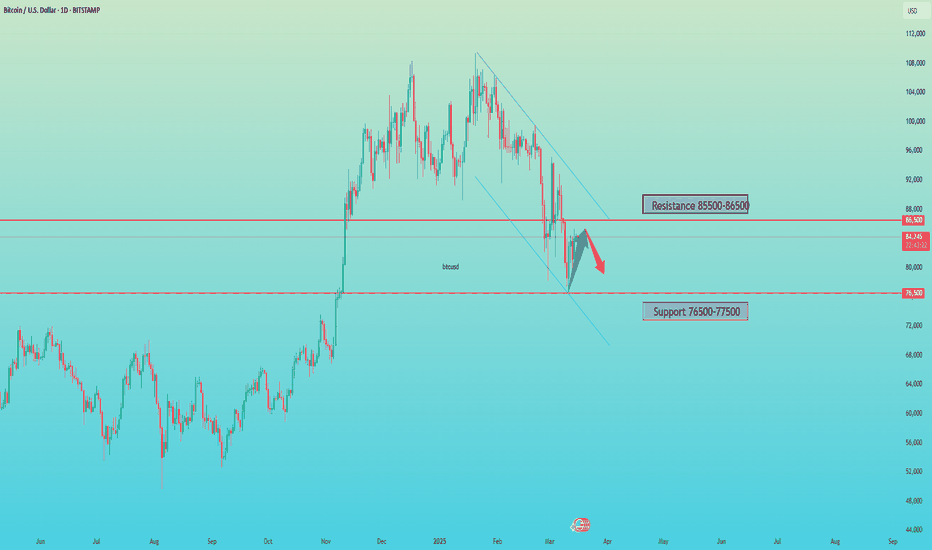

BTCUSD Analysis StrategyBitcoin prices are currently hovering around $84,000 as the market's bull-bear struggle intensifies.

In the short term, Bitcoin remains in a sideways consolidation and base-building phase. Traders are advised to remain nimble and adjust strategies based on the actual breakout direction.

Bitcoin Trading Strategy

sell @ 87000

buy @ 81500,78500

Finally, I'd like to remind every investor that the cryptocurrency market is inherently highly volatile, and every decision you make may have an impact on your investment returns.

you can visit my profile for free strategy updates every day.

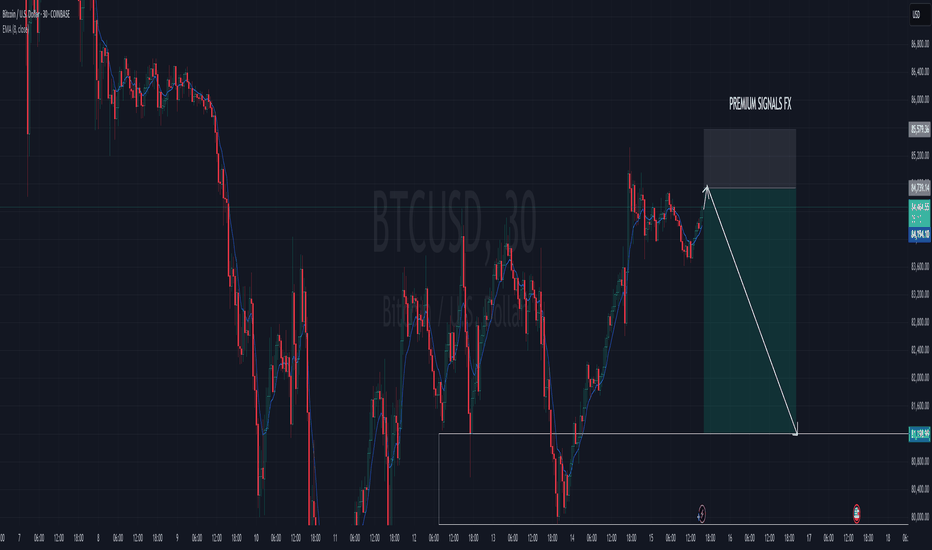

Btcusdshort

BTC Today's strategyThe support level for Bitcoin has started to move upwards. Currently, the market is still trading in the range of 80K to 85K. The consecutive short bets I have offered have also been profitable many times

If you are currently unsatisfied with the bitcoin trading results and are looking for daily accurate trading signals, you can follow my analysis for potential assistance.

