Just In: Bitcoin ($BTC) Reclaims $90,000 The world's renown digital asset Bitcoin ( CRYPTOCAP:BTC ) surged nearly 4% today to reclaim the $90k resistant zone, amidst breaking out of a bullish symmetrical triangle pattern enroute to $100k.

Bitcoin for almost 1 month now has been swinging within the $80k price range, since losing it's $100k resistant in the month of February, 2025 but with increasing momentum a move to the $100k resistant doesn't seem far fetch because CRYPTOCAP:BTC has already broken the ceiling of the symmetrical triangle.

With the 4-hours RSI at 79, we may experience a respite before the major leap to $100k price point. Notable firms like Micro strategy and Michael Saylor the CEO were integral in this price movement.

The company purchased 6,556 CRYPTOCAP:BTC for ~$555.8 million at ~$84,785 per bitcoin and has achieved CRYPTOCAP:BTC Yield of 12.1% YTD 2025. As of 4/20/2025, Micro strategy holds 538,200 CRYPTOCAP:BTC acquired for ~$36.47 billion at ~$67,766 per bitcoin.

Notably, financial bodies like Standard Chartered Bank says Bitcoin ( CRYPTOCAP:BTC ) could reach a new all-time high due to concerns over the Federal Reserve's independence.

As of the time of writing, CRYPTOCAP:BTC is up 3.70% currently trading at $90,715 per CRYPTOCAP:BTC setting the coast for $100k resistant.

However, on bearish tone, should CRYPTOCAP:BTC fail to pull up that stunt, a price correction might send CRYPTOCAP:BTC back to FWB:83K support.

Btcusdbuy

BTC & ETH Weekly Forecast – Will Week 16 Bring a Breakout?🔍 Weekly Outlook – Week 16, 2025

• BTC remains below the daily Ichimoku Cloud.

• Volatility (BBWP) is at historical lows — potential breakout setup.

• ETH hovering above key EVWMA zones

• If BTC enters the cloud, 92K becomes a valid short-term target.

• ETH needs to reclaim 1600+ to sustain bullish momentum.

📌 This is a quick overview of my weekly analysis.

I explore the full setup across 1D, 4H, and 12H timeframes,

with Ichimoku, BBWP, and EVWMA discussed in detail elsewhere.

Bitcoin Is Entering Into The New ImpulseHello, Skyrexians!

We hope you remember our previous BINANCE:BTCUSDT analysis where we told you that Bitcoin will not go significantly lower than $77k. Now price is already at $85k and people now can't understand what is happening. We can see a lot of charts where traders are calling for bear market and further deep dive.

On the daily time frame we can see the clear picture. At $110k the previous impulse has been finished. Bearish divergence on the Awesome Oscillator and two red dots on the Bullish/Bearish Reversal Bar Indicator were the sign of large correction ABC. Now it has been finished with the confirmation with opposite signals. Moreover, wave C has been finished inside the Fibonacci target area. We are 90% sure now that Bitcoin is going to ATH now and this time it can happen with the altcoins growth.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

BITCOIN Smart Money SetupPrice reclaimed a key support zone with a bullish structure shift (CHoCH), followed by a strong rally into a premium resistance area. Volume confirms the push with increased participation. Multiple timeframes show bullish sentiment, and a potential continuation is in play unless rejection from the current resistance zone triggers a reversal. Watch for reaction and volume cues.

Where is Bitcoin Now ? Daily and 4 hour chart - BULLISH

On this chart, the Bold While rising lines are the upper and Lower Trendlines of the Ascending channel

The Blue Dashed line is tha current ATH line

PA finally reached the Lower trend line having spent Months in a controlled descent from the ATH in January. PA attempted to rise over the Local line of resistance ( dashed white line) on a number of occasions but was defeated.

This is probably duwe to the Bulls as that Fib circle we were heading towards was possibly Strong and they wanted to wait until we had the support of the Lower rising Trend line.

And, as you can see, we still got defeated when that Fib circle Met the rising line of support and PA Fell below..But thankfully, we had that 2.272 Fib extension to bounce off.

The battle we now have, is trying to reclaim that rising line as Support. ( Arrow)

And for Days now, we have attempted , Failed, reattempted.

The BEARS are determined.

However, Bitcoin Bulls have the advantage here.

The 4 hour shows more detail

This weekend offers the best chance of reclaiming this line as support.

