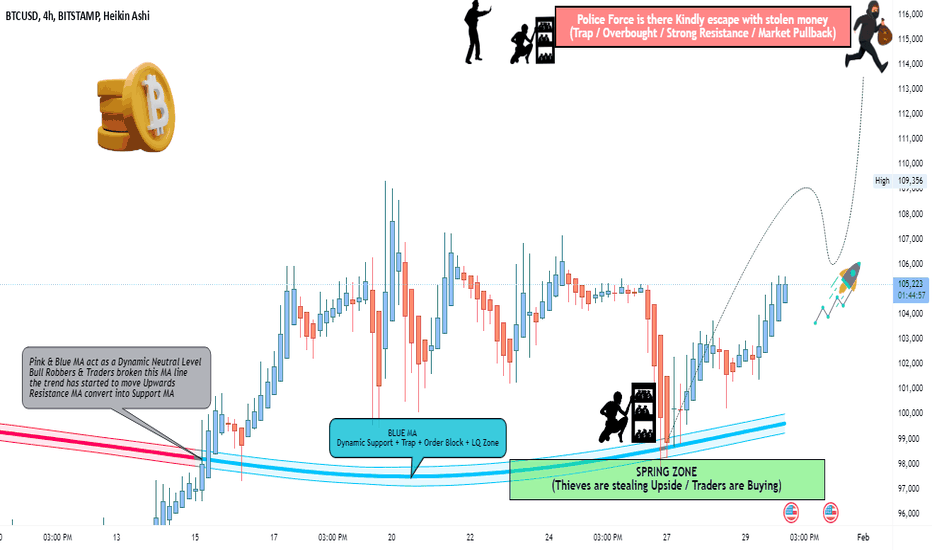

BTC/USD "Bitcoin vs US Dollar" Crypto Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BTC/USD "Bitcoin vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!"

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Goal 🎯: 115,000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

🚩 Fundamental Analysis

- Bitcoin's Limited Supply: The total supply of Bitcoin is capped at 21 million, which could lead to increased demand and higher prices.

- Increasing Adoption: Growing acceptance of Bitcoin as a form of payment and store of value could drive up demand and prices.

🚩Macroeconomic Analysis

- Global Economic Uncertainty: Ongoing economic uncertainty and inflation concerns could lead to increased investment in Bitcoin as a hedge against traditional assets.

Monetary Policy: Central banks' monetary policies, such as interest rate decisions, can impact Bitcoin's price.

🚩COT Report

- Speculative Positions: The latest COT report is not available, but speculative traders are likely to be net long on BTC/USD, indicating a bullish sentiment.

🚩Sentimental Analysis

- Market Sentiment: Market sentiment is mixed, with some investors expecting a bullish movement due to increasing adoption and limited supply, while others are bearish due to regulatory uncertainty and market volatility.

🚩Institutional Trader Analysis

- Institutional Positions: Institutional traders are watching the market closely, awaiting regulatory clarity and economic developments.

🚩Retail Trader Analysis

- Retail Positions: Retail traders are also cautious, with some taking long positions on BTC/USD due to increasing adoption and limited supply, while others are taking short positions due to regulatory uncertainty and market volatility.

🚩In terms of institutional and retail trader positioning, here's what we know:

- Institutional Traders: 55% are holding long positions in Bitcoin, indicating a bullish sentiment.

- Retail Traders: 42% are holding long positions, while 58% are holding short positions, indicating a slightly bearish sentiment.

🚩Outlook

- Based on the analysis, the BTC/USD pair is expected to move into a bullish direction in the short term, with a target level of 115,000. However, the movement is likely to be volatile, and investors should be cautious ahead of regulatory developments and economic data releases.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

Btcusdtrading

BTCUSDT 30-Min Chart - Market Analysis & Trading Strategy📊 BTCUSDT 30-Min Chart - Market Analysis & Trading Strategy

Alright, bro, let’s break this BTC chart down and see what’s cooking. 🚀

📉 Trend & Market Sentiment

Uptrend Facing Resistance

Price made a strong push from demand (around 91K-94K USDT)

EMA 20, 50, and 100 all aligned bullish but facing resistance at 102.5K USDT

EMA 200 rejection means we need a strong breakout for continuation

Key Levels to Watch

Support Zone: 98K - 95.8K USDT (Demand Area)

Resistance Zone: 101.5K - 102.5K USDT (Supply Zone)

🎯 Trading Strategy

1️⃣ Bullish Scenario (If BTC Breaks 102.5K USDT)

Entry: 102.5K USDT 📍

Targets (TP):

TP1: 103.5K USDT

TP2: 105K USDT

TP3: 107K+ USDT

SL (Stop-Loss): 100.5K USDT

2️⃣ Bearish Scenario (If BTC Gets Rejected at 102.5K USDT)

Short Entry: 101K - 102.5K USDT 🎯

TP Levels:

TP1: 98.9K USDT

TP2: 96K USDT

TP3: 94K USDT (Deep pullback)

⚠️ Risk & Warnings

BTC is testing major resistance—if it breaks, we could see a strong pump! 🚀

If BTC fails 101K, bears could take control and send it back to 95K or lower.

