BTC - IDEA to a broader porpsects!I have marked two green lines, BTC looks weak and certain "news" can make it get bonked a lot, What you can plan is - BTC looks to fall till the green line below, marks up as 95,758 and breaking that would slit to 95,121. Now also, look at the doodle, theres a small depression made and from there the reversal can happen back to 101k and eventually to 102,453.

Eventually its enough for spikes to eat you up!

BTCUSDTPERP

BTCUSDT TRADING POINT UPDATE > READ THE CHAPTIAN Buddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ crypto Traders SMC-Trading Point update you on New technical analysis setup for crypto currency BTC USDT. Crypto traders last time post signals 🚀 hit sucksfully My target 🎯. Now post new analysis setup for crypto BTC USDT still holding it up 💪 trend 📉📈 now if close below and close above technical analysis BTC USDT close below 👇 97k next support strong 🪨💪 level of 89k. Don't close this level pullback up closed above 102k Next target 109. Wait for closing any said it take entry

Key Resistance level 102k + 106k + 109k

Key Support level 97k - 91k 89k

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

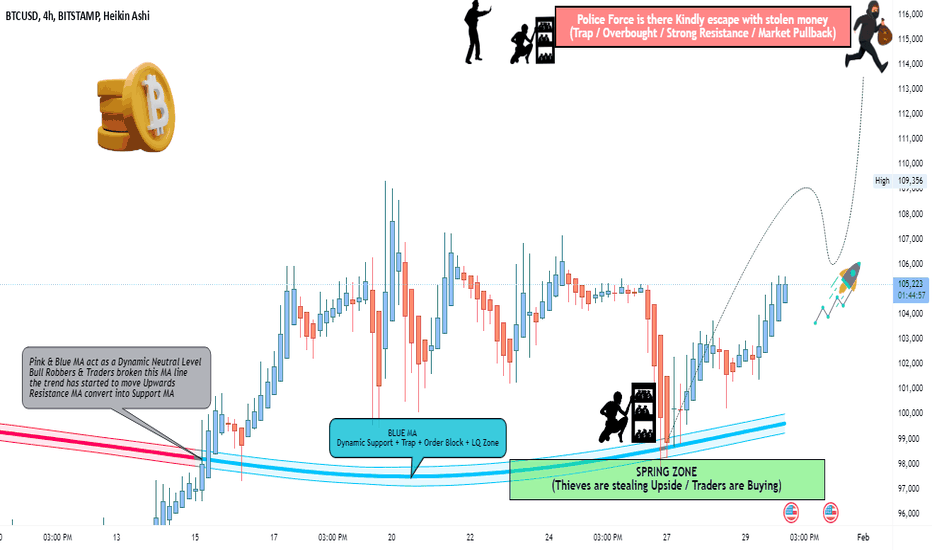

BTC/USD "Bitcoin vs US Dollar" Crypto Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BTC/USD "Bitcoin vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!"

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Goal 🎯: 115,000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

🚩 Fundamental Analysis

- Bitcoin's Limited Supply: The total supply of Bitcoin is capped at 21 million, which could lead to increased demand and higher prices.

- Increasing Adoption: Growing acceptance of Bitcoin as a form of payment and store of value could drive up demand and prices.

🚩Macroeconomic Analysis

- Global Economic Uncertainty: Ongoing economic uncertainty and inflation concerns could lead to increased investment in Bitcoin as a hedge against traditional assets.

Monetary Policy: Central banks' monetary policies, such as interest rate decisions, can impact Bitcoin's price.

🚩COT Report

- Speculative Positions: The latest COT report is not available, but speculative traders are likely to be net long on BTC/USD, indicating a bullish sentiment.

🚩Sentimental Analysis

- Market Sentiment: Market sentiment is mixed, with some investors expecting a bullish movement due to increasing adoption and limited supply, while others are bearish due to regulatory uncertainty and market volatility.

🚩Institutional Trader Analysis

- Institutional Positions: Institutional traders are watching the market closely, awaiting regulatory clarity and economic developments.

