BTC Rebounds After 100000 Drop, Eyeing Short at 109500 Resistanc📈 BTC Rebounds After 100000 Drop, Eyeing Short at 109500 Resistance

BTC dropped below the 100000 threshold 🔻 and then rebounded near 98000 🔺. This movement is related to the decline of DXY and the reduction of geopolitical risks. Now, BTC is challenging the 110000 level 🔼. The overhead resistance is around 109500. First - time tests of the 110000 level typically trigger pullbacks, so we favor short positions here 📉

🚀 Sell@109500 - 108500

🚀 TP 107500 - 106500 - 105500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

BTCUSDTPERP

1 Year of Bitcoin Bull Run Remaining? In the chart above, we’re analyzing Bitcoin’s historical cycles to see if the current cycle follows a similar pattern.

Bear Run (1 Year): In each of the last three cycles, Bitcoin experienced a bear market lasting exactly 1 year from the all-time high (ATH). This phase saw a significant drop in price as the market corrected.

Bull Run from Bottom (1,064 Days): In the last two cycles, once the bottom was established, Bitcoin entered a consistent bull market that lasted approximately 1,064 days. During this period, the price gradually climbed, eventually reaching new highs.

Current Bitcoin Cycle:

So far, the current cycle appears to be following the same pattern as previous cycles. We’ve already experienced a 1-year bear market after reaching the previous all-time high (ATH).

Currently, we have completed 2 years of a bull run from the bottom, aligning with the 1,064-day bull run observed in past cycles. Based on this historical pattern, we may have 1 year of bull run remaining, which could potentially push Bitcoin to new highs by late 2025.

If this trend continues, it suggests a strong opportunity for growth over the next year, mirroring the end phase of past cycles.

BINANCE:BTCUSDT BITSTAMP:BTCUSD CRYPTOCAP:BTC

Regards

Hexa

BTCUSDT: Bounce Incoming?BTCUSDT Technical analysis update

-March 2024 resistance is now expected to act as a strong support level.

-The price has touched the 0.618 Fibonacci retracement level, suggesting a potential reversal from this zone.

-The 200 EMA on the 2-day chart is positioned as a strong dynamic support, reinforcing the bullish case.

We can expect a bounce from the $72-75k level.

Bitcoin Roadmap: Key Levels to WatchBitcoin( BINANCE:BTCUSDT ) managed to pump as I expected yesterday , of course, the main catalyst could have been the ceasefire announcement between Iran and Israel , which had a major impact on high and medium risk assets in the financial markets .

Bitcoin is once again moving near the Heavy Resistance zone($110,720-$105,820) and the Resistance zone($107,520-$106,100) after breaking the Resistance lines .

In terms of Elliott Wave theory , it seems that given Bitcoin’s bullish momentum , Bitcoin has completed the main wave 3 and is currently completing the main wave 4 on the 1-hour time frame . The corrective wave structure of wave 4 could be a Double Three Correction(WXY) .

I expect Bitcoin to start rising again near the Support zone($104,380-$103,060) , 50_SMA(Daily) , Support lines , and Cumulative Long Liquidation Leverage($104,412-$103,812) to rise at least to the Potential Reversal Zone(PRZ) and Resistance lines .

Note: Stop Loss(SL)= $102,600 = We can expect more dumps.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Can #BTC continue to rise?📊Can #BTC continue to rise?

🧠From a structural perspective, we started to rebound after being very close to the ideal target area of the bearish cup-handle structure, and broke through the downward trend line, which means that the correction phase is over.

➡️So next we need to pay attention to the long trading opportunities after the pullback. At present, this position belongs to the contradictory range. It can continue to rise, but it will be very uncomfortable if we chase the rise. So wait patiently for trading opportunities after the pullback. We can pay attention to the neckline support area (102000-103000).

➡️If there is no pullback, but it continues to rise, then the resistance near 106500 is also worth our attention. This is the support-resistance conversion area that has been tested many times.

🤜If you like my analysis, please like 💖 and share 💬

BITGET:BTCUSDT.P

Bitcoin Reclaims Momentum: War Fears Fading, Bulls Eye $125K! MARKETSCOM:BITCOIN just delivered a powerful bounce right off the critical $100K level. A key psychological and technical support zone tested multiple times in recent sessions. This time, the bounce came with strong volume confirmation, signaling renewed buyer interest. As geopolitical tensions in the Middle East begin to ease, market confidence is returning, fueling bullish sentiment across the board.

