BTCUSDT TRADING POINT UPDATE >READ THE CHPTAIANBuddy'S dear friend

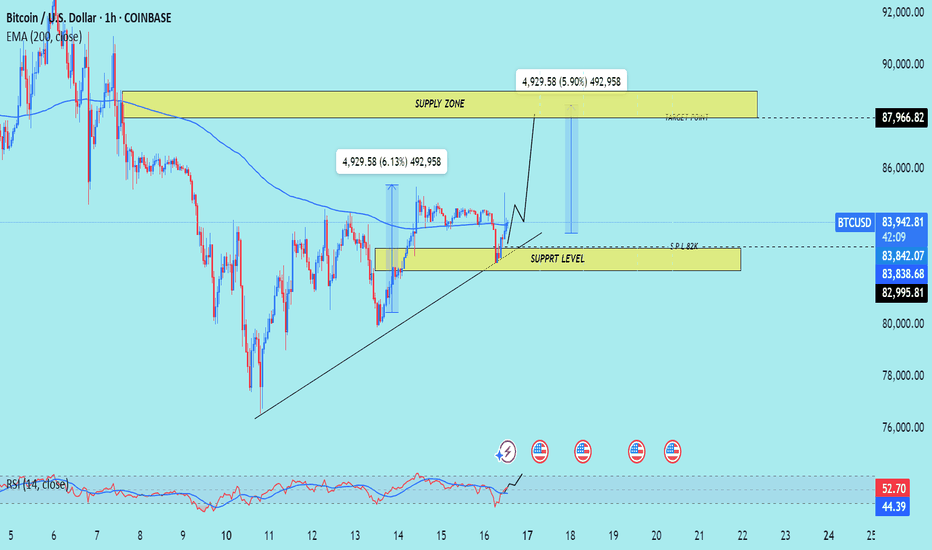

SMC Trading Signals Update 🗾🗺️ crypto Traders SMC-Trading Point update you on New technical analysis setup for crypto BTC USDT. ) list time post signals 💯 reached target point ) 👉 New technical analysis setup BTC USDT looking for bullish trend 📈 FVG level support level. 83k 82k support level 87k 88k resistance level ). Guys 🤝 good luck 💯💯

Key Resistance level 87k + 88k

Key Support level 83k - 82kà

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

BTCUSDTPERP

#BTC breaks resistance, what's next?📊#BTC breaks resistance, what's next?

🧠From a structural perspective, we broke through the resistance near 84500 that was tested many times, so resistance will turn into support, but since we are in the blue resistance zone, we need to be conservative in chasing up here. The next strong resistance is near 86000, and the extreme pressure is near the downward trend line and the blue neckline, which is about 90000-91000.

➡️Since the long structure is established, but it is currently in the blue resistance zone, if we can't continue to attack upward here, then we need to find support at a low point to participate in long transactions, then the support area worthy of our attention is 79545-81500 (unfortunately, it was $359 away from our entry point yesterday). The extreme support area is 69000-73000 (it is difficult to reach here quickly without major negative events).

Let's see 👀

🤜If you like my analysis, please like 💖 and share 💬 BITGET:BTCUSDT.P

Bitcoin’s Monthly RSI Nearing Danger Zone – Time to Sell?The chart above illustrates Bitcoin’s price action alongside the Relative Strength Index (RSI) on a monthly timeframe, which helps identify overbought and oversold conditions. Historically, Bitcoin’s major bull cycle peaks in 2013, 2017, and 2021 coincided with the monthly RSI reaching between 85-95, as highlighted by the blue circles. A downward trendline connects these peaks, suggesting that each cycle has seen slightly lower RSI highs, indicating a potential long-term momentum decline.

Currently, the RSI is approaching this historical resistance zone, signaling that Bitcoin may be nearing its market peak. If this trend continues, it could mark the final phase of the bull run, making it a strategic period for profit-taking. Traders should closely monitor RSI behavior, as a rejection from this level could indicate the start of a correction.

Historically, a monthly RSI of 85-95 has been a strong sell signal, marking the end of Bitcoin’s bull markets. If Bitcoin follows this pattern again, a distribution phase followed by a downturn could be expected.

