Bitcoin Bounces Back — Is $120K the Next Stop?!Bitcoin ( BINANCE:BTCUSDT ) reacted well to the 50_SMA(Daily) and the Heavy Support zone($112,000-$105,800 and started to rise again.

The question is, can Bitcoin reach $120,000 again and even create a new All-Time High(ATH)!?

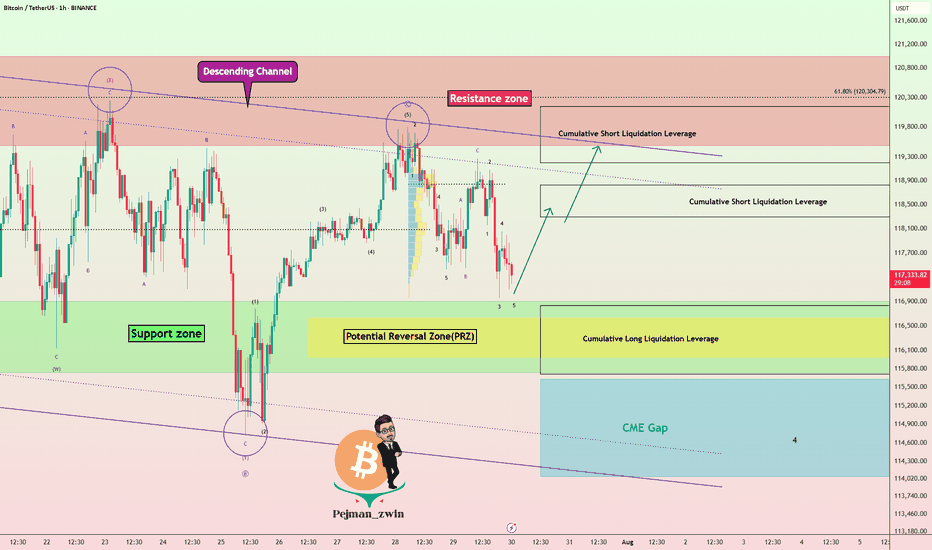

In terms of Elliott Wave theory , it seems that Bitcoin has managed to complete the main wave 4 in the descending channel . To confirm the end of the main wave 4 , we must wait for the upper line of the descending channel to break. The structure of the main wave 4 is a Zigzag Correction(ABC/5-3-5) .

I expect Bitcoin to trend higher in the coming hours and attack the resistance area and the upper line of the descending channel(First Target: $117,490) .

Do you think Bitcoin's main correction has begun, or does Bitcoin still have a chance to create a new ATH?

Second target: $119,991

Cumulative Long Liquidation Leverage: $113,526-$112,591

Note: Stop Loss: $111,070

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BTCUSDTPERP

Next Volatility Period: Around August 13th (August 12th-14th)

Hello, fellow traders!

Follow us to get the latest information quickly.

Have a great day!

-------------------------------------

(USDT 12M Chart)

A lot of money has been flowing into the coin market through USDT.

A decline in USDT indicates capital outflow from the coin market.

(USDT.D 12M chart)

As USDT continues to rise, its dominance naturally rises.

However, if USDT is used to purchase coins (tokens) in the coin market, its dominance will decline.

USDT dominance peaked in 2022 and is showing a downward trend.

This indicates that a significant amount of capital flowing into the coin market was used to purchase coins (tokens).

USDT dominance is expected to fall to around 2.84 this year before beginning an upward trend, marking the end of its three-year bull market.

I believe this trend will inject new vitality into the coin market.

For the coin market to maintain an upward trend, USDT dominance must remain below 4.91 or show a downward trend.

If this fails and the price rises above 4.91, the coin market is likely already in a downward trend.

A decline occurred on May 8, 2025, creating a reverse trend.

To maintain this reverse trend, we need to see if it can fall below 4.24.

If USDT dominance declines, the coin market is likely to show an upward trend.

------------------------------------------------------

(BTCUSDT 1D chart)

As the new week begins, the HA-High indicator on the 1W chart is showing signs of forming a new level at 114454.57.

Accordingly, the key question is whether the price can rise after finding support in the 114454.57-115854.56 range.

