Rising Wedge for #BTCUSDTWhat’s visible on the BYBIT:BTCUSDT.P chart:

📈 Rising Wedge:

➡️ This is a potentially bearish pattern for BYBIT:BTCUSDT.P , especially when it appears after a strong rally following a deep drop (which is exactly the case here).

➡️ The price has almost reached the upper boundary of the wedge and has already formed a second top (Top 2) — a signal of possible weakness.

🔵 Levels:

➡️ POC BYBIT:BTCUSDT.P — $82,490.8 has already been broken to the upside, indicating current market strength.

➡️ The price is approaching major resistance at $83,807.1 — momentum is already slowing down in this zone.

➡️ Support remains in the $80,449.7 – $78,412.7 area.

📊 Volume:

➡️ The rally was supported by high volume, but the most recent candles show declining volume as the price nears the top of the wedge.

➡️ This could indicate weakening buying pressure.

📉 Why it’s important to be cautious with long positions:

➡️ A rising wedge can act as a bull trap.

➡️ The price is near a critical resistance — even a small pullback could lead to a wedge breakdown.

➡️ After such a steep run (from 73K to almost 84K), the chance of profit-taking and a pullback is high.

➡️ Volume is declining — bullish momentum may be fading.

📢 Conclusion:

➡️ Opening a BYBIT:BTCUSDT.P long position right now is risky because:

- the wedge structure suggests a potential reversal to the downside;

- there’s no breakout above the previous high with confirmation;

- and volume does not support further upward movement.

❗️ It's better to watch how the price reacts to the wedge and BYBIT:BTCUSDT.P key levels — a long entry is only valid if the price breaks and holds above $83,800–84,000 with strong volume.

➡️ Until then, a neutral or cautiously bearish position is more appropriate.

BTCUSDTPERP

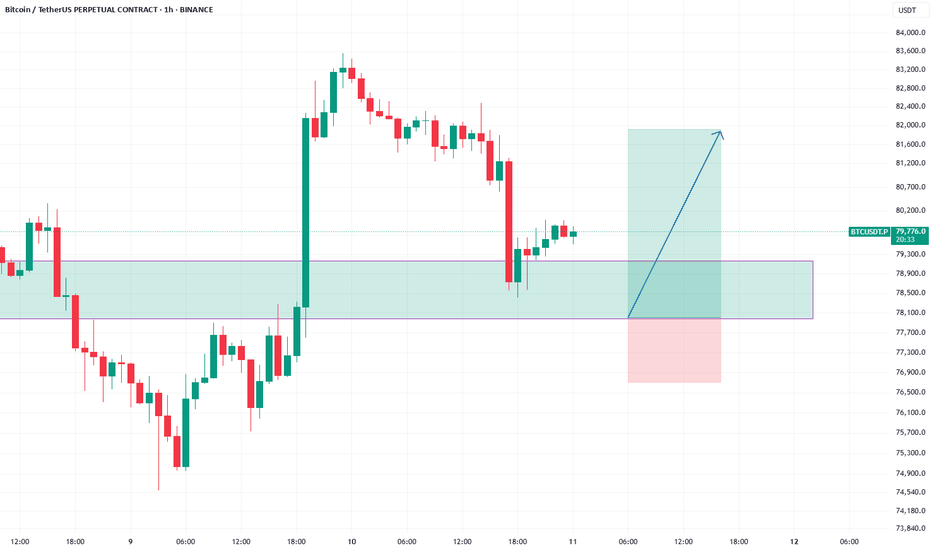

Bitcoin Short-Term Setup: Watch $79K Resistance!!!Bitcoin ( BINANCE:BTCUSDT ) started to fall again ,as I expected in the previous post .

This post is also a short-term analysis and is on the 15-minute time frame .

Bitcoin is moving near the Potential Reversal Zone(PRZ) .

In terms of Elliott Wave theory , Bitcoin appears to have completed a 5-wave downtrend on the 15-minute timeframe.