🚩Retail Trader Analysis

- Retail Positions: Retail traders are also cautious, with some taking long positions on BTC/USD due to increasing adoption and limited supply, while others are taking short positions due to regulatory uncertainty and market volatility.

🚩In terms of institutional and retail trader positioning, here's what we know:

- Institutional Traders: 55% are holding long positions in Bitcoin, indicating a bullish sentiment.

- Retail Traders: 42% are holding long positions, while 58% are holding short positions, indicating a slightly bearish sentiment.

🚩Outlook

- Based on the analysis, the BTC/USD pair is expected to move into a bullish direction in the short term, with a target level of 115,000. However, the movement is likely to be volatile, and investors should be cautious ahead of regulatory developments and economic data releases.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

BTCUSDT 30-Min Chart - Market Analysis & Trading Strategy📊 BTCUSDT 30-Min Chart - Market Analysis & Trading Strategy

Alright, bro, let’s break this BTC chart down and see what’s cooking. 🚀

📉 Trend & Market Sentiment

Uptrend Facing Resistance

Price made a strong push from demand (around 91K-94K USDT)

EMA 20, 50, and 100 all aligned bullish but facing resistance at 102.5K USDT

EMA 200 rejection means we need a strong breakout for continuation

Key Levels to Watch

Support Zone: 98K - 95.8K USDT (Demand Area)

Resistance Zone: 101.5K - 102.5K USDT (Supply Zone)

🎯 Trading Strategy

1️⃣ Bullish Scenario (If BTC Breaks 102.5K USDT)

Entry: 102.5K USDT 📍

Targets (TP):

TP1: 103.5K USDT

TP2: 105K USDT

TP3: 107K+ USDT

SL (Stop-Loss): 100.5K USDT

2️⃣ Bearish Scenario (If BTC Gets Rejected at 102.5K USDT)

Short Entry: 101K - 102.5K USDT 🎯

TP Levels:

TP1: 98.9K USDT

TP2: 96K USDT

TP3: 94K USDT (Deep pullback)

⚠️ Risk & Warnings

BTC is testing major resistance—if it breaks, we could see a strong pump! 🚀

If BTC fails 101K, bears could take control and send it back to 95K or lower.

EMA 200 is a make-or-break level—watch price action carefully!

🔥 Final Thoughts

Right now, BTC is at a critical resistance—it either breaks 102.5K and runs, or fails and retraces back to demand zones. Stay sharp, set your SLs, and don’t get rekt! 💎🙌

What’s your take on this? You thinking long or short? 🤔

Bitcoin’s Next Big Move: Road to $118K?Hey Realistic Traders, Is BINANCE:BTCUSDT Bullish Outlook Over Yet?

Let’s dive into the analysis...

For nearly a month, BTC/USDT remained in a consolidation phase. However, on January 17, 2025, it successfully broke through resistance, signaling the beginning of a bullish phase.

Since then, the price has consistently traded above the EMA 200, reinforcing a strong uptrend.

On the H4 timeframe, a Falling Wedge Breakout has been confirmed, accompanied by a bullish MACD crossover, further supporting the likelihood of continued upward momentum.

Based on these technical factors, the price is projected to rise toward Target at 118,000, as long as it stays above the critical stop-loss level of Stop Loss 97,777.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on Bitcoin."

MY BEST BET FOR BTC🚀 High-Probability Trading Setup: The Final Shakeout Before the Gigapump 🚀

📌 Scenario Breakdown:

We are approaching a critical inflection point in the market, where price action is setting up for a high-risk, high-reward opportunity. My best bet for the upcoming move follows this sequence:

1️⃣ Final Pump to the Fibonacci Extension Pocket

- The market is likely to push higher one last time, targeting the Fibonacci range extension zone where liquidity is stacked.

- This move serves to trap breakout buyers and trigger late FOMO entries before the reversal.

- Smart money will use this opportunity to distribute while retail piles in.