The formation of the HA-High indicator means that the price has fallen from its high.

This also means that further declines are highly likely.

Therefore, if possible, the price should rise above the 114454.57-115854.56 range and maintain its upward momentum.

This period of volatility is expected to last until August 6th.

Therefore, the key question is whether the price can rise above the 114454.57-115854.56 range after the volatility period.

If not, we assume the price will decline until it meets the HA-Low indicator and consider countermeasures accordingly.

This is because the HA-Low and HA-High indicators are paired.

As the price declines, indicators such as the HA-Low or DOM(-60) may appear.

Therefore, if the price declines, you should monitor for the emergence of indicators such as the HA-Low or DOM(-60).

The basic trading strategy is to buy between the DOM(-60) and HA-Low ranges and sell between the HA-High and DOM(60) ranges.

-

If the price falls below the M-Signal indicator on the 1D chart, it is highly likely that the trend will be re-established upon meeting the M-Signal indicator on the 1W chart.

Therefore, if the price fails to rise to the 114454.57-115854.56 range, it is highly likely that the price will eventually meet the M-Signal indicator on the 1W chart.

At this time, a key support and resistance level is expected to be around 108353.0.

When new support and resistance levels are formed, they must remain horizontal for at least three candlesticks to function as support and resistance.

In other words, the HA-High indicator on the 1W chart is showing signs of forming, but it hasn't yet.

Therefore, if the current price holds this week, it will form next week.

Therefore, for the HA-High indicator to function properly as support and resistance, it must remain horizontal for three candlesticks, or three weeks.

This rule must be acquired through significant time and observation.

-

If you sold partially in the 115854.56-119177.56 range according to your basic trading strategy, you will find it easier to observe the current movement. If not, you will likely become anxious.

The key to trading is maintaining a stable psychological state.

If you begin to feel anxious, you should consider how to stabilize your psychological state.

Otherwise, you'll end up making the wrong trades.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- Here's an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I'll explain more in detail when the bear market begins.

------------------------------------------------------

Bitcoin Ready for Takeoff - $150K Target Ahead! MARKETSCOM:BITCOIN is showing impressive strength after successfully retesting its May high and bouncing back with conviction. This level, along with the 50 EMA, is currently acting as a strong support zone. Holding above this area signals that buyers are in control, and this zone now serves as a major support for the ongoing bullish trend.

At the moment, CRYPTOCAP:BTC is facing minor resistance in the $115K–$116K range. A decisive breakout above this level is likely to trigger strong momentum, opening the doors for a new all-time high. Once this resistance is cleared, our previous projection of $150K comes into play as the next major target.

For now, it’s crucial for MARKETSCOM:BITCOIN to hold the current support zone to maintain the bullish structure. As always, traders should manage risk effectively and place stop-losses to protect their capital in case of unexpected volatility.

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

BTC intraday strategy analysis and operation layout#BTCUSD

Currently, BTC rebounded again to test the upper resistance area of 115000-116000, indicating that buyers are still defending this structure, but it is still suppressed by the upper resistance. From a derivatives perspective, open interest has fallen by 0.91% over the past 24 hours, while options trading volume has also fallen by over 13%, indicating a decrease in speculative activity. Despite a 34.28% increase in 24-hour trading volume to $61.71 billion, the long-short ratio has fallen below 1.0, reflecting cautious market sentiment.

As long as BTC maintains above 114,000-113,000, the short-term structure remains neutral. If it fails to break through the overhead resistance and stabilize above 116,500, bulls may lose control of the lower trendline of the channel, triggering a renewed bearish push.

If BTC can successfully hold above 116,500, it could potentially return to 118,000 or even challenge the macro resistance level of 120,000. On the contrary, if BTC finds it difficult to break through the short-term resistance level, it will still return to the 114,000-113,000 area.

🚀 BUY 116,500-117,000

🚀 TP 118,000-119,000

#BTC hits neckline resistance and pulls back📊#BTC hits neckline resistance and pulls back✔️

🧠From a structural perspective, we've retreated after hitting resistance at the neckline, as expected. If the current structure continues to decline rapidly, we could potentially retest support near 112,000, or perhaps break below the previous low to sweep liquidity before rebounding.