Bitcoin's 1065-Day Bull Run Nearing Its End – A Cycle ComparisonThis chart illustrates Bitcoin’s historical price action over three major market cycles, each lasting approximately 1065 days (35 months). The pattern suggests that Bitcoin follows a well-defined four-year cycle, influenced by its halving events. Each cycle begins with a bearish phase (marked in red), followed by a strong uptrend (green), leading to a peak before another correction phase starts.

A key observation is that the duration of each bull run remains consistent, lasting around 35 months (~1065 days) before reaching its peak. Historically, Bitcoin has followed a similar trajectory, with price action mirroring previous cycles. If this pattern holds, the current bull run may reach its peak within the next 6-8 months, placing the market top around late 2025.

Additionally, past cycles show that altcoins tend to experience their strongest moves after Bitcoin peaks, meaning an altseason could emerge by Q3–Q4 2025.

BTC Today's strategyAt present, BTC is still fluctuating in the range of 80K-85K. This week, after reaching around 85K many times, it started to fall, and the consecutive short bets I provided also made profits many times.

If you are currently unsatisfied with the bitcoin trading results and are looking for daily accurate trading signals, you can follow my analysis for potential assistance.

Today's BTC trading strategy:

btcusdt sell@85K-87K

tp:83K-81K

Bitcoin - Comprehensive AnalysisThis is a Bitcoin TA article. In it, I will review the bullish and bearish scenarios. I will also provide price and time cutoff points, which could help us find trade opportunities.

Short-Term Bias is Bullish:

Before reviewing potential scenarios, I want to clarify one point: regardless of whether Bitcoin is long-term bearish or bullish, I expect a short-term upside in the coming days and weeks. The only question is how high it will go and how long it will last. I am optimistic about the short-term because Bitcoin is in the initial stages of the 60-day cycle that began on March 14, and the broader 200-day cycle is also in its early phase. Thus, when both the short and medium-term cycles trend upwards, Bitcoin is bullish, at least for the short-term.

Figure 1: Bitcoin Cycles

The Bearish Scenario:

Let’s begin with the bearish scenario. In this case, Bitcoin has completed primary wave five, and the correction in primary wave A is currently in progress. Primary wave A consists of an ABC structure, with the A wave likely completed. Currently, it appears to be in the initial stages of wave B. If this assumption holds, the likely target for wave B is the 0.618 retracement of A, both in terms of price and time, which sets our price target at 97K and our time target for April 7th or later.

Figure 2: The Bearish Scenario

The Bullish Scenario:

The bullish scenario posits that within primary wave five, Bitcoin completed intermediate wave four on March 14, and that intermediate wave five is about to commence. In this case, the likely target for wave five lies between 111K and 117K, although it could extend even higher. The time ratio for the fifth wave is 0.618 of the duration of wave three, which brings us to April 21.

Figure 3: The Bullish Scenario

Short-Term Minimum Target:

Even if we assume Bitcoin is bearish and that we are about to enter a prolonged correction period, I still expect Bitcoin to retrace 50% of wave A, which also marks the intersection of the upward and downward sloping channels. This retest could occur as early as Monday, March 17th, the soonest decision point.

A cross above the 50% retracement and entry into the upward sloping channel will signal a bullish bias. A rejection from the 50% line and a continuation lower will strengthen the bearish bias.

Figure 4: Minimum Short – Term

Max Target:

The maximum target suggests an extended fifth wave, and in that scenario, Bitcoin could reach as high as $123K, representing the 1.272 extension as early as April 13th. These points of price and time intersect along the 45-degree angle that marked the top of primary waves one and three. Wave five can extend even more, but at this point it is hopeium.

Figure 5: Max Target

Additional Considerations:

Yearly Cycles. In the last four years, Bitcoin reached an intermediate top between mid-March and mid-April. However, on March 14, 2020, it indicated the bottom before a bull run. I am leaning toward the bear case because March 2020 was an exceptional year due to the COVID crisis.