Today's BTC trading strategy:

btcusdt sell@85K-87K

tp:83K-81K

Bitcoin (BTC/USDT) Short Trade Setup | 30-Min Chart AnalysisThis chart is a Bitcoin (BTC/USDT) 30-minute timeframe trading setup from Binance on TradingView, showing a short (sell) trade setup with a stop loss, entry, and multiple take profit (TP) levels.

Key Observations:

Indicators Used:

200 EMA (blue line at 83,177.82 USDT) – Long-term trend indicator.

30 EMA (red line at 84,064.45 USDT) – Short-term trend indicator.

Trade Setup:

Entry: 84,423.01 USDT

Stop Loss: 85,315.76 - 85,330.89 USDT (Above the recent high)

Take Profit Levels:

TP1: 84,064.45 USDT

TP2: 83,953.94 USDT

TP3: 83,439.48 USDT

Final Target: 81,850.69 USDT

Market Context:

Price recently tested the 30 EMA and is potentially rejecting it.

Bearish outlook: If price fails to break higher, it may drop to TP levels.

Risk-to-Reward Ratio (RRR): Favorable since the potential reward is significantly greater than the risk.

Possible Trading Plan:

✅ Entry at 84,423.01 USDT

✅ Stop Loss at 85,315.76 USDT (to protect capital)

✅ Take Profits at TP1, TP2, TP3, or full exit at 81,850.69 USDT

Would you like further insights or adjustments on this trade?

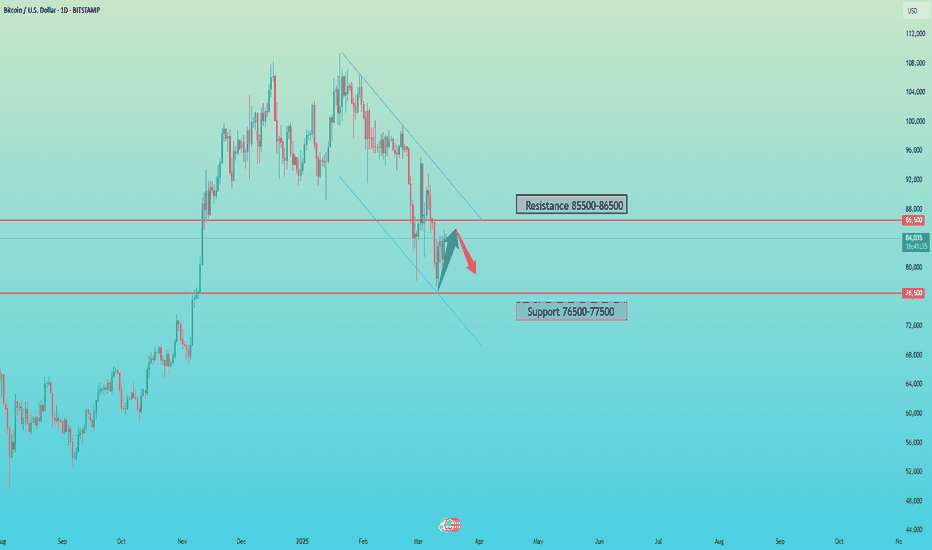

BITCOIN (BTC/USD)BTC/USD – Technical Outlook

Bias: Bearish

BTC/USD has completed the ABCD pattern and is now printing lower highs and lower lows, confirming a shift in market structure to bearish.

Price is currently retesting a previous support, now turned resistance. If this level holds, it could open the door for continued downside; with the 68K–50K zone as a potential BTD (buy-the-dip) area.

TARGET 1 (78K):

A key structural zone. A clean break and close below this level would confirm bearish momentum and increase the likelihood of price falling.