PA has the strength of a Neutral MACD on the weekly, a Strong RSI and turning Sentment

LETS GO

BITCOIN WEEKLY ANALYSIS - April 18th, 2025BTC/USD is currently hovering just below a major descending trendline and key horizontal resistance near the 91,500 level. 🧱

🔍 What We’re Watching:

- Price has tested the downtrend line multiple times — the structure is weakening.

- A breakout above 87,500 could trigger a strong bullish move.

- Until then, "Wait for the Breakout" remains the strategy. No confirmed long entries yet.

📉 Current Price: $84,500

📈 Breakout Confirmation: Clean close above resistance zone + volume spike = 🔥🔥 potential rally.

🧠 Pro Tip: False breakouts are common. Watch for confirmation — not just a wick!

Stay sharp, stay patient. Breakouts give the best reward-risk trades! 💹

BTC LONG TP:91,000 15-04-2025🚀 Time to go Long! Targets are set between 90,000 and 91,000, with the 4-hour and 8-hour timeframes showing a strong bullish trend.

We expect this movement to materialize within 2 to 3 days, so be sure to enter and average down as needed.

Stay tuned for updates to optimize your gains. Follow me to stay informed, and let’s work together to boost those profits! 💰🔥

Waiting for a big boost for the market, over 90K BTC💎 BTC PLAN UPDATE (April 16)

First of all, congratulations to the investors. Everything went according to our trading plan and we had very good comments. Specifically, yesterday the price fell from the 86k area straight to 83k. We had more than 3000 prices together. Today's BTC trading plan did not change much.

NOTABLE NEWS ABOUT BTC:

According to Bloomberg, Bitcoin (BTC) mining hardware manufacturer Bitdeer is preparing to launch its own mining operation in the United States (US). The company intends to speed up the shipment of equipment following President Donald Trump's announcement of a 90-day tariff suspension. In addition, the pressure from tariffs has led to a decrease in Bitcoin mining hashrate among miners in the United States over the past month.

TECHNICAL VIEW

Bitcoin has faced multiple rejections around the 200-day exponential moving average (EMA) at $85,000 since Sunday. On Tuesday, BTC attempted to break above this level but was rejected and fell 1.12%. At the time of writing on Wednesday, the price was hovering around $83,500.

If BTC closes above $85,000 on a daily basis, it could extend its rally to the psychologically important $90,000 level. A successful close above this level could extend the rally to test the March 2 high of $95,000.

Please continue to pay attention to the 84.2k resistance zone, this is an important resistance zone before we DCA to higher and more important areas

==> Comments are for reference only. Wish investors successful trading

#BTC/USDT#BTC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 82900.

We have a downtrend on the RSI indicator that is about to break and retest, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 83240

First target: 85150

Second target: 86435

Third target: 87858

#BTC/USDT#BTC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 74,300

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 79,056

First target: 80,422

Second target: 81,950

Third target: 84,000

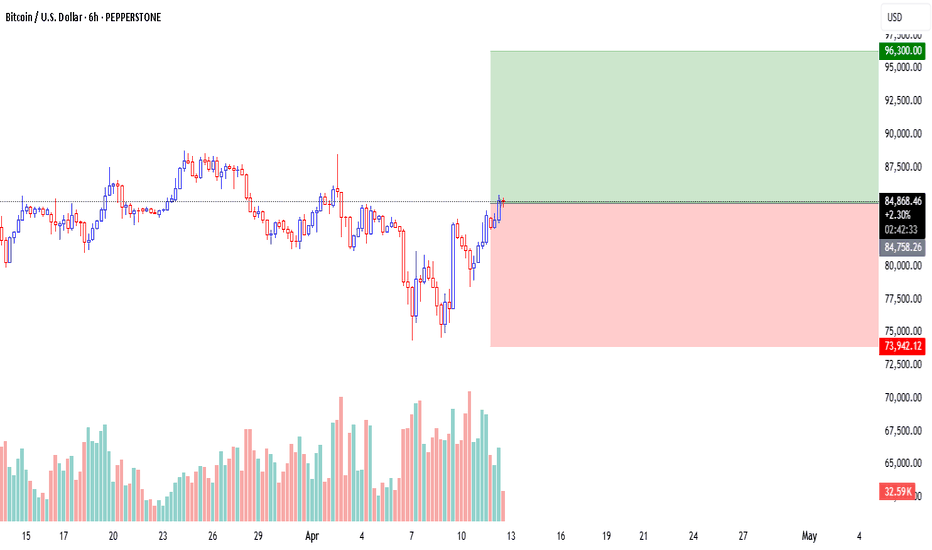

BTC LONG TP:88,200 13-04-2025🚀 It's time to go Long! The targets are set between 88,000 and 88,300, with the 1-hour and 2-hour timeframes showing a clear bullish pattern in favor of this trend.

