BTGUSD

BTG fell down from the last support point. BTG fell down from the last support point. The triangle broke and fell. Our new point of support is $ 42.Stop loss point is $ 40 . There is a lower cliff. It may fall by 20 dolars. BTG is in a very difficult situation. If you continue to fall like this, BTG could be a rubbish in 2018 second term.

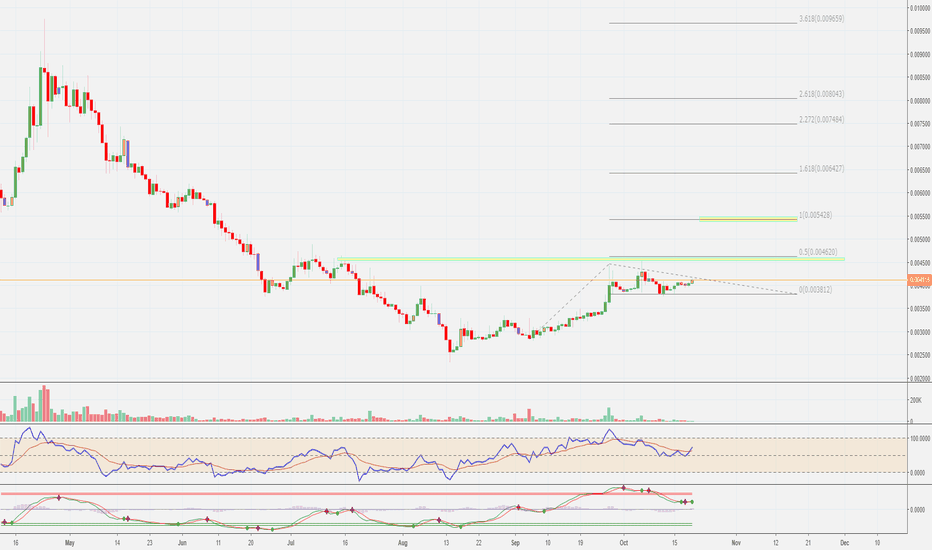

BTG/USD; 4H; 05.10 by @SupernovaEliteBTG shows a local rising trend after

protracted falling movement and

big flat. This local trend formed

with a good volumes.

Now price is above the local Support zone

and above the Movings 100,200.

So, I waiting for continuation rising

to next resistance zone as target (32$-33$).

Do not forget about Risk/Capital management!

Green Marubozu in Bitcoin Gold. Is it waking up?I have just opened a position with a stop at the minimum of the day: high volume, green Marubozu almost consolidated, and it is also designing a hammer in the monthly graph. Quite promising!

BTG Keep trying.This is a long I too this when I looked at stuff this morning. Nothing really happening but I think it should go up, I have done many times. Its a safe enough coin should BTC not drop like a bomb, like can fall a $ or 2 - it has been doing better than NEO, my stop is 18.50 but can be higher to save money. This one jump should see 24-25$ if BTC stays up/breaks up. BTC on my fibs is kind of at the top for the moment and can retrace from here but it could also break up. Kind of in limbo. But have this long lets see how it goes.

BTC

#BTG Volume Analysis Prediction 8/24/2018Hi, friends.

BTG is in the main balance with the range 17.68-21.70. Intraday balance (range 14.80-17.68) after fixing goes up, that means we have a bull priority in intraday charts at the moment. The support level 17.68 is very important. If the main balance goes down and the price will break down this level, bull priority will change to bearish again. As long as the price is in the balance we trade inside from the its borders.

The chart shows the label notes, how to operate at key points.

Glossary of terms

Point of Control (P O C) – The price level for the time period with the highest traded volume .

Value Area (V A) – The range of price levels in which a specified percentage of all volume was traded during the time period. Typically, this percentage is set to 70% however it is up to the trader’s discretion.

Balance - Accumulation Area.

F L - flat level.

T L - trend level.

Fixing (fix, culmination) - reverse price reaction then the markets stops i'ts movement for a short time. The trend stops when it passes through 1-3 fixing movement.

BTGUSD Next Short Set-Up from HereBTGUSD Next Short Set-Up from Here

The wider spread compared to BCHUSD has seen

volume shrink away on this pair and swell on BCH.

But it's still a good shorting vehicle nevertheless. It halved

from 26 to 13 in a matter of days for example.

"No coin is ever too low to sell" - to update a W D Gann quote

for the 21st century.

