Bitcoin - Weekend OutlookCRYPTOCAP:BTC | 6h

Bitcoin is compressing below its all-time high, with 108k as the local resistance that must be reclaimed for a bullish continuation to retest the highs.

I expect the price to clear some poor highs around 108.8k–109.6k before taking out the bad lows around 106.3k-105.4k

As long as we hold above 104k , I believe we’re in a strong position and expect we will retest the highs.

However, losing the 103k support level would be concerning.

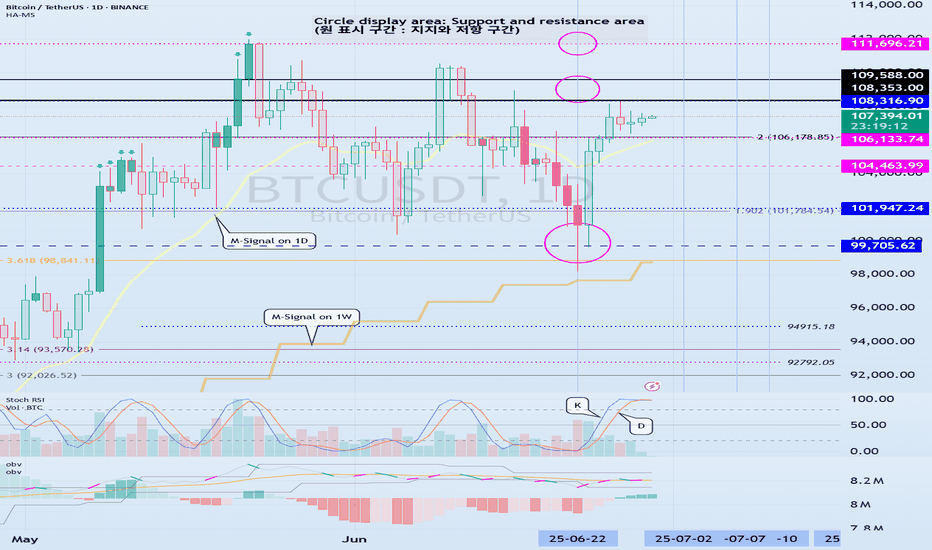

BTCUSDT

StochRSI indicator and support and resistance levels

Hello, traders.

If you "follow" me, you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

The StochRSI indicator on the left chart is slightly different from the StochRSI indicator on the right.

The StochRSI indicator on the left chart is the StochRSI indicator provided by default in TradingView, and the StochRSI indicator on the right chart is an indicator with a modified formula.

The StochRSI indicator is a leading indicator that is reflected almost in real time.

Therefore, it reacts sensitively to price changes.

Although it is advantageous because it reacts sensitively, it also increases the possibility of being caught in a fake, so I thought that a slight delay(?) was necessary, and so I created the StochRSI indicator on the left chart.

If you look at the relationship between the K and D of the StochRSI indicators on the two charts, you can see that there is a big difference.

In the end, you can predict the movement by checking whether the movement of the K line has escaped the overbought or oversold section.

However, I think that you will receive information that can determine the sustainability of the trend depending on the positional relationship between K and D.

Therefore, it is important to distinguish the inflection points that occur in the StochRSI indicator.

This is because these inflection points provide important information for drawing trend lines.

Therefore, the StochRSI indicator on the left chart, which better expresses the inflection point, is being used to draw the trend line.

(Unfortunately, this indicator was not registered on TradingView because I did not explain it well.)

-

As a new candle was created, the StochRSI indicator on the left chart is showing an inflection point on the K line.

The StochRSI indicator on the right chart is showing a transition to a state where K < D.

We will have to check whether the inflection point was created only when today's candle closes, but I think that the fact that it is showing this pattern means that there is a high possibility of a change in the future trend.

Since the next volatility period is expected to start around July 2nd (July 1st-3rd), I think it has started to show meaningful movements.

-

It is true that you want to buy at the lowest price possible and sell at the highest price.