CRYPTOCAP:BTC now looks poised to retest the $110K resistance zone, where some short-term rejection could occur. However, a decisive breakout above $110K opens the gates for a potential rally toward the next major target at $125K. Stay sharp, always manage your risk, and don’t forget to set a proper stop loss. The trend is strong, and momentum is building!

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

BTCUSD 4-Hour Chart Analysis: Range Bound with Bearish BiasFrom the 4 - hour chart of BTCUSD, the price movement shows obvious range - bound fluctuation characteristics 📊.

Currently, it is necessary to focus on the key resistance and support zones 🎯:

From a technical perspective, BTC is likely to oscillate repeatedly within the range in the near term 🔄, yet the overall trend leans bearish 🐻.

In the short term, opportunities for buying low and selling high within the range can be monitored 📈📉

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Sell@106500 - 105500

🚀 TP 104500 - 103500

🚀 Buy@102500 - 103500

🚀 TP 104500 - 105500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

SUSDT Forming Falling WedgeSUSDT is currently displaying a textbook falling wedge pattern, a bullish reversal formation often seen at the end of a downtrend. This setup is known for signaling a breakout to the upside once the price compresses within the narrowing range. In the case of SUSDT, the wedge has been forming with consistent downward sloping resistance and support lines, accompanied by steady volume — a key confirmation of this pattern’s strength. The current technical outlook suggests that a bullish breakout could be imminent.

Technical indicators and chart structure support a possible breakout that could deliver a substantial move. Based on historical wedge breakout performance, SUSDT has the potential to rally with a projected gain of 140% to 150%+ from current levels. This would place the asset in a prime position for traders looking to capitalize on early-stage momentum. The increasing volume profile further adds conviction, signaling active accumulation and growing market interest.

Recent activity and sentiment around SUSDT indicate that investors are starting to pay attention to this opportunity. As capital flows into smaller-cap altcoins showing strong technical setups, SUSDT stands out with its clean wedge formation and bullish potential. If the price breaks above the wedge resistance with volume confirmation, it could trigger a strong upward rally, attracting both short-term traders and long-term holders.

This pattern-driven setup, combined with bullish market behavior and investor activity, puts SUSDT in a favorable zone for significant upside. Keep an eye on key resistance levels and watch for bullish engulfing candles or breakout confirmation to enter at optimal points.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

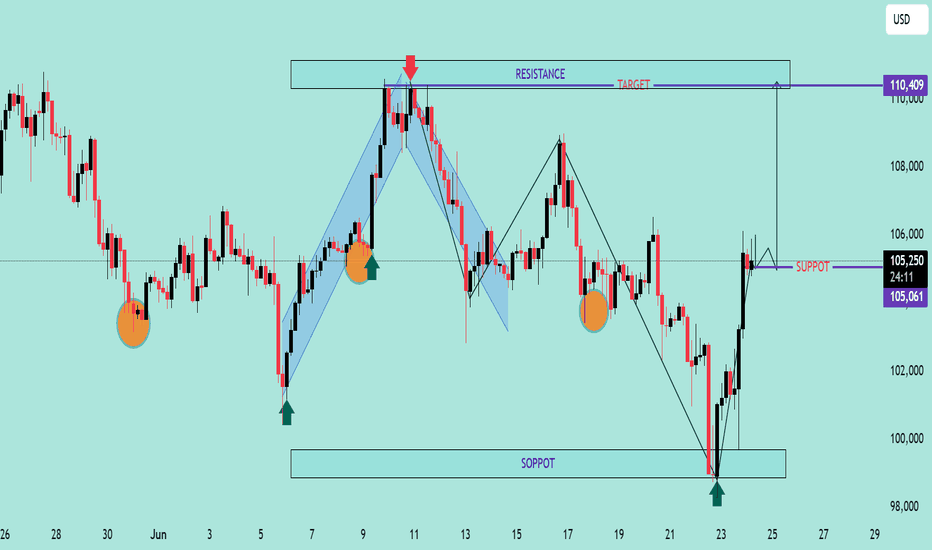

USD Index (DXY) Bullish Reversal & Breakout PotentialThe DXY chart displays a strong bullish reversal structure from the support zone near the 99,800–100,200 area. Here’s a professional breakdown of the technical setup:

🔍 Key Observations:

🟢 Bullish Reversal Formation

The price rebounded aggressively from a strong demand zone (support), marked by a green arrow and orange highlight.