➡️The resistance zone remains clear. Only if the neckline resistance zone is broken and stabilizes for a day or so can we maintain a positive bullish stance.

Let's see 👀

🤜If you like my analysis, please like 💖 and share 💬 BITGET:BTCUSDT.P

BTC/USD) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of (BTC/USDT) on the 4-hour timeframe, using Smart Money Concepts and a falling channel breakout approach.

---

Technical Breakdown:

1. Market Structure:

Price has been moving within a descending channel, forming lower highs and lower lows.

BTC just bounced strongly from the Fair Value Gap (FVG) zone, marked in yellow, and the lower boundary of the channel, suggesting a potential trend reversal.

2. Key Levels:

FVG (Demand Zone): Between ~112,000–114,000 — price reacted from this zone with clear bullish momentum.

200 EMA (114,799.70): Price is currently below it, but if it reclaims this level, it will strengthen the bullish setup.

Target Point: ~123,287–123,327 — aligns with the upper boundary of the channel and previous resistance.

3. Projected Price Path:

Step 1: Price is expected to retest the mid-channel resistance and potentially break above.

Step 2: If confirmed, BTC may rally toward the 123k+ target zone, continuing the trend reversal.

4. RSI (14):

RSI is currently at 42.70, moving up from oversold territory (33.05 low), which supports a bullish reversal.

No bearish divergence seen, indicating room for upside.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bullish

Entry Confirmation: Strong bounce from FVG and bullish candle close above 114,800 (EMA)

Target Zone:

TP1: 118,000 (channel midline)

TP2: 123,327.97 (channel top / resistance zone)

Invalidation: Close below 112,000 or breakdown of channel and FVG

Indicators: RSI recovery + strong volume bounce supports bullish scenario

plesse support boost this analysis)

#BTC enters neckline resistance zone📊#BTC enters neckline resistance zone⚠️

🧠From a structural perspective, we hit the daily neckline support and began to rebound. Unfortunately, it's about $170 away from the overlapping support zone I'm focused on, and the rebound didn't establish a 1-hour bullish structure. This suggests a high probability of encountering resistance and a pullback after this rebound. Therefore, don't chase the rally at the neckline resistance zone! Only if we can break through the neckline resistance zone and stabilize for a day or so should we actively consider a bullish move.

➡️Support is clearly around 120,000. Even if it falls below this level, as long as the 4-hour closing price is above it, this support level will remain valid. Extreme support is still around 110,000!

🤜If you like my analysis, please like 💖 and share 💬

BITGET:BTCUSDT.P

Bitcoin Traps Bulls and Bears – Real Move Next?Bitcoin is trading in a descending channel on the 4H chart, with two recent fakeouts — one above resistance and one below support — trapping traders on both sides. After reclaiming support, BTC is pushing toward the upper boundary with rising volume, hinting at strong demand. A breakout above $119K could drive a rally toward $125K–$135K.

Cheers

Hexa

BINANCE:BTCUSDT BITSTAMP:BTCUSD

The key is whether it can rise above 115854.56

Hello, traders!

Follow us to get the latest information quickly.

Have a great day.

-------------------------------------

(BTCUSDT 1W chart)

The key is whether it can rise above the newly created DOM (60) indicator point of 119086.64.

If this fails and the price declines, we need to check for support near the previous all-time high (ATH) of 108,353.0.

Since the M-Signal indicator on the 1W chart is rising near 108,353.0, this area is expected to serve as important support and resistance.

-

(1D chart)

This period of volatility is expected to continue until August 6th.

Therefore, the key question is whether the price can rise above 115,854.56 and maintain its upward momentum.

If not, further declines are likely.

-

To rise above 115,856.56,

- The StochRSI indicator must rise within the oversold zone and remain above K > D.

- The On-Bottom Volume indicator must continue its upward trend with OBV > OBVEMA. - The TC (Trend Check) indicator should maintain an upward trend. (If possible, it's best to rise above the 0 point.)

If the above conditions are met and the price rises above 115854.56, it is expected to attempt to rise above 119177.56.