I expect Bitcoin to continue its upward trend in the coming hours , at least to the Resistance zone($79,350-$78,540) .

Note: If Bitcoin falls below $75,470, we can expect further declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BTC/USD) rejected point analysis Read The ChaptianSMC Trading point update

This chart presents a bearish short-term technical analysis for Bitcoin (BTC/USD) on the 2-hour timeframe. Here’s a breakdown

---

Key Observations:

1. Downtrend Structure:

Price is forming lower highs and lower lows.

A clear downtrend is marked on the chart.

2. Rejection Zone:

The yellow highlighted area near $83,800–$84,000 is labeled as a “rejected point.”

Price touched this zone and got rejected again, confirming resistance.

3. 200 EMA (Exponential Moving Average):

The 200 EMA is at $82,291, acting as dynamic resistance. Price is currently below it, reinforcing bearish momentum.

4. Support Level / Target:

The yellow box at the bottom around $74,559 is marked as the support zone and target level.

This is the previous low and aligns with the lower boundary of the descending channel.

5. RSI (Relative Strength Index):

RSI is showing a potential bearish divergence and is pointing downward, suggesting weakening bullish momentum and a likely move lower.

Mr SMC Trading point

---

Trade Idea:

Bias: Bearish

Entry: Around $81,300–$82,000 (after rejection confirmation)

Target: $74,559 (support level)

Stop-loss: Could be placed just above the rejection zone, around $84,000

---

Pales support boost 🚀 analysis follow)

#BTC bearish trend intact📊#BTC bearish trend intact📉

🧠From a structural perspective, the bearish structure is intact. We are still in a downward trend, and the downward trend line has not been successfully broken. The downside risk has not been eliminated, so we still need to be vigilant against the risk of further decline.

➡️Currently in the rebound stage, the staged resistance area is around 78800-81100. We can only maintain a slightly optimistic attitude if we break through this resistance area and stabilize.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

#BTCUSDT at a Turning Point: Volume, Pattern & Macro Analysis🚀 BYBIT:BTCUSDT.P is potentially entering the final phase of a correction, but key levels have not yet been broken or confirmed — caution and reliance on validated signals are essential.

✅ Technical Analysis:

📈 Overall Timeframe Context:

➡️ 1H (hourly chart): A “double bottom” structure is forming, suggesting potential for a local rebound. Volume is gradually increasing at the second reversal point (Bottom 2), confirming growing buyer interest. A resistance zone is forming near the POC (83,236.9), but the price has yet to firmly break above 77,000.

➡️ 4H (4-hour chart): A more distinct “double top” pattern (Top 1 / Top 2) has already played out. Price broke down from the sideways range, falling below the lower boundary of the rectangle. It is currently trading near the key support level of 74,907.8 with an attempt to bounce back upward.

➡️ 1D (daily chart): A key observation is the breakdown of the ascending wedge, followed by the formation of a falling wedge — a potentially bullish pattern. The price is testing the lower edge of this wedge. A sharp increase in volume may indicate the start of an accumulation phase.

📍 Key Point:

➡️ The 74,907.8 level has been tested twice with strong volume response, reinforcing its role as a critical support zone.

➡️ A large liquidity cluster around the 83,000–84,000 POC zone could act as a price magnet in the event of a reversal.

📊 Volume Profile Analysis:

➡️ Across all timeframes, the POC is shifting toward the upper part of the range, confirming that buyers previously dominated the market. Redistribution now appears to be underway.

➡️ Most of the volume activity has been concentrated in the 83,000–85,000 range — if price returns to this zone, strong resistance is expected.

🔄 Market Structure:

➡️ A transition is underway from a distribution phase to a potential accumulation phase.

➡️ The downtrend remains active on the daily chart, but there are signs of momentum slowing and attempts to form a bottom.

✅ Fundamental Analysis:

🌐 Macroeconomic Outlook:

➡️ In early April, discussions about a potential Federal Reserve interest rate cut are expected to continue — a moderately positive factor for risk assets, including cryptocurrencies.