Fed Pivot. The next FOMC meeting is on March 19th. According to CME’s Fed Watch tool, the Fed will unlikely pivot on March 19th. Whether it does or doesn’t pivot on March 19th, the latest inflation data increases the chances of a pivot soon, which could ignite the final fifth wave and the blow-off top.

Figure 6: Yearly Cycles

Bitcoin Dream:

This is a “feel good” scenario. If everything aligns, it could become a reality.

Figure 7: Bitcoin Dream

BTC Today's strategyThe balance of long and short power in the market suggests that there may be explosive movements in the short term. At present, the price of Bitcoin is fluctuating in the range of 82,000-85,000 US dollars, and the short-term resistance is at 86,000 US dollars. A break through 86,000 US dollars could trigger a new round of gains

Bitcoin ETF funds have seen net outflows for five consecutive weeks, with demand falling to the lowest level in 2025, indicating that institutional funds are withdrawing and market sentiment is turning cautious. However, institutions such as MicroStrategy continue to buy, providing some support for bitcoin prices

The market is worried about the risk of possible liquidity tightening before the FOMC meeting in March, the uncertainty of the global economic situation and the signs of monetary policy adjustment in some major economies, making traditional financial marekts more attractive, and there is a trend of capital flowing back from the cryptocurrency market to the traditional financial field, which has some pressure on the bitcoin price

btcusdt sell@85500-86500

tp:83K-81K

We will share various trading signals every day. Fans who follow us can get high returns every day. If you want stable profits, you can contact me.

BTC Today's strategyIndustry News: Japanese listed company Metaplanet increased its holdings of 162 BTC, which to some extent reflects institutional optimism towards Bitcoin, and may have a positive impact on market sentiment, attracting more investors to pay attention and buy. However, Bitcoin's real-world application is still relatively limited, and its fundamentals are still relatively weak, which may limit the price of Bitcoin in the long run.

From the supply side, after bitcoin hit its highest price in history, short-term holders (STH) increased their holdings, while long-term holders (LTH) decreased their holdings. This change in supply pattern reflects the growing speculative atmosphere in the market, and short-term traders are more sensitive to price fluctuations, which may lead to increased volatility in bitcoin prices. From the demand side, despite the continued increase in bitcoin holdings by institutional buyers and ETFs, actual spot demand continues to decline. If demand does not recover, bitcoin's continued rally may be difficult to maintain.

Overall, the price of Bitcoin on March 14, 2025 is currently showing a certain upward trend, but the overall trend is still facing many uncertainties. A variety of factors such as the macroeconomic environment, the Federal Reserve's monetary policy, industry dynamics, and market supply and demand are all having an impact on the trend of Bitcoin.

buy:77K-79K

tp:83K-85k

We will share various trading signals every day. Fans who follow us can get high returns every day. If you want stable profits, you can contact me.

BTCUSDT SHORT (FIXED 1-ST target NOW) I fix the 1st take at $80,913 and move the stop order to breakeven .

1- the position itself is correct, but such manipulations with the news background and constant volume shift do not allow to correctly assess the moment of price reversal

2- Key markings before opening the position also took the format of price manipulation and should not have reached the value of $84,000 again in a normal market

In this regard, I decide to secure the position and take part of the profit in order to calmly continue trading while respecting the risks .

Main overview:

Further targets remain unchanged

#BTC Horizontal Consolidation Expected📊#BTC Horizontal Consolidation Expected📊

🧠From a structural perspective, we still failed to successfully break through the resistance of 84,500, but there was no rapid callback. Instead, we were doing horizontal consolidation to digest the selling pressure near the blue pressure zone, so we can maintain the sideways fluctuation to execute the transaction. This is why I chose to close the long order near 84,000.

➡️Since the horizontal consolidation view is maintained, what we need to find is the gradually rising oblique support. The support points that can be paid attention to are 81,400 and 82,400.

➡️Since it is difficult to fall, the profit space of short selling will be squeezed, which will make us feel very strenuous. So if we want to short sell, we need to find high resistance to try. Then the resistance worth our attention is 86,000, and the resistance zone in extreme cases is 88,000-90,000

Let's take a look👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

Is the #BTC downtrend over?📊 Is the #BTC downtrend over?

