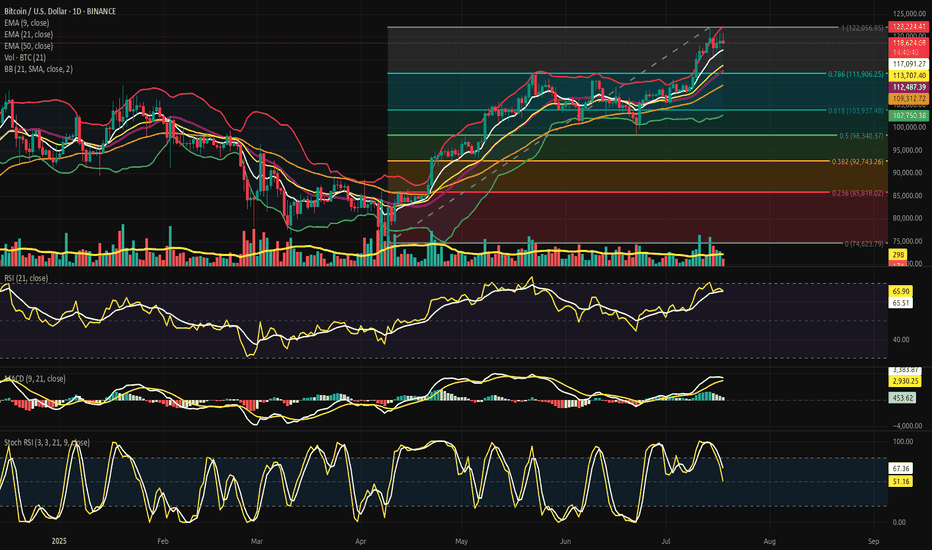

⟁ BTC/USD - BINANCE - (CHART: 1D) - (Jul 18, 2025).

◇ Analysis Price: $118,866.60.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1D):

▦ EMA9 - (Exponential Moving Average - 9 Close):

∴ EMA9 is currently positioned at $119,077.81, closely tracking the current price, acting as dynamic micro-support;

∴ The slope of EMA9 remains upward, with price consistently closing above it in the past sessions;

∴ Compression candles are forming above this line, suggesting it is being defended as a tactical floor.

✴️ Conclusion: EMA9 is structurally supportive, signaling short-term bullish control beneath compression.

⊣

▦ EMA21 - (Exponential Moving Average - 21 Close):

∴ EMA21 is placed at $118,537.29 and holds a clear upward slope;

∴ Recent pullbacks have tested the region near EMA21 but failed to close beneath it;

∴ EMA21 is establishing itself as the primary mid-range buffer zone within this bullish phase.

✴️ Conclusion: EMA21 confirms intermediate momentum preservation and mid-term trend integrity.

⊢

▦ EMA50 - (Exponential Moving Average - 50 Close):

∴ EMA50 is located at $116,804.80 and remains untouched during the current rally phase;

∴ The distance between EMA21 and EMA50 is widening, confirming structural momentum;

∴ This line now functions as the lower tier of the bullish envelope - a defensive anchor.

✴️ Conclusion: EMA50 reflects resilient bullish understructure and rising support basin.

▦ Fibonacci Retracement - (ATH = $122,056.95 / Low = $74,623.79):

∴ Price is currently positioned just under the 0.786 level, a classic tension zone before ATH retests;

∴ The 0.618 level has already been claimed and held as support, showing strength through key retracements;

∴ The market is coiling between 0.786 and 1.000 in preparation for decisive expansion or rejection.

✴️ Conclusion: BTC sits within the golden gate - structurally pressurized near final resistance thresholds.

⊢

▦ Bollinger Bands:

∴ Bands are visibly contracting, forming a volatility funnel around the current price zone;

∴ The price is maintaining proximity to the upper band without closing beyond it;

∴ The base band remains far beneath ($116k zone), indicating untriggered potential.