This period of volatility is a significant period of volatility.

Therefore, if the price falls below the HA-High ~ DOM(60) range and encounters resistance during this period, you should prepare for further declines.

-

The basic trading strategy is to buy in the DOM(-60) ~ HA-Low range and sell in the HA-High ~ DOM(60) range.

However, if the price rises in the HA-High ~ DOM(60) range, a stepwise upward trend is likely, while a decline in the DOM(-60) ~ HA-Low range is likely to result in a stepwise downward trend.

Therefore, a split trading strategy is recommended as the basic trading strategy.

When executing a trade, appropriate profit taking secures the liquidity of your investment, giving you the opportunity to seize new opportunities.

To achieve this, you should consider your intended investment horizon before initiating the trade and divide the trade accordingly.

-

The HA-Low indicator on the 1D chart is currently at 89294.25.

Therefore, I believe the market believes it's in a position to take profit.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain in more detail when the bear market begins.

------------------------------------------------------

BTC Plummets Post-NFP; Go Long for Rebound to 116500BTC has plummeted significantly under the influence of the non-farm payroll data 📉, and now is an excellent opportunity to go long. Its Support level is around 112800, and according to the current trend, we can wait for a rebound to around 116500.

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Buy@ 113000 - 113800

🚀 TP 114500 - 115500 - 116500

Daily updates bring you precise trading signals 📊 When you hit a snag in trading, these signals stand as your trustworthy compass 🧭 Don’t hesitate to take a look—sincerely hoping they’ll be a huge help to you 🌟 👇

$BTC /USDT – Breakdown from Channel, Bears Gaining ControlBitcoin has broken down from its descending channel on the 4H chart after repeated rejection from the upper trendline. Price is now hovering near key support at $111,785.

Key Technicals:

Rejection from the descending trendline resistance

Breakdown of the mini-channel structure

Current price: $113,637

Support levels:

$111,785 (Immediate)

$106,057

$101,409

$98,398

Bearish continuation is likely if $111,785 breaks with volume

If the $111.7k zone fails to hold, BTC could see further downside toward $106k and even $98k in the coming sessions.

Invalidation: Bullish only on reclaim of $117K+ with strength.

DYOR | Not Financial Advice

Is the #BTC pullback over?📊 Is the #BTC pullback over?

🧠From a structural perspective, a bearish structure has formed on both the 1-hour and 4-hour charts, so we should be wary of the risk of a further pullback.

➡️Resistance is the area formed by the two necklines (114675-115729).

Support is primarily the overlap between the yellow and green areas (110000-111688). If we can establish a bullish structure on the 1-hour chart here, we still have a chance of continuing the bullish trend.

🤜If you like my analysis, please like 💖 and share 💬 BITGET:BTCUSDT.P

#BTC Potential Trading Opportunities📊#BTC Potential Trading Opportunities🔥

🧠We've been trading sideways for quite some time, and selling pressure has largely been exhausted, so we need to find support to enter a long trade.

➡️From a structural perspective, there's a chance for a bullish head-and-shoulders pattern to form. If this pattern holds, we could see a move above $120,000 or even higher.

Potential support is likely between $116,300 and $117,000.

Short-term resistance is around $120,000.

⚠️Note: A break below L1 would destabilize the structure and significantly reduce bullish expectations.

🤜If you like my analysis, please like 💖 and share 💬 BITGET:BTCUSDT.P

BTC Next Move Toward $150K?Bitcoin recently broke out above a long-standing resistance zone ($110K–$115K), supported by a clean move through the volume profile high node. After testing local highs, BTC is now pulling back to retest the breakout area, a critical level that could act as new support.

Key Points:

Breakout Retest: Price has pulled back into the breakout zone around $114K, aligning with strong previous resistance that may now flip to support.

Volume Profile: A strong high-volume node is visible below ($105K–$110K), which reinforces this area as a major demand zone.

EMA Confluence: The 50-day and 100-day EMAs are trending upward and aligning near the retest area, providing additional support.

If this level holds, BTC could resume its bullish leg toward the $150K level.

