Bitcoin in Tactical Suspension - Beneath the Compression Veil.⊣

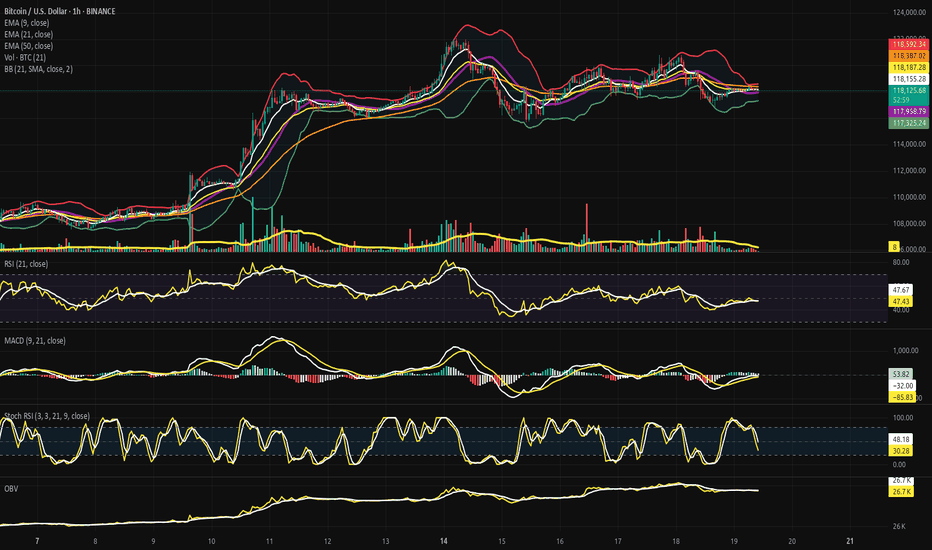

⨀ BTC/USD – BINANCE – (CHART: H1) – (July 19, 2025).

◇ Analysis Price: $118,192.34.

⊣

⨀ I. Temporal Axis - Strategic Interval - (H1):

▦ EMA9 - (Exponential Moving Average - 9 Close):

∴ Price: $118,192.34 | EMA9: $118,176.07;

∴ EMA9 is currently being pierced by price - neither clearly above nor decisively rejected;

∴ The EMA9 has flattened - signaling short-term equilibrium tension, not momentum dominance;

∴ Price candles are compressing into the EMA9 without thrust - indecision at the microstructure.

✴️ Conclusion: Logic sealed - EMA9 reflects tactical stalling; energy coiled at surface level.

⊢

▦ EMA21 - (Exponential Moving Average - 21 Close):

∴ EMA21: $118,199.53 - now above current price, acting as immediate tactical resistance;

∴ A minor bearish slope is forming in EMA21, reflecting recent downside pressure;

∴ Price failed to sustain any candle close above this level in the last 5 sessions - confirming resistance activation.

✴️ Conclusion: Logic sealed - EMA21 has turned from guide to barrier; tactical trend favors compression below.

⊢

▦ EMA50 - (Exponential Moving Average - 50 Close):

∴ EMA50 stands at $118,400.31, well above both price and the shorter EMA's - defining a ceiling of short-term exhaustion;

∴ Its curve is turning sideways, indicating that dominant upward momentum has faded;

∴ The last time price touched EMA50 was during the failed attempt to reclaim the upper Bollinger band - sign of rejection.

✴️ Conclusion: Logic sealed - EMA50 confirms the upper boundary of compression; the short-term trend remains capped.

⊢

▦ Bollinger Bands - (21 SMA, 2 Standard Deviations):

∴ Current BB range:

• Upper Band: $118,586.19;

• Lower Band: $117,291.33;

• Midline - (SMA21): $117,938.76;

∴ Price sits marginally above the midline, but beneath the upper band - indicating a neutral stance within the envelope;

∴ Bands are in a state of mild contraction, reflecting reduced volatility and lack of decisive breakout pressure;

∴ Price has failed to close above the upper band on multiple attempts, suggesting exhaustion without thrust;

✦ Tactical Signal:

• The flattened curvature of the bands and the centering of price near the midline indicates that the market is in compression;

• This condition favors mean-reversion trades or breakout anticipation setups, but lacks directional conviction;

• No squeeze pattern is imminent - but energy is coiling slowly.

✴️ Conclusion: Logic sealed - Bollinger structure is balanced, with compression overtaking directional thrust; breakout not yet awakened.

⊢

▦ Volume + EMA21 - (Tactical Volume Profile H1):

∴ The latest H1 volume candle registers 9 (unit scale), significantly below the average trend of the prior days;

∴ There has been a consistent decline in volume since the spike observed near the $120k rejection zone - participation is fading;

∴ Volume EMA21 is now visibly above most recent volume bars, signaling that market energy has dropped beneath its tactical baseline;

✦ Tactical Diagnosis:

• A market with low volume near compression zones often reflects lack of initiative, not calm;

• The absence of sellers is not strength - it is hesitation;

• The lack of follow-through volume confirms that current price action is drifting, not being driven.

∴ No volume-led breakout is forming - the structure is floating within silence.

✴️ Conclusion: Logic sealed - tactical volume profile confirms stasis; market awaits external spark to ignite movement.