However, because of this greed, one mistake can lead to a loss that can overturn nine victories, so you should always be careful.

Therefore, if possible, it is better to check for support and respond.

In that sense, I think it is worth referring to the relationship between K and D of the StochRSI indicator on the left chart.

This is because the actual downtrend is likely to start when K < D.

-

In order to check for support, you definitely need support and resistance points drawn on the 1M, 1W, and 1D charts.

Ignoring this and checking for support at the drawn support and resistance points can result in not being able to apply the chart you drew to actual trading.

Therefore, you should draw support and resistance points first before starting a trade.

Otherwise, if you draw support and resistance points after starting a trade, you are more likely to set support and resistance points that reflect your subjective thoughts, so as I mentioned earlier, you are more likely to lose faith in the chart you drew.

If this phenomenon continues, it will eventually lead to leaving the investment market.

-

It is important to determine whether there is support by checking the correlation between the StochRSI indicator and other indicators at the support and resistance points drawn on the 1M, 1W, and 1D charts.

Even if the inflection point of the StochRSI indicator or other indicators occurs at a point other than the support and resistance points you drew, you should consider it as something that occurred beyond your ability to handle.

In other words, you should observe the price movement but not actually trade.

As I mentioned earlier, if you start to violate this, you will become less and less able to trust the chart you drew.

-

Accordingly, the basic trading strategy I suggest is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, since the HA-Low and HA-High indicators are expressed as average values, they may move in the opposite direction to the basic trading strategy.

In other words, if the HA-Low indicator is resisted and falls, there is a possibility of a stepwise downward trend, and if the HA-High indicator is supported and rises, there is a possibility of a stepwise upward trend.

Therefore, the basic trading strategy mentioned above can be considered a trading strategy in the box section.

In the case of deviating from this box section, it is highly likely to occur before and after the volatility period indicated by the relationship between the trend line using the StochRSI indicator mentioned above and the support and resistance points drawn on the 1M, 1W, and 1D charts.

Therefore, special care is required when conducting new transactions during the volatility period.

This is because there is a high possibility of being caught in a fake when trading during the volatility period.

-

The DOM(60) and DOM(-60) indicators are good indicators to look at together with the HA-Low and HA-High indicators.

The DOM indicator is an indicator that comprehensively evaluates the DMI, OBV, and MOMENTUM indicators.

Therefore, the DOM(60) indicator is likely to be at the end of the high point range, and the DOM(060) indicator is likely to be at the end of the low point range.

In the explanation of the HA-Low and HA-High indicators,

- I said that if the HA-Low indicator receives resistance and falls, there is a possibility that a stepwise downtrend will begin,

- and if the HA-High indicator receives support and rises, there is a possibility that a stepwise uptrend will begin.

In order for an actual stepwise downtrend to begin, the price must fall below DOM(-60), and in order for a stepwise uptrend to begin, it must rise above DOM(60).

In other words, the DOM(-60) ~ HA-Low section and the HA-High ~ DOM(60) section can be seen as support and resistance sections.

-

If these correlations start to appear, I think you will be able to create a trading strategy that fits your investment style without being swayed by price volatility and proceed with trading.

The reason for analyzing charts is to trade.

Therefore, the shorter the time for chart analysis, the better, and you should increase the start of creating a trading strategy.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

BTC/USD INDEXEach cycle typically spans 4 years. Historically, the cycle peak occurs near the end of year 3, followed by a year-long market downturn in year 4, with the cycle bottom forming closer to the end of that final year.

Based on previous cycles, a reasonable peak for Bitcoin in this cycle would be around $120K–130K, followed by a correction down to the $45K–50K range.

BTC's Mid 2025 OutlookBitcoin is currently trading around $107,000 on the 4-hour 4H timeframe, navigating a consolidation phase following a sharp rally that culminated in a new all-time high of $111,900 in May 2025. Despite recent price corrections, BTC remains up 3% on the week, reflecting underlying bullish momentum. This sustained strength hints at continued confidence in the market, particularly among larger players.