TARGET 2 (66K):

Likely to act as a magnet; a previous resistance turned support that launched price toward 100K. A return here would retest the foundation of the previous rally to 100k.

TARGET 3 (50K):

From a fractal and psychological standpoint, double tops often retrace to the origin of the bullish move. In this case, around the 50K zone.

Invalidation:

A reclaim of 85K–90K would shift bias back to bullish, signalling potential for upside momentum.

BTC Today's strategyAt present, BTC is still fluctuating in the range of 80K-85K. This week, after reaching around 85K many times, it started to fall, and the consecutive short bets I provided also made profits many times.

If you are currently unsatisfied with the bitcoin trading results and are looking for daily accurate trading signals, you can follow my analysis for potential assistance.

Today's BTC trading strategy:

btcusdt sell@85K-87K

tp:83K-81K

BTC/USDT "Bitcoin vs Tether" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BTC/USDT "Bitcoin vs Tether" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 93000

🏁Sell Entry below 84000

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 88000 (swing Trade Basis) for Bullish Trade

🚩Thief SL placed at 92000 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 11000 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 68000 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future Prediction:

BTC/USDT "Bitcoin vs Tether" Crypto market is currently experiencing a Neutral Trend (slightly Bearish🐼),., driven by several key factors.

1. Fundamental Analysis⭐⚡🌟

Fundamental analysis evaluates Bitcoin’s intrinsic drivers:

Adoption Trends:

Institutional inflows via Bitcoin ETFs remain strong, with $1.5 billion added in Q1 2025. MicroStrategy holds 300,000 BTC, reinforcing corporate adoption—bullish.

Regulatory Environment:

The U.S. signals a pro-crypto stance with talks of a strategic Bitcoin reserve, boosting confidence—bullish. However, global regulatory uncertainty (e.g., EU tax proposals) adds mild bearish pressure.

Halving Impact:

Post-2024 halving (April), supply issuance dropped to 450 BTC/day. Historical patterns suggest price appreciation 12-18 months later, supporting a bullish outlook for 2025.

Network Usage:

Transaction volume is up 10% year-over-year, driven by Layer 2 solutions (e.g., Lightning Network)—bullish for utility and value.

Inflation Hedge Narrative:

With U.S. inflation at 3.0%, Bitcoin’s appeal as a store of value grows—bullish, though tempered by short-term risk-off sentiment.

Detailed Explanation: Fundamentals are strongly bullish long-term due to adoption, supply scarcity, and macro trends. Short-term bearish pressures from regulatory uncertainty and profit-taking explain the current dip to 87,000.

2. Macroeconomic Factors⭐⚡🌟

Macroeconomic conditions influencing BTC/USD:

U.S. Economy:

Fed rates at 3.0% with no immediate cuts signal tighter conditions—bearish short-term as capital favors yield-bearing assets.

Unemployment steady at 4.2% supports economic stability—neutral.

Global Growth:

China’s GDP growth slows to 4.2%, reducing demand for risk assets like Bitcoin—bearish.

Eurozone PMI at 47.8 indicates contraction, pressuring global markets—bearish.

Currency Markets:

USD strength (DXY at 106) weighs on BTC/USD, as a stronger dollar reduces Bitcoin’s appeal—bearish short-term.

Commodity Prices:

Oil at 668/BBL

and gold at $2,950 reflect a mixed risk environment—neutral for Bitcoin.

Geopolitical Risk:

Middle East tensions elevate safe-haven demand, but Bitcoin’s correlation with gold is weakening—neutral to mildly bearish.

Detailed Explanation: Macro factors tilt bearish short-term due to USD strength and global slowdown, countering Bitcoin’s long-term bullish fundamentals. This tension explains the current downward trend from higher levels.

3. Commitments of Traders (COT) Data⭐⚡🌟

COT data reflects futures positioning:

Speculative Traders:

Net long positions at 15,000 contracts, down from 25,000 at the 95,000 peak. Reduced bullishness suggests caution—bearish signal.

Commercial Hedgers:

Net short at 20,000 contracts, stable. Hedgers locking in gains indicate no panic—neutral.