➡️ BYBIT:BTCUSDT.P remains in the spotlight for institutional investors (with ongoing inflows into BYBIT:BTCUSDT.P ETFs), though geopolitical uncertainty and dollar liquidity pressure persist.

🏦 Capital Flows:

➡️ Trading volume remains high, but there is a lack of significant inflows, suggesting that major players may be adopting a wait-and-see stance.

📢 Recommendations for BYBIT:BTCUSDT.P :

📢 Closely monitor the price reaction in the 74,900–75,000 zone — a breakout or confirmation of support will determine short-term direction.

📢 The 78,279.2 level is a key resistance — its breakout could attract new buyers.

📢 Watch how price behaves within the falling wedge (1D); if the structure tightens and volume increases, a breakout may follow.

📢 Keep monitoring macroeconomic events — particularly U.S. inflation data and upcoming Fed meetings.

📢 Pay close attention to volume activity at local lows — this may be the key to spotting a trend reversal.

BTC/USD) Bullish reversal analysis Read The ChaptianSMC Trading point update

This is a bullish reversal analysis on BTC/USD (Bitcoin to USD) on the 4-hour chart, suggesting a potential long opportunity after a sharp corrective move.

---

Key Breakdown of the Chart:

1. Strong Downward Move with Potential Reversal:

Bitcoin experienced a sharp drop from the 88k region to ~74,387.50, now hitting a key demand zone (marked as "Orderblock").

2. Bullish Reaction Expected:

From the Orderblock support zone, a bullish reversal is anticipated.

The projected move aims to fill the imbalance and test the target zone between 87,152.94 and 88,557.14.

3. RSI Oversold:

RSI is around 32.27, indicating oversold conditions and adding confluence for a potential bounce.

4. EMA (200):

The 200 EMA lies around 85,153.85, which may act as dynamic resistance on the way up.

Mr SMC Trading point

5. Price Target:

The expected upside move is approximately +13,722.85 points (+18.75%), aiming for the supply zone above 87k.

---

Conclusion / Trade Idea:

Entry Zone: Near 74,387.50, the orderblock/demand area.

Target Zone: 87,152.94 – 88,557.14

Bias: Bullish short- to mid-term reversal.

Confluences: Oversold RSI, clean support zone, potential trendline bounce, and price inefficiency above.

---

Pales support boost 🚀 analysis follow)

Bitcoin Holding Strong — Next Stop: $150K?BTCUSDT Technical analysis update

BTC price is currently retesting its major support zone, which was previously a strong resistance area, now acting as support at the $70K–$75K level. The price has just touched the $75K support zone, and we can expect a consolidation above the $70K level followed by a potential bounce back or a V-shaped recovery from the current level.if we see a strong bounce from the current support level, the next potential target could be around $150K

Buying BTC at 73.5k - Why I’m Buying This Range Price has now dropped into a key demand zone where previous volume imbalances were left untested. The range around 74.6k–73.8k shows signs of absorption and buyer interest based on low volume nodes (LVNs) and volume profile structure. This zone acted as a major breakout area in the past, and with no acceptance below 74.6k on the 1H close, it suggests sellers are getting exhausted. I’m watching for signs of accumulation and structure shifts in this area to initiate longs, with invalidation on clean 1H closes below 73.7k. If BTC reclaims 75.1k on the 1H, expect momentum to shift and buyers to take it toward higher POCs and imbalance zones

Bitcoin: Breaking Below $80K Soon,10% Correction on the Horizon?Hey Realistic Traders, Bitcoin is consistently hitting new lower lows. Could this signal that the bear market is here to stay? Let’s dive in.......

On the H4 chart, Bitcoin is clearly in a bearish phase. It consistently trades below both the trendline and the EMA 200, reinforcing the downtrend. Additionally, a rising wedge pattern has formed and broken out, and the MACD has shown a bearish crossover. This crossover is a key indicator, signaling that momentum is shifting from buyers to sellers.