✴️ Conclusion: Volatility is compressing structurally; directional resolution is imminent.

⊢

▦ Volume + EMA21:

∴ Volume bars have declined steadily during this upper-range consolidation;

∴ EMA21 on volume confirms weakening participation relative to early July moves;

∴ Absence of breakout-volume suggests either stealth accumulation or passive stalling.

✴️ Conclusion: Volume behavior is non-confirmatory - the structure floats without conviction.

⊢

▦ RSI - (21) + EMA9:

∴ RSI(21) currently prints 60.45, above its own EMA9 at 59.41, suggesting net upward pressure;

∴ The RSI slope remains neutral-to-positive without entering overbought;

∴ The absence of bearish divergence confirms internal momentum coherence.

✴️ Conclusion: RSI structure is clean, moderate, and aligned with sustainable trend energy.

⊢

▦ Stochastic RSI - (3,3,21,9):

∴ K = 78.78 | D = 71.55 - both above 70, nearing the overbought ceiling;

∴ The fast line (K) shows minor inflection but no confirmed cross;

∴ Momentum is elevated, but historical context shows price can remain extended.

✴️ Conclusion: Momentum is entering saturation zone - caution on short-term exhaustion.

⊢

▦ MACD - (9,21):

∴ MACD line (540.52) remains above the signal line (414.93) in sustained bullish crossover;

∴ The histogram has begun flattening, indicating reduced acceleration;

∴ There is no bearish cross yet, but momentum build is slowing.

✴️ Conclusion: MACD supports bullish continuation, but thrust intensity is decaying.

⊢

▦ OBV + EMA9:

∴ OBV reads 71.13M and is currently flat, with no new highs in accumulation;

∴ EMA9 on OBV closely hugs the raw OBV line, confirming stagnation;

∴ Prior upward surges in OBV are not being extended, showing tactical pause in conviction.

✴️ Conclusion: Liquidity expansion has halted; OBV structure is tactically neutral.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The BTC/USD structure is entering a compressed apex between structural momentum (EMA stack, RSI, MACD) and tactical exhaustion signals (Stochastic RSI, Bollinger Band constriction, flattening OBV);

∴ Price is stabilizing just beneath the ATH gate ($122,056), indicating a threshold scenario - where breakout and rejection probabilities are approaching parity;

∴ Volume decline reflects the absence of forced participation, and suggests that the next move will be event-triggered or liquidity-engineered. The current environment favors volatility re-expansion, not trend reversal;

✴️ This is a threshold phase: structurally bullish, tactically suspended, awaiting ignition.

⊢

∫ II. On-Chain Intelligence – (Source: CryptoQuant):

▦ Exchange Netflow Total + EMA9:

∴ Current Netflow: -938 Bitcoins - sustained negative flow over time indicates coins leaving exchanges;

∴ Persistent outflows reflect holding sentiment and reduced immediate sell pressure;

∴ Price action shows historical upside alignment when netflows remain negative across clusters.

✴️ Conclusion: Exchange behavior signals macro holding bias, not liquidation cycles.

⊢

▦ Binary CDD + EMA9:

∴ Binary CDD has spiked into high activity zones in the past week, showing awakened dormant coins;

∴ This metric historically precedes localized tops when synchronized with weak flows;

∴ However, no consistent clusters are forming - signals remain scattered.

✴️ Conclusion: Binary CDD reflects isolated movements, not systemic awakening or distribution.

⊢

▦ Exchange Whale Ratio + EMA9:

∴ Current ratio hovers at ~0.62 - elevated but not extreme;

∴ Sustained whale activity near 0.60+ can precede volatility events;

∴ Trendline is rising since May, showing gradual uptick in dominance from top senders.

✴️ Conclusion: Whale activity is tactically elevated, implying latent strategic intent.