Open Interest:

45,000 contracts, down 10% from February highs. Declining participation hints at fading momentum—bearish.

Detailed Explanation: COT data supports a bearish short-term view. Speculators unwinding longs and falling open interest align with the downward trend, though hedgers’ stability prevents a sharper collapse.

4. On-Chain Analysis⭐⚡🌟

On-chain metrics provide insights into Bitcoin’s network activity:

Exchange Balances:

2.6 million BTC on exchanges, up 5% in March. Rising supply suggests selling pressure—bearish.

Transaction Volume:

Daily volume at $10 billion, flat month-over-month. Lack of growth signals reduced buying interest—neutral to bearish.

HODLing Behavior:

70% of BTC unmoved for over a year (13.8 million coins). Strong holder conviction limits downside—bullish long-term.

Miner Activity:

Miners hold 1.8 million BTC, with minimal outflows. Stable miner behavior supports price floors—mildly bullish.

Realized Price Levels:

Realized cap indicates a cost basis of 78,000 for recent buyers, acting as support—bullish if held.

Detailed Explanation: On-chain data is mixed. Short-term bearish signals from exchange inflows contrast with long-term bullishness from HODLing and miner stability, suggesting a correction rather than a collapse.

5. Intermarket Analysis⭐⚡🌟

Correlations with other markets:

USD Strength:

DXY at 106 pressures BTC/USD inversely—bearish short-term.

S&P 500:

At 5,900, down 2% this week, reflecting risk-off sentiment. Bitcoin’s 0.6 correlation with equities adds downward pressure—bearish.

Gold:

At $2,950, gold rises as a safe haven, decoupling from Bitcoin—neutral to bearish.

Bond Yields:

U.S. 10-year yields at 3.8% attract capital away from risk assets—bearish.

Altcoins:

ETH/BTC ratio at 0.035, with altcoins underperforming Bitcoin, reinforcing BTC’s relative strength—mildly bullish.

Detailed Explanation: Intermarket signals are bearish short-term due to USD strength, equity declines, and yield competition. Bitcoin’s resilience versus altcoins offers some support, but broader risk-off trends dominate.

6. Market Sentiment Analysis⭐⚡🌟

Investor and trader mood:

Retail Sentiment:

Social media analysis shows 45% bullish sentiment, down from 60% at 95,000. Fear of further drops prevails—bearish.

Analyst Views:

Consensus targets range from 80,000 (short-term support) to 100,000 (Q3 2025), reflecting uncertainty—mixed.

Options Market:

Call/put ratio at 0.9, with balanced positioning. No strong directional bias—neutral.

Fear & Greed Index:

At 40 (neutral), down from 70 (greed) in February, indicating cooling enthusiasm—bearish shift.

Detailed Explanation: Sentiment has turned bearish short-term as retail investors react to the decline from 95,000. Analysts’ mixed views and neutral options activity suggest a wait-and-see approach, aligning with the current trend.

7. Next Trend Move and Future Trend Prediction⭐⚡🌟

Price projections across timeframes:

Short-Term (1-2 Weeks):

Range: 84,000 - 88,500

Likely to test support at 86,000-84,000 if selling persists; a bounce to 88,500 possible on relief rally.

Catalysts: U.S. economic data (e.g., CPI on March 12), ETF flows.

Medium-Term (1-3 Months):

Range: 80,000 - 92,000

Below 84,000 targets 80,000 (realized price support); above 88,500 aims for 92,000 if risk appetite returns.

Catalysts: BOJ policy update, institutional buying.

Long-Term (6-12 Months):

Bullish Target: 100,000 - 110,000

Driven by halving cycle, adoption, and inflation hedging—65% probability.

Bearish Target: 70,000 - 75,000

Triggered by global recession or regulatory crackdown—35% probability.

Catalysts: U.S. strategic reserve decision, Q3 GDP data.

Detailed Explanation: Short-term downside to 84,000 aligns with current bearish momentum. Medium-term consolidation reflects macro uncertainty, while long-term upside to 100,000+ hinges on fundamentals prevailing over temporary setbacks.