Together, these signals suggest that Bitcoin may drop toward our first target at 79,081. After reaching this level, a short pullback is expected as traders take profits before the price continues its descent toward a new low at 73,633.

This outlook remains valid as long as the price moves below the stop-loss level at 89,557

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on Bitcoin.

TC/USD Bearish Flag Breakdown Targeting 81,660 Support ZoneThis is a 1-hour BTC/USD (Bitcoin/US Dollar) chart showing a bearish setup. Here's the breakdown:

---

Key Observations:

1. Bearish Rejection Zone (Purple Box - ~83,174.62):

Price is showing rejection at a key resistance zone.

Both the 30 EMA and 200 EMA are above current price, adding downward pressure.

2. EMA Analysis:

30 EMA (Red Line): ~83,174.62 – acting as dynamic resistance.

200 EMA (Blue Line): ~83,715.92 – strong long-term resistance.

Price is below both EMAs, reinforcing bearish sentiment.

3. Pattern Analysis:

Bearish flag/wedge breakdown has already occurred.

Target projection based on measured move suggests a ~1.44% downside.

Anticipated drop towards 81,660.29, which aligns with prior support zone.

4. Price Action:

Recent breakdown from a small rising channel (bear flag).

Pullback to resistance (purple zone) seems complete, and continuation downward is expected.

---

Strategy Summary:

Bias: Bearish

Entry Zone: Near 83,174.62 (already rejected)

Target: 81,660.29

Stop Loss Idea: Above 83,715.92 (EMA 200)

#BTC ideal target zone has been achieved📊#BTC ideal target zone has been achieved✔️

🧠From a structural perspective, the ideal target zone of the hourly bullish structure has been fully achieved, so the corresponding decline is very reasonable. Moreover, the daily closing price of the candlestick chart is lower than the downward trend line, so we failed to successfully break through and stabilize. The downward trend at the daily level is still intact, so we need to be alert to the risk of further decline.

➡️Because of the risk of further decline, I closed the long position in advance yesterday. Although I finally reached the ideal target zone, I would also feel distressed, but trading is like this, there are gains and losses. When the market goes crazy, what we need is not a more sophisticated technical analysis, but a calm observation of the greedy self in the mirror.

➡️If the market rebounds further, then the resistance zone we can pay attention to is 84576-86000. 📉

➡️If the market falls further, then the support zone we can pay attention to is 78363-79500. 📈

Let’s see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

"Bitcoin vs Tether" Crypto Market Heist Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BTC/USDT "Bitcoin vs Tether" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (87000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 2H timeframe (83000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 93000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

BTC/USDT "Bitcoin vs Tether" Crypto Market Heist Plan (Swing Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BTCUSDT, We were moved like ...Hello everyone

According to the chart that you can see the price movement was exactly moved to our route but at this time we expect because of the reason in world and US Reciprocal Tariffs at this time Gold movement is important after the Gold start the corretion wave the smart money comes to the cryptocurrency market and we expect the excitement movement.be patient until ...

Be Lucky

AA

#BTC #BTCUSD #BTCUSDT #BITCOIN #LONG #SWING #Analysis #Eddy#BTC #BTCUSD #BTCUSDT #BITCOIN #LONG #SWING #Analysis #Eddy

BTCUSDT.P Swing Long Analysis With Entry Point

This is my first possible scenario and analysis of Bitcoin's future trend.

This Analysis is based on a combination of different styles, including the volume,ict & Price Action Classic. (( Head & Shoulder Pattern ))

Based on your strategy and style, get the necessary confirmations for this Swing long to enter the trade.

Don't forget risk and capital management.

Entry point already touched : 🟢 79285.50

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

🗒 Note: The price can go much higher than the first target, and there is a possibility of a 500% pump on this currency. By observing risk and capital management, obtaining the necessary approvals, and saving profits in the targets, you can keep it for the pump.