EMA 200 is a make-or-break level—watch price action carefully!

🔥 Final Thoughts

Right now, BTC is at a critical resistance—it either breaks 102.5K and runs, or fails and retraces back to demand zones. Stay sharp, set your SLs, and don’t get rekt! 💎🙌

What’s your take on this? You thinking long or short? 🤔

BTC/USD "The Bitcoin" Crypto Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BTC/USD "The Bitcoin" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated at any price level.

However I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Goal 🎯: 118,000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental & Macro Outlook 📰🗞️

Here's a comprehensive fundamental and macro analysis for BTC/USD:

Fundamental Analysis---🗞️

Network Congestion: The Bitcoin network has been experiencing increased congestion, with the average transaction fee rising to $2.35, up from $1.25 in January. This could lead to a decrease in demand and subsequently, a bearish trend.

Miner Revenue: The total revenue earned by Bitcoin miners has been declining, from $13.4 million in January to $10.3 million in March. This decrease in revenue could lead to a reduction in mining activity, potentially resulting in a bearish trend.

Open Interest: The open interest in Bitcoin futures has been increasing, with a current value of $4.3 billion, up from $3.5 billion in January. This indicates a growing interest in the market, which could lead to increased volatility and potentially, a bullish trend.

Institutional Investment: Institutional investment in Bitcoin has been on the rise, with Grayscale's Bitcoin Trust (GBTC) seeing a significant increase in assets under management (AUM) from $1.2 billion in January to $2.5 billion in March. This influx of institutional investment could lead to a bullish trend.

Regulatory Environment: The regulatory environment for Bitcoin has been improving, with the US Commodity Futures Trading Commission (CFTC) allowing institutionally-focused Bitcoin derivatives to be listed on regulated exchanges. This could lead to increased adoption and a bullish trend.

Macro Analysis---🗞️

Global Economic Uncertainty: The ongoing COVID-19 pandemic has led to a significant increase in global economic uncertainty. As a result, investors may turn to safe-haven assets like Bitcoin, potentially leading to a bullish trend.

Central Bank Policies: The expansionary monetary policies of central banks worldwide, including the US Federal Reserve, could lead to a decrease in the value of traditional currencies and an increase in demand for alternative assets like Bitcoin, resulting in a bullish trend.

US-China Trade Tensions: The ongoing trade tensions between the US and China could lead to a decrease in global trade and economic growth, potentially resulting in a bearish trend for Bitcoin.

Commodity Prices: The recent decline in commodity prices, such as oil and gold, could lead to a decrease in demand for alternative assets like Bitcoin, resulting in a bearish trend.

Fiscal Policy: The US government's increasing fiscal deficit and debt levels could lead to a decrease in the value of the US dollar and an increase in demand for alternative assets like Bitcoin, potentially resulting in a bullish trend.

Market Sentiment---🗞️

Fear and Greed Index: The Fear and Greed Index, which measures market sentiment, is currently at 52, indicating a neutral sentiment.

Bitcoin Sentiment Index: The Bitcoin Sentiment Index, which measures the sentiment of Bitcoin investors, is currently at 60, indicating a slightly bullish sentiment.

Social Media Sentiment: The social media sentiment for Bitcoin is currently at 55, indicating a neutral sentiment.

Google Trends: The Google Trends data for Bitcoin is currently at 45, indicating a decrease in interest and a bearish sentiment.

Survey of Investors: A recent survey of investors found that 55% of respondents expect Bitcoin to rise in the next 6 months, while 25% expect it to fall, and 20% are neutral.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

#BTCUSDT: Three Entries Going On Good, Next Target 150k! Dear Traders,

Three of our entries going good so far, where our third entry reversed and moved on nicely. We are now focusing on 120k first and then we will moving forward toward 150k. Correction is not likely to happen in meantime. Please use accurate risk management while trading BTC.

Btc scenario 1.1.2025For btc i am waiting for sfp confirmation if sfp is valid then it is likely that the price can start rising to a new ath if we are able to break through the monthly level at a price of around 96k then i see the closest tp around 100k and above 100k there is a large amount of liquidity

BITCOIN (BTCUSD): Intraday Bullish Confirmation?!

Bitcoin looks bullish after a test of a key daily/intraday horizontal support.

The price violated a resistance line of a minor falling channel and formed a local

Change of Character CHoCH.

Chances are high that the price will continue growing.

Goals: 96900 / 100000

❤️Please, support my work with like, thank you!❤️

BTC/USDT "Bitcoin Tether" Crypto Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the BTC/USDT "Bitcoin Tether" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a short trade at any point,

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high/low level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest high level.