⊢

▦ Supply-Adjusted Dormancy + EMA9:

∴ Dormancy values are near historical lows, indicating old coins are staying inactive;

∴ EMA9 confirms a downward trend in dormant supply movement;

∴ Long-term holders are not distributing at this level.

✴️ Conclusion: Structural dormancy supports holder conviction - no exit signals from old supply.

⊢

▦ Realized Cap + EMA9:

∴ Realized Cap is now exceeding $1T, rising consistently without parabolic spikes;

∴ EMA(9) and line are in lockstep - a healthy ascent;

∴ No acceleration = no blow-off = sustainable revaluation.

✴️ Conclusion: Value accumulation remains organic, not euphoric.

⊢

▦ MVRV Ratio + EMA9:

∴ MVRV sits at 2.36 - below historical overvaluation levels (>3.0);

∴ EMA(9) confirms gradual slope upward, consistent with price;

∴ Ratio is not overheated - risk/reward remains structurally favorable.

✴️ Conclusion: MVRV indicates non-euphoric regime - mid-phase of value appreciation.

⊢

▦ BTC vs GOLD vs S&P500 - (BGemetrix Comparative Graph):

∴ BTC continues to outperform both GOLD and SPX in long-term slope, even after corrections;

∴ Current phase shows GOLD flattening and SPX slightly lagging BTC in verticality;

∴ This divergence hints at BTC leading in speculative rotation while traditional assets stabilize.

✴️ Conclusion: BTC holds macro-dominance position, operating as the apex volatility proxy in current intermarket structure.

⊢

🜎 Strategic Insight - On-Chain Oracle:

∴ Despite short-term compression, the on-chain structure reveals no distribution threats;

∴ Holder conviction, realized valuation, and MVRV slope all suggest controlled structural appreciation, not mania;

∴ Whales are tactically present, but dormancy and exchange flows confirm no mass exit;

∴ This is an internally coherent, tactically patient regime.

✴️ Bitcoin is preparing, not peaking.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish - Tactically Suspended:

∴ All key EMA's (9/21/50) are stacked and rising; price remains elevated yet non-parabolic;

∴ Fibonacci apex is active, with price compressing beneath the ATH zone ($122,056), not retreating;

∴ On-chain intelligence confirms long-term conviction, with no distribution from whales or dormants.

✴️ Conclusion: The system retains structural strength; pressure is latent, not expired. The architecture is bullish, not euphoric.

⊢

▦ Tactical Range Caution:

∴ Stochastic RSI and MACD show early-stage exhaustion;

∴ Volume has declined into apex, favoring liquidity traps or volatility bursts;

∴ Whale Ratio elevation implies pre-positioning behavior, not public confirmation.

✴️ Conclusion: Tactical maneuvering is dominant. Breakout potential exists but is not trustable until confirmed by volume and displacement.

⊢

⧉

Cryptorvm Dominvs · ⚜️ MAGISTER ARCANVM ⚜️ · Vox Primordialis

⌬ - Wisdom begins in silence. Precision unfolds in strategy - ⌬

⧉

⊢

$BTC/USDT daily chart $121K next.CRYPTOCAP:BTC just broke out of a descending wedge on the daily chart, a strong bullish signal.

It’s now holding well above key support and the 50-day moving average, showing buyers are in control.

If BTC stays above $106,400, we could see a move toward $121K next.

DYRO, NFA

BTCUSD Trade Setup Idea on 1D Timeframe - Bullish MomentumBitcoin (BTCUSD) is currently trading at $109,348, showing strong bullish momentum on the 1H chart. The recent breakout from consolidation signals potential continuation, provided key resistance levels are breached and held.

Must Consider Analysis Timeframe : 1Day.

Strictly follow the trading rules for Entry..... only on Retracement.

SL on Previous or Close swing low.

🔍 Key Levels to Watch:

Bullish Continuation Confirmation: If price sustains above 112,150, we expect bullish momentum to accelerate.