A notable development supporting this view is the increase in the number of Bitcoin wallets holding at least 10 BTC, which has surged to a three-month high of 152,280. This metric is widely regarded as a proxy for whale activity and may indicate renewed institutional interest, especially amid accelerating inflows into spot Bitcoin ETFs.

On the 4H chart, Bitcoin appears to be consolidating within a tight range, hovering just beneath a key supply zone at $107,000, which could act as short-term resistance.

Several potential outcomes are currently in play:

Bullish scenario:

A breakout above the $107,000–$108,000 range could clear the path toward the critical resistance at $115,000. A successful move above this threshold would likely signal resumption of the broader uptrend, with some technical analysts eyeing a potential cup and handle formation that could project long-term targets up to \$180,000

Bearish scenario:

If BTC fails to hold above the current level, it may correct toward the first major support at $102,800, with further downside risk to $98,500. In a more pessimistic setup, price could extend losses toward $96,000, especially if macroeconomic or geopolitical pressures intensify

Key levels to watch:

Resistance: $107,000 - $115,000

Support: $102,800 - $98,500 - $96,000

Market Sentiment and External Drivers:

Bitcoin's price is being shaped not only by technical dynamics but also by powerful external forces

Spot Bitcoin ETFs:

The US regulatory greenlight for spot ETFs has dramatically altered market dynamics. With projections of $190 billion in assets under management AUM for these products by the end of 2025, institutional access to BTC has become more streamlined, providing strong tailwinds for long-term accumulation

Geopolitical risk and macro conditions:

Global uncertainty, particularly due to escalating tensions in the Middle East and potential US military involvement, has introduced volatility. At the same time, rising inflation and economic instability in developed markets is a double-edged sword, either undermining risk assets or conversely boosting Bitcoin’s narrative as digital gold and a hedge against fiat devaluation

Forward-Looking Outlook:

Bitcoin is at a critical juncture. The ability to sustain above $107,000 and reclaim the $115,000 resistance will be pivotal. A confirmed breakout could open the door to price discovery and possibly a surge toward $130,000 to $150,000, with $180,000 as an extended target in more bullish scenarios

However, a failure to hold key support levels could shift momentum toward the bears, prompting a deeper correction toward the $96,000 zone. Traders should monitor:

- Price reaction around $107,000 and $115,000

- ETF inflow data and AUM growth

- Macro news especially inflation reports and central bank commentary

- Developments in global conflict zones impacting risk appetite

Conclusion:

Bitcoin’s medium-term direction hinges on a delicate interplay of technical consolidation institutional flow and macro geopolitical signals. While the bullish structure remains intact for now a decisive move in either direction above $115,000 or below $98,000 could set the tone for the next major trend.

FISUSDT Forming Falling WedgeFISUSDT is currently displaying a classic falling wedge pattern, which is widely regarded as one of the most reliable bullish reversal signals in technical analysis. This pattern suggests that sellers are gradually losing their grip, while buying pressure is steadily building up inside this narrowing range. With volume starting to align positively with this structure, the setup is gaining momentum for a potential breakout that could yield an impressive 190% to 200%+ upside move if confirmed.

StaFi (FIS) is an innovative project that focuses on unlocking liquidity for staked assets — an area gaining increasing traction within the DeFi ecosystem. As investors look for opportunities to maximize yield without compromising on network security, interest in projects like StaFi is expected to grow. This increasing attention could act as a strong fundamental catalyst, complementing the promising technical setup and fueling sustained buying interest in FISUSDT.

For traders watching this pair, it’s crucial to monitor the breakout zone above the descending trendline. A decisive close above this resistance, backed by strong volume, could trigger a significant rally towards key psychological price levels. Historically, falling wedge breakouts can deliver explosive moves as sidelined investors jump in to catch the momentum. This makes FISUSDT a compelling chart for both swing traders and position traders seeking high-risk, high-reward opportunities.