🧠From a structural perspective, the current rally is over. If we want to reverse the daily downtrend, we need to build a bullish structure of the same cycle. That is to say, we can only remain optimistic if we succeed in standing above 84,500.

➡️If we continue to break below the low L: 76,562, the next support area worth our attention is 69,000-72,000

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

BTCUSD buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

BTCUSDT TRADING POINT UPDATE >READ THE CHAPTIANSMC Trading Signals Update 🗾🗺️ crypto Traders SMC-Trading Point update you on New technical analysis setup for crypto BTC USDT. ) crypto Traders BTC USD ) list time post signals 🚀 Hit sucksfully My target point ) Now update on New analysis setup. BTC USDT still drop 💧. Trend 📉. Technical patterns FVG) 85k. Back down trand target point 78k.

Key Resistance level 85k

Key Support level 81k- 78k

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

There are no failed investments, only failed operationsI. Trend analysis

🔹 overall trends:

Since the beginning of 2024, Bitcoin has experienced a clear upward trend, peaking at nearly $115,000.

The price has recently fallen below several key support levels and entered a downward trend, with prices testing support in the 80,000-85,000 range.

The short-term trend remains weak, and the market may continue to seek lower support levels.

🔹 moving average system:

The short-term moving average (red, 10th) indicating that the market is still dominated by short-term bears.

The long-term moving average (blue, 60 days) has also started to turn downward, suggesting a weakening of the medium-term trend.

Conclusion: The market is still in a downward trend, and the moving average system shows no obvious signs of stabilization.

Structural analysis (K-line morphology)

📌 head and shoulders may have been completed:

From the high level formed by 93,000 to 115,000, there is a more obvious head and shoulder structure, which is currently falling below the neckline (82,000) and accelerating the decline.

If this pattern holds, the target decline level may test the 77,000-80,000 area.

📌 M head shape:

The previous two highs (around 100,000) formed an M-head and fell below key support, remaining weak in the short term.

📌 support area:

77000 (important support, if broken, the medium-term trend may accelerate to short)

72000~ 75000 (target in extreme cases)

📌 resistance areas:

89000~ 90000 (early neckline, has turned to strong resistance)

93000 (if the market rebounds, it needs to break through this level to reverse the trend)