The downtrend is still strong here and the last 3 rallies have

all failed at the upper dynamic. BTG remains vulnerable

whilst trapped below this dominant line. Once 17.5 breaks it

should fall away to the 13.2-12.1 range. And once 12 breaks

the next obvious downside target becomes 6.5-6.0

Will follow Bitcoin around as usual, just moves faster.

Not ready to short again yet but worth setting an alert for

maybe.

BTG - Bullish patterns - Good R/R ratioDear all,

I'm entering BTG with tight Stop loss:

- Price in the Apex of the falling wedge

- Current pattern is bullish (ascending triangle)

- $22 Support tested OK

Targets on the chart.

All the Best from the Crypto Space

Alteroc

Not a Financial advise, be a better trader tomorrow than you are today by DYOR

If you liked the idea press the like button :)

BitcoinGold Uptrend Begins?On the 24th of June, BitcoinGold has found the bottom at $22, where it rejected 927.2% Fibonacci retracement level cleanly. After bouncing off the $22 support price went up and broke above the 200 Moving Average.

The past month price action shows that BTG/USD is printing higher highs and higher lows, while continues to reject the uptrend trendline and Fibonacci retracement support levels. First it has rejected 61.8% Fibs at $25, then 38.2% Fibs at $27.

Such price behavior might suggest the beginning of an uptrend that could result in a 100% growth in a relatively short time span. Strong resistance is seen at $60 area, that is confirmed by two Fibonacci retracement levels, 227.2% and 527.2%.

At the same time consolidation period might be extended and BTG could drop towards $25 area prior to moving higher. But only break and close below $22 support could invalidate bullish outlook.

BTC Regaining Dominance BTC is gaining dominance once again probably in anticipation of the ETF on the way. Many alts are showing this head and shoulders pattern on the alt to btc pairs. WATCH OUT. BTG also just broke a key support on the BTGBTC pair. Also on the lower time frames we are seeing the moving averages bearishly crossing over one another. Also there is a fanning effect going on in the EMAs which is a very bad sign. This means they are gaining momentum to the down side.

Time to know when to reverse your position. Trading isnt about being right. Its about being right enough.

God Speed Gents

BTG another buying oppturnityHaving a down 2 days for some reason but it is giving us some more buying opportunities. I am interested in this one because I think there is a big upside very close vs BTC. Will look for a buy in here if I see it turning.

Look at it vs BTC it has lots of upside if it starts to go.

BTGUSD - Trade on breakout - 20% gainzHello crypto shaggers,

Another trade on breakout, if BTGUSD breaks 33.5 USD double top level.

BUY : After breakout (above 33.5USD)

Sell : 35 - 37 - 39

ETA : Max 1 week

BTG will moon !!

Who here wants to grow up? BTG!!!for a long time BTG is searching for a bottom from which it can start a good long. At the price of $ 17, two trend lines: global support and the current down channel are converging.

Targets:

1) 30 - 35$

2) 40 - 45$

3) 70 - 80$

There is a trading opportunity to buy in BTGUSD Technical analysis:

. BITCOINGOLD/DOLLAR is in a downtrend but the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 44.

. The RSI downtrend & The price downtrend in the daily chart are broken, so the probability of resumption of uptrend is increased.

Trading suggestion:

. We have already opened 10 BUY trade(s) @ 26.145 based on 'a reversal candle (Valley)' entry method at 2018.06.30 in our suggested support zone (27.00 to 22.00).

Beginning of entry zone (27.00)

Ending of entry zone (22.00)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 39.00

TP2= @ 47.00

TP3= @ 68.00

TP4= @ 84.00

TP5= @ 146.00

TP6= @ 196.00

TP7= @ 250.00

TP8= @ 380.00

TP9= @ 478.00

TP10= Free

There is a trading opportunity to buy in BTGUSD Technical analysis:

. BITCOINGOLD/DOLLAR is in a downtrend but the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 44.

. The RSI downtrend & The price downtrend in the daily chart are broken, so the probability of resumption of uptrend is increased.

Trading suggestion:

. We have already opened 10 BUY trade(s) @ 26.145 based on 'a reversal candle (Valley)' entry method at 2018.06.30 in our suggested support zone (27.00 to 22.00).

Beginning of entry zone (27.00)

Ending of entry zone (22.00)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 39.00

TP2= @ 47.00

TP3= @ 68.00

TP4= @ 84.00

TP5= @ 146.00

TP6= @ 196.00

TP7= @ 250.00

TP8= @ 380.00

TP9= @ 478.00

TP10= Free