Keep an eye on the broader crypto market sentiment as well, since a supportive macro trend can further amplify this breakout. With the perfect blend of technical strength, solid fundamentals, and growing investor interest, FISUSDT could be set to surprise many market participants with its next major move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

PENGUUSDT Forming Strong BreakoutPENGUUSDT is showing signs of a strong breakout pattern, which often indicates the end of a consolidation phase and the beginning of a new bullish trend. With good volume accompanying this breakout, the setup looks promising for traders looking to capture a significant upward move. This breakout could pave the way for a gain of 90% to 100%+, which aligns with how similar patterns have performed historically in the crypto market.

The PENGU ecosystem has been drawing increasing attention from investors who are keen on innovative community-driven tokens. As the crypto space continues to reward fresh narratives and strong communities, PENGU could benefit from renewed investor sentiment and social media hype, fueling further upside potential. A well-timed entry around the breakout zone can help traders maximize the reward-to-risk ratio on this high-potential move.

Technically, the breakout pattern is being validated by consistent higher lows and a decisive push above key resistance levels. Sustained volume and follow-through buying are critical to confirm the move, so traders should watch closely for a retest and bounce, which could act as an ideal entry point. This structure suggests that bullish momentum could accelerate quickly once the breakout is confirmed.

Overall, PENGUUSDT is a chart worth keeping on the radar for anyone interested in trading breakouts in altcoins. With its strong community backing and attractive chart setup, this pair could offer a compelling swing trade or even a short-term momentum play for those seeking robust gains.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Middle East peace/war = Bitcoin’s Explosive Price CoilDo you know why every time tensions rise in the Middle East, Bitcoin springs upward like a compressed coil?

This market reaction isn’t just a coincidence it’s the result of a mix of psychological and economic factors we’ll explore today.

Get ready to understand how these crises can create golden opportunities for the world’s favorite digital currency.

Hello✌

Spend 3 minutes ⏰ reading this educational material.

🎯 Analytical Insight on Bitcoin:

Price is approaching a significant support level that has held strong historically. A potential rebound from this zone could lead to at least a 7% upside move 📈, with the primary target set around $115,000—near a key descending trendline on the daily chart. Watching this level closely for confirmation 🔍.

Now , let's dive into the educational section,

Market Psychology: When War Plays with Fear and Greed 🧠

Middle East crises act like a spring: when released, they trigger intense fear in the market. Many traders react emotionally and start selling their holdings. The key point: this fear often flips into greed.

When Bitcoin’s price drops due to war fears, savvy traders seize the opportunity and enter the market. This cycle of fear and greed causes Bitcoin’s price to surge faster than usual just like a compressed spring suddenly releasing.

If you understand these market emotions and trade without bias, you can maximize gains from such volatility.

Key TradingView Tools for Bitcoin Analysis 📊

When the Middle East conflict heats up, market volatility spikes, affecting Bitcoin as a high-risk asset.

Using essential indicators like RSI , Fibonacci retracements , and volume on TradingView helps you pinpoint precise entry and exit points and better understand market reactions.

Practical Tips for Better Tool Usage ⚙️

To get the most out of TradingView:

Activate several indicators simultaneously and compare price movements with volume.

Draw Fibonacci retracements on previous trends to find key support and resistance levels.

Check RSI to see if Bitcoin is overbought or oversold.

Monitor trading volume to confirm momentum shifts.

This approach turns your analysis from guesswork into a logical, actionable strategy.

How Middle East War Drives Bitcoin Growth: Final Analysis 🚀

As tensions escalate, investors seek safe-haven assets, and Bitcoin, known as digital gold, attracts massive attention. Also, banking restrictions and sanctions push liquidity toward cryptocurrencies.

These condition s, combined with market psychology and the analytical tools we covered, make Bitcoin behave like a compressed spring that suddenly leaps upward, driving significant growth. Traders aware of these trends and skilled in using indicators and sentiment can find better profit opportunities.

Recommendations 📌

Geopolitical tensions in the Middle East act as a powerful trigger for Bitcoin volatility. Understanding market psychology, smart use of TradingView tools, and having a solid risk management strategy are key to success in such times. I recommend keeping an eye not just on technical analysis but also on market sentiment and political news to make the best timely decisions.