Goal 🎯: 86,500 (or) Escape before the goal

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

BTC/USD "Bitcoin" Crypto Market Heist Plan on Bearish Side🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the BTC/USD "Bitcoin" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a short trade at any point,

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest high level.

Goal 🎯: 86,000

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

BTC/USD "Bitcoin" Crypto Market Heist Plan on Bearish Side🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the BTC/USD "Bitcoin" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a short trade at any point,

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest high level.

Goal 🎯: 90,000

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

BTCUSD BUY signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

BTC/USD "BITCOIN" Crypto Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the BTC/USD "BITCOIN" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a bull trade at any point,

however I advise placing Multiple Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low & high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low level.

Goal 🎯: 118,000

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

BTC/USDT "BITCOIN vs USDT" Crypto Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the BTC/USDT "BITCOIN vs USDT" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a bull trade at any point,

however I advise placing Multiple Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low & high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low level.

Goal 🎯: 114,000.00

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

BTCUSD next possible move

🔑 "Success is not final, failure is not fatal: it is the courage to continue that counts." – Winston Churchill

Every success we achieve is just a step, not the final destination. Likewise, every failure is merely a temporary lesson, an opportunity to grow and improve 🌱.

🔥 What truly matters is our ability to persevere, to keep moving forward despite obstacles and setbacks. Those who succeed in the long run are those with the unbreakable courage to rise after every fall 🏆.

💪 Don’t fear failure. See it as a stepping stone to your future victories. Each challenge is a chance to become stronger, wiser, and more resilient.

✨ Keep moving forward with confidence and determination, because your true strength lies in that perseverance. 🚀

BTC/USD "BITCOIN" Crypto Market Bullish Heist PlanHola! Ola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist BTC/USD "BITCOIN" Crypto Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry should be in pullback.

Stop Loss 🛑 : Recent Swing Low using 4H timeframe

Target 🎯 : 110,000.0

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

BTCUSDT: $100k is Done, Next $130K? Dear Traders,

As we explained in our previous analysis that we had made on BTC, price have reached successfully 100k since the US Election fuelled up the prices of BTC and other cryptocurrencies. Now we are expecting price to drop 96k and then reverse from there.

Good luck.

BTC/USDT "BITCOIN/TETHER" Crypto Market Bullish Heist PlanOla! Bonjour! Hi! Hallo!

Dear Money Makers & Robbers, 🤑 💰

Based on Thief Trading style technical analysis, here is our master plan to heist the BTC/USDT "BITCOIN/TETHER" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. So Be Careful, wealthy and safe trade.

Entry 📈: You can enter a trade anywhere,

however I advise placing buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low level should be in retreat.

Stop Loss 🛑: Using the 2H period, the recent / nearest low level.

Goal 🎯: 118.100

Scalpers, take note: only scalp on the long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.

I'll see you soon with another heist plan, so stay tuned 🫂

BTC/USD "BITCOIN" Crypto Market Heist Plan on Bullish SideHi there! Dear Money Makers, Losers, and Robbers, 🤑 💰

Based on Thief Trading style technical analysis, here is our master plan to heist the BTC/USD "BITCOIN" cryptocurrency market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entrance. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy, cautious, and safe.

Entry 📈: Acceptable anywhere; I advise placing buy limit orders within a 15-minute window. The entry for the Recent/Nearest Low Point should be in pullback.

Stop Loss 🛑: Using the 4H period, the recent swing low

Goal 🎯: 110,000

Scalpers, take note: only scalp on the long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.

I'll see you soon with another heist plan, so stay tuned 🫂

BTC/USD "BITCOIN" Crypto Market Heist Plan on Bearish SideOla! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist BTC/USD "BITCOIN" Crypto Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Near the Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry 👇 📉: Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe, Recent / Nearest High Point entry should be in pullback.

Stop Loss 🛑: Recent Swing High using 2H timeframe

Target 🎯 : 90,000

Attention for Scalpers : Focus to scalp only on Short side, If you've got a money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

#BTCUSDT: As advised in our last chart, price has hit 80K, 100K?Dear Traders,

As we had explained our previous analysis, that price is likely to reverse from 66k, now since price has crossed 77k region and its on the verge to hit 80k. We can expect a strong price movement now. The momentum has not shifted now after months and months of wait for bitcoin to hit the record high of 100k. Good luck.

#BTCUSDT: On The Way $80,000, Stay Alert! BINANCE:BTCUSDT

Bitcoin in currently accumulating which is a strong sign for traders who is looking for a swing entry on BTC, we expect price to drop and reverse from our buying zone. This idea is in making which means it can take time to develop and so execution of the trade can become difficult. Good luck.

Scenario on Btc From a technical analysis perspective, we are fighting for the main level and that is the price around 95k, which means at this moment that we do not have any real reason to start anything yet. In short, we have the 95k level here. If the market does not hold this level, a short at 90-87k is very likely. If the market holds this level, it is quite likely that it will go for a new all-time high, but I personally see a short setup there.