Multiple historical reaction zones confirm this level's validity as a reliable support.

📉 Previous Decline & Correction

After reaching the resistance area near 110.400, the price corrected with a bearish channel.

This pullback formed a classic bull flag, a bullish continuation pattern, eventually leading to the current breakout.

🟦 Current Price Action

The market has broken out of the recent downtrend and is forming higher highs and higher lows.

A strong bullish impulse candle confirms renewed buying interest.

🧱 Support & Resistance Levels:

🔵 Resistance Zone (Target): 110.409 — a historically respected area and target for the bullish move.

🟣 Current Support Zone: 105.061 — previously resistance, now likely to act as support after the breakout.

🎯 Bullish Target Projection

If price retests and holds the support at 105.061, the next potential leg can extend towards 110.409, offering a strong risk-to-reward setup.

⚠️ Caution

Watch for a pullback and retest near the support level.

A failure to hold above 105.061 could invalidate the bullish structure.

🧠 Conclusion

The DXY is showing a bullish trend continuation after a breakout from a corrective structure. A successful retest of support could propel price towards the 110.400 target zone 📊.

Bias: ✅ Bullish above 105.061

Invalidation: ❌ Below 105.000

#BTC Bounced, 100EMA saved the day!100 EMA saved the day.

But the one concern? We’ve printed a new Lower Low, not a great sign.

The chart looks bouncy, but the overall structure still feels uncertain.

No point guessing or forcing trades here, I’d rather wait for clear confirmation.

I’ll share updates if I spot any changes or interesting altcoin setups.

For now, patience is our best edge. I know many altcoins might look great, but BTC Dominance is not yet done. I'll be sharing that chart tomorrow.

Stay sharp.

Hit that like button if you find this short update useful.

Thank you

#PEACE

BANANAS31 Forming Bullish FlagBANANAS31USDT is currently displaying a bullish flag pattern, which is typically a continuation formation that appears after a strong upward movement. This pattern suggests that the market is temporarily consolidating before potentially continuing its bullish trend. The price action has pulled back slightly in a controlled and descending manner, forming a flag structure after a steep rise, indicating that bulls are taking a breather before possibly driving prices higher once again.

Volume remains healthy and consistent, supporting the legitimacy of the pattern. A breakout above the upper resistance of the flag would likely attract additional buyers and could trigger a new wave of momentum. This setup is particularly attractive to technical traders looking for breakout opportunities with clear entry and target zones. Given the current setup, a projected gain of 20% to 30% is reasonable and aligns well with recent resistance levels visible on the higher timeframes.

In addition to the pattern itself, market sentiment around BANANAS31USDT appears to be improving. Social engagement, increased interest from retail traders, and a rise in transaction activity suggest that this project is gaining attention. Short-term traders may find this an ideal opportunity to capitalize on a relatively low-risk/high-reward trade setup, especially if the broader crypto market continues its upward trajectory.

BANANAS31USDT is worth keeping on your radar if you are tracking breakout-ready coins. With solid technical structure and growing investor interest, this coin has the potential to deliver moderate but consistent gains in the coming sessions. Watching for a confirmed breakout with strong volume could be the key to capitalizing on this move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ACTUSDT Forming Classic Falling Wedge ACTUSDT is currently exhibiting a classic falling wedge pattern on the chart—a bullish reversal setup known for its high probability of a breakout to the upside. After a consistent downtrend, the price action has started to compress within converging trendlines, suggesting that selling pressure is diminishing. A breakout above the wedge's resistance line could trigger a sharp price surge. Technical traders often look to such formations for potential entries, especially when combined with growing volume and renewed market sentiment.

Volume analysis reveals a notable uptick in recent sessions, signaling that investors are beginning to accumulate ACTUSDT. This increased interest could be due to fundamental news or broader market momentum returning to altcoins. When volume expands near the apex of a falling wedge, it usually reinforces the validity of the pattern and strengthens the breakout potential. With this setup, the projected move points to a possible gain of 140% to 150%, aligning with previous key resistance levels that the price could retest post-breakout.