Target 1 (TP1): 112,150 – Key breakout level that may act as support once reclaimed.

Target 2 (TP2 - Major): 121,128 – Long-term resistance and major profit-taking zone.

📊 Trade Logic:

A confirmed breakout and hold above 112,150 indicates strong buyer interest and could drive price toward 116,572 and 121,128.

The trend remains bullish as long as price holds above the breakout structure.

REMEMBER:- RESPECT THE LEVELS, LELEVLS RESPECT YOU THEN.

💡 Strategy: Monitor for retests and bullish candle confirmations above 112,150 to add or enter long positions with proper risk management.

! Disclaimer & Important Note:

This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any financial instrument. All trading involves risk. We are not responsible for any kind of loss incurred, whether financial, emotional, or otherwise. Always do your own research and consult with a licensed financial advisor before making any trading decisions.

Trading involves significant risk, and you should never invest more than you can afford to lose. Past performance is not indicative of future results.

The trade idea shared above reflects personal market interpretation and is subject to change based on new market conditions.

Posted by: THEPATELCRYPTO, 45Degree

Stay safe. Trade smart.

Follow for more ideas!

📍Posted by: THEPATELCRYPTO, 45Degree

📈 Stay safe. Trade smart.

🔔 Follow for more ideas!

Short BTC, it is about to retrace and test 100000 again!As BTC gradually fell back, the rebound did not stand above 110,000 in the short term, proving that there is strong selling pressure above, and the trend line formed by the technical high point 111,000 and the second high point 110,000 formed an important resistance area, which limited the rebound space of BTC and strengthened the demand for BTC's short-term retracement.

According to the current trend, the short-term oscillation bottom area of 106,000 may be broken at any time. Once it falls below the oscillation area, it may arouse a certain degree of profit-taking chips and stimulate BTC to accelerate its decline. I think BTC will at least test the 105,000-104,000 area again during the retracement, and may even test the 100,000 integer mark again.

Therefore, shorting BTC is still the preferred option for current short-term trading.

Consider shorting BTC in the 108,000-109,000 area, and the target area in the short term is 104,500-103,500. After breaking this area, the target can be extended to 101,000-100,000.

BINANCE:BTCUSDT BINANCE:BTCUSDT BITSTAMP:BTCUSD

New buying opportunity may emerge for BTCBTC tends to fluctuate in the short term, but as BTC builds a double bottom structure to support the rebound pattern, it is currently inclined to fluctuate upward. Although the upward momentum has weakened after reaching around 106,000, as long as it stays above the 105,300-104,800 area, BTC is still expected to continue to rise and may challenge the 108,000-109,000 area again.

And with the collapse of the gold and oil markets, funds in the two markets may flow into BTC, which is more attractive and the mainstream market of cryptocurrencies. So as BTC retreats in the short term, BTC may have new short-term buying opportunities. Then if BTC retreats to the 105,500-104,500 area and does not fall below this area, we can consider going long on BTC at the right time.

BTC Volatility Range Shifts Upward: Focus on Shorting The volatility range is moving upward, rising from 101,500–105,000 to 104,000–107,000 📈. It’s advisable to focus on shorting at higher levels ⏬. Currently, BTC is still in a range-bound fluctuation—just control your trade position sizes properly, and there won’t be any major issues essentially 😊!

⚡⚡⚡ BTCUSD ⚡⚡⚡

🚀 Sell@107000 - 106000

🚀 TP 104500 - 103500

👇Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 👇

BTCUSD BULLISH CHART PATTERNHere I Created This BTCUSD Chart Analysis

Pair : BTCUSD (BITCOIN)

Timeframe: 15 - Minutes

Pattern: Parallel Channel

Momentum: Bullish/ Buy

Entry Level : BUY 103200

Support zone : 104800

Target Will Be : 104200

Disclaimer : This signal is based on personal analysis for learning purposes. Trade at your own risk and always use proper risk management.