✨ Need a little love!

We put so much love and time into bringing you useful content & your support truly keeps us going. don’t be shy—drop a comment below. We’d love to hear from you! 💛

Big thanks,

Mad Whale 🐋

📜 Please remember to do your own research before making any investment decisions. Also, don’t forget to check the disclaimer at the bottom of each post for more details.

BTC BTC/USDT LONG_TERMChannels are drawn, long-term targets are clear. The upper extreme visible so far is around $200K for Bitcoin — possible within this cycle.

More realistic targets for this cycle are around $135K.

In the short term, a correction to the lower red channel zone ($88K–94K) is possible.

Watching closely.

Bitcoin Bullish But... Support Zones (Incl. Altcoins)Bitcoin is bullish right now but we know things can change. As long as the action is happening within the blue and gray space, all is good, the bullish bias remains intact. If the action moves below the gray zone and enters the orange zone, this is the danger zone. This danger zone can turn into a buy opportunity or a wait and see approach.

On the other hand, if Bitcoin remains above the blue zone this is ultra-bullish short-term. This is specially bullish for the altcoins but it is bullish for Bitcoin as it reveals consolidation at high prices, but right now we have a lower high so anything goes.

The chart is mixed when looked at up-close. Bullish long-term and on all bigger timeframes. Corrections tend to develop from high prices.

One more thing to consider

When we look at the action short-term we can miss the bigger picture, we can become clouded with noise. The bigger range is $100,000 - $110,000, this is the new long-term support zone that is being established and created before additional growth. Bitcoin can remain here for weeks or even months, if this happens, the altcoins will continue to grow.

We are in a bull market. Bitcoin is obviously in a bull market as it is trading near its all-time high after years of growth. The altcoins are just getting started after years of sideways action... Some altcoins hit new all-time lows but still part of a broad, long-term consolidation phase. Many produced higher lows, some produced lower lows, it makes no difference.

The bear market ended in mid/late 2022 and the ensuing two years we had mix growth. Bullish waves and bearish waves, with the usual variations of course.

The year is now 2025 and Bitcoin is up, most of the big projects have been growing for years now and we are getting close to the final advance, the major fifth wave and the bull market bull run. When this happens, close to its end, all the smaller projects will produce the biggest growth in their history and this will be the boom that will catapult Crypto to take over the financial world.

It won't be the first time this event happens nor the last, the market will continue to fluctuate.

I know there is a lot of information out there and we can become uncertain with every drop, but look at the price; what do you see? Bitcoin is going up.

The altcoins are set to follow, the altcoins do what Bitcoin does.

Namaste.

Bitcoin, The Next High Is The All-Time HighThe title might be a bit misleading but, the truth is that Bitcoin stays bullish short-term and this is bullish on all terms...

Good afternoon my fellow Cryptocurrency trader, how are you feeling today?

Any day, any week, any moment; every month, place or year, the market provides everything we need to know. This information is made available to us through the chart.

Bullish Bitcoin

The present signal is the fact that Bitcoin remains very high, challenging resistance, after a strong recovery and advance. This is happening with the altcoins also.

If you look at the last two peaks, as soon as resistance was hit there was an immediate crash. The next day was full red; very strong bearish action and momentum and this led to a new low. The situation is not the same today.

22-May peak. 23-May, strong bearish action.

9-June peak. 11-June, strong bearish action.

26-June lower high (not a peak). Today, neutral action. This neutral action is what I am taking as a bullish signal. Many other factors of course support this conclusion yet, this is still an early signal.

Fib support

A closer view of the daily timeframe:

4H. The grey line represents Fib. retracement. Dark blue—Fib. extension:

Conclusion

Each time there is a price peak a retrace follows, if there is no retrace then you are not witnessing a peak but rather a stop, a pause; resistance being met.

It seems that the current lower high is not the end but rather just a pause before additional growth. Market conditions can change.