8. Overall Summary Outlook⭐⚡🌟

BTC/USD at 87,000 is in a short-term bearish correction within a broader bullish cycle. Fundamentals (adoption, halving) and on-chain HODLing support long-term gains, but macro headwinds (USD strength, global slowdown), COT unwinding, and risk-off sentiment drive the current downward trend. Exchange inflows and declining sentiment reinforce near-term weakness, with support at 84,000-80,000 likely to hold. Medium-term recovery to 92,000 and long-term growth to 100,000+ remain plausible if catalysts align.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BTC Today's strategyThe balance of long and short power in the market suggests that there may be explosive movements in the short term. At present, the price of Bitcoin is fluctuating in the range of 82,000-85,000 US dollars, and the short-term resistance is at 86,000 US dollars. A break through 86,000 US dollars could trigger a new round of gains

Bitcoin ETF funds have seen net outflows for five consecutive weeks, with demand falling to the lowest level in 2025, indicating that institutional funds are withdrawing and market sentiment is turning cautious. However, institutions such as MicroStrategy continue to buy, providing some support for bitcoin prices

The market is worried about the risk of possible liquidity tightening before the FOMC meeting in March, the uncertainty of the global economic situation and the signs of monetary policy adjustment in some major economies, making traditional financial marekts more attractive, and there is a trend of capital flowing back from the cryptocurrency market to the traditional financial field, which has some pressure on the bitcoin price

btcusdt sell@85500-86500

tp:83K-81K

We will share various trading signals every day. Fans who follow us can get high returns every day. If you want stable profits, you can contact me.

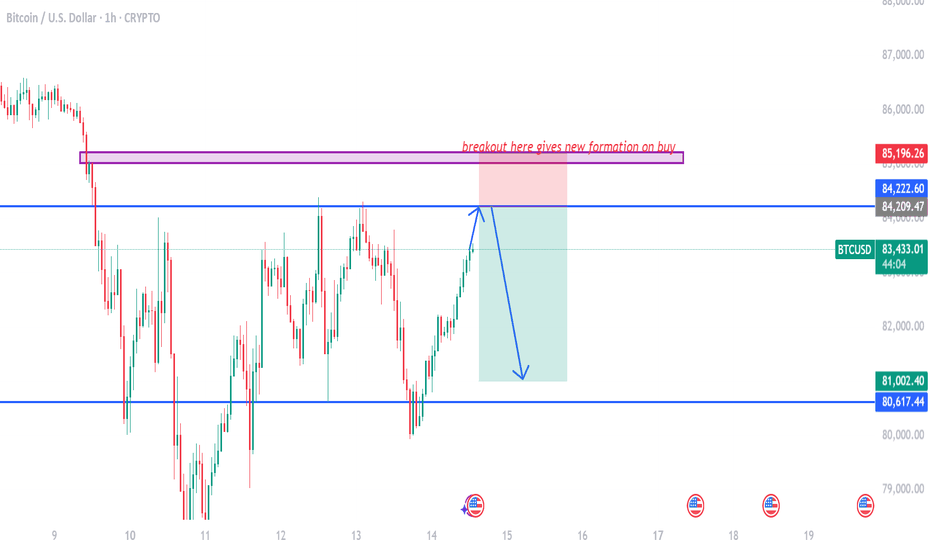

BTC/USDT Trade Setup & Analysis – Key Support Bounce & TargetsSupport: The lower purple zone indicates a strong support level where the price has bounced.

Resistance: The upper purple zone marks a resistance area where price has been rejected multiple times.

2. Moving Averages:

200 EMA (Blue): At 82,800.42, acting as dynamic resistance.

30 EMA (Red): At 82,090.72, indicating short-term trend direction.

3. Trade Setup:

A long position is planned from the current support level.

Entry: Around 80,026.98 (near support).

Stop Loss: Around 76,980.09 (below support).