BTC/USD 4H Chart Setup – Bullish Breakout Targeting $104K1. Trend Direction

⬆️ Uptrend Detected

* Price is forming higher highs and higher lows

* Trading inside a bullish channel

* Breakout potential above the top trendline.

2. Key Zones

🟦 Support Zone: $95,252.31

* Labeled as RBS + RBR ZONE

* Strong buy area → previous resistance turned support

* Perfect area to catch a bounce

📏 Support Line & Trendline

* Trendline keeps price supported along the climb

* Acts as a launch pad for the next move.

3. EMA 70 (📉 Red Line)

* Current value: $93,636.88

* Price is above EMA, showing strong bullish pressure

* EMA acts as dynamic support.

4. Trade Setup

🎯 Target Point: $104,000

🟦 Target Zone: $103,918.60 – $104,747.91

🔥 Entry Zone: $95,252.31 (marked blue box)

⚠️ Stop Loss: $94,091.28

* Positioned safely below support

* Good Risk/Reward Ratio.

5. Extra Cues

📅 Economic event icons near May 3–6 → Potential volatility ahead

⚡ Pullback in progress → May offer a buying opportunity.

Conclusion

🚀 Bullish Setup!

* Watch for a bounce from the blue demand zone

* Targeting $104K breakout

* Strong support + momentum = solid long opportunity.

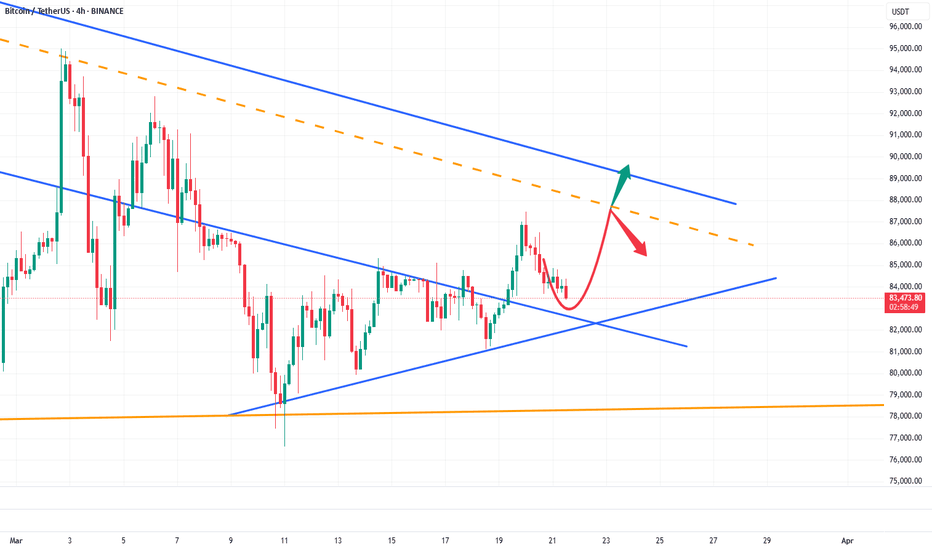

BTC Trade Idea — React, Don’t PredictBINANCE:BTCUSD

Smart Trading Requires Patience!

Bitcoin is currently undergoing a healthy correction.

Strong support is located around $87,500, and if confirmed by price action, it could offer a great buying opportunity.

Trading without a plan = gambling!

** Alternative Scenario:

If the $87,500 level breaks with strong confirmation, after a pullback to this zone, a short

opportunity could emerge.

Follow us for more professional insights!

#CryptoAnalysis #BTCUSD #TradingStrategy #Forex #Cryptocurrency

$BTC Long Setup | Entry @ 90700 | 15-20x Leverage | DCA FriendlyLooking to long BTC from the 90,700 zone with a high-conviction setup on support.