Cheers

Hexa

Bullish Flag Forming on BTCUSDT – Is the Next Big Move Coming?🧠 Complete and Insightful Technical Analysis:

The 12H BTCUSDT chart is currently showcasing a textbook Bullish Flag pattern, a powerful continuation structure that often precedes major upward moves.

---

🏗️ Pattern Breakdown: Bullish Flag

1. Flagpole:

The sharp breakout from around $107,000 to $123,000 marks the impulsive rally — this is the flagpole, created by strong bullish momentum.

Represents the "lift-off" phase where buyers dominate the market.

2. Flag (Consolidation Phase):

After the strong rally, price consolidates inside a downward-sloping parallel channel, forming the flag.

This pullback is healthy, characterized by declining volume, a key feature of the Bullish Flag.

Indicates temporary profit-taking before continuation.

3. Confirmation:

A breakout above the flag's upper boundary (around $123,000 – $124,000) with strong volume would confirm the pattern.

Breakout traders often use this as a high-probability entry.

---

📈 Bullish Scenario (High Probability):

If BTC breaks above the flag structure:

🎯 Measured Move Target (Based on Flagpole Height):

$123,000 + ($123,000 - $107,000) = $139,000

🚀 Potential for further upside if macro conditions and sentiment support the move, possibly reaching $135,000+ in the medium term.

Confirmation Required: A strong candle close above $123,500 with volume spike.

---

📉 Bearish Scenario (If Breakdown Occurs):

If BTC breaks down below the flag (~$117,000):

Retracement likely toward previous breakout zones at $112,000 – $109,000

Such a breakdown could turn the current structure into a fakeout or bear trap

However, this zone may present a strong re-entry opportunity for long-term bulls.

---

📚 Educational Insight for Traders:

Bullish Flags often appear during strong uptrends, acting as a pause before the next leg up.

A healthy pattern shows shrinking volume during the flag and rising volume at breakout.

Traders should monitor key horizontal resistance and volume behavior for confirmation.

---

🧭 Conclusion:

BTCUSDT is at a critical technical juncture. The formation of a clean Bullish Flag suggests the potential for a major continuation rally. Confirmation through a breakout is key — this is the time to prepare, not react.

#BTCUSDT #Bitcoin #BullishFlag #BTCBreakout #CryptoTechnicalAnalysis #CryptoTrading #PriceAction #BTCAnalysis #BitcoinPattern #CryptoEducation #BTCFlag #ContinuationPattern

Bitcoin at a Decisive Moment! Rising Wedge Formed — Breakout?🧠 In-Depth Technical Analysis (BTCUSDT – Weekly Timeframe)

Bitcoin is currently trading within a large Rising Wedge pattern, formed over the long term from late 2022 to mid-2025. This structure is typically a bearish reversal formation, although it can also lead to a breakout in strong bull markets.

The wedge is defined by:

Consistently higher lows on the lower trendline

A gradually rising upper resistance line that currently caps price around $123K–$125K

Decreasing volume, indicating consolidation and energy buildup near the apex

This wedge reflects a period of euphoric price action post-2022 bear market accumulation, with price now testing the top of a historically significant resistance zone.

---

📊 Key Price Levels:

🔹 Current Price: ≈ $118,436

🔹 Recent Weekly High: $123,226

🔹 Critical Resistance (Wedge Top): $123,000–$125,000

🔹 Dynamic Support: Rising wedge base (~$90,000–$95,000)

---

🐂 Bullish Scenario: “Historic Breakout Incoming”

If BTC successfully breaks above the wedge’s upper resistance and closes a weekly candle above $125K with strong volume, it would signal a confirmed breakout from the long-term wedge structure.

📈 Upside Targets:

🎯 Target 1: $140,000

🎯 Target 2: $155,000+ (based on Fibonacci extension and macro targets)

🚀 A breakout of this magnitude may trigger a new parabolic rally, especially if accompanied by:

Increased institutional adoption

Spot ETF inflows

Favorable macroeconomic shifts (e.g., rate cuts)

---

🐻 Bearish Scenario: “False Breakout or Breakdown Risk”

If Bitcoin fails to break out and faces strong rejection from the resistance zone (possibly a false breakout), the rising wedge formation may break down — leading to a steep correction.