On a momentum front, indicators like RSI and MACD are starting to turn bullish, offering early signs of a reversal. The price is also holding above short-term support zones, suggesting the formation of a base. The combination of technical structure, volume dynamics, and improving sentiment makes ACTUSDT a strong contender for a breakout move in the near term. Such opportunities are especially attractive in trending markets where capital rotates quickly into coins showing strong chart setups.

Given this confluence of bullish signals, ACTUSDT could become a leading performer in the altcoin space over the coming weeks. Traders and investors are advised to keep a close watch for breakout confirmation and subsequent retest levels, which could offer optimal entry points for both short-term gains and medium-term swing setups.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#BTC bearish cup-handle structure, beware of a pullback!📊#BTC bearish cup-handle structure, beware of a pullback!

🧠From a structural perspective, we broke below the neckline, which means a bearish structure is established, so we need to be wary of further declines.

➡️Yesterday's decline was rapid, so we can wait for a rebound to appear and look for shorting opportunities near the blue resistance area or the downward trend line.

➡️Since it is the weekend, the trading volume may be less. If there is no rebound, then we need to wait patiently for a period of sideways consolidation before looking for shorting opportunities.

⚠️Note that the area around 106500 is a support-resistance conversion zone. If it breaks through here and stabilizes, we can remain optimistic.

🤜If you like my analysis, please like 💖 and share 💬 BITGET:BTCUSDT.P

Bitcoin Hits PRZ — Is This the Perfect Short Entry?Bitcoin ( BINANCE:BTCUSDT ) has entered the Potential Reversal Zone (PRZ) after a strong bullish impulse , testing the confluence of Daily Resistance(3) .

In terms of Elliott Wave analysis , the market seems to have completed a complex WXY corrective structure , with the recent rally likely representing the final wave Y . This makes the current zone highly reactive for potential reversal .

I expect Bitcoin to retrace toward the CME Gap($105,075-$105,055) and possibly continue downward toward the Support zone($104,380-$103,060) and Cumulative Long Liquidation levels if the sellers regain momentum .

Cumulative Short Liquidation Leverage: $107,568-$106,601

Cumulative Long Liquidation Leverage: $105,360-$104,784

Cumulative Long Liquidation Leverage: $103,937-$103,217

Note: It is better to look for short positions at the Potential Reversal Zone (PRZ) or if Bitcoin touches $104,780 before reaching PRZ. That is why I chose to label this analysis as ''Short".

Note: If Bitcoin can touch $107,620 , there is a possibility of breaking the resistance lines and increasing further.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BTC Consolidates 104000-105000: Bearish Breakdown Looming?BTC Technical Update: Bitcoin has been consolidating within the 104000-105000 range for an extended period, with the overall trend showing a downward bias. With the overall trend tilting bearish, traders should watch for a break below 103500 to confirm the next leg down. 📉

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Sell@ 105000 - 104500

🚀 TP 102500 - 101500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

#BTC Descending Triangle📊#BTC Descending Triangle✔️

🧠From the perspective of the chart, we have been sideways here for about three days, and the price is gradually being squeezed to form a descending triangle. Generally, we regard this model as a model that continues the original trend force (the trend at the hour level is a downward trend).

➡️A similar model analysis was also made in the previous article. Because the closing price at the 4h level is already below the lower edge of the triangle, I think the probability of further decline will be higher, so please be cautious in chasing the rise!

⚠️Note that if we break through the H point and stabilize, it means that my view is wrong.

🤜If you like my analysis, please like 💖 and share 💬 BITGET:BTCUSDT.P

Expect BTC/USD to drop to 102000 post-Fed rate decisionBTC/USD Update 📈

BTC rebounded from 103500 support, now at ~105500. Short-term correction may test 100000 psychological support ⚠️

I think the Fed's interest rate decision this time may cause BTCUSD to drop directly to 102000 .

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Sell@ 105000 - 104500

🚀 TP 102500 - 101500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

#BTC Ascending Triangle📊#BTC Ascending Triangle

🧠From a structural perspective, the daily upward trend has ended, which means that the correction expectation at the daily level has always existed, so we need to be alert to this possibility and do a good job of risk management. At present, there is no short structure, so if you want to participate in short trading, you need to look for opportunities in the heavy resistance area (106500-108200).