Trade Plan:

Entry 1: 90,700

Leverage: 15-20x

Setup: Price holding above key support with bullish structure forming on lower timeframes

Note: Leave room for DCA if price dips further

Monitor closely for reaction around support — tight SL recommended for capital protection.

Disclaimer: Not financial advice. DYOR and manage your risk accordingly.

BTC/USD Daily Technical Outlook – Approaching Cycle Top?Bitcoin is currently trading around $85,500, maintaining short-term bullish momentum within a well-formed ascending structure on the daily chart. The price is now entering a mid-phase rally, with a clear target of $98,000, a key resistance level that coincides with the upper boundary of a rising wedge formation and historical trend extension zones.

Key Technical Levels:

Immediate Resistance: $88,800 (local supply zone)

Major Target Zone: $97,000–$98,000 (macro resistance + psychological round number)

Short-Term Support: $82,000

Key Breakdown Level: $78,500

While the momentum suggests BTC may continue to push higher in the near term, the $98,000 resistance is likely to act as a distribution zone, where buying may slow and profit-taking increases. This level could falsely signal a breakout, leading to a spike in retail long positions before the market enters a longer-term correction phase.

If rejection occurs at or near $98,000, BTC could begin a multi-month correction, with the primary downside target set at $49,000 by July 2025. This level aligns with previous weekly support, volume profile lows, and would represent a typical deep retracement following a major cycle top.

Outlook:

Near-term bias: Bullish toward $98,000

Macro bias: Bearish reversal expected from resistance zone

Cycle correction target: $49,000 (Q3 2025)

Daily BITCOIN Bull Bear candles showing return of the Bulls ?I have used this chart often and have posted it here on a number of occasions with out the Bull Power Bear Power Histogram by CEYHUN active.

This is how the chart Looks when it is active.

This indicator calculates trading action to determine if a Candle is Bullish or Bearish and is VERY ACCURATE

And, Currently, Today's candle is GREEN, for the first time in a LONG TIME.

We can see how the candles have remained RED for most of the Drop in channel.

But now, while we sit on support on a Fib Speed Resistance Fan, we are GREEN.

Long Term, we can see that the climb back to current ATH could be tough. The VRVP on the right is clearly showing rising levels of resistance we climb higher.

Currently, we need to watch closely, to see that candle remain Green and that we do not loose support here.

I feel Bullish

BTC already has the conditions to hit the 90000-95000 zone!A few days ago, I mentioned that BTC had the potential to surge towards the 90000-95000 range. Currently, BTC has already climbed above 87000 during its rebound, effectively opening the door to the 90000-95000 zone.

From a fundamental perspective, with bearish factors becoming clearer, if Trump adopts a more lenient stance on tariffs, BTC could extend its rebound. On the technical side, BTC has successfully broken through the short-term resistance around the 85500 level, turning the 85500-84500 area into a short-term support structure. This transition further supports BTC’s continuation to the upside, potentially testing the 90000-95000 range.

For short-term trading, we can consider waiting for a technical pullback and looking to go long on BTC once it retraces to the 85500-85000 region. The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

BTC is expected to hit 85000-86000 again, or even higherBTC has once again built a strong double bottom structural support in the 82000-81000 zone. BTC is likely to continue to rise. Once it breaks through the short-term resistance area near 83600, BTC may usher in a wave of accelerated rise and has the potential to continue to the 85000-86000 zone.

So we can still go long on BTC in the 82500-81500 zone. In addition, once BTC rises as expected, it is likely to grab the market share of gold, so it may also accelerate the decline of gold to a certain extent. This is a point we must be careful about next.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

BTC:BTC is expected to continue to rise to 95000BTC has built a perfect upward structure in an oscillating upward manner, and has continuously strengthened the bottom support during the oscillation process. BTC is expected to continue to rise. However, BTC is facing the 88500-89500 resistance area, so BTC needs to accumulate energy to break through this resistance area, so we should focus on the 86500-85500 area support below. Once BTC touches this area and stops falling and rebounds, BTC is bound to break through the 88500-89500 resistance area and is expected to continue to 95000.