2️⃣ Slow Grind Down to Range Bottom

- After tapping the key extension level, momentum will fade, and a controlled slow dump will begin.

- Market makers will use this phase to offload longs and absorb early shorts.

- Traders expecting an immediate breakdown might get shaken out as price holds the range bottom.

3️⃣ Range Top Retest – The Bull Trap

- Before the real move down, expect a sharp retest of the range highs to trap more longs.

- This fakeout will fuel the liquidity needed for the next leg down as leveraged longs get wiped out.

4️⃣ Capitulation to ~$74 k

- Once liquidity is efficiently absorbed, we’ll see a swift capitulation towards $74ish as stops get triggered en masse.

- This move will create extreme fear, forcing weak hands out of the market.

5️⃣ Rebuilding Phase: Market Inefficiency Refill & Short Trap

- After the capitulation, the market will establish a new range, filling the imbalance left behind.

- The goal? Lure in aggressive shorts, making them believe the breakdown is real.

- Once enough liquidity is stacked, the market will flip, triggering the gigapump.

📊 How to Play It:

✅ Short the top fib extension area if price action shows exhaustion, reversal signs, or a fakeout wick.

✅ Watch for liquidity absorption at the range bottom. If it holds, expect a retest of the highs.

✅ Prepare for the capitulation wick. Look for divergences, liquidation flushes, and high volume around $74k for a potential long entry.

✅ Ride the gigapump once liquidity is fully absorbed. If shorts get trapped, reversal confirmation could lead to an explosive move up.

🔮 Big Picture:

This setup is a classic smart money play, designed to trap both bulls and bears before the real move. Stay patient, trade the levels, and don’t get baited by emotions.

What do you think? Would you tweak anything in this setup? 🔥

BTCUSDT at daily support, likely to bounce towards 103500The price has come down to daily support DS1. There is a likelihood that the price will find support here and will bounce. A long trade is favorable here from probability point of view. The target of this trade should be around 103.5k. There we have a resistance and the price may face struggle to cross that region and eventually retrace from there.

#BTC Support Zones Worth Watching📊#BTC Support Zones Worth Watching💥

🧠From a structural perspective, there is an opportunity to build a short structure here. If it starts to fall according to this structure, then the support zone we can pay attention to is 94500-96700.

⚠️Since the trend of the big cycle is a bullish trend, it is safer to participate in long transactions at low levels than shorting.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

#BTC rebound has been achieved📊#BTC rebound has been achieved✔️

🧠From the perspective of the graph, the triangle chose to break downwards and started to rebound after touching the yellow support area. This rise can only be defined as a rebound stage. There is no condition for building a reversal, so we can't be too optimistic. There is an expectation of a fall back when reaching the resistance area again, so we need to be alert to the risk of further decline.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

BTC Retests Trendline Support – Breakout to $125K Incoming?BTC has once again successfully retested the rising trendline, which continues to act as strong support. Currently, the price is consolidating near the resistance zone.

If BTC breaks above this marked area, we could witness a significant rally, potentially driving the price toward $125K.

If you find our work valuable, please like, comment, and follow. Thank you for your support!

Accumulation to Breakout: BTC’s Next Target RevealedBitcoin Analysis

After a 47% surge from the first accumulation zone, the price entered a consolidation phase.

Breaking out of the next accumulation zone, Bitcoin rallied by 61%, showcasing strong bullish momentum.

Currently, the price is consolidating again, with a potential 40% upside if the bullish trend continues.

Previous breakout levels now act as key support for any pullbacks.

#BTC Ascending Triangle Failed📊#BTC Ascending Triangle Failed❌

🧠From the perspective of the chart, we broke below the low (L), so the expectation of the ascending triangle failed. Since we chose to break down, if we want to participate in long trades, we need to find a suitable participation opportunity in the support area at a lower level.

➡️Currently in the buy zone, the risk of chasing shorts is too high. If there is a good rebound, you can pay attention to the resistance effect of the lower edge of the triangle and the blue resistance zone to participate in short trades.