⊢

▦ RSI (21) + EMA9 - (Relative Strength Index – H1):

∴ RSI value: 48.13, EMA9 of RSI: 47.86 - both seated precisely on the neutral axis (50), indicating momentum equilibrium;

∴ RSI has been flatlining between 45/50 for several hours, reflecting a lack of directional force from both bulls and bears;

∴ The minor bullish crossover of RSI over its EMA9 is present, but lacks slope, strength, or historical reliability in the current formation;

✦ Interpretation Layer:

• This is a classic pause zone - RSI not weak enough to signal reversal, not strong enough to suggest advance;

• The close proximity of RSI and its EMA9 suggests a market suspended in technical indecision;

• No bullish or bearish divergence is visible - just momentum silence.

∴ Tactical RSI echoes the broader reading: structure without drive, energy held in restraint.

✴️ Conclusion: Logic sealed - RSI reflects equilibrium; momentum direction is undefined and dormant.

⊢

▦ MACD (9,21) - (Tactical Momentum Engine - H1):

∴ Current MACD Line: (+165.21), Signal Line: (+188.36) - forming a bearish crossover, with the MACD line now trailing the signal line for multiple candles;

∴ The histogram is negative and expanding, confirming that bearish momentum is actively growing, not stalling;

∴ The slope of the MACD line has turned definitively downward, with no flattening in sight - this indicates a sustained momentum bleed;

✦ Tactical Interpretation:

• The momentum crest occurred near $119,700, and since then, MACD has been fading consistently;

• Price has failed to reclaim the MACD highs despite proximity, suggesting a divergence in effort vs. energy;

• This is not a false cross - but a validated tactical downturn with histogram acceleration.

∴ The engine beneath the structure is declining in output - the wheels turn, but they no longer drive.

✴️ Conclusion: Logic sealed - MACD confirms tactical momentum decay; the engine is reversing beneath the surface.

⊢

▦ Stochastic RSI (3,3,21,9) - (Short-Term Momentum Oscillator - H1):

∴ %K: 51.29, %D: 68.32 - a confirmed bearish crossover has occurred, with %K now beneath %D and both values descending;

∴ The oscillator has recently exited the overbought region (>80) and is now transitioning through the mid-zone, reflecting short-term loss of thrust;

∴ Price has failed to respond to prior overbought readings with continuation — indicating momentum dissipation without execution;

✦ Microstructure Insight:

• The current descending arc of %K + %D shows that micro-traders are unwinding positions;

• The zone between 50/70 is a tactical fading region, not a place of strength;

• Absence of a rebound in %K suggests that short-term buyers are standing down.

∴ This oscillator confirms that momentum is not only absent - it is actively declining at the tactical level.

✴️ Conclusion: Logic sealed - short-term momentum cycle is unwinding; compression reigns over velocity.

⊢

▦ OBV + EMA9 - (On-Balance Volume with Tactical Smoothing - H1):

∴ Current OBV: (–89.21K, EMA9 of OBV: –89.02K) - OBV remains slightly below its moving average, indicating a net negative flow of volume;

∴ While price has drifted sideways, OBV has continued to tilt downward, reflecting silent capital outflow beneath surface price stability;

∴ There is no upward curvature or crossover attempt - the OBV line remains submissive, signaling passivity or tactical retreat from market participants;

✦ Strategic Implication:

• The sustained divergence between OBV and price implies that larger hands are not accumulating - rather, they are disengaged;

• This condition often precedes fake breakouts or downward drifts, especially when unconfirmed by volume or RSI;

• The EMA9 serving as a lid rather than support confirms that internal flow is structurally bearish at the H1 frame.

∴ The tactical OBV structure reveals the undercurrent: orderless and hollow, despite price still holding ground.

✴️ Conclusion: Logic sealed - OBV confirms quiet withdrawal of pressure; tactical structure lacks foundational support.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The H1 tactical frame reveals a market in constrained inertia - price floats between short-term EMA's, yet every major momentum engine (MACD, Stochastic RSI, OBV) confirms internal recession;

∴ EMA's no longer guide - they constrain;

∴ Bollinger Bands contract - but hold no breakout;

∴ Volume is absent - and OBV confirms retreat;

∴ The chart is alive in form, yet dead in force;

∴ No element acts as initiator - only sustainers remain;

∴ The next tactical move must emerge externally, not organically.

✴️ Conclusion: The Tactical Oracle speaks - market energy is sealed beneath compression; movement is possible, but currently unprovoked.

⊢

▦ Structurally (H1):

✴️ Structurally: Neutral.

∴ Price floats near EMA9, below EMA21 and EMA50 - without rejection or breakthrough;

∴ No directional dominance has been established in the current cycle;

∴ Compression prevails over construction - this is not collapse, but pause.

✴️ Conclusion: Logic sealed - the structure is balanced but unsustained; no active trend is in command.

⊢

▦ Tactically: Suspended under Soft Compression:

∴ Momentum indicators (MACD, Stoch RSI, OBV) are all aligned in tactical decay - no upside thrust is evident;

∴ Volume remains below threshold and fails to accompany price fluctuations - a sign of apathy, not conflict;

∴ Price is trapped between EMA's and centered within Bollinger range - with no pressure buildup for breakout.

✴️ Conclusion: Logic sealed - the market is in tactical suspension, drifting within a soft compression chamber; movement requires external ignition.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Wisdom begins in silence. Precision unfolds in strategy - ⌬ ⚜️

⧉

⊢