So in terms of short-term trading, if gold pulls back to the 86500-85500 area, we can go long on BTC.I will make more detailed trading plans and trading signals every day according to the real-time market situation, which is also the testimony of every successful transaction and profit of mine; the article has a certain lag, if you want to copy the trading signals to make a profit, or master independent trading skills and thinking, you can choose to join the channel at the bottom of the article

BTC: Accumulate energy for the rise and soar into the sky!📍BTC's volatility has narrowed, with selling pressure showing signs of weakening. Throughout the choppy price action, the 84000-83500 zone has established itself as a critical support area in the short-term structure. This level now serves as a key defensive line.

📍Following this consolidation phase, BTC may stage a rebound from this support region. If the price manages to break through the resistance around 84800 with strength, further upside momentum could drive it towards the 90000 level.

🔎Trade Idea:

BTCUSD:Buy at 83500-83000

TP:84500-85000

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

BTC: Capture buying opportunities accurately📍Fundamentals: From a macro perspective, with increased government endorsement, cryptocurrencies are gaining greater credibility and popularity in the market.

📍Technical Analysis:The downward momentum of BTC is showing signs of exhaustion, with multiple rebounds forming a structural bottom that provides strong support. Overall, the bullish trend remains intact. The key support zone to monitor is 83000-82000.

📌If BTC fails to break below this level in the short term, a rebound is likely, with upside potential targeting the 88000-89000 range.

🔎Trade Idea:

BTCUSD: Buy at 83000-82000

Target (TP):88000-89000

Stop Loss (SL):Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

BTC Buy at this Level - NFP News This Week (Volatility Risk!)Short term Buy idea on Bitcoin. This is a riskier idea because:

A) BTC is showing signs of Weakness (so we are counter trend trading)

B) This idea is based on NFP news timing

I may wait until Monday to get clarity (unless you also trade on the weekend)

Overall Idea for this is:

- W1/M candles have big rejection wicks to the downside, retesting the previous Week's wick, hinting at some Buyside potential

- We see divergence with ETH.

- The LTF H4 shows a Break of Structure, momentum move to the upside.

- We've already had a retracement down after, and it validated the gap in price (blue zone), reacting off it, hinting that it will hold.

- Now I'm waiting for the next best price to enter.

Again, NFP volatility can create bigger than usual spikes, so keeping that in mind.

If NFP takes it higher without coming to a better price, so be it - the train will leave without me. Will wait for further PA.

Price will be giving the validation to enter.

Bitcoin at $80,000. A Defining Crossroads: $65,000 or $120,000?Bitcoin stands at a critical juncture at $80,000, where market participants are engaged in a decisive battle between bullish momentum and bearish resistance. The outcome of this struggle will shape the next major move, with two distinct scenarios emerging.

Scenario 1: A Retracement Toward $65,000

If Bitcoin fails to maintain its current momentum, profit-taking and increased selling pressure could lead to a decline toward $65,000. This level serves as a crucial support zone, where demand may re-emerge to stabilize the price before any potential recovery. A break below this threshold would signal a deeper correction, potentially delaying any further upside in the near term.

Scenario 2: A Breakout Toward $120,000

For Bitcoin to sustain a move toward $120,000 by late March or early April, the market must see uninterrupted buying pressure over the next 10 days. There can be no hesitation—buyers need to absorb selling liquidity consistently, preventing any major pullbacks. The key level to watch in this scenario is $109,000, a major resistance zone that has the potential to act as the final barrier before BTC enters price discovery. A clean break and consolidation above this level would significantly increase the probability of an accelerated move toward $120,000.

At this stage, Bitcoin is at a make-or-break point, and the direction it takes from here will set the tone for the coming weeks. Whether it experiences a healthy correction or an explosive rally depends entirely on how market participants respond at these critical price levels.