📉 A breakdown from this structure often leads to sharp drops due to:

Overextension of the current trend

Distribution phase by smart money

🎯 Downside Targets:

Support 1: $95,000–$90,000

Support 2: $76,000

Major Support: $54,000 (historical demand & EMA zones)

---

🔍 Optional Indicators for Chart Confirmation:

Weekly RSI: Watch for bearish divergence

Volume Profile: Can highlight distribution or accumulation zones

EMA 21/50: Ideal for identifying dynamic support levels in retracements

---

📌 Conclusion:

Bitcoin is at a crucial inflection point within this multi-year Rising Wedge. A confirmed breakout could lead to new all-time highs, while a breakdown may trigger a broad correction. Traders should prepare for high volatility, wait for clear confirmation signals, and manage risk wisely in this pivotal zone.

#Bitcoin #BTCUSDT #RisingWedge #BTCBreakout #TechnicalAnalysis #CryptoMarket #PriceAction #BearishReversal #CryptoSignal #ChartPattern #BitcoinAnalysis #Cryptocurrency

Important Volatility Period: August 2nd - 5th

Hello, fellow traders!

Follow us for quick updates.

Have a great day!

-------------------------------------

(BTCUSDT 1M Chart)

Let's take a moment to check the trend before the new month begins.

There have been two major declines so far, and a third major decline is expected next year.

For the reason, please refer to the "3-Year Bull Market, 1-Year Bear Market Pattern" section below.

-

My target point for 2025 is around the Fibonacci ratio of 2.618 (133889.92).

However, if the price surges further, it could touch the Fibonacci range of 3 (151018.77) to 3.14 (157296.36).

If it rises above 133K, it's expected that prices will never fall below 43823.59 again.

Since the HA-Low indicator hasn't yet been created on the 1M chart, we need to monitor whether it appears when a downtrend begins.

Based on the current trend, the HA-Low indicator is expected to form around 73499.86.

More details will likely be available once the movement begins.

-

The basic trading strategy involves buying in the DOM(-60) ~ HA-Low range and selling in the HA-High ~ DOM(60) range.

However, if the price rises above the HA-High ~ DOM(60) range, a step-up trend is likely, while if the price falls below the DOM(-60) ~ HA-Low range, a step-down trend is likely.

Therefore, the basic trading strategy should be a segmented trading approach.

The further away from the HA-High indicator, the more likely it is that the DOM(60) indicator will act as a strong resistance when it forms.

Therefore, if the current price and the HA-High indicator are trading far apart, and the DOM(60) indicator forms, it is expected to face significant resistance.

-

Looking at the current trend formation, the high trend line is drawn correctly, but the low trend line is not.

This is because the StochRSI indicator failed to enter the oversold zone.

Therefore, the low trend line is marked with a dotted line, not a solid line.

Therefore, what we should pay attention to is the high trend line.

We need to see if the uptrend can continue along the high trend line.

-

(1D chart)

If we use the trend lines drawn on the 1M, 1W, and 1D charts to predict periods of volatility, the periods around August 5th and August 13th are significant periods of volatility.

By breaking this down further, the volatility periods are around July 31st, August 2nd-5th, and August 13th.

Therefore, trading strategies should be developed based on the assumption that the volatility period extends from July 30th to August 14th.

The current price is moving sideways in the 115,854.56-119,177.56 range.

This range, the HA-High ~ DOM (60), is a crucial area to consider for support.

This will determine whether the price will continue its upward trend by rising above 119,177.56, or whether it will turn downward by falling below 115,854.56.

If the price falls below 115854.56, it is expected to meet the M-Signal indicator on the 1W chart and reestablish the trend.

The HA-High indicator on the 1W chart is forming at 99705.62, and the DOM (60) indicator on the 1W chart is forming at 119086.64.

Therefore, when the price declines, it is important to check where the HA-High indicator on the 1W chart forms and determine whether there is support near that point.

-

The On-Board Value (OBV) indicator within the Low Line ~ High Line channel is showing a downward trend.

If the OBV falls below the Low Line, the price is expected to plummet.

Therefore, it is necessary to closely monitor the movements of the OBV indicator.