Take Profit Targets:

TP1: 81,636.34

TP2: 82,800.42 (near 200 EMA)

TP3: 84,481.83

TP4: 86,260.26

Final Target: 88,297.36

4. Conclusion:

The setup expects a bounce from support with a target back towards resistance levels.

Breaking 82,800 (200 EMA) is crucial for further bullish momentum.

If the price falls below 80,000, the setup might get invalidated.

Would you like a deeper breakdown on any part? 🚀

btcusd on bearish retrace#BTCUSD price have multiple retest below 81k, now we await for next double rejection to sell.

If price touch 84200 then bearish retracment is active which will drop the price till 81k. Stop loss at 85196.

Above 85196 have bullish breakout which forms new buy to reach 88k-90k limit.

BTC Today's strategyIndustry News: Japanese listed company Metaplanet increased its holdings of 162 BTC, which to some extent reflects institutional optimism towards Bitcoin, and may have a positive impact on market sentiment, attracting more investors to pay attention and buy. However, Bitcoin's real-world application is still relatively limited, and its fundamentals are still relatively weak, which may limit the price of Bitcoin in the long run.

From the supply side, after bitcoin hit its highest price in history, short-term holders (STH) increased their holdings, while long-term holders (LTH) decreased their holdings. This change in supply pattern reflects the growing speculative atmosphere in the market, and short-term traders are more sensitive to price fluctuations, which may lead to increased volatility in bitcoin prices. From the demand side, despite the continued increase in bitcoin holdings by institutional buyers and ETFs, actual spot demand continues to decline. If demand does not recover, bitcoin's continued rally may be difficult to maintain.

Overall, the price of Bitcoin on March 14, 2025 is currently showing a certain upward trend, but the overall trend is still facing many uncertainties. A variety of factors such as the macroeconomic environment, the Federal Reserve's monetary policy, industry dynamics, and market supply and demand are all having an impact on the trend of Bitcoin.

buy:77K-79K

tp:83K-85k

We will share various trading signals every day. Fans who follow us can get high returns every day. If you want stable profits, you can contact me.

BTCUSD buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Sweet Spot To Sell The BTC Pullback In a strong downtrend. Every pullback on the 4hr and Daily chart will be hyped by the bulls & super cycle evangelists as a "WE'RE BACK" moment.

I will continue to take this same setup, selling Major swing highs on 4HR & Daily chart on BTC until the Daily Chart flips bullish. Until then or some news come out, we will remain in the downtrend until we hit the target shown in my last analysis, see link below.

BTC | 4H - 1W | MACRO UpdateBTC has seen a clear bearish trend in the 4h timeframe, after the cup and handle pattern failed to play out. We also notice consecutive lower lows and lower highs, a key sign of a bearish trend.

The technical indicators have turned bearish, and from a macro timeframe is shows a stairstep down may be on the cards.

The moving averages in the daily has turned bearish as we lose the 200d MA.

I hate to say it - but BTC is in full fledge bear mode 🐻

________________

BINANCE:BTCUSDT

There are no failed investments, only failed operationsI. Trend analysis

🔹 overall trends:

Since the beginning of 2024, Bitcoin has experienced a clear upward trend, peaking at nearly $115,000.

The price has recently fallen below several key support levels and entered a downward trend, with prices testing support in the 80,000-85,000 range.

The short-term trend remains weak, and the market may continue to seek lower support levels.

🔹 moving average system:

The short-term moving average (red, 10th) indicating that the market is still dominated by short-term bears.

The long-term moving average (blue, 60 days) has also started to turn downward, suggesting a weakening of the medium-term trend.

Conclusion: The market is still in a downward trend, and the moving average system shows no obvious signs of stabilization.

Structural analysis (K-line morphology)

📌 head and shoulders may have been completed:

From the high level formed by 93,000 to 115,000, there is a more obvious head and shoulder structure, which is currently falling below the neckline (82,000) and accelerating the decline.

If this pattern holds, the target decline level may test the 77,000-80,000 area.

📌 M head shape:

The previous two highs (around 100,000) formed an M-head and fell below key support, remaining weak in the short term.