It can happen that several days Bitcoin goes sideways with the bulls failing to garner enough strength. In this scenario, there would be a move lower before additional growth.

The present scenario shows a bullish chart even if prices drop, remember, the market is in no hurry.

Easy money

In September we will have lower interest rates and this is a bullish development for Bitcoin. Advanced money minds see easy money as inflationary for the currency, while Bitcoin is inflation-proof. So the dollar goes down and Bitcoin goes up.

I didn't quite develop this point, next time I'll do a better job.

Summary

The market is good even if it shakes. The market is good and isn't shaking, the recovery is already in place.

Bitcoin's price is very strong and there are many layers of support. The altcoins are in a similar situation, growing from the bottom up.

The Fed will reduce interest rates in September and then once more before the year ends, this is bullish for everything so, everything will be going up, at least everything that we are interested in, support and trade.

Thanks a lot for your continued support.

Never give up!

You are divine! You are blessed.

If you are reading this now, you will be blessed for your great timing. Hard work and dedication always pays.

Keep moving forward, keep pushing forward, never give up.

When life hits you hard, do take a break if you need it, only to comeback with new energy, a new mind and an infinite drive to achieve your goals.

You are the reason why Bitcoin exist... You are the lifeblood of the market.

Without you, nothing is possible. It is because of you that we all continue to grow.

Thanks again for taking the time to read.

I appreciate your support.

Namaste.

BTC next boom beginning I'm going to see boom in btc

Here’s the analysis of Bitcoin’s (BTC) next expected move in English, based on current market conditions and technical indicators:

---

### **1. Short-Term Outlook (Next 24-48 Hours)**

- Bitcoin is currently trading around **$107,400**, with **$108,000-$109,000** acting as a strong resistance zone.

- If BTC breaks above **$109,870** and closes above it, the next target could be **$114,950**.

- If the price fails to break resistance, a pullback to **$105,300** or **$103,900** (support levels) is possible.

- The **30-minute RSI is at 52.22** (neutral-bullish), and the MACD histogram is in positive territory.

---

### **2. Medium-Term Outlook (1 Week to 1 Month)**

- **Coincodex predicts**:

- **$116,914** (+8.98%) by July 2025.

- **$136,858** in the next 3 months.

- **DigitalCoinPrice forecasts**:

- Average price of **$221,961** by late 2025, with a potential high of **$235,354**.

---

### **3. Key Technical Indicators**

- **4-Hour Chart**:

- BTC is testing the **upper Bollinger Band ($108,672)**. A breakout could target **$114,956**.

- **Support Levels**:

- Immediate support: **$105,358** (EMA 100).

- Strong support: **$103,996**.

---

### **4. Market Sentiment**

- The **Fear & Greed Index** is currently at **74 (Greed)**, indicating bullish sentiment but also potential overbought conditions.

- **Volume**: Stable buying volume suggests sustained interest, but a drop could signal consolidation.

---

### **5. Potential Scenarios**

- **Bullish Case**: Break above **$109,870** → Rally toward **$114,950-$116,000**.

- **Bearish Case**: Rejection at resistance → Drop to **$105,300-$103,900**.

BTC 120K READY ???BTC 4H Chart Update 📉📈

Bitcoin is still trading inside a descending channel, but bulls are now testing the upper trendline for a potential breakout.

Price is consolidating just below $107K, showing strength after the recent bounce from the bottom of the channel.

🔹 Structure: Descending Channel

🔹 Current Resistance: $107K–$110K zone

🔹 Break & close above = bullish breakout confirmation

🔹 If breakout and close above 110k than this target possible

🔹 Target after breakout: $112K-120K+

⚠️ Rejection = pullback likely toward $103K–$104K support

📊 Breakout or breakdown — decision time is near!

#BTC #Bitcoin #Crypto #TechnicalAnalysis #BreakoutSetup

Bitcoin Top is In! Bear considerationsPrice has been carving out an unclear correction off the high. The recent structure has many squinting. Is it done or the calm before another wave of selling?