The Trend Check indicator is a comprehensive evaluation of the StochRSI, PVT-MACD Oscillator, and On-Board Value (OBV) indicator.

The TC (Trend Check) indicator interprets a rise from the 0 point as a buying trend, while a decline indicates a selling trend.

In other words, a rise from the 0 point is likely to indicate an uptrend, while a decline is likely to indicate a downtrend.

Currently, the TC (Trend Check) indicator is below the 0 point, suggesting a high probability of a downtrend.

However, if the TC (Trend Check) indicator touches a high or low, the trend may reverse.

In other words, touching a high increases the likelihood of a reversal from an uptrend to a downtrend, while touching a low increases the likelihood of a reversal from a downtrend to an uptrend.

When such movements occur, it's important to consider the support and resistance levels formed around the price level to determine a response.

In other words, consider the support and resistance levels formed at the current price level.

As a significant period of volatility approaches, prepare to transition from box trading to trend trading.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- Here's an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I'll explain more in detail when the bear market begins.

------------------------------------------------------

White House Crypto Report Incoming: Will BTC Pump from Support? One of the important news for Bitcoin ( BINANCE:BTCUSDT ) that was released today was that " White House confirms first Bitcoin and crypto report will be released TOMORROW ". Bitcoin is likely to rise with the release of the White House report .

What do you think? At least a temporary pump may be in store for Bitcoin.

Bitcoin fell to the Support zone($116,900-$115,730) and filled the New CME Gap( $119,500-$118,295) as I expected in the previous idea .

Bitcoin is currently moving near the Support zone($116,900-$115,730) , Cumulative Long Liquidation Leverage($116,828-$115,710) and Potential Reversal Zone(PRZ) .

I expect Bitcoin to rise from the Support zone($116,900-$115,730) to at least $118,680(First Taregt) .

Second target: Upper line of the descending channel

Note: Stop Loss: $114,680 = Worst Stop Loss(SL)

CME Gap: $115,060-$114,947

Cumulative Short Liquidation Leverage: $118,827-$118,298

Cumulative Short Liquidation Leverage: $120,144-$119,200

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Bitcoin Rejected Near $120K – Bears Wake Up!First of all, I have to say that Bitcoin’s movements over the last 12 days have been a bit difficult to trade , generally, the hardest market to make a profit in is the range market with a swing movement .

Bitcoin( BINANCE:BTCUSDT ) is currently trading near the Resistance zone($121,000-$119,500) , Cumulative Short Liquidation Leverage($121,336-$120,000) , and the upper line of the descending channel .

Since Bitcoin has lost support lines , we can consider this increase in Bitcoin over the last two days as a pullback to the support lines(broken) . Do you agree with me!?

In terms of Elliott Wave theory , it appears that Bitcoin is still completing the main wave B. The main wave B is a Regular Flat(ABC/3-3-5) . The structure of the microwave B of the main wave B was a Double Three Correction(WXY) .

Additionally, the SPX 500 index ( SP:SPX ), which Bitcoin is correlated with , is poised for a correction in my opinion, which could also impact Bitcoin .

Also, unlike previous Mondays, MicroStrategy has NOT purchased Bitcoin , and the company currently holds 607,770 BTC .

Old Bitcoin wallets also seem to be waking up to the fact that they can create movements in the crypto market . " In recent days, 471,867.8 BTC worth $56.39 million have been transferred from old wallets from 2012 to 2017 . ".

I expect Bitcoin to decline to at least the Support zone($116,900-$115,730) and fill the CME Gaps in the coming hours .