Spot Investing : ((long 'buy' position)) :

🟢 Entry 1 : 79285.50

🟢 Entry 2 : 61845.77 (( This Entry is for secound scenario ))

First entry point calculations :

⚪️ SL : Behind the last shadow created.

⚫️ TP1 : 250000 ((215.32%))

⚫️ TP2 : 500000 ((530.63%))

⚫️ TP3 : 999000 ((1160.00%))

‼️ Futures Trading Suggested Leverages : 3-5-7

The World Let it be Remembered...

Dr. #Eddy Sunshine

4/4/2025

Be successful and profitable.

Do you remember my first Bitcoin swing long signal entry & targets?

My first swing long signal was provided on BTC, which was spot pumped by more than 150% and was profitable :

Bitcoin (BTC/USD) Technical Analysis: Breakout or Rejection at K200 EMA (Blue Line): 84,124 – This is a long-term trend indicator.

30 EMA (Red Line): 83,925 – A short-term trend indicator.

Key Levels

Resistance Point: Around 83,925 (marked in blue).

Support Zone: Around 82,184 (Stop Loss zone).

Target Point: 88,197, indicating a potential 6.34% upside.

Potential Trade Setup

Scenario 1 (Bullish Case):

If price breaks above resistance (83,925) and EMA 200, then a move towards 88,197 is expected.

A breakout confirmation might lead to an uptrend continuation.

Scenario 2 (Bearish Case):

If price rejects at resistance (83,925) and falls back below the support zone (82,184), a downward move could happen.

Pattern Analysis:

The chart suggests a potential accumulation phase before a breakout.

Possible retest of resistance before a rally.

Conclusion

Bullish above 83,925, targeting 88,197.

Bearish below 82,184, with potential downside.

Price action near the 200 EMA is crucial for the next move.

#BTC tests the resistance zone again!!📊#BTC tests the resistance zone again!!

🧠From a structural perspective, the bullish structure is still intact, bullish expectations still exist, and the ideal target zone (86500-88188) has not yet been achieved, so we can still keep a small number of positions to look forward to this possibility.

➡️However, at present, we are testing the downward trend line at the daily level again, and whether it can be successfully broken through is still unknown, so we are conservative and lock in 80% of the main profits, and don’t chase the resistance zone.

➡️If it breaks through successfully, it will also reach the ideal target zone of the bullish structure, so new long transactions need to observe whether it can stabilize above the downward trend line, otherwise it should not be too optimistic.

⚠️Note that if the downward trend line cannot be successfully broken through, we need to be wary of the risk of further decline.

Let’s see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

#BTC reaches resistance zone📊#BTC reaches resistance zone✔️

🧠From a structural point of view, we have built a bullish head and shoulders structure in the green buy zone, so such a rise is very reasonable. And the market reached the resistance zone of 85000-86000 as expected.

➡️It is no problem to lock in profits after the target is achieved. Although it is currently in the resistance zone, there is no short signal, and the ideal target zone of the bullish head and shoulders structure (86500-88188) has not been achieved, so there will be some contradictions.

➡️Therefore, we need to pay attention to the short signals that appear in the resistance zone, or try to participate in some short trades after the ideal target zone is achieved, otherwise wait patiently for the callback to appear before participating in long trades, and do not chase the rise in the resistance zone.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

Bitcoin (BTC/USD) Short Trade Setup: Resistance Rejection & TargThis chart is a Bitcoin (BTC/USD) 15-minute price chart from TradingView, showing a potential short trade setup based on technical analysis. Here’s a breakdown of the key elements:

1. Resistance Zone & Short Setup

The purple highlighted area represents a resistance level around $85,358.

Price is consolidating within this resistance zone, suggesting a potential reversal.

The expected scenario involves a price rejection from this resistance, leading to a downward move.

2. Moving Averages

EMA (200, blue line) at $83,433: A long-term trend indicator suggesting a strong support zone.

EMA (30, red line) at $84,657: A short-term trend indicator, currently above the price, indicating a potential bearish setup if the price moves below it.

3. Target & Stop-Loss Le