I am weighing two bearish scenarios here. One is more aggressive than the other. But both start with the same idea. No new high before another low.

Let’s start at the top.

The initial move down off the recent high could count as an impulse. Whether that is a wave 1 or a wave A is still up for judgment. Either way, that first leg sets a bearish tone at the larger degree.

Here’s where it gets interesting. The correction since then shows traits of a flat. A running one at the moment.

This opens the door to two active bearish projections:

A wave C collapse, implying a completed A B C correction and a downside resolution.

A wave 3 drop, for a possible top if this is an impulsive sequence.

That is the fork in the road. And it all hinges on the next move.

Right now, the smallest degree impulse off the low is doing some heavy lifting.

If that pivot holds and we only get an internal retracement like a micro wave 2, the door is still open for upside continuation.

But if that impulse gets invalidated, I would expect bears to press. First for a break below 100k, then toward the 95k area.

Here is how to think about it:

Hold the small impulse → Potential upside

Break the impulse base → Wave C or 3 likely underway

Context still leans bearish. Lower highs are still in play. But we are hunting a specific structure to confirm it.

BTC Rebounds After 100000 Drop, Eyeing Short at 109500 Resistanc📈 BTC Rebounds After 100000 Drop, Eyeing Short at 109500 Resistance

BTC dropped below the 100000 threshold 🔻 and then rebounded near 98000 🔺. This movement is related to the decline of DXY and the reduction of geopolitical risks. Now, BTC is challenging the 110000 level 🔼. The overhead resistance is around 109500. First - time tests of the 110000 level typically trigger pullbacks, so we favor short positions here 📉

🚀 Sell@109500 - 108500

🚀 TP 107500 - 106500 - 105500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Timeframes in Trading: Which Chart Tells You WhatHello, traders! 👋🏻 Why can the same chart tell a different story on 1D, 4H, or 15M? You’ve probably been there. BTC looks bullish on the daily… bearish on the 4-hour… and totally sideways on the 15-minute. So, which one is right?

The truth is: none of them is wrong. They’re just telling different parts of the story. Understanding timeframes in trading isn’t just a technical skill. It’s how you decode what the market is actually doing.

Every Timeframe Has a Role

Think of timeframes like zooming in and out on a map: The 1W chart tells you where the mountain ranges are, the macro trend. The 1D chart shows the highways and the current direction within that macro. The 4H chart reveals city streets, the local trend swings. And the 15M chart? That’s the back alleys, where the noise and micro moves live. BTC, for example, doesn't behave the same way across these views, and it shouldn't.

What Happens If You Ignore Timeframes?

You try to short a "breakdown" on the 15M, only to realize you just sold into 4H support.

You enter a 1D bullish breakout, only to panic when price pulls back aggressively on the 4H… forgetting that the 4H was just doing a retest. Or worse, you start trading against the macro trend, thinking the 15M chart holds more weight than it actually does.

How Professionals Read Timeframes (BTC Example)

Example:

You can start high, work down: 1W → 1D → 4H → 1H/15M. Check the macro first. Is BTC bullish, bearish, or ranging on the 1D or 1W? Then, you can map key levels: Support/resistance from higher timeframes is 10x more meaningful on lower timeframes. For example, BTC’s $30K, a weekly level, creates reactions even down on 5-minute charts. And, align context: A bullish setup on 15M is excellent, but check if it aligns with the 4H trend direction. If the 4H is also bullish, your setup has context. If not, expect chop.

🔗 BTC Right Now: Timeframe Confusion in Action

Just look at the current BTC structure. On the 1W, BTC is still trending higher, higher highs and higher lows from the $15K bottom in 2023. On the 1D, BTC trades inside a broad consolidation range after a strong uptrend. The price has repeatedly tested the $107K–$112K zone, acting as a key resistance cluster, while forming a series of higher lows. It's not a breakdown but a correction inside a bullish structure, testing previous supply zones. The 4H? Chaos. The price bounces between $105K and $112K, which is pure range behavior. The 15M? Traders are getting whipped trying to catch fake breakouts that mean nothing in the daily or weekly context.