➡️From a graphical perspective, we have been sideways for nearly a month, and the price is gradually being squeezed to form an ascending triangle. At present, the price shows signs of stabilization at the lower edge of the triangle, and we need to be alert to the risk of rebound. Only when the closing price at the 4h level is lower than the lower edge of the triangle or the price falls below the inflection point of 102611, can we think that the market direction has chosen to go down.

⚠️Note that there will be a Fed interest rate decision and geopolitical negotiations in the Middle East today, and the market may fluctuate violently, so be sure to do a good job of risk management.

Let's take a look👀

🤜If you like my analysis, please like💖 and share💬 BITGET:BTCUSDT.P

BTCUSD Analysis UpdateBTC/USD Analysis Update 📈

Bitcoin has rebounded successfully after touching the 103500 support level and is currently trading around 105500. However, the ongoing correction may continue to test the psychological support at the 100000 round number in the short term ⚠️.

Key Points:

Support Bounce 🎯: BTC found buying interest at 103500, in line with our previous strategic analysis.

Immediate Resistance 📉: The current rebound faces direct resistance near 106000 (200-hour moving average).

Downside Risk 📉: Failure to hold above 105000 could trigger another decline toward 100000.

Risk Management:

Long positions should set stop-loss below 103000 ⛔️.

Short entries may consider the 106000–107000 range, targeting 102500 and 100000

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Buy@ 102500 - 103500

🚀 TP 106000 - 106500

🚀 Sell@ 106000 - 106500

🚀 TP 103500 - 101500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Current BTC Trend Analysis and Trading RecommendationsThe daily candlestick chart of BTC shows a three - day consecutive bearish retracement, having fallen back to the vicinity of the starting point of the previous pinbar rebound and currently remaining in a recent low - level sideways consolidation zone. However, the 4 - hour trend is pressured by the middle band of the Bollinger Bands, staying within a downward channel and forming a rebound - retracement wave pattern.

For short - term strategies, anticipate a further retracement first. Long positions should be initiated only after the support level is confirmed valid. This retracement represents a necessary consolidation phase before the bullish trend continues, and the current adjustment range does not pose a substantial threat of trend reversal to the overall uptrend. With the core upward trend intact and the direction remaining clear, BTC is expected to resume its upward momentum after a brief consolidation. The operational approach remains to go long on retracements.

BTCUSD

buy@103500-104000

tp:105500-106500

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

BTC/USD Potential Bullish ReversalBTC/USD Potential Bullish Reversal 🟢📈

🔍 Technical Overview:

The chart shows a potential bullish reversal pattern forming near a key support zone. Price action has consistently bounced from the support range between $100,000 – $103,700, marked by multiple higher lows (🟠 orange circles), suggesting strong buyer interest.

📌 Key Levels:

Support Zone: $100,000 – $103,700 🛡️

Immediate Resistance: $110,384 🔼

Current Price: $105,202 💰

📊 Pattern Observed:

The price structure shows a possible inverted head and shoulders pattern forming, with the right shoulder currently developing. If this structure completes and breaks the $106,000–$107,000 neckline region, we can expect a bullish breakout toward the resistance target of $110,384 or higher.

📈 Bullish Confirmation:

Bullish rejection from support area ✅

Clean structure with repeated higher lows 📈

Potential breakout arrow suggests move toward the top resistance zone

⚠️ Watch For:

Price must hold above $103,700 to maintain bullish bias

Break below this level may invalidate bullish setup and retest the broader support zone near $100,000

📌 Conclusion:

BTC/USD is setting up for a potential upside breakout if the neckline is broken. Traders should monitor for bullish confirmation before entering long positions.

🔔 Strategy Suggestion:

Buy Zone: $103,700 – $104,500 (on bullish confirmation) 🛒

Target Zone: $110,000 – $111,000 🎯

Stop-Loss: Below $103,000 🛑

BTCUSD Tests Support—Buy for ReboundBTCUSD opened high and trended lower today 📉, now approaching the support zone—time to buy directly and ride the rebound! 🚀

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Buy@ 105000 - 105500

🚀 TP 106000 - 107500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