➡️If the green buy zone does not rebound but directly breaks the inflection point (99501), you can pay attention to the support effect of the support line (97042)

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

#BTC/USDT LONG Ready to go higher#BTC

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 101300

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 101900

First target 103400

Second target 105500

Third target 107500

#BTC Ascending Triangle📊#BTC Ascending Triangle📈

🧠From the perspective of the chart, the price is gradually being compressed to form a triangle. Because this model is formed in an upward trend, we define it as an ascending triangle.

➡️If the price approaches the lower edge of the triangle and does not break the low point (L), then we can continue to be bullish, otherwise we need to wait for a lower position.

➡️If we go out of the black path, then the pullback after we break through the blue turning point is also a new long participation opportunity

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

#BTC complex consolidation phase📊#BTC complex consolidation phase☕️

🧠From a structural point of view, we have reached the resistance zone again. Only if we continue to hit a record high and then pull back can we maintain a positive attitude to be bullish, because the second goal at the weekly level has been fully achieved, so we need to be wary of the corresponding cycle adjustment.

➡️If we fall below the rising trend support line and build a short structure at the 4h level, then we need to be cautious. It may be wise to watch more and do less during this period, and try to control the position risk.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

Bitcoin to 34000BINANCE:BTCUSDT

Possible Targets and explanation idea

➡️We trade in a range. After deviation at the bottom we made a deviation at the top

➡️Now would be good to see sweep liquidity at 29630

➡️Main target is full fill of next Weekly gap above.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Bitcoin Cycle Top Discussion IITLDR:

Cycle Top Price: Between 123K (min.) and 144K (max.)

Cycle Top Time: Between mid-March and early April.

Bitcoin Cycle Top Price:

Bitcoin Primary Count:

Currently, Bitcoin is in the final stages of Primary Wave 5. The price has already reached the 1:1 Fibonacci extension and will likely extend higher. The following Fib extensions are:

1. 272 at 123.6K.

2. 1.382 at 130K.

3. 1.618 at 143.7K.

The primary 1.272 extension corresponds with the intermediate degree wave five target, establishing it as the most probable cycle top price.

Figure 1: Bitcoin Primary Wave Count.

Figure 2: Bitcoin Intermediate Wave 5 Count.

Bitcoin cycle Top Time:

The common practice in EW theory is to measure the 1.272 Fibonacci time extension of wave 4. According to the primary count, the Fibonacci 1.272-time ratio points to February 10th. According to the intermediate count, the Fibonacci 1.272-time ratio points to February 18th.

Figure 3: Bitcoin cycle Top Time – Primary Count.

Figure 4: Bitcoin Cycle Top Time – Intermediate Count.

Bitcoin Cycle Top According to Yearly Cycles:

The last four years have shown an interesting phenomenon. Bitcoin reached a significant top between mid-March and Early April. Should this trend persist, I expect the next cycle to top between mid-March and early April.

Figure 5: Bitcoin Yearly Cycle Tops.

Bitcoin Cycle Top According to the 4-Year Cycle:

If the March top is THE cycle top, what about the 4-year cycle? Bitcoin will likely form a higher price in an irregular correction by the end of 2025. If this scenario comes to pass, it will be in line with the 4-year cycle. The previous 4-year cycle top of 69K was also an overshooting wave B. Time will tell how the PA will evolve, but this scenario is highly likely.

Figure 6: Bitcoin 4-Year Cycle Top 2021.

If you read this post until the end, I appreciate your diligence. I hope it will be useful information that will help you make the most out 2025.

Best wishes

NTC

#BTC reaches resistance zone📊#BTC reaches resistance zone📉

🧠From a structural perspective, we have reached overlapping resistance zones, so we need to be alert to the risk of a pullback. This upward trend is difficult to reach a new all-time high because there is no bullish structure to support it, so it is highly likely that it will maintain a complex horizontal consolidation, so wait patiently for a pullback opportunity before considering going long.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P