📌 support area:

77000 (important support, if broken, the medium-term trend may accelerate to short)

72000~ 75000 (target in extreme cases)

📌 resistance areas:

89000~ 90000 (early neckline, has turned to strong resistance)

93000 (if the market rebounds, it needs to break through this level to reverse the trend)

Bitcoin Collapses $80K, What’s Next?Its price briefly stabilized around $86K over the weekend before heading south at the start of the business week. It dropped to around $80K, leaving millions in liquidations on a 24-hour basis. Later, bulls stepped in and pushed the valuation to nearly $84K. The resurgence, however, was short-lived and was followed by another free fall to as low as $79,500. As of this writing, BTC is trading around $79,000, representing a 5% drop on the day. Its market cap dropped below $1.6 trillion.

While many industry players are hopeful that this is another temporary pullback that can be replaced by a new bull run, others are not so optimistic. Next up is a re-estimation of $78K for BTCUSD, “if that fails, the next $76300, 75,500 in the crosshairs.” BINANCE:BTCUSDT BITSTAMP:BTCUSD COINBASE:BTCUSD BYBIT:BTCUSDT.P

The bitcoin will continue decreaseOn the monthly chart it is visible that the turning figure was created. MACD shows divergence, other technical indicators it confirm. I expect decrease the price at least up to 0.5 according to Fibonacci - the purpose for me 62800.

Information provided is only educational and should not be used to take action in the market.

BTC/USD Ready for a BIG DROP? Next Target: Demand Zone!Bitcoin Showing Weakness – Smart Money Preparing a Move!

BTC/USD is struggling to hold key resistance levels, signaling potential distribution before a larger sell-off. Institutional players have grabbed liquidity, and a Break of Structure (BOS) to the downside confirms bearish momentum.

BTC/USD Daily Forecast – Sell Setup from Supply Zone🔍 Market Breakdown Analysis:

Bitcoin has broken the key demand zone, indicating potential bearish momentum. As price pulls back, we will be looking for sell opportunities from the supply zone based on institutional order flow.

🎯 Trade Plan:

✅ Entry Zone: Supply Zone (Decision Point)

✅ Target 1: Key Structural Level (Decision Point Zone)

✅ Target 2: Extreme Order Block (Deeper Liquidity Grab)

✅ Confluence Factors: BOS (Break of Structure) + Liquidity Sweep

📊 Technical Outlook:

🔹 Market structure shift confirms a bearish bias.

🔹 Price may retest the supply zone before continuing downward.

🔹 Smart Money Concepts (SMC) suggest a high-probability short setup.

⚠️ Risk Management:

Always use a proper stop-loss and follow your trading plan. Stay disciplined and patient for the best entry.

💬 Drop your thoughts below! Are you bearish or bullish on BTC/USD? 👇🔥

Today btcusd analyisBitcoin Price Trend Analysis (30-Min Chart)

Current Price: 92,005 USD

1. Key Levels & Distances

Resistance Zone: 94,000 USD (+1,995 USD from current price)

Support Zone: 91,500 USD (-505 USD from current price)

Major Support: 90,000 USD (-2,005 USD from current price)

2. Trend Analysis & Possible Scenarios

Bullish Scenario (Uptrend)

If the price maintains support above 91,500 USD and breaks 94,000 USD, it could push higher toward 95,000 USD or more.

Confirmation of higher highs and higher lows will strengthen bullish momentum.

Bearish Scenario (Downtrend)

If the price fails to break 94,000 USD and drops below 91,500 USD, a correction towards 90,000 USD is possible.

Breaking below 90,000 USD could indicate a larger downtrend.

---

3. Trading Strategy Insights

For Buyers (Long Positions):

Look for a breakout above 94,000 USD before entering.

A stop-loss around 91,500 USD.

Target profit at 95,000+ USD.

For Sellers (Short Positions):

If price rejects 94,000 USD, short entries below 91,500 USD could be considered.

Stop-loss near 92,500 USD.

Profit target around 90,000 USD.