We expect this movement to materialize within a timeframe of 20 to 25 hours, so make sure to enter and average down.

Stay tuned for updates to maximize your gains. Follow me to stay informed and add those greens! 💰🔥

If BTC pullsback to 80K, DO NOT PANIC -Here is why

Very simply, Bitcoin recently broke over the line of resistance ( dashed line) that has kept it down since the ATH at the beginning of the year.

As you can see, it has not yet returned to that line on a larger time scale chart, to retest it as support. It did do that on a 4 hour chart but maybe we are about to see that on a daily to, just to check how strong it is.

After all, things are very uncertain right now in many ways.

The Federal Reserve of the Usa has a speech day tomorrow and so this may act as a catalyst, one way or another.

Bitcoin Weekly MACD is in a position of strength now

And we have seen a positive reaction of PA already, if a little subdued while we wait for the Macro environment to calm down

The Histogram is looking Bullish though this can change quickly but over all, we are in a very good place right now.....

So, Worry not if PA drops some in the next 24 hours.

If we loose 78K, then get a little uncertain.

The next level of support below that is the 2.272 fib extension at 76900 - we do not want to loose that one for too long but I doubt we will get there, providing Macro stays steady

So, Chill out and let see what happens tomorrow with the FED speech.

BTC/USD Daily Technical Outlook – Approaching Cycle Top?Bitcoin is currently trading around $85,500, maintaining short-term bullish momentum within a well-formed ascending structure on the daily chart. The price is now entering a mid-phase rally, with a clear target of $98,000, a key resistance level that coincides with the upper boundary of a rising wedge formation and historical trend extension zones.

Key Technical Levels:

Immediate Resistance: $88,800 (local supply zone)

Major Target Zone: $97,000–$98,000 (macro resistance + psychological round number)

Short-Term Support: $82,000

Key Breakdown Level: $78,500

While the momentum suggests BTC may continue to push higher in the near term, the $98,000 resistance is likely to act as a distribution zone, where buying may slow and profit-taking increases. This level could falsely signal a breakout, leading to a spike in retail long positions before the market enters a longer-term correction phase.

If rejection occurs at or near $98,000, BTC could begin a multi-month correction, with the primary downside target set at $49,000 by July 2025. This level aligns with previous weekly support, volume profile lows, and would represent a typical deep retracement following a major cycle top.

Outlook:

Near-term bias: Bullish toward $98,000

Macro bias: Bearish reversal expected from resistance zone

Cycle correction target: $49,000 (Q3 2025)

BTCUSD – Bullish Breakout Loading ?

📈 *Bitcoin Daily Chart Analysis – April 14, 2025*

Bitcoin is looking 🔥 as it pushes higher from a key **accumulation zone** after a sharp recovery from recent lows. The previous **rising channel** was broken to the downside, but now the price is forming a solid **bullish structure**, suggesting a strong comeback is in play!

---

### 🔍 Technical Highlights:

- ✅ **Demand Zone Bounce:** Clean rebound from the highlighted green box (accumulation area), signaling buyer strength.

- 📈 **Higher Highs Incoming?** Price is now consolidating near **$85,000**, with bullish momentum building.

- 📊 **Upside Target:** Eyes on $87,000 → $88,500 if momentum sustains and daily closes continue above resistance.

- 📌 **Key Support:** $84,000 holds the line — invalidation below that would shift bias.

---

### 🧠 Trader's Insight:

The structure is setting up for a **potential bullish continuation**. Momentum traders should watch for a confirmed break and close above $85,400 for further upside! 🚀

💬 *"Patience in accumulation pays in breakout."*

Ready to catch the next leg up? 📲 Let’s trade smart and ride the wave.