Which Chart Tells You What?

All of them. But differently.

THE 1W TELLS YOU THE NARRATIVE.

THE 1D SHOWS YOU THE CURRENT DIRECTION.

THE 4H REVEALS TRADEABLE SWINGS WITHIN THAT DIRECTION.

THE 15M CAPTURES THE NOISE, THE TRAPS, AND THE MICRO OPPORTUNITIES.

If you’re only looking at one timeframe, you’re only seeing part of the picture. So, timeframes aren’t about right or wrong. They’re about perspective. If you’re a day trader, you probably live on the 5-minute to 15-minute charts, while still peeking at the 1H or 4H for structure.

If you’re a swing trader, the 4H and 1D are your home base, with the weekly chart guiding the bigger story. And if you’re thinking in months or quarters, the 1W and 1M are what actually matter – everything else is just noise.

So next time BTC feels “confusing”… zoom out. Or zoom in. The answer is probably hiding in the chart, just not the one you were looking at. Which timeframe do you trust the most when trading crypto? Drop it in the comments!

BNB to Make History Before 2026 BeginsCRYPTOCAP:BNB is setting up for something big. Price is holding strong above the rising support line, with the 50 EMA acting as dynamic support.

It's consolidating just below the all-time high — a classic sign of strength. Structure looks solid, momentum is building, and the chart favors bulls.

Mark my words — BNB will not only retest its ATH, but break it and go beyond before the year ends.

DYOR, NFA

VOXELUSDT Forming Falling Wedge VOXELUSDT is currently displaying a textbook falling wedge pattern, a bullish formation that often signals the end of a downtrend and the start of a powerful rally. The price has been compressing within this pattern, forming lower highs and lower lows, but with decreasing bearish momentum. This technical setup is gaining attention from experienced traders as it historically leads to strong breakout moves when confirmed with increased volume and a decisive breakout above resistance.

The trading volume for VOXELUSDT is showing healthy activity, which supports the credibility of this setup. With volume gradually building and price nearing the apex of the wedge, a breakout could be imminent. Current analysis suggests a potential gain of 140% to 150%+ once VOXELUSDT clears its overhead resistance. This target is consistent with previous moves triggered by similar patterns in comparable market conditions.

VOXEL, the native token of the Voxie Tactics ecosystem, continues to garner investor interest due to its presence in the growing GameFi and NFT gaming sectors. With increased adoption and renewed interest in blockchain gaming, VOXELUSDT is positioning itself as a sleeper gem that could rally significantly once market sentiment aligns with the technical picture.

For traders focused on pattern-based entries, VOXELUSDT provides a promising high-reward setup. The falling wedge combined with good volume and emerging community interest points to a bullish opportunity that could unfold swiftly.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

AWEUSDT Forming Bullish WaveAWEUSDT is showing early signs of a bullish wave pattern formation, with price action beginning to reflect strength after a period of consolidation. The emergence of this pattern is a classic indication of market participants preparing for a continuation move to the upside. With healthy volume accompanying this recent uptick, the current structure supports the probability of a short- to mid-term bullish breakout.

The expected price appreciation ranges between 20% to 30%, making AWEUSDT an appealing watchlist candidate for swing traders and short-term investors. The increasing interest around this project, both technically and fundamentally, indicates accumulating pressure beneath resistance levels. The pattern's wave formation suggests that we could be in the early stages of a broader upward movement if market sentiment remains positive.

AWE is gaining traction in the community as more investors look for innovative utility-driven tokens in a saturated altcoin landscape. With renewed focus on promising low-cap tokens, AWE is positioning itself to potentially benefit from upcoming bullish momentum. Traders are watching this setup closely, with the technicals aligning with growing social buzz and investor curiosity.

Given the strengthening price structure, volume confirmation, and bullish wave potential, AWEUSDT could offer an attractive risk-reward setup. Maintaining support above recent lows and continuing to push higher with solid volume will be key signals of further upside confirmation in this pattern.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!