New CME Gap: $119,500-$118,295

CME Gap: $115,060-$114,947

Cumulative Long Liquidation Leverage: $117,401-$116,615

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

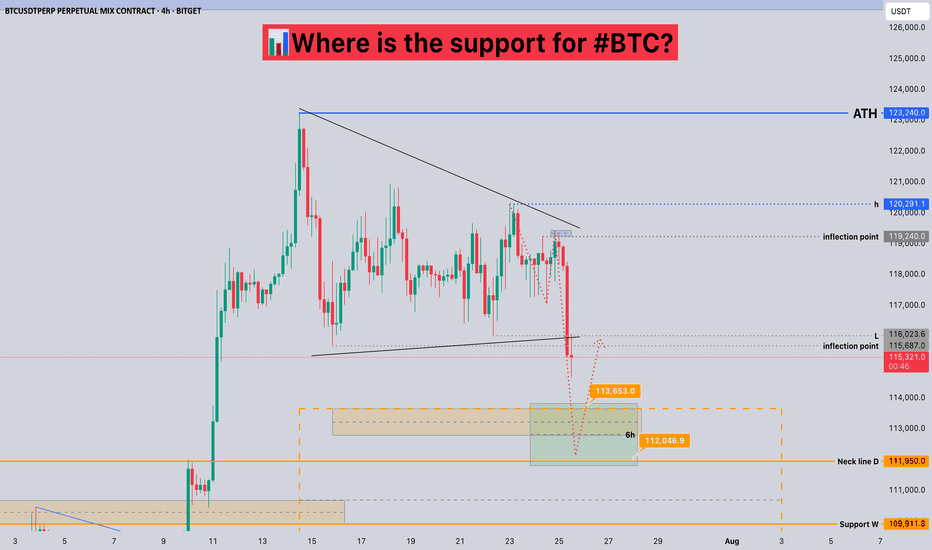

Where is the support for #BTC?📊Where is the support for #BTC?

🧠From a structural perspective, we did not stabilize after breaking through the inflection point of 119240, but broke down quickly. According to the current structure, the short-term support area is 112000-113700.

➡️From a morphological perspective, we failed to successfully break through the h point, but chose to break down, so we need to be vigilant about further pullbacks!

🤜If you like my analysis, please like 💖 and share 💬

BITGET:BTCUSDT.P

Bitcoin Correction Maturing – Long Setup Brewing!Bitcoin ( BINANCE:BTCUSDT ) has fallen by more than -4% over the past day.

Let's take a look at the reasons for the decline.

One of the key reasons behind Bitcoin’s decline in the past 24 hours ( July 25 ) could be the reduced likelihood of Jerome Powell being replaced as Chair of the Federal Reserve.

In recent days, market participants were speculating that Donald Trump might replace Powell — a scenario that was considered bullish for risk assets like Bitcoin. However, recent reports of a meeting between Trump and Powell, and signs that Powell might not be dismissed, have weakened this fundamental narrative.

This meeting may signal a truce or reduced tension between Trump’s team and Powell , which could imply a continuation of current Fed policies. That’s bad news for Bitcoin, as it removes a potential psychological tailwind from the market and dampens speculative sentiment.

As a result:

Over $500 million in liquidations(Long Positions) occurred

Weak inflows into Bitcoin ETFs

A stronger U.S. Dollar Index ( TVC:DXY )

And declining Gold( OANDA:XAUUSD ) prices over the past two days

all added additional selling pressure on BTC. Now let's take a look at Bitcoin's conditions on the 4-hour time frame .

Bitcoin currently appears to have broken the Support zone($116,900-$115,730) , Support lines , 100_SMA(4-hour TF) , and the lower line of the Symmetrical Triangle Pattern with a bearish Marubozu candle .

Note : In general, trading was difficult when Bitcoin was inside a symmetrical triangle (about 10 days).

It also seems that the pullback to these zones has ended and Bitcoin is waiting for the next decline .

In terms of Elliott Wave theory , Bitcoin appears to be completing microwave 5 of microwave C of major wave 4 . There is a possibility that main wave 4 will create a descending channel and complete at the bottom of the descending channel (at Potential Reversal Zone(PRZ) ).

I expect Bitcoin to start rising again after completing the CME Gap($115,060-$114,947) from Cumulative Long Liquidation Leverage($114,480-$114,000) or Cumulative Long Liquidation Leverage($113,284-$112,603) near the PRZ and Heavy Support zone($111,980-$105,820) .

Cumulative Short Liquidation Leverage: $117,904-$116,665

Cumulative Short Liquidation Leverage: $121,046-$119,761

Do you think Bitcoin has entered a major correction, or does it still have a chance to create a new ATH?

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.