Short - term Upside & Mon. Outflow RiskAnalysis of the Price Trend of Bitcoin 📈: Short - term Upward Expectations 💰 and the Risk of Capital Outflow on Monday 💸

The current price of BTC is at 84,500 points. 📊

Considering various factors comprehensively, there is a possibility that the price will rise to around 86,500 points tomorrow. 🚀 This could be due to factors like positive market sentiment or recent trends in the cryptocurrency space. 💰

However, when other markets open on Monday, the situation of a large amount of capital flowing out to other trading fields also deserves attention. 😟

Especially the flows to the XAU/USD and USOIL markets, or other foreign exchange markets. 💱 The movement of funds to these areas might be influenced by economic news, geopolitical events, or simply portfolio re - balancing by investors. 📰

💰💰💰 BTCUSD 💰💰💰

🎯 Buy@84000 - 84500

🎯 TP 85500 - 86500

Recently, the market has been extremely volatile 😱, which has led to the clearing of many traders' accounts or significant losses 😫. You can follow my signals and gradually recover your losses and achieve profitability 🌟💪.

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

Time to get Bitcoin Range in perspective again -where are we ?

This chart clearly shows us where BTC PA is in relation to the ATH it created in Early 2025.

PA sits just above centre line of current Lower range box.

There is still a Long way to go, against some strong resistance, to get back into the upper Range box and to that ATH line

We will manage it, I have no doubt about that But we may get to top of current Range box and be rejected before that time comes.

There are a number of different scenarios that exist right now and it is next to impossible to pin point when we may reach higher, to a New ATH.

My Feeling is that we will hit top of this current range box in the near future ( in april )

From that point, we have to weigh up the Macro and Sentiments of Markets and see.

But for now, Bitcoin PA is with Strength and has tha bility to reach higher.

I am still Bullish fora Cycle ATH in Q4

Bitcoin (BTC/USD) Long Trade Setup – Breakout Strategy with TargCurrent Price: $80,724.28

Entry Point: $80,671.23 (just above current price)

Stop Loss: $78,052.44

Target Point: $88,573.60

Resistance Point: $82,260.90

📈 Trend & Moving Averages

EMA 30 (red): $80,220.87 — Short-term trend.

EMA 200 (blue): $80,788.61 — Long-term trend.

The price is currently between the EMAs, indicating potential indecision or a shift in trend. A break above both EMAs with momentum would confirm bullish strength.

🔑 Trade Setup Summary

Element Level

Entry 80,671.23

Stop Loss 78,052.44

Target (TP) 88,573.60

Resistance 82,260.90

Risk-Reward ~1:2.7 (approx)

📊 Analysis & Expectations

Bullish Bias: The chart suggests a long trade with a breakout strategy.

Volume and momentum confirmation will be key above resistance.

Resistance at 82,260.90 may cause a brief pullback before continuation to the target.

The stop loss is well-placed below a support zone and the most recent swing low.

✅ What to Watch For

Break and close above EMA 200 and resistance at 82.2K.

Bullish volume increase on breakout.

Price action around the entry zone (wait for confirmation candle if unsure).

Bitcoin Trade Setup: Bullish Breakout Targeting $87K!🔹 Key Levels Identified:

📌 Target Point: 87,008.21 USD 🏁🔵

👉 Expected price move (+9.07%) 🚀

📌 Entry Point: 79,719.00 USD ✅

👉 Suggested buying level in demand zone 🏦

📌 Stop Loss: 78,213.25 USD ❌🔻

👉 Risk management level 📉

📊 Technical Analysis:

📈 Trendline Support:

🔵 The price bounced off the trendline 📊, confirming an uptrend 📈

🔵 Demand Zone:

🟦 Marked blue area = Buyer interest 📊

💰 Expected reversal zone if price retests

📊 Moving Average (DEMA 9):

🔸 82,343.85 USD (current level)

🔺 Price slightly below DEMA ➝ possible bullish reversal 🚀

⚡ Trade Setup:

✔️ Risk-to-Reward Ratio:

🟢 Potential profit: +7,220.76 USD

🔴 Risk: -1,500 USD

📊 Favorable trade setup with high reward vs low risk ✅

✔️ Momentum Confirmation:

🟢 Above 79,719 USD = 🚀 Bullish breakout

🔴 Below 78,213.25 USD = ❌ Stop Loss triggered

🔮 Conclusion:

🔥 Bullish setup if price holds demand zone!

🚀 Target: 87,008 USD

⚠️ Manage risk with stop loss! 📉