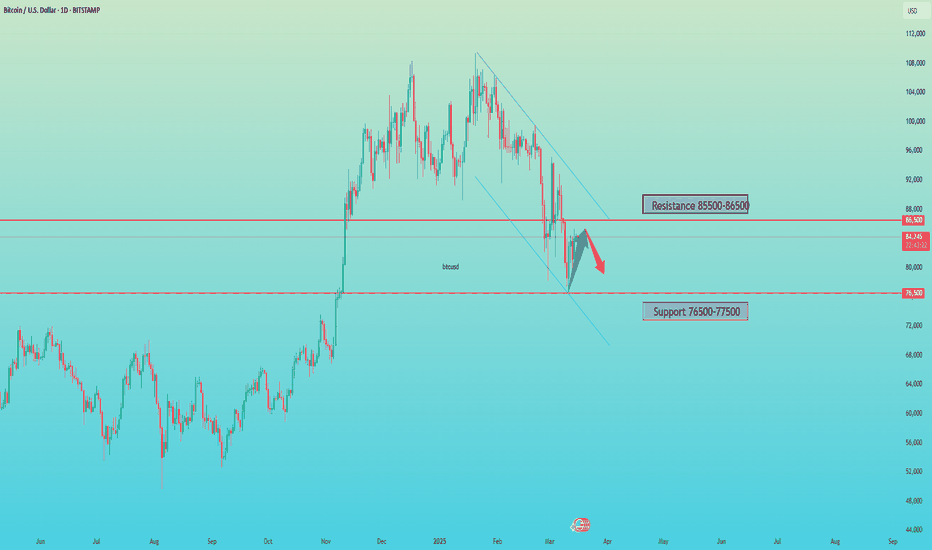

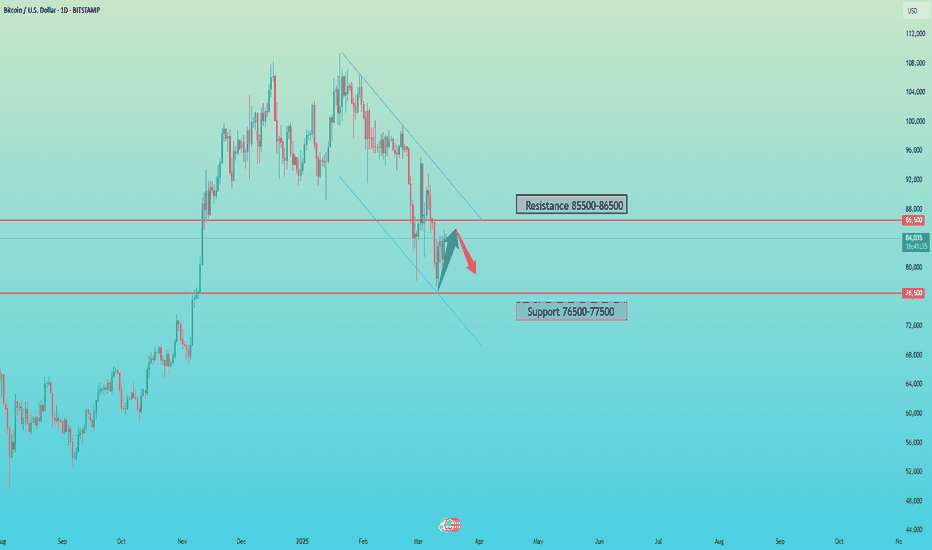

Bitcoin Collapses $80K, What’s Next?Its price briefly stabilized around $86K over the weekend before heading south at the start of the business week. It dropped to around $80K, leaving millions in liquidations on a 24-hour basis. Later, bulls stepped in and pushed the valuation to nearly $84K. The resurgence, however, was short-lived and was followed by another free fall to as low as $79,500. As of this writing, BTC is trading around $79,000, representing a 5% drop on the day. Its market cap dropped below $1.6 trillion.

While many industry players are hopeful that this is another temporary pullback that can be replaced by a new bull run, others are not so optimistic. Next up is a re-estimation of $78K for BTCUSD, “if that fails, the next $76300, 75,500 in the crosshairs.” BINANCE:BTCUSDT BITSTAMP:BTCUSD COINBASE:BTCUSD BYBIT:BTCUSDT.P

#BTC reaches target zone📊#BTC reaches target zone✔️

🧠The weekly close is below the grey zone, so this zone has turned into the blue resistance zone (W).

➡️From a structural point of view, we have reached the support line and the target zone of the small bearish structure is also here, so don't chase the short here, if the price can rebound to the blue resistance zone or the lower edge of the triangle again, then you can try to participate in some short trades.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

#BTC Descending Triangle📊#BTC Descending Triangle📉

🧠From a graphical perspective, we broke below the lower edge of the triangle, so we need to be wary of further declines.

➡️From a structural perspective, we broke below the support zone (84000-86000), so support turned into resistance. If the price returns to this area again, consider participating in some short trades.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

BTCUSDT TRADING POINT UPDATE >READ THE CHAPTIAN Buddy's dear friend 👋

SMC Trading Signals Update 🗾🗺️ crypto Traders SMC-Trading Point update you on New technical analysis setup for crypto BTC USDT BTC still rejected supply zone. Again. Back Short Trade. FVG level) 83k I'm want to Sell now short trend 📈

Key Resistance level 93k + 95k

Key Support level 85k - 83k

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

BTC/USD Ready for a BIG DROP? Next Target: Demand Zone!Bitcoin Showing Weakness – Smart Money Preparing a Move!

BTC/USD is struggling to hold key resistance levels, signaling potential distribution before a larger sell-off. Institutional players have grabbed liquidity, and a Break of Structure (BOS) to the downside confirms bearish momentum.